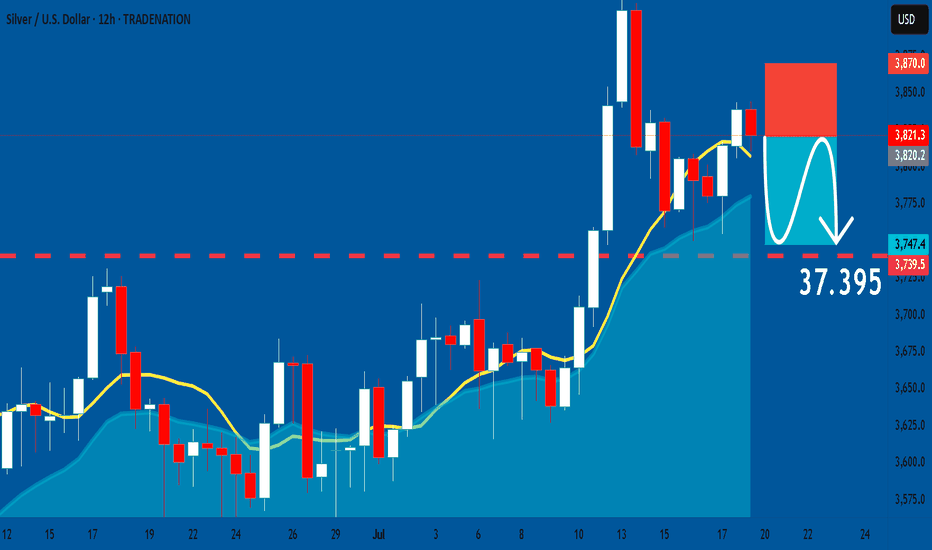

SILVER: Short Trade with Entry/SL/TP

SILVER

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short SILVER

Entry Point - 38.213

Stop Loss - 38.700

Take Profit - 37.395

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Signal

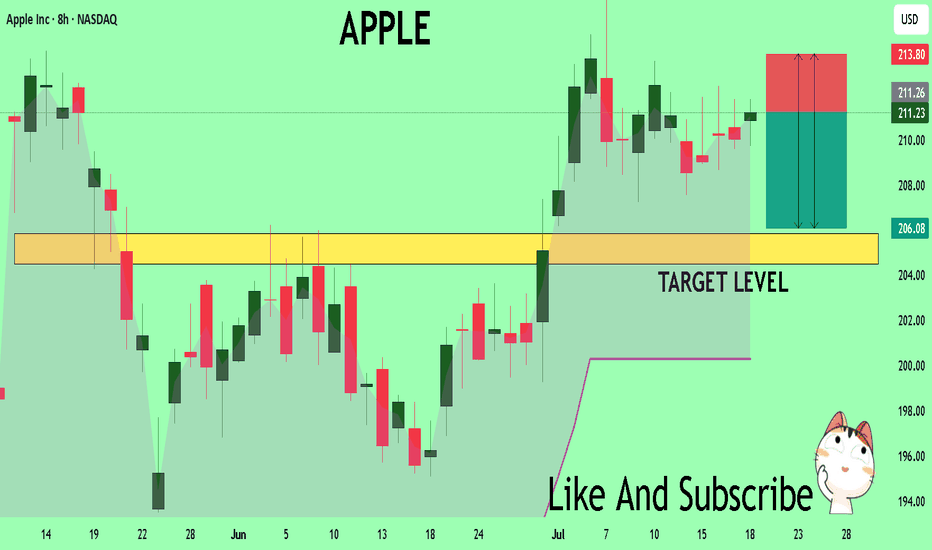

APPLE A Fall Expected! SELL!

My dear friends,

My technical analysis for APPLE is below:

The market is trading on 211.18 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probableBearish continuation.

