TON/USDT Monthly Structure Flip – Smart Money Targets $3.30+ Aft🔍 Key Observations:

Current Price: 2.974 USDT

Support Zone (Demand Area):

Strong demand zone around 2.870 - 2.800 USDT.

Price previously reacted multiple times from this zone, showing strong buyer interest and BOS confirmations.

Resistance Zone (Supply Area):

The next significant resistance lies in the range of 3.306 - 3.400 USDT.

This zone previously caused a BOS to the downside, making it a critical level to monitor for potential profit-taking or reversals.

Market Structure:

Price is currently consolidating just above the demand zone after a bullish BOS.

Recent BOS confirms a shift in structure from bearish to bullish bias.

Potential Price Path:

If price sustains above the 2.870 support, a bullish move targeting the 3.306 level is likely.

Expect short-term retracements within the structure but with a medium-term bullish bias.

Liquidity Mapping:

Liquidity is likely resting above the 3.088 local highs and the 3.306 major resistance.

Smart money may push price to these levels to mitigate orders or engineer exit liquidity.

📈 Educational Perspective:

This chart is a strong representation of Smart Money Concepts (SMC), particularly the use of BOS as confirmation for directional bias. Traders can look to:

Use the demand zone for potential long entries.

Watch for confirmation (like bullish engulfing or internal BOS) within the zone.

Manage trades toward the premium zone near 3.3 for a favorable risk-reward.

Smartmoney

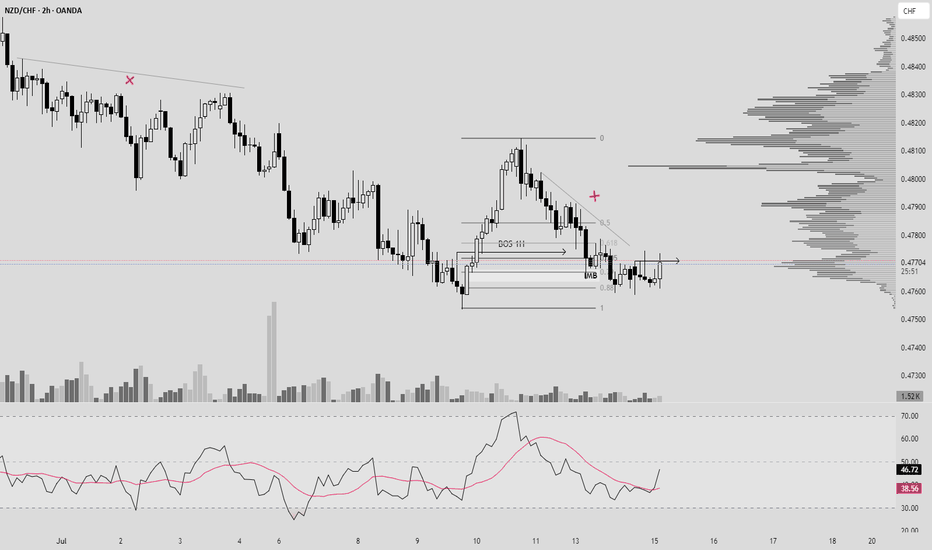

NZD_CAD LOCAL LONG|

✅NZD_CAD is set to retest a

Strong support level below at 0.8114

After trading in a local downtrend for some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 0.8145

