XAGUSD – Bullish Setup for a Move Toward 40 1. What happened recently

After the massive selloff in early April, Silver (XAGUSD) reversed aggressively — gaining nearly 10,000 pips and breaking into multi-decade highs near 38. That kind of move is not noise. It’s power.

The month of June brought consolidation, with price slowly correcting and stabilizing. But this doesn’t look like distribution — it looks like new accumulation.

2. The key question

Is Silver building a base for the next breakout, or has the rally run out of steam?

3. Why I expect another leg up

- 35.00 is now acting as a solid support — tested, respected

- The correction has been shallow, typical for a bull rectangle structure

- Momentum remains on the buyers’ side — no major breakdown signs

- If buyers step in strongly, the next target is clearly the 40.00 psychological level

- This is a textbook bullish continuation setup.

4. Trading plan

Swing traders should watch the 35.00–35.20 zone for buying opportunities.

The risk/reward is attractive — with a potential for +5000 pips on a move toward 40, while keeping stops under the base.

Buy the dips — not the breakouts.

5. Final thoughts 🚀

Silver is shining again. The trend is up, the structure supports further gains, and the chart is offering a clean setup. Until 35 fails, the bias remains bullish.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Signals

Gold Rebounds from 3250 – But Bears Still in Control1. What happened last week

As you know, I’ve been bearish on Gold all last week long. Even though the geopolitical situation in the Middle East escalated over the weekend, the fact that price couldn’t reclaim the 3400 resistance was a major red flag.

It showed us that the bullish sentiment was fragile, and that downside pressure is just around the corner.

And indeed — Gold sold off. The weekly close below the 3300 level confirmed the weakness.

2. The key question now

Has Gold found a bottom at 3250, or is this just a temporary rebound before another leg down?

3. Why I expect a continuation lower

- The weekly close was under 3300, breaking key support

- 3250 is being tested again — a level touched multiple times since the mid-April ATH

- The current rebound looks corrective, not impulsive

- Resistance levels at 3320 and 3340 are likely to hold as ceilings

- No major catalyst yet to justify a reversal

- This looks like a classic “sell the rally” setup in a weakening trend.

4. Trading plan

The idea is simple: sell the spikes.

If price bounces into 3320–3340, I will look to short again, anticipating a renewed test of the 3250 support zone.

If 3250 breaks — we could see acceleration toward 3200 or lower.

5. Final thoughts 🚀

No need to complicate things. Gold remains vulnerable unless it clears 3340. Until then, the trend is your friend — and that trend points down.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

GOLD MARKET ANALYSIS AND COMMENTARY - [Jun 30 - Jul 04]Last week, OANDA:XAUUSD fell sharply from an opening price of $3,392/oz to a low of $3,255/oz and closed at $3,274/oz. The reason was that Israel and Iran had officially ceased fire, although negotiations with the US remained difficult. In addition, FED Chairman Jerome Powell reaffirmed that there was no rush to cut interest rates due to high inflation risks. In addition, summer is a period of weak demand for physical gold, continuing to put pressure on gold prices.

In addition, summer is typically the low season for physical gold demand, which could continue to weigh on gold prices.

In addition to the seasonal lull in trading that has affected the gold market, improving economic sentiment as the Trump administration has said there is progress in trade agreements, especially the framework agreement on trade with China, will also continue to negatively impact gold prices next week.

Thus, gold prices next week may continue to be under downward pressure, but the decline may not be too large as gold prices next week are still supported by some fundamental factors.

This week, the US will release the non-farm payrolls (NFP) report and the unemployment rate for June. According to forecasts, NFP may reach 120,000 jobs. If NFP increases higher than expected, the FED will continue to delay cutting interest rates, negatively affecting gold prices next week. On the contrary, if NFP drops sharply below 100,000 jobs, it will increase the possibility of the FED cutting interest rates, helping gold prices rise again next week, but not too strongly.

📌Technically, the gold price closed below $3,300/oz this week, which could pave the way for a drop to $3,200/oz next week, or below that to $3,120/oz. If the gold price rebounds above $3,300/oz next week, it could trigger a recovery to $3,330-$3,360/oz.

Notable technical levels are listed below.

Support: 3,246 – 3,228USD

Resistance: 3,292 – 3,300USD

SELL XAUUSD PRICE 3367 - 3365⚡️

↠↠ Stop Loss 3371

BUY XAUUSD PRICE 3178 - 3180⚡️

↠↠ Stop Loss 3174

ETHEREUM WILL GROW|LONG|

✅ETHEREUM consolidated

Above the horizontal support

Around 2400$ and now we are

Finally seeing a bullish rebound

So we are bullish biased and

We will be expecting a

Further move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Support Ahead! Buy!

Hello,Traders!

GOLD keeps falling just

As I predicted but the price

Will soon hit a horizontal support

Around 3235$ from where we

Will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_AUD LOCAL SHORT|

✅EUR_AUD is going up now

But a strong resistance level is ahead at 1.8018

Thus I am expecting a pullback

And a move down towards the target of 1.7900

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETHUSD: Strong Bearish Sentiment! Short!

My dear friends,

Today we will analyse ETHUSD together☺️

The market is at an inflection zone and price has now reached an area around 2,437.2 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 2,426.5..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

BTCUSD: Bulls Are Winning! Long!

