SILVER h4 bullish pattansilver bullish mode Bearish Disruption Scenario:

Fake bounce to ~$37.00

Rejection → Break $36.00 support

Bear momentum pushes to $35.00–34.50

Neutral/Range Disruption:

Price oscillates between 36.00 and 36.80 for longer than expected — builds up coiled energy before either sharp breakout or breakdown

Only Bullish IF:

Clean reclaim of 37.25 with strong close above

Silversignal

Silver Analysis – Strong Bulls and a Clean Setup AheadLast month, Silver printed a new multi-decade high, a major technical milestone.

Since then, price has entered a sideways consolidation, forming a rectangle — but what stands out is this:

👉 Silver bulls have absorbed every dip, even when Gold dropped.

That’s strength. And strength usually precedes breakout.

🔍 Current Situation

At the time of writing, price is trading around 37.20,

and from the current structure, it looks like nothing is standing in the way of an upside break.

We don’t predict — we prepare...

And this chart looks ready.

🎯 Next Target: 40.00 USD?

A push to 40.00 looks like the next “normal” target.

But don’t forget: that’s a 3,000 pip move.

This type of move will require patience

Plan your trade.

Respect your risk.

Let the bulls work. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

KOG - SILVERSILVER

As with gold and oil, looking at this expecting a gap on open and potential for a move driven by the news. If we do spike down, the red box is the level to watch with the red box levels above as potential target levels on the breaks.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Silver - Short Term Buy IdeaM15 - Strong bullish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Can You Snatch Silver’s Profits? XAG/USD Stealth Trade Plan🔥Silver Snatch Strategy: XAG/USD Stealth Trade Plan🔥

👋 Greetings, Profit Pirates & Chart Ninjas! 🕵️♂️💸

Welcome to the Silver Snatch Strategy—a sly, calculated approach to raiding the XAG/USD market with finesse. This plan fuses razor-sharp technicals with real-time fundamentals to swipe profits from silver’s wild swings.

Let’s move like shadows, strike fast, and vanish with the gains! 🌑📈

📜 The Silver Snatch Blueprint

Entry Triggers 🔑:

🔼 Bullish Ambush: Enter on a breakout above the 50-period EMA at ~$34.20, signaling a potential rally.

🔽 Bearish Strike: Dive in on a breakdown below the 200-period EMA at ~$31.50, riding the downward momentum.

💡 Pro Tip: Use price alerts to catch these levels without glued eyes! 🔔

Stop Loss (SL) 🛡️:

🟢 Bullish Trade: Set SL at $31.90 (recent daily low, cushioning against wicks).

🔴 Bearish Trade: Place SL at $33.80 (daily high, guarding against fakeouts).

📉 Stay Flexible: Adjust SL based on your risk tolerance, lot size, and market volatility. This is your safety net!

Take Profit (TP) 💰:

🚀 Bullish Raiders: Target $36.50 (Fibonacci 61.8% retracement) or exit on fading volume.

🕳️ Bearish Thieves: Aim for $28.80 (key support zone) or slip out if momentum stalls.

🚪 Escape Tactic: Watch RSI for overbought (>70) or oversold (<30) signals to dodge reversals.

🌐 Why Trade XAG/USD Now?

Silver’s price action is a treasure chest of opportunity, driven by:

💵 USD Strength: The US dollar is flexing due to hawkish Fed signals and robust US economic data (e.g., Q1 2025 GDP growth at 2.8% annualized). A stronger USD typically pressures silver prices.

🕊️ Geopolitical Shifts: Easing US-China trade tensions reduce safe-haven demand for silver, tilting sentiment bearish.

🎲 Speculative Bets: Speculative net-short positions on silver are rising, with traders leaning against XAG/USD.

📊 Technical Edge: RSI (14-day) at 45 signals bearish momentum, while Fibonacci retracement levels highlight resistance at $34.50 and support at $31.00.

📈 Intermarket Dynamics: Rising US Treasury yields (10-year at 4.2%) and equity market optimism divert capital from non-yielding assets like silver.

📉 Silver’s recent dip to $31.60 (May 19, 2025) reflects these pressures, but a potential rebound looms if geopolitical risks flare up.

