Gold: Buy setup brewing around 3045 – wait for confirmation!Hey traders! 👋

I’m eyeing a potential long opportunity on Gold in the 3030–3045 zone, but only with proper confirmation.

The shiny metal has broken and closed above Monday’s high with strong momentum, signaling short-term strength. However, considering the overall short-term bearish bias, I anticipate a pullback toward the 78.6% Fibonacci retracement level.

💡 Here's the plan:

🔸 Wait for price to dip into 3030–3045

🔸 Watch for bullish rejection candles or confirmation patterns

🔸 If confirmed, go long with targets at 3088 and 3123

🎯 This could be a great opportunity to catch the next leg up while still respecting short-term corrections.

If this setup adds value to your analysis, I’d truly appreciate your boost. Thanks for the continued support and happy trading! 💛📈

Signalprovider

Buy the Dips Towards 3080 – Gold Builds a Strong Base 🟡 What happened with Gold (XAUUSD) yesterday?

In yesterday's analysis, I mentioned that I was bullish on Gold, expecting a resumption of the upward move with targets extended to 3080 and interim resistance at 3050.

Although the price rose, it found strong resistance at the 3020 zone, which prompted me to close my buy trade with around 400 pips profit (although I was aiming for closer to 1k pips).

Afterward, the market started to drop and breached under 3000 again.

However, once the price reached the 2970 zone, bulls entered the market strongly and pushed the price back above 3000.

❓So now what? Is the correction over or will it continue?

Looking at the chart, we can clearly see two things:

✅ A solid support has formed around 2960-2970 zone

✅ A double bottom is in the making, with a well-defined neckline at 3020

________________________________________

📌 Why the bullish bias remains valid:

• 2960-2970 proved to be a strong demand zone

• Price reclaimed the 3000 level after the dip

• Double bottom structure is forming = possible breakout ahead

• 3020 is the key level to break for continuation

________________________________________

🎯 Trading Plan:

The preferred strategy remains:

➡️ Buy the dips

🎯 Main target: 3080

❌ Invalidation: daily close below 2960

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Bulls Take Control – Can EURUSD Reach 1.1150 Again?1. What happened (recap):

Last week, EURUSD reached the 1.1150 zone, a level that hasn't been touched since August-September last year. After that, the pair started a correction. Although the week started with a gap down yesterday, bulls took control and pushed the pair higher.

2. Key Question:

Has EURUSD completed its correction, or is another drop coming?

3. Why I expect further upside:

• 🔑 A retest of the formed support at 1.09 occurred during yesterday’s New York session, followed by a fresh rebound.

• 📊 The drop from 1.1150 appears corrective in nature, suggesting the possibility of a new leg up.

• 🎯 As long as 1.09 holds, my strategy is to buy dips with the primary target being a retest of the 1.1150 resistance zone.

4. Trading Plan:

📌 I’m looking for buying opportunities on dips, aiming to retest the 1.1150 resistance area. This scenario is invalidated only by a daily close below 1.09.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold's Rollercoaster: From 3167 ATH to 2950 Support–What's Next?Since the beginning of the year, Gold has been on an impressive uptrend, gaining over 5000 pips, culminating with last week's ATH at 3167.

As I highlighted throughout last week's analyses, even though we're in a strong uptrend, the price was too far deviated from the mean, making a correction inevitable.

✅ Friday Recap:

After testing the resistance zone formed at 3135-3140, Gold dropped hard, closing the week 1000 pips lower from its peak during Friday's session.

📉 Recent Developments:

The correction continued yesterday, with Gold recently touching an important confluence support around 2950.

📈 What's Next?

