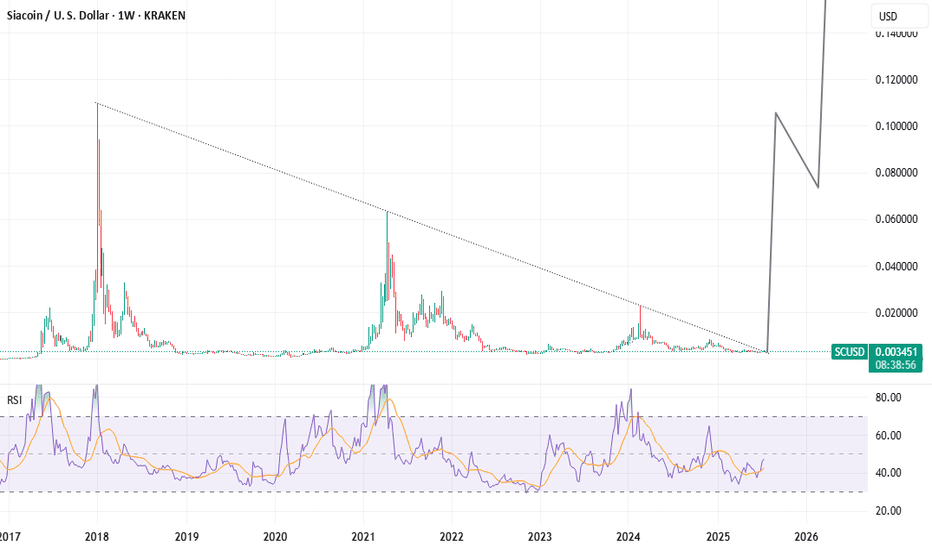

8-Year Breakout Confirmed! SIACOIN Hardfork Activated!Breaking out from a near-identical structure to XRP’s Q3 2024 move, Siacoin (SC) is poised to moon.

Once a top 20 crypto, SC has just closed outside an 8-year falling wedge on the weekly—marking the end of nearly a decade of compression.

But this isn’t just a pattern breakout—it coincides with the biggest technical overhaul in Sia’s history, rolled out on the 10-year anniversary of the token’s launch. Some of the new features:

- Full protocol overhaul — complete rewrite in Go (from siad to hostd/renterd)

- Faster performance — significantly improved upload/download speeds

- Modular architecture — easier dev integration, plug-and-play infrastructure

- Efficient storage contracts — new ephemeral account system for faster payments

- Lower gas costs — more cost-effective microtransactions for storage users

- Better redundancy & reliability — improved renter-host coordination

- Stronger developer tools — RESTful APIs + CLI tools for building on Sia

V2 basically turned Sia from a clunky decentralized Dropbox into a scalable, developer-friendly Web3 storage protocol, just in time for the AI + data sovereignty wave.

Still buried in market cap rankings, SC has the potential to quietly reclaim a top 30 spot as the world rediscovers decentralized storage. This isn’t a meme coin—it’s a battle-tested, utility-rich project with real infrastructure, real adoption potential, and serious upside.

#Siacoin #SC #Sia

SIA

Siacoin (SC) completed setup for upto 13.50% pumpHi dear friends, hope you are well, and welcome to the new update on Siacoin (SC) with US Dollar pair.

Previously we caught almost 75% pump of SIA as below:

Now on a daily time frame, SIA has formed a bullish BAT move for the next pump.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

Liquid-staking > Bitcoin ETF? Why did some coins do well?Trying to make sense of what happened this week in the markets - glad that Tezos is getting some shine but what made this week interesting is that it coincided with Bitcoin's ETF - news which didn't really help Bitcoin all that much but it helped a *select few* coins, while most of them actually went down.

My gut tells me that both $XTZ and NYSE:SUI have something "normal people" want - which is basic, L1 liquid staking that allows people to earn "interest" on their money in a way where they don't have to lock it up. (Don't get me started on ETH on this one, lol.) LSE:TIA might've gotten some attention because they were marketing their liquid staking protocol recently but it's similar to other workaround solutions where you get tokens instead of the actual coin itself.

I think it's safe to say that most people won't bother with L2 staking since managing sub-tokens within a currency itself is just too much work, and too much risk. This is mostly just a hunch the hypothesis right now is that some of the money that was supposed to flow into Bitcoin ETFs took a closer look at saw liquid staking as something potentially appealing since it's one of the few things in crypto that's easier to understand. What do you think?

SIA shows sign of price peakRecent rebound in SIA shows multiple high volume in 5 mins chart yesterday with limited price up.

This indicates the big boys are churning at the high price to creates Fear-Of-Missing-Out to retail investors to place order in.

