Skechers Steps Up: Breaking Records and Setting the PaceSkechers ( NYSE:SKX ), the renowned Comfort Technology Company™, is striding confidently into the future with yet another remarkable performance in the first quarter of 2024. The global footwear leader announced its financial results, showcasing impressive growth and reaffirming its position as an industry powerhouse.

Record-Breaking Sales and Exceptional Earnings

In a testament to its unwavering strength and consumer appeal, Skechers ( NYSE:SKX ) achieved record sales of $2.25 billion, marking a substantial 12.5% increase. Both wholesale and direct-to-consumer segments experienced robust growth, with wholesale sales climbing by 9.8% and direct-to-consumer sales soaring by 17.3%. Moreover, diluted earnings per share surged by an impressive 30.4%, reaching $1.33.

Global Expansion and Market Penetration

Skechers' success story extends far beyond its financial achievements. With a keen focus on global expansion, the company's international sales represented a significant portion, comprising 65% of total sales. Notably, growth was witnessed across all regions, with Europe, the Middle East, and Africa experiencing a 17% surge, Asia Pacific recording a 16% increase, and the Americas growing by 8%.

Innovation and Partnerships

Behind these stellar results lies a dedication to innovation and strategic partnerships. Skechers ( NYSE:SKX ) continues to captivate consumers of all ages and interests with its exceptional product offerings. From memorable Super Bowl commercials featuring icons like Mr. T and Tony Romo to collaborations with NBA players and sponsorship deals with cricket teams in India, Skechers is leaving no stone unturned in its quest for global prominence.

Looking Ahead with Confidence

As Skechers ( NYSE:SKX ) celebrates its 100th earnings call as a public company, its leadership remains optimistic about the future. With a robust inventory position, innovative technologies, and an unwavering commitment to consumer satisfaction, the company is poised for continued success. Skechers' relentless pursuit of excellence and its ability to adapt to evolving consumer preferences make it a formidable force in the competitive footwear industry.

SKX

SKX - Failed Trade(1) - Trade JournalThis will be the beginning series of my failed trades that will act as my trading journal. Will be posting these to learn from my mistakes. Failed trade #1 SKX:

Mistakes made:

1. Failed to recognize resistance zone and take profits at that zone.

- Make sure to expand your chart so you can see the stock from the BEGINNING. Set chart to monthly/weekly time frame if needed. I missed a resistance back that was present back in 2016.I was stuck on the short term time frame on the 30m chart, failing to recognize a vital resistance point to take profits and/or exit trade.

2. Poor options structure.

- Went with single call options on this one, I should’ve entered in as a credit spreads/short puts as this stock will move up, but gradually. Next time enter slow moving trends as a credit/debit spread to protect against corrective moves.

3. Failed to continue monitoring trade after the belief that I was good after a triangle break

- After that last candle on the triangle break, I stopped watching my trade for 2hrs or so while I was at work thinking that price would go higher, next time monitor big position trades closesly. No longer than 30m w/o checking.

Overall: I was up around 600 on this trade and then had to cut losses at the break below the support. I made too many mistakes here that are sending my acc lower and breaking down my mental morale. I need to start laddering my trades and drawing any possible resistance, getting rid of a portion of my contracts at those levels with the size of that portion based off of the strength of the resistance. Ex. Weak resistance 1/4 of contracts, strong resistance 1/2. I also need to focus on bettering my options structure, adding protective options legs to each contract rather than buying straight calls.

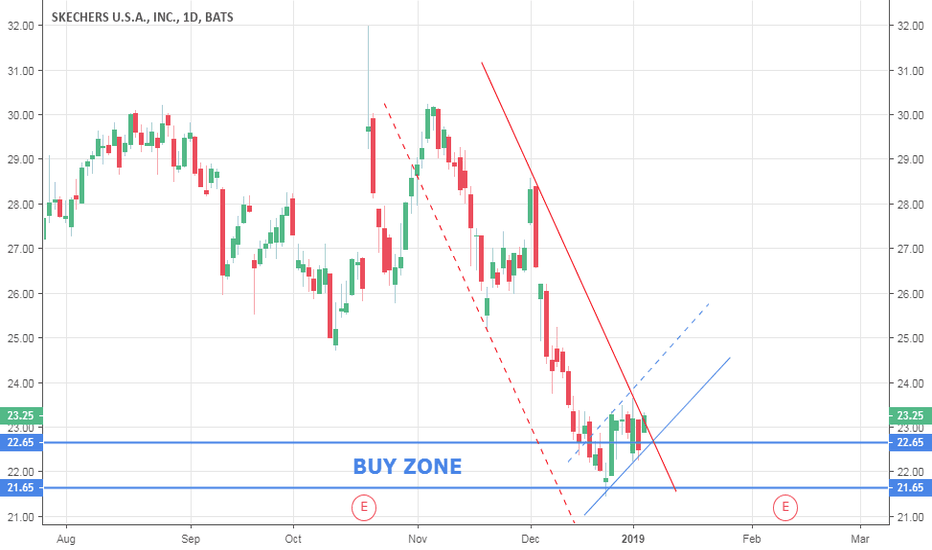

Bearish gap fill for Sketchers? SKXLook out for confirmation, we have seen recently with the Sketchers SKX stock that the gaps tend to get 50% filled, so this could mean a possibility to short this stock in the next few days. RSI is very oversold today.

Let me know what you think in the comments, like the idea if you agree, and follow me for more tips like this.

SKX is going to pop very soon!It is looking like SKX wants to take a rise. It has been on a rise since 2016 and then it suddenly took a massive gap down. The stock is going to rise back up to fill in the gap. Look to buy soon, then look to sell when it nears the resistance line, because it will then be inside of the upward trend that it has been on for so long.

SKX on the rise, and will be a fantastic swing tradeSKX 2.55% has been on a trend upward since the end of 2016, and its not breaking now. The Q2 earnings went well and there is a massive gap that will be filled soon. It was severely over sold on the gap down and now if you look at the MACD it shows a bullish cycle ready to begin. The support line at 21.20 may be hit again before it goes back up but be on the lookout for higher highs and higher lows for a tell tale that its on the rise.

I bought once it passed the 21.20 and I recommend you do to. Will keep you updated on what's going on...

Skechers (SKX). Finishing sideways correction. Could drop again The price could have topped here within a large sideways correction wave X (yellow).

The wave C (white) is already larger than the wave A.

The target is highlighted with the white rectangle.

Previous low at the 18.81 could be aimed first.

The 78.6 Fibonacci retracement level (13.15) could be the optimistic goal.

SKX BreakoutSKX have been trading for the few days between 24,85 and 25,6 respecting a channel from 2016/10/21. Today we see a possible breakout. If daily candle ends really bullish with a good volume, we could wait for a pullback to support 25,6 to enter long.

KL: 25,6

SL: 24,85

TP1: 27,6

TP2: 28,5

Skechers light on its feet to ResistanceSKX today had unusual Call Volume. Some traders are betting on this going up.

The long term action on Monthly and Weekly is showing this stock to be bearish. The move today brought the stock up to Daily resistance. I'm looking to test this resistance with short term JUL 16 29 Puts, holding them for just a few days, to see if this is the top of the move up. If it holds the resistance I'll be looking to take longer term bearish Put Options through earnings.