Signal

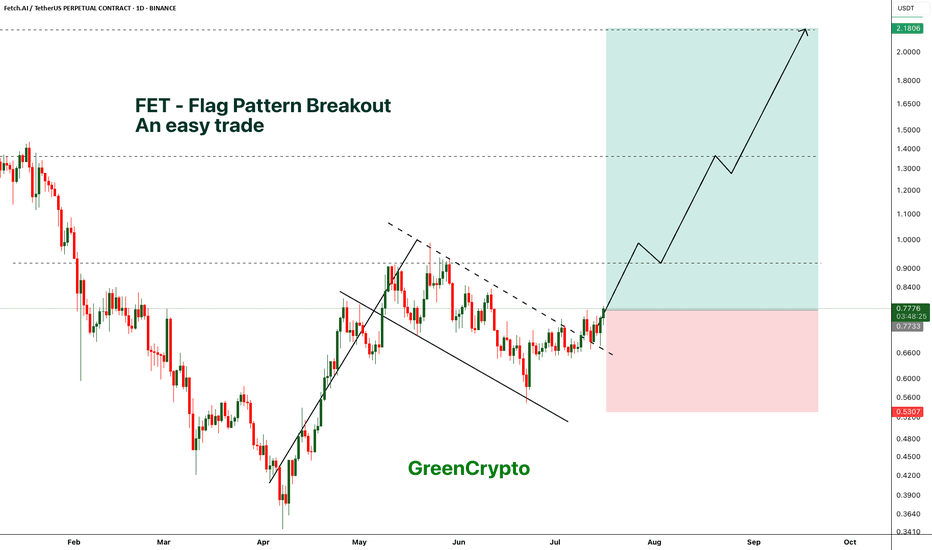

FET - Perfect trade for beginner- FET is breaking out from the flag pattern and we have clear and confirmed breakout

- most of the like flag pattern breakout succeeds, this gives a high confidence trade

Entry Price: 0.775 (current price)

Stop Loss: 0.5307

TP1: 0.9072

TP2: 1.1495

TP3: 1.3791

TP4: 1.7927

TP5: 2.1468

Max Leverage 5x

Don't forget to keep stoploss

Cheers

GreenCrypto

UAL United Airlines Holdings Options Ahead of EarningsIf you haven`t exited UAL before the recent selloff:

Now analyzing the options chain and the chart patterns of UAL United Airlines Holdings prior to the earnings report this week,

I would consider purchasing the 92.5usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $5.12.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

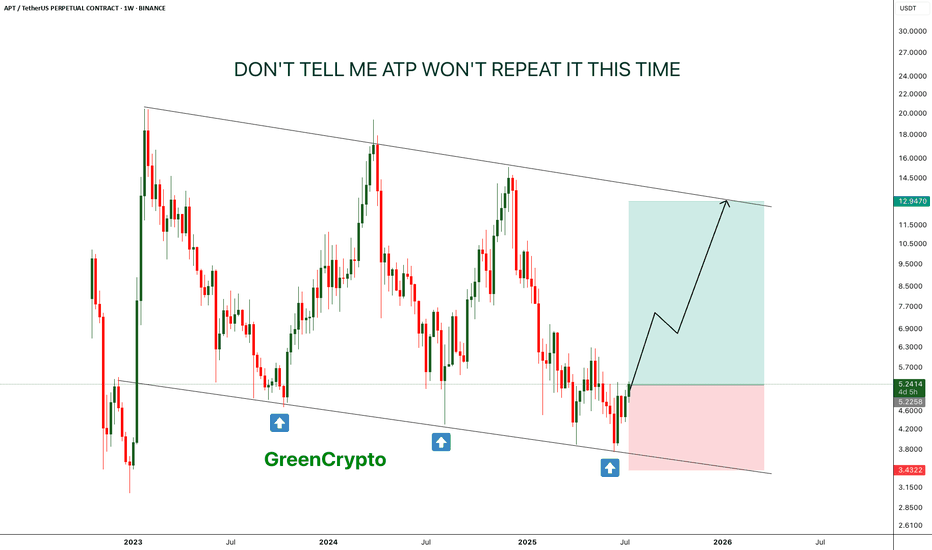

APT - Don't tell me this pattern won't repeat- This time is the charm, APT is is reversing from lower low on weekly chart.

- just like last two time, it is expect to forma new HL.

- there is a high chance that previous two patterns will repeat again

Entry Price: 5.22

Stop Loss: 3.4

TP1: 6.6632

TP2: 8.5059

TP3: 12.6945

Max Leverage: 5x

Don't forget to keep stoploss

Cheers

GreenCrypto

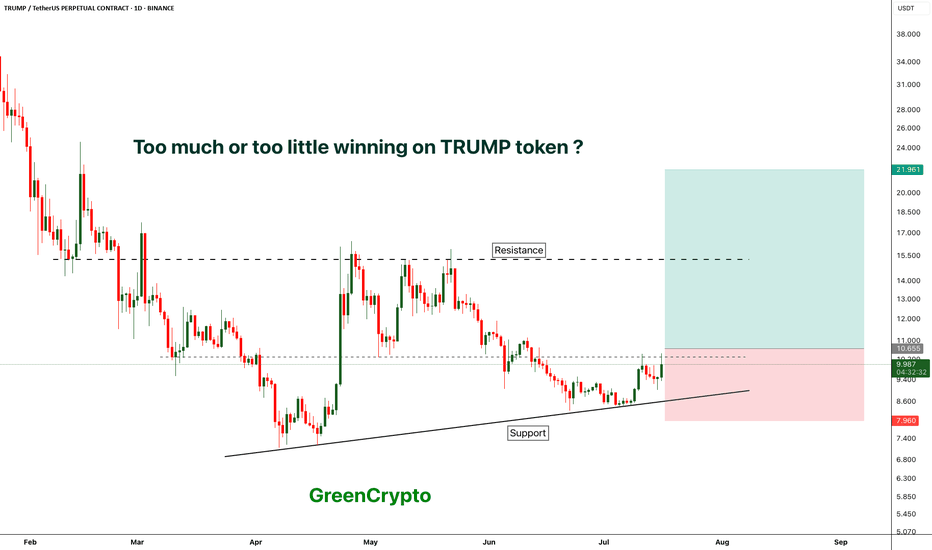

TRUMP - TOO MUCH WINNING ?Trump token is finally seeing some greens after hitting the bottom

currently price is trading near the local resistance.

We have long trade opportunity if the candle closes above local resistance.

Entry Price: Above 10.655

Stop Loss: 7.9

TP1:12.592

TP2: 15.218

TP3: 21.843

TP4++: Keep 20% of the position running with trailing stoploss.

