NZDJPY - Potential bounce to 85.300 from SupportOANDA:NZDJPY has reached a major support level, an area where buyers have previously shown strong interest. This zone has acted as a key zone, increasing the likelihood of a bounce if buyers step in.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would strengthen the case for a move higher. If buyers take control, the price could bounce toward the 85.300 target. However, a decisive breakdown below this support would invalidate the bullish scenario and could lead to further downside.

This isn’t financial advice, just my take on how I approach support and resistance zones. Best to wait for clear confirmation, like a strong rejection or a volume spike, before making a move.

Every trader has a unique perspective. Let’s discuss this setup within the TradingView community!

Signalsfree

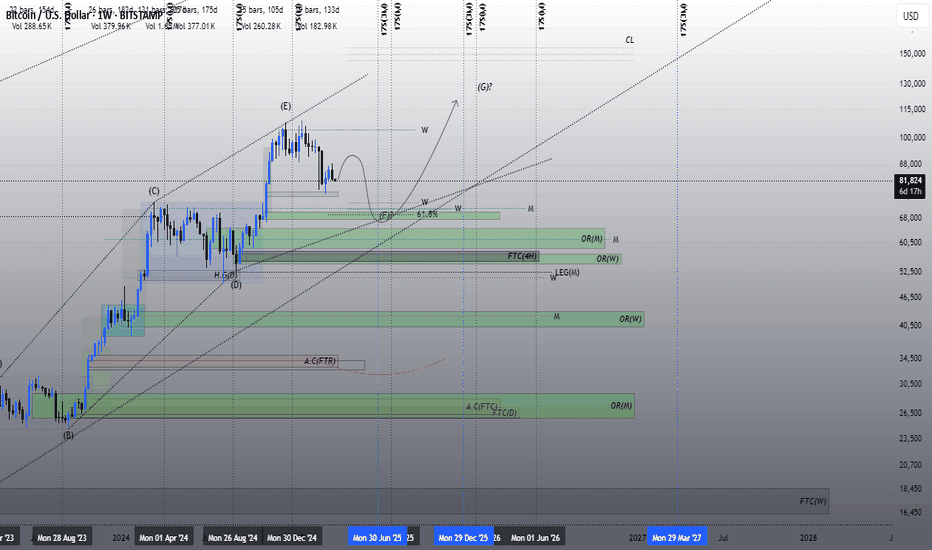

BTCUSDTAccording to this analysis, if the price reaches around $70,000 in a corrective structure with a time-consuming and low momentum in the form of wave F, it may grow to around $120,000 and even higher in the form of wave G.

But it seems that the ideal buying point is around $60,000 and the origin of the breakout node. In this case, of course, we will have a strong wave F, which means that we must be a little flexible in the possible targets of wave G.

In terms of time, late June, July and early August are the ideal time areas for the end of wave F, and late 2025 and early 2026 are the time areas for the end of the two waves G.

AMD Advanced Micro Devices Price TargetAdvanced Micro Devices (AMD) has positioned itself as a major player in the semiconductor industry, capitalizing on growing demand for high-performance computing, artificial intelligence (AI), and data center solutions. As of now, AMD’s forward price-to-earnings (P/E) ratio stands at 17.12, indicating that the stock is trading at a reasonable valuation compared to its growth potential.

AMD has benefited from the increasing adoption of AI-driven solutions, particularly through its MI300 series of AI accelerators, which have gained traction among major cloud service providers. The company’s expansion into the data center market has also been a key growth driver, with strong sales in EPYC processors contributing to revenue growth.

Furthermore, AMD's strategic acquisition of Xilinx has strengthened its position in the FPGA (Field-Programmable Gate Array) market, enhancing its ability to offer diversified and high-margin products. This, combined with improving margins and consistent product innovation, positions AMD for steady financial performance in the coming quarters.

Given AMD’s solid fundamentals, growing market share in AI and data centers, and attractive valuation at a 17.12 forward P/E, a price target of $125 by the end of the year appears achievable. This would represent approximately 15% upside from current levels, driven by continued revenue growth and expanding profit margins.

