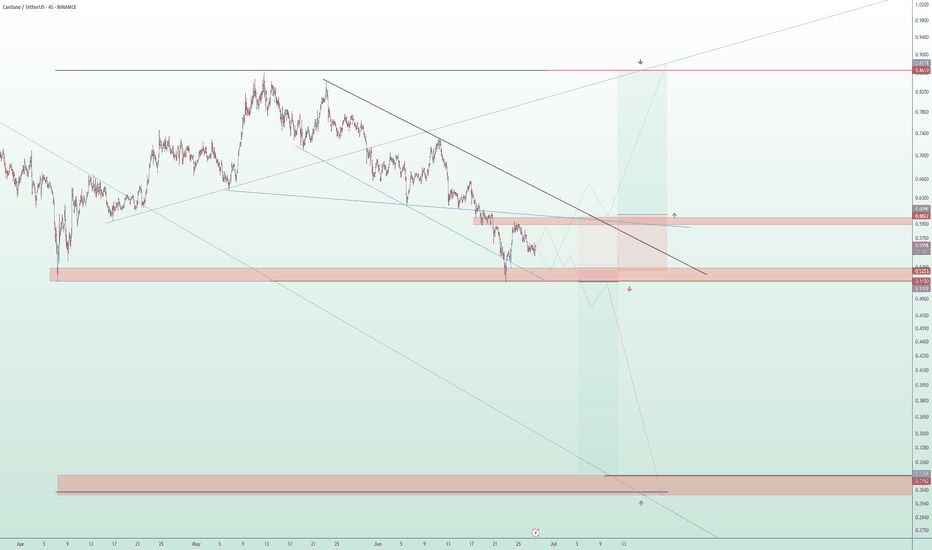

Major Move Ahead for ADA – Breakout or Breakdown?

🔍 ADA/USDT Analysis – Dual Scenario Setup (BUY & SELL)

Currently, ADA is ranging between major supply and demand zones. Two clear scenarios are in play depending on how price reacts to key levels:

📈 Bullish Scenario (Long):

Entry: On breakout and confirmation above $0.6027

Target: $0.869 (major resistance zone)

Stop Loss: Below $0.523

Trigger: Break of descending trendline and solid structure above $0.6027

📉 Bearish Scenario (Short):

Entry: Around $0.5120 (rejection from supply zone)

Target: $0.315 (strong demand zone)

Stop Loss: Above $0.6027

Trigger: Failed breakout and rejection from $0.5120 level, with confirmation below it

📌 Based on the descending channel structure, this might have been the final leg of the downtrend, and a reversal to the upside could be underway. However, for confirmation, we prefer to wait for stronger price action signals before fully committing.

🛑 Always use risk management. Market remains bearish until proven otherwise.

Signal

TRX Approaching Cup Breakout – Market Decision Imminent

TRX/USDT – Daily Chart Analysis

TRX is shaping a textbook Cup Pattern on the daily timeframe — a strong bullish continuation signal if confirmed. Price has gradually curved upward, and we are now testing the key resistance area at 0.29–0.30.

📌 Key Scenarios:

🔹 Bullish Breakout Scenario:

A confirmed breakout and daily close above 0.30 would validate the cup formation and set the stage for a rally toward the next target zones at 0.35 and 0.45 — measured based on the cup’s depth.

🔹 Bearish Rejection Scenario:

If the resistance holds, expect a pullback toward the midline (~0.24) for potential accumulation and base-building before the next move.

💡 Volume confirmation and breakout momentum are critical to watch here. The market is approaching a decision point.

🟢 Our directional bias remains bullish — we anticipate the breakout to occur, leading to an upward continuation. However, we’ll wait for confirmation of the breakout and completion of the pattern before entering a long position.

The Critical Blue Line – Will Bitcoin Soar or Sink

🔹 Bitcoin Technical Analysis – Key Blue Line, Bear Trap Possibility & Long-Term Scenario

On the Bitcoin chart, the blue horizontal level has acted multiple times as both support and resistance. The price has broken it several times but failed to sustain above, indicating high-volume decision-making zones by institutions and large players.

📉 Why this pattern keeps repeating:

Strong supply and demand concentration at this level.

Inability to break and hold shows market indecision.

Repeated fakeouts are likely used to shake out weak hands.

🔍 Important hidden scenario: Bear Trap Potential

If the price dips below the blue line but quickly reclaims it, it may form a bear trap, tricking short sellers into entering prematurely. This move could ignite strong bullish momentum from trapped sellers and renewed buyers.

🔮 If price holds above the blue line:

Signals market strength and potential bullish structure shift.

Targets:

109,800

117,200

120,000+ (Long-term)

📛 If support fails again:

Retracement toward the lower channel near 101,000 or lower is possible.

