NZDUSD Will Collapse! SELL!

My dear friends,

My technical analysis for NZDUSD is below:

The market is trading on 0.5997 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target -0.5855

Recommended Stop Loss - 0.6073

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Signal

GBPAUD Will Explode! BUY!

My dear friends,

Please, find my technical outlook for GBPAUD below:

The instrument tests an important psychological level 2.0776

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 2.0844

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

ETH - Those levels played out perfectly. I had given ETH TA days ago and updated it again and again.

Now: Look how those level played out nicely.

after a weekend and Easter days full of volatility

void level and last low was rejected very clearly and bullish Divergence in CVD.

Price came up above our 4h key level and went above last highs upper blue TL.

Here was a clear Entry for Long: Above blue TL, AVWAP and OBV structure was broken clearly.

to the POC : 5.5 % 🎯 👌

Look at previous ETH TA and more important at that TA about Alts 2 days ago:

Alts TA:

ETH TA:

Follow for more ideas/Signals.💲

Just donate some of your profit to Animal rights or other charity :)✌️

Beautiful TA played out. That was initiation for many Alt LONGsLook at this TA from 2 days ago, then you will understand my Alt LONGs.

Despite BTC D. made higher highs, but Alts moved up too.

7.5 % till now🎯 👌 😎

In Update, I will paste the Alts LONGs ;).

Original TA from 2 days ago:

Follow for more ideas/Signals.💲

Just donate some of your profit to Animal rights or other charity :)✌️

EURCHF: Short Trade with Entry/SL/TP

EURCHF

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short EURCHF

Entry - 0.9389

Sl - 0.9438

Tp - 0.9296

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURNZD What Next? BUY!

My dear subscribers,

This is my opinion on the EURNZD next move:

The instrument tests an important psychological level 1.9047

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.9308

My Stop Loss - 1.8907

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCHF Set To Fall! SELL!

My dear friends,

Please, find my technical outlook for GBPCHF below:

The price is coiling around a solid key level - 1.0950

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.0844

Safe Stop Loss - 1.1013

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD The Target Is UP! BUY!

My dear subscribers,

My technical analysis for EURUSD is below:

The price is coiling around a solid key level - 1.1418

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.1465

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTC - Bullish Control, Confirmed!Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

🚀 As per my last two setups (highlighted on the chart), BTC rejected the $72,000 support and pushed higher with strength.

📈 This week, BTC broke above the $90,000 structure, confirming a shift in momentum from bearish to bullish.

🟢 For the bulls to stay in control, a break above the $95,200 resistance is still needed.

📊 In the meantime, as BTC retests the $89,000–$90,000 zone, we’ll be looking for medium-term trend-following longs to catch the next impulsive move.

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

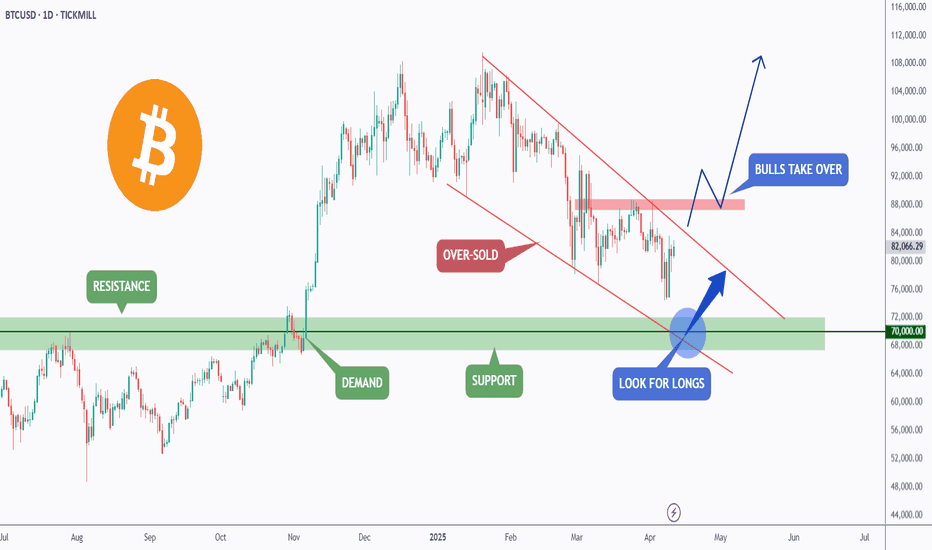

BTC - Two Bullish Scenarios...Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

📉 BTC has been overall bearish, trading within the falling channel marked in red.

The $70,000 area is a key confluence zone — it aligns with the lower red trendline, horizontal support, a psychological round number, and a potential demand zone.

📚 According to my trading style:

As #BTC approaches the blue circle zone, I’ll be looking for bullish reversal setups — such as a double bottom pattern, trendline break, and more.

🏹In parallel, for the bulls to take over long-term, and shift the entire trend in their favor, a break above the last major high marked in red at $88,888 is needed!

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

xauusd what is happening?Gold (XAU/USD) Market Overview – April 22, 2025

🧨 Geopolitical & Trade Tensions

Ongoing US-China trade disputes and President Trump’s tariff policies continue to amplify uncertainty.

Market chatter on platforms like X (formerly Twitter) reflects investor anxiety over potential global trade disruptions, increasing gold’s appeal as a safe-haven asset.

