Tariff Fears Drive Silver to $33.10Silver rose above $33.10 per ounce on Tuesday, snapping a four-day losing streak. The market focused on U.S. diplomatic efforts in the Russia-Ukraine conflict and escalating violence in the Middle East after an Israeli airstrike on a Gaza hospital.

A weaker U.S. dollar also supported silver, with concerns growing that Trump’s proposed tariffs could slow economic growth, fueling speculation of further Fed rate cuts. Meanwhile, investors assessed China’s outlook after Premier Li Qiang urged global cooperation to stabilize economic conditions.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

Silver

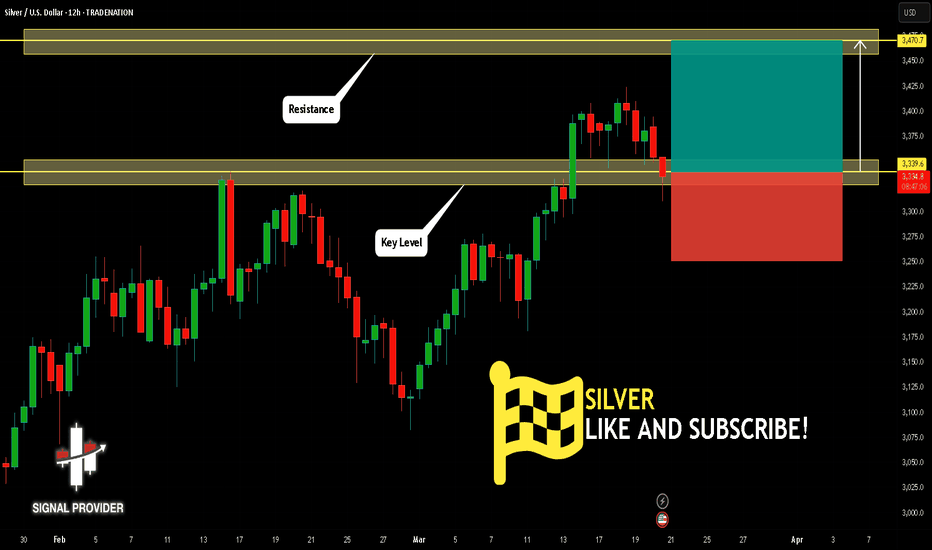

SILVER SHORT FROM RESISTANCE

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,314.3

Target Level: 3,276.5

Stop Loss: 3,339.5

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

SPY/QQQ Plan Your Trade for 3-24-25 : Bozu Trending PatternToday's Bozu Trending pattern suggests a very aggressive price move is likely. I believe this move will be to the upside after my weekend research suggested we are moving into a "blow-off" topping pattern that will act as a Bull Trap.

Overall, I belive the SPY/QQQ have about 2-3 days up upward price trending early this week, then the markets will suddenly roll into a topping pattern and start to aggressively move downward.

The next base/bottom of the continued downward price trend sets up in early/mid April. The March 21-24 base/bottom is likely the minor base/bottom we have seen over the past 3-5+ days.

I believe the breakdown in the SPY/QQQ late this week and into next week will result in a new lower low - causing the Consolidation phase of this downturn to extend down to the 520-525 level on the SPY.

Bitcoin is very close to my $88,000 upper target level (only about $250 off that level). Get ready, BTCUSD should make an aggressive move downward after stalling near the FWB:88K level peak.

Gold and Silver are moving into a trending mode. I believe both Gold and Silver will rally this week and into the next few weeks as we expand into the Expansion phase.

Buckle up. If my research is correct, we are going to see a BIG ROLLOVER this week.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SILVER Will Go Lower From Resistance! Short!

Take a look at our analysis for SILVER.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 33.211.

Taking into consideration the structure & trend analysis, I believe that the market will reach 31.952 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish Setup📊 Overview of the Chart

This 4-hour chart of Silver (XAG/USD) provides a classic example of a Rising Wedge Breakdown, a bearish reversal pattern. The price initially followed a strong uptrend, forming a series of higher highs and higher lows, but failed to sustain momentum at the key resistance zone (~$34.00 - $34.50). This led to a breakout to the downside, which has now confirmed a shift in market sentiment from bullish to bearish.

This analysis will break down each key level, the technical indicators supporting this trade setup, and how traders can approach it effectively.

🛠️ Breakdown of the Chart Components

1️⃣ Rising Wedge Formation (Bearish Pattern Identified)

The price action created a Rising Wedge, which is a bearish pattern characterized by an uptrend where the higher highs and higher lows start converging into a narrowing range.

This shows that while buyers were pushing prices higher, their strength was gradually fading.

The breakdown of this structure signaled a loss of bullish momentum, leading to a shift in trend.

