Trading Is Not Gambling : Become A Better Trade Part IOver the last few weeks/months, I've tried to help hundreds of traders learn the difference between trading and gambling.

Trading is where you take measured (risk-restricted) attempts to profit from market moves.

Gambling is where you let your emotions and GREED overtake your risk management decisions - going to BIG WINS on every trade.

I think of gambling in the stock market as a person who continually looks for the big 50% to 150%++ gains on options every day. Someone who will pass up the 20%, 30%, and 40% profits and "let it ride to HERO or ZERO" on most trades.

That's not trading. That's flat-out GAMBLING.

I'm going to start a new series of training videos to try to help you understand how trading operates and how you need to learn to protect capital while taking strategic opportunities for profits and growth.

This is not going to be some dumbed-down example of how to trade. I'm going to try to explain the DOs and DO N'Ts of trading vs. gambling.

If you want to be a gambler - then get used to being broke most of the time.

I'll work on this video's subsequent parts later today and this week.

I hope this helps. At least it is a starting point for what I want to teach all of you.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Silver

SILVER Free Signal! Buy!

Hello,Traders!

SILVER is trading in an

Uptrend but the price

Made a bearish correction

And will soon hit a horizontal

Support of 33.35$ from where

We can go long with the

TP of 33.93$ and SL of 33.13$

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold at $3,000: The Ultimate Panic Buy or Just Another Bubble? 💰 Gold Hits Record Highs – Because the World is on Fire 🔥

Ah, gold—humanity’s favorite panic button. As of March 2025 , gold prices have skyrocketed past $3,000 per ounce . Why? Because the world can’t go five minutes without a crisis. 🌍💥

Trade wars? Check.

Geopolitical conflicts? Check.

The eternal struggle between "experts" predicting doom and moonboys screaming ‘buy the dip’? Check.

With the U.S. economy wobbling like a Jenga tower after a few tequila shots and global uncertainty at an all-time high, investors are piling into gold like it’s the last lifeboat on the Titanic. 🚢💨

🏦 Central Banks: The Ultimate Gold Hoarders

If you think you have a gold addiction, meet central banks. These guys have been buying over 1,000 metric tons per year —basically turning their vaults into dragon lairs. 🐉💰

Why? Because they definitely trust fiat currencies… just not enough to NOT hedge against their own policies. 😏

China, India, and Turkey are leading the charge, stacking gold like it’s a limited edition NFT.

The logic? If everything goes to hell, at least they’ll have something pretty to look at.

📈 What Do the ‘Smart People’ Think? (Spoiler: They Don’t Agree 🙄)

Let’s check what the big banks are saying—because if there’s one thing banks are great at, it’s being consistently wrong with their predictions.

JP Morgan Private Bank is feeling "constructive" about gold. Which is just a fancy way of saying "Eh, we have no clue, but it looks good." They think potential Fed rate cuts could send gold higher. 🚀

VanEck highlights how central banks and investors drove gold to new highs in 2024. Basically, everyone’s running for cover while pretending it’s a “strategic allocation.”

🤔 Should You Buy Gold or Just Watch the Chaos?

Pros: You get a shiny rock that everyone suddenly cares about during a crisis. 🌟

Cons: No dividends, no passive income, and you basically just hope some sucker will pay more than you did. 😬

Gold is a great hedge when the world is melting down, but let’s not pretend it’s some magical wealth generator. If you’re buying, just make sure it’s not because your Uber driver said it’s "going to the moon." 🚀🌕

(Not financial advice. But definitely sarcastic advice. 🤷♂️)

If you want the deeper breakdown (the one nobody’s telling you), drop a comment or DM me. Maybe I’ll let you in on the real insights. 👀🔥

Silver – Lagging but Still Strong!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 SILVER has been bullish, trading within the rising wedge pattern marked in red.

Following the latest aggressive bullish movement, XAGUSD has formed a demand zone, marked in blue.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups, as it represents the intersection of demand, support, and the lower red trendline, which acts as a non-horizontal support.

📚 As per my trading style:

As #XAGUSD approaches the blue circle, I will be looking for bullish reversal setups, such as a double bottom pattern, a trendline break, and so on.

