SIGN buy/long setup (4H)A tight consolidation range has been broken to the upside, and price has not yet pulled back to it.

On the chart, we have a trigger line breakout and the formation of a bullish change of character (CH).

When the price reaches the green zone, we can look for buy/long positions.

Targets are marked on the chart.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

SIGN

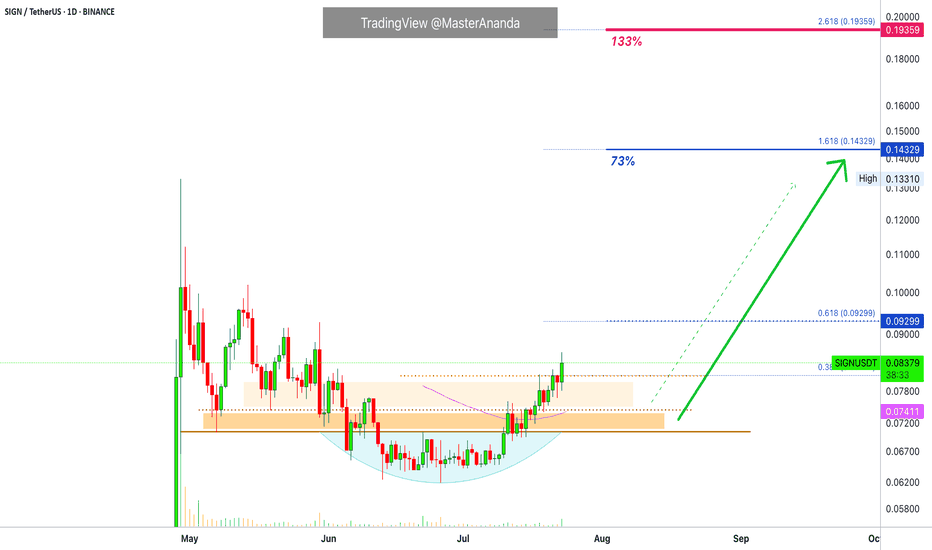

Sign · Same Chart, Same Pattern, Easy Profits · 133% PotentialThe same chart, the same dynamics and the same highly profitable easy to win trading opportunity.

The main low happens 7-May. There are lower prices after this but this is the stop-loss hunt event. We know this based on the rounded bottom pattern.

SIGNUSDT is back above its 7-May low and also trading above EMA55 on a daily basis. Above EMA55 after hitting a major low is as bullish as it gets. On top of that, we can see slow and steady growth; remember, the build-up process that leads to a strong bullish wave.

Notice how each candle, each day, prices are climbing higher and higher. The strongest signal of all is price action. When prices are rising, that is all you need. Supported by a volume breakout and we have another chart setup that will produce profits short-term.

The exchange I am looking at allows up to 5X, but you can do spot; less risk and no stress. If something goes wrong, the worst case scenario is a long wait or a small loss. On the other hand, a mistake with leverage can mean losing your entire position. Which one do you prefer?

There is no right or wrong answer. Higher risk will translate into a higher potential for reward. A lower reward potential translates into less stress and less risk. Whatever you choose is up to you. It all depends on your personality, your capital, your trading style, the available tools and your goals.

I say, start small. If you can secure many small wins, eventually you will be able to handle the big ones. Only go big when you have experience securing the small trades.

If you are in a hurry to win big, then you might end up losing everything; over and over, again and again.

Avoid repeating the same mistakes. Learn from the Master.

Thanks a lot for your continued support.

Namaste.

SIGNUSDT Forming Bullish Pennant SIGNUSDT is currently exhibiting a strong bullish pennant pattern on the daily timeframe—a continuation setup that often precedes substantial upward movement. Following an aggressive price surge, the pair has entered a brief consolidation phase within converging trendlines, suggesting that bulls are simply regrouping for the next leg higher. This is typically a bullish signal, especially when paired with increasing volume and positive sentiment surrounding the project.

