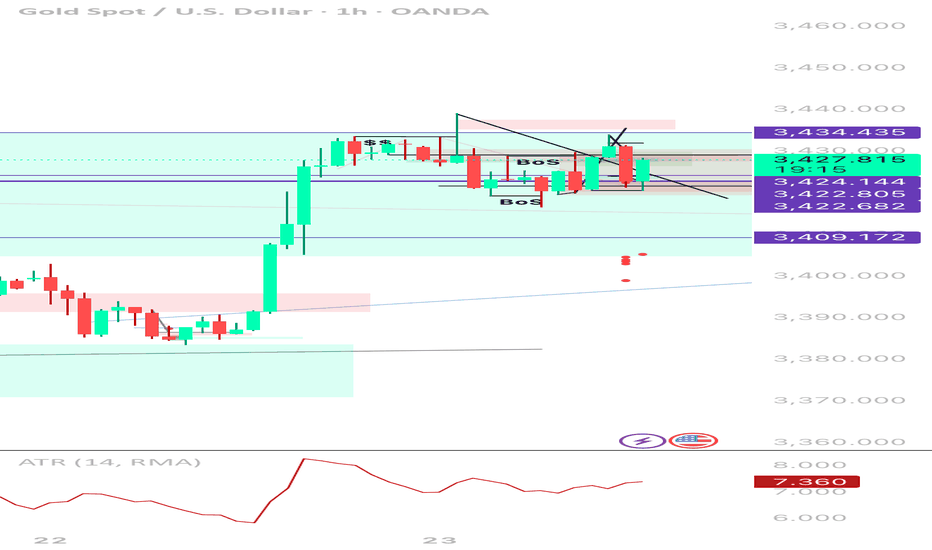

XAUUSD 1H | Sell TP Hit → Now Flipping Long After Liquidity SweeSmart Money Buy Setup | 1H Execution | Reversal from Demand Zone

Just hit full TP (396 pts) on a clean short from 3,434. Now flipping bias to long after price tapped into a key 4H OB and demand zone near 3,422. Price swept downside liquidity, mitigated the imbalance, and is now showing bullish intent.

⸻

🔄 Trade Narrative:

• ✅ Sell-side liquidity swept below previous HLs

• 🧱 Price tapped into 4H Order Block + FVG zone

• 💧 Internal liquidity vacuum filled (3,422–3,409)

• 🔁 Potential 1H BOS to the upside forming

• 🕯️ Bullish wick reaction from demand = early entry signal

• 📉 ATR low + building pressure = potential expansion incoming (likely NY)

Buy plan:

Entry Zone

3,422–3,424 (with confirmation on BOS)

Stop Loss

Below 3,409

TP1

3,434.435 (prior supply tap)

TP2

3,439.210 (range high)

TP3

3,455–3,460 (weekly extension target)

📌 Why I’m Flipping:

Price didn’t just reject randomly — it reacted exactly where smart money would’ve wanted to rebalance after the previous long impulse. This is the textbook scenario where you don’t marry a bias — just follow liquidity and structure.

🧠 Key Lessons:

• Don’t force continuation when the market is clearly absorbing

• Liquidity grabs often lead to strong reversals — watch BOS to confirm

• Same zone that gave you your TP? Can give you your next entry 💡

🔖 Tags:

#XAUUSD #SmartMoney #LiquiditySweep #OrderBlock #BreakOfStructure #BuySetup #PriceAction #1HChart #GoldTrading

Smart-money-concepts

BTCUSDT Fresh Short Setup: Targeting Key Support Zones with SMC Description:

This trade setup presents a Bitcoin short opportunity on the 4H timeframe using the Smart Money Concepts (SMC) framework. After a significant reaction from the supply zone, Bitcoin's price structure aligns with bearish confluences, signaling potential downside. Additionally, external events, such as the recent announcement of China's AI application "DeepSeek," may have amplified market volatility, further supporting the setup.

Trade Setup:

Entry:

Between 103,300 and 104,500

Take-Profit Levels (TP):

101,897

99,825

97,565

95,208

Stop Loss (SL):

Above 105,975

Analysis and Confluences:

Market Structure:

Bitcoin remains in a bearish trend on the 4H timeframe, with consistent lower highs and lower lows.

Supply Zone:

The price is entering the 103.3k–104.5k supply zone, a key resistance area where sellers are expected to dominate.

