AMZN Amazon Options Ahead of EarningsIf you ahven`t bought the recent dip on AMZN:

Now analyzing the options chain and the chart patterns of AMZN Amazon prior to the earnings report this week,

I would consider purchasing the 245usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $7.02.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Signalfree

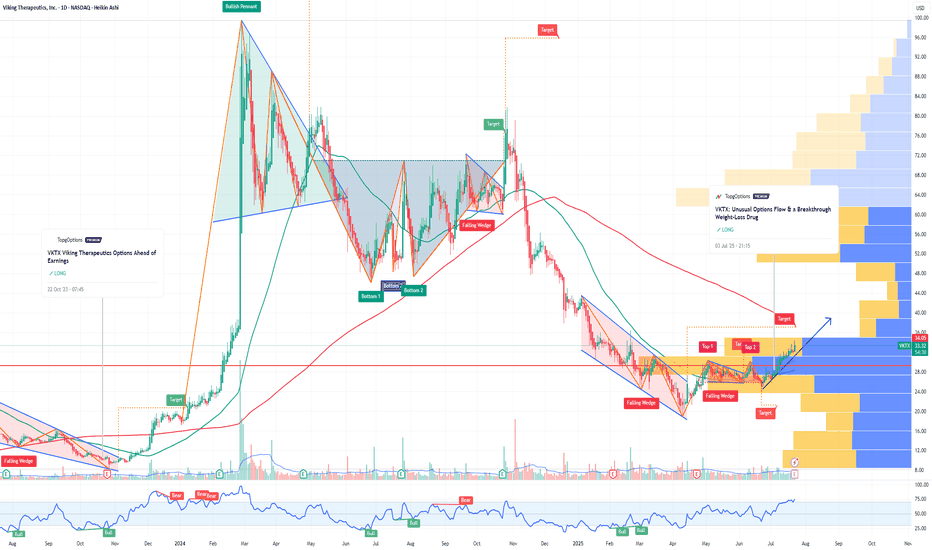

VKTX Viking Therapeutics Options Ahead of EarningsIf you haven`t bought VKTX before the breakout:

Now analyzing the options chain and the chart patterns of VKTX Viking Therapeutics prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $7.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FIVE Five Below Options Ahead of EarningsIf you haven`t bought FIVE before the previous earnings:

Now analyzing the options chain and the chart patterns of FIVE Five Below prior to the earnings report this week,

I would consider purchasing the 115usd strike price Puts with

an expiration date of 2025-6-20,

for a premium of approximately $4.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GBPUSD SHORT FORECAST Q2 W23 D3 Y25GBPUSD SHORT FORECAST Q2 W23 D3 Y25

🔥👀TECHNICAL HOT PICK

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block

✅15' order block

✅4 hour order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

ELF Beauty Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ELF Beauty prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2025-5-30,

for a premium of approximately $5.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RKT Rocket Companies Options Ahead of EarningsIf you haven`t bought RKT before the previous earnings:

Now analyzing the options chain and the chart patterns of RKT Rocket Companies prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.37.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TEAM Atlassian Corporation Options Ahead of EarningsIf you haven`t sold TEAM on this top:

Now analyzing the options chain and the chart patterns of TEAM Atlassian Corporation prior to the earnings report this week,

I would consider purchasing the 245usd strike price Calls with

an expiration date of 2025-5-2,

for a premium of approximately $8.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

RIOT Platforms Options Ahead of EarningsIf you haven`t bought RIOT before the previous earnings:

Now analyzing the options chain and the chart patterns of RIOT Platforms to the earnings report this week,

I would consider purchasing the 12usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $1.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AAL American Airlines Group Options Ahead of EarningsIf you haven`t bought the dip on AAL:

Now analyzing the options chain and the chart patterns of AAL American Airlinesprior to the earnings report this week,

I would consider purchasing the 9usd strike price Puts with

an expiration date of 2025-5-2,

for a premium of approximately $0.44.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 5.50usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $1.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SEDG SolarEdge Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2025-2-28,

for a premium of approximately $1.76.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AMAT Applied Materials Options Ahead of EarningsAnalyzing the options chain and the chart patterns of AMAT Applied Materials prior to the earnings report this week,