Max Leverage: 5x

Don't forget to keep stoploss

Cheers

GreenCrypto

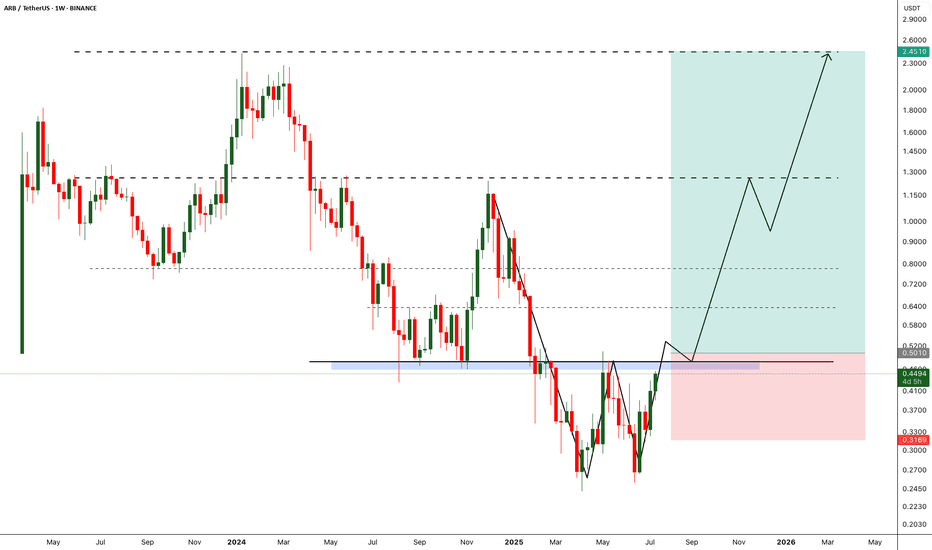

ARB - Breakout will break the market- Arbitrum is one of the fundamentally strong token on ETH L2.

- After back to back crashes finally we are seeing some reversal from the bottom

- A breakout from the local resistance would push the arb price further, we need to wait till the breakout to enter the trade.

Entry Price: 0.5010 (after breakout)