I expect an upward movement and resumption of the uptrend, with targets at:

• 3050 zone 📌

• 3080 zone 📌

🎯 Plan:

Buy dips near support, aiming for the mentioned targets. The analysis would be negated if we see a clear break below 2950. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

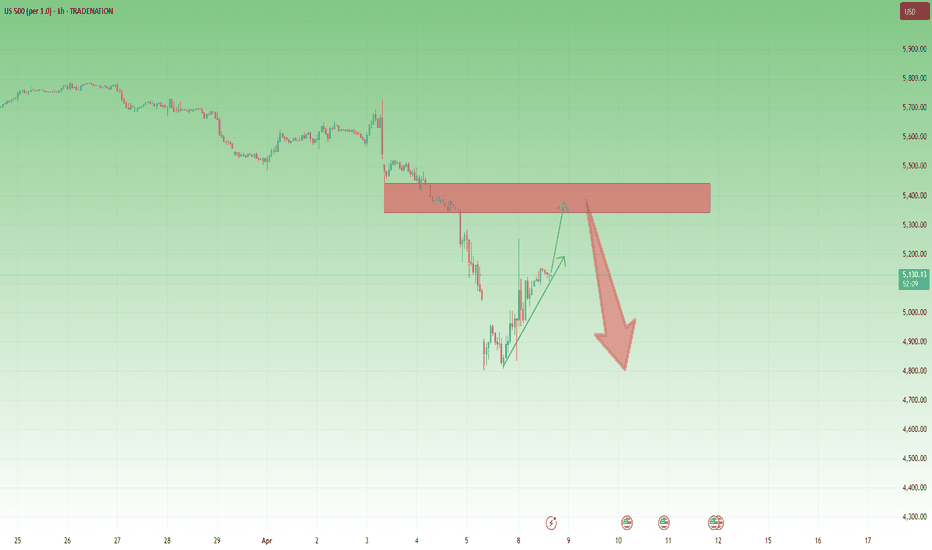

Bulls are not of the woods, not by far1. What happened yesterday?

In my weekend analysis covering US indices , I mentioned that US500 (SP500) could drop and test the ascending trend line starting back at the pandemic low. This line is confluent with the horizontal support level given by January 2022 ATH, offering a good opportunity for traders to open long positions.

Indeed, at least on CFDs and futures, this trend line was touched, and the price rebounded strongly from there.

2. Key Question:

Will we have a full V-shape recovery, or will the price drop back below 5k in the coming sessions?

3. Why I expect a continuation of the correction:

🔸 Strong Resistance: The US500 has established a robust ceiling around the 5350-5400 zone(also a gap there)

🔸 Lack of Building Momentum on Support: There's no clear indication that this resistance will be broken anytime soon with the lack of accumulation under 5k

🔸 Potential for Further Decline: Given the current market structure, a drop below 5k remains a realistic possibility in the upcoming sessions.

4. Trading Plan:

🎯 My Strategy: Playing the range.

✅ Buy near the 4800 support.

✅ Sell into the resistance zone between 5350 and 5400.

5. Conclusion:

I’m watching for market confirmations and will continue applying this range strategy until there’s a clear directional change. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold’s Wild Ride: Is the Correction Over?Yesterday was an insane day for Gold—while I expected a strong drop to at least 3,080, I didn’t anticipate such a sharp reversal after the sell-off.

Now, the big question is: Has Gold finished correcting, or is more downside coming?

________________________________________

Why I Expect Another Wave of Selling

📉 Gold Still Looks Vulnerable – Despite the rebound, I don’t believe the correction is over.

📉 Key Resistance Established – The 3,135–3,140 zone has now formed a strong ceiling, limiting upside potential.

📉 Selling Rallies Remains the Plan – Even with yesterday’s bounce back above 3,100, my outlook remains unchanged.

________________________________________

Trading Plan: Selling Spikes During NFP

🔻 Looking for price spikes during the NFP report as opportunities to sell into strength.

🔻 Targeting a new leg down toward the 3,030 support zone.

The correction is likely not done yet—let’s see if the market confirms it. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Nasdaq's Drop: A Temporary Rebound Before More Downside?I've been calling for a strong correction in the Nasdaq (and all major U.S. indices) since the start of the year—long before the tax war even began. I warned that a break below 20,000 was likely, with my final target set around 17,500.

And indeed, the index has fallen—regardless of what the so-called "cause" might be. Right now, Nasdaq is trading at 18,400, sitting right at a minor horizontal support zone.

________________________________________

A Short-Term Rebound Before More Downside?

📉 Overall Bias Remains Bearish – The broader trend still points lower.

📈 Rebound Likely – A push above 19,000 in the coming days wouldn’t be surprising.

⚠️ High-Risk Setup – Going long here is risky, given the current macroeconomic backdrop.

________________________________________

Trading Strategy: Short-Term vs. Long-Term

✅ For Short-Term Traders & Speculators – A temporary upside correction could offer a buying opportunity.

❌ For Swing & Long-Term Traders – It's better to wait for this rebound to fade and position short for the next leg down.

While a bounce could be on the cards, the bigger picture still points lower—I remain bearish in the long run. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold new ATH at 3,168: A Final Push Before the Drop?Yesterday was a high-volatility day, and we all know why.

Gold surged to yet another all-time high at 3,168, and luckily, I had already closed my sell trade around break-even—otherwise, my stop loss would have been triggered.

________________________________________

Gold Still Set for a Hard Drop?

Despite the rally, my outlook remains unchanged—I still believe Gold is due for a significant correction.

📉 3,100 Held as Support – But buyers are struggling to hold onto gains around 3150

📉 Every New High is a Selling Opportunity – So far, Gold has failed to sustain its breakouts, reinforcing a potential distribution phase.

________________________________________

Trading Plan: Selling the Rallies

🔻 Target: At least 3,080

🔻 Preferred Strategy: Continue selling into rallies

For now, I remain bearish and will keep looking for opportunities to short the market. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Bitcoin- Short term recovery?As you know, I am bearish on Bitcoin in the long term. However, in the short term, the cryptocurrency could see a recovery.

Yesterday, the price tested the 81,000 support zone once again and rebounded from that level. Now, Bitcoin is pushing against the 83,500 resistance, and I believe a breakout is likely.

If that happens, we could see further gains, with 86,500 as the next key target for the bulls.

In conclusion, I’m bullish on BTC in the coming days and will be looking to buy dips.

Gold's trend has too many friendsThere’s a well-known saying in trading: “The trend is your friend.”

I firmly believe in this principle. However, when price movements become too extreme—too fast and too far—it’s wise to exercise caution, even if you’re not ready to take the opposite side of the trade.

And right now, I believe that’s exactly the case with Gold.

________________________________________

Why a Major Gold Correction is Likely

As I’ve been repeating like a broken record since Monday, Gold’s price is severely deviated from the mean, signaling that a brutal correction is on the horizon.

After reaching a new all-time high of 3,150, Gold retraced yesterday, dropping to 3,100—a support level formed earlier in the week. A rebound followed, but as I’ve explained in an educational article, this price action looks more like a stepwise distribution rather than true buying strength.

The key point?

➡️ Support isn’t holding because buyers are stepping in—it’s holding because big sellers have paused selling.

________________________________________

Still Bullish, But a Drop is Coming

There’s no doubt that Gold is in a strong uptrend. But even if it drops 1,000 pips, the overall bullish trend would still be intact.

Key Technical Signs of Weakness

📉 Trendline Break – Yesterday, Gold broke below the rising trendline, marking the first sign of weakness.

📉 Failed Rebound – Despite a short-term bounce, the price is now more likely confirming the break rather than invalidating it.

📉 Lower High in Progress? – The next minor support sits at 3,120. If Gold breaks below this level, we’ll have confirmation of a lower high, which strengthens the bearish case.

________________________________________

Targeting the Correction

If Gold breaks below 3,120, I expect a move below 3,100, targeting:

🎯 Soft target: 3,080

🎯 Likely target: 3,030 – 3,040

I believe it’s only a matter of time before this brutal correction plays out.

