Lingrid | AUDJPY pullback After the BEARISH MomentumThe price perfectly fulfilled my last idea . It reached the target zone. FX:AUDJPY market is approaching a test of the previous month's low. Prior to this movement, price formed a triangle pattern, then broke below it and an upward trendline, creating a bearish impulse leg. This current pullback may present a shorting opportunity if we receive a sell signal, especially considering that on the daily timeframe the market remains bearish. This potential setup would be further confirmed if the price forms a fake break of the previous week's high. Overall, I expect the price to move lower, ultimately breaking below the support level at 90.000. My goal is supprot zone around 88.510

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Signalsprovider

Lingrid | LINKUSDT potential BULLISH Reversal at the SUPPORTBINANCE:LINKUSDT market made a fake break of the March low then bounced off strongly. The market took liquidity below the psychological level at 10.00 before recovering. Furthermore, the market broke and closed above the downward trendline that represented correction. The market also tested the demand zone where price skyrocketed from in November 2024. I think if the price pulls back toward the support level and trendline, I expect the price to move higher because previously we saw price rebound from this level before. This false breakdown pattern, combined with the trendline break and test of a historic demand zone, sets up a potentially significant bullish reversal opportunity if support continues to hold. My goal is rsistance zone around 14.80

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

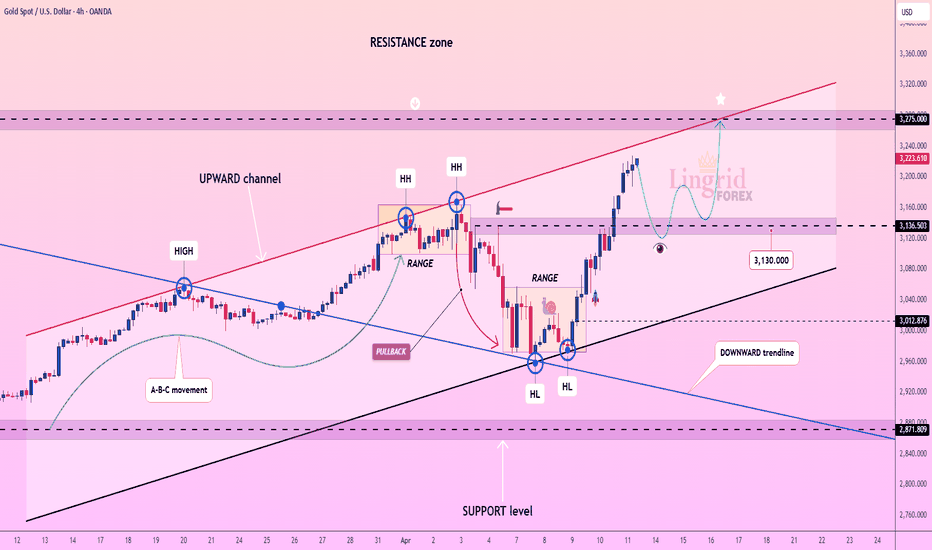

Gold Market Outlook: Potential Pullback in Play Following Early Early this morning, the gold market opened with a downside gap, potentially signaling the beginning of a corrective phase. With no high-impact economic events on the calendar today, price action may remain sideways or retrace toward the previous session’s low. On the 1-hour timeframe, bearish divergence has already been identified, supporting the case for a short-term pullback.

A similar consolidation phase occurred after the bullish momentum seen from March 11 to March 20. If no unexpected developments influence the market, comparable price behavior could emerge. Overall, conditions suggest a classic breakout–pullback–continuation scenario, which is consistent with typical movements following strong directional trends. A key resistance zone near the 3280 level is currently being observed as a potential target area

Lingrid | GOLD Weekly ANALYSIS: UNPRECEDENTED Rally ContinuesOANDA:XAUUSD market continues pushing to higher and higher levels. The market went up approximately 7% in a single week. This was a big upward move, if not the biggest upward move in one week this year. As the market approaches the 3250 level, we can see some price deceleration. This may lead to a corrective move. After such an impulse move, the market usually consolidates. Therefore Monday and Tuesday might be sideways move days.

