Be prepared for large sell off of $SPX around 4350 levelThe moving average 300 is an indicator of trends for the S&P 500, and prices often tumble to it during bull market rallies or bounce to it in bear market rallies. Currently, $SPX is making a push towards the moving average 300, which is currently‘ at 4350.34. At this level, the volume histogram indicator across a 200 day timeframe and 500 day timeframe shows that there was historically a very high volume executed, which indicates that this may be a critical point for the market, and lots of volume may happen when it is reached.

Given that US markets are now in a recession, as dictated by two quarters of negative GDP growth, the war is still ongoing, and inflation rates are still high, I'd personally guess that the current rally is a bull market trap, which will reach the MA 300 then experience large volume and reverse downwards.

Comparing the current situation to two crashes, 2008 and 2020, I'd say that the state of the market is more similar to 2008, where prices came close to the ma 300 then crashed, instead of 2020, where the stock market rallied strongly after crossing over the moving average 300. This is because, in 2020, the rally after the crash was largely fueled by the federal reserve's quantitative easing and asset buying, whereas now in 2022, the federal reserve's actions are on the opposite end, with "quantitative tightening" and rate hikes.

Sma

$LDO - Lido long idea 20Period SMA relcaimlooking around today for things that haven't popped off yet, and i think $LDO has a chance.

Its had a nice little consolidationbelow 20 period SMA on the H4 and reclaimed it giving us a clear invalidation level to put our stop below.

for the target I've used a bit of classical charting for a bull flag pattern measuring the length of the "flag pole" and placing that at the breakout level, its all just guess as LDO is currently in price discovery, so could go a lot further, i will prob hold for while on this if i don't get stopped out

entry 2.6

stop 2.28ish

target 3.5ish

follow me on the twitter website

$ETC - Bounce from 60 period SMA on the 4 hour chart - LONGA simple idea along the lines of my last couple if you've seen, we've had a large expansion when ethereum classic started to get a lot of attention surrounding the merge narrative and mining moving over, a range was set on the break down from that rally and price has managed to break out and is currently come back down to retest it, also lining up with a bounce from the 20 period SMA which I like.

this is a good level to buy imo and i think we go to at least 40.6ish which is towards the top of the prior consolidation before breaking down

tldr

buy 37.6

target 40.6

stop 36ish (below a prior wick and 20 period SMA)

follow me on the tweeter :)

$BTC finally overtaking the 60day simple moving averageOK time to dust off the old TV account again!

$BTC has moved above the 60 day simple moving average and historically when this happens after a period of consolidation, BTC will trend for at least a couple of weeks with the 60 day mean price offering a good spot to rebuy in the result of a pull back.

I expect some headwinds obviously at the 28k-29k level for the obvious reason of being a zone of major bounces in the past, so would probably be looking to take profits there and rebuy the retest of the 60day SMA.

If this idea is to fail i have a stop below the wick of the prior thrust candle and below the 60 day SMA around 20.4k

tldr

Initial Target 29k

Stop 20.4k

using the 60 day SMA as a guide to buy pull backs or to get out if it gives way

Sign up to the best exchange FTX right here

and help a brother out 👇👇

ftx.com

DOT above support#DOT/USDT

$DOT is above the trend line that is the same as the support zone.

🐻 price may have more drop in the short term to touch the support zone where meets curved support.

break down from this support will drop the price to descending trend line (green).

🐮 holding above the support zone can bring back bulls in play and attempt to break out descending trend line to reach the next trend line above.

BTC 1970 and 1420 Daily Simple Moving Averages Are Your Friend1420 Daily SMA - This is basically the 200 Week Simple Moving Average. It’s held pretty consistently throughout BTC’s history and only been violated twice since 2015. Once during the Covid market meltdown of 2020, and once during the 3AC meltdown of 2022. These two violations have held at around the 1970 daily SMA

1970 Daily SMA - This was formed on March 13, 2020 during the Covid market crash. It also marked the local bottom of the crash on 2022, which bottomed on June 18, 2022.

During future market crashes, one should start buying with size near these two levels. This will provide you with excellent market positioning for future bull markets.

Analysis on the ES Futures chart on the Weekly Time FrameI am trying in this analysis to figure out the price movement of the ES futures in the coming months

Using the Bollinger Band as a simple tool to analyse I am basing this analysis on previous price action

and its relevance to the current place of price on the chart. We are revisiting the 20 WSMA and a significant

supply zone on the price front. We could see some resistance on the strong up move that we have seen in the

last 2 to 3 weeks and the rally may be coming to a climax in this cycle.

We should wait for the confirmation signals before we begin to trade on this analysis and commit our capital

only once the price action gives us the desired moves. I am not a registered financial advisor and just releasing

this idea as a piece of educational information on how price analysis can lead to action that can help us profit

from engagement with the market.

Please opine on this analysis and comment your views

Nasdaq Futures Price Action analysis for the coming monthsAm basing my analysis on the weekly chart using the Bollinger Bands which is the most simple tool to understand

In my analysis, the price action has brought us to a point on the weekly where we are bound to face resistance

around the middle line of the BB - which is the 20 SMA in our case the 20 WSMA. The prices have reversed from

a similar area twice before and also as a concurrence these areas have been near previous areas of interest where

either price has broken out or reversed from acting as resistance and support points at different times.

The prices may give us confirmation signals if they close below the 13000 levels in the current week or next one

from where one can aim to take a short which can take us down to the 11000 levels.

I am not a registered financial advisor and the release is just an expression for educational purposes. Using futures

as a trading instrument is risky and should be done only under proper guidance and with proper risk management.

Please comment on the analysis and contribute with your ideas on the subject

Ethereum at the Gates!We see that we have reached the end of the ascending channel in Ethereum , and if this ascending channel is broken down, it seems inevitable that the price level of $775, which is just fib support, will come.

We clearly observe the interaction of 3 separate support and resistance levels with the price.

As long as the vitally important 3rd level is not broken upwards, the channel structure we are in is suitable to be broken downwards.

In addition, the 50-day simple moving average acts as a resistance element for us.

Dailiy EMA 30 Rejection Phases for BitcoinAs can be seen, when we examine the rejections associated with the 30-day exponential moving average in two separate channels, it is expected that the price moving in the falling channels will break the falling trend after the 4th phase.

However, it is useful to be careful and not to enter a position without using stoploss, especially in margin transactions.

Expressive Subjective Predictions About BTCThere is currently an ascending channel and two different symmetrical triangle formations that we are in at the same time.

Although the support zone and trend for the lower band seem to hold the price tight, if the fundamental data creates a selling pressure, the targets of the relevant formation formations seem clear.

On the 4-hour timeframe, the 200-hour exponential moving average is clearly acting as resistance. Also, the Stochastic Relative Strength Index is likely to exert negative pressure.

Further decline or range trend?Hello to all members of TradingView and my followers.

As you can see, Bitcoin is currently trading at the bottom of the $19,632 range (which is also resistance).

Even though the 100-hour simple moving average is at the $20,000 level, Bitcoin's efforts to break above the $19,632 level have been unsuccessful.

In general, Bitcoin's movement is under its downward trend line.

In the previous hours, we saw that the price of Bitcoin reached $18,800.

There are two major resistances to Bitcoin right now. The first is the $19,632 level, and the second is the 100-hour simple moving average line I mentioned.

Of course, the downward trend line is also considered a resistance.

As you can see, the green histograms formed on MACD; are tied to the buy signal on the chart. Although the indicator displayed a buy signal, buyers still struggled in the market.

Bollinger Bands portray the price volatility of the asset.

Until the powerful $18,700 support range is broken to the downside, Bitcoin can fluctuate between this range and the $19,800 resistance.

If it breaks, the situation will be different, and the movement towards $17,500 will start.

If it is helpful to you, please like it. If you have a comment, I'll be happy to know. Respectfully.

Ethereum ETHUSDT - Millennium Elliott Wave + 200 weekly MA!- As per my Elliott Wave analysis on the weekly scale, we have 2 impuls waves successfully completed and now we are missing the final impulse wave!

- ABC correction (Wave 4) can be done, because wave 4 should not overlap the first wave.

- 200 weekly moving average is currently acting as a very strong support!

- Also the price is currently sitting on 0.786 fibonacci retracement.

- If you take a look at RSI indicator, you can spot a bearish divergence from previous waves, which helps us to identify the Elliott wave structure.

- Looks like the bear market can be over and we are ready for another massive bull market!

- Check my related analysis for Bitcoin down below!

SMA, EMA & Bollinger Bands on S&P500Current Price = 4072.17

💲EMA 20 = 4048.62 (below CP, Buy territory)

💲SMA 20 = 4022.81 (below CP, Buy territory)

💲SMA 50 = 4249.27 (above CP, Sell territory)

💲SMA 200 = 4450.25 (above CP, Sell territory)

💲Bollinger Bands = Middle Band SMA 20, 2 SD (4022.81) (below CP, Buy territory); Overbaught (4196.95); Oversold (3848.68);

🚀 Overall sentiment =

1. Go Long for short term trading,

2. Go Short for intermediate and long term.

Potential Gain

= 9.28% + 4.35% + 1.74%

= 15.37 %

Potential Loss

= -5.49 %

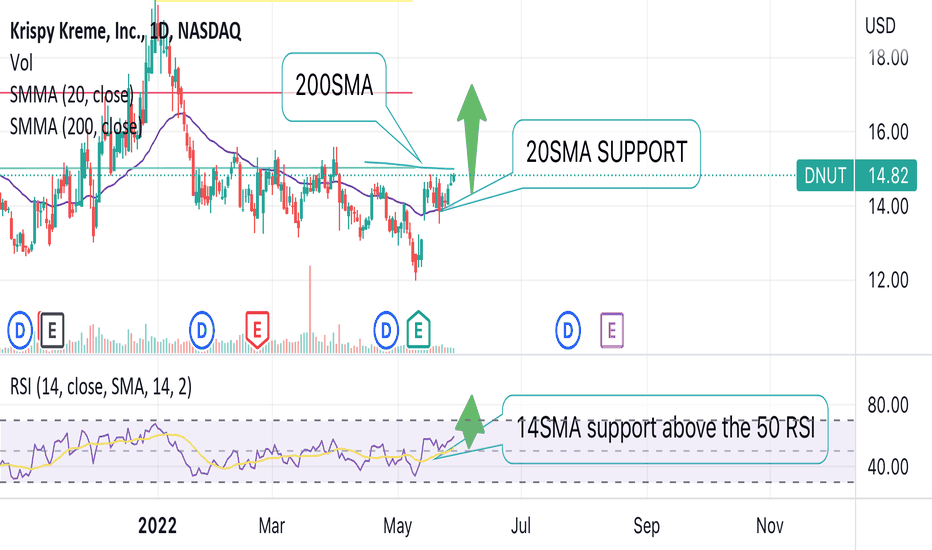

Strength on Krispy Kreme $DNUT has seen very good signs of strength from the support of the 20SMA. Also you’ll notice that the RSI Is holding above the 14SMA while it sits on top of the 50RSI. With this being a newer stock on the market and many years in business. We could see the company making expansive moves to catch the eyes of investors moving forward.

I see a lot of potential in the company to keep growing into something more than just donut shops and store products.