Silver - Short Term Buy IdeaM15 - Strong bullish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silverprediction

SILVER TO 40$ HELLO TRADERS

As i can see Silver is still trading inside a upward channel and did not created any big moves like Gold and its under value i am expected a boost from this zone to 40 $ incoming days if it did notr break the channel friends its just a trade idea share ur thoughts with us we love ur comments and support Stay Tuned for more updates

Silver - Short Term Sell Trade Update!!!Hi Traders, on April 30th I shared this idea "Silver - Expecting Retraces Before Prior Continuation Lower"

I expected retraces and further continuation lower until the two Fibonacci resistance zones hold. You can read the full post using the link above.

The bearish move delivered, as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver - Expecting Retraces Before Prior Continuation LowerH1 - Strong bearish momentum

Lower lows on the moving averages of the MACD indicator.

Expecting retraces and further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

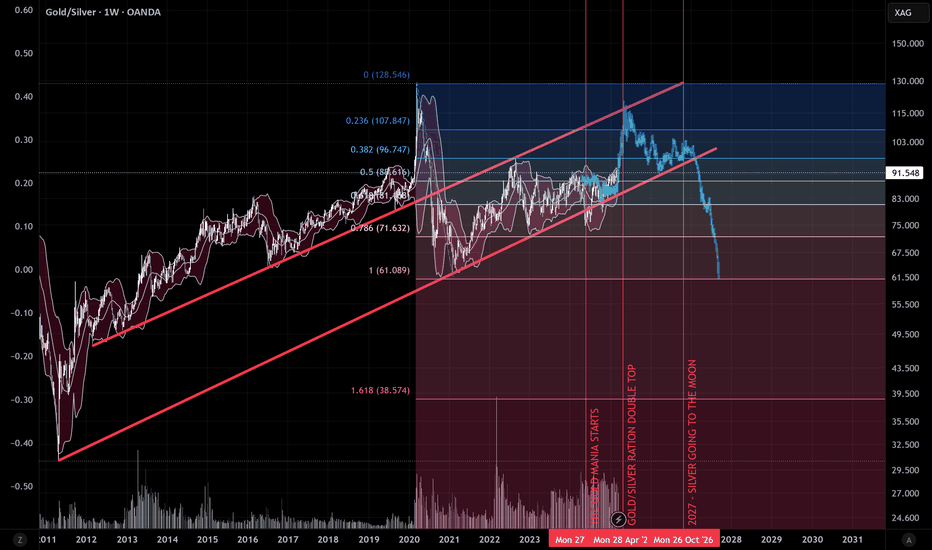

GOLD TO SILVER RATIO ABOUT TO TOP OUT !!OANDA:XAUXAG The current Gold rush and the weak demand in Retail for Silver, Platinum or even Palladium clearly shows that Gold TVC:GOLD is heading for a double top in the coming two to three months against Silver TVC:SILVER , after which Silver will start having the upper hand and totally outperform Gold (add in Platinum and Palladium as well). This would also perfectly coincide with my editorial Silver prediction to break the $45-50 barrier in 2027 from a year ago:

SILVER MCX OUTLOOK MARCH 2025SILVER MCX:

The Worlds Most Underperforming Asset SILVER, has started to gain some momentum. Today on 13th March 2025 (Thursday) cross all time highs and touched phychological level of 1Lac per Kilogram in INR.

We are currently mildly bullish on Silver MCX, its trading in a rising Wedge Techical Pattern which and expect SILVER to touch levels of wedge pattern Resistance of 1,03,200/- Per Kg (Marked on the Chart) in Next 15 to 20 Days. Currently Weaks low of 96355 should be Stoploss for the long traders.

SILVER is a very volatile commodities do not forget to place stoploss.

Silver Sell-Off Alert: 10% Drop Dead Ahead● After hitting a high of $34.87, the price entered a notable consolidation phase, eventually created a Head & Shoulders pattern.

● Following the breakdown from this pattern, the price also fell beneath its trendline support, paving the way for a more significant decline.

● Immediate support is anticipated at the $27.8 level.

● If the price drops below this threshold, it could plummet to $26.5, representing a 10% decrease from the current position.

XAG/EUR "Silver vs Euro" Market Heist Plan on Bullish SideHello!! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist XAG/EUR "Silver vs Euro" Market Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry in pullback.

Stop Loss 🛑 : Recent Swing Low using 4H timeframe

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

SILVER LOOKING FOR A SUPPORT TO START 2025 HELLO TRADERS

As I can see Silver is now rejected from ATH 35$ and looking for a support to make new ATH as we had mention in our analysis for Weekley based view on Silver for incoming 2025

technically its now trading under the support zone which was 32$ we expected one more retest to that level so it kiss the Fib Golden Ratio 0.50 zone which is our selling zone till design TP

Friends its just a trade idea share Ur thoughts with us

Stay Tuned for more updates

SILVER XAGUSD TO 40$ IN YEAR 2025 !!!HELLO TRADERS

As I can see silver is trading in uptrend channel and after a new ATH its retracing to the broken resistance zone which can be a support for silver NFP ahead and geopolitical bad conditions with a weak $ us elections impact on economy and bricks trading in 2025 will can make some new historically high in precious metals have a look on GOLD and other commodities all are make huge moves so it will be a great opportunity for Silver traders that they can join the next bull run from these given zone till design TP friends its just an trade idea with technical and fundamental view share Ur thoughts on it we appreciate Ur support and love Stay Tuned for more updates

Silver (XAG/USD) Red Alert Technical Update📉 Silver (XAG/USD) Technical Update

Resistance at 34.40 met! 🛑

Expecting a drop towards 33.00 first, followed by 30.00 as the next target if bearish momentum continues. 📉💡 Keep an eye on these key levels!

