Silver Breakout Long SetupToday a member of my social media pointed out that Silver may be setting up for a long trade. I like the price action on the Daily where Silver instruments (futures and SLV) have broken the 6 month 50% Retracement Resistance at 23 and confirmed the break by holding above it for the last few days. This sets up a breakout trade to retest the recent major highs around 26. I expressed this trade with the instrument SLVO

SLV

Getting excited for Silver?So with much elation those that were pumping silver over the weekend cheered a 7% gap open on futures. However, this move fails to break the most recent high. If traders are looking for technical confirmation first then this would be the high to mark as the breakout level. Jumping in at the open Monday would be doing so at a dangerous level.

1 of multiple scenarios for the S&PThe S&P closed right under major resistance on friday. This leaves the door open for 1 of multiple scenarios to play out.

1- the market tanks from here and dips below 3800

2- the market dips, hold a higher low then breaks thru resistance to 4321, then 4400

3- the market melts up to the top of the channel at 4400

$SLV Elliott Wave BeginnerStill sticking with my original EW counting.

Not sure if the corrective waves is done yet.

It can possibly go down to 15 before it hits TP1 because silver and gold tends to dramatically decrease during recession.

Still in the long run $SLV might have a lot of potential to go higher than ath.

SILVER XAGUSD Supply And Demand Support And Resistance AnalysisPlease see picture for analysis.

-Price is reacting off of demand/support that's been holding for 2 years now.

-Still a very high demand for REAL physical silver.

-Waiting for confirmation.

Thoughts? if you like it don't forget to hit the like =)

XAUUSD GOLD Supply And Demand AnalysisSee Picture Short for analysis..

Thoughts? I love gold for buying so this woud be a small risk.

SILVER XAGUSD Supply And Demand Support And Resistance AnalysisSee picture for analysis.

Feel free to share your thought...

#silver #supplyanddemand #supportandresistance #technicalanalysis

$SLV Long 50 JUL callsWent long 50 JUL SLV 23.5 calls.

Nice looking chart and I like the R/R on a move to at least the top of the box. Will reduce the position there and manage on price reaction.

Mental stop just below 30 wk MA.

Nice consolidation with accumulation type buying, cup and handle with a good retrace from the JAN to MAR move, I think it's going for next leg higher.

A break above the box should expect a massive move, as this has been digesting since AUG 2020.

If calls go farther ITM may sell bi-weekly calls against them to reduce my cost basis, playing it day by day week by week.

Miners and Metals look good overall, many above 30wk MA.

Cheers

LONG SLV more upside potential than GLDGLD and SLV tend to do well during these chaotic times, with inflation sky-high, Russian attacks, and crypto still at an early stage. At the moment, I believe investing in GLD and SLV is a hedge against risk and has potential upside growth until inflation drops.

Since the Easter holiday, SLV has broken the downtrend line and found a bottom around $22.37. It's shooting for the March high (where the resistance is around 24.50)

Long GLD With rising inflation and politicals risk all around the world, Gold continues to perform as a safe haven for assets. From the TA perspective, Gold has formed a double bottom and it is breaking out late march level ($1957ish). It is aiming for a 0.61 Fib level around $2000, possibly all-time high,

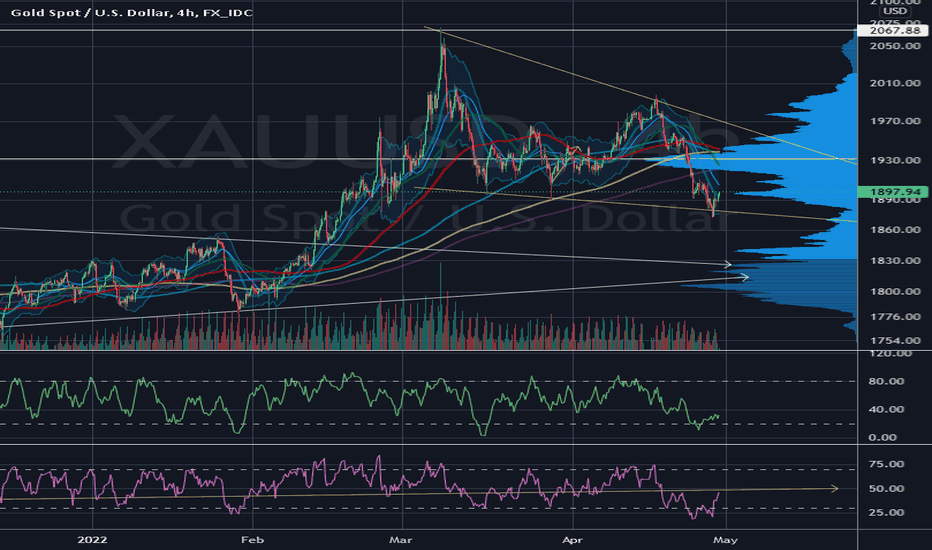

Gold Trading RangeGold may have found a floor today as both MFI and RSI indicators have bounce out oversold territory. Looking at the 4H chart, the MFI and RSI indicators have been a consistent indicator this year of telling when gold bottoms.

I have started entering into gold again but I will be trading with caution as the range is small and I am looking to liquidate my positions once we reach around 1950 range. There is a wedge pattern forming and it could be bullish but it will need momentum and volume to break out past 1950.

Forewarn, Dollar is still going strong and bonds are starting to look attractive so gold may continue to get pummeled. Gold and silver will need the dollar to come down for the two metals to start rising again.

$SIlJ wants lower. $8-9 over the coming monthsOn high timeframes, we seem to be continuing the trend of forming lower highs. The rejection of price at $15.49 gives me the setup I was looking for to think $SILJ is going lower.

On top of the rejection, the RSI is overbought, the moving averages on ichi are stretched with price above the moving averages giving me reason to believe price will snap back lower, and I have a hard time seeing how price gets above the cloud (on higher timeframes, there's thick resistance w/ the clouds).

I think there's good reason to believe we're heading lower here. I think price will first head down to $11.66 but being its' already been tested as support multiple times, it's weakened and price should break through that support fairly easily. Which leads me to believe the next target on the downside would be $9.44 and below that $8.32 if that support fails to hold.

Let's see how it plays out over the comings weeks/months.

Silver in the Channel Published an earlier version of this idea with more poorly drawn corridors, but it seems for the most part to be validated for the time being. I expect silver to challenge recent highs and potentially cool back down toward mid 20s once that happens (before moving up further). However it is entirely possible that once silver reaches these targets that it simply continues to tear through them - it depends on other factors, but regardless, I am LONG.

I think metals, and silver especially, will be rising moving forward both in the short, medium, and long term. Inflation is only beginning, monetary conditions are changing worldwide and the financial system is on the brink of a paradigm shift. Out with "old" thinking and in with even older thinking!

Post Script: I'm a noob here, so apologies for any miss-steps.

Silver Breakout In The Works - Big Move ComingSilver broke out of a descending wedge, a consolidation after its February 2022 run. The 2X silver fund AGQ is looking great here with a technical breakout retest. A bullish MACD cross will likely send this to $50 + then it is going much higher with silver. Precious metals are about to have their moment as stocks and crypto sell off.