The volume has remained healthy during the pennant formation, indicating sustained interest and participation from investors. With a clean technical structure and no major overhead resistance in the immediate zone, SIGN has positioned itself for a breakout move. Based on the height of the flagpole and the pattern formation, a price surge of 40% to 50% is anticipated, with targets aligning near the $0.13 zone. Such a move would mirror the breakout potential we’ve seen in similar setups across the altcoin market.

From a sentiment perspective, market participants have shown growing confidence in the SIGN project. Social mentions, trading volume, and overall engagement metrics are on the rise. This kind of grassroots enthusiasm often precedes strong rallies, and with Bitcoin and Ethereum holding steady, the stage may be set for altcoins like SIGN to shine. Technically and fundamentally, the alignment for an upward push appears to be falling into place.

Traders should watch for a clean breakout with volume confirmation above the resistance trendline. A decisive candle close above the pennant could act as a strong bullish catalyst. Risk management is key, but the risk-reward profile currently leans heavily in favor of the bulls.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

SIGN/USDT – Bullish Breakout Alert!🚀 SIGN Breakout Alert – 80% Potential Incoming?! 👀🔥

Hey Traders! If you're all about high-conviction plays and real alpha, smash that 👍 and tap Follow for more setups that actually deliver! 💹💯

SIGN has just broken out from a symmetrical triangle after consolidating tightly for weeks. The breakout is supported by strong volume and a solid bounce from the base of the structure.

Entry: $0.082 - $0.085 (post-breakout zone)

Targets:

• $0.095

• $0.112

• $0.134

• $0.159

Stop-loss: Below $0.076

Risk-Reward: Over 6:1 — Excellent setup for trend traders.

This move could mark the beginning of a strong upside wave. Keep it on your radar and manage your risk accordingly!

Let me know your thoughts or if you're riding this one too!

Phemex Analysis #77: Pro Tips to Trade SIGN! SIGN token ( PHEMEX:SIGNUSDT.P ) has experienced a remarkable surge this week, gaining 60% in a short period as seen on the 1-hour chart. This surge has attracted significant investor attention, driven by SIGN's unique approach to cross-chain verification. Cross-chain verification addresses a critical challenge in the blockchain space: the secure and efficient transfer of data and assets between different blockchain networks. SIGN aims to streamline this process, enhancing interoperability and reducing the risks associated with cross-chain transactions. This innovative solution has positioned SIGN as a potentially valuable asset in the expanding multi-chain ecosystem, contributing to the recent price appreciation.

Possible Scenarios (1-hour Chart)

Given the recent surge and the volatility inherent in the cryptocurrency market, here are potential scenarios for SIGN token, focusing on the 15-minute timeframe:

1. Continuation of the Uptrend

If SIGN maintains strong buying pressure and volume, the uptrend observed could continue. This scenario suggests that the market is highly optimistic about SIGN's cross-chain verification technology.

Pro Tips:

Identify key resistance level, such as $0.10. If the price breaks out of this level, it would suggest the continuation of this uptrend.

Consider entering long positions on the breakout, with stop-loss orders below a recent low like $0.092.

Short-term profit targets include $0.109 & $0.125.

2. Short-Term Consolidation

Following the rapid price increase, SIGN may enter a period of consolidation on the 1-hour chart. This consolidation could be characterized by sideways price action within a defined range.

Pro Tips:

$0.105 might act as the upper boundary, and $0.09 might act as the lower boundary of the consolidation range.

Be patient and watch for a breakout from the consolidation range, which could signal the resumption of the uptrend or a trend reversal.

Use volume and breakout confirmation techniques to validate any breakout trades.

3. Rapid Price Correction

Given the sharp price increase, SIGN is vulnerable to a rapid price correction, especially if profit-taking occurs or negative news emerges.

Pro Tips:

Monitor for signs of weakening momentum, such as lower highs with lower lows, and RSI divergence.

Be prepared to exit long positions quickly if a correction begins.

Consider shorting opportunities if the price breaks below key support levels (such as $0.09) with strong volume, but manage risk carefully.