📊 Conclusion:

This zone is one of the most critical decision points in the current market. Traders should combine volume, candlestick behavior, and confirmation signals to avoid getting trapped by fake breaks

Wings of Opportunity: LINK’s Harmonic Setup Unfolding🦋 Title: A Butterfly on the Edge – But Only with Confirmation

On the 2H timeframe, a Bullish Butterfly Harmonic Pattern is unfolding. The wave structure (X → A → B → C → D) aligns closely with harmonic principles, and point D lies above X, within the 1.27 to 1.618 Fibonacci extension of XA — reinforcing the pattern’s validity.

📌 No entry has been triggered yet.

We are currently waiting for price to break and hold above the key resistance at 13.60 to confirm the bullish scenario.

🔹 Bullish Scenario (our primary and preferred outlook):

Given the strong reaction around the 12.74 demand zone and the harmonic structure completion, we are primarily focused on a long opportunity, if and only if confirmation is achieved above 13.60.

📥 Entry Zone: 13.05 – 13.65

🎯 Target 1: 17.94

🎯 Target 2: 18.76

🛑 Stop-Loss: Below 12.74 (structural invalidation)

🔻 Alternative Bearish Scenario:

If price fails to break 13.60 and instead loses the 12.74 support, the bullish setup becomes invalid, and the market could enter a deeper correction phase.

Potential downside targets in that case:

📉 11.80

📉 10.90 – 10.30 (if bearish momentum continues)

📊 Risk Management Notes:

Position sizing should not exceed 1% of total capital

Avoid early entries before confirmation

Prefer partial entries after breakout and retest

Stick to the invalidation level strictly

📈 While both scenarios are on the table, we are currently favoring the bullish setup, as long as price action supports it. Discipline and patience are key — confirmation first, trade second.