📊 Real-Time Sentiment Snapshot (May 19, 2025)

Retail Traders:

📈 Bullish: 38% 🌟 (Eyeing silver’s safe-haven appeal amid global uncertainty).

📉 Bearish: 48% ⚡ (Swayed by USD rally and trade deal optimism).

⚖️ Neutral: 14% 🧭 (Waiting for clearer signals).

Institutional Traders:

🏦 Bullish: 25% 🏦 (Hedging with silver for recession risks).

📉 Bearish: 65% 📉 (Favoring USD assets amid higher yields).

⚖️ Neutral: 10% ⚖️ (Monitoring Fed commentary).

💥 Why This Trade?

🔥 Volatility Goldmine: XAG/USD’s recent 3% daily ranges offer quick profit potential for agile traders.

📚 Data-Backed Setup: RSI, Fibonacci, and EMA alignments provide high-probability entry/exit points.

🌬️ Macro Tailwinds: USD strength and trade optimism create a clear bearish bias, with bullish setups as contingency plans.

🛡️ Risk Control: Tight SL and dynamic TP levels keep your capital safe while chasing 2:1 reward-to-risk ratios.

🗞️ News & Risk Management ⚠️

Silver is sensitive to sudden news spikes. Stay sharp:

⏰ Avoid Entries Pre-News: Skip trades 30 minutes before major releases (e.g., Fed speeches, US CPI data on May 20, 2025).

🔁 Trailing Stops: Lock in gains as price moves your way (e.g., trail SL by 50 pips on bullish trades).

🌪️ Volatility Play: Use smaller lot sizes during high-impact events to navigate choppy waters.

Join the Silver Snatch Squad!

👉 Click that Boost button to amplify this Silver Snatch Strategy and make it a TradingView legend! 🚀

Every like and share fuels our crew to drop more high-octane trade plans.

Let’s conquer XAG/USD together! 🤜🤛

Keep your charts locked, alerts primed, and trading spirit electric.

See you in the profit zone, ninjas!

XAG/USD "The Silver" Metal Market Heist Plan(Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (33.500) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (34.200) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 32.800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XAG/USD "The Silver" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

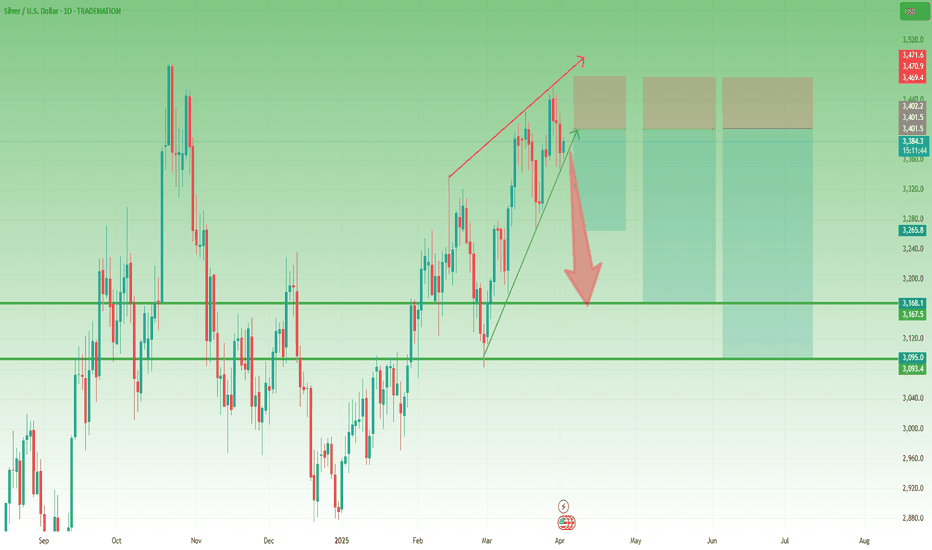

Silver could drop 2k+ pipsSilver has been on the rise recently, but unlike its big brother, Gold, it started rolling back down on Friday—even as Gold continued to print new all-time highs, culminating at 3,150 yesterday.

This divergence between the two metals could be an early sign that Silver is losing momentum.