Target - 205.87

Recommended Stop Loss - 213.80

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

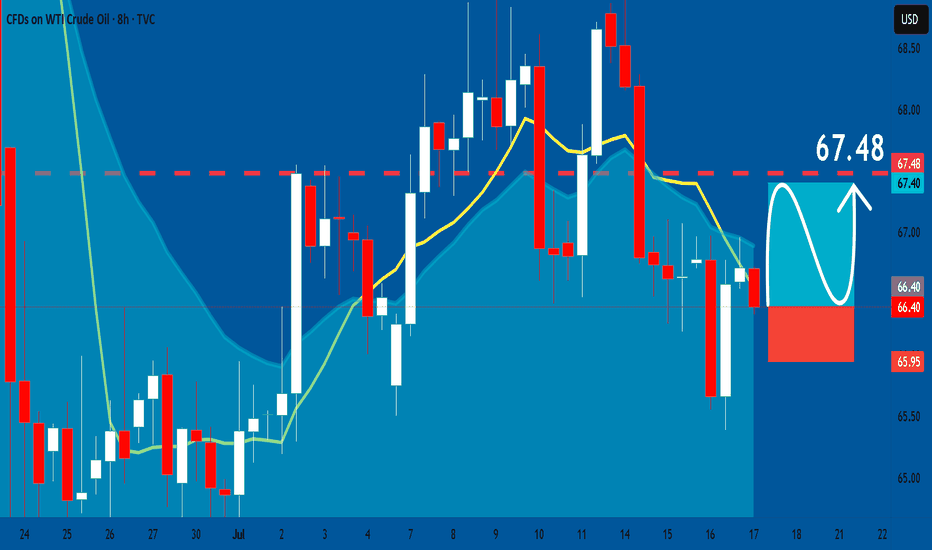

USOIL: Bullish Continuation & Long Trade

USOIL

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy USOIL

Entry - 66.40

Stop - 65.95

Take - 67.48

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

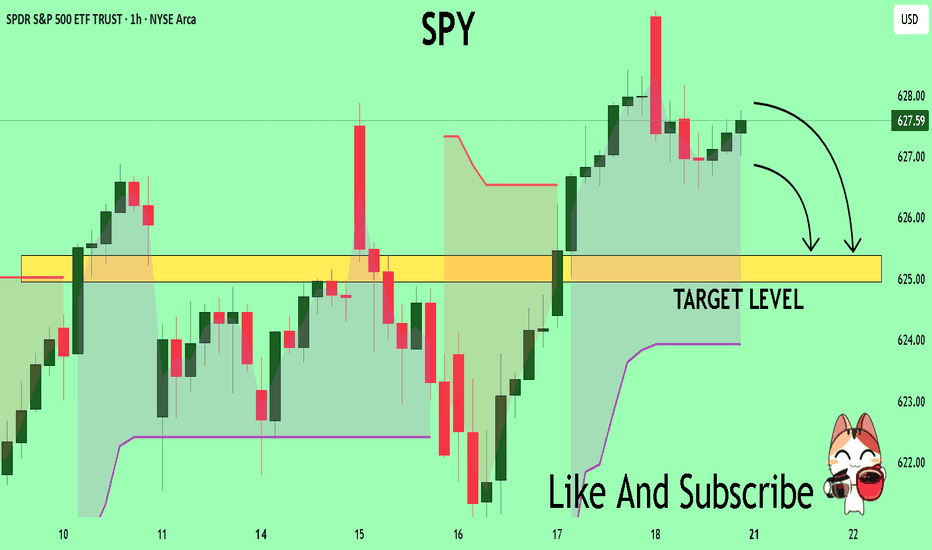

SPY What Next? SELL!

My dear friends,

Please, find my technical outlook for SPY below:

The instrument tests an important psychological level 627.59

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 625.38

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Time to Peel Some Gains — BananaUSDT Ripening at the Midline

📈 Technical Overview:

BananaUSDT is currently testing the midline of the descending channel. A confirmed breakout above this level could trigger a bullish move toward the top of the channel, which aligns with our secondary target. Until the breakout is validated, the price may continue to range within the current structure.

🔸 Watchlist Status:

Setup is not confirmed yet — keep this on your watchlist and wait for a clear breakout above the midline.

📍 Next resistance: Top of the channel

📍 Invalidation: Rejection at midline or breakdown below recent support

📉 Risk Management:

Enter only after confirmation, and risk no more than 1% of your capital. Always define your stop-loss.

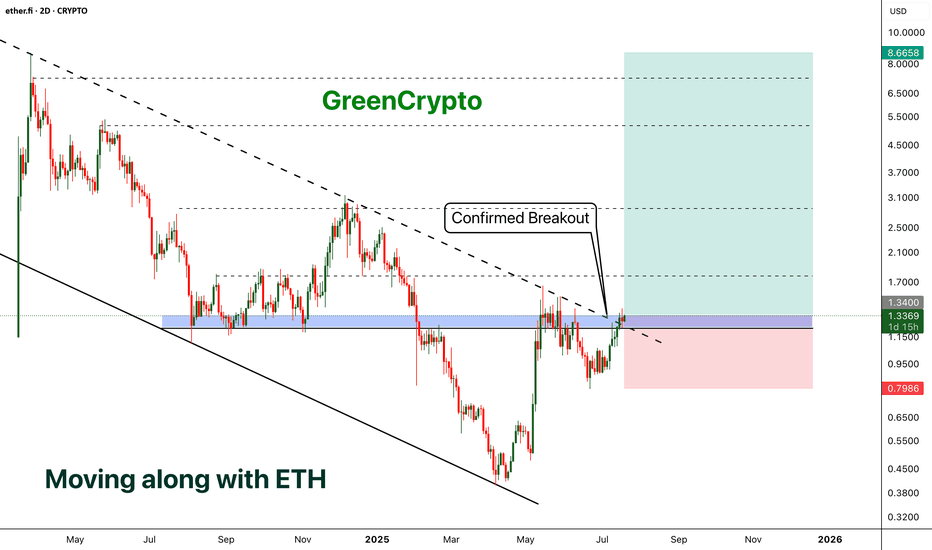

ETHFI - Moving along with the ETH- ETHFI has finally broken out from the descending channel pattern and now price is above the trending resistance line.