On the daily timeframe, the price is creating an ABC move which potentially completes around the 3300 level. If Monday's candle opens with a gap up, this suggests the price may surge again. However, if we get a pullback, then we can look for buying opportunities below the 3200 support level or the previous day's low.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | BTCUSD Consolidation PHASE Following Double Bottom BINANCE:BTCUSDT market formed a double bottom below March levels before bouncing to close above the psychological 80,000 mark. Price action is currently narrowing, suggesting the market is coiling up before its next extension—as if awaiting another news catalyst to drive movement. Given that the price closed above the swap zone, any pullback to this level presents a high probability of a price rebound. Additionally, on the daily timeframe, the market has broken and closed above the downward trendline that represented the correction phase.

Overall, I expect a potential triangle pattern formation around current levels before a surge higher toward liquidity above the previous week's high. My goal is resistance zone around 89,300

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | SUIUSDT trend CONTINUATION Pattern In The MARKETThe price perfectly fulfills my last idea . BINANCE:SUIUSDT market bounced off the key support level at 2.00 and then broke and closed above the triangle pattern as well as the trendline. Additionally, the market made a fake breakout of the previous month's low before heading toward the next resistance zone by making higher highs and higher lows. Recently, the market broke the downward trendline, and I believe the price may rise further if it remains above the support zone at 2.20. I expect the price to continue moving higher, as we are seeing a contraction-expansion price action pattern. My goal is resistance zone around 2.4685

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | GOLD bullish MOMENTUM Continues. Pullback OpportunityThe price has perfectly fulfilled my previous forecast . OANDA:XAUUSD market surged straight up and reached the resistance level at 3200 without any pullback. Additionally, the price broke and closed above last week's high, confirming bullish continuation. As the market tests this key level, we may see increased volatility in this area considering that we have high-impact news in the NY session. The price seems to be decelerating at the channel border, which suggests there might be a corrective move in the market. If the price makes a pullback toward the support level, there is a strong opportunity to go long, with the potential for the price to continue moving upwards. My goal is resistance zone around 3275

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | EURUSD potential Short-Term PULLBACK from 2022 HighThe price perfectly fulfilled my previous idea . It hit the take profit. FX:EURUSD market is making higher highs, showing bullish momentum. Also the price broke and closed above the consolidation zone. However, on the daily timeframe, the price is forming an ABC move where point C completes at the psychological level of 1.15000. After the completion of this move, a pullback typically follows. Furthermore, this resistance zone represents the high of 2022, and I believe there may be liquidity above which could lead to a rollover. If we see rejection at this level, we can expect a short-term pullback. My goal is support zone around 1.12700

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | TONUSDT inverse HEAD and SHOULDERS patternThe price perfectly fulfilled my previous idea . It reached the target zone. OKX:TONUSDT appears to be forming a consolidation zone between 2.70 and 4.20 on the daily timeframe. The market has bounced off this range twice before and there is a possibilty the price to rebound again. Since the price reached the key support zone, it's likely that the market may continue to move sideways for a while suggesting potential bounce off. Additionally, the formation of an inverse head and shoulders pattern suggests a possible reversal ahead. If TON remains above the 2.75 level, it could potentially make an upward move toward the top of the range zone. My mid-term goal is resistance zone 4.20

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

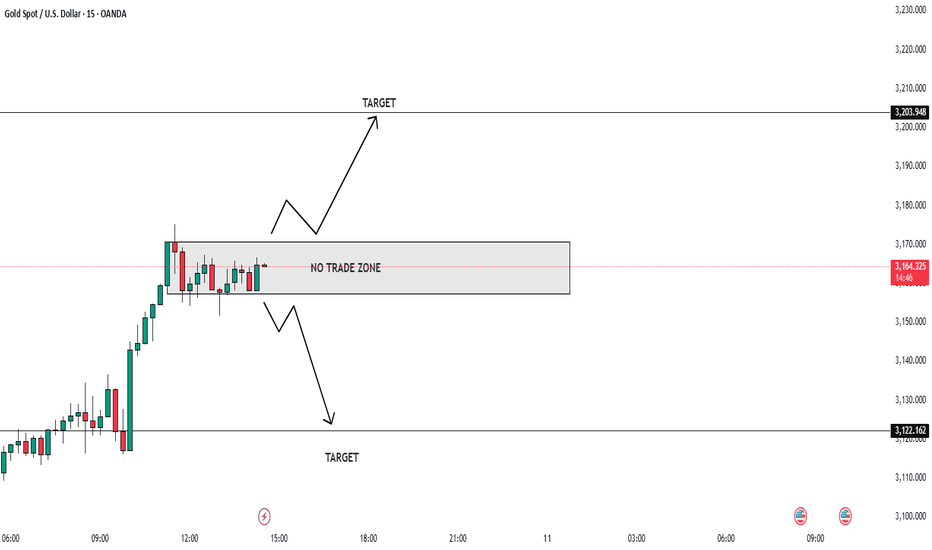

XAUUSD Alert: Critical Zones in Play — Trade Smart, Trade Safe!📊 XAUUSD Market Insight 🌍

Gold is heating up once again, currently testing a tight range between 3160 and 3174. A breakout in either direction could set the tone for the next big move.

🔻 If price breaks below, we may see a slide toward 3150 and 3130—potential areas to watch for bearish momentum.

🔺 However, a strong push above 3174 could spark bullish energy, aiming for short-term targets at 3200 and 3227.

💡 Trade Smart

The market is full of opportunity, but don’t forget: risk management is key. Use proper position sizing, set clear stop-losses, and never overexpose your capital. Stay sharp, trade safe, and let the market come to you. 🧠💼

Lingrid | EURUSD breaks HIGHER Amid Dollar WeaknessFX:EURUSD market broke and closed above the consolidation zone. The price broke above the previous month's high and nearly tested the high of 2024. The price overall is making higher highs and higher lows, and at this point, the price may form a triangle pattern around the key level at 1.1000 before continuing to push higher. If the market rejects the support level, we can expect the price to move to higher levels, at least retesting the recent resistance zone. My goal is resistance zone around 1.11075

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | GOLD Retracement Likely Before UPWARD Continuation The price perfectly fulfilled my previous idea . It reached the target. OANDA:XAUUSD broke and closed above the swap zone around 3050, which was also Monday's high. The price is now testing the zone above the 3100 level, and I anticipate a potential pullback following the recent bullish extension. Given today's high-impact news, the market may drop from the resistance zone. If the price forms a retracement toward the support level, where we have an upward trendline and swap zone, there is a good chance of the price to rebound. Another scenario could be sideways movement, as we previously observed sideways action at this zone when looking to the left. Overall, I expect a pullback followed by continuation. My goal is resistance zone around 3145

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

NZDUSD Faces Resistance After Recent Sell-OffFollowing the significant sell-off last week, the NZDUSD price has retraced to approximately 60% of the previous bearish move. The price appears to have encountered resistance at a zone marked by an upward trendline and the boundary of the channel. Additionally, there is a psychological level at 0.57000. Should the price reject this resistance, it may continue to decline and retest the middle of the consolidation range. On the other hand, if upcoming news releases favour the market, there could be potential for a move higher. The target for the market is a resistance zone near 0.55940

TRXUSDT Eyes Breakout Amid Bullish StructureThe TRXUSDT market appears to be forming an ABC extension pattern, characterized by a series of higher lows, while the highs remain relatively flat. The price has been consistently testing the 0.2400 resistance area, indicating the possibility of a breakout and a sustained move above this level. Recently, the price surpassed the previous week's high, which may signal either a short-term pullback or continued upward momentum. A retest of the support zone is anticipated before the market potentially resumes its upward trend. The next key resistance level is projected around the 0.2500 mark

Lingrid | NZDUSD potential PULLBACK Trading OpportunityThe price perfectly fulfilled my previous idea . It hit the take profit level. After last week's massive sell-off, FX:NZDUSD price has pulled back toward 60% of the bearish move. The price appears to have bounced off the resistance zone where we have upward trendline and channel border. Additionally, there is a psychological level at 0.57000 as well. I believe the price may move lower and retest the middle of the consolidation zone if the price rejects the resistance. However, the market might move higher if the upcoming news release favors the market. My target is resistance zone around 0.55940

