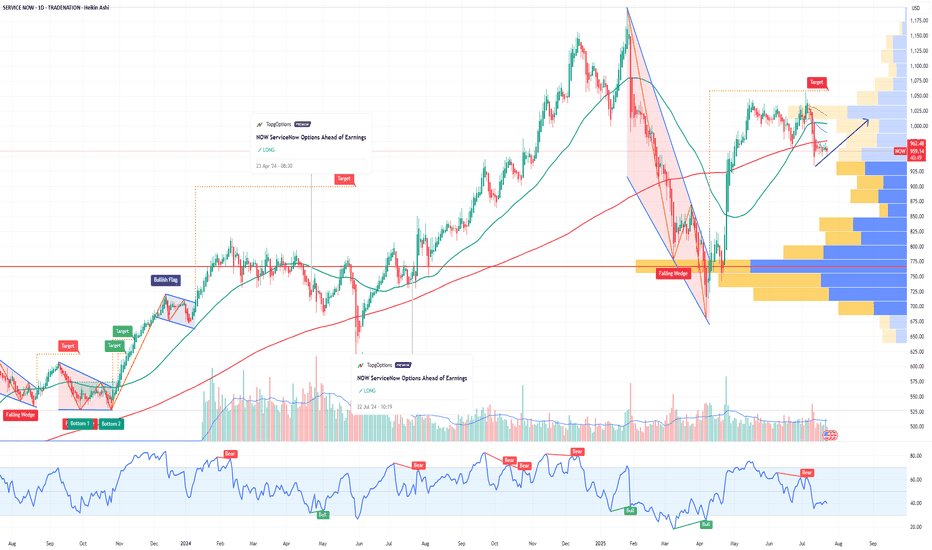

NOW ServiceNow Options Ahead of EarningsIf you haven`t bought NOW before the recent rally:

Analyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week,

I would consider purchasing the 960usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $97.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Signaltelegram

LVS Las Vegas Sands Options Ahead of EarningsIf you haven`t bought LVS before the rally:

Now analyzing the options chain and the chart patterns of LVS Las Vegas Sands prior to the earnings report this week,

I would consider purchasing the 48.5usd strike price Puts with

an expiration date of 2025-7-25,

for a premium of approximately $1.22.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

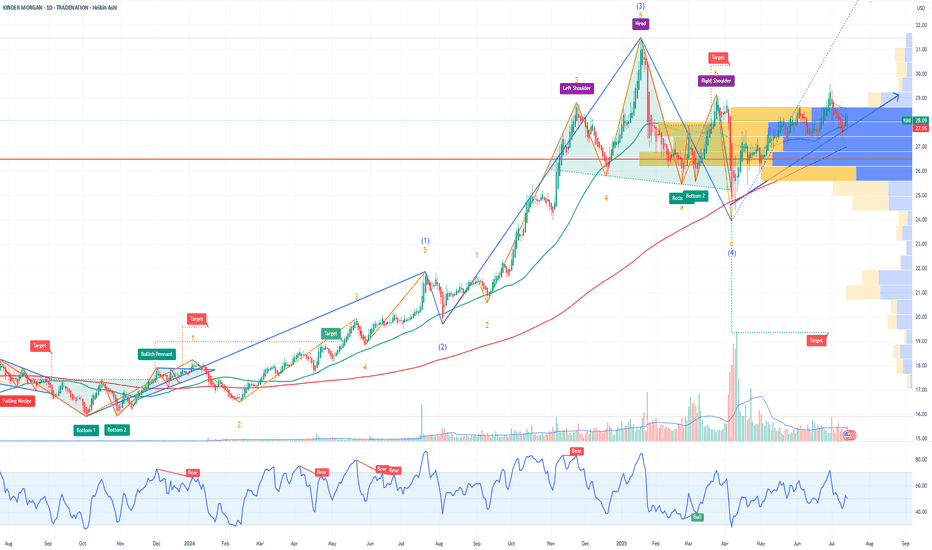

KMI Kinder Morgan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of KMI Kinder Morgan prior to the earnings report this week,

I would consider purchasing the 28.5usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $0.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

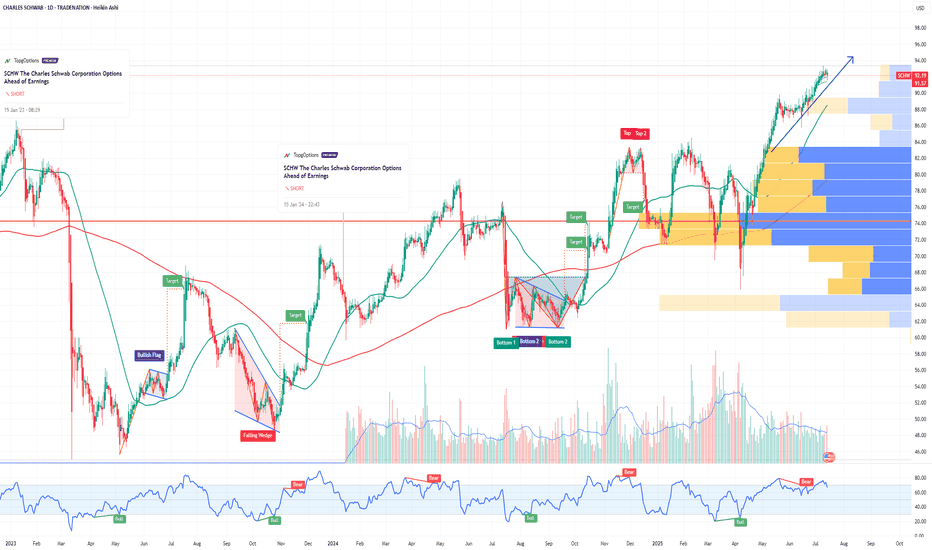

SCHW The Charles Schwab Corporation Options Ahead of EarningsIf you haven`t sold SCHW before the sell-off:

Now analyzing the options chain and the chart patterns of SCHW The Charles Schwab Corporation prior to the earnings report this week,

I would consider purchasing the 92.5usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $7.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

VKTX: Unusual Options Flow & a Breakthrough Weight-Loss DrugIf you haven`t bought CKTX before the recent rally:

Now you need to know that Viking Therapeutics (VKTX) is a speculative biotech stock in the GLP-1/GIP agonist space, aiming to challenge market leaders like Eli Lilly and Novo Nordisk. Recently, I noticed unusual options flow — specifically, Jan 16, 2026 $60 strike calls

Key Bullish Points

1) Riding the Obesity Drug Boom

VK2735 is Viking’s dual agonist candidate showing promising early weight-loss efficacy, with potential overlap benefits in NASH (liver disease). The obesity treatment space is expected to exceed $100B by 2030—huge upside if their trials continue positively.

2) Options Flow Tells a Story

Those Jan 2026 $60 calls caught my attention precisely because the stock currently trades in the mid-$60s. These aren’t cheap lottery plays—they’re strategically timed wrt trial readouts, partnerships, or acquisition interest. Essentially, someone anticipates meaningful upside in the near future.

3) Descending Wedge — Chart Looks Bullish

VKTX peaked near $100, then pulled back into a well-defined descending wedge. If it breaks out above $70–$72 with volume, that could kick off a classic reversal trade.

Smart Money Options Flow — Near-Term Bet:

Recently, I spotted unusual open interest in $60 strike calls expiring Jan 16, 2026 — that’s only about 7 months away.

This means someone is positioning for a big upside move relatively soon, likely betting on positive Phase 2b/3 data, a partnership deal, or even buyout chatter within the next few quarters.

Short-dated, out-of-the-money call flow like this often hints at near-term news — not just a long-dated hedge.

Baidu ($BIDU): China’s Google Is Ready to Break OutIf you haven`t bought BIDU on the previous dip:

What you need to know now:

1. Baidu = The Google of China

Baidu dominates China’s search engine market, holding over 60% market share, making it the Google equivalent in the world's second-largest economy.

Its advertising business is deeply entrenched in Chinese internet infrastructure.

As digital ad spending rebounds in China, Baidu’s core business benefits directly.

2. AI and Autonomous Driving Moonshots

Baidu is China’s national AI champion, pouring billions into next-gen technologies:

Ernie Bot (Baidu’s ChatGPT competitor) is now integrated across its ecosystem and enterprise offerings.

Apollo Go, Baidu’s autonomous driving platform, already operates robo-taxis in multiple Chinese cities and has received licenses for fully driverless operations.

Baidu also provides AI cloud services, competing with Alibaba Cloud and Huawei.

With the Chinese government pushing AI self-sufficiency, Baidu is one of the biggest beneficiaries.

3. Cheap Valuation with High-Tech Exposure

Baidu trades at a forward P/E under 10 and price-to-sales under 2, despite being a major player in AI, cloud, and mobility.

That’s a fraction of what US tech firms with similar ambitions (like Alphabet or Tesla) are valued at.

Over $25 billion in cash and investments on the balance sheet adds a margin of safety.

4. Government Support & Stimulus Tailwinds

The Chinese government is pivoting back toward supporting tech innovation, especially in AI, after years of regulatory crackdowns.

Baidu is aligned with national AI and autonomous driving goals.

If the government ramps up fiscal stimulus, especially in infrastructure and technology, Baidu will likely benefit.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SNAP Upside PotentialIf you haven`t bought SNAP before the previous earnings:

SNAP Key Fundamental Strengths in Q1 2025:

Metric Q1 2025 Result Year-over-Year Change

Revenue $1.36 billion +14%

Daily Active Users (DAU) 460 million +9%

Monthly Active Users (MAU) 900 million+

Net Loss $140 million -54% (improved)

Adjusted EBITDA $108 million +137%

Operating Cash Flow $152 million +72%

Free Cash Flow $114 million +202%

SNAP strong fundamental performance in Q1 2025, marked by accelerating revenue growth, expanding user engagement, sharply improving profitability, and robust cash flow generation, sets a solid foundation for a potential stock rally this year.

The company’s innovation in AR, diversified revenue streams, and healthy balance sheet further support a bullish outlook. Investors focusing on fundamentals can view Snap as a growth stock with improving financial health and significant upside potential in 2025.

My price target is $14.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MDB MongoDB Options Ahead of EarningsIf you haven`t exited MDB before the selloff:

Now analyzing the options chain and the chart patterns of MDB MongoDB prior to the earnings report this week,

I would consider purchasing the180usd strike price Puts with

an expiration date of 2025-6-6,

for a premium of approximately $4.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AI C3ai Options Ahead of EarningsIf you haven`t bought AI before the previous earnings:

Now analyzing the options chain and the chart patterns of AI C3ai prior to the earnings report this week,

I would consider purchasing the 23.5usd strike price Calls with

an expiration date of 2025-5-30,

for a premium of approximately $1.31.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NTNX Nutanix Options Ahead of EarningsIf you haven`t bought NTNX before the recent rally:

Now analyzing the options chain and the chart patterns of NTNX Nutanix prior to the earnings report this week,

I would consider purchasing the 80usd strike price Puts with

an expiration date of 2025-6-20,

for a premium of approximately $5.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DKNG DraftKings Options Ahead of EarningsIf you haven`t bought DKNG before the rally:

Now analyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $1.43.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RKT Rocket Companies Options Ahead of EarningsIf you haven`t bought RKT before the previous earnings:

Now analyzing the options chain and the chart patterns of RKT Rocket Companies prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.37.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CVX Chevron Corporation Options Ahead of EarningsIf you haven`t sold CVX before the retracement:

Now analyzing the options chain and the chart patterns of CVX Chevron Corporation prior to the earnings report this week,

I would consider purchasing the 125usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $5.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AAL American Airlines Group Options Ahead of EarningsIf you haven`t bought the dip on AAL:

Now analyzing the options chain and the chart patterns of AAL American Airlinesprior to the earnings report this week,

I would consider purchasing the 9usd strike price Puts with

an expiration date of 2025-5-2,

for a premium of approximately $0.44.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TDOC Teladoc Health Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TDOC Teladoc prior to the earnings report this week,

I would consider purchasing the 20usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.04.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SRPT Sarepta Therapeutics Options Ahead of EarningsAnalyzing the options chain and the chart patterns of SRPT Sarepta Therapeuticsprior to the earnings report this week,

I would consider purchasing the 120usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $9.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BMBL Bumble Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BMBL Bumble prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $1.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SEDG SolarEdge Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2025-2-28,

for a premium of approximately $1.76.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PANW Palo Alto Networks Options Ahead of EarningsSnalyzing the options chain and the chart patterns of PANW Palo Alto Networks prior to the earnings report this week,

I would consider purchasing the 195usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $9.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AMAT Applied Materials Options Ahead of EarningsAnalyzing the options chain and the chart patterns of AMAT Applied Materials prior to the earnings report this week,

I would consider purchasing the 180usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $6.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CMCSA Comcast Corporation Options Ahead of EarningsAfter CMCSA reached the previous price target:

Now analyzing the options chain and the chart patterns of CMCSA Comcast Corporation prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $1.86.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DFS Discover Financial Services Options Ahead of EarningsIf you haven`t bought DFS before the previous earnings:

Now analyzing the options chain and the chart patterns of DFS Discover Financial Services prior to the earnings report this week,

I would consider purchasing the 190usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $6.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NZDSGD - in Resistance zone - Can it get to 0.76700?OANDA:NZDSGD is in a supply zone that has before been an area for bearish reversals.

As of now, the pair is testing this critical region, and based on previous price action, a rejection could potentially drive the price lower toward the 0.76700 level.

But if the price breaks through this resistance, it would invalidate the bearish bias and open up the possibility of a continued upward movement. In that case, you can look for the next key resistance levels for potential targets for bullish continuation.

Keep a close watch on price behavior in this region and use prudent RISK management strategies to navigate the market's uncertainty.

Feel free to share your thoughts or views in the comments!