#Silver #XAGUSD #Forex #Commodities #TradingView #PriceAction #TechnicalAnalysis

---

Silver Lining: Breakout Signals Imminent Price SurgeThe price previously formed a Falling Wedge Pattern, and after breaking out, it entered a phase of consolidation.

This led to the emergence of a Symmetrical Triangle pattern on the chart, and with a recent breakout, silver is now trending upward.

Key level to watch

First target - $32.2

Second target - $33.0

It is recommended to set a strict stop-loss just below the $30.9 level to mitigate significant losses.

GOLD is going to start getting much cheaper in SILVER terms.Gold has been on an absolute tear lately as the de facto U.S. corporate government has been printing and spending FRNs (Federal Reserve Notes) into oblivion. As a result, real money is gaining value against the Federal Reserve's monopoly money. Naturally, those who saw the money devaluation coming have been buying gold to preserve their purchasing power, but silver has been lagging behind, even though it has also been appreciating. Although the price of precious metals is, and will continue to be, on the rise, the price of gold is about to get much cheaper in terms of silver. Instead of buying gold, I believe the best move right now is to buy silver, hold it, and once the exchange rate drops to the 35/45 to 1 area, then exchange your silver for gold.

I believe that in the next year to a year and a half, we will see the price of gold cut in half in silver terms, which means it will take half the silver to buy the same amount of gold, effectively doubling the purchasing power of silver versus gold.

Good luck!

What's next for Silver and Gold?OANDA:XAGUSD

OANDA:XAUUSD

TVC:DXY

Finally 😎 Silver broke through $30.

So what's next?

Long-term: I would say there is nothing on its way to go for $50. BUT, what would support Silver to go for $50? where's the demand for silver? How would supply change in the coming years? ....

I would say, let's not get ahead of ourselves and focus on what's going on now, then I try to prepare a separate post for the reasons I have for staying bullish on silver in the coming years.

Short-term: As you might have noticed, on 15 May, after the US Fed announced the CPI data, silver started its rally to $30. The recent CPI y/y data came out at the expected level of 3.4% and the CPI m/m was at 0.3% which was lower than the market expectations. So, Fed Chair Jerome Powell continued his recent interviews with a dovish tone which signals that we are very close to a rate cut **. For now, the first rate cut is expected to happen in September.

Long story short, gold and silver are pricing in the rate cuts now as this sentiment pulling DXY down. So, in the short-term , I would like to see Silver between $33.6 - $36.4 and Gold entering the $2580 - $2650 area. In the meantime, DXY can reach to 103. I have highlighted these areas on the chart 😊.

** Watch out for unemployment numbers as the Fed shifts its focus on that. If you are a day trader, you can expect higher volatility around unemployment news than before and you expect this number to have a higher impact on the longer-term trends of DXY.

** Also, keep that in mind, if they want to normalize the 3% inflation rather than 2%, it means we can expect higher levels of interest rates for a longer period of time.

SILVER MORE BULLISH TILL 35$ IN 2024HELLO FRIENDS

As I can see silver hit all time high 30$ in this bull run and now retrace we are expecting a new ATH in Silver with the fundamental and technical views all dose Time matter Friends chart is crystal clear for entries on this pair for more info Stay tuned.

Share Ur thoughts it helps many traders.

Gold and Silver We had a nice week for gold and silver.

Both rallied higher as DXY fell and reached below 103. The level that we have been waiting for in the past weeks. Now that DXY had a nice weakly bearish candle closing below 103, what should we expect for gold and silver?

Would this rally continue this week as well? I don't know. I'm just enjoying the ride. However, there will be always a correction. so let's talk about that.

As you can see silver exactly followed our green scenario in the past three weeks. Gold also moved in the direction we expected and surprised me with its vertical move. 😁

I think this week we can also see green weekly candles in gold and silver and a big red candle in DXY. However, in case of a correction at THESE PRICES, these are my expected levels for gold, silver, and DXY.

GOLD: A strong support for gold would be $2040 - $2080 area.

SILVER: A strong support for silver would be $23 - $23.5

DXY: A strong resistance for DXY would be 103.5

SILVER SELL TILL 23$HELLO TRADERS

As we can see silver hit out TP-2 on buying idea which we had updated in our channel this level we expected a retrace till 23$ and then up to the buying levels as we had perdition in our buying idea Friends its just a trade idea share Ur thoughts with us

Stay Tuned for more updates