KOG - SILVERSILVER

As with gold and oil, looking at this expecting a gap on open and potential for a move driven by the news. If we do spike down, the red box is the level to watch with the red box levels above as potential target levels on the breaks.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Silvertrading

Silver Price Hits Year-to-Date HighSilver Price Hits Year-to-Date High

As shown on the XAG/USD chart, silver prices rose on Monday, surpassing the previous high of the year, which was set on 28th March at around $33.50 per ounce.

Why Is Silver Rising?

A bullish driver came from statements made by the White House. According to media reports:

→ US President Donald Trump announced on Friday evening plans to double tariffs on steel and aluminium imports to 50%, starting 4th June. This intervention in the global metals market may have also impacted silver prices, given silver’s significant industrial value.

→ Trump's claims that China violated the trade agreement reached in Geneva last month further cast doubt on the prospects of a phone call between Trump and Chinese President Xi Jinping.

Technical Analysis of the XAG/USD Chart

Today’s bearish candlestick (marked with a red arrow) indicates that sellers are becoming active, willing to open short positions near the 2025 high. From a technical analysis perspective, there are signs of:

→ a bearish engulfing candlestick pattern forming;

→ a false breakout above the March high (trapping bullish traders).

However, the bulls may attempt to keep the price in the upper half of the emerging ascending channel (shown in blue), relying on support from the former resistance level at $33.67.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAGUSD: Wait for a clear breakout to buy.Silver turned bullish on its 1D technical outlook (RSI = 57.038, MACD = 0.169, ADX = 26.102) but that alone isn't enough to turn us into buyers again just yet, as the Channel Up on the 4H timeframe has failed so far twice to break over the R1 level. If it does, then we will turn bullish, aiming for a +5.75% rise from the last 4H MA50 contact with TP = 34.4500.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Silver Surfers & Profit Pirates!Dive into the XAG/USD Silver Market with our slick Coastal Trader Blueprint! We’re blending razor-sharp technicals with juicy fundamentals to surf both bullish and bearish waves. Ready to ride the silver tide and stack those pips? Let’s make waves! 🌊📈

🏄♂️ The Silver Surf Strategy

Entry Signals 🚦:

🐬 Bullish Ride: Catch a dip to the Coastal Support Zone at 34.200—your ticket to ride the bullish swell!

🦈 Bearish Drop: Spot a break below 31.300—dive in for the bearish plunge!

Pro Tip: Set price alerts to nab these levels! 🔔

Stop Loss (SL) 🛡️:

Bullish Trade: Anchor SL at 31.300 (4H swing low, Coastal Support Zone).

Bearish Trade: Fix SL at 33.700 (4H swing high).

Tweak SL based on risk, lot size, and order count. Stay safe—this is your lifeline! ⚓

Take Profit (TP) 🏝️:

Bullish Surfers: Aim for 36.500 or bail if the tide turns.

Bearish Surfers: Target 28.800 or slip out before the market flips.

Exit Trick: Watch RSI for overbought/oversold signals to dodge wipeouts! 🚨

🌍 Why XAG/USD?

Silver’s riding a bearish current 🐻 as of May 12, 2025, fueled by:

Fundamentals: USD strength from Fed hawkishness, US economic growth, and tariff talks.

Macroeconomics: US resilience outshines global slowdown.

COT Data (Latest Friday, May 9, 2025): Speculative net shorts on silver rise, favoring USD

Intermarket: Soaring US yields and equities lift USD, capping silver.

Quantitative: RSI (oversold hints) and Fibonacci (61.8% retracement) signal bearish bias.