When there are enough buyers at the lower pricing, the big boys will start selling for profit taking.

Singapore Airlines (SIA : C6L) targets $7.00 and attempts to breLong term DOWNTREND SINCE 010908

Medium term UPTREND since 111021

Short term UPTREND since 311022

Singapore Airlines is 1 of 8 component stocks supporting the rise of the STI at the start of 2023.

The long signal for this recent run started on 311022 at the price of $5.21.

$7.00 is a significant target as it marked the start of last 7 year decline of the stock to a low of $3.20.

PIVOT 5.74

Long positions above $5.74 for $7.00 and $8.65

Short positions below $5.74 for $4.89 and $3.20

SCUSD - Rejected by Trend Line & Broken Below SupportThere's a few lines on this chart, all of them are relevant. We've got 2 clear descending trend lines which Siacoin has recently tested simultaneously and been rejected by them both.

After this rejection we've seen the price descend through layers of support (a historical consolidation zone, to be exact) and now we're left hanging off the underside anticipating a 20-25% price decline.

This is great news for us as we've received a Short signal from Crypto Tipster v2, bring on the drop!

If you enjoyed or agree with this idea - drop us a comment, like & follow! :)

Siacoin (SC) formed a bullish Gartley for upto 57% pumpHi dear friends, hope you are well, and welcome to the new update on Siacoin (SC) with US Dollar pair.

Previously we had a nice trade of SC .

Now on a 4-hr time frame, SC has formed a bullish Gartley pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

$SC SiaCoin a strong case for the bullsSiaCoin the dentralized storage platform has had a 500% increase in storage used on its network since 2021 constantly growing and repeatedly setting ATH's in usage, the network had 0.5 PetaBytes stored by its users and at writing today has 2.5 Petabytes stored on the network. Behind the scenes of the token itself, the project is consistently growing in its utility and users, the sia network and the coin are paired like an elastic band and its only a matter of time as the sia network pulls further and further ahead that the coin will shoot back to the project and catch up to the gains the network is making.

The calm before the storm.....

In this analysis i've touched on some rough wave theory on the weekly marked by points 1 through 5 and points w,x & y. Ive then also brought in the fibs as it seems to have been respected at the .236 and .5 indicating the possibility of the more significant fibs being tested.

View siastats.info to view the growth of the network.

SCTBTC A HOLE-IN-1🏌🏼🏌🏼Greetings,

Today we're looking at SIA coin (SC) - Instead of looking at SCUSDT , We're looking at the SCBTC pair. “Trading pairs” or “cryptocurrency pairs” are assets that can be traded for each other on an exchange. I especially like trading against BTC, a few examples; ETHBTC, SCBTC, EOSBTC. Using both BTC & USDT pairs against what ever your trading is always a good idea before entering trades.

BUY ZONES;

20-27 sats

27-35 sats

TARGETS;

51 sats

62 sats

71 sats

84 sats

103 sats

We're especially taking into consideration that SIA has broken the 50MA. Historically moves after this.

Keep in mind, we're always looking at BTCUSDT price as that price movement will always effect the whole market prices. We're also consistently using BTC.D, USDT.D when trading BTC pairs.

SATS/SATOSHIS;

A satoshi represents one hundred millionths of a bitcoin. Because bitcoin has increased in value exponentially, smaller denominations are needed for smaller transactions. Small denominations make bitcoin transactions easier to conduct while making them readable by people. For example, if you bought a $100 item with one bitcoin, your charge might ring up as .00210028 BTC, or 210,028 satoshi (if BTC equaled $47,612.81). In this example, it's easier to understand satoshi.

I hope this idea helps with someone looking at trading BTC pairs.

Remember, nothing is guaranteed, control the controllables.

Mogues

Siacoin (SC) formed bullish Shark for upto 224% big moveHi dear friends, hope you are well, and welcome to the new update on Siacoin (SC).

During the previous market crash of April to Jun 2021, SIA formed a big bullish BAT, which I shared as below:

The priceline moved close to the sell targets but move down back inside the buying zone. Therefore the above trade is still valid.

Now during the current drop, on a weekly time frame, SIA has formed a huge Shark move.

The MOTHER of all Cup and Handles - SCUSD Log scale storyHi all,

Main TA Points;

***

1. Log scale chart.

2. Big cup and handle on monthly.

3. 20MA currently acting as support.

4. Break of Ichi looking imminent.

5. Incredible R:R

***

Talking Points;

***

Going to keep it simple,

Log scale is a fantastic tool to use over long term chart views as well as high volatility markets such as crypto.

SCUSD is painting an enormous cup and handle suggesting a price target of anywhere between $1 - $3.50.

