Bitcoin ETF: Sideways Action to Pattern Out Excessive GainsProbably the most popular Stock Exchange Traded Bitcoin Trust at this time, AMEX:GBTC has started a consolidation that may turn into a small triangle formation. Triangles are a form of a consolidation that can work to pattern out excessive price gains without a run or correction down.

This is the weekly chart where we can see that GBTC is now above its previous all-time highs. It is still affordable and poses less risk than the actual Bitcoin, which is very expensive.

Sidewayspattern

AUDUSD Sideways / Ranging M30AUDUSD Sideways / Ranging will be clearly visible on the M30 timeframe, Starting from March 31, You can enter the demand area (when this idea was created) or enter supply with a CONFIRMATION note, Don't try to enter without confirmation, because maybe the price will trying to penetrate Supply / Demand, the direction of price movement will remain the same, namely down when it touches supply, and vice versa.

For CONFIRMATION, this time I use the EMA 25 ( EMA 25 timeframe M30) when the price crosses/breaks the EMA with a stop loss at the previous Swing Low

Pay attention to your risk/reward when you enter

I suggest R/R Minimum 1:1.5

i do not guarantee anything, i only share my analysis

Do your own research!

Failed Breakout Sends Price into RangeAfter looking like price going to breakout and make a new leg higher. price quickly snapped lower and moved into the range.

As the chart shows; price is trading within a fairly clear range.

Until one of these level gives we can look to trade both sides of the market from the intraday support and resistance back.

Thanks for your like and support...

Price Moves Back Into Box,ConsolidationThere have been some solid contrarian moves in the last 24 hours.

The GBPUSD is a good example of this with price quickly snapping back below the major resistance level just as quickly as it broke out.

The support level of the recent consolidation and sideways pattern looks a key level for where this market moves next.

CERN Short-Term Top Finds SupportCERN has shifted to a sideways pattern well above the gap support level. The stock is under moderate Dark Pool Quiet Rotation™.

ADP Platform Sideways PatternADP has shifted to a Platform sideways candlestick pattern, and is experiencing some Dark Pool Quiet Rotation™. However, there is underlying buying activity of Smaller Funds, Professional Traders, and Investors. The candlestick pattern is compressing on the upside of the Trading Range at this time.

CAT Sensitive to Tariffs & Trade WarsHuge growth in 2016 as speculative anticipation of more sales to China & other developing industrialization nations occurred. Unsupported by Fundamental & Technical support and resistance levels. Now in a sideways pattern, inevitably selling down toward a Business Bear Cycle pattern. Weekly chart view.

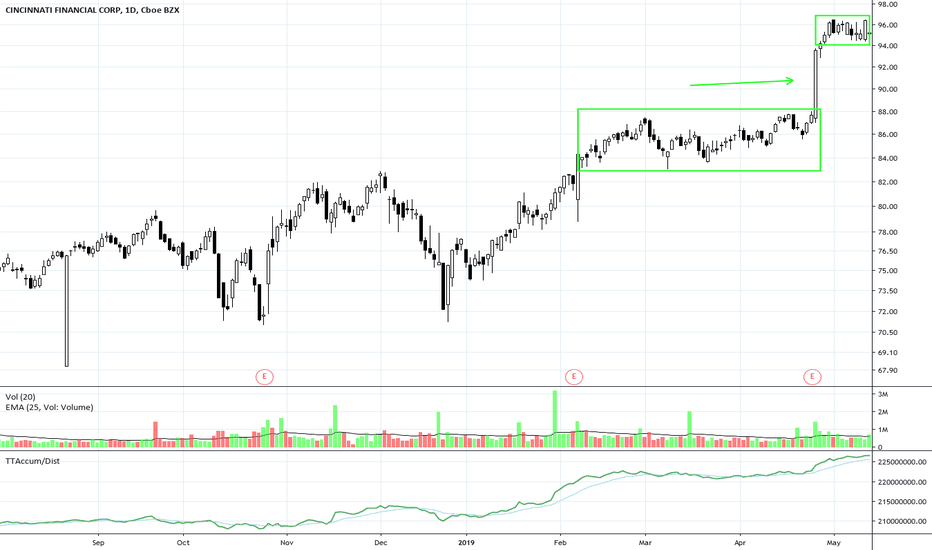

CINF Platform Pattern Hidden AccumulationCINF is an S&P 500 index component. The chart shows a platform sideways pattern typical of Dark Pool hidden accumulation. This was followed by a long white candle that was not HFT driven. The stock is now in another consolidation, at a new high with more hidden accumulation.