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

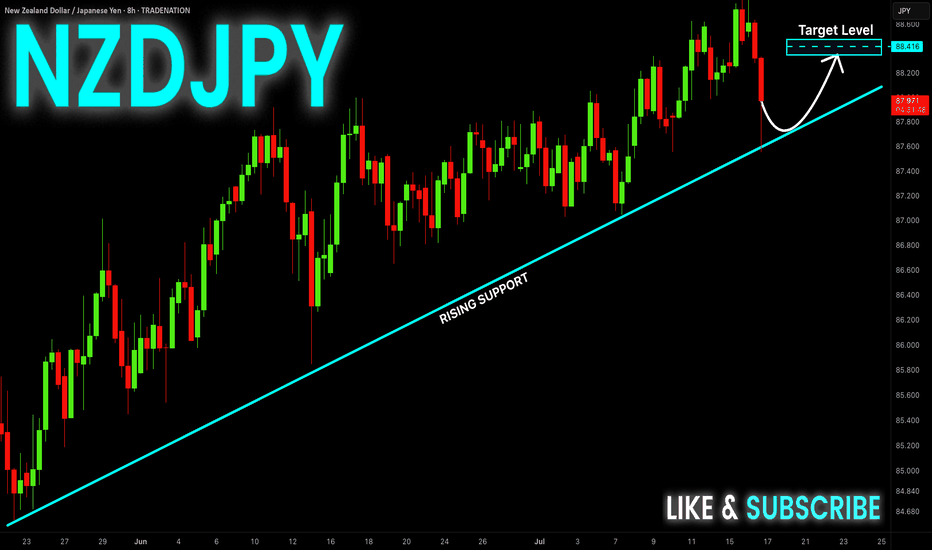

NZD-JPY Long From Rising Support! Buy!

Hello,Traders!

NZD-JPY keeps trading in

An uptrend along the rising

Support line and the pair made

A quick retest and we are seeing

A rejection so we are bullish

Biased and we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

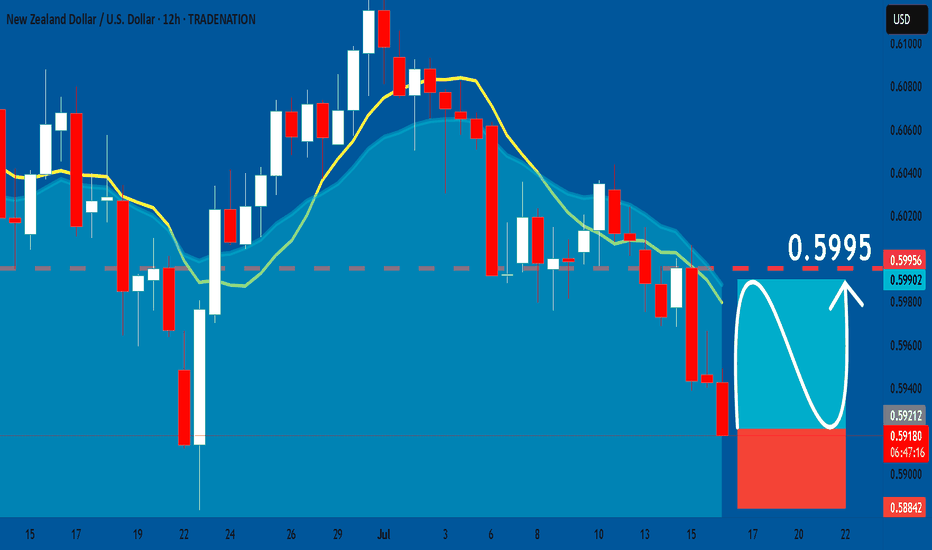

NZDUSD: Bullish Continuation & Long Signal

NZDUSD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long NZDUSD

Entry Point - 0.5922

Stop Loss - 0.5884

Take Profit - 0.5995

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

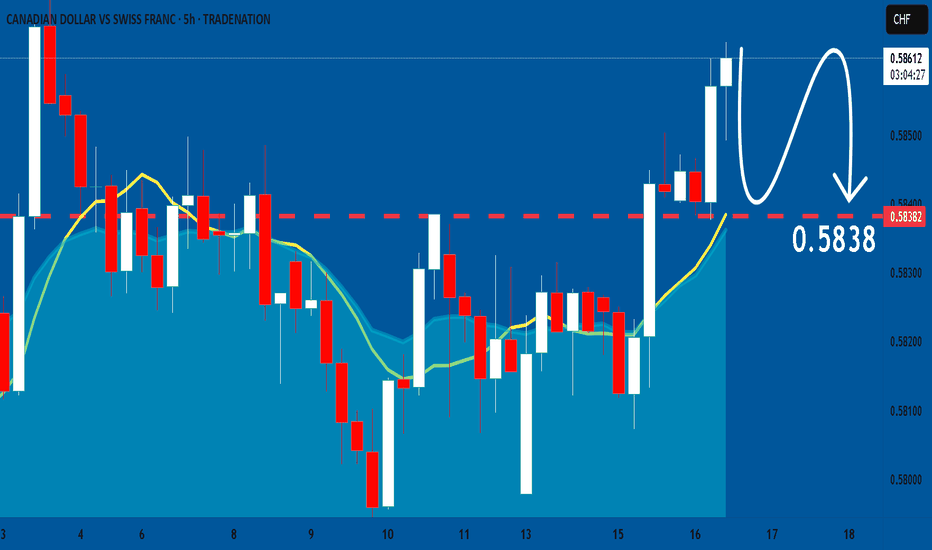

CADCHF: Bearish Continuation

Looking at the chart of CADCHF right now we are seeing some interesting price action on the lower timeframes. Thus a local move down seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

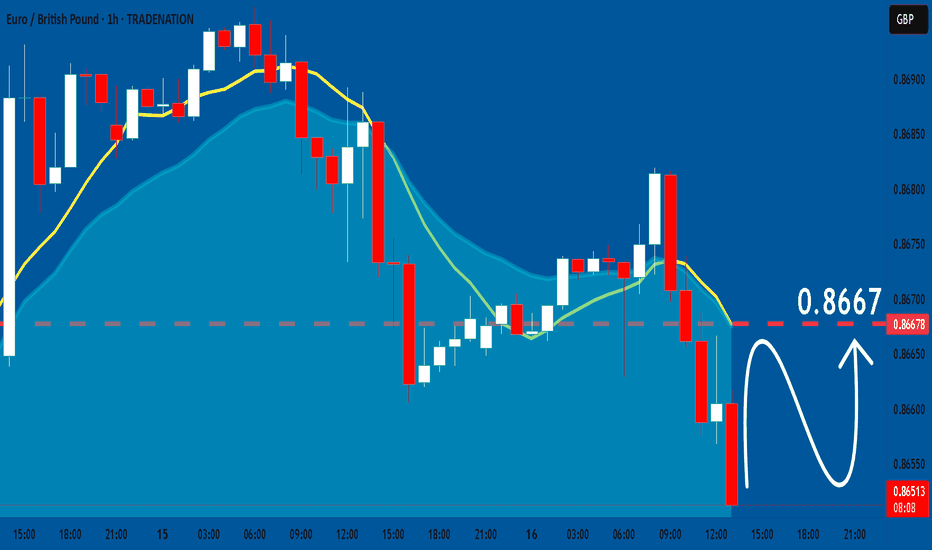

EURGBP: Expecting Bullish Movement! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the EURGBP pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