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | TRXUSDT short-term BULLISH move in CONSOLIDATION zoneThe price perfectly fulfilled my last idea . It reached the target level. BINANCE:TRXUSDT market is forming an ABC extension pattern and has established higher lows, while the highs remain relatively equal. Price continues to test the 0.2400 resistance zone, and I anticipate a potential breakthrough and close above this level. Recently, price broke above the previous week's high, suggesting it may either pull back or continue moving upward. However, I expect price to retest the support zone before resuming its upward trajectory. My target is resistance zone around 0.2500

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | GOLD key LEVELS for Potential BULLISH ContinuationThe price perfectly fulfilled my last idea . It hit the take profit level. OANDA:XAUUSD market bounced off the 3000 support level, potentially signaling the end of the corrective move. However, examining the 1H timeframe reveals the price still remains within the consolidation zone. If the price breaks and closes above the 3050 resistance zone, we can anticipate a continuation of the bullish move. I expect the price may continue moving sideways until the next trading day. However, if the price retests the psychological level below, we can look for buying opportunities. My goal is resistance zone around 3100

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | USDJPY Bearish MOMENTUM. Potential ShortFX:USDJPY price is showing lower lows and lower closes, indicating bearish dominance in the market. After testing the previous week's low, the market rebounded, forming a pullback. Currently, the price trades below the psychological 146.000 level, the upward trendline, and the channel border. Overall, the price action is forming an ABC pattern, suggesting that point C may complete at the 142.000 support level. If the price closes below the previous week's low, there is a high probability of further downward movement. My goal is support zone around 143.050

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | XRPUSDT Correction Following ABC move CompletionThe price perfectly fulfilled my previous idea . It reached the target. BINANCE:XRPUSDT price has completed its ABC move, which is typically followed by the pullback we're currently witnessing. The market has broken below the psychological 2.00 level and its established range zone. I think the price may move toward the middle of the range zone, as this area historically acts as both support and resistance. However, considering the downward trendline and the key resistance at 2.00 above, I anticipate the price may rebound from that zone and continue its downward trend. My goal is support zone around 1.60

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | GOLD sideways MOVE after Failed SUPPORT BreakOANDA:XAUUSD market is oscillating between 2970 and 3050 levels, showing a potential consolidation phase. The price broke below the last 3 weeks' low but pulled back, forming a fake breakout. The price also tested February's high then bounced off, suggesting this support zone has significance to the market. Recently, the price formed a bullish divergence after creating a fake breakout of the previous support level. I think the market will continue moving sideways since the price is trading within the previous day's range. I expect the market to retest the swap zone above. My goal is resistance zone around 3050

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | SOLUSDT testing MARCH low. Short OpportunityBINANCE:SOLUSDT market is making lower lows and lower closes, indicating a bearish trend. It is slowly approaching the key psychological level at 100.00 while currently testing the previous month's low. The price broke and closed below the upward trendline that had been holding for a couple of weeks. I think the price may continue to move lower toward the key support level, and there is a possibility it could push even lower. Furthermore, the price has been consolidating around the 120.00 level, demonstrating significant bearish sentiment in the market. I expect the price to move lower, possibly breaking below the March low. My goal is support zone around 102.00

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

XAUUSD Analysis: Will It Soar or Dip? Esential Levels to Monitor🚨 Attention Traders! 🚨

XAUUSD is making waves and breaking through key levels! 🔥 The price is currently battling between 2977 and 2987 — will we see a breakout soon?

Bearish Alert: A dip below this range could lead us to targets like 2960 and 2955. ⚠️

Bullish Opportunity: A move above 2987 could trigger buying opportunities, with targets around 3004 and 3030. 🚀

💬 Let’s Talk Strategy! What’s your take on this? Share your insights as we ride this golden wave together and unlock new opportunities! 💰