BANANA/USDT with a 61.77% potential

BANANA/USDT (6H timeframe)

Current Price: 24.82 USDT

Recent High: 28.19 USDT

Resistance Level Highlighted: 34.28 USDT

Projected Target: Around 34.28 USDT (with a 61.77% potential increase of 13.08 points from current price)

+FVG (Fair Value Gaps):

Two bullish FVG zones are marked, indicating potential areas of interest where price may return for liquidity or support.

Expected Price Movement (Blue Line Path):

A slight retracement is anticipated toward the lower FVG zone (around 20–22 USDT).

After that, a bounce is expected, targeting the major resistance zone around 34.28 USDT.

A heart symbol marks this target area, possibly indicating strong bullish sentiment or a key zone to take profit.

Visual Markers:

Orange box at 34.28: Price target zone.

Vertical purple line: Measures the potential gain (13.08 points or 61.77% rise).

WELCOME 3000 GOLD WILL GOLD MARK NEW ATH AGAIN!🔥 Attention Traders! 🔥

XAUUSD is heating up! Here's the latest analysis:

🔻 Bearish Setup: Watch for a potential decline if the price breaks below 2979-3003. Key targets: 2960 & 2945.

🔺 Bullish Setup: A breakout above 2911 could signal buying opportunities! Keep an eye on these targets: 3015 & 3030.

📉 Risk Management: Always protect your capital by setting stop-losses and adjusting position sizes based on your risk tolerance. Trading with discipline is key to success!

📊 Stay Engaged: Share your thoughts and strategies as we navigate through this volatile market. Let’s aim for new highs while managing risk effectively! 💵🚀

TIGR UP Fintech Holding Limited Options Ahead of EarningsIf you haven`t bought TIGR before the previous earnings:

Now analyzing the options chain and the chart patterns of TIGR UP Fintech Holding Limited prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $0.76.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 5.50usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $1.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BE ALERT AUDJPY IN SUPPORT ZONE.Audjpy in support zone of Daily Timeframe if Any Daily Candle Give Us Confirm To Prices Go Up Market Will Go Their Rest Lequidity Areas To Hunt Or Fill The FVGs Of Sell Side.

Tip! Trading, like any high-performance endeavor, requires skill, focus, and discipline. Those who are in it for the money alone aren’t likely to focus on the process of being a good trader.

CLOV Clover Health Investments Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CLOV Clover Health Investments prior to the earnings report this week,

I would consider purchasing the 4usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.42.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ONYXUSDTBased on this wave count and other considerations, we are probably in wave 4 and the areas indicated on the chart are ideal ranges for the bottom of wave 4 and the hunt for wave 5.

Buying spot this currency around $0.011 to $0.0125 seems low-risk and reasonable.

March 5th to 10th is an ideal time zone for the end of wave 4.

Just an analysis that could easily be wrong.

Alikze »» W | Formation of the Double Bottom pattern - 1D🔍 Technical analysis: Formation of a Double Bottom pattern in a descending channel

📣 BINANCE:WUSDT It is moving in a descending channel on the daily time frame.

🟢 In the Buyer Zone, by forming a Double Bottom and a candlestick pattern, it can continue its growth in the first step to the first supply zone.

🟢 If an inverted head and shoulders pattern is formed in the supply zone, it can continue its upward trend to the next supply zone.

🟢 Therefore, if the Buyer Zone is maintained, an upward trend in the form of a three-wave up to the 40 cent range is expected.

»»»«««»»»«««»»»«««

Please support this idea 💡 with a LIKE 👍 and COMMENT 💬 if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email 📧 in the future.

Thanks for your continued support.🙏

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««

BABA Alibaba Group Holding Limited Options Ahead of EarningsIf you haven`t bought the dip on BABA:

Now analyzing the options chain and the chart patterns of BABA Alibaba Group Holding Limited prior to the earnings report this week,

I would consider purchasing the 135usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $14.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

MRNA Moderna Options Ahead of EarningsIf you haven`t bought MRNA before the previous earnings:

Now analyzing the options chain and the chart patterns of MRNA Moderna prior to the earnings report this week,

I would consider purchasing the 45usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $3.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

EURJPY - Potential Bullish Reversal from Key Demand ZoneOANDA:EURJPY is showing signs of a potential bullish reversal around a well-defined demand zone. This level has previously acted as strong support, making it a key area to watch. While the current market structure remains bearish, with a series of lower highs and lower lows, the projected scenario suggests a possible liquidity sweep below recent lows before a rebound toward 159.000.

