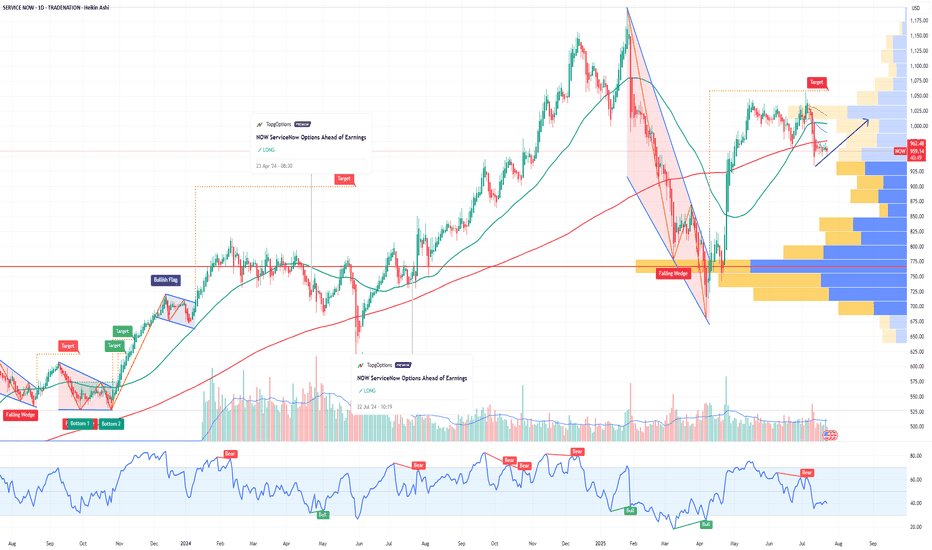

NOW ServiceNow Options Ahead of EarningsIf you haven`t bought NOW before the recent rally:

Analyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week,

I would consider purchasing the 960usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $97.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Signalsgroup

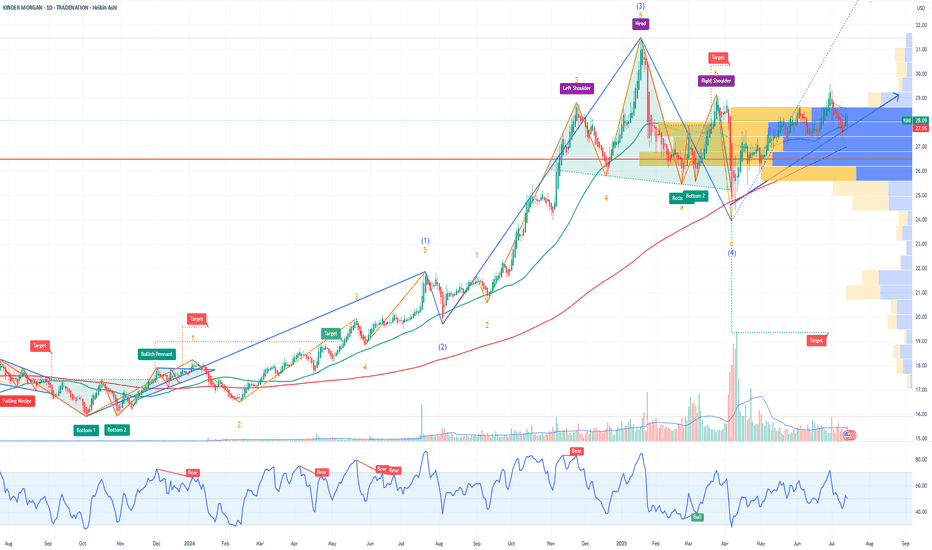

KMI Kinder Morgan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of KMI Kinder Morgan prior to the earnings report this week,

I would consider purchasing the 28.5usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $0.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

TSLA bearish: Musk vs Trump! Subsidy Spotlight & Sentiment RisksIf you haven`t bought TSLA before the recent breakout:

Now you need to know that Tesla (TSLA) is sitting around $315, but the vibe is getting shakier. Elon Musk’s feud with Donald Trump — complete with jokes about “putting the DOGE on him” if deported — might feel like another meme moment, but it spotlights Tesla’s huge dependency on federal and state support.

Estimates show Tesla could face up to $48 billion in lost government contracts and incentives over the next decade if the political tide turns. With Trump’s base calling out “green subsidies” as wasteful, Tesla’s funding pipeline could get squeezed — just as competition ramps up and margins get tighter.

Key Bearish Points

1) Political Risk Is Real

Musk’s public fight with Trump is a double-edged sword: he risks losing goodwill on both sides of the aisle. If the next administration decides to gut EV credits, Tesla could take a huge hit — far more than its rivals who rely less on U.S. incentives.