📊 Sentiment Snapshot (May 12, 2025, UTC+1)

Retail Traders:

🟢 Bullish: 40% 😄 (Betting on silver’s safe-haven spark)

🔴 Bearish: 47% 😣 (USD rally and yield spikes dominate)

⚪ Neutral: 13% 🤷♂️

Institutional Traders:

🟢 Bullish: 28% 💼 (Geopolitical hedges fuel demand)

🔴 Bearish: 62% ⚠️ (USD strength and high yields crush silver)

⚪ Neutral: 10% 🧐

⚡ Market Movers: News & Risk Control 📰

Volatility’s our wave, but surf smart:

Avoid new trades during high-impact news (FOMC, NFP).

Use trailing stops to lock profits and cap losses.

Stay alert—ride the news, don’t wipe out! 🌪️

💸 Real-Time Market Data (May 12, 2025, UTC+1)

Forex (USD Pairs): USD Index (DXY) at 102.50, up 0.3% (source: Financial Juice).

Commodities CFD: Silver (XAG/USD) at 31.850, down 1.2% daily.

Metals: Gold (XAU/USD) at 2,650, down 0.8%; Copper at 4.20, flat.

Energies: WTI Crude Oil at 78.30, up 0.5%.

Crypto: BTC/USD at 62,400, down 0.4%.

Indices: S&P 500 at 5,820, up 0.2%; Nasdaq 100 at 20,100, flat.

🚀 Join the Coastal Trader Crew!

Smash the Boost Button to supercharge our Coastal Trader Blueprint and make this silver surf legendary! 🌟 Every boost powers our squad to conquer the markets. Let’s dominate XAG/USD together! 🤙

Stay locked on your charts, keep alerts active, and vibe high. See you in the profits, surfers! 🤑🎈

#CoastalTrader #XAGUSD #SilverSurf #TradingView #RideTheTide

XAGUSD: 2 year Channel Up bottomed.Silver turned oversold intra day on its 1D technical outlook (RSI = 34.341, MACD = -0.553, ADX = 36.363) but recovered as it hit the bottom (HL) of the 2 year Channel Up and rebounded. It may be under the 1D MA50 but so were the lows of October 2nd 2023 and February 12th 2024 that formed the last important bottom. In the meantime the 1W RSI hit its LL trendline, an additional bullish signal. The DT Resistance and DB Support offer a great and high probability range for sideways trading, so our recommendation is to long but contain buying under the DT (TP = 34.500). If on the other hand the candle closes under the Channel Down, short and aim for the 1W MA200 (TP = 25.600).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

SILVER (XAGUSD): Strong Resistance Ahead

Silver is very close to the resistance based on the last year's high.

Watching how strong is the bullish momentum, I got a feeling

that it is going to be broken.

A daily candle close above that will provide a strong bullish confirmation.

The price will keep rising to the new highs then.

❤️Please, support my work with like, thank you!❤️

XAG/USD "The Silver" Metal Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (32.0000) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 32.8000 (swing Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 31.2000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XAG/USD "The Silver" Metal Market is currently experiencing a Neutral trend., driven by several key factors.

🔱Fundamental Analysis

Fundamental factors driving XAG/USD include supply-demand dynamics, industrial usage, and monetary policy.

Interest Rates:

U.S. Federal Reserve: Rates likely at 3-3.5% in Feb 2025, with cuts from 2024 highs (4.5-5%). Lower real yields support silver, though a strong USD caps gains.

Impact: Neutral to mildly bullish for silver as yields decline.

Inflation:

U.S.: Inflation at ~2.5-3%, above the Fed’s 2% target, driving safe-haven and inflation-hedge demand for silver.

Impact: Bullish, though tempered by industrial demand sensitivity.

Industrial Demand:

Silver’s use in solar panels, electronics, and EVs remains strong. Global green energy push (e.g., U.S. infrastructure spending) boosts demand.

Supply: Mining output stable, but disruptions (e.g., Peru strikes) could tighten supply.

Impact: Strongly bullish if industrial growth persists.

Geopolitical Factors:

U.S.-China trade tensions and Trump’s 2025 tariff policies may enhance silver’s safe-haven appeal while boosting Japan/EM currencies, indirectly pressuring USD.