Additionally, for the bulls to maintain long-term control, a break above $3,500 is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

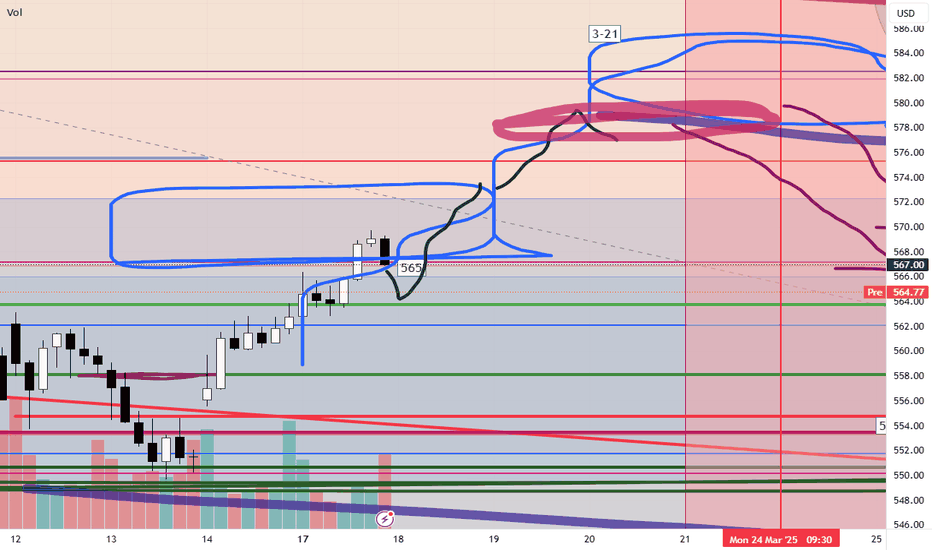

SPY/QQQ Plan Your Trade For 3-19-25 : Top PatternToday's Top pattern suggests the SPY/QQQ will attempt to rally up to resistance, then form a peak/top in price, and then roll over a bit.

After yesterday's fairly consolidated price range, I believe the SPY/QQQ may rally through most of the day and move into the topping pattern near the end of today's trading day.

Overall, I believe the markets are still rolling into the Excess Phase Peak consolidation phase and that means traders need to prepare for extreme price volatility.

What is interesting is how BTCUSD is trying to rally a bit, but not finding upward momentum.

As I stated in today's video, I believe a fairly big move upward, possibly $3000 or more, in BTCUSD could happen between now and the end of this week.

This would be a perfect upward price advance into resistance that could correlate with a move h higher in the SPY/QQQ - targeting the upper level of the Consolidation Phase.

Gold and Silver have reached a "pause" level. I believe Gold and Silver will only pause for 48 to 96 hours before attempting to break higher. So, metals will still attempt to break higher into late March 2025.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

GOLD market Update: BUY DIPS 2990 USD TP 3100 USD🏆 Gold Market Update / Wednesday

📊 Technical Outlook

🔸Bullish OUTLOOK

🔸5 waves Bullish Sequence on H1

🔸2846/2930 w1, 2930/2887 w2, 2887/3045 w3

🔸3045-3055/2980-2990 wave 4 pullback now

🔸2980-2990/3100 - final wave 5 pump

🔸Recommend to BUY DIPS 2980/2990 USD

🔸Price Target BULLS: 3100 USD in Wave5

🏆🔥 Latest Gold Market Update – March 2025 🔥🏆

🚀 Gold Prices Hit New Highs!

💰 Gold Breaks $3,040+ – Soaring to record levels as investors seek safe-haven assets. 🏦✨📈

📊 Analysts Raise Targets – UBS forecasts $3,200 by June amid strong bullish momentum. 🔮💎

🌎 Key Market Drivers:

⚠️ Geopolitical Tensions Rising – Middle East conflicts fuel gold’s safe-haven appeal. 🌍🔥

📉 Stock Market Volatility – Investors flee equities, boosting gold demand. 📊📢

SPY/QQQ Plan Your Trade For 3-18-25 : Gap Reversal Counter-TrendFirst off, thank you for all the great comments and feedback. I really love hearing from TradingView subscribers and how my research is helping everyone find success.

Just recently, I received some DMs from viewers saying my research has been "dead on" - which is great.

One thing is for sure, the big move in Gold/Silver is just getting started.

Today's SPY Cycle Pattern is a Gap-Reversal in a Counter Trend mode. The long-term & short-term bias is currently BEARISH - so I believe the GAP Reversal will be to the upside.