My dear friends,

Today we will analyse BTCUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 107,630.73 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 108,207.06.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

GBPUSD Will Move Lower! Short!

Please, check our technical outlook for GBPUSD.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 1.371.

Considering the today's price action, probabilities will be high to see a movement to 1.359.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NZD-JPY Potential Short! Sell!

Hello,Traders!

NZD-JPY is slowly approaching

A horizontal resistance level

Around 87.994 so despite

The strong uptrend

We will be expecting a

Local bearish pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

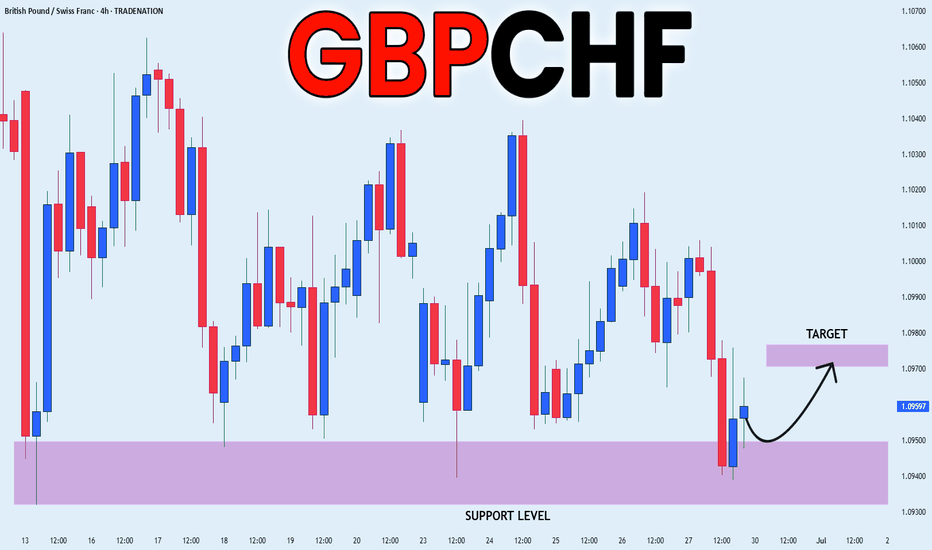

GBP_CHF RISKY LONG|

✅GBP_CHF fell down sharply

But a strong support level was hit at 1.0932

Thus as a rebound is already happening

A move up towards the target of 1.0970 shall follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_JPY SHORT FROM RESISTANCE|

✅NZD_JPY is set to retest a

Strong resistance level above at 88.000

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 87.341

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHF-JPY Local Long! Buy!

Hello,Traders!

CHF-JPY is trading in a strong

Uptrend and the pair made a

Bullish breakout from the bullish

Triangle pattern and is now seems

To be consolidating above the

Support cluster around 180.740

So we are bullish biased and

We will be expecting a further

Bullish move up on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CHF Will Fall! Sell!

Hello,Traders!

USD-CHF keeps falling down

And the pair broke the key

Horizontal level of 0.8090

Decisively so we are bearish

Biased and we will be expecting

A further move down next week

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Lingrid | BNBUSDT breakout Setup. Preparing for Bullish Surge? BINANCE:BNBUSDT is facing strong resistance below the red descending trendline, repeatedly forming lower highs as it struggles to break above 650. The price is coiling between the 636 and 648 zones, hinting at a potential breakout or breakdown move. A clean rejection could drag price back to the 601 support area, while a surge above 650 opens the path toward 665.

📈 Key Levels

Buy zone: 636–640

Sell trigger: rejection from 648 or breakdown below 636

Target: 665

Buy trigger: breakout and close above 650 with volume

💡 Risks

Range continuation may trap breakout traders

Failure to hold 636 could accelerate downside

Resistance at 665 may cap bullish move short-term

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

DXY STRONG DOWNTREND CONTINUES|SHORT|

✅DXY is going down currently

In a strong downtrend and the index

Broke the key structure level of 98.000

Which is now a resistance,

And after the pullback

And retest, I think the price

Will go further down next week

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-NZD Bullish Bias! Buy!

Hello,Traders!

EUR-NZD is trading in a

Strong uptrend and the pair

Is printing higher highs and

Higher lows while breaking

Important key levels such

As 1.9270 which is now

A support and the pair

Is consolidating above the

New support so we are

Bullish biased and we will

Be expecting a further move

Further up on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL: Next Move Is Up! Long!

My dear friends,

Today we will analyse USOIL together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 65.100 will confirm the new direction upwards with the target being the next key level of 65.468 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

NG1!: Target Is Down! Short!

My dear friends,

Today we will analyse NG1! together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 3.745 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

NI225: Move Down Expected! Short!

My dear friends,

Today we will analyse NI225 together☺️

The market is at an inflection zone and price has now reached an area around 40,150.79 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 39,753.50..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

BITCOIN Is Bullish! Buy!

Here is our detailed technical review for BITCOIN.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 106,865.57.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 112,099.80 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURJPY Is Very Bullish! Long!

Take a look at our analysis for EURJPY.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 169.470.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 174.552 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPCHF Is Going Up! Buy!

Please, check our technical outlook for GBPCHF.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 1.095.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 1.098 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!