Fibonacci Confluence:

This zone overlaps with the 0.618–0.786 Fibonacci retracement levels, a high-probability reversal area.

Liquidity Sweeps:

Liquidity above previous highs has been swept, leaving the path clear for potential downside.

Bearish Targets:

The targets align with previous demand zones and liquidity pools at 101,897, 99,825, 97,565, and 95,208.

Trade Plan:

Confirmation: Wait for bearish price action signals or smaller timeframe BOS (Break of Structure) within the supply zone before entering.

Risk Management: Adjust position size to keep risk within acceptable levels. After reaching TP1, move your stop loss to breakeven and secure partial profits.

Final Note: While bearish bias dominates, unexpected macroeconomic events can cause reversals, so use tight risk management.

BTCUSD | 1D SMC Short Setup with Refined SL and TargetsDescription:

This analysis identifies a high-probability short opportunity for BTCUSD on the 1D timeframe using the Smart Money Concepts (SMC) framework. The chart shows clear bearish confluences, including market structure, supply zones, liquidity levels, and Fibonacci retracement zones. I believe the current bullish momentum is merely a manipulation driven by inflation news and the upcoming Trump inauguration. Following these events, I anticipate a significant market correction. Here’s the detailed breakdown and trade plan:

Analysis:

Market Structure:

Break of Structure (BOS): Price has confirmed a bearish trend with BOS to the downside, signaling a continuation of lower highs and lower lows.

Trendline Resistance: A well-defined downward trendline indicates selling pressure, reinforcing the bearish bias.

Key Zones and Liquidity:

Supply Zone: Highlighted in purple at $102,000-$104,000 . This zone represents an area where strong selling previously occurred, creating an imbalance.

Golden Zone (Fibonacci Retracement): Located around $101,000-$103,000 , this area aligns with the 61.8%-78.6% retracement levels and offers a high-probability reversal opportunity.

Weak High: The high near $104,000 represents untapped liquidity, which smart money may target for a liquidity grab before reversing lower.

Equal Lows (EQL): Around $92,000 , these act as a bearish target where liquidity rests, aligning with the continuation of the bearish trend.

Confluences for Short Entry:

Price is approaching the supply zone and Fibonacci Golden Zone , indicating a potential reversal point.

The weak high may trigger a liquidity grab to entice buyers before sellers regain control.

Previous BOS and trendline resistance add further validation to the bearish bias.

Trade Plan:

Short Entry Setup:

Entry Zone: $102,000-$104,000 (inside the supply zone and Golden Zone).

Stop Loss (SL): $105,500 (above the supply zone and imbalance to account for liquidity grabs).

Take Profit Levels:

TP1: $97,000 – Close partial profits at this imbalance mitigation level.

TP2: $92,000 – Target the equal lows and resting liquidity.

TP3: $88,000 – Final target near the blue demand zone for maximum reward.

Risk-Reward Ratio:

With the entry at $103,000 (midpoint of supply), SL at $105,500, and TP at $92,000, the trade offers a 1:4 RR or better, depending on execution and scaling.

Additional Notes:

Monitor the price action closely as BTC approaches the supply zone for confirmation, such as bearish candlestick patterns or lower timeframe CHoCH (Change of Character).

Scaling into the trade in smaller portions across the supply zone can improve overall entry precision.

Adjust stop loss or take profit levels as market conditions evolve

Bullish Dollar Within a Trading Range. TVC:DXY is currently trading in a consolidation pattern and is located in the premium end of the trading range between 104.447 and 103.013.

The August 30 candle swept the short term daily sellside liquidity at 103.013 into the Weekly BISI fair value gap which was nearly totally rebalanced. Upon leaving the Weekly FVG range, it was repriced to the premium end of the range, forming a daily BISI Fair Value Gap.

Sept 4th trading range appears to still be forming a Daily BISI fair value gap in which I expect price to protract into early in the week before either staying in a consolidated range or move higher toward daily and weekly buyside liquidity pools toward the daily Volume Imbalance.

Price points of interest:

D.Volume Imbalance: 105.278 & 105.125

Wk.Buyside Liquidity: 104.700

D.Buyside Liquidity: 104.447

D BISI Fair Value Gap: 104.025 high & 103.740 low

D. BISI Fair Value Gap: 102.771 high & 102.654 low.

Smart Money Concepts swing trading odyssey|Ep.12|8R long|EURUSDBack yet again with the Phase C continuation limit order entry model for swing trading, using ICT's SMC toolkit. This is again being documented as a reference for my future YouTube channel.

