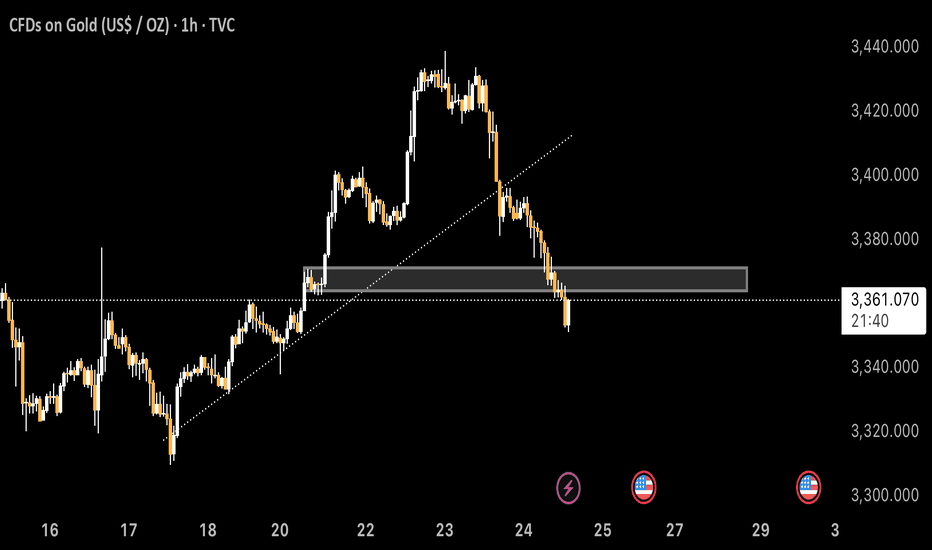

Lingrid | GOLD Weekly Market Outlook: Resistance Zone RejectionOANDA:XAUUSD markets have encountered significant resistance at the $3,450 level, resulting in a notable rejection and subsequent pullback toward support zones. The precious metal is now testing critical technical levels that will determine whether the broader bullish momentum can be sustained or if deeper correction is imminent.

The 4H chart reveals a clear level rejection at the resistance zone, followed by an impulse leg lower that has broken the upward trendline. This development suggests a potential shift in short-term momentum, with gold now trading within the consolidation zone between $3,365 and $3,285. The break of the ascending trendline is particularly significant, indicating that bulls may be losing control of the immediate price action.

The second chart provides valuable context with the weekly and 16-hour timeframe analysis. The pinbar rejection candle on the weekly chart confirms strong selling pressure at these elevated levels. The 16-hour chart shows multiple tests of the upward trendline, with the recent break potentially signaling a bearish impulse leg. However, the overall structure remains within the broader ascending channel, suggesting this could be a healthy correction within the long-term uptrend.

Critical levels to monitor include the $3,285 support zone and the broken trendline at $3,365. A decisive break below $3,285 could trigger a deeper correction toward $3,200, while reclaiming the upward trendline would restore bullish momentum toward new highs.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Signalsprovider

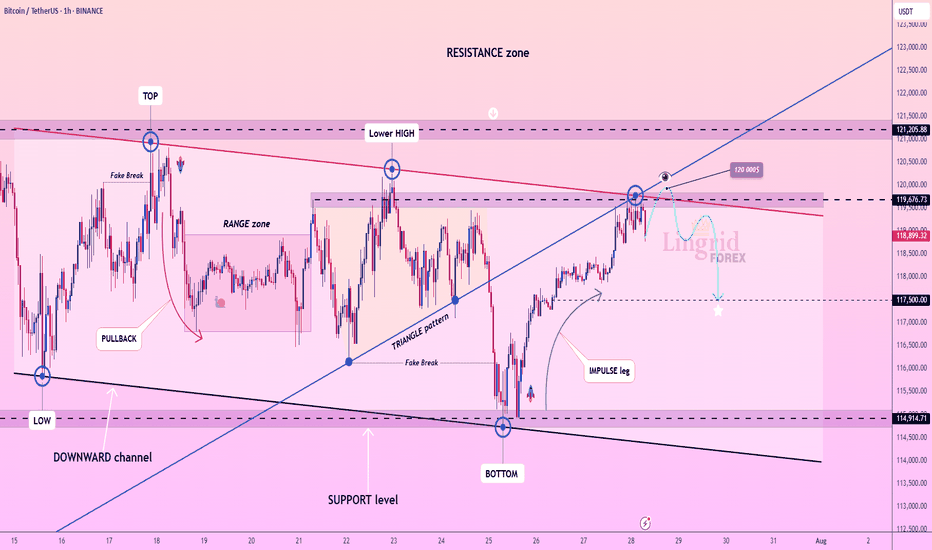

Lingrid | BTCUSDT Range-Bound Market: Short-Term Bearish MoveBINANCE:BTCUSDT has failed to break through the descending resistance near 120,000 and is now forming a lower high within the broader resistance zone. The price action follows an impulsive leg up and is currently tracing a potential reversal pattern under key structural resistance. As long as the market remains capped below 120,000, continuation toward 117,500 is likely. The downward bias is supported by weakening momentum after the bull trap and resistance rejection.

📉 Key Levels

Sell trigger: Breakdown below 119,000

Sell zone: 119,400 – 120,000

Target: 117,500

Invalidation: Break and close above 120,500

💡 Risks

Sudden bounce from the 119,000 handle could trap late sellers

Breakout above 120,000 would shift structure to bullish

Support near 117,500 may slow or reverse bearish pressure

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

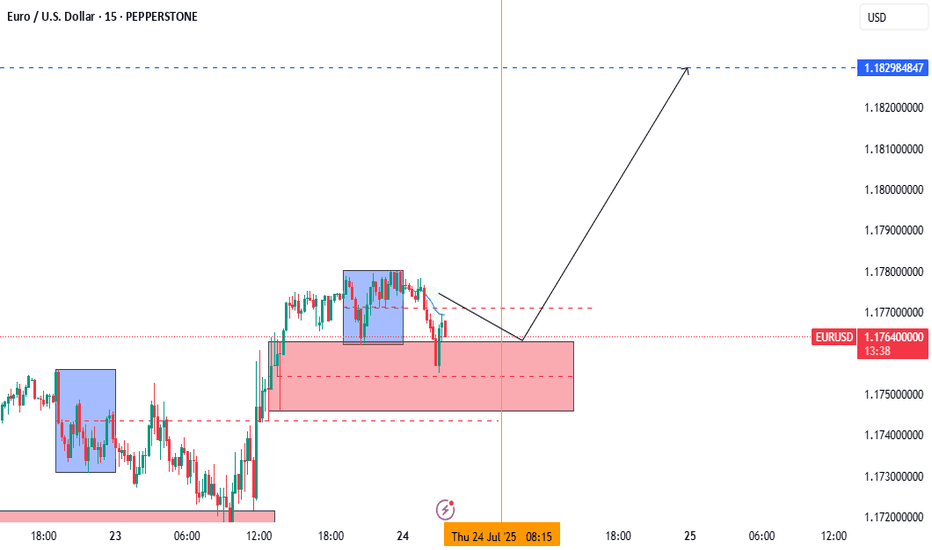

Lingrid | EURUSD Drops from 1.18000 RESISTANCE. Possible ShortFX:EURUSD is showing strong rejection at the resistance zone near 1.1790 after multiple fake breaks and failed attempts to sustain above the key level. Price has now broken below the mid-range and is forming a bearish rejection pattern right at the edge of the breakout area. With bearish momentum accelerating and a move toward 1.1620 support appears likely. Breakdown from the consolidation channel favors trend continuation to the downside.

📉 Key Levels

Sell trigger: Breakdown below 1.1660

Sell zone: 1.1700 – 1.1730

Target: 1.1620

Invalidation: Break above 1.1750

💡 Risks

Sudden bullish engulfing near 1.1670 could negate the breakdown

Support at 1.1620 may trigger a bounce

US macro data could shift trend dynamics mid-move

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | USDCHF Potential Bullish Move Following Level BreakoutFX:USDCHF surged from a higher low and is now retesting the broken structure near 0.802, maintaining its position within the broader upward channel. A clean bounce from this zone would confirm the bullish structure, targeting the upper channel resistance near 0.815. Pullback and higher low structure support continued upside movement with short-term consolidation possible. A breakout from the consolidation box could accelerate momentum toward the resistance area.

📈 Key Levels

Buy zone: 0.802 – 0.805

Buy trigger: Bullish confirmation above 0.805

Target: 0.815

Invalidation: Drop below 0.796

💡 Risks

False breakout near 0.805 may lead to rejection

Failure to form higher high would invalidate bullish sequence

Momentum divergence could slow rally near resistance

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | GOLD shorting Opportunity at Confluence ZoneThe price perfectly fulfilled my previous idea . OANDA:XAUUSD broke down sharply after forming a local top at the 3433 resistance zone, with clear bearish momentum dominating recent candles. Price is now consolidating below the broken trendline and previous structure at 3349, setting up for a possible retest and rejection. If price confirms rejection under this resistance, continuation toward the 3288 support area becomes highly likely. A lower high formation below the blue upward trendline would validate the bearish thesis.

📉 Key Levels

Sell trigger: Rejection near 3349–3350

Sell zone: 3345–3355

Target: 3288

Invalidation: Break above 3355 and trendline recovery

💡 Risks

Sudden bullish breakout could reclaim upward trendline

Support near 3288 may create a rebound

Thin liquidity could exaggerate short-term wicks

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | AVAXUSDT Corrective Move In The MarketThe price perfectly fulfilled my previous idea . BINANCE:AVAXUSDT retraced sharply from the 27.34 resistance zone after making a higher high but found support above the descending trendline. The recent corrective move has paused at a key structure level near 24.96, hinting at potential bullish continuation. A breakout above this local resistance could trigger a rally toward the 26.50–27.34 target zone. Momentum builds as long as price remains above the trendline and higher low structure.

📈 Key Levels

Buy zone: 24.80 – 25.30

Buy trigger: Break and hold above 25.30

Target: 26.50

Invalidation: Close below 24.00

💡 Risks

Downward trendline still active and could act as resistance

Potential for bearish fakeout before breakout

Failure to reclaim 25.30 quickly weakens bullish scenario

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

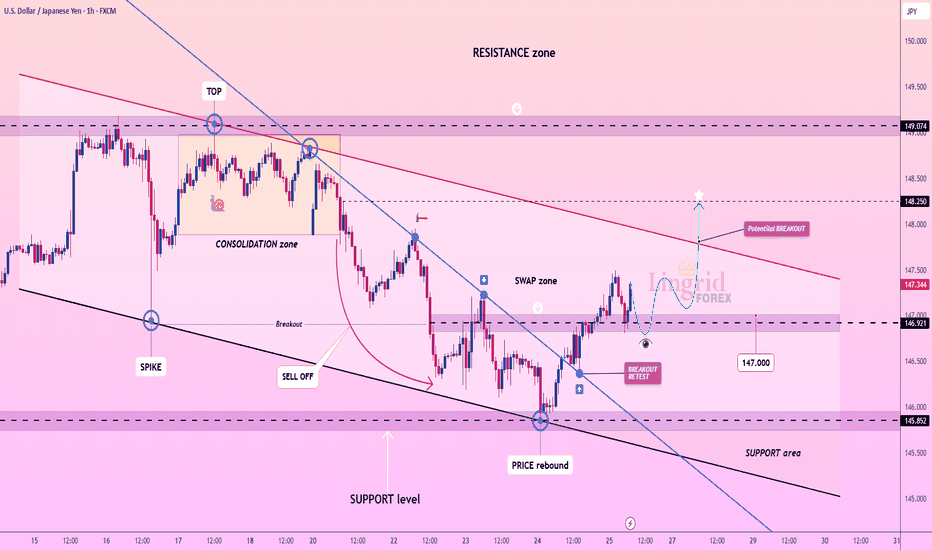

Lingrid | USDJPY Potential Channel Breakout. LongFX:USDJPY is retesting the breakout zone after reclaiming support from a prior swap area near 146.9. Price action has broken above a downward trendline and is forming a bullish retest structure. As long as USDJPY holds above 146.920 zone, the setup favors a continuation toward the resistance barrier. A breakout above the red descending trendline could accelerate upside momentum.

📉 Key Levels

Buy trigger: Break and hold above 147.500

Buy zone: 146.900 – 147.000

Target: 148.250

Invalidation: Break below 146.000

💡 Risks

Failure to break the descending red trendline may trigger renewed selling

Consolidation below resistance could signal buyer exhaustion

Break below 146.000 would invalidate bullish retest setup

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

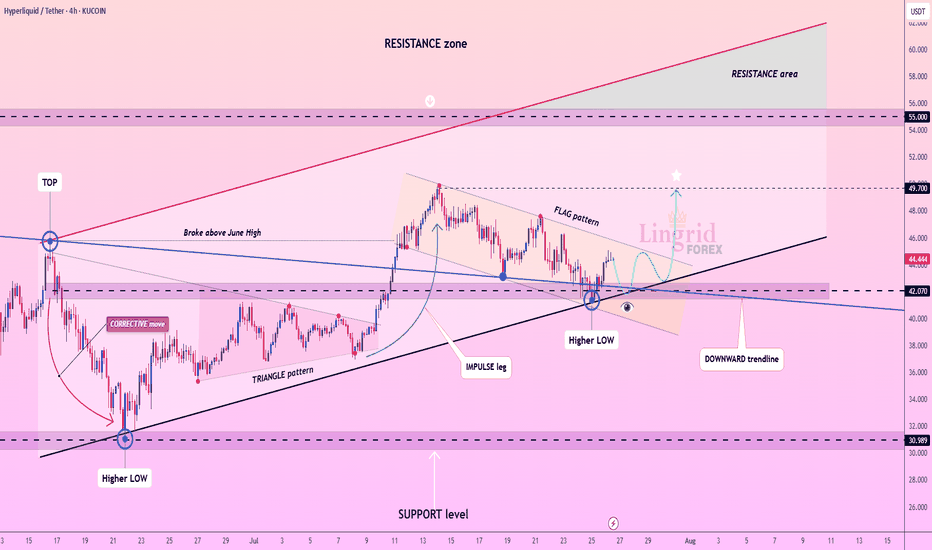

Lingrid | HYPEUSDT Potential Continuation After PullbackKUCOIN:HYPEUSDT is bouncing from a higher low near the 42.070 zone after breaking a descending flag pattern. Price action remains above the ascending support trendline while pressing into a key structure retest. As long as GETTEX:HYPE stays above 42, a bullish leg toward the 49.700 resistance remains likely. Structure suggests a resumption of the impulse phase within the broader uptrend.

📉 Key Levels

Buy trigger: Clean breakout above 45.00

Buy zone: 41.5 – 43.0 (support + flag bottom)

Target: 49.700

Invalidation: Close below 40.00

💡 Risks

Breakdown below the ascending support would weaken the bullish setup

Failure to reclaim mid-flag resistance may lead to deeper consolidation

Broader market weakness in altcoins could delay breakout momentum

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

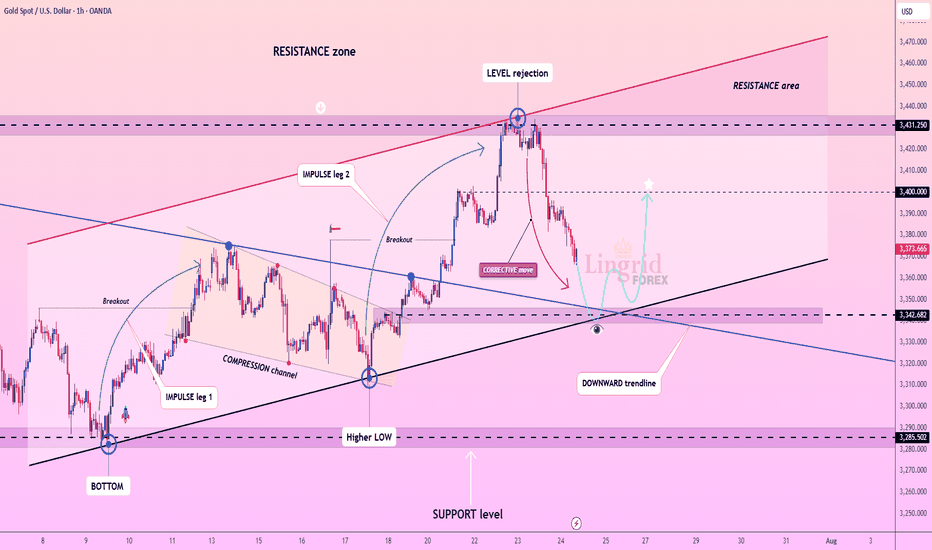

Lingrid | GOLD Corrective Move: Potential Long Trade OpportunityThe price perfectly fulfilled my last idea . OANDA:XAUUSD is pulling back sharply after facing rejection from the key resistance level at 3431, following a two-leg impulse wave. The structure shows a correction within an active uptrend, nearing confluence support from the upward trendline and horizontal level. As long as price holds above 3342, a bounce and continuation toward 3400 remain the favored scenario. Broader bullish structure and momentum buildup point to a possible resumption after the current retracement.

📉 Key Levels

Buy trigger: Break above 3350

Buy zone: 3345 – 3340

Target: 3400

Invalidation: Break below 3320

💡 Risks

Failure to hold the upward trendline could shift momentum

Weak bounce may trap buyers before real breakout

Resistance at 3400 could remain firm without stronger volume support

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

XAUUSD H1 BUYING SETUPScenario:

Gold is showing strong buying momentum 📈. The best entry points are around the H1 FVG (Fair Value Gap) and Order Block (OB) zones. Wait for confirmation signals in either of these areas.

Gold could take off 🚀 from the FVG or OB. Once you see confirmation in any of these zones, take the entry ✅.

