META: Short From Resistance! SELL!

META

- Classic bearish resistance pullback

- Our team expects a move down

SUGGESTED TRADE:

Swing Trade

Sell META

Entry Level - 708.68

Sl - 742.00

Tp - 667.90

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Sl

USOIL: Bullish Correction Ahead! Buy!

USOIL

- Classic bullish correction formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy USOIL

Entry Level - 65.16

Sl - 62.68

Tp - 68.86

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZD_CAD LONG SIGNAL|

✅NZD_CAD is going down to

Retest a horizontal support of 0.8160

Which makes me locally bullish biased

And I think that we will see a rebound

And a move up from the level

So we can go long wit the

TP of 0.8206 and the SL of 0.8152

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETHEREUM: Will Go Up! Long!

My dear friends,

Today we will analyse ETHEREUM together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1801$ Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1810$ Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

GBP_NZD LONG SIGNAL|

✅GBP_NZD is going down

To retest a horizontal support

Level of 2.2200 so after the

Retest we can enter a long

Trade with the TP of 2.2459

And the SL of 2.2132

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CAD Free Signal! Sell!

Hello,Traders!

USD-CAD is trading in a

Downtrend and the pair is

Consolidating below the

Horizontal resistance

Around 1.3880 so we are

Bearish biased and we can

Enter a short trade on Monday

With the Take Profit of 1.3725

And the Stop Loss of 1.3908

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_CAD SHORT SIGNAL|

✅AUD_CAD made a retest

Of the horizontal resistance

Of 0.8880 then established

A beautiful double top pattern

And then broke the local neckline

Around 0.8832 so its a great

Setup for a short trade

With the TP of 0.8778 and

The SL of 0.8887 above the

Resistance upper bound

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_USD LONG SIGNAL|

✅GBP_USD made some crazy

Moves last week and was eventually pushed

Back down to the horizontal support of 1.2874

From where we will be expecting a local

Rebound, therefore we can go long on

The pair with the TP of 1.2946

And the SL of 1.2849

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_CAD SHORT SIGNAL|

✅USD_CAD is going up now

But a strong resistance level is ahead

Thus I am expecting a pullback

And a move down so we can

Enter a short trade with the

TP of 1.4171 and the SL of 1.4280

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_CHF SHORT SIGNAL|

✅USD_CHF is going up now

But a strong resistance level is ahead at 0.8860

Thus I am expecting a pullback

Which means we can enter a

Short trade with the TP of 0.8835

And the SL of 0.8866 but its is a

Risky setup so we recommend to use

A small lot size

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_CHF LONG SIGNAL|

✅EUR_CHF made a retest

Of the horizontal support level

Of 0.9500 and we are already

Seeing a bullish rebound so

We can enter a long trade

With the TP of 0.9567

And the SL of 0.9488

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_AUD SHORT SIGNAL|

✅GBP_AUD keeps growing

In a strong uptrend but

The pair will soon hit a

Horizontal resistance

Of 2.0620 from where

We can enter a counter-trend

(and therefore a riskier) short

Trade with the TP of 2.0532

And the SL of 2.0653

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

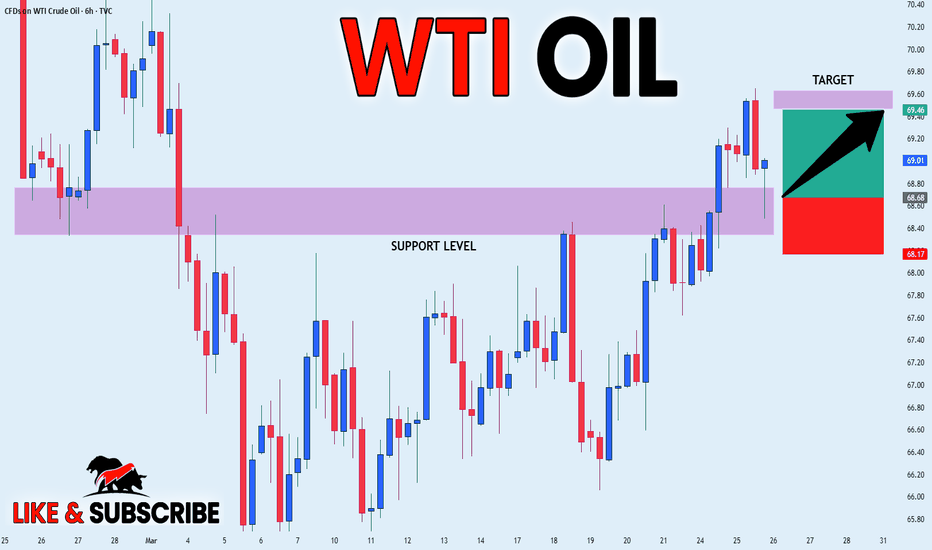

CRUDE OIL LONG SIGNAL|

✅USOIL made a retest

Of the horizontal support

Of 68.60$ so we are bullish

Biased so we can enter a

Long trade with the TP of 69.46$

And the SL of 68.17$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD LONG SIGNAL|

