Possible Short Position SGD/JPYSELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Chart time frame - H4

Timeframe - 1 Day

Actions on -

A – Activating Event

Currency Pair creating a Double Top .

B – Beliefs

Market will be rejected at @82.37 level and move towards the first Target 1 level @ 82.00 level.

FOREXCOM:SGDJPY

Trade Management

Entered @ Still waiting for confirmation.

Stop Loss @ Still waiting for confirmation.

Target 1 @82.00

Risk/Reward @ 2:1

Happy trading. Will let you know closer to the time if or when executed:)

Follow your Trading plan, remain disciplined and keep learning !!

Please Follow, Like,Comment & Follow

Thank you for your support :)

This information is not a recommendation to buy or sell. It is to be used for educational purposes only!

Singapore

$cmt and its struggle to breakout.CMT has been accumulating for long time now and should breakout in coming week.

open a position only after it breaksout.

Do share your opinion about my analysis and hit a like if you agree with my thoughts.

STI $ES3 shortGreen 6 on the hourly small break upwards, given that other markets hourly candles such as Nikkei and $SHCOMP are already beyond a green 9 on the hourly it signifies trend exhaustion and a red day is expected real soon. Macro view still remains very weak and as such might be a deadcat although a real bounce is not discounted.

Actionables:

1) Take profit & do not chase

2) Stay out and wait for a Green 2 above a Green 1

Stay safe.

Straits Times Index (Daily Chart) - Where is the Bottom?Since our last predictions on the Straits Times Index, the price has continued to fall from 3300 to 3000, and then below it.

At this rate of decline, is there any support or bottom in sight?

I generally do not like to do projections, because most projections are just guesses.

The best way to know is to observe the price as it moves, then you will know when it has likely bottomed.

And for now, it still looks like it can continue to fall.

So i will stay bearish and continue to monitor.

USDCAD Trading PlanThe fundamentals that move the Canadian Dollar the past week or so were the updates on the NAFTA deal. If a deal struck, Canadian will definitely strengthen. However, the Commodity Market is an important catalyst as well specifically Oil. US-China Trade war somewhat affecting market sentiment and the energy market is no different. The market sentiment at the moment is fragile.

Having said that though, technically we have setups and if the market players decided to dump their CAD longs that I would hope will be illustrated in the chart as a bullish engulfing candle, then I will be a CAD Bull. Should there be an update of the NAFTA deal specifically hinting or confirming a NAFTA deal will be struck, I will short the pair and target according to the daily range.

City Development SG Stock (It can fall further first)City Development

The smart money must have been dumping these stocks to unsuspecting value investors and technical "trend" traders in the late 2017 and early 2018.

With the latest property curbing news, it had a very big gap down.

I will advise you not to go and buy in as it will be similar to catching falling knives.

It is not a good idea to BUY now.

I see some potential support near $8.80 instead, let wait patiently for the drops to stabilize first and let the price action to show as well.

Press "Like" and "Follow".

Sonic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

Straits Times Index (Daily Chart) - Very BearishSince my last call to short (on my blog and during my events), the STI has fallen about 5.5%, and has corrected 13.3% from the highs.

This is the reason why I am bearish on Singapore stocks and have liquidated my portfolio a long time ago to focus on the US markets.

I have a feeling price will continue falling until the 3000 support level. I will be watching to see once it reaches there.

Weekly Momentum On Major Pairs (Wk36/2018)XXX/USD: XXX/USD: Slightly Bullish (Mixed)

Gold & Silver: Slightly Bearish

XXX/JPY: Mixed (Leaning toward Bear)

USD/XXX: Bearish

Indexes: Mixed

BitCoin: Slight Bullish

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

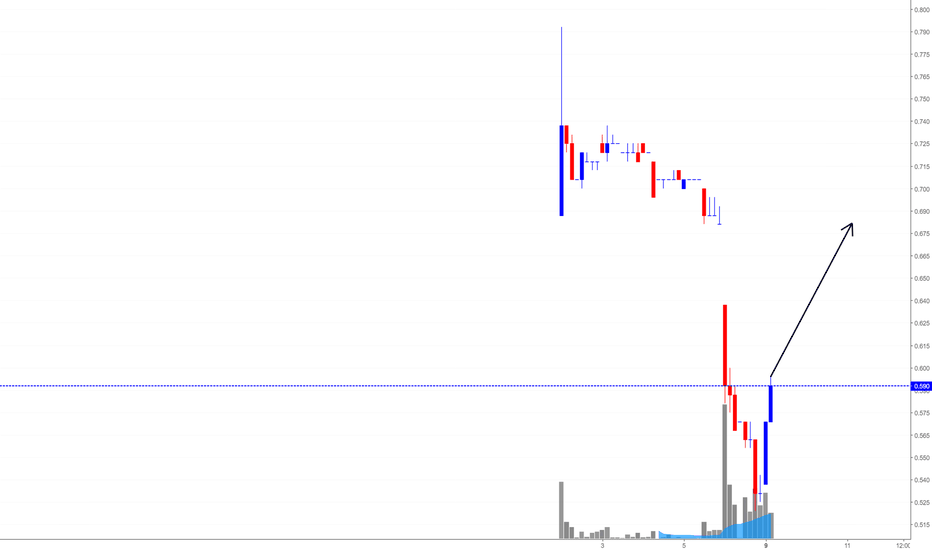

Propnex (SGX) (*Be careful with your short)PropNex

So, let's talk the immediate timeframe.