I would consider purchasing the 180usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $6.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CMCSA Comcast Corporation Options Ahead of EarningsAfter CMCSA reached the previous price target:

Now analyzing the options chain and the chart patterns of CMCSA Comcast Corporation prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $1.86.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

INTC Intel Corporation Options Ahead of EarningsIf you didn’t buy during last year’s double bottom on INTC:

Now analyzing the options chain and the chart patterns of INTC Intel Corporation prior to the earnings report this week,

I would consider purchasing the 22usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $1.56.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GE Aerospace Options Ahead of EarningsIf you haven`t bought GE before the breakout:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 185usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $8.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

USDIDR - Short Opportunity from resistance zonePEPPERSTONE:USDIDR is testing a significant resistance zone that has consistently reversed bullish trends into bearish moves. The recent bullish push into this area suggests potential selling opportunities.

I personally anticipate a move toward 16,215.2.

On the other hand, a break above this resistance could indicate a shift in sentiment.

Traders should monitor this zone closely and wait for confirmation before entering short positions. If you have any thoughts on this setup or additional insights, drop them in the comments!

BBAI BigBear ai Holdings Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 2usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $0.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GIS General Mills Options Ahead of EarningsIf you haven`t sold GIS before the previous earnings:

Now analyzing the options chain and the chart patterns of GIS General Mills prior to the earnings report this week,

I would consider purchasing the 57.5usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $1.92.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

HELE Helen of Troy Limited Options Ahead of EarningsIf you haven`t sold HELE before the previous earnings:

Now analyzing the options chain and the chart patterns of HELE Helen of Troy Limited prior to the earnings report this week,

I would consider purchasing the 70usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $1.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PACS Group Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PACS Group prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $0.27.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

INTC Intel Corporation Among My Top 10 Picks for 2025 | Price TaIf you haven`t bought the Double Bottom on INTC:

My price target for INTC in 2025 is $30, driven by the following fundamental factors:

Strategic Product Launches and Technological Advancements:

Intel is set to launch its new Lunar Lake and Arrow Lake processors, designed specifically for artificial intelligence (AI) and personal computing. These chips, expected to be manufactured using Intel's advanced 18A process technology, promise significant performance improvements and energy efficiency. The successful rollout of these products could revitalize Intel's position in the competitive CPU market, especially as demand for AI capabilities continues to grow across various sectors. Analysts anticipate that these innovations will contribute to a recovery in Intel's data center and AI segments, which are critical for future revenue growth.

Financial Recovery and Growth Projections:

After experiencing a challenging period marked by declining revenues and operational setbacks, Intel is projected to report a strong recovery by 2025. Analysts expect the company to achieve earnings per share (EPS) of approximately $0.98, a significant rebound from anticipated losses in 2024. Revenue is also expected to grow by about 6%, reaching approximately $55.84 billion, indicating a positive shift in Intel's financial health. This recovery is supported by robust cash flow generation and a healthy balance sheet, which provides the necessary capital for ongoing investments in R&D and production capabilities.

Market Position and Competitive Advantages:

Despite recent challenges, Intel maintains a dominant market share in the global CPU market, estimated at 60-70%. This strong position provides a competitive advantage as the company looks to regain momentum against rivals like AMD and NVIDIA. Intel's shift towards an outsourced foundry model will not only enhance production efficiency but also open new revenue streams by manufacturing chips for other companies. This strategic pivot is indicative of Intel's adaptability in a rapidly evolving semiconductor landscape.

Investor Sentiment and Valuation Potential;

Currently trading at a significant discount relative to its historical valuation metrics, Intel presents an attractive investment opportunity. The stock's price-to-earnings (P/E) ratio remains low compared to industry peers, suggesting potential upside as market sentiment improves with the anticipated product launches and financial recovery. Investors are increasingly optimistic about Intel's long-term prospects, particularly as the company navigates its operational challenges and focuses on innovation.