There is a strong possibility that Web 3.0 will be the "meta" paradigm during the peak of the current bull run. Sia/Skynet is arguably the strongest offering in this space with Siacoin offering a significant investment opportunity with considerable upside.

These price estimates are also inline with SCBTC hitting its all time high of 800 satoshis. Should it do this with BTC hitting upwards of 100K we are definitely talking price targets in this range.

***

Estimates;

***

Log scale modifies your drawing tools and I'm having difficulty calculating the exact measured move. At this price entry however, liquidating a portion of holdings at 1 dollar would be a prudent strategy having banked significant profits.

I think targets should involve averaging out of the trade in this case given we are looking at a range of $1 - $3.50.

Good luck,

Please consider donating, following or leaving a comment if this analysis was valuable to you.

SIA donations;

807db3f1186dd2a5a40418200064b44a94bffb0e32fac9e713923088a7e3bb0886c2d0281374

***

***

Any trading advice provided has been prepared without taking into account your objectives, financial situation or needs. Before acting on the information provided you should consider the appropriateness of the information, having regard to your objectives, financial situation and needs. You should seek professional personal financial advice before making any financial or investment decisions.

All investment and trade decisions, no matter how well investigated, involve risk.

DAX H16: BEST Level to SHORT IT +1000/+1500 points(SL/TP)(NEW)Why get subbed to me on Tradingview?

-TOP author on TradingView

-2000+ ideas published

-15+ years experience in markets

-Professional chart break downs

-Supply/Demand Zones

-TD9 counts / combo review

-Key S/R levels

-No junk on my charts

-Frequent updates

-Covering FX/crypto/US stocks

-before/after analysis

-24/7 uptime so constant updates

🎁Please hit the like button and

🎁Leave a comment to support our team!

DAX H16: BEST Level to SHORT IT +1000/+1500 points(SL/TP)(NEW)

IMPORTANT NOTE: speculative setup. do your own

due dill. use STOP LOSS. don't overleverage.

🔸 Summary and potential trade setup

::: DAX 16hour/candle chart review

::: BUY alerted at 15100 +700 points now

::: trading in massive range since May 2021

::: 16000 range highs / 15000 range lows

::: focus on BUY LOW / SELL HIGH strategy

::: we will trade sideways next 4/8 weeks

::: bearish fractal in progress now

::: setup still valid as of today

::: new wave of global lockdowns

::: upside limited from here

::: short-term limited upside

::: HOWEVER heavy resistance overhead

::: 15 900 strong resistance

::: get ready to SHORT from overhead

::: BEARS will take over soon

::: lower risk setup is SHORT

::: get ready to SHORT HIGH later

::: once we hit resistance at 15 900

::: TP BEARS TP1 +1000 points TP2 +1500 points

::: SHORT/HOLD setup with great risk:reward

::: BEARS TP FINAL is 14 800

::: recommend to SHORT/HOLD

::: recommended strategy: SHORT/HOLD

::: 15 900 reversal level to SHORT IT

::: BULLS focus on BUYING LOW

::: near 15 000 / 15 200 later

::: TP BULLS is 15 900 points

::: SWING trade setup do not expect

::: fast/miracle overnights gains here

::: good luck traders

🔸 Supply/Demand Zones

::: 15 000 fresh demand zone

::: 15 850 fresh supply zone

🔸 Other noteworthy technicals/fundies

::: TD9 /Combo update: N/A

::: Sentiment short-term: BEARS

::: Sentiment outlook mid-term: BEARS

RISK DISCLAIMER:

Trading Crypto, Futures , Forex, CFDs and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use tight stop loss.

SIA COIN- Ready for a new Liftoff?3 Reasons to Buy Siacoin

Siacoin provides tangible real-world utility and an attractive investment thesis based on disruption and innovation in the cloud-storage space.

Key Points

The Sia network provides decentralized cloud storage in a secure way.

This decentralized cloud storage is provided at extremely low prices, making the Sia network competitive with established industry giants.

The security of this network is impressive, a key factor that could spur mass adoption.

For cryptocurrency investors, the search for meaningful utility is always on. Finding the next cryptocurrency network with the disruptive ability to innovate in hyper-growth sectors of the economy is the goal.

However, breaking into certain segments of the tech economy can be difficult. Big Tech seems to control everything these days, and cloud storage is no exception. Companies dominating the cloud storage space include major players such as Google, Amazon, and Microsoft.

However, there's one upstart decentralized network seeking to take a slice of this growing pie. The Sia network, powered by Siacoin (CRYPTO:SC), is a unique offering in this oligopolistic space.