- We can expect a minor reversal (chances are less ) and parabolic move from here.

- I'm expecting at-least 500+% profit from this opportunity

Entry Price: 1.3384

Stop Loss: 0.7965

TP1: 1.7657

TP2: 2.5436

TP3: 4.5055

TP4: 5.6136

TP5: 8.5626

Max Leverage 5x.

Don't forget to keep stoploss.

Support us by Liking and following.

Thanks and Cheers!

GreenCrypto

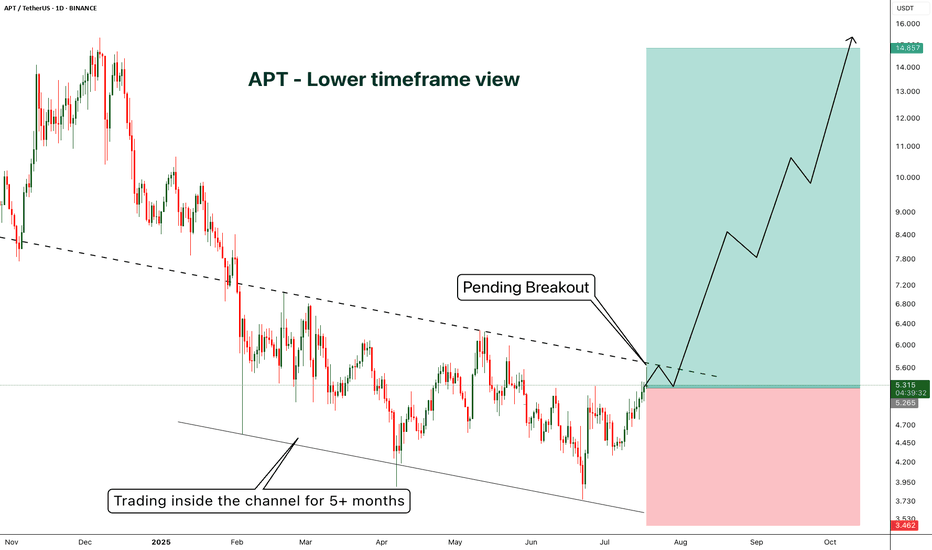

APT - A lower timeframe view - Breakout Entry- On 1D candle, APT is still trading inside the channel

- currently price is trading near the resistance and got rejected from the resistance as expected.

- I'm expecting few more candles near the resistance zone before breakout.

If we look at the higher timeframe (1W) view we shared earlier, there is huge potential for uptrend as we are expecting past pattern to repeat

if you are looking for a short term trade without focusing on weekly chart, this is a good opportunity

Entry Price: 5.313

Stop Loss: 3.462

TP1: 6.141

TP2: 7.270

TP3: 8.634

TP4: 10.583

TP5: 14.768

Don't forget to keep stoploss

Cheers

GreenCrypto

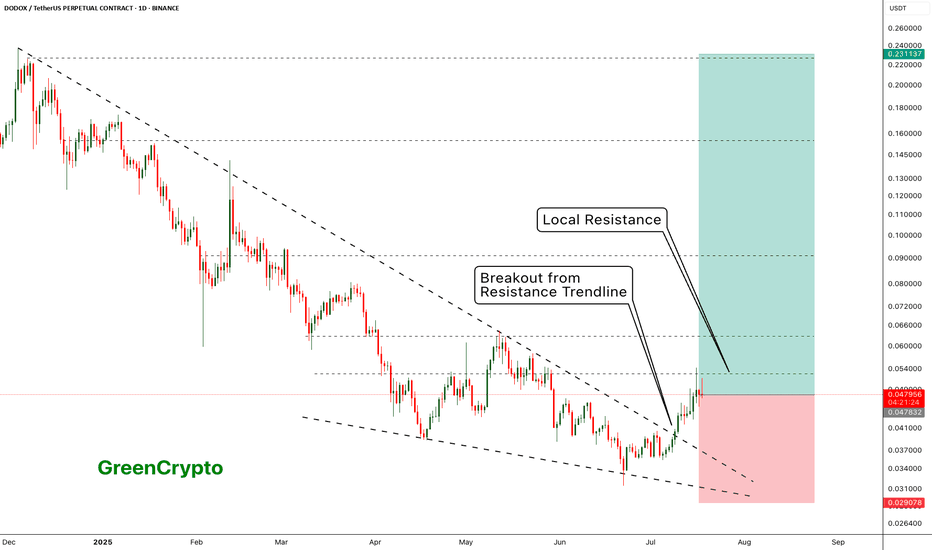

DODOX - Resistance is holding it back - Huge Potential- DODOX has successfully broken out from the resistance trendline

- Now its being pushed back back the weak local resistances

- I see a huge upward potential here.

Entry Price: 0.048271 ( Or you can wait for it breakout from the local resistance of 0.063051)

Stop Loss: 0.029078

TP1: 0.062621

TP2: 0.079766

TP3: 0.103243

TP4: 0.151853

TP5: 0.222332

Max Leverage 5x.