Use a small lot size and follow strict risk management rules ⚠️💰.

Stay disciplined and trade smart! 🧠📊

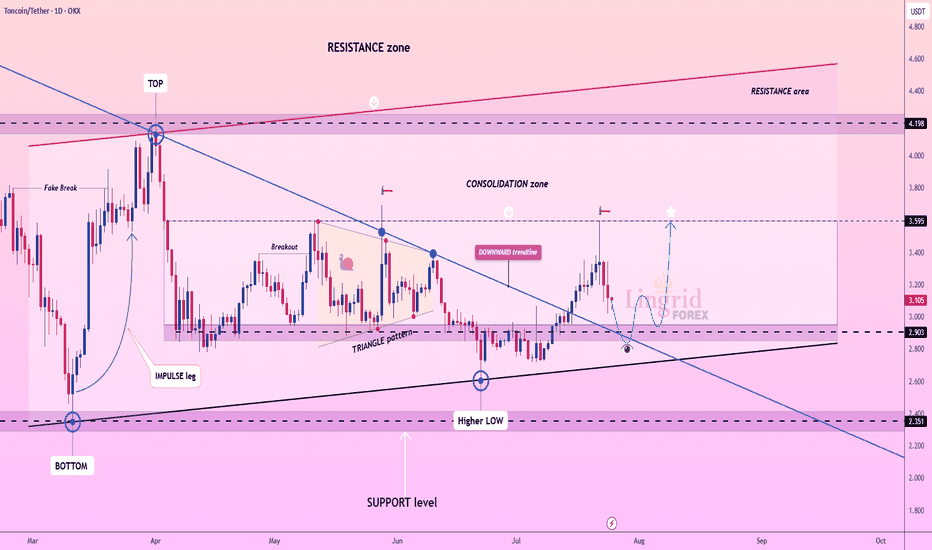

Lingrid | TONUSDT Potential Rebound from Support ZoneThe price perfectly fulfilled my last idea . OKX:TONUSDT is testing support after pulling back from the consolidation zone and forming a higher low above key structure. The chart shows a breakout from the downward trendline followed by a corrective retracement back toward confluence support. As long as price stays above 2.903, a bounce and renewed move toward 3.595 remains the base case. Structure favors bullish continuation after the retest of the breakout level.

📉 Key Levels

Buy trigger: Break and hold above 3.200

Buy zone: 2.903 – 3.050

Target: 3.595

Invalidation: Break below 2.903

💡 Risks

Failure to hold confluence of upward trendline and horizontal support

Weak follow-through above 3.2 could indicate distribution

Resistance at 3.595 may trigger renewed selling before breakout

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Gold Next Move Possible Hello Traders, Today I’m back with another idea.

As you know gold has changed the trend from bullish to the bearish.

The gold has fallen from the area 3438 to 3351. Now the current price is 3358.

I’m looking for the sell zone, In my view gold will drop till 3310.

I’m monitoring the sell zone 3364-3371, when the market touches the zone, I will add sell and my target will be 3310. Keep in bear my first target is 3351, second target is 3337 and the last target is 3310.

In the case if price breaks the 3377 area then we will have to wait until confirmation for another setup.

Stay Tune for every update.

Kindly share your ideas and leave positive comments. Thanks Everybody.

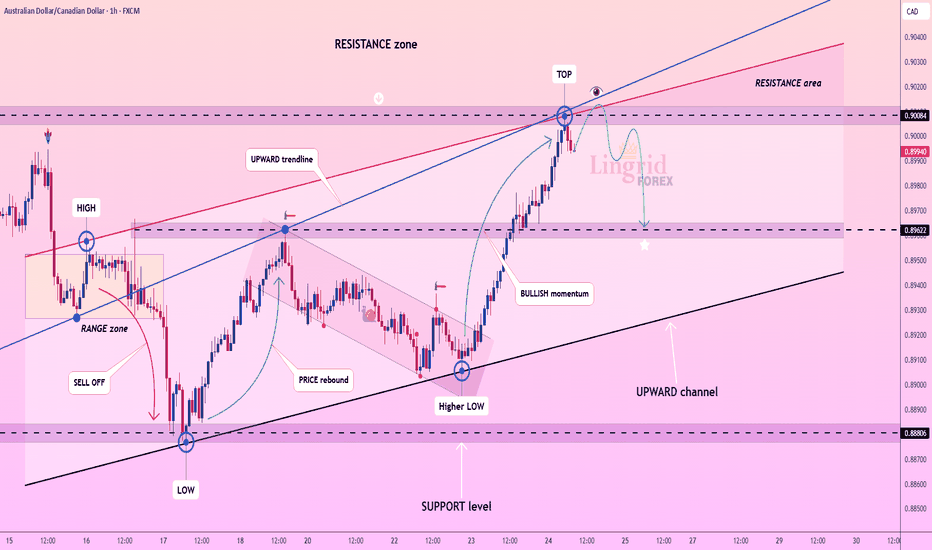

Lingrid | AUDCAD Short Following Resistance Fake Breakout The price perfectly fulfilled my last idea . FX:AUDCAD is rejecting from the top of the resistance zone after a strong bullish impulse and has started forming a rounded top pattern. Price remains inside an upward channel but is showing signs of exhaustion with the blue arrow projecting a pullback. As long as the price stays below 0.9008, we expect a descent toward the 0.8962 region. Momentum is cooling, and a bearish correction is likely before any bullish attempt resumes.