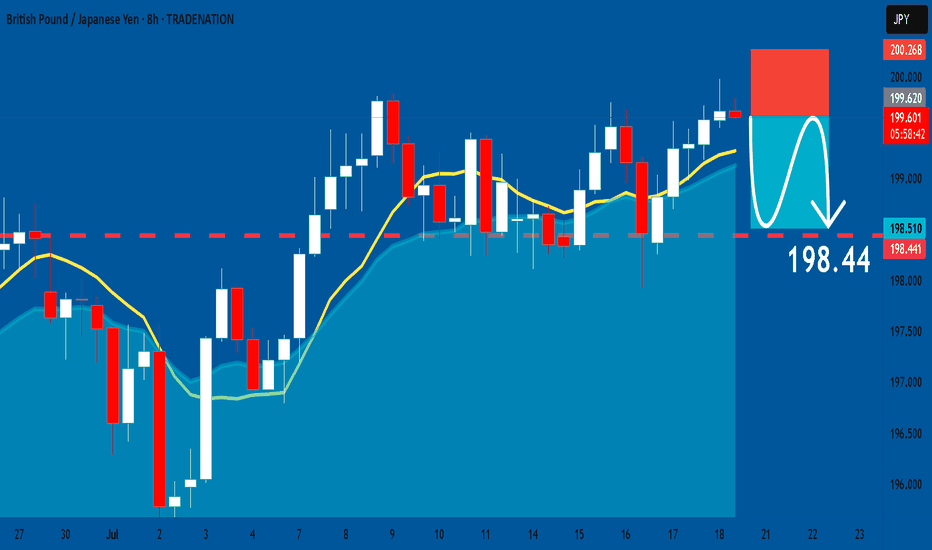

GBPJPY: Short Trading Opportunity

GBPJPY

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short GBPJPY

Entry - 199.63

Sl - 200.26

Tp - 198.44

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

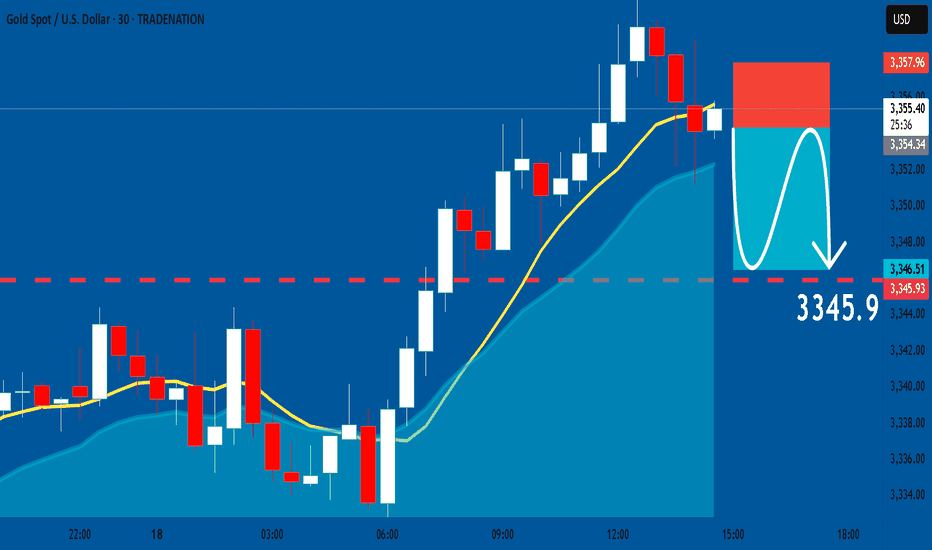

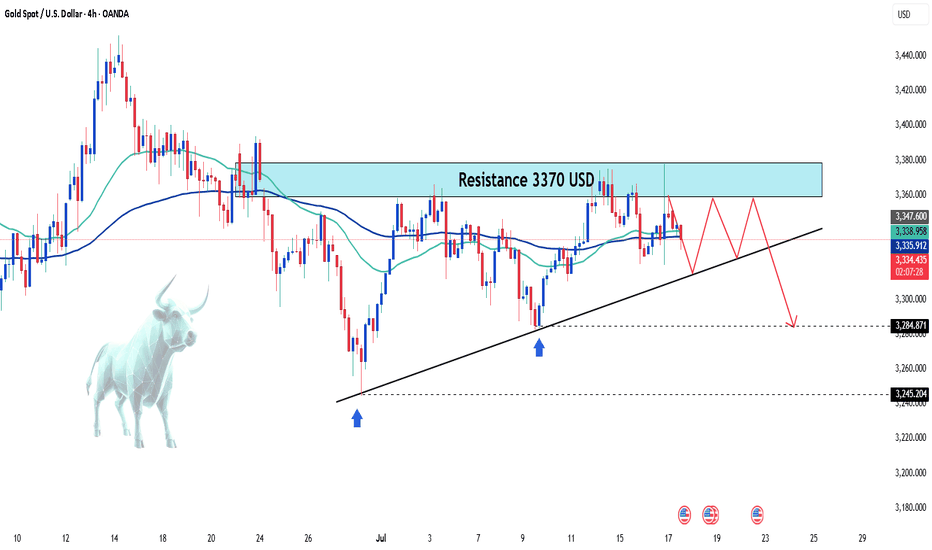

GOLD: Short Trade Explained

GOLD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry - 3354.53

Stop - 3357.9

Take - 3345.9

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURNZD On The Rise! BUY!

My dear friends,

EURNZD looks like it will make a good move, and here are the details:

The market is trading on 1.9481 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.9535

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

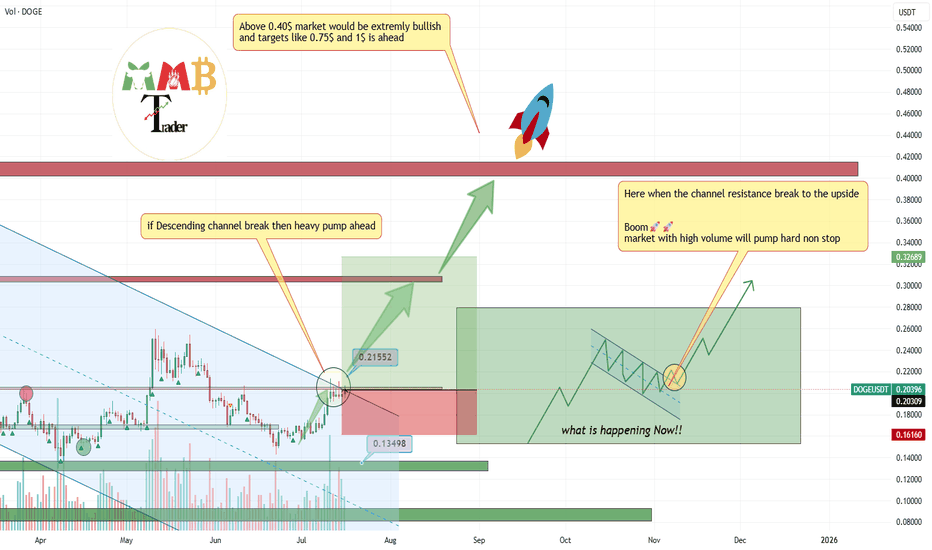

DOGEUSDT major breakout to the upside with at least 2x cookingThis breakout would be huge and it is happening now at least +60% gain is easy target so we put Take profit 1 there with our buy Setup which is 1:3(Risk:Reward).

Hope you all enjoy and it is time for BINANCE:DOGEUSDT to #pump this time and be a leader of MEME for weeks.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

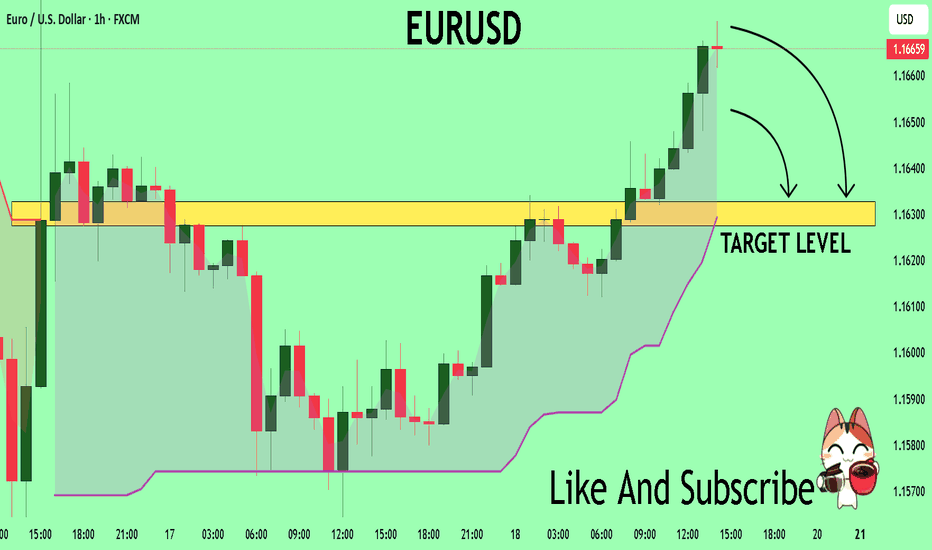

EURUSD Will Collapse! SELL!

My dear subscribers,

This is my opinion on the EURUSD next move:

The instrument tests an important psychological level 1.1663

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.1632

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

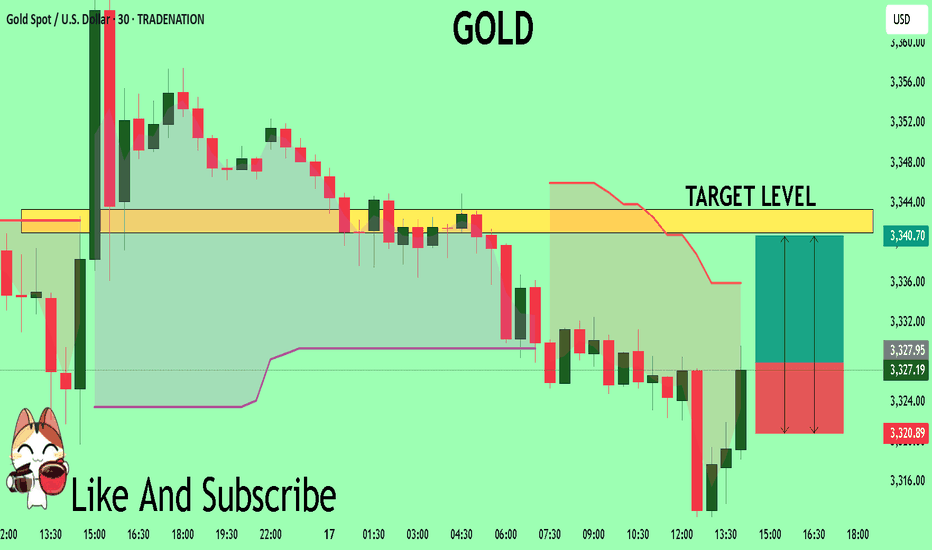

GOLD What Next? BUY!

My dear friends,

GOLD looks like it will make a good move, and here are the details:

The market is trading on 3328.1 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 3340.9

Recommended Stop Loss - 3320.8

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

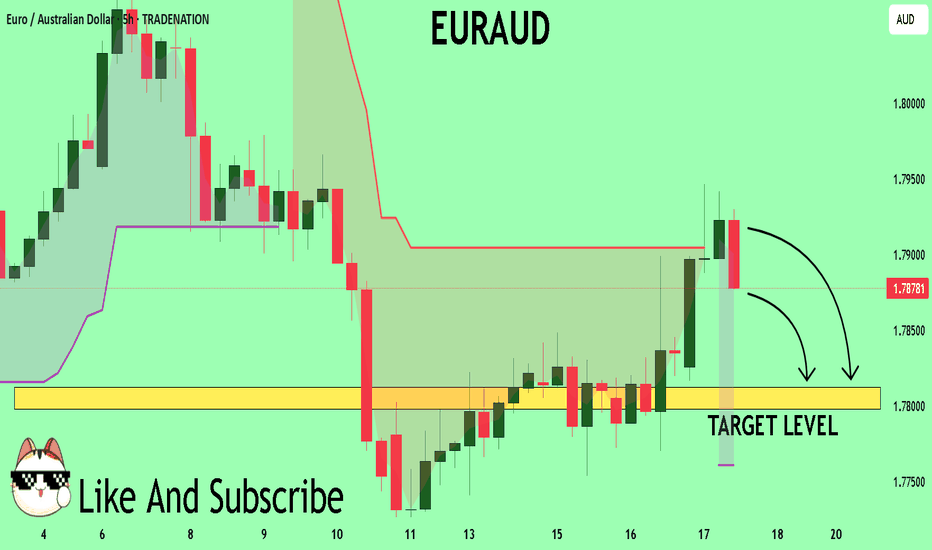

EURAUD Buyers In Panic! SELL!