Don't forget to keep stoploss

Cheers!

GreenCrypto

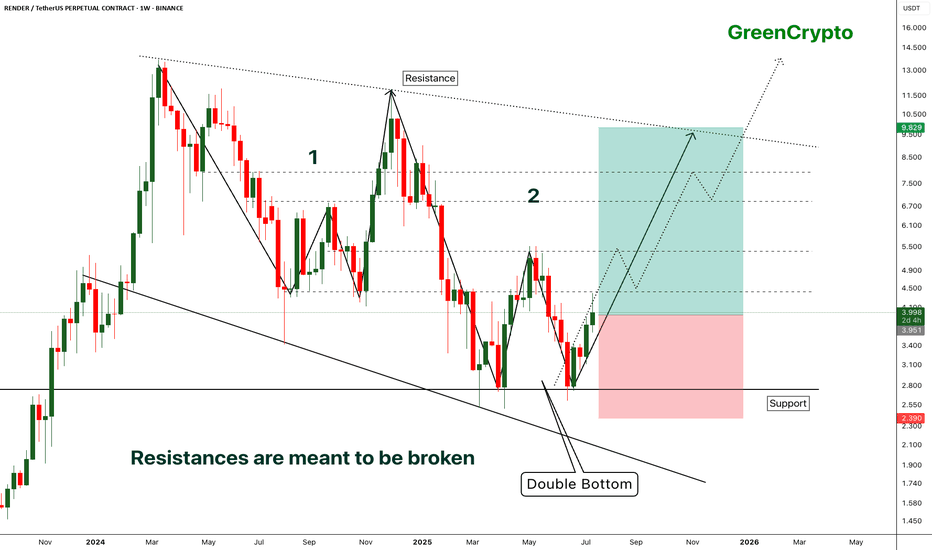

RENDER - [Double bottom] - Resistances are meant to be broken- RENDER has successfully bounced back from the support by forming the double bottom pattern.

- Double bottom pattern is bullish pattern, when it forms at the strong support it becomes extremely bullish. this is one of such scenario.

- Im expecting some minor resistance at the local resistance around 4.3

- A successfull breakout this local resistance will push the price further high.

Entry Price: 3.941

Stop Loss: 2.378

TP1: 4.413

TP2: 5.350

TP3: 6.887

TP4: 8.092

TP5: 9.810

Max Leverage 5x.

Don't forget to keep stoploss.

Support us by Liking and following.

Thanks and Cheers!

GreenCrypto

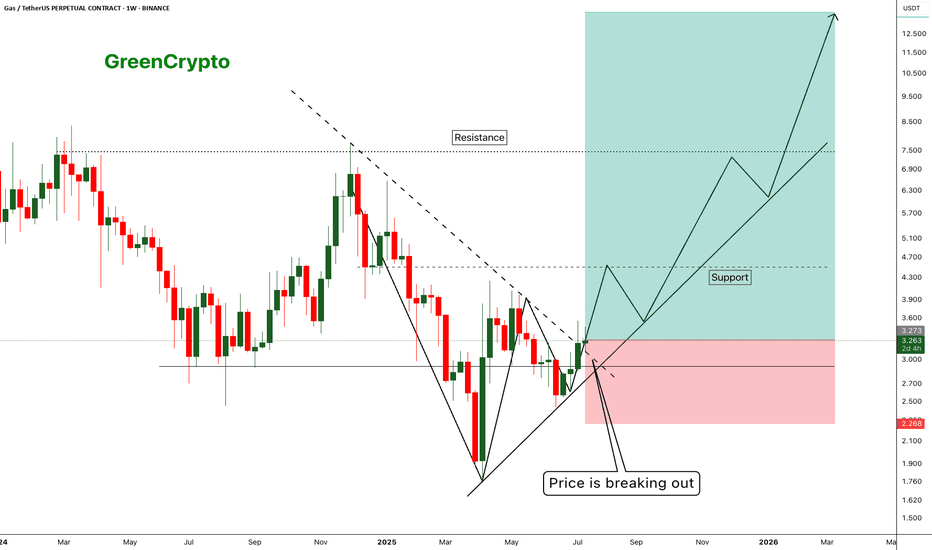

GAS - Huge Risk:Reward Trade 1:10 - Is there any Gas Left ?- Gas has finally managed to breakout from the resistance trendline and now trading just above the resistance

- I'm expecting this trend to continue along the support line shown in the chart.

Entry Price: 3.281

Stop Loss: 2.271

TP1: 3.944

TP2: 4.589

TP3: 6.775

TP4: 8.412

TP5: 13.512

Max Leverage 5x.

Don't forget to keep stoploss.

Support us by Liking and following.

Thanks and Cheers!