StopLoss: 0.3169

TP1: 0.6300

TP2: 0.7698

TP3: 1.2297

TP4: 1.7566

TP5: 2.3943

Max Leverage: 5x

Don't forget to keep stoploss

Cheers

GreenCrypto

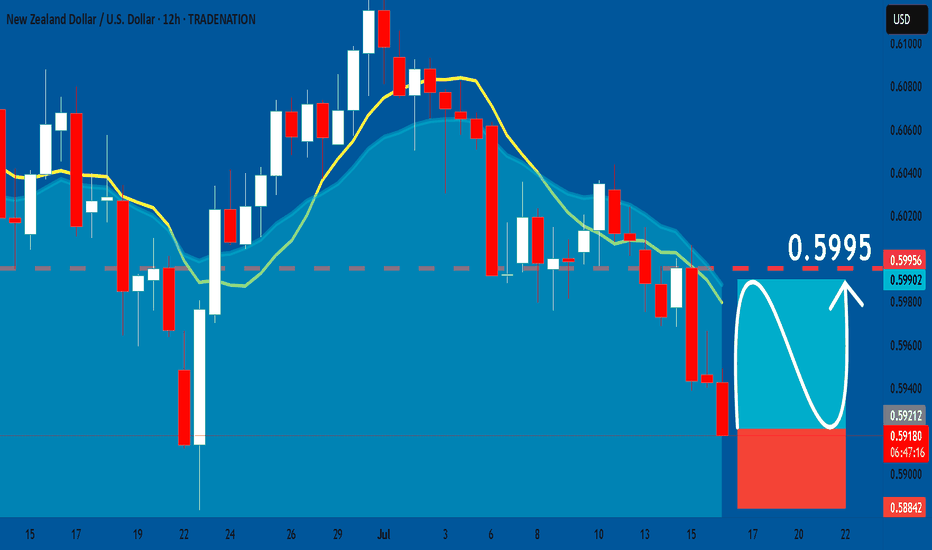

NZDUSD: Bullish Continuation & Long Signal

NZDUSD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long NZDUSD

Entry Point - 0.5922

Stop Loss - 0.5884

Take Profit - 0.5995

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

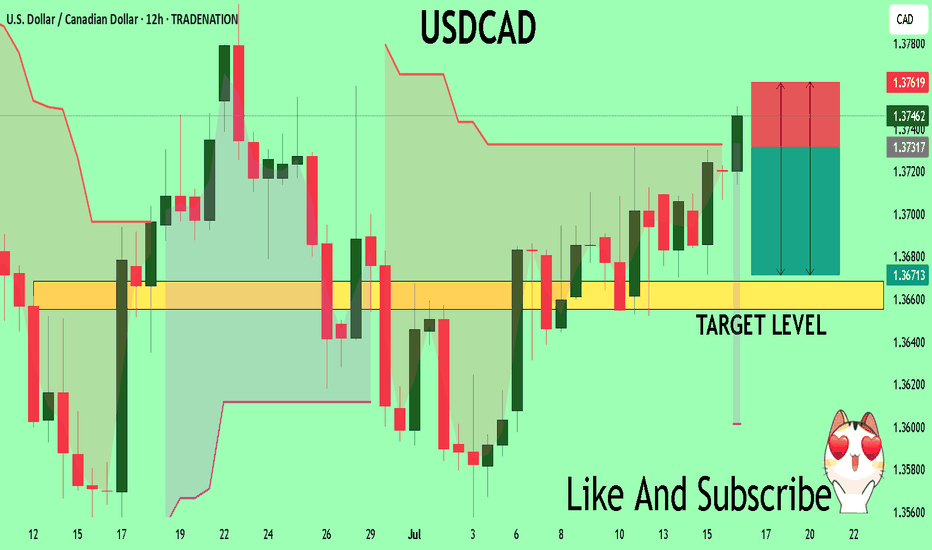

USDCAD Massive Short! SELL!

My dear subscribers,

This is my opinion on the USDCAD next move:

The instrument tests an important psychological level 1.3730

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.3668

My Stop Loss - 1.3761

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

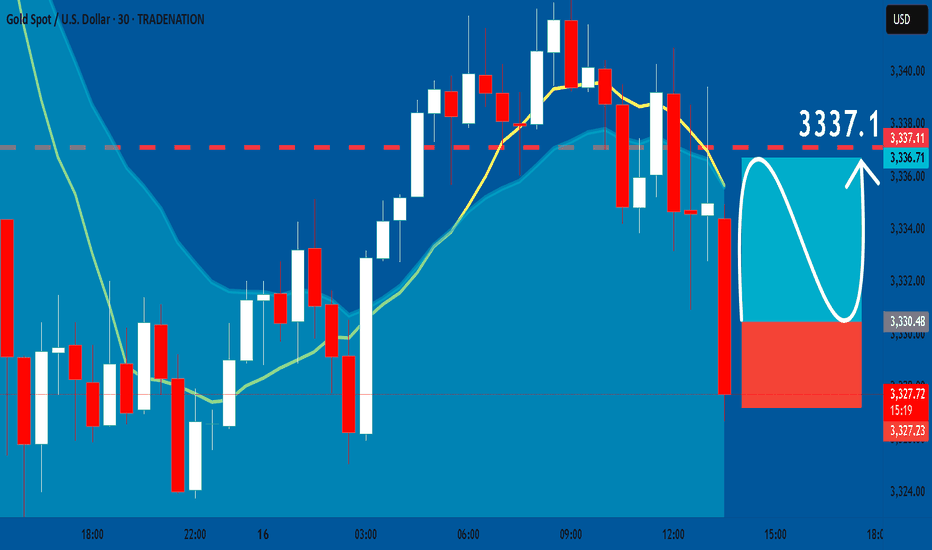

GOLD: Long Trading Opportunity

GOLD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy GOLD

Entry Level - 3330.3

Sl - 3327.23

Tp - 3337.1

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

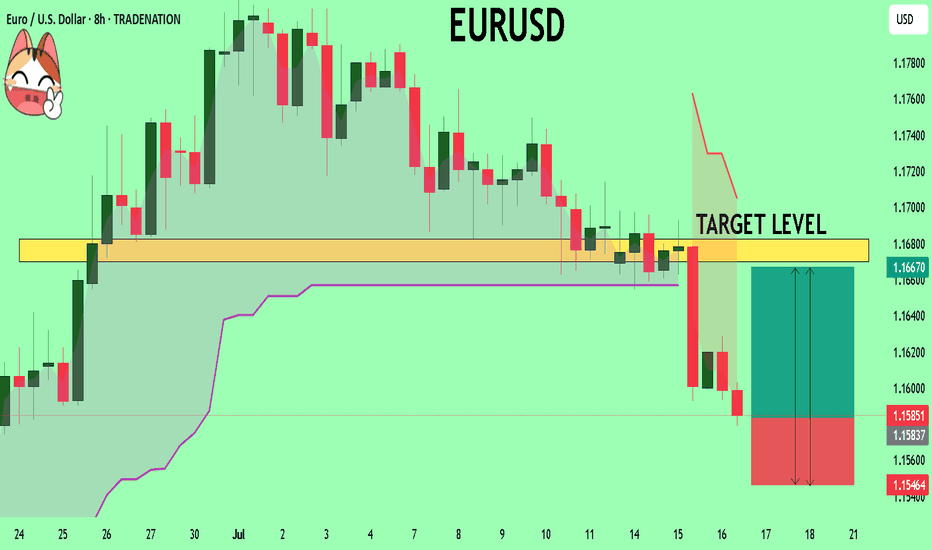

EURUSD My Opinion! BUY!

My dear friends,

Please, find my technical outlook for EURUSD below:

The price is coiling around a solid key level - 1.1584

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.1670

Safe Stop Loss - 1.1546

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

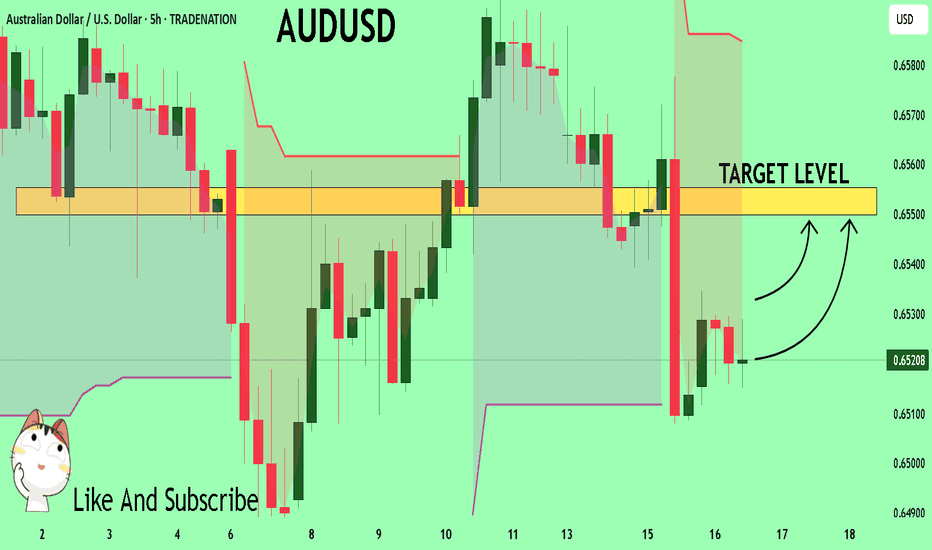

AUDUSD Set To Grow! BUY!

My dear subscribers,

AUDUSD looks like it will make a good move, and here are the details:

The market is trading on 0.6521 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.6550