My dear friends,

Please, find my technical outlook for EURAUD below:

The price is coiling around a solid key level - 1.7893

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.7812

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

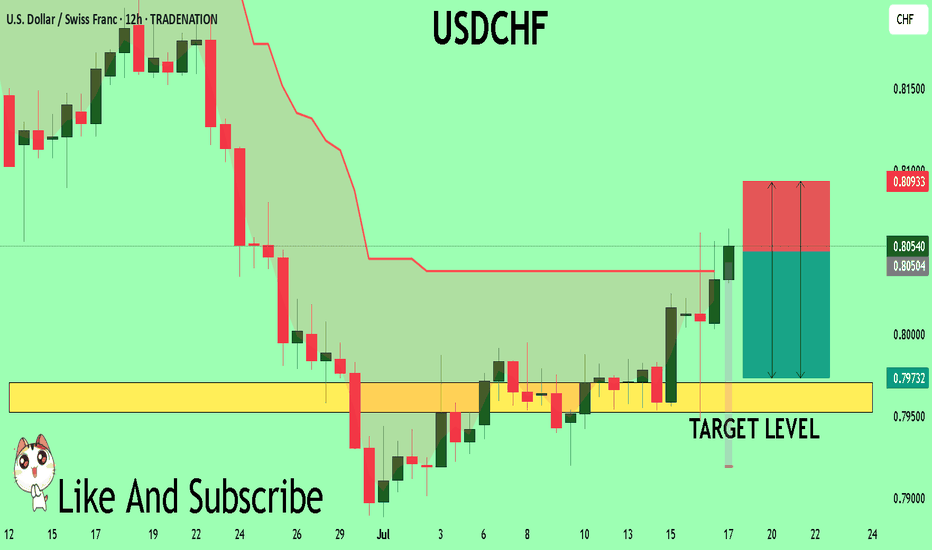

USDCHF The Target Is DOWN! SELL!

My dear followers,

I analysed this chart on USDCHF and concluded the following:

The market is trading on 0.8050 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.7970

Safe Stop Loss - 0.8093

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD long Lion SETUPhello everyone

the price is in a strong demand area

as liquidity has been withdrawn

and the fair value gap has been filled

but we are waiting for formation pattern on a smaller frame in order to enter an upward wave.

we also have resistance area

so in short. I expect an upside go upppp

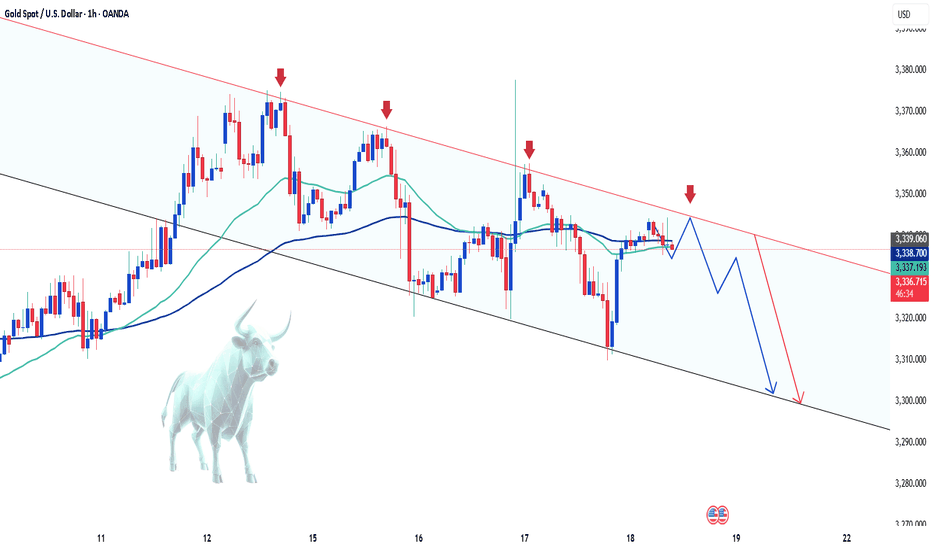

Gold's Short-Term Decline: What's Next?Hello everyone, what do you think about gold?

Today, gold continues its short-term downtrend. After new data was released at the end of yesterday’s trading session, the USD rose by 0.3%, and U.S. Treasury yields also increased, reducing the appeal of gold. Additionally, the latest unemployment claims data shows improvement in the U.S. economy, which has contributed to the drop in the precious metal.

As of writing, gold is trading around the EMA 34, 89 levels at 3,336 USD. With the recent news, the market is expected to maintain its current stance throughout the day, as no new significant updates are expected.

From a technical standpoint, the downtrend remains in place, with prices continuing to be capped below the trendline. The series of lower highs and lows could likely lead XAUUSD to test lower levels, with the possibility of reaching the 3,300 USD mark.

What do you think about the price of gold today? Let us know in the comments!

Latest Gold Price Update TodayGold prices today continue to maintain a short-term uptrend, driven by trade tensions and U.S. inflation data.