💵 US Dollar Dynamics

The US dollar remains weak, partly due to Trump’s continued criticism of Fed Chair Jerome Powell and his calls for rate cuts.

A weaker dollar supports gold by making it more attractive to international investors.

🏦 Institutional & Central Bank Demand

Strong ETF inflows: Over 23 tonnes added in a single session, suggesting large-scale accumulation.

Central banks, particularly China, continue adding gold to reserves—contributing to bullish long-term sentiment.

🧯 Macro Environment

Persistent inflation concerns and dovish central bank policies are reinforcing gold's status as an inflation hedge.

Markets await US retail sales data and Fed Chair Powell’s speech, which could introduce volatility or direction.

📊 Technical Analysis of XAU/USD @ $3,424

📈 Trend & Chart Structure

Gold is trading in a well-defined ascending channel, with a recent breakout above $3,400 confirming bullish structure.

However, the presence of a rising wedge pattern and overbought conditions warns of a potential short-term correction.

🔐 Key Support & Resistance Levels

Type

Level

Notes

Support 1

$3,400

Psychological level & prior breakout point

Support 2

$3,320–$3,325

Fibonacci zone and fair value gap

Support 3

$3,296–$3,284

April 18 low; deeper support

Resistance 1

$3,445

Immediate resistance

Resistance 2

$3,500

All-time high; psychological milestone

Long-term

$3,550–$3,637

Medium-term upside targets

📟 Indicators & Volume Analysis

RSI: >70 on short-term charts → Overbought, suggesting risk of pullback.

MACD: Bullish crossover intact, but declining momentum is a caution flag.

Moving Averages:

Price is well above the 30-EMA ($3,265) and 200-EMA ($3,163) — strongly bullish.

Volume: Recent rally on declining volume = possible divergence, implying weakening buying strength.

📌 Trading Scenarios

✅ Bullish Case

If XAU/USD holds above $3,400 and breaks $3,445, next targets = $3,500 → $3,550 → $3,600.

Entry: Wait for a pullback to $3,400–$3,405 or bullish confirmation (e.g., bullish engulfing candle, rising volume).

Stop Loss: Below $3,390

Rationale: Strong uptrend + safe-haven flows + USD weakness = sustained bullish bias.

🚫 Bearish Case

If price breaks below $3,400 with momentum, correction toward $3,325 or $3,296 is likely.

Entry: Below $3,400 after confirmation (e.g., high-volume bearish candle)

Stop Loss: Above $3,430

Rationale: Overbought RSI + volume divergence → short-term profit-taking or macro catalyst risk.

📈 Volatility Note

Recent daily swings around 2.25% — use tight stop-losses and risk/reward ≥ 1:2.

📅 Key Events to Watch

US Retail Sales Data

Fed Chair Powell’s Speech

US-China trade news

Dollar index (DXY) movement

📅 Medium-Term Outlook (1–3 Months)

Projected move toward $3,600+ remains valid due to:

Global uncertainty

Persistent inflation

Central bank buying

Key swing support: $3,137

Upside resistance: $3,500 → $3,600

⚠️ Risks & Reversals

Risk Factor

Impact on Gold

US-China Trade Deal

↓ Demand (safe-haven outflows)

Strong US Economic Data

↑ Dollar → ↓ Gold

Hawkish Fed Comments

↓ Gold

Continued Overbought Status

Pullback/Cool-off likely

🎯 Conclusion

Gold (XAU/USD) is in a strong long-term uptrend, currently consolidating near $3,424. While bullish fundamentals support a move toward $3,500–$3,600, technical overbought signals and volume divergence suggest caution in the short term.

#xauusd #gold #usd #tariff #tradingview

SUI - HOLD / POTENTIAL LONGAnalyzing SUI/USDT on the 4H chart, I see a clear breakout from a descending wedge — a classic bullish reversal pattern. The price has broken through the resistance line with volume, suggesting early momentum shift.

This zone might be the beginning of a bigger move. I’m personally considering this coin for a mid-term hold, with potential to scale into a long if confirmation continues.

CHFJPY Massive Long! BUY!

My dear subscribers,

My technical analysis for CHFJPY is below:

The price is coiling around a solid key level - 173.75

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 174.91

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CMCSA Comcast Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CMCSA Comcast Corporation prior to the earnings report this week,

I would consider purchasing the 37.5usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $1.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

EURUSD: Target Is Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.14656 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 1.14432..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

NZDJPY - Following the Bears...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈From a long-term perspective, NZDJPY has been overall bearish trading within the falling wedge pattern in red.

Moreover, the orange zone is a strong supply.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper red trendline and supply.

📚 As per my trading style:

As #NZDJPY approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCAD: Bearish Continuation & Short Signal

EURCAD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell EURCAD

Entry - 1.5898

Stop - 1.5970

Take - 1.5735

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPCAD: Short Trading Opportunity

GBPCAD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short GBPCAD

Entry Point - 1.8517

Stop Loss - 1.8601

Take Profit - 1.8348

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USOIL Technical Analysis! SELL!

My dear followers,

This is my opinion on the USOIL next move:

The asset is approaching an important pivot point 63.68

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 61.56

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDCAD Will Explode! BUY!

My dear friends,

My technical analysis for USDCAD is below:

The market is trading on 1.3840 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.3958

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK