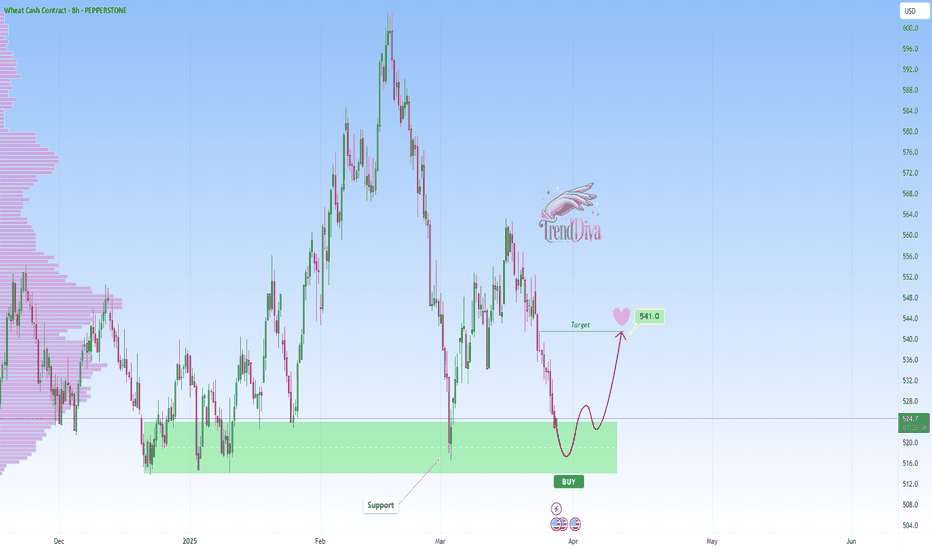

WHEAT at Key Support Level - Will Price Rebound to 541$?PEPPERSTONE:WHEAT has reached a major support level, an area where buyers have previously shown strong interest. This area has previously acted as a key demand zone, increasing the likelihood of a bounce if buyers step in.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would strengthen the case for a move higher. If buyers step in, the price could rally toward the 541$ target. However, a decisive breakdown below this support would invalidate the bullish scenario and could lead to further downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Best of luck , TrendDiva

Smart_money

CADCHF - Short Setup at Key ResistanceOANDA:CADCHF Is getting closer to a resistance zone that has times before lead to strong bearish momentum. A confirmation of selling pressure, such as a bearish engulfing pattern or multiple rejection wicks at the resistance level, would increase the likelihood of a downward move.

If sellers take control at this zone, the pair could move downward, with a target around the 0.63200 level.

NOT financial advice - just my view on support and resistance zones, Always confirm your setups and trade with solid risk management!

Best of luck! Again!

Dirty context in a week of FOMC and ECB conferencesI expect price to be pretty calm today. I see more likely a return to the orange trendline followed by its breakout to take an entry in one of the many candidates I have drew.

I will most likely just watch the price action of today and don't execute any trade.

Confirmation entry on a Break Block (5m) + FVG (4H) confluencePrice already reacted to the BB (5m/ Yellow Border Square) + FVG (4H - Yellow Background Square) confluence and created a CHoCH. I expect price to react and continue pushing up after touching one of the two EQL zones.

I will risk 0.25% of my account size if in case price triggers both of my stoploss, I will still have another 0.5% to use because I think price will go bullish this week the next one.