2️⃣ Resistance Level & Sell Zone Identified

The resistance level at $34.00 - $34.50 has acted as a supply zone where sellers stepped in, preventing further upside.

A bearish rejection at this zone confirms that sellers are still dominant.

3️⃣ Retest of the Broken Support (Key Confirmation)

After the breakout from the wedge, the price made a retest of the broken trendline, a classic move before further downside.

Retesting this area confirms that it is now acting as resistance rather than support, further strengthening the bearish case.

4️⃣ Trendline Breakout – Shift in Market Structure

The dashed trendline was previously supportive, but now that the price has broken below it, it has turned into a resistance level.

This shift in market structure is a strong bearish signal.

5️⃣ Key Support Levels & Target Projection

The next major support level is at $32.00, a level where price previously found demand.

The ultimate target price is around $31.18, which aligns with historical support and Fibonacci retracement levels.

📉 Trading Strategy – How to Trade This Setup?

✅ Entry Point (Short/Sell Setup)

A good shorting opportunity arises if the price retests the resistance at $33.50 - $34.00 and shows bearish confirmation (like a rejection candlestick or a bearish engulfing pattern).

📍 Stop Loss (SL) Placement

SL should be above $34.20 to avoid getting stopped out by potential fakeouts.

🎯 Take Profit (TP) Levels

TP1: $32.00 (First support level)

TP2: $31.18 (Final bearish target)

📊 Risk-Reward Ratio

Entry at $33.50 - $34.00 with SL at $34.20 and TP at $31.18 provides an excellent risk-to-reward ratio (~1:4).

📌 Market Sentiment & Conclusion

🔴 Bearish signals are dominant, suggesting further downside potential.

📉 A strong bearish move is expected if the price fails to reclaim $34.00.

🎯 Targeting $31.18 in the upcoming sessions.

📢 Final Advice: Traders should watch for confirmation before entering trades. A successful retest and rejection at $33.50 - $34.00 will be a high-probability short setup. 🚀

🔥 Follow price action and risk management principles for a successful trade! 🔥

Silver's Limited Rebound at $33.06Posting a modest rebound after last week’s dip, silver currently trades around $33.06 per ounce. The recovery is limited as easing geopolitical tensions compete with the pressure from a strong U.S. dollar. Demand stays strong due to tariff uncertainty and inflation risks, but weak industrial outlook, mainly from China, and hopes for a Russia-Ukraine ceasefire are limiting silver’s gains. Still, tightening supply and global economic concerns are helping keep silver near five-month highs.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

GOLD H1 Update: Pullback in Progress BUY DIPS TP 3 100 USD🏆 Gold Market Update (March 24th 2025)

📊 Technical Outlook update

🔸Bullish OUTLOOK

🔸Broke out and set new ATH

🔸Strong UPTREND: Sequence of Higher Lows

🔸Recommend to BUY DIPS 2950 USD

🔸Price Target BULLS: 3075 USD - 3100 USD

📈 Market Performance & Price Action

🚀 Gold Hits All-Time High – Reached $3,057.21/oz this week

📊 Driven by: Geopolitical tensions + economic uncertainty

🏦 Federal Reserve Impact

🛑 Fed Keeps Interest Rates Steady at 4.25%–4.50%

🔮 Signals 2 rate cuts likely in 2025 due to slowing growth

📉 Lower rate outlook supports bullish gold sentiment

💹 Gold Investment Trends

📈 Gold ETFs Outperform Physical Gold

GDX (Gold Miners ETF) ↑ 32%

GLD (SPDR Gold Shares) ↑ 15.5%

📊 Investors leaning toward mining stocks & ETF exposure for higher returns

Trading Is Not Gambling: Become A Better Trader Part III'm so thankful the admins at Tradingview selected my first Trading Is Not Gambling video for their Editor's Pick section. What an honor.

I put together this video to try to teach all the new followers how to use analysis to try to plan trade actions and to attempt to minimize risks.

Within this video, I try to teach you to explore the best opportunities based on strong research/analysis skills and to learn to wait for the best opportunities for profits.

Trading is very similar to hunting or trying to hit a baseball... you have to WAIT for the best opportunity, then make a decision on how to execute for the best results.

Trust me, if trading was easy, everyone would be making millions and no one would be trying to find the best trade solutions.

In my opinion, the best solution is to learn the skills to try to develop the best consistent outcomes. And that is what I'm trying to teach you in this video.

