XRP is Back!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈XRP has been overall bullish from a medium-term perspective trading within the rising channel marked in blue.

Moreover, the green zone is a strong structure!

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #XRP approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Signal

LUMN Lumen Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of LUMN Lumen Technologies prior to the earnings report this week,

I would consider purchasing the 3.50usd strike price Calls with

an expiration date of 2025-5-30,

for a premium of approximately $0.41.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XYZ Block Options Ahead of EarningsIf you haven`t sold XYZ before the previous earnings:

Now analyzing the options chain and the chart patterns of XYZ Block prior to the earnings report this week,

I would consider purchasing the 58usd strike price Calls with

an expiration date of 2025-5-2,

for a premium of approximately $3.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RIOT Platforms Options Ahead of EarningsIf you haven`t bought RIOT before the previous earnings:

Now analyzing the options chain and the chart patterns of RIOT Platforms to the earnings report this week,

I would consider purchasing the 12usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $1.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XRP - Higher TF TA I had this TA about XRP in higher TF 2 days ago. ( Couldn't bublish it cause of an issue With TV last days ).

- those marks could give at least 4-5 % . For Long even moooore.

- Ichimoku 4H and lower TF is bullish.

Now: POC gave us 5 % 🎯 👌

Here Both TA with several lines and aspects:

Follow for more ideas/Signals.💲

Check out my previous TA/Signals which played out nicely. :)

Just donate some of your profit to Animal rights or other charity :)✌️

SOL - PERFECT Levels still played out.18th April i published a SOL TA/Signal and updated it through days.

Those given Levels played out again and again and have some nice profits.

Days ago : "We are ready to short below POC or long above hVn or loc Daily :)"

Look how those 3 Levels played out nicely. Even with nice retests.

loc-D and 2x hVn. 🎯 👌

5-6 Trades though days ...

Look at all previous SOL TA and more important at that TA about Alts days ago to understand the levels and lines.

Alts TA:

previous SOL Signal:

Follow for more ideas/Signals.💲

Check out my previous TA/Signals which played out nicely. :)

Just donate some of your profit to Animal rights or other charity :)✌️

NZDJPY: Short Signal with Entry/SL/TP

NZDJPY

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell NZDJPY

Entry Level - 85.689

Sl - 86.057

Tp - 85.033

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUDCHF On The Rise! BUY!

My dear friends,

Please, find my technical outlook for AUDCHF below:

The price is coiling around a solid key level - 0.5250

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 0.5282

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCAD Buyers In Panic! SELL!

My dear subscribers,

My technical analysis for GBPCAD is below:

The price is coiling around a solid key level - 1.8563

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.8412

My Stop Loss - 1.8655

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDJPY What Next? BUY!

My dear subscribers,

NZDJPY looks like it will make a good move, and here are the details:

The market is trading on 84.472 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 84.990

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCAD Sellers In Panic! BUY!

My dear friends,

My technical analysis for EURCAD is below:

The market is trading on 1.5585 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.5728

Recommended Stop Loss - 1.5506

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD: Bullish Continuation & Long Trade

GOLD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long GOLD

Entry - 3219.9

Sl - 3207.5

Tp - 3246.2

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

TIA - Some Major LevelsTIA, i would call it for more Short purposes, but market sentiment can change really quickly.

If you wanna be on safer side, then trade it on retest of those levels.

12h: Bigger TL as R on Chart and on OBV.

1: Below an overview of Lines of 1h OBV.

Follow for more ideas/Signals.💲

Check out my previous TA/Signals which played out nicely. :)

Just donate some of your profit to Animal rights or other charity :)✌️

CHFJPY My Opinion! SELL!

My dear friends,

CHFJPY looks like it will make a good move, and here are the details:

The market is trading on 174.67 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 173.76

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BANK - TA/signal played out good. Still tradable.I had this idea/trade before my eyes 2 days Ago.

I was going for a small Spot Buy on marked Level.

Spot because: I don't Trade the new coins with leverage.

Boom over 12% up to Fib 🎯👌😎

Original TA 2 days ago:

Follow for more ideas/Signals.💲

Check out my previous TA/Signals which played out nicely. :)

Just donate some of your profit to Animal rights or other charity :)✌️

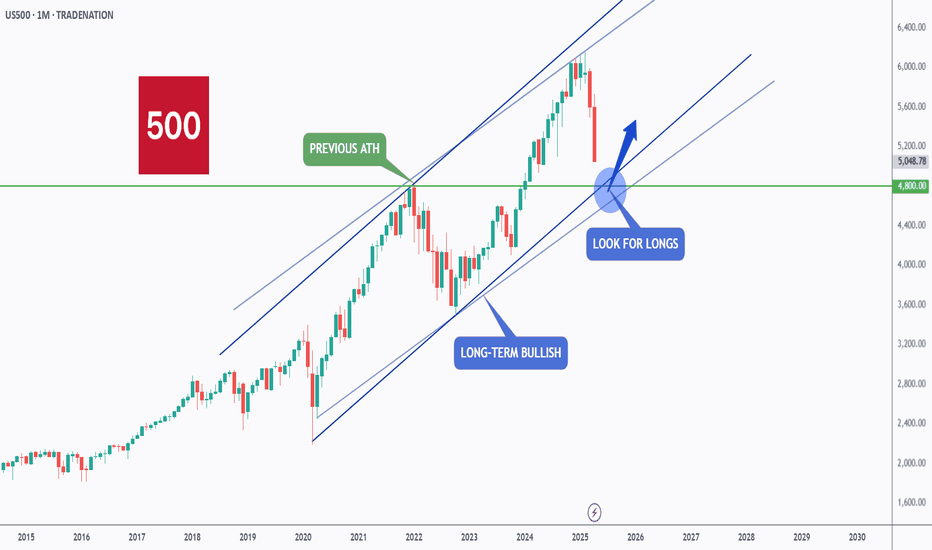

US500 - Long-Term Long!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈US500 has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting its previous all-time high at $4,800 and round number $5,000.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of previous ATH and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #US500 approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD Massive Short! SELL!

My dear followers,

I analysed this chart on GBPAUD and concluded the following:

The market is trading on 2.0992 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 2.0899

Safe Stop Loss - 2.1039

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCAD: Free Trading Signal

EURCAD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURCAD

Entry - 1.5687

Stop - 1.5644

Take - 1.5778

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUDNZD: Short Signal Explained

AUDNZD

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short AUDNZD

Entry - 1.0768

Sl - 1.0795

Tp - 1.0722

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CADCHF Trading Opportunity! BUY!

My dear friends,

My technical analysis for CADCHF is below:

The market is trading on 0.5947 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.5955

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD The Target Is DOWN! SELL!

My dear friends,

Please, find my technical outlook for GOLD below:

The instrument tests an important psychological level 3307.3

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 3292.2

Recommended Stop Loss - 3314.4

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK