BTCUSD: Next Move Is Down! Short!

My dear friends,

Today we will analyse BTCUSD together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 118.878 will confirm the new direction downwards with the target being the next key level of 118.470.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

Signals

EUR_AUD WILL GO UP|LONG|

✅EUR_AUD is trading in an uptrend

And the bullish bias is confirmed

By the rebound we are seeing

After the pair retested the support

So I think the growth will continue

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL RISKY LONG|

✅CRUDE OIL is trading along

The rising support line

And as the price is going up now

After the retest of the line

I am expecting the price to keep growing

To retest the supply levels above at 70.20$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

JPM JPMorgan Chase & Co Options Ahead of EarningsIf you haven`t bought JPM befor the rally:

Now analyzing the options chain and the chart patterns of JPM JPMorgan Chase & Co prior to the earnings report this week,

I would consider purchasing the 290usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $20.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD MARKET ANALYSIS AND COMMENTARY - [Jul 14 - Jul 18]This week, OANDA:XAUUSD opened at $3,342/oz, dropped to $3,282/oz, but then rebounded sharply to close at $3,355/oz. The recovery was mainly driven by former President Trump's announcement of new tariffs ranging from 20% to 50% on imports from 22 countries, effective August 1st. Particularly, a 35% tariff on Canadian goods — a key U.S. trading partner — raised concerns about global trade stability and supply chains.

Trump also proposed 15–20% tariffs on most other trading partners, reigniting fears of global trade disruptions. At the same time, ongoing conflict between Israel and Hamas continued to weigh on sentiment, despite U.S. diplomatic efforts showing little progress.

However, analysts note that gold still lacks strong momentum for a breakout. Trump's tariff threats may be more about negotiation leverage than triggering a full-blown trade war. Meanwhile, with the labor market recovering and inflation rising, the Fed is expected to maintain its neutral monetary policy, limiting short-term gold price movements.

Although geopolitical tensions remain (e.g., Russia-Ukraine, Israel-Hamas), the ceasefire between Israel and Iran has reduced gold’s geopolitical risk premium.

Looking ahead, key U.S. economic data next week — including CPI, PPI, and retail sales — will be closely watched. A strong June core CPI (0.4% or higher) could reduce the likelihood of a Fed rate cut in September, strengthening the USD and pushing gold lower. Conversely, weaker inflation data could boost expectations of a rate cut, supporting gold prices.

📌In terms of technical analysis, gold prices next week may continue to adjust and accumulate. Accordingly, if they surpass the 3,370 USD/oz mark, gold prices next week will challenge the 3,400-3,450 USD/oz range. On the contrary, gold prices next week will adjust down to 3,285 USD/oz, or even 3,245 USD/oz.

Notable technical levels are listed below.

Support: 3,350 – 3,310 – 3,300USD

Resistance: 3,371 – 3,400 – 3,430USD

SELL XAUUSD PRICE 3435 - 3433⚡️

↠↠ Stop Loss 3439

BUY XAUUSD PRICE 3329 - 3331⚡️

↠↠ Stop Loss 3326

US500 Is Bullish! Long!

Here is our detailed technical review for US500.

Time Frame: 3h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 6,252.40.

The above observations make me that the market will inevitably achieve 6,297.19 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

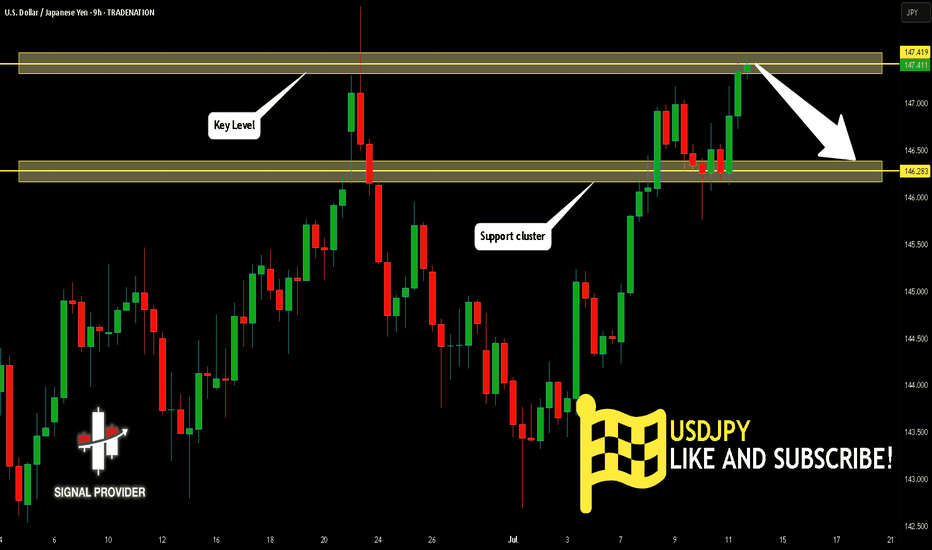

USDJPY Is Very Bearish! Short!

Take a look at our analysis for USDJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 147.419.

Taking into consideration the structure & trend analysis, I believe that the market will reach 146.283 level soon.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUD_JPY IS OVERBOUGHT|SHORT|

✅AUD_JPY is trading in a strong

Uptrend but the pair is now

Locally overbought so after the

Pair hits the horizontal resistance

Level of 97.350 we will be expecting

A pullback and a bearish correction

On Monday!

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-CHF Bearish Breakout! Sell!

Hello,Traders!

GBP-CHF is trading in a strong

Downtrend and the pair

Broke the key horizontal

Level around 1.0780 which

Reinforces our bearish

Bias and we will be

Expecting a further

Bearish move down

On Monday!

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_CAD GROWTH AHEAD|LONG|

✅EUR_CAD went down to retest

A horizontal support of 1.5964

Which makes me locally bullish biased

And I think that a move up

From the level is to be expected

Towards the target above at 1.6040

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-AUD Bullish Bias! Buy!

Hello,Traders!

EUR-AUD went down but

A strong horizontal support

Level is below around 1.7690

And as the pair is trading in

An uptrend we will be expecting

A round and a move up

On Monday!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL: Local Bearish Bias! Short!

My dear friends,

Today we will analyse USOIL together☺️

The market is at an inflection zone and price has now reached an area around 68.669 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 67.925..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

NG1!: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse NG1! together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.377 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 3.408.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

NI225: Will Go Up! Long!

My dear friends,

Today we will analyse NI225 together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 39,581.12 will confirm the new direction upwards with the target being the next key level of 39,719.48 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

Soybeans Loading a Bounce? Demand Zone + COT1. Price Action & Technical Structure

Price has bounced off a strong daily demand zone (1011–969).

Today’s daily candle shows a clear rejection wick from the low, and RSI is signaling a potential reversal.

The market is trading inside a falling channel, currently near the lower boundary — setting up a possible breakout move.

Technical Targets:

• First upside target: 1039–1049

Invalidation: daily close below 990, which would confirm structural breakdown.

2. COT Report – Soybeans Futures (as of July 9, 2025)

• Non-Commercials:

+11,539 spreads | +7,017 shorts | –7,520 longs → Slight bearish pressure, though spreads suggest growing speculative complexity.

• Commercials:

+7,876 longs | –9,084 shorts → Moderate commercial bullish bias.

• Open Interest:

+8,076 contracts → Market activity increasing.

Overall COT positioning is neutral to slightly bullish, with growing signs of accumulation around the 1000 level.

3. Seasonality – MarketBulls

Historically, July is one of the weakest months for Soybeans:

• –44.82 (20Y avg)

• –36.86 (15Y avg)

• –34.74 (10Y avg)

However, early August shows signs of seasonal recovery, and price action is already diverging from typical seasonal behavior.

This makes a deeper breakdown less likely — we could be nearing the end of the seasonal weakness.

Operational Takeaway

Current Bias: Neutral-to-Bullish

Confluence of signals supports the idea of a technical rebound:

✅ Bullish reaction candle in demand

✅ Fibonacci support + lower trendline touch

✅ COT data stabilizing with rising open interest

✅ Seasonal weakness possibly exhausted

EURJPY Hits Supply | Pullback Is ComingPrice has entered the daily supply zone (red area) between 170.80 and 171.80, showing immediate rejection with a long upper wick — a signal of potential short-term bearish reaction.

The RSI is turning lower, indicating loss of momentum, although it hasn’t reached extreme levels yet.

The current map suggests a technical pullback toward the 169.40–168.50 zone (FVG + dynamic support) before any potential bullish continuation toward 174+.

The overall structure remains bullish, but a correction looks likely due to technical exhaustion and retail positioning.

📊 2. COT Report (JPY Futures – as of 2025-07-01)

Non-Commercials (speculators) reduced long positions on the JPY by -7,779 contracts, and also slightly trimmed shorts → clear sign of position reduction.

Net positioning remains strongly negative (JPY weakness), but it's starting to recover slightly.

Commercials added both longs (+2,830) and shorts (+5,977), indicating indecision but growing interest.

Open interest slightly decreased (–516), though it remains elevated.

👉 The market has not yet reversed, but the JPY downtrend may be approaching exhaustion.

🧠 3. Retail Sentiment

86% of retail traders are short EUR/JPY — a strong contrarian bullish signal.

Average retail short entry: 166.27, while current price is 171.55 → retail traders are trapped and under pressure.

A short squeeze is likely underway or already completed, increasing the risk of a technical correction after distribution.

📅 4. Seasonality

July is historically weak for EUR/JPY:

20Y: -0.35

15Y: -0.49

10Y: -0.18

August tends to be even worse from a seasonal perspective.

This supports the idea of a potential pullback in the coming days or weeks.

Trading Conclusion

Current Bias: Short-term Neutral–Bearish, Medium-term Bullish.

✳️ Potential pullback from 172.30 toward 169.40–168.50

🎯 If price holds and builds clean bullish structure, expect continuation toward 174.00–175.00

❌ Invalidation on daily close below 167.80

EUR/USD Reversal Ahead? COT + DXY Strength Signal Price has broken below the ascending channel that started in mid-May.

The current candle is rejecting the weekly supply zone (1.17566–1.18319), leaving a significant upper wick.

Daily RSI is losing strength but has not yet reached extreme levels.

A key daily Fair Value Gap (FVG) lies between 1.1600 and 1.1480, with the first potential downside target at 1.14802, which aligns with support and the FVG zone.

A deeper bearish continuation could push price towards 1.1350, but only if the FVG lows are clearly broken.

📊 COT Data (CME - Euro FX & USD Index)

Euro FX

Net long: +15,334

Commercials increased both longs (+13,550) and shorts (+9,913) → mild divergence.

Non-Commercials (speculators) increased shorts (+4,786) more than longs (+1,188) → speculative bias tilting bearish.

USD Index

Strong net long accumulation across all trader types: +4,597 net.

Non-Commercials added +3,590 longs, with only a minor increase in shorts.

→ USD strength continues, reinforcing potential weakness in EUR/USD.

🧠 Retail Sentiment

67% of retail traders are short EUR/USD → typically a contrarian bullish signal.

However, the price is already showing distribution, not accumulation, so we may see price push lower first to trap remaining retail longs, invalidating the contrarian signal in the short term.

📅 Seasonality

July is historically bullish, especially on the 2Y (+0.0142) and 10Y (+0.0106) averages.

However, the 15Y and 20Y averages show a much more moderate performance (+0.007 / +0.0025).

Based on current price action, the seasonal rally may have already played out with the run-up to 1.1830. A correction now seems likely, even if the broader macro remains supportive mid-term.

🧩 Conclusion

Despite historically bullish seasonality for July, both price action and COT data indicate distribution with early signs of reversal.

Retail sentiment is too skewed short for a major breakdown just yet, but the technicals support a short-term pullback toward more balanced levels.

USD strength from COT and DXY structure reinforces a corrective short bias for now.

EURAUD Breakdown Incoming? Price + COT + Seasonality🧠 MACRO & INSTITUTIONAL FLOWS (COT)

EURO (EUR)

Strong increase in net long positions by non-commercials: +16,146

Commercials also added long exposure: +25,799

Bias: moderately bullish

AUSTRALIAN DOLLAR (AUD)

Non-commercials remain heavily net short (long/short ratio: 15% vs 63.6%)

Slight increase in commercial longs: +2,629

Bias: still bearish, but showing early signs of positioning exhaustion

COT Conclusion: EUR remains strong, AUD remains weak — but the recent extension calls for caution on fresh EURAUD longs.

📊 SEASONALITY (JULY)

EUR shows historically positive July performance across 2Y, 5Y, and 10Y averages

AUD also shows mild strength, but less consistent

🔎 Net differential: No strong seasonal edge on EURAUD in July

📈 RETAIL SENTIMENT

54% of retail traders are short EURAUD, 46% long

Slight contrarian bullish bias, but not extreme yet → neutral to slightly long

📉 TECHNICAL STRUCTURE – MULTI-TIMEFRAME

1. Weekly Chart

Strong bearish engulfing candle after 4 weeks of upside

RSI dropped below 50 → clear momentum shift

1.7960–1.8100 is now a liquidity zone that’s been tapped

2. Daily Chart

Confirmed break of the ascending channel formed since May

Price reacted from demand zone around 1.7460–1.7720, signaling potential pullback

Watch for rejection around 1.7910 (50% body of the weekly engulfing candle)

3. Entry Setup

Key area for short entries: 1.7910–1.7940

This zone aligns with:

✅ Former support now turned resistance

✅ Inside a valid bearish order block

✅ Ideal retracement level (50% engulfing body)

🎯 OPERATIONAL CONCLUSION

While the macro context still favors a stronger EUR against AUD, price action tells another story.

The weekly engulfing candle is a strong technical reversal signal, and the daily structure confirms the break.

→ Shorting the pullback into 1.7910–1.7940 could offer an excellent R/R trade setup.

Bias: Short-term bearish – Targeting 1.7700, 1.7550, and potentially 1.7315

Invalidation: Daily close above 1.8040

EUR_NZD RESISTANCE AHEAD|SHORT|

✅EUR_NZD has been growing recently

And the pair seems locally overbought

So as the pair is approaching a horizontal resistance of 1.9500

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-JPY Short From Resistance! Sell!

Hello,Traders!

USD-JPY keeps growing but

A strong horizontal resistance

Is ahead around 148.500

So after the retest we will

Be expecting a local

Bearish correction on Monday!

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-USD Swing Long! Buy!

Hello,Traders!

GBP-USD is trading in a

Long-term uptrend along

The rising support support

Line and the pair will soon

Hit it and from there we will

Be expecting a bullish

Rebound on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_USD STRONG UPTREND|LONG|

✅EUR_USD is trading in an uptrend

With the pair set to retest

The rising support line

From where I think the growth will continue

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD_JPY BULLISH BREAKOUT|LONG|

✅CAD_JPY broke the key

Structure level of 107.400

While trading in a strong uptrend

Which makes me bullish biased

And I think that after the retest of

The broken level is complete

A rebound and bullish continuation will follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.