📉 Key Levels

Sell trigger: Break below 0.8990

Sell zone: 0.8995 – 0.9012

Target: 0.8962

Invalidation: Break and close above 0.9025

💡 Risks

Strong bullish momentum may resume if support holds

Failure to break 0.8990 could trap early sellers

Macro data from AUD/CAD region may disrupt the structure

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

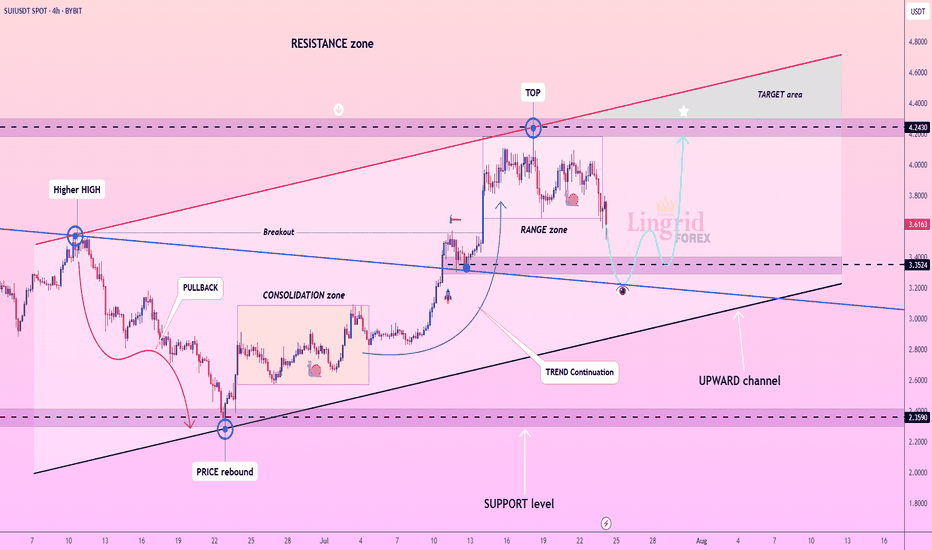

Lingrid | SUIUSDT Buying Opportunity from Support ZoneBYBIT:SUIUSDT is pulling back from the recent range top after testing the resistance zone and is approaching the key breakout area. The structure shows an upward channel with a prior consolidation breakout and an ongoing corrective retracement. As long as the price holds above the confluence zone near 3.35, the bullish structure remains intact. Broader momentum supports trend continuation toward the upper resistance boundary and the target area.

📉 Key Levels

Buy trigger: Break above 3.75 with volume

Buy zone: 3.25 – 3.35

Target: 4.24

Invalidation: Break below 3.22

💡 Risks

Breakdown below channel support would flip structure bearish

Fading volume on bounce may signal exhaustion

Broader market weakness could suppress upside momentum

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

EURUSD LONG AND EDUCATIONAL BREAKDOWN ECB INTRESTRATE RELEASE The European Central Bank is expected to hold key rates for the first time in over a year on Thursday.

The Eurozone inflation rate has hit the ECB’s 2% target as the US-EU trade deal uncertainty lingers.

The EUR/USD pair could experience intense volatility following the ECB policy announcements.

The European Central Bank (ECB) is on track to leave its key interest rates unchanged after its July policy meeting, after having reduced rates at each of its last seven meetings. The decision will be announced on Thursday at 12:15 GMT.

The interest rate decision will be followed by ECB President Christine Lagarde’s press conference at 12:45 GMT.

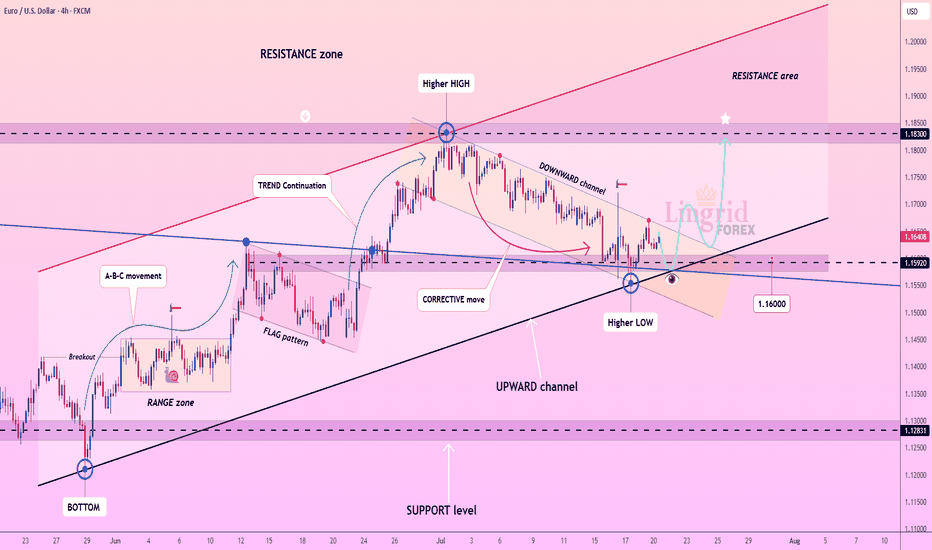

Lingrid | EURUSD Potential Surge Following Channel BreakoutFX:EURUSD is consolidating after bouncing from a key confluence of support around 1.16000 and forming a higher low within the upward channel. The recent corrective pullback through a downward channel now appears complete, with bullish structure resuming. Price is likely to advance toward the 1.18300 resistance as long as the 1.15900 zone holds. Momentum favors a continuation of the A-B-C and trend continuation sequences already established.

