AMZN Amazon Options Ahead of EarningsIf you ahven`t bought the recent dip on AMZN:

Now analyzing the options chain and the chart patterns of AMZN Amazon prior to the earnings report this week,

I would consider purchasing the 245usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $7.02.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Signaltrading

LVS Las Vegas Sands Options Ahead of EarningsIf you haven`t bought LVS before the rally:

Now analyzing the options chain and the chart patterns of LVS Las Vegas Sands prior to the earnings report this week,

I would consider purchasing the 48.5usd strike price Puts with

an expiration date of 2025-7-25,

for a premium of approximately $1.22.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

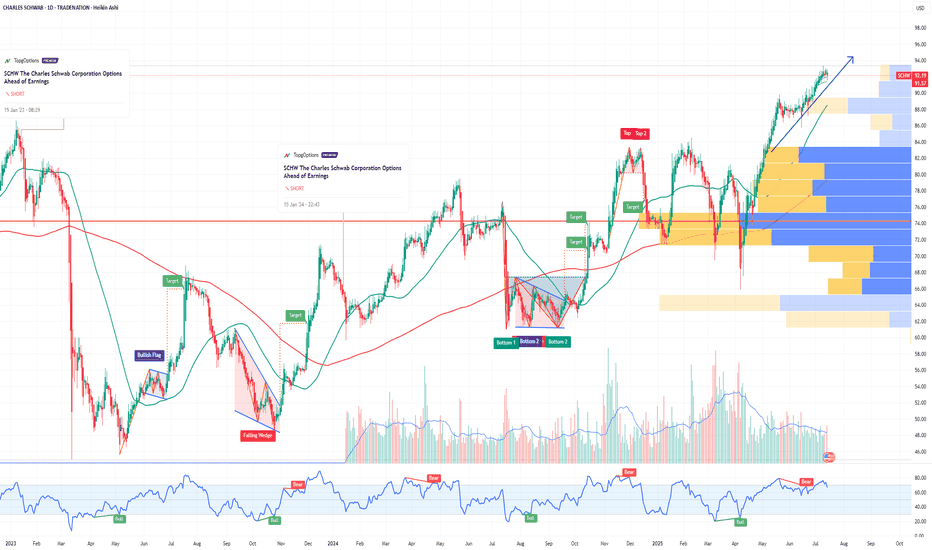

SCHW The Charles Schwab Corporation Options Ahead of EarningsIf you haven`t sold SCHW before the sell-off:

Now analyzing the options chain and the chart patterns of SCHW The Charles Schwab Corporation prior to the earnings report this week,

I would consider purchasing the 92.5usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $7.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

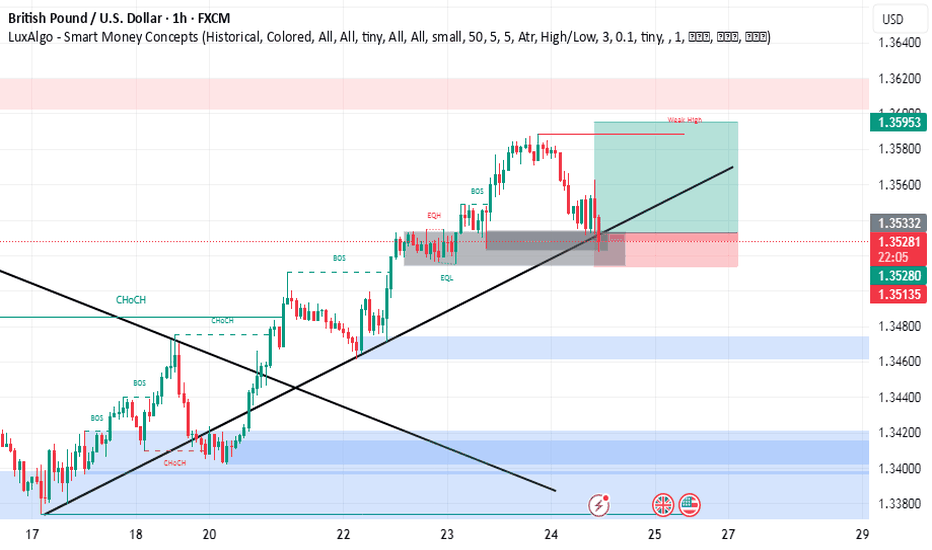

EURGBP SHORT DAILY FORECAST Q3 D10 W28 Y25EURGBP SHORT DAILY FORECAST Q3 D10 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

VKTX: Unusual Options Flow & a Breakthrough Weight-Loss DrugIf you haven`t bought CKTX before the recent rally:

Now you need to know that Viking Therapeutics (VKTX) is a speculative biotech stock in the GLP-1/GIP agonist space, aiming to challenge market leaders like Eli Lilly and Novo Nordisk. Recently, I noticed unusual options flow — specifically, Jan 16, 2026 $60 strike calls

Key Bullish Points

1) Riding the Obesity Drug Boom

VK2735 is Viking’s dual agonist candidate showing promising early weight-loss efficacy, with potential overlap benefits in NASH (liver disease). The obesity treatment space is expected to exceed $100B by 2030—huge upside if their trials continue positively.