2) Subsidy Dependence

Tesla’s success is partly built on a foundation of tax credits, carbon credits, and favorable policies. $48B in potential lost value is nothing to shrug off — especially when competitors like BYD are gaining ground.

3) Bearish Technical Setup

TSLA’s chart is rolling over inside a bearish channel. It recently failed to hold the $330 level and now sits around $315. A clean breakdown below $300 could open the door to your target zone at $262 — a major support area from earlier this year.

Catalysts:

Any new comments from Trump’s camp about EV subsidies

Weak delivery/margin numbers from Tesla

Broader tech/equity pullback

Musk’s crypto distractions no longer propping up sentiment

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

VKTX: Unusual Options Flow & a Breakthrough Weight-Loss DrugIf you haven`t bought CKTX before the recent rally:

Now you need to know that Viking Therapeutics (VKTX) is a speculative biotech stock in the GLP-1/GIP agonist space, aiming to challenge market leaders like Eli Lilly and Novo Nordisk. Recently, I noticed unusual options flow — specifically, Jan 16, 2026 $60 strike calls

Key Bullish Points

1) Riding the Obesity Drug Boom

VK2735 is Viking’s dual agonist candidate showing promising early weight-loss efficacy, with potential overlap benefits in NASH (liver disease). The obesity treatment space is expected to exceed $100B by 2030—huge upside if their trials continue positively.

2) Options Flow Tells a Story

Those Jan 2026 $60 calls caught my attention precisely because the stock currently trades in the mid-$60s. These aren’t cheap lottery plays—they’re strategically timed wrt trial readouts, partnerships, or acquisition interest. Essentially, someone anticipates meaningful upside in the near future.

3) Descending Wedge — Chart Looks Bullish

VKTX peaked near $100, then pulled back into a well-defined descending wedge. If it breaks out above $70–$72 with volume, that could kick off a classic reversal trade.

Smart Money Options Flow — Near-Term Bet:

Recently, I spotted unusual open interest in $60 strike calls expiring Jan 16, 2026 — that’s only about 7 months away.

This means someone is positioning for a big upside move relatively soon, likely betting on positive Phase 2b/3 data, a partnership deal, or even buyout chatter within the next few quarters.

Short-dated, out-of-the-money call flow like this often hints at near-term news — not just a long-dated hedge.

AAPL Poised for Continued GrowthIf you haven`t bought AAPL before the rally:

What to consider now:

1. AI-Driven iPhone Upgrade CycleApple’s integration of Apple Intelligence, its proprietary AI platform, is set to catalyze a significant iPhone replacement cycle. Posts on X highlight positive sentiment around AI-driven demand, with estimates suggesting a 40% year-over-year surge in iPhone shipments in China during May 2024, signaling strong consumer interest. New AI features, such as on-device processing for enhanced privacy and functionality, are expected to drive accelerated hardware upgrades. Analysts, including Bernstein, project these features could boost upgrade rates, with even a 1% increase in upgrades driving meaningful revenue growth. With the iPhone 15 and future iterations leveraging AI, Apple is likely to capture pent-up demand, as noted by industry observers who see long-term revenue growth from its 7% year-over-year increase in active installed base.

2. Strong Ecosystem and Services GrowthApple’s ecosystem—spanning iPhones, iPads, Macs, and wearables—continues to drive customer loyalty and recurring revenue. The company reported record services growth in Q2 2025, with revenue reaching $95.4 billion, up 5% year-over-year. Services like Apple Music, iCloud, and Apple TV+ benefit from the growing active device base, which ensures sticky, high-margin revenue streams. This ecosystem strength mitigates concerns about short-term iPhone sales fluctuations, as Apple captures upgrade revenue over time. The seamless integration of hardware and services creates a moat that competitors struggle to replicate, reinforcing AAPL’s long-term growth potential.

3. Technical Bullish MomentumFrom a technical perspective, AAPL exhibits strong bullish patterns across multiple timeframes. TradingView analyses point to a rising bullish channel, with higher highs and higher lows signaling sustained upward momentum. Key bullish patterns, such as an ascending wedge and triangle, are forming around current price levels, suggesting potential breakouts. For instance, if AAPL clears $203.21 with volume, it could target $204.98 or higher, with some analyses eyeing $240 as a near-term resistance. Technical indicators like a rising RSI and MACD convergence further support short-term bullish momentum. Despite recent consolidation, reduced volatility and a strong setup pattern indicate AAPL is primed for a breakout.