📉 Key Levels

Buy trigger: Break above 1.16500

Buy zone: 1.16000–1.16250

Target: 1.18300

Invalidation: Close below 1.14500

💡 Risks

Failure to break the corrective channel resistance

Bearish divergence on lower timeframes

Broader USD strength reversal

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

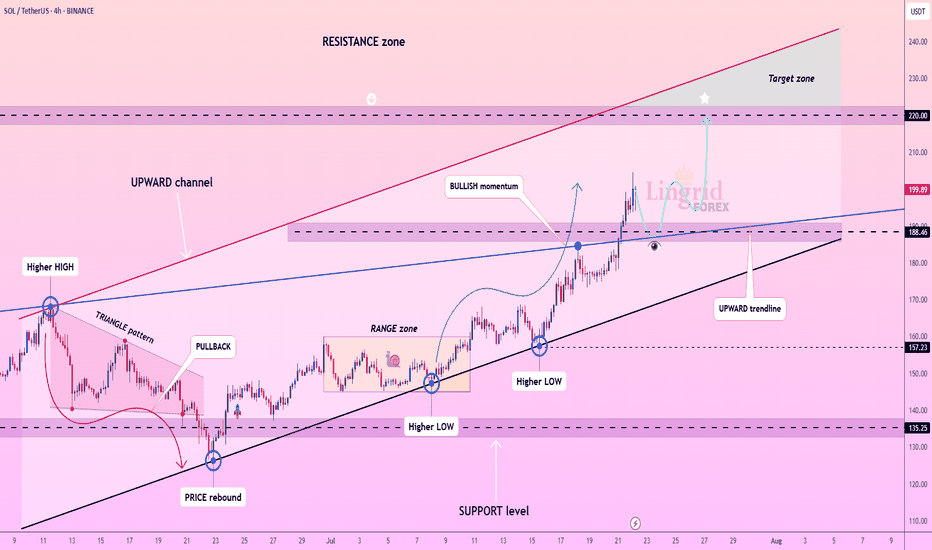

Lingrid | SOLUSDT Pullback Opportunity From the Support ZoneThe price perfectly fulfilled my previous idea . BINANCE:SOLUSDT is gaining upside traction after a clean breakout from the range zone and reclaim of the upward trendline near the 188.46 area. Bullish momentum from the higher low confirms buyers' control inside the rising channel, and price is now consolidating above key support. As long as the price holds above 188, the bias favors another move into the 220.00 resistance region. This ascending pattern reinforces the bullish structure with a likely continuation toward the upper boundary.

📉 Key Levels

Buy trigger: Break above 202.00

Buy zone: 188.00–194.00

Target: 220.00

Invalidation: Close below 188.46

💡 Risks

Failure to hold above 188.00 support

Loss of momentum after breakout

Macro-driven volatility reversal

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

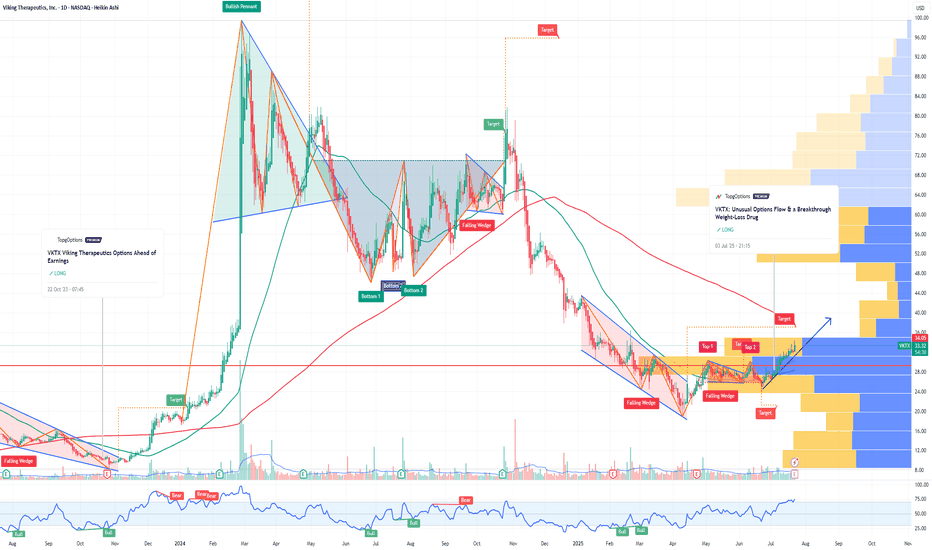

VKTX Viking Therapeutics Options Ahead of EarningsIf you haven`t bought VKTX before the breakout:

Now analyzing the options chain and the chart patterns of VKTX Viking Therapeutics prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $7.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

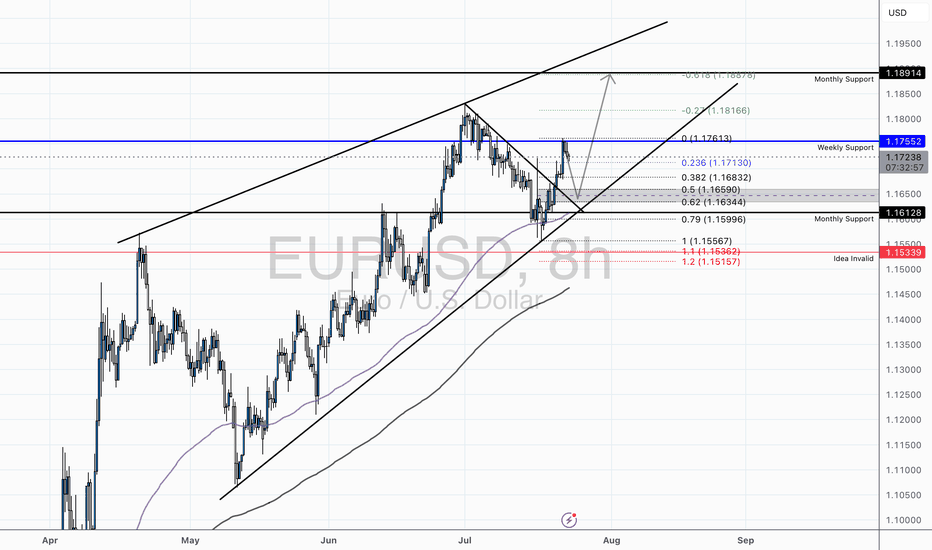

EUR/USD - Holding Bullish Structure Above Key Fibs and TrendlineTechnical Overview:

EUR/USD continues to respect its ascending channel structure, currently rebounding from the lower trendline support while trading above the 50 EMA and 200 EMA. After a healthy retracement to the monthly support (1.16128), the pair has shown strong buying interest, supported by bullish RSI divergence from oversold conditions on the 8H chart.

Key Levels:

Support Zone: 1.1613 – 1.1634 (Fib Cluster + Channel Support + Monthly Support)

Resistance Zone: 1.1755 (Weekly Resistance) followed by 1.1816 (0.27 Fib Extension) and 1.1887 (0.618 Extension)

Invalidation Level: Below 1.1533 (1.272 Fib + Structural Breakdown)

Confluences:

Price broke above a descending correctional trendline, indicating a potential bullish continuation.