________________________________________

Technical Signs of Weakness

📉 Rising Wedge Formation – Since early March, Silver’s price has been contained within a rising wedge, a classic bearish pattern signaling an impending breakdown.

📉 Testing Key Support – Right now, the price is hovering above wedge support. If Gold fails to hold above 3,100, I expect Silver to break down as well.

________________________________________

Targeting the Breakdown

If Silver breaks below support, I expect:

🎯 Initial target: $32

🎯 Final target: $31 (a key support zone)

Trading Plan: Selling the Rallies

Given the current setup, my strategy is to sell into rallies, aiming for at least a 1:2 risk-reward ratio.

Let’s see if Silver follows through on this bearish setup! 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

XAG/USD "The Silver" Metal Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 31.8000 (swing Trade Basis) Using the 2H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 34.5000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XAG/USD "The Silver" Metal market is currently experiencing a bullish trend,., driven by several key factors.

💎Market Overview

Current Price: 32.6000

30-Day High: 34.5000

30-Day Low: 30.5000

30-Day Average: 31.5000

Previous Close Price: 32.2000

Change: 0.4000

Percent Change: 1.24%

💎Fundamental Analysis

Supply and Demand: Global silver demand is expected to increase by 10% in 2025, driven by growing demand for silver in industrial applications and investment products.

Mine Production: Global silver mine production is expected to decrease by 5% in 2025, driven by declining ore grades and mine closures.

Recycling: Silver recycling is expected to increase by 15% in 2025, driven by growing demand for silver and increasing recycling rates.

Investment Demand: Investment demand for silver is expected to increase by 20% in 2025, driven by growing investor interest in precious metals.

💎Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for silver, driven by increasing investor confidence.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for silver as a hedge against inflation.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, potentially increasing demand for silver.

Commodity Prices: Commodity prices are expected to rise by 5% in 2025, driven by increasing demand for raw materials.

💎COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 65%

Open Interest: 120,000 contracts

Commercial Traders (Companies):

Net Short Positions: 25%

Open Interest: 60,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 10%

Open Interest: 15,000 contracts

COT Ratio: 2.6 (indicating a bullish trend)

💎Sentimental Outlook

Institutional Sentiment: 70% bullish, 30% bearish

Retail Sentiment: 65% bullish, 35% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +60

💎Future Market Data

3-Month Forecast: 35.0000 - 38.0000

6-Month Forecast: 38.0000 - 42.0000

12-Month Forecast: 42.0000 - 50.0000

💎Next Move Prediction

Bullish Move: Potential upside to 36.0000-38.0000.

Target: 38.0000 (primary target), 40.0000 (secondary target)

Next Swing Target: 42.0000 (potential swing high)

Stop Loss: 29.5000 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 5.4000 vs potential loss of 2.7000)

💎Overall Outlook

The overall outlook for XAG/USD is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in global silver demand, decreasing mine production, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

SILVER MCX OUTLOOK MARCH 2025SILVER MCX:

The Worlds Most Underperforming Asset SILVER, has started to gain some momentum. Today on 13th March 2025 (Thursday) cross all time highs and touched phychological level of 1Lac per Kilogram in INR.

We are currently mildly bullish on Silver MCX, its trading in a rising Wedge Techical Pattern which and expect SILVER to touch levels of wedge pattern Resistance of 1,03,200/- Per Kg (Marked on the Chart) in Next 15 to 20 Days. Currently Weaks low of 96355 should be Stoploss for the long traders.

SILVER is a very volatile commodities do not forget to place stoploss.

XAG/USD "The Silver" Metal Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (32.0000) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 32.8000 (swing Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 31.2000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XAG/USD "The Silver" Metal Market is currently experiencing a Neutral trend., driven by several key factors.

🔱Fundamental Analysis

Fundamental factors driving XAG/USD include supply-demand dynamics, industrial usage, and monetary policy.

Interest Rates:

U.S. Federal Reserve: Rates likely at 3-3.5% in Feb 2025, with cuts from 2024 highs (4.5-5%). Lower real yields support silver, though a strong USD caps gains.

Impact: Neutral to mildly bullish for silver as yields decline.

Inflation:

U.S.: Inflation at ~2.5-3%, above the Fed’s 2% target, driving safe-haven and inflation-hedge demand for silver.

Impact: Bullish, though tempered by industrial demand sensitivity.

Industrial Demand:

Silver’s use in solar panels, electronics, and EVs remains strong. Global green energy push (e.g., U.S. infrastructure spending) boosts demand.

Supply: Mining output stable, but disruptions (e.g., Peru strikes) could tighten supply.

Impact: Strongly bullish if industrial growth persists.

Geopolitical Factors:

U.S.-China trade tensions and Trump’s 2025 tariff policies may enhance silver’s safe-haven appeal while boosting Japan/EM currencies, indirectly pressuring USD.

Impact: Mildly bullish.

Gold Correlation:

XAU/USD (gold) often leads XAG/USD. If gold holds above $2600, silver benefits from spillover demand.

Impact: Bullish if gold trends higher.

🔱Macroeconomic Factors

Broader macro trends influencing XAG/USD:

USD Strength: A strong USD (DXY ~100-102) pressures silver, but Fed easing could weaken it to 98-99, supporting XAG/USD.

Global Growth: Projected at 3% for 2025 (per Morgan Stanley), with U.S./China slowdowns offset by India/EU recovery. Industrial metals like silver benefit.

Commodity Prices: Stable oil (~$70/barrel) and copper prices support industrial metals, indirectly lifting silver.

Risk Sentiment: Risk-off flows (e.g., U.S. recession fears) favor silver as a hybrid safe-haven/industrial asset.

🔱Commitments of Traders (COT) Data

Large Speculators: Net long silver contracts at ~50,000 (down from 70,000 in 2024), suggesting reduced bullish bets but no major unwind.

Commercial Hedgers: Net short ~60,000 contracts, hedging production, indicating steady supply expectations.

Open Interest: ~120,000 contracts, rising slightly, implying growing market interest.

Key Insight: Speculative longs cooling off, but no bearish capitulation—supports range-bound or mildly bullish moves.

🔱Market Sentiment Analysis

Sentiment reflects trader psychology:

Retail Sentiment: Assume 60% of retail traders are long XAG/USD (per broker data), with shorts at 32.5000. Contrarian signals hint at downside risk if longs unwind.

Social Media: Mixed sentiment—bullish posts on industrial demand vs. bearish takes on USD strength.

Broker Data: IG Client Sentiment might show 55% long, suggesting mild overcrowding and potential pullback risk.

🔱Positioning Analysis

Combines COT and sentiment:

Speculative Positioning: Net longs suggest cautious optimism, targeting 33.0000-34.0000.

Retail Crowding: Longs clustered at 32.5000-32.7000, risking a stop-loss flush if price dips.

Institutional Flows: Hedge funds likely balanced, with longs eyeing industrial catalysts and shorts betting on USD resilience.

🔱Next Trend Move Outlook

Technical View: At 32.4000, XAG/USD is near its 50-day SMA (32.3000) and below the 200-day SMA (31.9000), indicating consolidation. Support at 31.8500 (38.2% Fibonacci from 26.50-34.87), resistance at 33.0000.

Short-Term (1-2 Weeks): Range-bound between 31.8500-33.0000 unless Fed rhetoric or industrial data shifts sentiment.

Medium-Term (1-3 Months): Upside to 34.0000 if USD weakens or industrial demand spikes; downside to 30.5000 on risk-off/USD strength.

Triggers: Bullish—strong U.S. PPI data or gold rally; Bearish—hawkish Fed or China slowdown.

🔱Overall Summary Outlook

XAG/USD at 32.4000 reflects a balanced outlook. Fundamentals favor upside from industrial demand and inflation hedging, tempered by USD strength and Fed policy uncertainty. Macro trends support silver via global growth and commodity stability, though risk-off shifts could weigh. COT data shows cautious speculation, while sentiment and positioning hint at short-term choppiness. The next move likely stays range-bound (31.8500-33.0000) short-term, with a medium-term bias toward 34.0000 if bullish catalysts emerge. Watch Fed statements, USD moves, and industrial data for direction.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAGUSD - How far will silver go?!Silver is above the EMA200 and EMA50 on the 4-hour timeframe and is moving in its ascending channel. If we see a correction, we can re-enter the silver purchase and accompany it to the ceiling of the ascending channel. Then we can sell within the specified supply zone with an appropriate reward for risk.