4. Analyst Optimism and Market SentimentAnalyst sentiment remains overwhelmingly positive, with a consensus “Buy” rating and a 12-month price target of $228.85, implying a 14.05% upside from the current price of $200.66 as of June 2025. Hedge funds like Third Point see “significant” upside, driven by AI features that could meaningfully boost earnings. Bernstein’s raised price target to $240 reflects confidence in Apple’s ability to monetize AI through hardware and services. Posts on X also highlight investor optimism, with AAPL’s $350 billion market cap increase in a single day underscoring strong market confidence in its AI-driven growth chapter.

5. Global Expansion and Emerging MarketsApple’s growth in emerging markets, particularly India and China, bolsters its bullish case. Improved guidance for December 2023, driven by iPhone 15 adoption and India’s market potential, signals untapped opportunities. Apple’s ability to penetrate these high-growth regions, combined with its premium brand appeal, positions it to capture a larger share of global smartphone and tech markets.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Baidu ($BIDU): China’s Google Is Ready to Break OutIf you haven`t bought BIDU on the previous dip:

What you need to know now:

1. Baidu = The Google of China

Baidu dominates China’s search engine market, holding over 60% market share, making it the Google equivalent in the world's second-largest economy.

Its advertising business is deeply entrenched in Chinese internet infrastructure.

As digital ad spending rebounds in China, Baidu’s core business benefits directly.

2. AI and Autonomous Driving Moonshots

Baidu is China’s national AI champion, pouring billions into next-gen technologies:

Ernie Bot (Baidu’s ChatGPT competitor) is now integrated across its ecosystem and enterprise offerings.

Apollo Go, Baidu’s autonomous driving platform, already operates robo-taxis in multiple Chinese cities and has received licenses for fully driverless operations.

Baidu also provides AI cloud services, competing with Alibaba Cloud and Huawei.

With the Chinese government pushing AI self-sufficiency, Baidu is one of the biggest beneficiaries.

3. Cheap Valuation with High-Tech Exposure

Baidu trades at a forward P/E under 10 and price-to-sales under 2, despite being a major player in AI, cloud, and mobility.

That’s a fraction of what US tech firms with similar ambitions (like Alphabet or Tesla) are valued at.

Over $25 billion in cash and investments on the balance sheet adds a margin of safety.

4. Government Support & Stimulus Tailwinds

The Chinese government is pivoting back toward supporting tech innovation, especially in AI, after years of regulatory crackdowns.

Baidu is aligned with national AI and autonomous driving goals.

If the government ramps up fiscal stimulus, especially in infrastructure and technology, Baidu will likely benefit.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MDB MongoDB Options Ahead of EarningsIf you haven`t exited MDB before the selloff:

Now analyzing the options chain and the chart patterns of MDB MongoDB prior to the earnings report this week,

I would consider purchasing the180usd strike price Puts with

an expiration date of 2025-6-6,

for a premium of approximately $4.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

U Unity Potential Buyout Soon?!If you missed my previous signal on U (Unity):

Now Unity Technologies (NYSE: U) just caught fire — surging 12.5% in a single day — on a massive uptick in volume that should have every sharp trader watching closely. With $39.1M in volume against a daily average of 9.4M shares, something is clearly brewing beneath the surface.

But this isn’t just about technicals — the options market is lighting up with unusual activity, and there’s fundamental buyout potential that’s getting harder to ignore.

🔍 Options Traders Are Making Bold Bets

Yesterday: Traders loaded up on January 16 $37 strike calls — deep out-of-the-money, high-risk, high-reward plays.

Today: A massive $3.5 million bet was placed on the $30 strike calls, also expiring January 16.

These aren’t casual bets. This is smart money positioning for a potential takeover or major catalyst, and the timeline is clear: January 2025.

📈 Why a Buyout Could Be Back on the Table

Let’s rewind. On August 9, 2022, AppLovin (APP) made an unsolicited offer to acquire Unity in an all-stock deal worth $17.5B, valuing Unity shares at $58.85 — an 18% premium at the time. Unity rejected the deal.

Fast forward to today:

AppLovin's market cap has exploded — now sitting at a jaw-dropping $127B, up 3,800% since late 2022.

Unity, meanwhile, is a shadow of its former self, trading far below its ATH of $201.12 (November 2021), with ongoing struggles in monetization and competition.

But this disparity creates a prime M&A setup:

AppLovin now has the firepower and strategic incentive to revisit the acquisition — with Unity’s depressed valuation, it’s arguably a bargain.

The AI + gaming narrative is red hot. Combining Unity’s engine with AppLovin’s ad and monetization capabilities could be the synergy Wall Street loves.

🎯 The Trade Setup

Unity just broke out with conviction on high volume — this could be the first leg of a larger move.