This description took too long to write, sorry if price has moved away from where I got tagged in...

So, these Phase C swing trades are proving to be a bane - the last one on Gold went sideways for about 2 weeks leading to me closing it today before inflation news with DXY showing weakness.

Fed sentiment: Hawkish? The bond market says another 0.25% rate hike is likely and I think it has been priced in for a while. US inflation slowly coming down; 5% down to 4% y/y. Month on month it's not improving though and employment is only just starting to maybe drop, meaning room for another interest rate hike to tighten the economy.

Trader sentiment: risk on (inflation easing + stock market rallying)

On the Euro side, employment seems to be going up, and inflation is still too high. A rate hike is practically a given with the ECB having room to do it.

Overall sentiment: The 0.25% rate hike seems to be baked in, and in spite of that, EURUSD continues to form a technical pattern that implies it's going higher. If the Fed doesn't make the expected rate hike, it will likely just accelerate Euro's move up.

I am forecasting a technical move up more than a fundamental one. At LEAST to fill in the weekly FVG - if not breaking the last supply zone creating a new high for the year - but with the Fed expected to hold rates ~5% until possibly 2024 v.s. the pace of Europe's hikes and their stagnant GDP putting a limiter on their hikes, right now I don't see how EURUSD could rally much higher than that (but maybe this is just a lack of understanding on my part?)

Technicals: W pattern formed on daily TF creating new demand zone. SMT divergence with the DXY gives me confidence that market makers won't push price lower during FOMC tomorrow.

Entry: Phase C pullback into discount/50% of 4h swing low/daily bullish OB. As I said above, the SMT divs with Dollar gives me confidence to put my stop below the last 4h swing low despite news tomorrow, which could give an opportunity to scale in with bigger size, providing Euro doesn't just slip 60 pips in the blink of an eye.

Exit/Terminus: mid-point of the gap (volume imbalance) on the weekly TF + old weekly high, which is an 8R trade. I plan to partial at the last supply zone which begins at ~$1.09500.

Confidence: 7.5/10 for directional bias & 6/10 that they won't stop me out during FOMC tomorrow 😋.

Here is the weekly chart. Notice the red box which is the volume imbalance I am using as my Terminus/DOL:

Smart Money Concepts swing trading odyssey|Ep.11|11R short|GoldTesting my own Phase C continuation limit order entry model for swing trading, using ICT's SMC toolkit.

Fed sentiment: Hawkish? bond yields up/possibly more hikes/USD strength

Trader sentiment: risk on? (Nasdaq rally/debt ceiling raise talks/inflation easing?)

Supply/Demand factors: people still in employment and spending money means demand

Overall sentiment: should be bullish if not for hawkish fed and dollar strength

Technicals: Gold overbought/in premium on higher timeframes, double top pattern yet to finish playing out. SMT divergence with Silver

Entry: Phase C pullback into premium of 4h swing high/fair value gap. tightened up stop because swept PDH (prev day high) giving a nice potential 11R return

Exit/terminus: MT of M -OB (50% of monthly bearish order block(Mean Threshhold))

Confidence: 7/10

Weekly chart:

Monthly chart (see order block):

V2.0 | 22R Gold Long Swing Trade | Smart Money Concepts/ICTThis is an updated plan for the macro Cup & Handle breakout

Previous setup for the 30R Gold long didn't play out; the unconfirmed SMT divergence didn't get confirmed and there was no impulsive move away.

The stop loss is larger due to the entry location.

Not financial advice but if this trade idea inspires you, you could use an even bigger stop to avoid potentially getting stopped out by an errant news spike. 22:1 risk reward sounds cooler though doesn't it?

SMT divergence in this setup between Gold & Silver has been confirmed this time; stops were swept on one pair but not on the other, before rallying upwards and creating a higher high on the daily timeframe.

In theory the swing where stops were swept SHOULD hold now.

Possible 30R Gold Long - Swing trade - Smart Money Concepts/ICT1. Price has come back to mitigate the 4H +FVG (Fair Value Gap) created on the 4th April, sweeping a PDL (Previous Day's Low) in the process to clean out the stop losses of anyone in early longs from this past week. This is an early entry signal and I have started to scale in with a scalp. (This higher risk trading, and not financial advice!)

2. Price has also retraced to a W +OB (Order Block)

3. We have SMT divergence with Silver, which has not swept the same low; another bullish signal in SMC (Smart Money Concepts) - although it would be better to have the SMT divergence with the previous structure than the current one as this is still unconfirmed (Silver can still make a lower low!)

ENTRY: ***IF*** price displaces/moves impulsively away now on the 15m timeframe, it can come back to fill the 15m +BPR (Balanced Price Range) left after the sweep of the 4th April lows. a 15m ChoCh (Change of Character) A.K.A. MSS (Market Structure Shift) would be ideal, but the last 15m swing high to be broken is a bit far away so the BPR fill is the alternative. This also lines up with the 4H +FVG which has a 4H +OB/Demand Zone below it.

I have placed my stop loss below the Pennant's rPOC (Range Point Of Control) for a peace of mind instead of the wick of the stop hunt.

I will post a zoomed in chart below.

Bitcoin 23R Long NOT Short | Smart Money Concepts | ICTThis is a re-entry to a 39R long that I posted the other week based on an inverted H&S on the daily timeframe.

This time it's another 23R long based on a sweep of a previous day low which I scalped yesterday, and a scale in after a 15m choch/MSS and pullback to OTE.

The strategy is the same, but this time it's based off a retracement to the top of this megaphone structure on the daily timeframe and a supply zone roughly at the 50% equilibrium point.

There is also SMT divergence between Ethereum and BTC as indicated on the chart

I think this is a bit more risky, but unless we get a bigger pullback, this is the best place to enter.

This scale-in swing trade is supported by:

1. A risk-off environment due to impending bank failures combined with the Fed's sentiment indicating an ostensible softening of interest rate rises.

2. Investors are seeking safety in Gold and BTC, as well as hedging against inflation. This combined with the weekly timeframe falling wedge and daily H&S pattern pointing to $37K or higher (supply zone and high volume node above).

This is not investment or financial advice, just my own opinion. I already partialed on my previous swing trade from ~24K so this scale-in is worth the risk:reward.

40R EURUSD Long Swing Trade (Smart Money Concepts)Testing one of my smart money concepts swing trading strategies using an early entry based on day trading setup. The setup normally involves a sweep of a 4h choch/MSS deep in premium/discount, then a daily pin bar or hammer, or a 4h choch.

Previous Day Opening Gap has been filled on DXY as well as three months of liquidity swept.

This early entry utilizes a long from a trendline following another strategy of mine. If successful, will take the majority of the position off after daily FVG fills and leave some on to run as a swing trade.

EURCHF EURCHF is trading in a downtrend and the pair broke a key level which confirms bearish bias. I have marked up a cheeky Counter Trade to where I feel like the price will reject and head towards my point of interest from where bearish continuation Will likely follow. I have a couple sells open so I don't mind if SL is hit. If the market does not give me my confirmations, I will not enter.

NZDJPY Long Entry IdeaPer myfxbook, retail is 78% short on NZDJPY, making me bullish. On the 1D, higher highs and higher lows have been made, giving me no reason to go bearish. There's also divergence between price and Cumulative Delta Volume (CDV). CDV has trended up short term, while price had trended down. Suggesting a weak sell. Price has seemed to find support right around 80.00, a nice whole number price. However, right below price is a large 4h imbalance inside of a 1D imbalance, where 50% of each imbalance lies right around 79.50, a nice half level. This area is also around the 50% retracement of the recent bull run if you apply a fib. My TP1 is the 4h imbalance that hasn't been filled, which is right around 81.5, another half level. Since this imbalance didn't break the previous short term market structure, I think price is likely to surpass this imbalance. Hence, my TP2 is targeting last month's highs at 82.5, another half level. A triple top formed right below last month's highs, providing liquidity for price to go to last month's highs, making it a likely target in my opinion.

CADJPY Long Entry IdeaPer myfxbook, retail is 68% short on CADJPY, making me short to mid term bullish. There are also more short term inefficiencies in CADJPY to the long side than the short side. Price has formed support right above the 50% mark of a 1D bullish imbalance, making me even more bullish. Looking for entry at the 50% mark of the 1D, and an ultimate TP at a major 1h imbalance. Plenty of places to trim along the way. Notice how the orderblocks and imbalances I marked up either start at, or have 50% levels around whole 25 pip values (quarters theory)