Multiple Fibonacci levels (0.382, 0.5, 0.618) have stacked around the previous consolidation area, increasing probability of a sustained move.

RSI bounce from below 40 suggests short-term momentum reversal.

Trade Idea:

We may see a minor pullback into the 1.16344–1.1659 area before a potential continuation higher. Conservative bulls may wait for a retest of this zone with a bullish engulfing or pin bar confirmation before entering long.

Targets:

First target at 1.1755 (prior weekly resistance)

Second target at 1.1816 (Fib extension)

Final target near 1.1887 (major resistance / upper channel boundary)

Risk Management:

A break and close below 1.1533 would invalidate the bullish setup and signal potential bearish pressure returning to the pair.

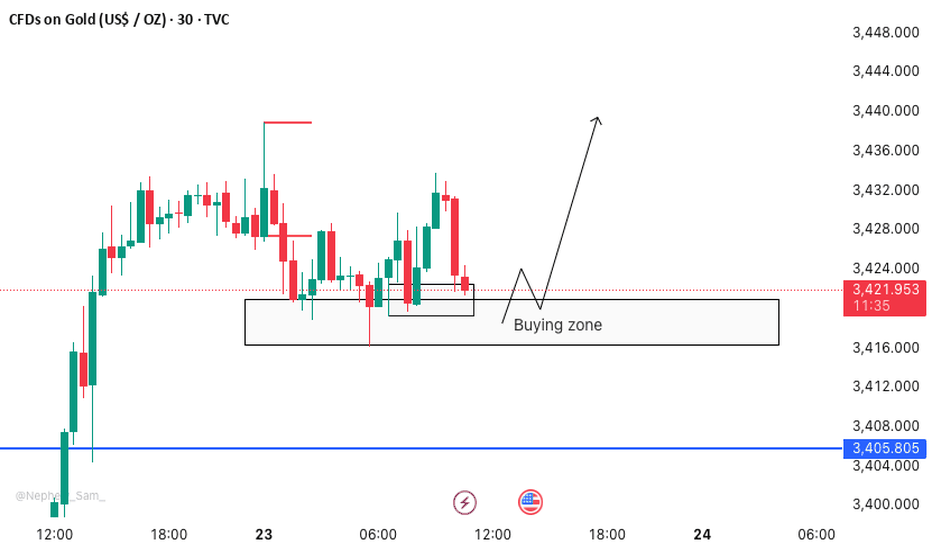

XAUUSD M30 BEST BUYING ZONE 📈 Gold is in a strong buying trend!

As always, I follow the trend — and right now, the trend is bullish. Here's what to look for:

✅ Strong Buying Zone

Look to buy if you see a solid bullish candlestick confirmation in this area.

📍 Alternative Entry Point

If price sweeps below 3416, we’ll look for a potential buy opportunity there — but again, only with candlestick confirmation.

🔓 Open Your Layers

Be prepared for both setups. Follow the market reaction and adapt accordingly.

⚠️ Risk Management is Key

No matter how strong the trend looks, always stick to your risk management rules. Discipline protects profits! 💼

🚀 Let’s ride the trend and stay smart!

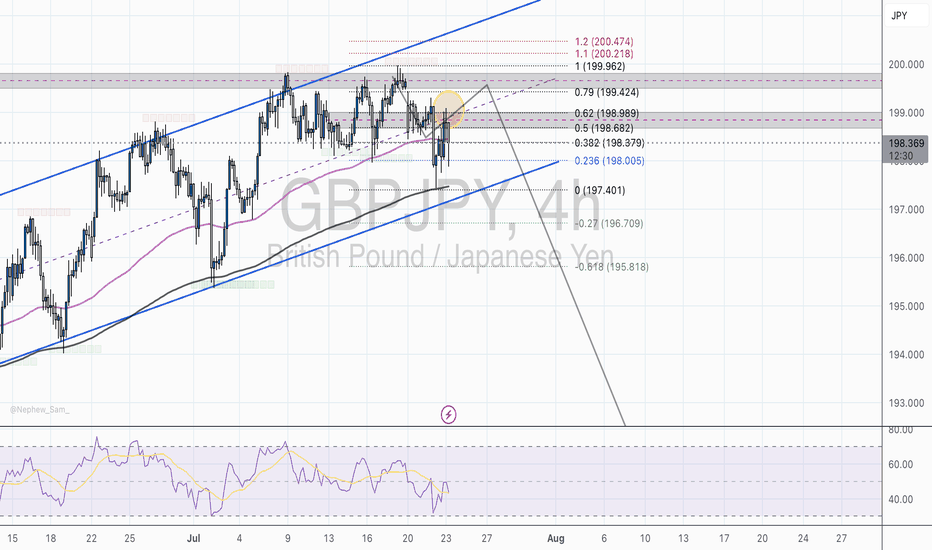

GBP/JPY 4H - Rejection from Supply Zone and Key Fib AreaOverview:

GBP/JPY is trading near 197.91, and recent price action suggests a potential short opportunity. The pair has been rejected from a key Fibonacci resistance zone, and bearish momentum appears to be building beneath a fading ascending channel. Let’s break down why this chart leans more bearish.

Market Structure Breakdown:

* Price action failed to sustain new highs above 199.90 and is now forming lower highs, a potential early sign of trend exhaustion.

* The recent bounce from 197.40 was muted and rejected near the 0.5 and 0.618 retracement levels, indicating strong supply around the 198.68–198.98 zone.

Fibonacci Confluence:

* The rejection occurred right at the 0.618 retracement of the prior downswing — a key Fibonacci level often used by institutional traders to re-enter in the direction of the trend.

* Price is now hovering below the 0.382 (198.38) and 0.5 (198.68) levels, which may now act as resistance.

* If the current rejection holds, downside targets are:

* 0.0 (197.40) – recent low

* -0.27 extension (196.70) – potential bearish continuation target

* -0.618 extension (195.81) – extended downside objective

Trendline & Channel Considerations:

* The ascending channel is losing momentum.