Meaning, I suggest we start the day with a mild lower GAP - followed by a moderate price reversal in early trading, leading to a continued melt-up type of trend for the SPY/QQQ

Gold and Silver are likely to attempt to melt a bit higher into the TOP pattern for today. I believe this is just a temporary resistance level for metals.

Bitcoin is struggling to find upward momentum - but I believe BTCUSD still has a $3k-$5k rally left to reach the current Consolidation highs. We'll see if it breaks higher over the next 3-5 days before rolling over into a new downtrend.

Again, I really appreciate all of my followers and viewers. I want all of you to learn to see, read, and understand price action more clearly than ever before.

That's why I don't use any technical indicators on my chart. I want you to understand PRICE is the ultimate indicator.

Get some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

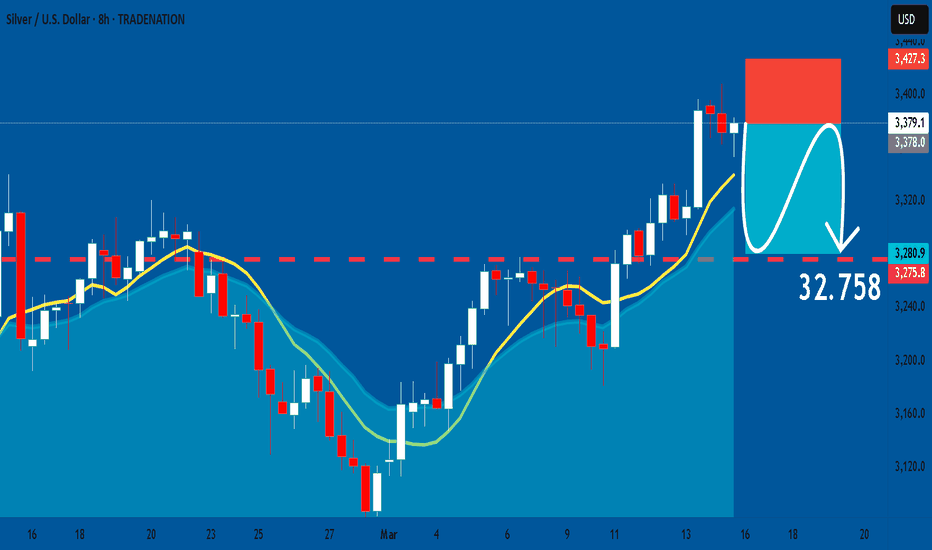

SILVER BEARS WILL DOMINATE THE MARKET|SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,408.6

Target Level: 3,244.3

Stop Loss: 3,517.4

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

SILVER (XAGUSD): Bullish Continuation Ahead

Silver formed a strong bullish pattern on a 4H.

I see a bullish flag with a candle close above its resistance line.

I think that the market is going to continue rising.

Next resistance 34.2

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver Surges to $33.90 as Safe-Haven DemandSilver surged to $33.90, its highest since October 2024, driven by a weaker dollar, geopolitical tensions, and strong industrial demand. Recession fears and trade disputes have supported safe-haven buying, with Trump planning new tariffs on China, steel, and aluminum starting April 2. Middle East tensions added support, as Netanyahu confirmed intensified military action in Gaza. Supply constraints and record industrial demand, especially in solar, 5G, and automotive sectors, further fueled the rally.

If silver breaks above $34.00, the next resistance levels are $34.85 and $35.00. On the downside, support is at $33.80, with further levels at $33.15 and $32.75 if selling pressure increases.

Silver Climbs on Weak Inflation DataSilver surged toward $33.90 an ounce, its highest since late October with ongoing trade tensions and rising Fed rate cut expectations after weak U.S. inflation data.

Trump threatened 200% tariffs on European wines in response to the EU’s 50% tariff on U.S. whiskey, further heightening market uncertainty. U.S. producer prices remained flat in February in the meantime, consumer inflation rose just 0.2%, and jobless claims declined, signaling a resilient labor market.

If silver breaks above $34.00, the next resistance levels are $34.85 and $35.00. On the downside, support is at $33.80, with further levels at $33.15 and $32.75 if selling pressure increases.

SPY/QQQ Plan Your Trade Video for 3-17: GAP PotentialAs we start moving into the Excess Phase Peak pattern consolidation phase, I believe the SPY/QQQ will attempt a moderate rally for about 3-5+ days, then roll into a deep selling mode after March 21-24.

I don't believe we have reached a bottom - yet.

I do see a lot of people talking about "the bottom is in" and I urge all of you to THINK.

What do you believe will be the basis of US and GLOBAL economic growth starting RIGHT NOW?

Can you name one thing that will be the driver of economic expansion and activity?

I can't either.

Thus, I suggest traders prepare for more sideways consolidation range trading over the next 60+ days as hedge assets and currencies attempt to balance risks.

BTCUSD, Gold, Silver should all be fairly quiet this week. I'm not expecting any huge price moves this week.

I expect the SPY/QQQ & BTCUSD to move a bit higher while Gold and Silver melt upward a bit further.

Then, after March 21, I expect bigger volatility and a broad rotation in the SPY/QQQ/Bitcoin where Gold/Silver will start a bigger move higher.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

GOLD H1 Update: Bullish Outlook BUY DIPS by ProjectSyndicate🏆 Gold Market Highlights (March 2025)

📊 Technical Outlook

🔸Bullish OUTLOOK

🔸Broke out and set new ATH

🔸Strong UPTREND: Sequence of Higher Lows

🔸Recommend to BUY DIPS 2925/2950 USD

🔸Price Target BULLS: 3050 USD - 3100 USD

📈 Historic Milestone Achieved

🏅 Gold Futures Surpass $3,000

🔥 Gold prices hit an all-time high, closing above $3,000 ATH

🚀 Major breakout in the precious metals market!

📊 Analyst Perspectives

🔮 Continued Bullish Sentiment

📉 Both Wall Street & Main Street expect further gains beyond $3,000.

💡 Analysts see upside momentum continuing in the coming weeks.

🌍 Market Dynamics

⚡ Factors Driving the Rally

🌎 Global trade tensions & geopolitical risks pushing investors toward gold.

📌 Safe-haven demand surging amid uncertainty.

⏳ Historical Context

📜 Comparisons to the 1980 Bull Run

🔄 Parallels drawn between the current rally and the historic 1980 surge.

❓ Can gold repeat history and extend its gains even further?

🏦 Global Demand Trends

🇨🇳 China’s Record Gold ETF Inflows

📈 Massive inflows into gold ETFs in China, signaling strong demand.

💰 Jewelry demand expected to stabilize as the economy recovers.

🏦 Investor Behavior

🎯 Increased Attention Amid Uncertainty

🏛️ Investors shifting focus to gold as a hedge against economic instability.

💎 Gold’s safe-haven status reaffirmed, attracting more institutional buyers.

📢 Final Takeaway:

🔹 Gold is shining brighter than ever! 🌟

🔹 Expect volatility, but long-term outlook remains bullish. 💹

🔹 Keep an eye on key resistance & support levels. 🔍

XAG/USD Breakout (17.3.2025)The XAG/USD pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 34.31

2nd Resistance – 34.66

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Silver XAGUSD at Resistance—Will We See a Deep Pullback?In this video, we take a deep dive into silver (XAGUSD) and its recent price action. Silver has been in a strong bullish trend 📈, but it's important to consider the broader market context. The stock markets have caught a bid and are rallying after trading into key support zones, triggering a strong retracement. Given this correlation, silver could follow a similar path as it approaches resistance.

Currently, XAGUSD appears overextended on both the weekly and daily timeframes, suggesting the potential for a deeper pullback 🔄. If this scenario plays out, I’ll be watching for a 50% Fibonacci retracement 📐 as a key buying zone—provided that price action aligns with the criteria outlined in the video.

⚠️ Not financial advice.

BRIEFING Week #11 : Are we done ? (nope)Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

SILVER Under Pressure! SELL!

My dear subscribers,

My technical analysis for SILVER is below:

The price is coiling around a solid key level - 33.804

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 33.034

My Stop Loss - 34.159

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

SILVER Swing Long! Buy!

Hello,Traders!

SILVER made a strong

Bullish brekaout and

The breakout is confirmed

As the daily candle closed above

The key horizontal level of 33.20$

So we are bullish biased

But we will fist expect some

Correction on Monday

With the potential retest

Of the new support level

From where we believe

Growth will continue

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver The Week Ahead 17th March '25Silver INTRADAY bullish & overbought, key trading level is at 3300.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

SILVER: Short Signal Explained

SILVER

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short SILVER

Entry Point - 33.791

Stop Loss - 34.273

Take Profit - 32.758

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️