The Sia network provides cloud-storage services on the blockchain. Since Sia is a decentralized service, there's no single point of failure. Users pay in Siacoin for this storage, and providers are paid in Siacoin for their troubles. Indeed, Siacoin could represent the decentralized future of the cloud.

Let's dive into three reasons why Siacoin could be a great long-term investment for those seeking disruptive blockchain technologies today.

1. A cost-effective cloud-storage solution

Running large numbers of connected servers isn't cheap. Accordingly, cloud-storage companies are increasingly being forced to increase prices to meet these costs. Inflation is real, and companies in many cases don't have a choice but to pass on costs to the consumer. For example, Microsoft Azure charges $18 per month for 1 terabyte (TB, or 1,000 gigabytes) of storage.

The Sia network, on the other hand, charges less than $4.50 for the same service. This is a rather significant price difference and could be meaningful for companies requiring cloud-storage services at scale.

If anything, the secular trends underpinning growth in cloud storage are only likely to accelerate over time. Undoubtedly, the pandemic helped accelerate cloud adoption to some degree. However, there are certainly reasons for investors to have a very positive outlook for cloud-storage providers in the years and decades to come.

The Sia network's current cost advantage could be viewed positively in this light. As adoption picks up across the network, expectations are that Siacoin's value should appreciate, as well.

2. Peer-to-peer storage solutions

The Sia network is the premier peer-to-peer cloud-storage solution in cryptocurrency today. This blockchain-based provider offers a solution that anyone can be a part of.

Decentralization is the name of the game in the cryptocurrency world. However, most of the focus in this space right now is on decentralized transactions. For cloud-storage providers, there are other advantages of being decentralized, peer-to-peer solutions.

Security is one of the key drivers of the Sia network's allure in this regard. However, the nuts and bolts of how this network operates are intriguing from this perspective.

In order for a cloud-storage provider to join the network, a certain amount of Siacoin must be locked into a contract. These contracts are cryptographically enforced in the blockchain, simplifying the process for users and providing collateral to ensure both parties will be satisfied with the arrangement.

Both the user (renter) and host put some amount of Siacoin into the contract. If the host fails to perform its duties or loses the client's data, the user is compensated in Siacoin. Additionally, since the renter pays upfront, the host is guaranteed to get their money from the transaction. It's a win-win.

3. Security is paramount

As a cloud-storage intermediary, the Sia network's security protocols are of utmost importance to those looking at this service. In this regard, there's a lot to like about how the Sia network has chosen to think about a security-first approach.

There are a few security advantages the Sia network has relative to traditional cloud storage providers. Perhaps the most obvious is the fact that the Sia network is decentralized. Since there's no central server to attack, a hacker would be required to carry out multiple attacks on various servers simultaneously in order to significantly disrupt the system. That's an obvious plus for those concerned about potential cloud-server hacks.

Additionally, the hosts are anonymous, and the level of encryption and data-transfer security appears to be among the best in class right now. Anonymity is ensured. Since the owners of the files are the only ones with private keys to access the data, no one other than the owner is able to access the files.

Finally, the Sia network uses redundancy, splitting files across many computers. This means that even if some of the nodes operating the network are offline for any reason, the renter will be able to access their files at any time.

A potential long-term winner

One of the drawbacks of many cryptocurrencies is that they power networks with no real utility outside of storing or transferring money. Other cryptocurrencies such as Siacoin support powerful utility-generating functionality in the real world. That can be both a good and bad thing.

Obviously, Siacoin's value as the currency used on the Sia network is dependent upon this network continuing to grow. Unfortunately, there aren't as many catalysts for Siacoin as there are for a cryptocurrency like Ethereum, for example, where an enormous network of projects utilizing smart contracts and tokens are built on top of it. This multipurpose functionality is what drove Ethereum to the heights it has reached. Siacoin's growth may not be as explosive.

There are other risks with Siacoin, as well. In 2019, the developers behind Siacoin were ordered to pay $250,000 for alleged securities fraud for offering an unregistered security. Although the SEC has chosen to take no further action against the Sia network at this time, the budding cryptocurrency world is certainly not without risk.

That said, for those intrigued by the potential disruption the blockchain could bring to the cloud-storage space, Siacoin is a compelling token to consider. Right now, Siacoin is one of the top smaller-cap cryptocurrencies I'm watching for this reason.

SCUSDT - 4h - LONG💡💡#SIGNAL 💡💡

SC / USDT

▶️ Buy NOW (25%) + 1Block (25%) + 2Block (50%)

🔴 SLT - 4h (Trigger, close 4h candle below)

I love this coin. But I try to be as objective as possible. At 4h, she looks up. In general, the final goal is seen in the area of 0.08 - 0.12. But it takes time.

#SCUSDT_4h_271121