The weakening of the USD and the drop in U.S. Treasury yields have increased gold's appeal as a safe-haven asset. The trade tensions between the U.S. and the EU, along with new tariff measures, further boost the demand for gold.

Additionally, the U.S. PPI for June rose by 2.3%, lower than the forecast and May’s increase, suggesting that inflation could decrease in the future. The market expects the Fed to cut interest rates in September, weakening the USD and supporting gold's uptrend.

With factors like trade tensions, a weaker USD, and positive inflation data, gold prices may continue to rise. Investors need to closely monitor these factors to devise an appropriate strategy.

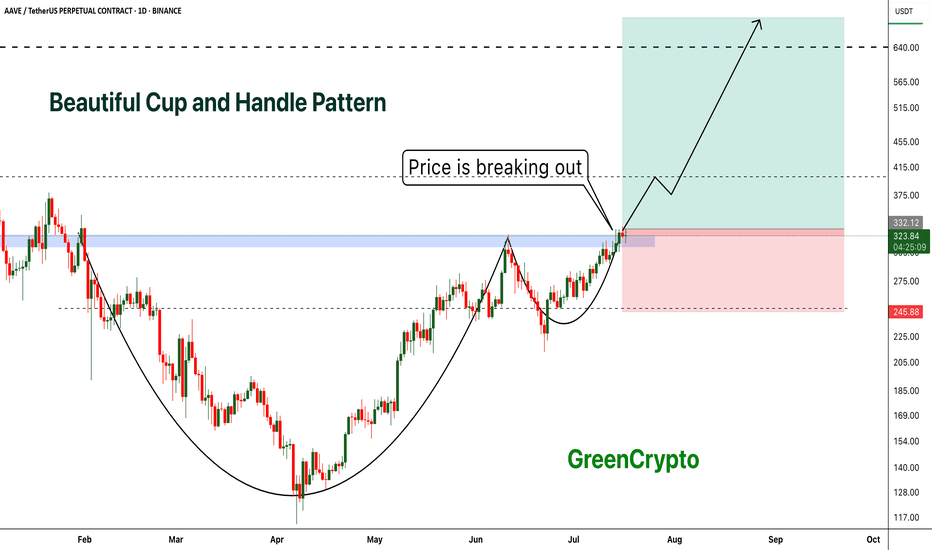

AAVE - Beautiful Cup and Handle Pattern Breakout- AAVE is breaking out from cup and handle pattern finally

- Cup and handle pattern breakout usually results in perfect trend continuation

- A huge long trade opportunity from this

Entry Price: 335 Above

Stop Loss: 245

TP1: 381.89

TP2: 429.16

TP3: 525.94

TP4: 628.78

TP5: 712.89

Max Leverage 5x:

Don't forget to keep stoploss

Cheers

GreenCrypto

ETH/BTC - Finally Trend is reversing - After a long time we are finally seeing a change in the trend of ETH/BTC pair.

- Compared to BTC, ETH was underperforming for last couple of years and we are seeing some strength in ETH