Options flow suggests bullish sentiment into early 2025.

A renewed takeover offer could easily push the stock back toward the $50–60 zone, if not higher.

🧠 Final Thoughts

Unity is no stranger to volatility, but when volume spikes, options explode, and a cash-rich suitor like AppLovin is thriving, traders should sit up and pay attention.

We may be watching the early stages of a buyout story 2.0 unfold — and Wall Street might be starting to price it in.

📌 Watch Unity (U) closely in the coming weeks. The market may be whispering — or shouting — "Takeover incoming."

AI C3ai Options Ahead of EarningsIf you haven`t bought AI before the previous earnings:

Now analyzing the options chain and the chart patterns of AI C3ai prior to the earnings report this week,

I would consider purchasing the 23.5usd strike price Calls with

an expiration date of 2025-5-30,

for a premium of approximately $1.31.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NTNX Nutanix Options Ahead of EarningsIf you haven`t bought NTNX before the recent rally:

Now analyzing the options chain and the chart patterns of NTNX Nutanix prior to the earnings report this week,

I would consider purchasing the 80usd strike price Puts with

an expiration date of 2025-6-20,

for a premium of approximately $5.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DKNG DraftKings Options Ahead of EarningsIf you haven`t bought DKNG before the rally:

Now analyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $1.43.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RKT Rocket Companies Options Ahead of EarningsIf you haven`t bought RKT before the previous earnings:

Now analyzing the options chain and the chart patterns of RKT Rocket Companies prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.37.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CVX Chevron Corporation Options Ahead of EarningsIf you haven`t sold CVX before the retracement:

Now analyzing the options chain and the chart patterns of CVX Chevron Corporation prior to the earnings report this week,

I would consider purchasing the 125usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $5.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOOG Alphabet Options Ahead of EarningsIf you haven`t bought GOOG before the previous rally:

Now analyzing the options chain and the chart patterns of GOOG Alphabet prior to the earnings report this week,

I would consider purchasing the 170usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $4.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SPY S&P 500 etf Oversold on the RSI ! 2025 Price Target ! The SPDR S&P 500 ETF Trust (SPY) is flashing a major buy signal, with its Relative Strength Index (RSI) currently sitting at 28.33 — firmly in oversold territory. Historically, every time SPY has entered oversold levels on the RSI, institutional buyers have stepped in aggressively, driving sharp rebounds in the following weeks and months.

The last time SPY dipped below the 30 RSI threshold was during market pullbacks in 2022 and 2023 — both of which were followed by significant rallies as institutions capitalized on discounted valuations. The current setup is no different. With earnings growth stabilizing, inflation cooling, and the Federal Reserve signaling a potential shift toward rate cuts in the second half of the year, the backdrop for a recovery is aligning perfectly.

Technically, SPY is also approaching key support levels that have held strong in past market corrections. The combination of an oversold RSI and strong institutional appetite at these levels creates a compelling case for a bounce.

My price target for SPY by year-end is $640, representing over 15% upside from current levels. With sentiment stretched to the downside and technical indicators flashing green, SPY looks primed for a sharp and sustained rebound. Now could be the perfect time to position for the next leg higher.

TDOC Teladoc Health Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TDOC Teladoc prior to the earnings report this week,

I would consider purchasing the 20usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.04.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SRPT Sarepta Therapeutics Options Ahead of EarningsAnalyzing the options chain and the chart patterns of SRPT Sarepta Therapeuticsprior to the earnings report this week,

I would consider purchasing the 120usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $9.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BMBL Bumble Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BMBL Bumble prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $1.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PANW Palo Alto Networks Options Ahead of EarningsSnalyzing the options chain and the chart patterns of PANW Palo Alto Networks prior to the earnings report this week,

I would consider purchasing the 195usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $9.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AMAT Applied Materials Options Ahead of EarningsAnalyzing the options chain and the chart patterns of AMAT Applied Materials prior to the earnings report this week,

I would consider purchasing the 180usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $6.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ABBV AbbVie Options Ahead of EarningsIf you haven`t bought ABBV before the previous earnings:

Now analyzing the options chain and the chart patterns of ABBV AbbVie prior to the earnings report this week,

I would consider purchasing the 175usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $6.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CMCSA Comcast Corporation Options Ahead of EarningsAfter CMCSA reached the previous price target:

Now analyzing the options chain and the chart patterns of CMCSA Comcast Corporation prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $1.86.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DFS Discover Financial Services Options Ahead of EarningsIf you haven`t bought DFS before the previous earnings:

Now analyzing the options chain and the chart patterns of DFS Discover Financial Services prior to the earnings report this week,

I would consider purchasing the 190usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $6.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.