I am expecting they are going to close the gap.. $0.68 - $0.69 region is possible.

Press "Like" and "Follow".

Sonic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your

Silver (July/18) AnalysisSilver

We are in the deep sell-down mode lately and there is no end in sight at this moment.

It shall go lower as there are more bear forces are in it.

I foresee a strong support nearly at $14.5. So, the sell is still the better bet.

Press "Like" and "Follow".

Sonic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

AUD/CHF (Please Read Them Carefully)This will be my views of AUD/CHF for July 2018

Please make sure to read the "update" comment as there will be changes along the way.

Cheers.

Sonic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

Hong Kong Stock Index (* A nice rebound shall be underway)Hong Kong Index

We are seeing a very potential early signs bullish rebound.

If all works well, it can swing back to 29280 and eventually 30200 region.

I am NOT with the BEAR anymore.

Press "Like" and "Follow". We will help you become a better trader

Sonic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

DBS (*Flushing of the weak holders is in progress)DBS

Slight Bearish, some signs of bull but it shall go lower first.

$25 seem to get a good support to build. If you want to time properly, I will suggest you wait for the time being as the flushing is not done yet.

I expect bank stocks are to go alot higher in the future such as 1 years or more horizon.

Press "like" and Follow.

Sonic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

Gold XAU/USD (Still under overall BEAR)Gold

I am Slightly Bearish.

We are in the strong downtrend for the past 3 weeks and I am expecting the danger of rebound is getting real as more and more joining the sell side.

If there is any rebound, it can travel up to 1269 to 1279 region.

If you want to short, wait at these levels (or) you can cautiously long toward these levels.

We use FOMC and it will impact on USD and gold.

Press "Like" and "Follow". We will help you become a better trader

Sonic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

STI - Not time to buy yet, but selling isn't a good idea too!As the trade war between US and China intensifies, general markets in Asia get the ripple effect too.

STI has dropped around 5.40% and is now trading around 3300 region.

If you're feeling worried because of this drop, you better be.

If you're feeling happy because now you think you can buy at a cheaper price, you better don't.

Now, why do we say so?

If you're feeling worried and uneasy because of the drop, it just shows that (1) you do not have a proper investment/trading plan to start with, and (2) you do not have the right risk management plan in place. And that's the exact reason why you should be worried.

If you're feeling excited to hop onto a trade or invest now, hold your horses. The time isn't right yet. Be patient. Wait for at least a sign of price bouncing before entering :)

Our bias remains to the upside for the general equities market at the moment. Our macro analysis is still showing room for the markets to rally. Perhaps for the last wave up between 2018 to 2019.

After that, we might eventually see the long-waited "clearance sales" in the equities market. When that happen, it will be a shopping spree for many well-prepared traders and investors.

*Disclaimer - This analysis alone DOES NOT warrant a buy or sell trade immediately. Before you enter any trade in the financial market, it is very important that you have a proper trading plan and risk management approach.

The sharing of this idea is neither necessarily indicative of nor a guarantee of future performance or success.

FTSE UK Stock Index (Ready to hunt Blind investors?)UK Stock Index

Now it is at decent double top, around 7800 region and now bears are clawing back.

If you have long, try to take profit for now as it can go lower for now.

The immediate support is near 7720 and it may get go to 7575 level. DO NOT LONG now.

DYODD and Trade Safe

s0nic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

Oil (Can Swing A bit Lower For Now)Oil

We had an abrupt sell down last week, and it is under strong BEAR trend. So, I will say "Sell" side is a better bet as an immediate term and it can swing to a nice and strong support level such as $63.8 for now.

In the medium term, I see 59 to 61 will be a very strong support region and the price will have have a very hard time breaking down from that regions.

Let's see.

DYODD and Trade Safe

s0nic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

GBP/USD (*Bear in control but watch out 1.32 region)GU

Now,it is under the bear influence for sure.

The only thing that Bull can look out for is 1.32 support region. So, we need to see if it holds.

In the short/mid term, I suggest you not to have high hope on the long/buy side just yet.

We have to see a lot of swapping first before it can start to turn bullish.

Until then, I am slightly bearish on GU.

DYODD and Trade Safe

s0nic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

Gold <XAU/USD> (*We are at a strong support region)Gold

I am Slightly Bearish. We have a strong sell down on the last Friday on tariff news. What it did was, it retested a strong support area of $1,274 region.

In the coming week, I expect there will be big sideway (or) slight bearish movement to come in first.

The next nearby decent support level is $1,270.

There shall be a movement with Powell’s speech again.

DYODD and Trade Safe

s0nic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.