Let’s see how it unfolds! 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

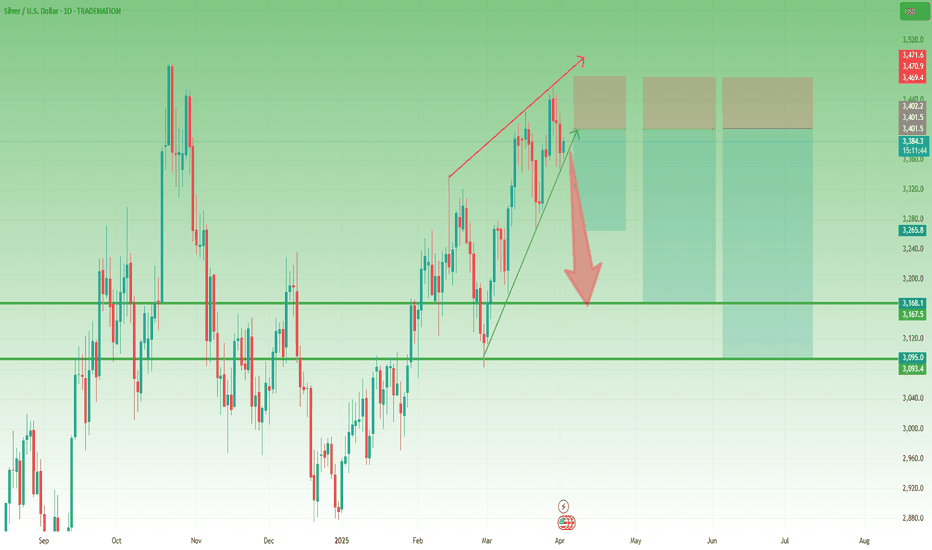

Silver could drop 2k+ pipsSilver has been on the rise recently, but unlike its big brother, Gold, it started rolling back down on Friday—even as Gold continued to print new all-time highs, culminating at 3,150 yesterday.

This divergence between the two metals could be an early sign that Silver is losing momentum.

________________________________________

Technical Signs of Weakness

📉 Rising Wedge Formation – Since early March, Silver’s price has been contained within a rising wedge, a classic bearish pattern signaling an impending breakdown.

📉 Testing Key Support – Right now, the price is hovering above wedge support. If Gold fails to hold above 3,100, I expect Silver to break down as well.

________________________________________

Targeting the Breakdown

If Silver breaks below support, I expect:

🎯 Initial target: $32

🎯 Final target: $31 (a key support zone)

Trading Plan: Selling the Rallies

Given the current setup, my strategy is to sell into rallies, aiming for at least a 1:2 risk-reward ratio.

Let’s see if Silver follows through on this bearish setup! 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold’s Unsustainable Rally: A Strong Correction Ahead?

In my analysis yesterday, I explained that XAU/USD is significantly deviated from the mean, with its 20-period moving average nearly 1,500 pips below the current price. This level of divergence is unsustainable.

As always, trading against the trend is risky—especially when there’s no clear guide, such as a resistance level, to structure the trade.

Although my sell trade from yesterday hit its stop loss this morning, my outlook remains the same: a strong correction is likely.

Looking at a smaller time frame, we can see that Gold has risen sharply since last week, gaining 1,000 pips. The 3,125–3,130 zone is acting as a key short-term confluence support.

At the time of writing, the price is hovering just above this level with significant volatility. Typically, strong volatility signals potential reversals, and considering all factors, a downward move is highly probable.

In conclusion, I maintain my expectation of a strong downside reversal. A break below the confluence support would confirm this move, and I anticipate at least a 500+ pip drop in the coming days.