GreenCrypto

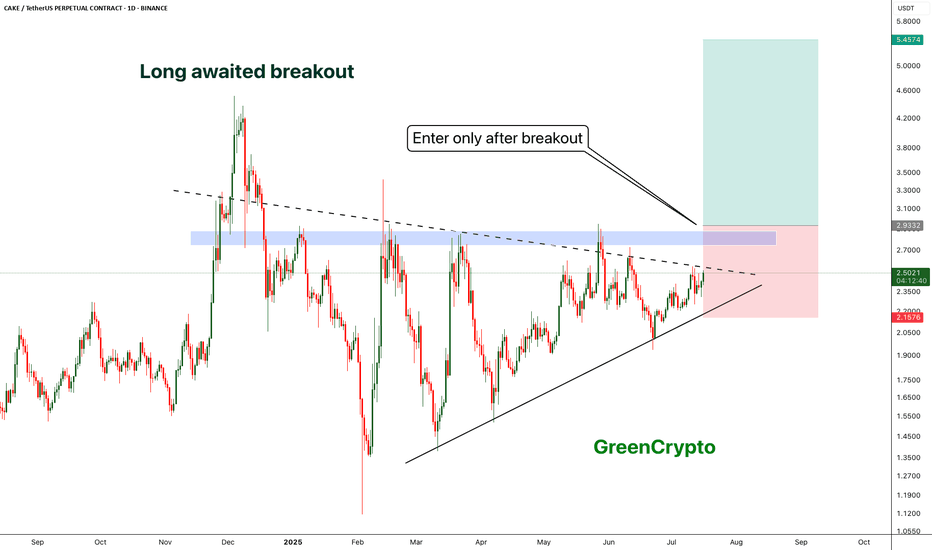

5$ is realistic target for CAKE- CAKE is trading inside the triangle since 2025

- now it seems like there is a possibility of breakout

- A clear breakout with decent volume would push the price towards 5$

- we will enter after the breakout

Entry Price: 2.9

Stop Loss: 2.15

TP1: 3.4371

TP2: 4.2671

TP3: 5.0083

Max Leverage 5x

Don't forget to keep stop loss

cheers

GreenCrypto

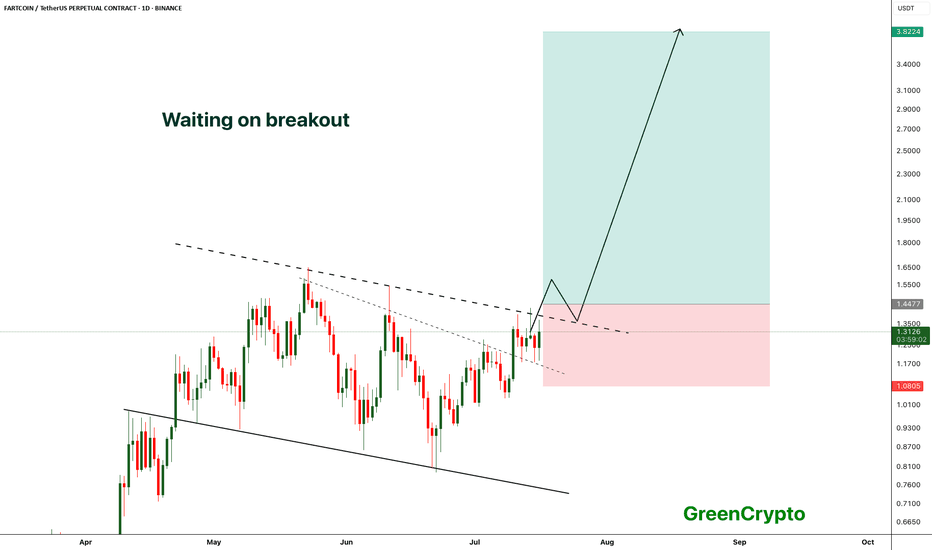

FARTCOIN - Breakout from the channel- FARTCOIN is waiting to breakout from the channel, a confirmed breakout would push the price to new all time high

- we have long trade opportunity once the price breaks above the resistance trendline