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

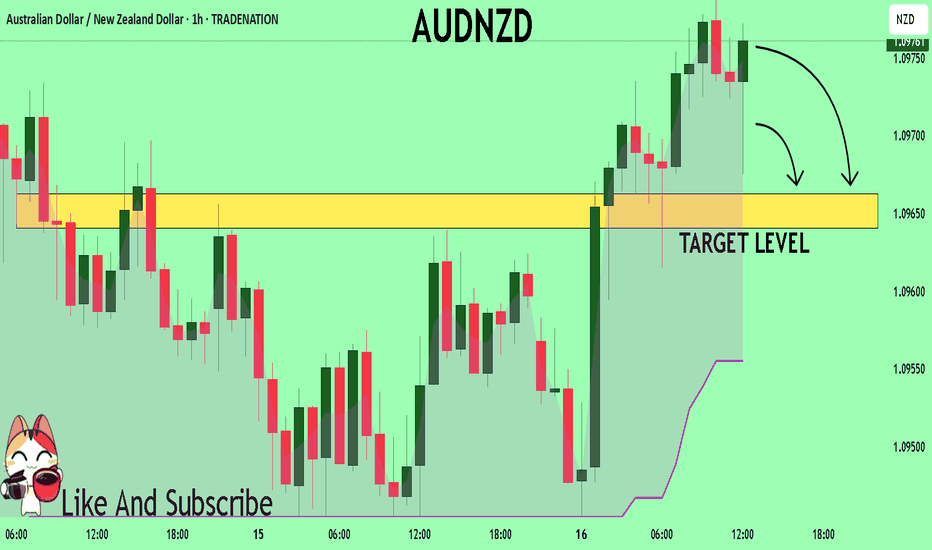

AUDNZD Under Pressure! SELL!

My dear followers,

This is my opinion on the AUDNZD next move:

The asset is approaching an important pivot point 1.0975

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 1.0966

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

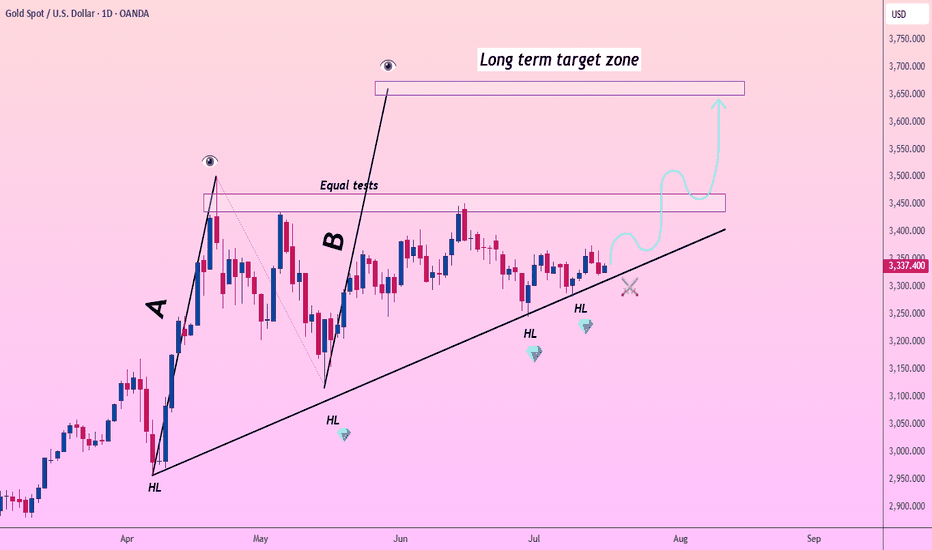

Lingrid | Gold ready to Make BoostOANDA:XAUUSD maintains a solid bullish structure with a clear series of higher lows (HLs) forming along the ascending trendline. After strong impulsive waves labeled A and B, price has repeatedly tested the resistance zone around 3450–3460, creating a double-top-like structure with equal tests. A confirmed close above 3460 would unlock the next leg higher in this ongoing uptrend.

📉 Key Levels

🔼 Buy trigger: Break and close above 3460

🟢 Buy zone: 3320–3340 (near HL and trendline)

🎯 Target: 3650–3700 (long-term breakout objective)

🚫 Invalidation: Drop below 3275 and trendline failure

💡 Risks

-Potential fakeout above 3460 without volume support

-Broadening consolidation range if breakout fails

-Macroeconomic catalysts (FOMC, CPI, geopolitical tensions)

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

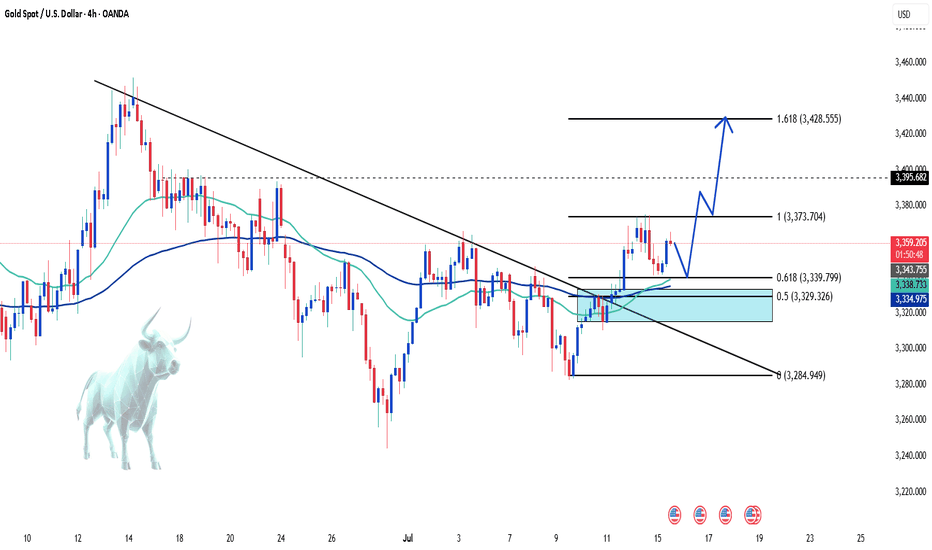

XAU/USD: Technical and News Signals Align for a Bullish Move💬 "When technicals and news align, traders can't ignore it."

Gold (XAU/USD) is at a critical juncture where both technical analysis and macroeconomic news are showing clear bullish signals. If you're waiting for a breakout, this might be the moment!

📊 Key Technical Analysis:

Gold bounced from a strong support zone at 3,339 – 3,329 (Fibo 0.618 & 0.5), confirming buying pressure.

EMA 34 crosses above EMA 89, signaling a potential trend reversal.

Breakout from the downtrend line opens up a target of 3,428 (Fibo extension 1.618).

Nearest resistance: 3,395 – if broken, a strong rally is likely.

🌐 Macroeconomic News Supporting the Bullish Trend:

The Fed may cut rates earlier than expected – USD weakens, benefiting gold.

Geopolitical tensions and financial instability in Europe increase demand for safe-haven assets.

US inflation cooling – market anticipates looser monetary policy.

Personal View:

If price breaks 3,395 with strong volume → long position, targeting 3,4xx.

Be cautious around resistance zones – short-term profit-taking could occur.

What do you think?

👉 Leave a comment, share your perspective or strategy – let’s ride the market wave together!

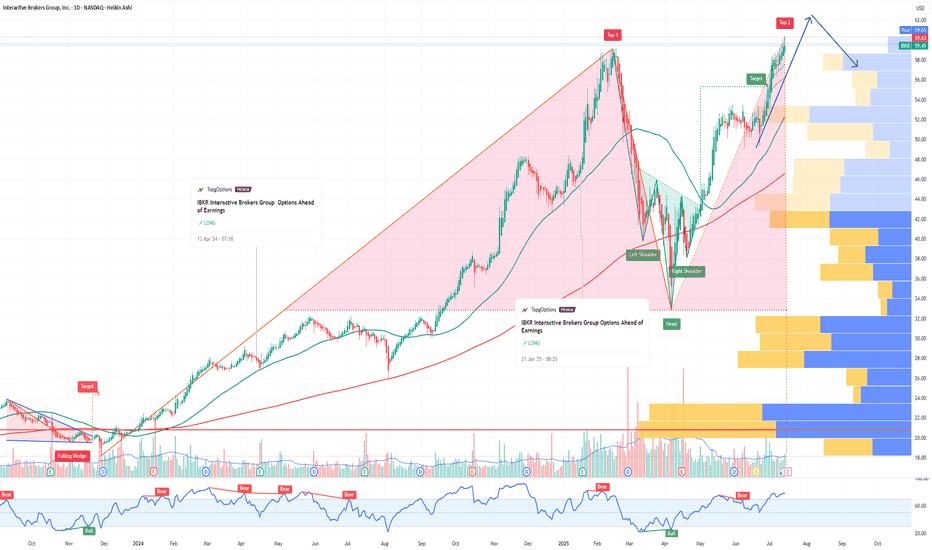

IBKR Interactive Brokers Group Options Ahead of EarningsIf you haven`t bought IBKR before the rally:

Now analyzing the options chain and the chart patterns of IBKR Interactive Brokers prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $3.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

COTI - Crazy Breakout Soooooon- COTI is trading inside the falling wedge pattern

- Price is currently nearing the resistance trendline,

- A clear breakout of this trendline will push the price higher

- we will enter a long trade after the breakout

Entry Price: 0.06696

Stop Loss: 0.03793

TP1: 0.07746

TP2: 0.10366

TP3: 0.14599

TP4: 0.25150

Don't forget to keep stoploss

Cheers

GreenCrypto

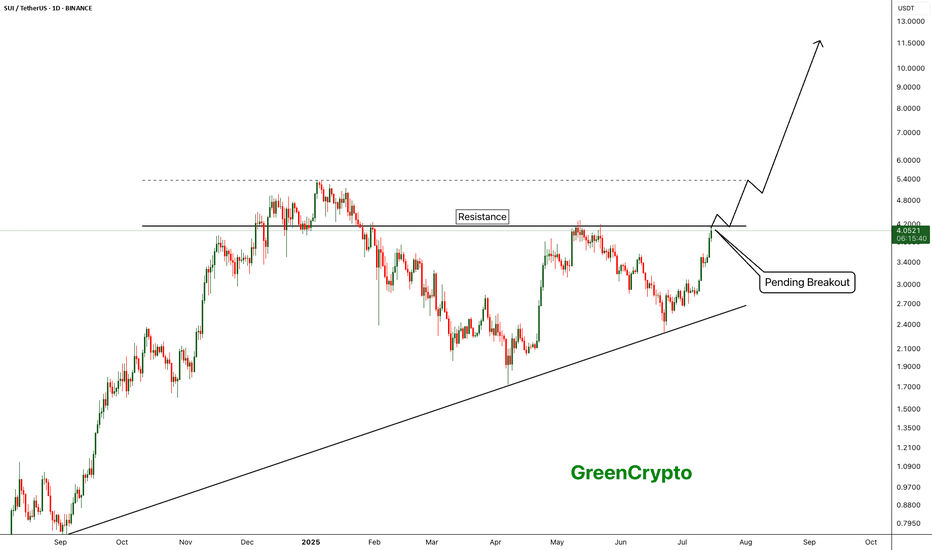

SUI - Breakout of the year- SUI is currently trading near the resistance line. Price was reject around this resistance line in the previous pump.

- Given the current bullish market, price is expected to breakout from this resistance easily

Entry Price: 4.04

StopLoss: 3.2

TP1: 4.5059

TP2: 5.3810

TP3: 6.5106

TP4: 7.8772

TP5: 10+

Don't forget to set stoploss.

Stay tuned for more updates

Cheers

GreenCrypto

CADCHF Sellers In Panic! BUY!

My dear friends,

CADCHF looks like it will make a good move, and here are the details:

The market is trading on 0.5811 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 0.5831

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD Will Explode! BUY!

My dear followers,

I analysed this chart on EURUSD and concluded the following:

The market is trading on 1.1686 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.1706

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPNZD: Long Trade Explained

GBPNZD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long GBPNZD

Entry - 2.2484

Sl - 2.2425

Tp - 2.2599

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPUSD Will Explode! BUY!

My dear friends,

My technical analysis for GBPUSD is below:

The market is trading on 1.3409 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.3535

Recommended Stop Loss - 1.3347

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD: Long Trade with Entry/SL/TP

EURUSD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURUSD

Entry - 1.1635

Stop - 1.1597

Take - 1.1708

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️