I look forward to your comments and suggestions.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

XAGUSD - Hunting for Bullish Entries on Smaller TFThe Silver/USD 4-hour chart displays a significant retracement from recent highs around $3,420, with price currently rebounding near the $3,300 level. This correction has brought price to test both the ascending trendline and the horizontal support at $3,275 (marked by the red line), creating a potential buying opportunity. Given the overall uptrend structure and the recent bounce from this dual support zone, we need to prepare for finding buy setups on smaller timeframes. Traders should shift to lower timeframe charts (15-minute, 30-minute, or 1-hour) to identify precise entry signals. The price action suggests a potential retest of the upper blue reaction zone after completing the current zigzag correction, as indicated by the directional arrow on the chart. Monitoring these smaller timeframes will help capture optimal entry points with tighter stop-losses while maintaining the broader bullish bias shown on this 4-hour chart.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER: Bullish Forecast & Outlook

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the SILVER pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

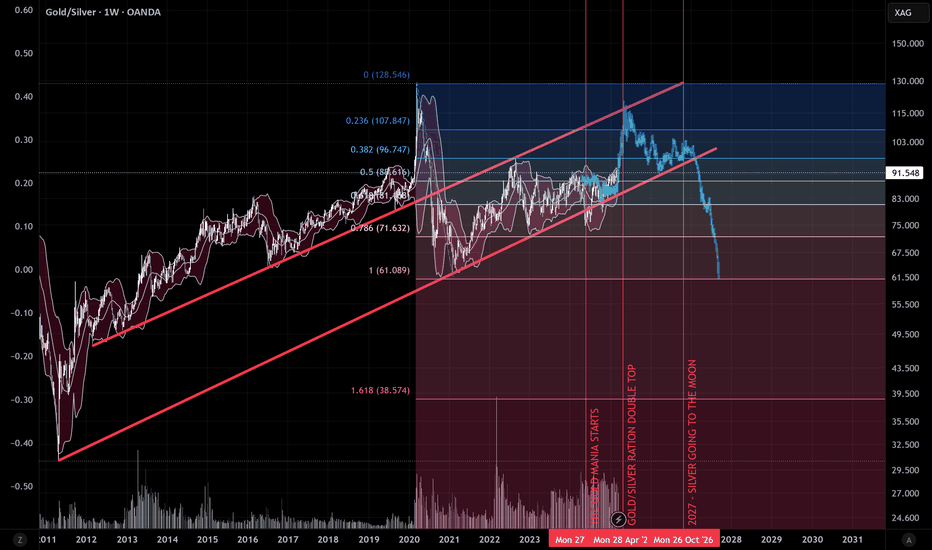

GOLD TO SILVER RATIO ABOUT TO TOP OUT !!OANDA:XAUXAG The current Gold rush and the weak demand in Retail for Silver, Platinum or even Palladium clearly shows that Gold TVC:GOLD is heading for a double top in the coming two to three months against Silver TVC:SILVER , after which Silver will start having the upper hand and totally outperform Gold (add in Platinum and Palladium as well). This would also perfectly coincide with my editorial Silver prediction to break the $45-50 barrier in 2027 from a year ago:

Silver The Week Ahead 24th March '25Silver bullish & overbought, the key trading level is at 3194

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

BRIEFING Week #12 : Alt-Season might be coming soonHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

SILVER Bullish Bias! Buy!

Hello,Traders!

SILVER went down and

Retested a horizontal

Support of 32.60$ from

Where we are seeing a

Bullish rebound so as we

Are bullish biased and we

Will be expecting a further

Bullish move up

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SPY/QQQ Plan Your Trade for 3-21-25 : BreakAway PatternToday's Breakaway pattern may show up in the form of an Island Top or break-away to the upside if my analysis is correct.

I see the markets stalling over the past few days, potentially setting up a "last breakaway" type of pattern today.

I've highlighted how these "last" patterns work where price sets up a peak or trough (in this case a peak) as a last/exhaustion move and how this move can sometimes be very aggressive.

I urge traders to stay cautious today as we are moving into a MAJOR REVERSAL weekend.

I believe the markets will suddenly change direction next week (early) and will move back into downward trending by March 25-26.

Gold and Silver may rally today if the markets move into that Exhaustion Peak pattern. Keep an eye out for Gold/Silver/Bitcoin to potentially rally today and into early next week.

Overall, traders should stay very cautious as we move into next week's peak/top/rollover.

Don't get too aggressive trying to prepare for the rollover or any potential upside move over the next 3-5+ days.

Let the markets show us what and when we need to be aggressive.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Silver Steadies Near $33.20 After PullbackSilver hovered near $33.20 on Friday morning after two consecutive sessions of decline. The recent upward momentum, initially fueled by China’s stimulus measures, has temporarily stalled. Nevertheless, the potential for further gains remains intact amid persistent uncertainty surrounding former President Trump’s tariff policies and escalating geopolitical risks. In addition, the Federal Reserve’s soft approach to interest rates, even if temporary, continues to support interest in non-yielding assets like silver.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

Silver Approaching Critical 32.95 Support LevelSilver has broken below the 33.50 support and is retreating quickly. The main support lies around the 32.95 area, where both the uptrend line and the 38.2% Fibonacci retracement level converge. This zone could potentially offer a buying opportunity, provided the support holds.