Entry Price: above 1.44

Stop Loss: Below 1.08

TP1: 1.6464

TP2: 1.8923

TP3: 2.2450

TP4: 2.9973

TP5: 3.8224

Max Leverage: 5x

Don't forget to keep stoploss

Cheers

GreenCrypto

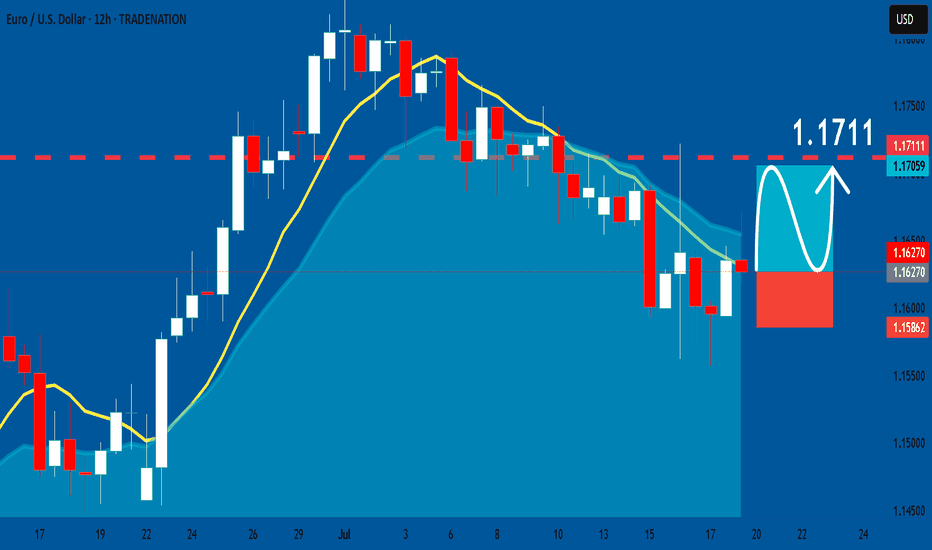

EURUSD: Long Trade with Entry/SL/TP

EURUSD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long EURUSD

Entry Point - 1.1627

Stop Loss - 1.1586

Take Profit - 1.1711

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NATGAS: Bearish Continuation & Short Signal

NATGAS

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell NATGAS

Entry Level - 3.567

Sl - 3.625

Tp - 3.432

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

SILVER Massive Short! SELL!

My dear subscribers,

SILVER looks like it will make a good move, and here are the details:

The market is trading on 38.213 pivot level.

Bias - Bearish

My Stop Loss - 38.708

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 37.413

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USOIL Technical Analysis! BUY!

My dear followers,

This is my opinion on the USOIL next move:

The asset is approaching an important pivot point 66.40

Bias - Bullish

Safe Stop Loss - 65.78

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 67.32

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

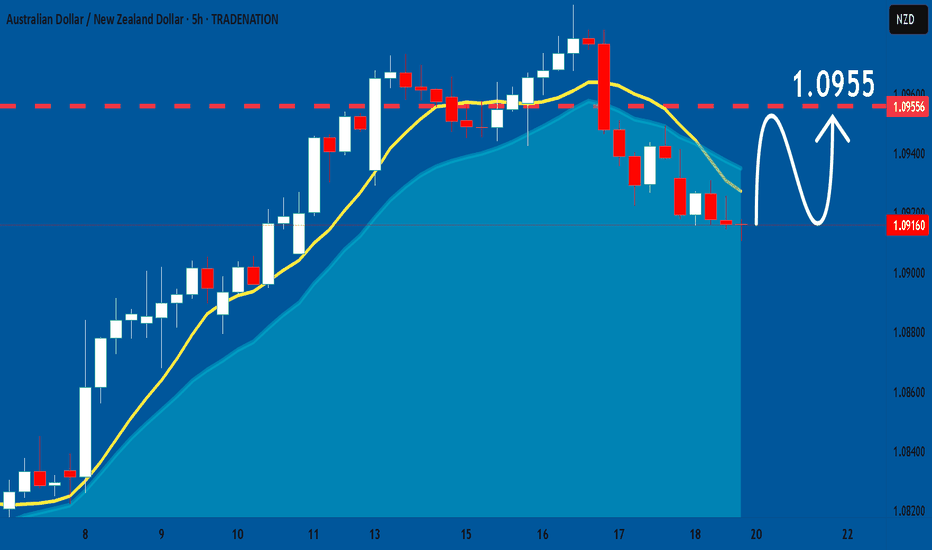

AUDNZD: Growth & Bullish Forecast

The analysis of the AUDNZD chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

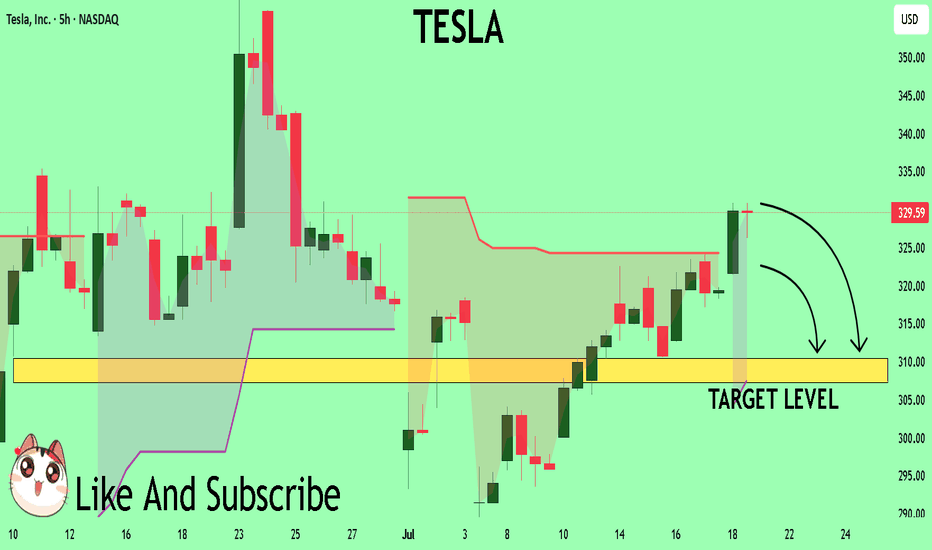

TESLA My Opinion! SELL!