In recent weeks, analysts have warned investors that gold prices breaking strongly above $2,800 suggest an overbought market.Therefore, it is not surprising to see some profit-taking finally occurring, especially since gold prices have surged by more than 11% since the beginning of the year.

In contrast, silver has been notably underwhelming. Despite having strong bullish fundamentals, it has not experienced price increases on par with gold. Moreover, silver is more unpredictable, as its volatility is twice that of gold.

In recent days, U.S. President Donald Trump has taken bold steps in trade and foreign relations. On Tuesday night, he announced plans to impose a 25% tariff on imported cars, pharmaceuticals, and semiconductor chips. This decision comes at a time when global markets are grappling with heightened uncertainties, while hopes remain for an end to the Ukraine conflict.

A 25% tariff on imported cars could significantly impact the global automotive industry, which has already been facing challenges. Trump has long criticized what he perceives as “unfair treatment” of American car exports in foreign markets. For instance, the European Union imposes a 10% tariff on imported cars—four times higher than the 2.5% tariff the U.S. levies on passenger vehicles.

Similar tariffs are planned for pharmaceuticals and semiconductor chips, starting at 25% and set to increase significantly next year. However, Trump did not specify an exact timeline for implementation, stating that he wants to give pharmaceutical companies and chip manufacturers time to establish production facilities in the U.S. to avoid these tariffs.

Beyond their immediate impact on specific industries, these tariffs could have long-term repercussions, such as higher business costs and rising prices for consumers. Trump also indicated that he expects major corporations to invest more in the U.S. soon, although he did not provide further details.

Amid these trade developments, Trump has initiated negotiations with Russia, signaling a potential shift in diplomatic relations between the two nations. On Tuesday, senior officials from both countries took steps toward rebuilding ties, agreeing to collaborate on ending the Ukraine conflict, increasing financial investments, and restoring diplomatic relations. This meeting marks a significant shift following three years of U.S. efforts to isolate Moscow.

Meanwhile, a massive influx of gold and silver has entered the U.S., as major banks and market players hedge against potential tariff threats. This surge in demand has driven up gold and silver prices, creating notable premiums in North American markets. However, a research firm argues that concerns over tariffs may be exaggerated.

In a report by BCA Research, commodity analysts revealed they had taken a short position in silver as a contrarian play against tariff fears.

They stated, “There is a strong likelihood that the U.S. will not impose import tariffs on gold, silver, platinum, or copper. There is no compelling economic or political motivation for the U.S. to take such action.” They added, “Since the recent surge in precious metal prices has been driven by tariff concerns, investors may react negatively to these price increases.”

BCA also noted that if the U.S. were to impose tariffs on gold and silver, they would likely be introduced alongside steel and aluminum tariffs.

Analysts concluded, “The silver market is relatively shallow and less liquid, making it more vulnerable to short-term price declines than gold. However, any short-term weakness presents an attractive opportunity for cyclical and structural positioning in this precious metal.”

BTC/USDT - Liquidity Grab & Potential UPSIDE MOVEMarket Analysis:

Liquidity Sweep: BTC recently grabbed sell-side liquidity around $95,215 - $95,141, triggering stop losses and gathering institutional orders.

Reversal Signs: After tapping into this liquidity, a bullish reaction has started, with price now moving towards the buy-side liquidity range.

Potential Upside Move: If BTC maintains support above $95,600, we can expect a push towards the $97,000 - $97,600 range.

Trade Setup:

✅ Entry: $95,800 - $96,000 (After price confirmation)

🎯 Target 1: $97,050

🎯 Target 2: $97,600

🚀 Extended Target: $98,800 (If momentum continues)

❌ Stop-Loss: Below $95,100 (Below liquidity grab zone)

Trade Rationale:

📌 Liquidity Grab: Market makers swept stop losses, indicating potential reversal.

📌 Market Structure: Bullish recovery from key support zone.