Conclusion

SIGN token's recent 60% surge, driven by its innovative cross-chain verification technology, has created short-term trading opportunities. Analyzing the 1-hour chart reveals potential scenarios, including a continued uptrend, short-term consolidation, and rapid price correction. Traders should employ appropriate risk management strategies, closely monitor price action and volume, and stay informed about any developments related to SIGN token and the broader cross-chain ecosystem.

Pro Tips:

Trade Smarter, Not Harder with Phemex. Benefit from cutting-edge features like multiple watchlists, basket orders, and real-time strategy adjustments. Our unique scaled order system and iceberg order functionality give you a competitive edge.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

Breaking: $SIGN Coin Surge Nearly 40% Amidst Binance Listing The price of SIX:SIGN coin saw a 40% uptick today amidst Binance and numerous CEX listings.

Sign Protocol ( SIX:SIGN ) is an omni-chain attestation protocol that powers digital public infrastructure for governments and functions as a foundational layer for decentralized apps. 2) TokenTable: A smart contract-based platform for token distribution, including airdrops, vesting, and unlocks.

As of the time of writing, SIX:SIGN is up 24% according to the 15 minutes price chart SIX:SIGN has formed a bullish pennant pattern and a breakout above the ceiling of the wedge could resort to another legged-up for SIX:SIGN coin.

Further attesting to the bullish thesis is the RSI at 46, hinting at a build up momentum below the falling wedge that could spark the bullish breakout.

Sign Price Data

The Sign price today is $0.103050 USD with a 24-hour trading volume of $963,726,950 USD. Sign is up 37.58% in the last 24 hours. The current CoinMarketCap ranking is #307, with a market cap of $123,659,605 USD. It has a circulating supply of 1,200,000,000 SIGN coins and a max. supply of 10,000,000,000 SIGN coins.

M Macy's Options Ahead of EarningsIf you haven`t sold M before the previous earnings:

Now analyzing the options chain and the chart patterns of M Macy's prior to the earnings report this week,

I would consider purchasing the 17usd strike price Calls with

an expiration date of 2024-8-30,

for a premium of approximately $1.47.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Ripple Notches Another Legal VictoryThe latest development in the SEC v. Ripple case could be welcomed by the XRP Army as a positive sign.

The regulator had cited a similar case that it had brought against blockchain content platform LBRY. In the said case, a New Hampshire magistrate judge ruled on the pleadings on unconnected “selective enforcement” defense.

Ripple’s attorneys, however, argued that the SEC shouldn’t be allowed to boost its case against the firm’s fair notice defense by referencing “out of circuit” recently-decided cases. Ripple also indicated that LBRY pled a fair notice defense but the SEC didn’t move to strike it, and the omission of this in the proposed Sur-Sur-Reply is “remarkable”.

And fortunately for Ripple, Judge Analisa Torres has denied SEC’s request to file its Sur-Sur-Reply, in a conspicuous one-word order.

SANDBTC Broke Above The Resistance

Welcome back Traders, Investors, and Community!

SANDBTC on H4 Has broken above the resistance, retested and after the rejection will go up.

⬆️Buy now or Buy at 0.00001344

⭕️SL @ 0.00001000

✅TP1 @ 0.00001923

✅TP2 @ 0.00002275

✅TP3 @ 0.00002800

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button. ❤️ Your Support is really appreciated! ❤️

Traders, if you have your own opinion about it, please write your own in the comment box. We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

We will have more FREE forecasts in TradingView soon

Have a Profitable Day

USD/CHF:BULLISH IMPULSE ON UPTREND CHANNEL | LONG SETUP READY 🔔Welcome back Traders, Investors, and Community!

Check the Links on BIO and If you LIKE this analysis, Please support our page by hitting the LIKE 👍 button

Traders, if you like this idea or have your own opinion about it, please write your own in the comment box . We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

Have a Good Day Trading !

Gold Bullish Push InsightWe have gold trading at a nice range here. I am expecting gold to break 1745 and target 1755x1760 area, we have grabbed liquidity at 1730ish area for buy orders to take control, NY volume will anticipate a push higher in the session! Lets monitor!

1:8 RR if you take this trade

Levels will be broken!