✅GOLD made a retest of the

Horizontal support of 3000$

And we are seeing a bullish

Reaction so we are bullish

Biased and we can enter

A long trade with the TP

Of 3023$ and the SL of 2997$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_CAD SHORT SIGNAL|

✅AUD_CAD is going down

And the pair made a bearish

Breakout of the key horizontal

Level of 0.9007 which is now

A resistance so we are bearish

Biased and we will be able

To enter a short trade on Monday

With the TP of 0.8970 and

The SL of 0.9030

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_CAD SHORT SIGNAL|

✅EUR_CAD is going down

Now and the pair made a

Bearish breakout of the local

Key level of 1.5580 which is now

A resistance so we are locally

Bearish biased and we will be

Expecting a further move down

So a short trade can be entered

With the TP of 1.5480 and

The SL of 1.5600

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CHF Free Signal! Buy!

Hello,Traders!

USD-CHF keeps falling down

But the pair will soon hit

A horizontal support

Of 0.8754 from where

We can enter a long trade

With the TP of 0.8795

And the SL of 0.8730

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-NZD Free Signal! Buy!

Hello,Traders!

AUD-NZD has been falling

Recently and the pair is locally

Oversold so after it hits the

Horizontal support level

Of 1.0956 a long trade

Can be entered with the

TP of 1.0990 and SL of 1.0937

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WHAT IS QM (SIMPLY)Quasimodo trading setup or QM is an advanced reversal pattern in which its formation signals the end of a trend, and most traders use its variants to improve trading results in the forex market.

If u don't understand it, there is high possibility for stop hunting.

u may heard HEAD AND SHOULDER pattern, yes?

QM is exactly HAD (head and shoulder) and u can trade it at: FL'S _ S&D ZONES and SR lines.

it is also a Great show for money back and u can short it at all.

What invalidates it?

only Do not ENG the first support.

The Best Strategy to Apply Trailing Stop Revealed

Hey traders,

In this post, I will share with you my strategy to apply a trailing stop.

Please, note that I am applying a trailing stop only in trend-following trades and only when a trade is opened on a key level. I trade price action patterns, so the following technique will be appropriate primarily for price action traders. Moreover, my entries are strictly on a retest.

1️⃣

Spotting a price action pattern, I am always waiting for its neckline breakout. (if we talk about different channels, then by a neckline we mean its trend line)

Once I see a candle close below/above the neckline, I set my sell/buy limit order on a retest.

Stop loss will strictly lie below the lows of the pattern if we buy and above the highs of the pattern if we sell.

I spotted a horizontal trading range on an hourly time frame on AUDUSD. I set a sell limit order after a breakout of its neckline. Stop loss is lying above the highs of the pattern.

2️⃣

Once we are in a trade, you should measure the pattern's range (distance from its high to its low based on wicks) and then project that range from the entry to the direction of the trade.

In the picture above, the pattern range and its projection are the underlined blue areas.

Once the price reaches the projection of the pattern's range, you should move your stop loss to entry and make your position risk-free.

Move stop to breakeven in traders' slang.

3️⃣

Then you should let the market go.

📈If you are holding a long position, you should let the market retrace and set a higher low and then a new higher high or AT LEAST an equal high. Once these conditions are met, you can trail your stop and set it below the last higher low.

📉If you are holding a short position, you should let the market retrace and set a lower high and then a new lower low or AT LEAST an equal low. Once these conditions are met, you can trail your stop and set it above the last lower high.

In the example above, stop loss was modified when the price set a new lower high. Stop loss is now lying above that.

Catching a trending market you should trail your stop based on new higher lows / lower highs that the price sets. Occasionally you will catch big winners.

How do you apply a trailing stop?

❤️Please, support my work with like, thank you!❤️

Stoploss hunting in banknifty 28 NOV 2023My view of how market will react according to the stoploss present of both buyers and sellers.

The yellow lines present are the psychological levels, market respect to these levels very much.

The white line present between both yellow lines indicated the presence of both buyers and sellers at that point those who took positions for btst. The rectangle which shows the stoploss is marked using fib retracement tool. Tomorrow if market opened gap up it will take down the profit of sellers by 50 to 60 percent which will result in a massive sale. and also gap up opening of market will trigger retail investers to buy ce side creating stoploss down side. Therefore, I am having view of PE side or selling side.

PLEASE COMMENT DOWN IF YOU HAVE ANY SUGGESTIONS OR WANT TO CORRECT ME! THANK YOU.