- If this trend continue we can finally see some new ATH on ETH

Entry: 0.02633

StopLoss: 0.02125

TP1: 0.02825

TP2: 0.03168

TP3: 0.03592

Don't forget to keep stop loss. Stay tuned for more updates

Cheers

GreenCrypto

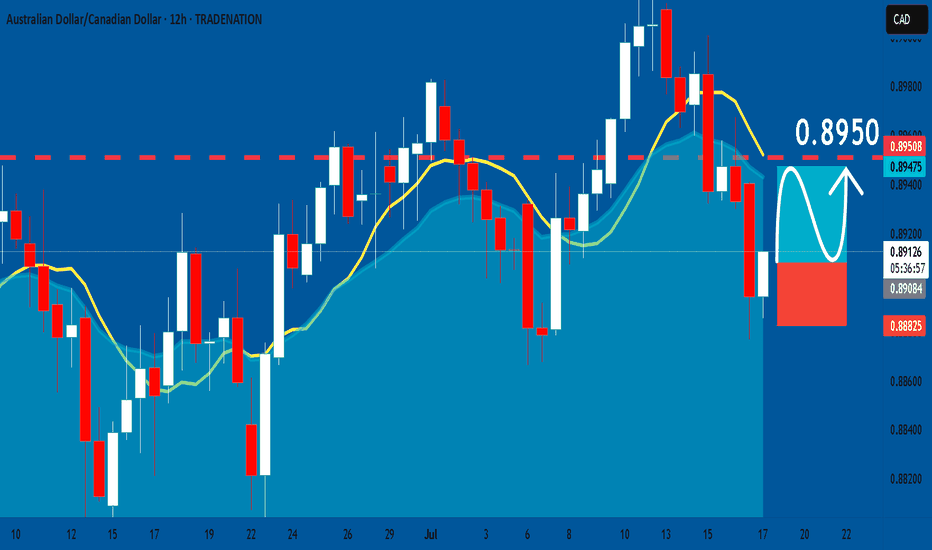

AUDCAD: Long Signal Explained

AUDCAD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long AUDCAD

Entry - 0.8908

Sl - 0.8882

Tp - 0.8950

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

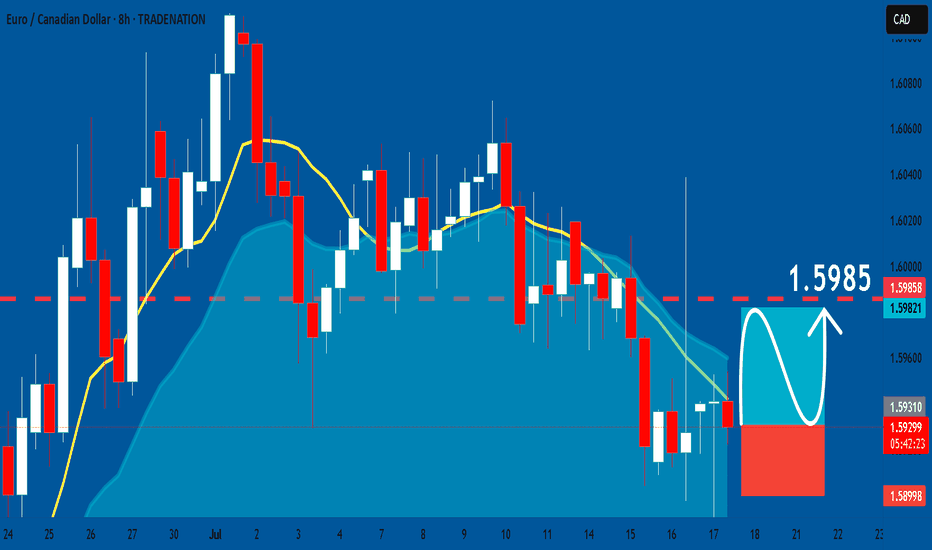

EURCAD: Long Signal with Entry/SL/TP

EURCAD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURCAD

Entry - 1.5929

Stop - 1.5899

Take - 1.5985

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

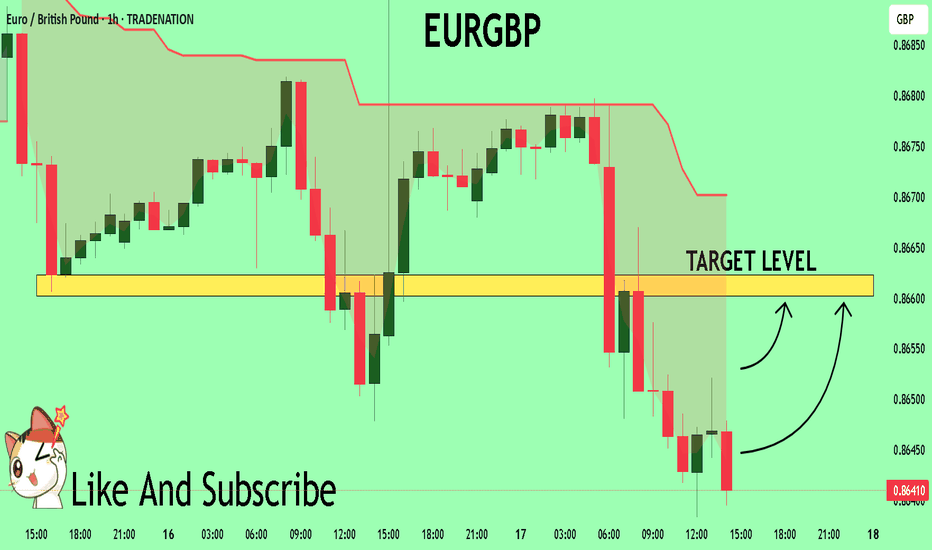

EURGBP Trading Opportunity! BUY!

My dear friends,

My technical analysis for EURGBP is below:

The market is trading on 0.8645 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.8660