📌 Risk-Reward Ratio: ~1:3 (low risk, high reward setup).

🔔 Waiting for confirmation before entry! A strong bullish candle close above $96,000 can confirm entry. 🚀

📢 Let me know your thoughts! Are you bullish or bearish on BTC? 📈👇

XAG/EUR "Silver vs Euro" Metal Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/EUR "Silver vs Euro" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point.

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 29.800 (or) escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, I would conclude that the XAG/EUR (Silver/Euro) pair is: Bullish

Reasons:

Increasing demand for silver: Silver is used in a variety of industrial applications, including solar panels, electronics, and automotive manufacturing, and demand for these products is expected to increase.

Limited supply of silver: The supply of silver is limited, and mining production is not expected to keep pace with growing demand, which could lead to a shortage and drive up prices.

Safe-haven demand: Silver is often seen as a safe-haven asset, and investors may seek to buy silver as a hedge against economic uncertainty, inflation, or market volatility.

Weakening euro: The euro has been weakening against other major currencies, which could make silver more attractive to European investors and drive up prices.

Central bank buying: Some central banks have been buying silver as a reserve asset, which could support prices and increase demand.

Bullish Factors:

Increasing demand for silver, driven by its use in industrial applications and its potential as a safe-haven asset.

Low interest rates and negative real interest rates, which can increase demand for silver as a store of value.

A strong euro, which can make silver more attractive to European investors.

Potential for a decline in the euro, which could increase demand for silver as a hedge against currency risk.

Growing investment demand for silver, driven by its potential as a diversifier and a store of value.

Market Sentiment:

Bullish sentiment: 75%

Bearish sentiment: 25%

Neutral sentiment: 0%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

SILVER IDEA : SHORT | SELL (WB: 23/12/24)Guys! End of the year - last bit of chart worklkkk until mid Jannnnnyyyyy!

Anyway! This. Is. A simple continuation trade. Silver MIGHT drop from this point but it is still in discount I’d seek for buys until price reaches premium and continues the trend… good luck trading next week!

This one will be interesting as I don’t like continuous trades.. nevertheless, we shall see

RR: 2.84

XAG/GBP "Silver vs Pound" Market Heist Plan on Bullish SideHallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist XAG/GBP "Silver vs Pound" Market Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry in pullback.

Stop Loss 🛑 : Recent Swing Low using 4H timeframe

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

SILVER:Today's strategy to do low - based long

Yesterday's silver is also surging all the way, long and short rapid conversion, today's thinking to follow the trend bullish, back pedal is more opportunity, silver attention 30.90 is a new support, strong support 30.40, there is a chance to back pedal 30.90 long. The target is 31.3-32.6

SILVER Downtrend Alert! Short Trade Setup Ready for Major ProfitSILVER Commodity Technical Analysis (INDIAN Market):

On the 1-hour timeframe, Silver (Commodity) is showing a clear bearish pattern, validating a short trade entry at 95437. The price is approaching key target levels, with TP1 (92725) nearly achieved, suggesting a continuation of the downtrend in the short term.

Trade Summary:

Entry Level: 95437

SILVER Target Levels:

TP1: 92725 (nearly hit)

TP2: 88337

TP3: 83948

TP4: 81236

Stop Loss: 97631

The Risological Dotted Trendline adds further confirmation to the bearish sentiment, guiding this setup toward anticipated targets. Silver’s momentum suggests traders should watch closely as it edges toward additional profit-taking levels!

For extra safe traders, the Trailing Stop for this position is at 96,160

SILVER XAGUSD TO 40$ IN YEAR 2025 !!!HELLO TRADERS

As I can see silver is trading in uptrend channel and after a new ATH its retracing to the broken resistance zone which can be a support for silver NFP ahead and geopolitical bad conditions with a weak $ us elections impact on economy and bricks trading in 2025 will can make some new historically high in precious metals have a look on GOLD and other commodities all are make huge moves so it will be a great opportunity for Silver traders that they can join the next bull run from these given zone till design TP friends its just an trade idea with technical and fundamental view share Ur thoughts on it we appreciate Ur support and love Stay Tuned for more updates