With that in mind, I will be looking to re-enter short.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

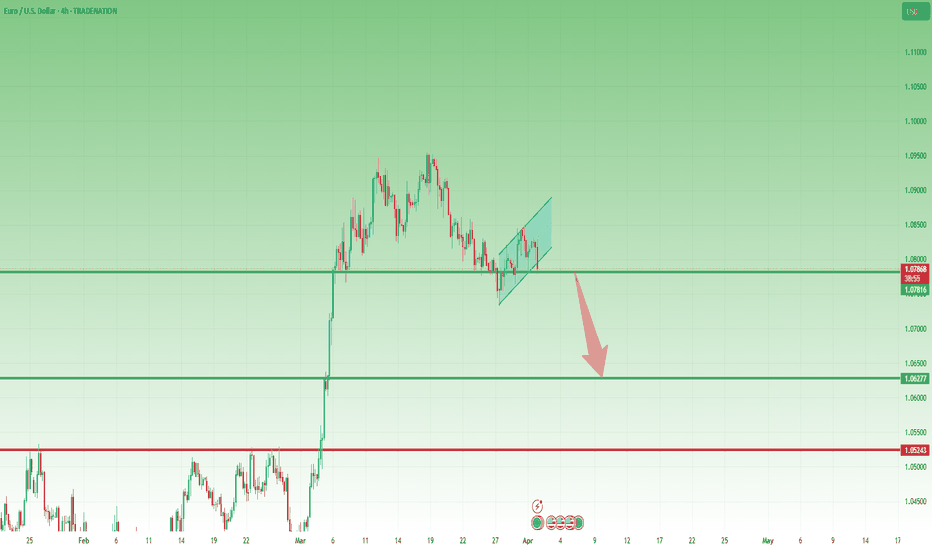

EurUsd could continue to the downsideTwo weeks ago, I mentioned that while a new high was possible, the bigger move in EUR/USD should be to the downside.

Indeed, the pair dropped from above 1.0900 and recently found support around the 1.0730 zone.

The recent recovery appears corrective, unfolding in a flag pattern, and I expect another leg down toward 1.0600.

Bearish confirmation comes with a daily close below 1.0750, and my preferred strategy is to sell rallies.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

DXY Bounces Back: I’m Staying BullishAfter breaking below the 104 support and hitting a low of 103.75, TVC:DXY staged a strong recovery, reclaiming support and signaling a potential false breakout.

The overnight retest of 104 established a higher low, suggesting further upside potential.

As long as 104 holds, I remain bullish and will look to sell EUR/USD and GBP/USD.

Gold- Way, way too deviated from the MEAN!!!As I’ve mentioned many times in my analyses, my trading approach focuses on identifying the next big move (500 to 1,000 pips) rather than chasing small gains of 30-50 pips, which often feels more like staying busy than truly making money.

In this post, I’ll explain why I believe the next major move in Gold is downward rather than upward.

I’ll take a slightly different approach than usual, focusing on the bigger picture and using a simple 20-period moving average (MA) to smooth price action.

Looking at the posted chart, since the beginning of the recent bull market—highlighted in the chart at the 1,600 zone back in November 2022—Gold has been in a strong uptrend. A key observation is that the 20-period moving average has been forming higher lows.

After the second higher low in October 2023, the trend became even more aggressive, with only two notable higher lows since (looking on MA)—one in July 2024 and another in January 2025.

However, even during these sharp bullish legs, the market has consistently reversed to the mean—with the mean being the 20-period moving average.

At the time of writing, Gold is trading around 3,110, which is significantly deviated from the mean, currently around 2,990.

Conclusion:

Based on this pattern, we could expect either a deep retracement or at least a period of consolidation to allow the moving average time to catch up with the price.

Of course, shorting into such a strong bull run carries high risk, especially without a clear stop-loss level. However, even if Gold spikes to 3,150 or even 3,170, I strongly believe that the price will eventually drop and touch the 20-period moving average.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

EUR/USD: Range-Bound with Bearish Potential Below ResistanceThe EUR/USD market recently completed an ABC pullback, briefly testing above Friday’s high, but price action remains contained within last week’s range, signaling a lack of clear trend direction.