Impact: Mildly bullish.

Gold Correlation:

XAU/USD (gold) often leads XAG/USD. If gold holds above $2600, silver benefits from spillover demand.

Impact: Bullish if gold trends higher.

🔱Macroeconomic Factors

Broader macro trends influencing XAG/USD:

USD Strength: A strong USD (DXY ~100-102) pressures silver, but Fed easing could weaken it to 98-99, supporting XAG/USD.

Global Growth: Projected at 3% for 2025 (per Morgan Stanley), with U.S./China slowdowns offset by India/EU recovery. Industrial metals like silver benefit.

Commodity Prices: Stable oil (~$70/barrel) and copper prices support industrial metals, indirectly lifting silver.

Risk Sentiment: Risk-off flows (e.g., U.S. recession fears) favor silver as a hybrid safe-haven/industrial asset.

🔱Commitments of Traders (COT) Data

Large Speculators: Net long silver contracts at ~50,000 (down from 70,000 in 2024), suggesting reduced bullish bets but no major unwind.

Commercial Hedgers: Net short ~60,000 contracts, hedging production, indicating steady supply expectations.

Open Interest: ~120,000 contracts, rising slightly, implying growing market interest.

Key Insight: Speculative longs cooling off, but no bearish capitulation—supports range-bound or mildly bullish moves.

🔱Market Sentiment Analysis

Sentiment reflects trader psychology:

Retail Sentiment: Assume 60% of retail traders are long XAG/USD (per broker data), with shorts at 32.5000. Contrarian signals hint at downside risk if longs unwind.

Social Media: Mixed sentiment—bullish posts on industrial demand vs. bearish takes on USD strength.

Broker Data: IG Client Sentiment might show 55% long, suggesting mild overcrowding and potential pullback risk.

🔱Positioning Analysis

Combines COT and sentiment:

Speculative Positioning: Net longs suggest cautious optimism, targeting 33.0000-34.0000.

Retail Crowding: Longs clustered at 32.5000-32.7000, risking a stop-loss flush if price dips.

Institutional Flows: Hedge funds likely balanced, with longs eyeing industrial catalysts and shorts betting on USD resilience.

🔱Next Trend Move Outlook

Technical View: At 32.4000, XAG/USD is near its 50-day SMA (32.3000) and below the 200-day SMA (31.9000), indicating consolidation. Support at 31.8500 (38.2% Fibonacci from 26.50-34.87), resistance at 33.0000.

Short-Term (1-2 Weeks): Range-bound between 31.8500-33.0000 unless Fed rhetoric or industrial data shifts sentiment.

Medium-Term (1-3 Months): Upside to 34.0000 if USD weakens or industrial demand spikes; downside to 30.5000 on risk-off/USD strength.

Triggers: Bullish—strong U.S. PPI data or gold rally; Bearish—hawkish Fed or China slowdown.

🔱Overall Summary Outlook

XAG/USD at 32.4000 reflects a balanced outlook. Fundamentals favor upside from industrial demand and inflation hedging, tempered by USD strength and Fed policy uncertainty. Macro trends support silver via global growth and commodity stability, though risk-off shifts could weigh. COT data shows cautious speculation, while sentiment and positioning hint at short-term choppiness. The next move likely stays range-bound (31.8500-33.0000) short-term, with a medium-term bias toward 34.0000 if bullish catalysts emerge. Watch Fed statements, USD moves, and industrial data for direction.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAGUSD: Buy opportunity inside this Channel Up.Silver has turned neutral on its 1D technical outlook (RSI = 53.179, MACD = 0.256, ADX = 29.375) as it posted a strong rebound this week, despite today's temporary pullback. This rebound took place at the bottom of the medium term Channel Up, pricing its HL. We are still at the start of this wave and we expect to repeat the +16% rise of the previous one. The trade is long, TP = 35.500.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