The main risk lies in the possibility of fakeouts or deeper liquidity grabs before a sustained move higher. Monitoring price reactions at the demand zone and using lower timeframes for confirmation could help refine entry points. How do you see this setup playing out?

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management,

Best of luck

GBPJPY TRADE DON'T MISS THIS OPPORTUNITY 📈 GBP/JPY Buy Setup - 4H Analysis 🚀

I'm currently looking at a potential bullish move on GBP/JPY based on recent price action. The pair has been in a downtrend but has found support around 188.00-188.50, showing signs of reversal.

🔹 Entry: Around 189.10-189.30

🔹 Stop Loss: 187.76 (Below recent lows)

🔹 Target: 191.83 (Previous resistance level)

🔍 Analysis Breakdown:

✅ Price has rejected a key support zone, indicating potential upside.

✅ Bullish momentum is forming with higher lows on lower timeframes.

✅ Risk-to-reward ratio is favorable, aiming for a 2:1+ setup.

I'll be monitoring this trade closely. Let me know your thoughts! 📊📢

#GBPJPY #ForexTrading #PriceAction #TradingView #ForexSignals #FXAnalysis 🚀💹

INTC Intel Corporation Options Ahead of EarningsIf you didn’t buy during last year’s double bottom on INTC:

Now analyzing the options chain and the chart patterns of INTC Intel Corporation prior to the earnings report this week,

I would consider purchasing the 22usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $1.56.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Alikze »» INJ | Bullish Diamond Pattern - 1D🔍 Technical analysis: Bullish Diamond Pattern on Daily Timeframe, Sideway Price Movement

📣 BINANCE:INJUSDT In the analysis presented in the 12-hour timeframe , it was noted that the INJ currency is moving in an ascending channel.

🟢 After reaching the $25 area, the price corrected, which extended to the green box area, and then in the green box area, with demand, the price advanced to the supply area.

🟢 Currently, in the daily timeframe, the price corrected with a zigzag correction to the Fibonacci 1.618 area after reaching the supply area and the ceiling of the ascending channel.

💎 After that, the price had a sideways movement and has now formed an ascending diamond pattern.

💎 Therefore, we expect the price to continue its growth again in accordance with the movement path to the supply area before the $35 area.

🔔It should also be noted that if the price breaks the Fibonacci 1.618 area, the bullish scenario will be invalid and must be reviewed and updated again.

»»»«««»»»«««»»»«««

Please support this idea 💡 with a LIKE 👍 and COMMENT 💬 if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email 📧 in the future.

Thanks for your continued support.🙏

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««

USDCHF - towards 0.90810?OANDA:USDCHF is currently approaching a key support level that has acted as a strong base for upward price movement. Recent price behavior suggests this level could once again turn into a significant demand zone.

If we see confirmation of bullish sentiment—such as increased buying activity or reversal candlestick patterns—there’s potential for the price to go towards 0.90810, aligning with the current trend. If the support is broken, it may point to a reversal in momentum, potentially leading to further declines.

I am prepared for potential volatility to adjust the risk management accordingly.

Alikze »» IO| Bullish Wave Five - 1D🔍 Technical analysis: Bullish Wave Five - 1D

📣 BINANCE:IOUSDT

🟢 In the analysis of the previous post on the 8-hour timeframe, it was noted that it is moving in a descending channel that can continue to correct to the Buyer Zone.

🟢 According to the analysis, after reaching the area, the price broke out of the congestion by touching the Buyer Zone several times and forming an ascending triangle pattern and continued its growth to the supply zone.

🟢 Currently, on the daily timeframe, it is suffering from a congestion in the supply zone.

💎 Therefore, if the price does not touch the Invalidation LVL zone, by breaking out of the congestion and breaking the supply zone, it can continue its growth to the next supply zone after breaking it.

»»»«««»»»«««»»»«««

Please support this idea 💡 with a LIKE 👍 and COMMENT 💬 if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email 📧 in the future.

Thanks for your continued support.🙏

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««