My dear subscribers,

My technical analysis for TESLA is below:

The price is coiling around a solid key level -329.59

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 310.44

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

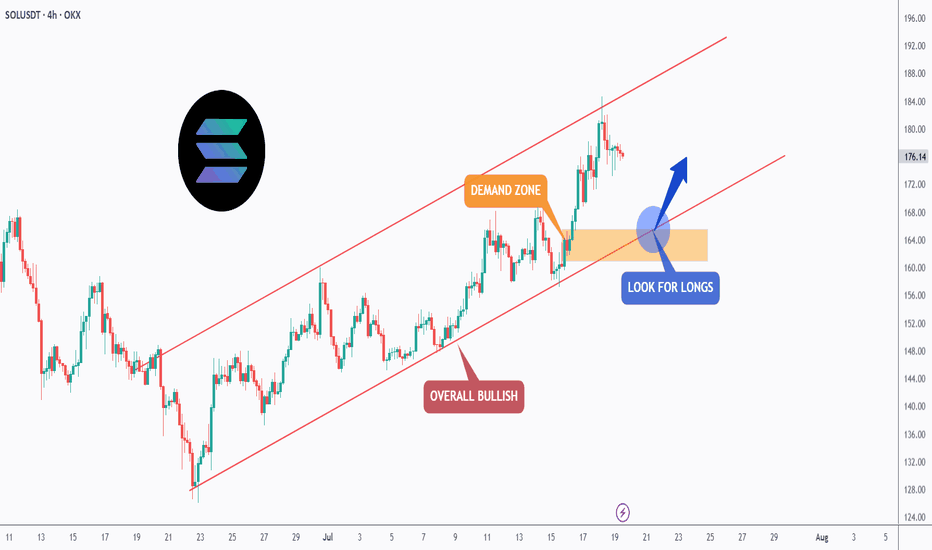

SOL - Trend-Following Longs in the making!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈SOL has been overall bullish trading within the rising channel in red.

Moreover, the orange zone is a strong demand.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the orange demand zone and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #SOL retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

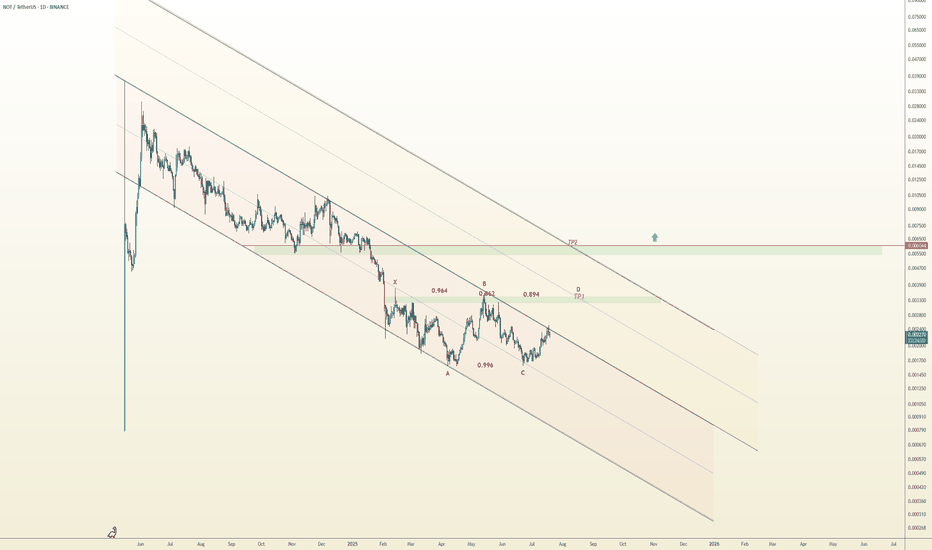

Notcoin and the Butterfly Effect

🦋 Bullish Butterfly Pattern Forming | NOTUSDT Analysis

A potential Bullish Butterfly is unfolding on NOTUSDT:

X to A: initial decline

A to B: ~94.3% retracement

B to C: higher low at ~99.6%

C to D: projected bullish leg toward 0.00327 (127.8% Fib), aligning with midline of the yellow descending channel

The price is currently testing the top of the red descending channel.

If bullish momentum holds and this upper boundary breaks, we anticipate a continuation toward point D, and potentially toward 0.006044, the upper yellow channel — a highly critical resistance. A breakout and close above this level may trigger the beginning of a major bullish trend.

🔸 Risk Management:

• Consider partial profit-taking near the midline of the yellow channel

• Trail stop-loss as the price nears point D

• Use only 1% of capital per position

⚠️ Key Note:

• If price breaks below point C, this bullish butterfly setup becomes invalid

SUPER - Getting ready for the super run- Price is trading near the resistance after forming higher high.

- it's highly likely that price will get rejected around the resistance and will form another higher high.