However, if Silver breaks below 32.95 and retests it from underneath, it could also present a selling opportunity. In both scenarios, a high risk/reward trade setup with well-placed stops may form.

Caution is advised, as Silver is known for sudden price spikes, especially around key support and resistance levels.

WILL SILVER DIP BELOW 32.6 BEFORE ITS RALLY TO TEST RECENT HIGH?Silver Price Movement...

N.B!

- XAGUSD price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#silver

#xagusd

SILVER LONG SIGNAL|

✅SILVER has retested a key

Support level of 33.39$

After a bearish correction

While trading in an uptrend

So we can enter a long trade

With the Take Profit of 33.89$

And the Stop Loss of 33.08$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver is in the bullish trendHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish OutlookChart Overview

This is a 1-hour chart of Silver (XAG/USD) from OANDA, showing recent price action forming a rising wedge pattern followed by a bearish breakdown. The price initially rallied within the wedge but failed to sustain gains above the key resistance zone, leading to a strong rejection and downward momentum.

Key Chart Elements & Analysis

1. Rising Wedge Formation (Bearish Pattern)

The market was in an uptrend, forming higher highs and higher lows within a rising wedge pattern.

A rising wedge is a classic bearish reversal pattern, which indicates weakening buying pressure as price consolidates upward.

The price eventually broke below the lower trendline, signaling a shift in momentum from bullish to bearish.

2. Resistance Zone & Rejection

A strong resistance zone was identified around $33.80 - $34.20 USD (highlighted in blue).

Price attempted multiple times to break above this level but faced selling pressure, leading to a sharp reversal.

The final breakout attempt failed, confirming that sellers are in control.

3. Breakdown & Retest of Support

After breaking down from the wedge, the price found temporary support around $33.20 USD, which aligns with a previous consolidation area.

A retest of the broken wedge support turned into resistance, further confirming the bearish bias.

The rejection from this level strengthened the case for a move lower.

4. Next Support Level & Target Projection

The next significant support zone is around $31.95 - $32.00 USD (marked as the "Target" area).

This level coincides with previous price action support, making it a high-probability bearish target.

The breakdown is expected to follow a measured move projection, bringing price toward this level.

Trade Plan & Execution Strategy

📉 Bearish Setup (Short Opportunity)

Ideal Entry: A pullback to the previous support (now resistance) at $33.20 - $33.40 USD could offer an entry for shorts.

Stop-Loss: Above $33.80 USD, just above the resistance zone.

Target Levels:

Primary Target: $32.50 USD

Final Target: $31.95 - $32.00 USD

Confirmation: Look for price rejection or bearish candlestick formations at resistance before entering.

⚠️ Risk Management & Considerations

Bullish Scenario: If price reclaims $33.80 USD, the bearish setup could be invalidated, and a move higher toward $34.50 USD is possible.

Market Conditions: Keep an eye on macroeconomic factors, news events, and USD strength, as they can influence silver prices.

Conclusion: Bearish Outlook with Downside Target 🎯

The rising wedge breakdown signals further downside potential.

A support retest rejection confirms selling pressure.

$31.95 - $32.00 USD remains the main target, aligning with technical projections.

Short positions with proper risk management remain favorable in this setup.

SPY/QQQ Plan Your Trade For 3-20-25 : Flat-Down PatternToday's SPY Cycle pattern suggests the SPY/QQQ will stay somewhat muted in trading range today.

I still believe the SPY/QQQ are in a moderate melt-up type of trend - attempting to reach a peak near the end of this week or early next week (see the patterns for March 24, 25, 26).

Even though I believe we are struggling to try to move higher, I do believe any failure of the SPY to move above the 0.382 Fibonacci retracement level would be a technical failure related to the breadth of this pullback.

Thus, I believe the markets have at least one more attempt to try to move higher over the next 5+ days before topping and rolling over into a broader downtrend.

Gold and Silver moved solidly lower this morning - almost like a Panic type of selling. I believe this is related to the Flat-Down pattern and I believe Gold/Silver will recover fairly quickly. I do believe this is a huge opportunity for Gold/Silver over the next 30+ days. I believe Gold will attempt to move above $3500-3600 before the end of April.

BTCUSD rolled higher yesterday by more than $4000 - just like I predicted.

Incredible.

And, that is another reason why I believe the SPY/QQQ have more room to the upside than we are seeing right now.

Remember this is a trader's market.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SILVER Is Very Bullish! Buy!

Here is our detailed technical review for SILVER.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 3,339.6.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 3,470.7 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!