Moving Averages:

* Price is now below the 50 EMA, and testing the 200 EMA, which is at risk of breaking.

* A clear close below both EMAs would confirm bearish momentum.

RSI & Momentum:

* The RSI shows bearish divergence on recent highs and is struggling to break above the midline (50).

* Momentum is tilting to the downside and failing to build higher on bounces.

Key Zones:

* Resistance Zone: 198.60–198.98

* Strong Fibonacci confluence + previous supply

* Support Zone: 197.40

* Prior swing low and 0.0 Fib level

* Bearish Continuation Zone: Below 197.30

* Breakout would confirm downside acceleration toward 196.70 and 195.80

Conclusion:

GBP/JPY is showing signs of bearish pressure beneath key resistance. With the rejection from the 0.618 Fib level and weakening channel structure, the path of least resistance may be to the downside — especially if price breaks and holds below 197.40.

A confirmed breakdown opens the door toward 196.70 and possibly 195.80, as bearish continuation unfolds. Overall we can even see price hitting past historical levels at 189.50

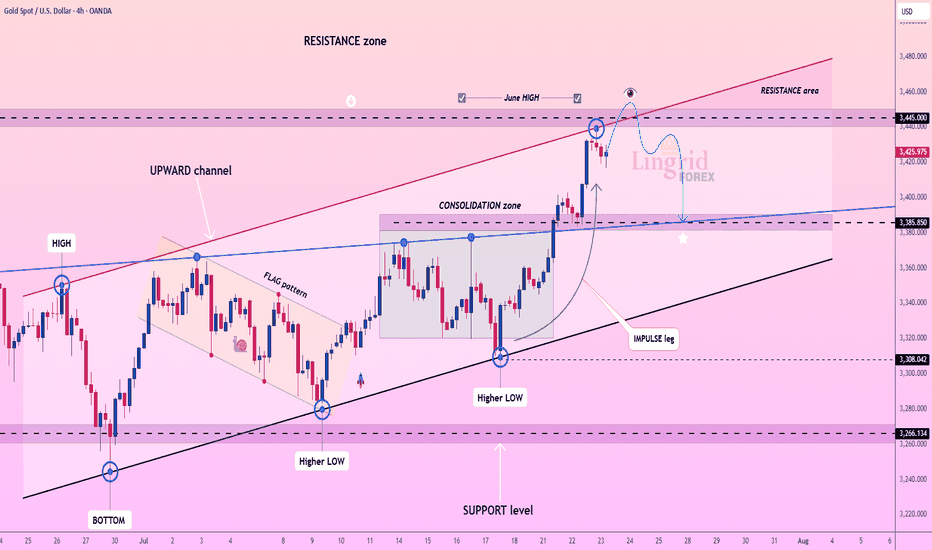

Lingrid | GOLD Key Resistance Zone. Possible Short-Term TradeThe price perfectly fulfilled my last idea . OANDA:XAUUSD has reached the upper boundary of the resistance zone around 3,445 after a strong impulse leg from the support trendline and the breakout of consolidation. Price action shows signs of exhaustion just below the June high, forming a potential reversal pattern near the channel top. If gold fails to hold above this resistance, a short-term pullback toward the 3,385 level becomes likely. The setup favors a short-term corrective decline unless bulls reclaim control with a breakout above the red trendline.

📉 Key Levels

Sell trigger: Rejection below 3,445

Sell zone: 3,430–3,445

Target: 3,385

Invalidation: Close above 3,480

💡 Risks

Breakout continuation toward 3,480

Sustained momentum from recent impulse leg

DXY weakness boosting gold's appeal

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

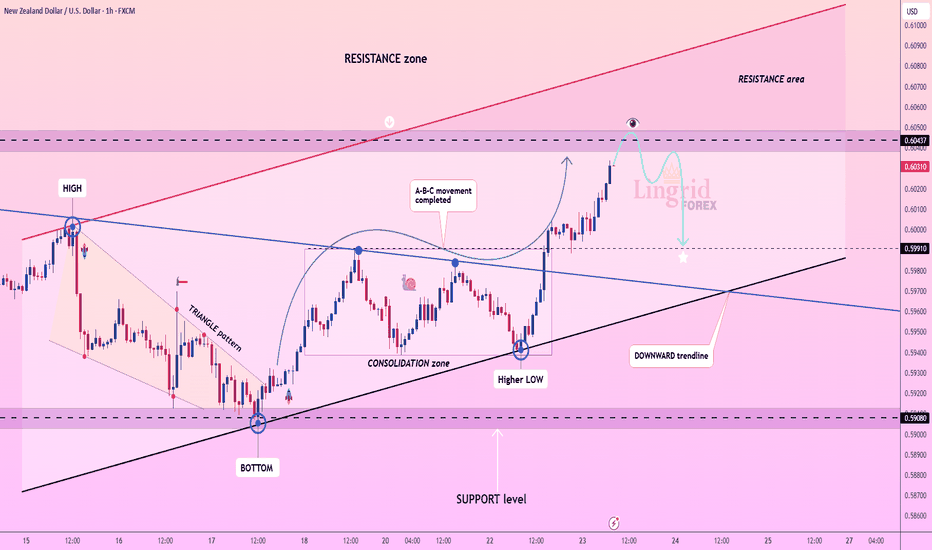

Lingrid | NZDUSD Potential Market Correction From ResistanceFX:NZDUSD has approached a key resistance zone at 0.6040 after completing an A-B-C upward move and forming a potential lower high. Price is testing both horizontal and trendline resistance, suggesting exhaustion within the broader upward move. A failure to hold above the 0.6040 area may trigger a reversal toward the 0.5991 support zone. The structure favors a bearish pullback if the breakout is rejected.

📉 Key Levels

Sell trigger: Rejection from 0.6045

Sell zone: 0.6035–0.6045

Target: 0.5991

Invalidation: Close above 0.6055

💡 Risks

Clean breakout above resistance zone

Strengthening NZD from risk sentiment shift

Holding above upward trendline support

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!