- this is an excellent opportunity for us to enter the trade.

Entry Price: 0.7322

Stop Loss: 0.5344

TP1: 0.8939

TP2: 1.0517

TP3: 1.2867

TP4: 1.6336

TP5: 2.2243

Max Leverage 5x.

Don't forget to keep stoploss.

Support us by Liking and following.

Thanks and Cheers!

GreenCrypto

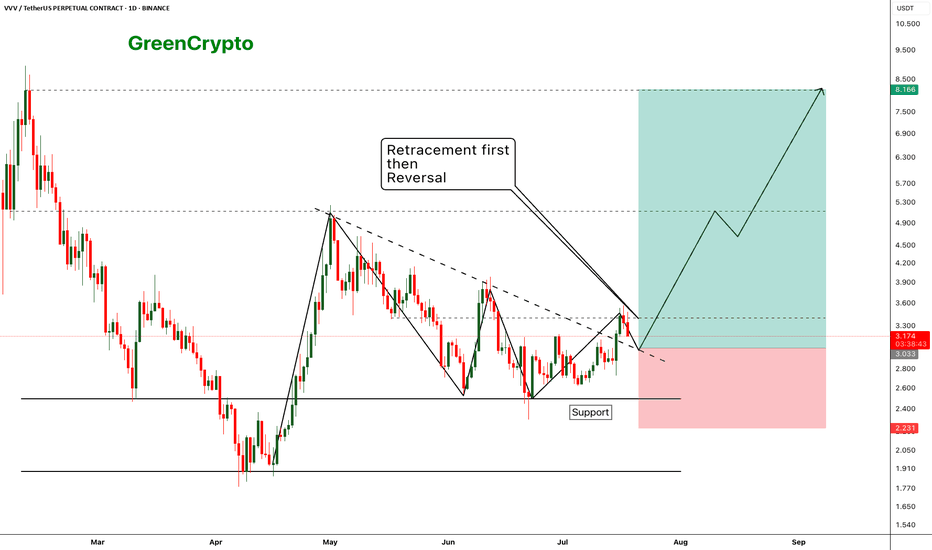

VVV - Expecting perfect reversal after the retracement- price has broken out from the resistance trendline and now we are seeing a retracement as expecting

- Price should hold the support (previous resistance) and reverse from the suppport zone.

- we can enter our trade once the retracement completed

Entry Price: 3.033

Stop Loss: 2.231

TP1: 3.411

TP2: 4.037

TP3: 4.851

TP4: 6.360

TP5: 8.028

Max Leverage 5x.

Don't forget to keep stoploss.

Cheers!

GreenCrypto

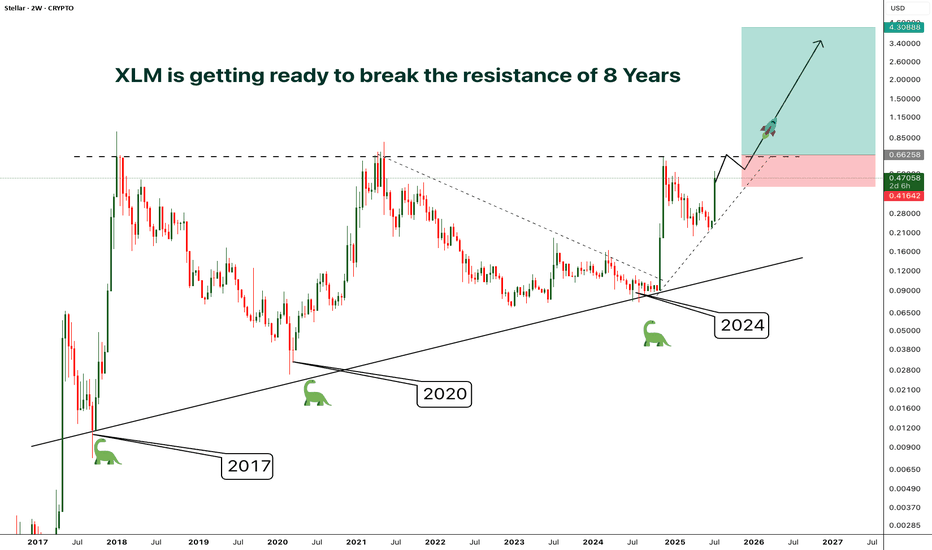

XLM - Resistance/Consolidation of 8 Years- Finally after 8 years of consolidation and getting rejected by the resistance at the same level around 0.65, XLM is preparing to break out from the almost decade old resistance

- A clear breakout from this resistance will phenomenal

- The price surge after the breakout will be unlike anything you've ever seen.

- I'm planning to enter after a confirmed breakout, entry before the breakout will be risky in case if the price gets rejected again.

Entry Price: Candle closeAbove 0.65

Stop Loss: Below 0.41

TP1: 0.88574

TP2: 1.21012

TP3: 1.92545

TP4: 2.68849

TP5: 4.27772

Don't forget to keep stoploss

Cheers

GreenCrypto