If the price rejects the current resistance zone, a move lower is likely, possibly forming another ABC structure toward the 1.06000 support level. With the zone below 1.07700 already cleared—despite a prior false breakout—a retest of that area is possible. Unless the price manages a close above 1.08500, the pair is expected to drift toward last week’s low, with the next target at the support zone around 1.07610

BTC/USDT: Range-Bound Movement with Rebound Potential from Key SThe BTC/USDT market recently tested last week’s high but pulled back after encountering resistance near the 89,000 level. On the daily timeframe, the latest candle formed a doji, signaling weakening selling pressure.

The price has reached the two-week low, where underlying liquidity may trigger a bounce—especially around the psychological 80,000 level. With the market consolidating after recent sell-offs, a move toward the 85,000 area is possible. A monthly doji close is also anticipated, reflecting the broader indecision. The next upside target is the resistance zone around 84,000

Gold Recovers After Dip – Is a New ATH Next?After reaching its recent all-time high exactly one week ago, Gold began a correction, dropping to $3,000, where buyers stepped in. This led to a recovery, pushing the price above a key resistance zone at $3,025–$3,030.

At the time of writing, the price is sitting at the upper boundary of this support zone. If it stabilizes above this level, a new ATH could be on the horizon.

I remain bullish as long as the daily close stays above this zone.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

LINK/USDT: Strong Momentum Points to Higher TargetsThe LINK/USDT pair has shown strong bullish momentum on the 1-hour timeframe, breaking above both the 15.00 level and a downward trendline. On the daily chart, four consecutive bullish candles reflect persistent buying pressure.

Recent movements suggest an ABC pattern is unfolding, hinting at a potential push toward the 17.00 resistance level. With momentum building, the market may soon test this zone, barring any negative news that could prompt a sell-off. A pullback may occur short term, but the overall outlook remains bullish, with a mid-term target at the resistance zone around 16.45

TRX/USDT: Consolidation Holds with Upside PotentialThe TRX/USDT market recently saw a false breakout below a key support level, followed by a rebound toward the upper boundary of the channel. On the broader timeframe, the price has been in a two-month consolidation, forming a range near the 0.2200 support, which has held firm through multiple tests.

This consistent rebound highlights the significance of the 0.2200 level, suggesting it may continue to act as a launch point for upward movement. A retest of the trendline is possible, with potential for the price to approach the channel's upper boundary. The next target is the resistance zone at 0.2370

GBP/JPY: Bullish Momentum Builds Near Key ResistanceThe GBP/JPY market is currently developing an ABC pattern, with point C forming near the 196.000 level. Recently, the price broke above both a downward trendline and the 194.000 support, signaling a potential shift in momentum.

At present, the pair is testing last week’s high, which aligns with the 195.000 psychological level. A strong bullish candle has emerged on the daily chart, indicating growing bullish pressure. The market may enter a consolidation phase around this level before attempting a breakout above the previous week’s high. The next target is the resistance zone at 195.750

XAU/USD: Bullish Momentum Holds with Breakout PotentialXAU/USD closed its third straight bullish week, with price testing Tuesday’s low before rebounding and closing near the 50% mark of the weekly range. Despite a brief dip, the candle closed above last week’s high, showing continued strength. A breakout above the 3,000 level raises the potential for further gains, especially if the market opens with a gap up.

On the daily timeframe, Friday's candle recovered after early weakness, resembling a previous pullback seen earlier this month. With a 1.90% retracement, the structure suggests possible upward continuation. The market is currently moving sideways within Friday’s range, hovering around the 3,030 key level.

While high-impact news could cause volatility, any pullback toward the 3,000 support zone—aligned with the trendline and previous week’s high—may offer buying opportunities. A breakout from the inside bar pattern forming on the daily chart could target the 3075 resistance zone