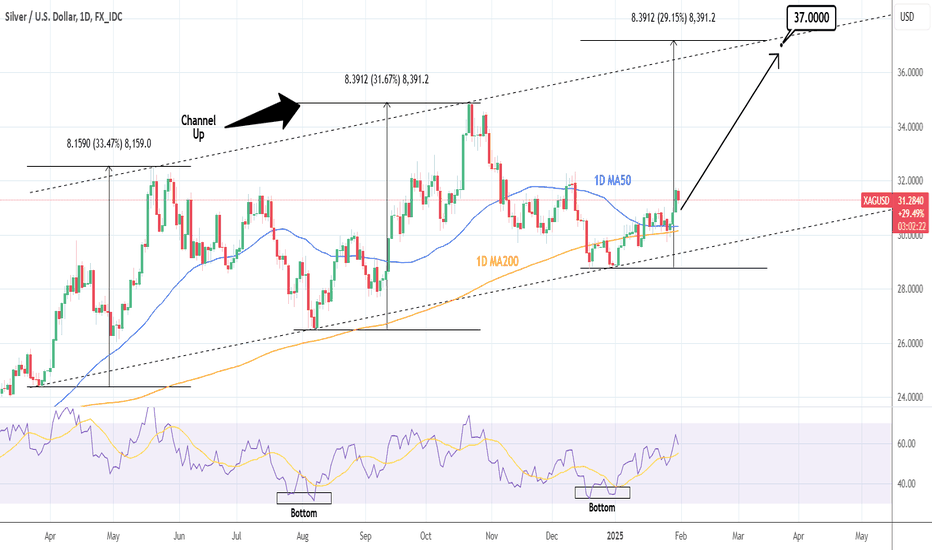

XAGUSD: Channel Up has started new rally to 37.000Silver turned bullish on its 1D technical outlook (RSI = 59.696, MACD = 0.197, ADX = 24.838) as it has validated the start of the new bullish wave of the long term Channel Up. The price has been detached from the 1D MA50 and is approaching the December 12th high. The 1D RSI is expanding a rebound from a Double Bottom much like Silver's previous low on August 7th 2024. So far the Channel Up has had two bullish legs of 33.47% and 31.67% respectively. Assuming a slight rate of decline on each subsequent bullish wave, we anticipate the current to reach +29.15% and we are targeting a little under it (TP = 37.000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

How Can You Trade Silver Online?How Can You Trade Silver Online?

Silver’s dual role as an industrial metal and investment asset makes it a fascinating market for traders. Its price volatility, global demand, and diverse trading options offer exciting opportunities for those looking to diversify their strategies. In this article, we’ll explore how to trade silver online, key market drivers, and what makes it such a unique asset.

What Makes Silver an Attractive Asset?

Silver is a unique asset that appeals to traders for several reasons, particularly its dual demand in industrial applications and silver investing for portfolio diversification. While gold is primarily an investment metal, silver is used in electronics, solar panels, and even medicine, equating to steady demand regardless of market conditions. This industrial relevance adds a layer of complexity to its price movements, which offers opportunities for a comprehensive analysis.

The metal is also known for its market volatility. Prices can swing significantly within short periods, creating numerous trading opportunities for those who monitor its fluctuations. Despite this volatility, silver remains highly liquid, meaning traders can buy or sell substantial amounts without causing major disruptions to the market.

For those trading and investing in silver, affordability is a key aspect that sets it apart. With a much lower price than gold, it’s accessible to a broader range of market participants. This affordability allows traders and investors to hold larger positions, which can help with diversification. Lastly, silver has long been seen as a hedge against economic uncertainty, often serving as a so-called safe-haven asset during periods of instability, alongside other precious metals like gold.

Silver Trading Hours

Silver trading operates nearly around the clock, opening at 11:00 pm GMT on Sunday and closing at 10:00 pm GMT on Friday. However, the market closes for short overnight breaks during the week, usually for around an hour each day between 10:00 pm and 11:00 pm GMT. It’s important to note that trading hours may vary depending on a trader’s location, but the market always follows this GMT schedule.

Key Factors That Influence Silver Value

Silver online trading is influenced by a mix of economic, industrial, and geopolitical factors, making it difficult for traders and investors to analyse silver market movements. Recognising these key factors is vital for anyone exploring how to trade silver.

- Supply and Demand Dynamics: The balance between a metal's availability and its demand significantly impacts its value. Industrial applications, such as electronics and solar panels, drive demand, while mining production and recycling affect supply. Disruptions in mining or shifts in industrial needs can lead to price fluctuations.

- Economic Indicators: Inflation rates, interest rates, and overall economic health play crucial roles. During inflationary periods, it often attracts investors seeking to hedge risks, potentially driving up prices. However, higher interest rates designed to quell inflation can make non-yielding assets like silver less appealing.

- Geopolitical Events: Global uncertainties, such as political tensions or conflicts, can increase its appeal as a so-called safe-haven asset, leading to price surges.

- Currency Strength: Since silver is priced in US dollars, its value often moves inversely to the dollar. When the dollar weakens, silver value typically rises, and vice versa.

- Market Speculation: Investor sentiment and speculative trading can lead to rapid price changes. Large trades or shifts in market sentiment can cause significant volatility, affecting the metal’s market value.

Different Ways to Trade Silver Online

When it comes to trading silver online, there are several ways to access the market, each with its own appeal and considerations.

1. Silver CFDs (Contracts for Difference)

Most traders interact with CFDs on silver. CFDs enable traders to trade based on silver's price movements without needing to own the physical asset. They can trade on both rising and falling prices, making CFDs a flexible option. CFDs also offer leverage, offering a way to control larger positions with a smaller initial investment. However, it’s essential to understand the risks, as leverage amplifies both potential returns and losses.

Silver CFD trading is available at FXOpen. Check the real-time chart on the free TickTrader trading platform.

2. Spot Silver Trading

Spot silver trading refers to the buying and selling of silver at its current market price, known as the "spot price," with settlement occurring immediately. Unlike silver futures or options, where traders agree to buy or sell silver at a predetermined price on a future date, spot trading reflects the present value of silver for direct exchange.

3. Silver Futures

Futures are contracts where traders agree to buy or sell silver at a specified price on a future date. They are ideal for those looking to speculate on longer-term trends. Futures require a margin account and involve high leverage, which can lead to significant returns or losses.

4. Exchange-Traded Funds (ETFs)

Silver ETFs provide exposure to the metal without needing to handle the metal physically. These funds are traded on stock exchanges and offer a more traditional investment route. While they’re less volatile than leveraged products like CFDs, they also lack the flexibility of short-term trading.

5. Silver Mining Stocks

Companies that mine silver are often used to invest in silver online, though they can be an indirect trading avenue. While stock prices often correlate with silver, they can also be influenced by other factors, such as a company’s operational performance or management decisions.

Comparing Silver with Other Precious and Industrial Metals

Silver occupies a unique position in the commodities market, bridging the gap between precious metals like gold and industrial commodities such as copper. Understanding these relationships can be an essential part of a silver trading strategy.

Silver vs Gold

Both are precious metals and often serve as so-called safe-haven assets during economic uncertainty. However, silver is more volatile than gold. This increased volatility stems from silver's significant industrial applications, which account for about 50% of its demand, compared to gold's 10%. Consequently, silver's price is more susceptible to fluctuations in industrial demand.

Additionally, accessibility in silver as an investment is important to note, since it’s more abundant and less expensive per ounce than gold.

Silver vs Platinum and Palladium

Platinum and palladium are also precious metals with substantial industrial uses, particularly in automotive catalytic converters. Palladium has seen a surge in demand due to stricter emission standards, leading to higher prices.

Silver, while used in various industries, has a more diversified application base, including electronics, solar panels, and medical devices. This diversification can lead to different demand dynamics compared to platinum and palladium. Moreover, silver's market is larger and more liquid, offering more trading opportunities.

Silver vs Industrial Commodities (e.g., Copper)

Silver shares some characteristics with industrial metals like copper, as both are essential in the manufacturing and technology sectors. However, silver's dual role as an investment asset and industrial commodity sets it apart.

While copper prices are primarily driven by construction and infrastructure developments, silver's price is influenced by both industrial demand and investor sentiment. This duality can lead to unique price movements not typically observed in purely industrial metals.

Silver Correlation with Other Assets

Silver exhibits some interesting correlations with other assets that can help traders better anticipate market movements.

Gold-Silver Correlation

Historically, silver and gold move in tandem due to their shared status as precious metals. However, silver tends to be more volatile, with sharper price swings during market upheavals. This relationship isn’t always consistent—during periods of intense industrial demand or unique market shocks, silver can diverge from gold, making it harder to analyse its market moves. Still, silver is an exciting trading option.

Equity

Silver often reacts inversely to stock market trends. When equities perform well, silver can lose appeal as investors shift to riskier assets. In contrast, during downturns, silver may gain traction as a defensive asset.

US Dollar

Like many commodities, silver has an inverse correlation with the US dollar. When the dollar strengthens, silver prices typically fall, as a stronger dollar makes it more expensive for foreign buyers and vice versa.

Crude Oil

Silver shares an indirect connection with oil prices, as energy costs significantly impact mining and refining processes. Rising oil prices can increase production costs, potentially influencing the silver supply.

Risks of Trading Silver

Silver trading online comes with its own set of risks, tied to its unique characteristics as both a precious metal and an industrial commodity.

- Volatility Risks: Silver is known for its price swings, which can be more pronounced than gold due to its smaller market size. These sharp movements create opportunities but also expose traders to the potential for significant losses, especially if positions aren’t carefully managed.

- Geopolitical and Economic Uncertainty: While silver often acts as a so-called safe haven, it may be difficult to analyse its price movements. For example, a strengthening US dollar or unexpected global events can cause sudden price drops, catching traders off guard.

- Market Sentiment: Speculation and emotional trading can also drive silver’s price, leading to rapid and sometimes irrational movements. This requires traders to exercise caution and use risk management strategies, such as position sizing and stop-loss levels.

- Market Liquidity: Although silver is generally liquid, certain market conditions can lead to reduced liquidity, making it challenging to execute trades at desired prices. This can result in slippage and losses.

- Regulatory Changes: Changes in regulations, such as margin requirements or trading restrictions, can impact silver markets. For instance, historical events like "Silver Thursday" in 1980 saw regulatory shifts that led to significant market disruptions.

The Bottom Line

Silver’s unique combination of industrial and investment demand, along with its market volatility, makes it an exciting asset for traders. Understanding the factors that influence its price and the different ways to trade it is essential for navigating this dynamic market. If you’re ready to explore silver CFD trading, open an FXOpen account today to access competitive spreads, advanced tools, and a reliable platform for your trading needs.

FAQ

How Can I Trade Silver Online?

Online silver trading can be done through various platforms offering spot markets, futures, exchange-traded funds (ETFs), and Contracts for Difference (CFDs). CFDs are particularly popular for online traders, as they allow speculation on silver’s price movements without owning the metal.

Can You Trade Silver in Forex?

The silver code XAG is typically used for trading against the US dollar as the XAG/USD pair. This pairing allows traders to speculate on silver prices relative to the dollar’s strength, combining commodity and currency market dynamics. However, silver can be traded against other currencies, for example, the euro.

Which Pair Correlates With Silver?

Silver (XAG/USD) is most closely correlated with gold (XAU/USD). Both metals often move in similar directions due to their shared status as so-called safe-haven assets, though silver’s industrial demand adds unique price drivers.

What Is the Best Time to Trade Silver?

The best time to trade silver depends on a trader’s trading strategy. However, the most active trading hours for silver are during the overlap between the London and New York sessions, from 1:00 pm to 5:00 pm GMT (winter time) or from 12:00 am to 4:00 pm GMT (summer time). These times offer high liquidity and volatility, creating more opportunities for traders.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAGUSD: Bottom of the Rising Wedge. Bullish.Silver is marginally bearish on its 1D technical outlook (RSI = 43.462, MACD = -0.151, ADX = 27.970) as it trades under the 1D MA50 but still over the 1D MA200. The latter is at the bottom of the long term Rising Wedge and is the technical support level. As long as it holds, we will be bullish on Silver, aiming at its top for the next HH (TP = 37.000).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XAG/EUR "Silver vs Euro" Market Heist Plan on Bullish SideHello!! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist XAG/EUR "Silver vs Euro" Market Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry in pullback.

Stop Loss 🛑 : Recent Swing Low using 4H timeframe

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

XAGUSD: Sell the bounce. Top about to be completed. Silver reached the top of the 3 month Channel Up, naturally on a bullish 1D technical outlook (RSI = 62.183, MACD = 0.939, ADX = 32.693) and since 3 days it got rejected to the 4H MA50 today. The 2 bullish waves before that show that this is technically the last bounce before the top is formed. We are ready to sell this back to the bottom of the Channel Up, targeting the 0.5 Fibonacci level (TP = 32.500).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Silver Lining: Breakout Signals Imminent Price SurgeThe price previously formed a Falling Wedge Pattern, and after breaking out, it entered a phase of consolidation.

This led to the emergence of a Symmetrical Triangle pattern on the chart, and with a recent breakout, silver is now trending upward.

Key level to watch

First target - $32.2

Second target - $33.0

It is recommended to set a strict stop-loss just below the $30.9 level to mitigate significant losses.

XAGUSD: If this Bearish Cross happens, it's a sell.Silver is bullish on its 1D technical outlook (RSI = 63.461, MACD = 0.757, ADX = 29.627) but hit yet again the top (HH) of the Channel Up and got rejected. The metal has gained recently due to the tensions in the Middle East and after today's much stronger than expected Nonfarm Payrolls report, it should see a retrace as the USD is expected to gain, while the geopolitical tensions ease. The last Channel Up correction hit the 0.618 Fibonacci level, so any sell target above it and the 1D MA50, is justified (TP = 30.400).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

KOG's RED BOXES - SILVERSILVER:

Key level here is 29.63 with the bias being bullish above.

Retracement needed with support just below at the red box which will need to break to go lower.

Have a look at the previous pinned posts on Red boxes to familiarise yourself with how they are so effective in keeping traders the right side of the markets.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

SILVER (XAGUSD): Bullish Rally Continues

Silver keeps rallying like crazy.

The price was rapidly growing the entire last week.

It managed to violate a significant horizontal daily resistance

and close above that on Friday.

With a high probability, the market will keep growing and reach 31.4 level soon.

❤️Please, support my work with like, thank you!❤️

SILVER (XAGUSD): Important Breakout

Silver was accumulating for almost 2 weeks

within a narrow horizontal range on a daily.

The release of the yesterday's fundamentals

triggered a strong bullish movement and the market violated

the resistance of the range.

The broken structure now turned into support.

I think that growth may continue, at least to 31.3

❤️Please, support my work with like, thank you!❤️

XAGUSD: Bullish Megaphone going for its top.Silver is almost overbought on its 1D technical outlook (RSI = 68.691, MACD = 1.067, ADX = 40.719) as it reversed last week's minor pull-back. Being supported on the 1D MA50, the current Bullish Megaphone pattern is aiming for its top. We are expecting a +33.66% rise (TP = 34.500), same as the first Bullish Wave.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##