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

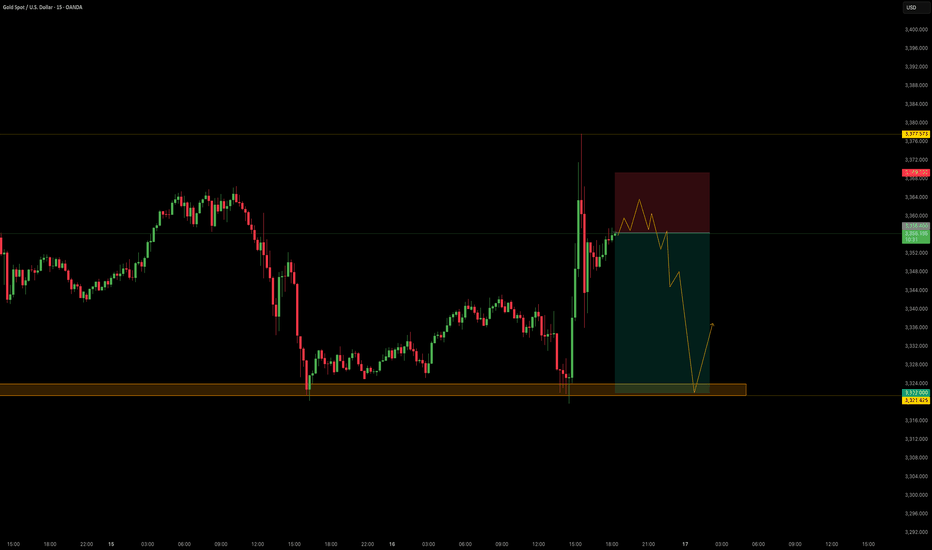

NordKern - XAUUSD InsightNordKern | Simplified Insight OANDA:XAUUSD Short Opportunity Ahead

Gold saw a sharp surge in price today, primarily driven by political headlines that temporarily shook market sentiment. To be specific:

📅 Jul 16, 2025 – 16:56 CET

CBS Reports: Trump asked Republican lawmakers whether he should fire Fed Chair Jerome Powell. This headline alone triggered an intraday spike of +$52/oz in gold as markets priced in increased macro and institutional risk.

As previously stated "Context Matters."

While the President cannot remove the Fed Chair without cause, even the suggestion introduces uncertainty and undermines confidence in the Fed’s independence especially ahead of a high-stakes election cycle.

However, further developments quickly followed: 📅 Jul 16, 2025 – 17:58 CET

Trump: “Firing Powell is highly unlikely.” 📅 Jul 16, 2025 – 18:06 CET

Trump: “Reports on me firing Powell are not true.” With this clarification, the initial rally appears overstretched and sentiment-driven, leaving room for a corrective pullback as the market digests the full picture.

Trade Setup - Short Bias

Parameters:

Entry: 3356.40

Stop Loss: 3690.30

Take Profit: 3322.00

Key Notes:

- The spike was headline-driven and not supported by policy shift or macro data.

- Trump’s denial removes much of the political risk premium that had been briefly priced in.

- Watch for momentum fading near resistance and confirmation via intraday structure.

This remains a tactically driven setup. Manage risk appropriately and stay alert for any renewed political developments.

EURJPY - Still Over-Bought!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURJPY has been overall bullish trading within the rising channel marked in blue. However, it is currently retesting the upper bound of the channel.

Moreover, the green zone is a major weekly supply.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper blue trendline and weekly supply.

📚 As per my trading style:

As #EURJPY approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

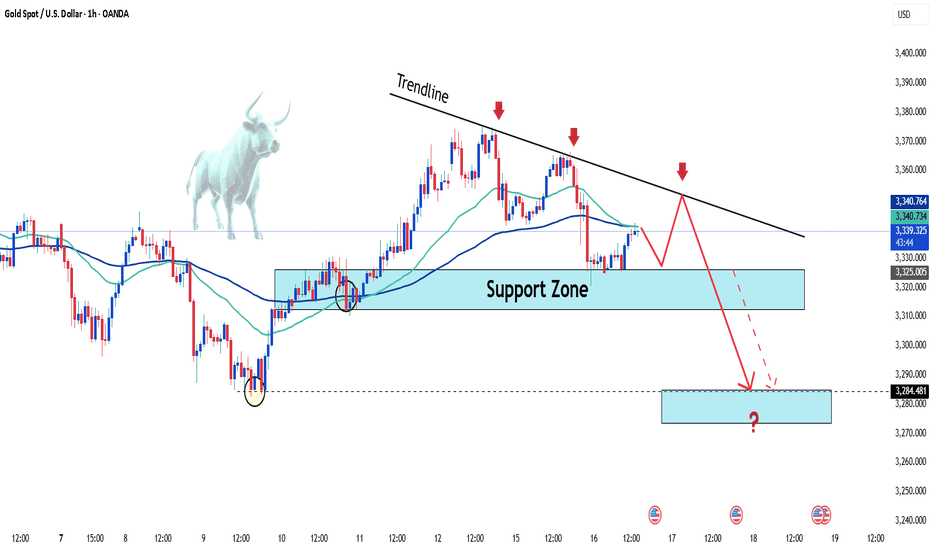

Gold's Downtrend: Is a Breakout Imminent?Hello traders, what do you think about the gold trend?

Let's set aside the news factors for now and focus on short-term technical analysis with a bearish outlook.

In the current technical picture, gold continues to trade below the trendline, lacking upward momentum, forming a descending wedge pattern. The behavior around the convergence of EMA 34 and 89 also indicates that sellers still control the market.

A sell strategy is favored, with attention to the support zone around 3,315 – 3,320 USD. If this level breaks, stronger sell-offs are likely to follow.

What do you think about gold’s price today? Leave your thoughts in the comments below!

Good luck!