2) Options Flow Tells a Story

Those Jan 2026 $60 calls caught my attention precisely because the stock currently trades in the mid-$60s. These aren’t cheap lottery plays—they’re strategically timed wrt trial readouts, partnerships, or acquisition interest. Essentially, someone anticipates meaningful upside in the near future.

3) Descending Wedge — Chart Looks Bullish

VKTX peaked near $100, then pulled back into a well-defined descending wedge. If it breaks out above $70–$72 with volume, that could kick off a classic reversal trade.

Smart Money Options Flow — Near-Term Bet:

Recently, I spotted unusual open interest in $60 strike calls expiring Jan 16, 2026 — that’s only about 7 months away.

This means someone is positioning for a big upside move relatively soon, likely betting on positive Phase 2b/3 data, a partnership deal, or even buyout chatter within the next few quarters.

Short-dated, out-of-the-money call flow like this often hints at near-term news — not just a long-dated hedge.

Why BABA Alibaba Could Rebound Strongly by Year-End 2025If you haven`t bought BABA before the recent rally:

What you need to know:

BABA’s fundamentals, fueled by e-commerce, cloud, and AI, support its technical bullishness:

E-commerce and Cloud Rebound:

Q1 2025 revenue grew 7% year-over-year, with Taobao/Tmall rebounding and cloud revenue surging due to AI demand.

Alibaba’s cloud division, China’s largest, benefits from hyperscaler AI workloads, with 15% profit margin projections by 2029.

AI Leadership:

BABA’s AI assistant and generative AI tools drove a 70% stock surge in early 2025, positioning it as a leader in China’s AI race.

At 12x forward P/E with 8% revenue CAGR, BABA is undervalued (fair value ~$162).

Share Buybacks:

Aggressive share repurchasing (6% annual reduction) boosts EPS, with $1 trillion GMV reinforcing e-commerce dominance.

Macro Tailwinds:

Easing CCP regulations and China’s stimulus measures (e.g., rate cuts) support BABA’s rally.

Minimal U.S. exposure insulates BABA from trade war risks.

Conclusion: BABA’s Path to $168

BABA’s technicals, with a bullish breaker and wedge, signal a breakout above $125–$130, targeting $150–$168 by year-end 2025. Fundamentally, its e-commerce dominance, cloud/AI growth, and undervaluation make it a standout. Traders should buy dips near $110–$115 or await a $130 breakout. With stimulus and buybacks as catalysts, BABA is set to soar.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SNAP Upside PotentialIf you haven`t bought SNAP before the previous earnings:

SNAP Key Fundamental Strengths in Q1 2025:

Metric Q1 2025 Result Year-over-Year Change

Revenue $1.36 billion +14%

Daily Active Users (DAU) 460 million +9%

Monthly Active Users (MAU) 900 million+

Net Loss $140 million -54% (improved)

Adjusted EBITDA $108 million +137%

Operating Cash Flow $152 million +72%

Free Cash Flow $114 million +202%

SNAP strong fundamental performance in Q1 2025, marked by accelerating revenue growth, expanding user engagement, sharply improving profitability, and robust cash flow generation, sets a solid foundation for a potential stock rally this year.

The company’s innovation in AR, diversified revenue streams, and healthy balance sheet further support a bullish outlook. Investors focusing on fundamentals can view Snap as a growth stock with improving financial health and significant upside potential in 2025.

My price target is $14.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

FIVE Five Below Options Ahead of EarningsIf you haven`t bought FIVE before the previous earnings:

Now analyzing the options chain and the chart patterns of FIVE Five Below prior to the earnings report this week,

I would consider purchasing the 115usd strike price Puts with

an expiration date of 2025-6-20,

for a premium of approximately $4.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NTNX Nutanix Options Ahead of EarningsIf you haven`t bought NTNX before the recent rally:

Now analyzing the options chain and the chart patterns of NTNX Nutanix prior to the earnings report this week,

I would consider purchasing the 80usd strike price Puts with

an expiration date of 2025-6-20,

for a premium of approximately $5.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ELF Beauty Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ELF Beauty prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2025-5-30,

for a premium of approximately $5.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RKT Rocket Companies Options Ahead of EarningsIf you haven`t bought RKT before the previous earnings:

Now analyzing the options chain and the chart patterns of RKT Rocket Companies prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.37.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TEAM Atlassian Corporation Options Ahead of EarningsIf you haven`t sold TEAM on this top:

Now analyzing the options chain and the chart patterns of TEAM Atlassian Corporation prior to the earnings report this week,

I would consider purchasing the 245usd strike price Calls with

an expiration date of 2025-5-2,

for a premium of approximately $8.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AAL American Airlines Group Options Ahead of EarningsIf you haven`t bought the dip on AAL:

Now analyzing the options chain and the chart patterns of AAL American Airlinesprior to the earnings report this week,

I would consider purchasing the 9usd strike price Puts with

an expiration date of 2025-5-2,

for a premium of approximately $0.44.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

#AUCTIONUSDT shows continued buyer weakness📉 Short BYBIT:AUCTIONUSDT.P from $16.370

⚡️ Stop loss $16.735

🕒 1H Timeframe

⚡️ Overview:

➡️ The POC (Point of Control) is located at $17.734, indicating the highest volume area and now acting as a strong resistance.

➡️ Price BYBIT:AUCTIONUSDT.P continues to trade below the accumulation zone, confirming sellers' control.

➡️ After a local bounce, the chart shows a breakdown below $16.370 — this triggers a potential short setup.

➡️ Target zones are set near previous reaction levels, making them suitable for profit-taking.

🎯 TP Targets:

💎 TP 1: $16.165

💎 TP 2: $16.040

💎 TP 3: $15.850

📢 Watch for solid confirmation below $16.370 — this would strengthen the case for downside continuation.

📢 If price moves back above $16.735, the short setup is invalidated.

BYBIT:AUCTIONUSDT.P shows continued buyer weakness — downside movement is expected if pressure remains.

NKE NIKE Options Ahead of EarningsIf you haven`t sold NKE before the previous earnings:

Now analyzing the options chain and the chart patterns of NKE NIKE prior to the earnings report this week,

I would consider purchasing the 73usd strike price Puts with

an expiration date of 2025-3-21,

for a premium of approximately $3.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Ethereum at a Key Level! ¿Rebound or More Drop?Hi traders! 🚀 I'm entering ETH/USD at a key zone. The price is testing support at $2,098, and while the trend is still weak, the RSI at 30 suggests we're in oversold territory. 👀

Trade Details:

🔸 Entry:$2,098 ✨

🔸 SMA 200:$2,213 → strong resistance.

🔸 SMA 20:$2,167 → could act as a barrier.

🔸 TP:$2,256 🟢

🔸 SL:$1,912 🔴

Clear risk management in place—let's see if we get the bounce! What do you think? 📉📈🔥

⚠️ Disclaimer: This is not financial advice. I'm just sharing my analysis and personal experience. Every trader should do their own research and manage their risk. 📢

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 5.50usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $1.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SEDG SolarEdge Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2025-2-28,

for a premium of approximately $1.76.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AMAT Applied Materials Options Ahead of EarningsAnalyzing the options chain and the chart patterns of AMAT Applied Materials prior to the earnings report this week,

I would consider purchasing the 180usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $6.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

#APTUSDT expecting further decline📉 SHORT BYBIT:APTUSDT.P from $5.5950

🛡 Stop Loss: $5.7250

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:APTUSDT.P remains in a downtrend, forming lower lows. The price broke key support at $5.6600 and continues downward.

➡️ POC (Point of Control) at $5.94 indicates the highest liquidity zone, confirming a bearish market sentiment.

➡️ A breakdown of $5.5950 strengthens the downtrend, opening the way toward $5.2950, where buyers previously showed interest.

➡️ Holding below $5.5950 will likely accelerate selling pressure.

⚡ Plan:

➡️ Enter SHORT after confirming a breakdown below $5.5950, signaling further downside.

➡️ Risk management through Stop-Loss at $5.7250, placed above resistance.

➡️ Primary downside target – $5.2950, where buyers may step in.

🎯 TP Targets:

💎 TP1: $5.2950 – key support level.

📢 BYBIT:APTUSDT.P remains in a strong downtrend with no clear signs of reversal. If the $5.5950 level breaks with increasing volume, the decline may accelerate.

📢 It is crucial to watch the reaction at $5.2950—if significant buying interest appears, a short-term bounce is possible. However, if selling pressure persists, the price may continue to fall toward $4.3450.

🚀 BYBIT:APTUSDT.P remains weak - expecting further decline!

GE Aerospace Options Ahead of EarningsIf you haven`t bought GE before the breakout:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 185usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $8.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.