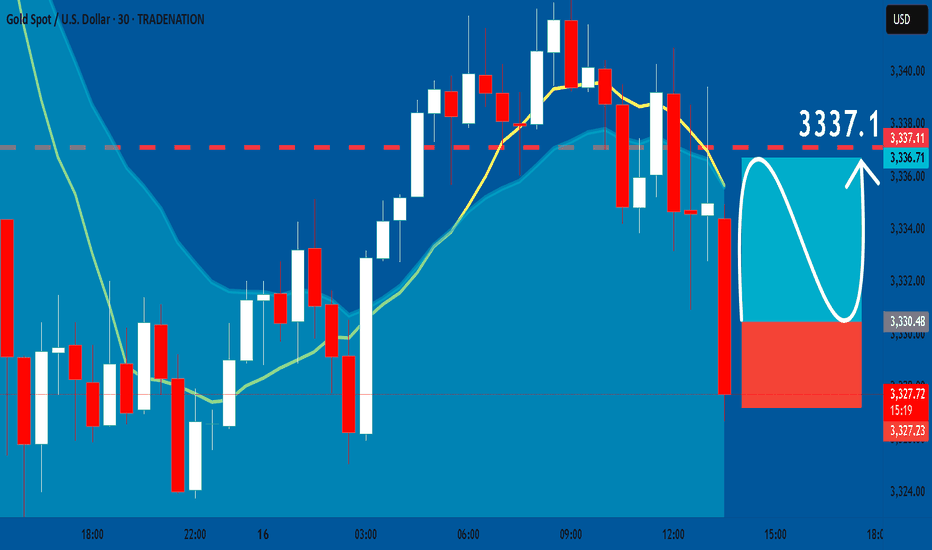

GOLD: Long Trading Opportunity

GOLD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy GOLD

Entry Level - 3330.3

Sl - 3327.23

Tp - 3337.1

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

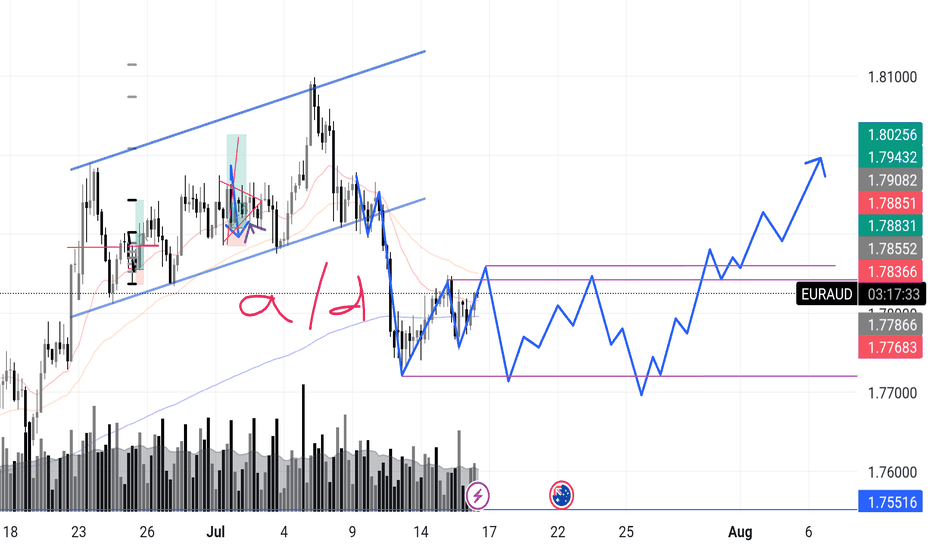

EURAUD – Incoming Upthrust? Accumulation or Distribution? Chart Context:

EURAUD recently completed a sharp markdown after a textbook rising channel break. What’s interesting now is that price has entered what looks like a potential box range between 1.7768 and 1.7885.

I'm anticipating a possible upthrust move into the 1.788x zone — and what follows will reveal the true intent.

Here’s the internal debate:

Are we looking at reaccumulation — smart money trapping shorts before driving higher in line with broader money flow?

Or is this a distribution — where the market builds a false sense of support before deeper downside?

🔍 What tips the scale for now is this:

>The overall money flow direction (via volume patterns + structure) has leaned bullish, so I’m favoring accumulation with a shakeout scenario.

Signs I’m watching:

✅ Absorption volume near the bottom of the range

✅ Higher lows inside the zone

✅ Fake breakout / upthrust into prior structure

❌ Failure to hold above 1.7855 could flip the bias short-term

📉 Expecting one more dip to test demand, followed by range tightening, and if buyers show up strong — the breakout can get explosive.

What’s your take?

Are we prepping for a markup or will this fakeout and roll over?

"I go long or short as close as I can to the danger point, and if the danger becomes real, I close out and take a small loss"

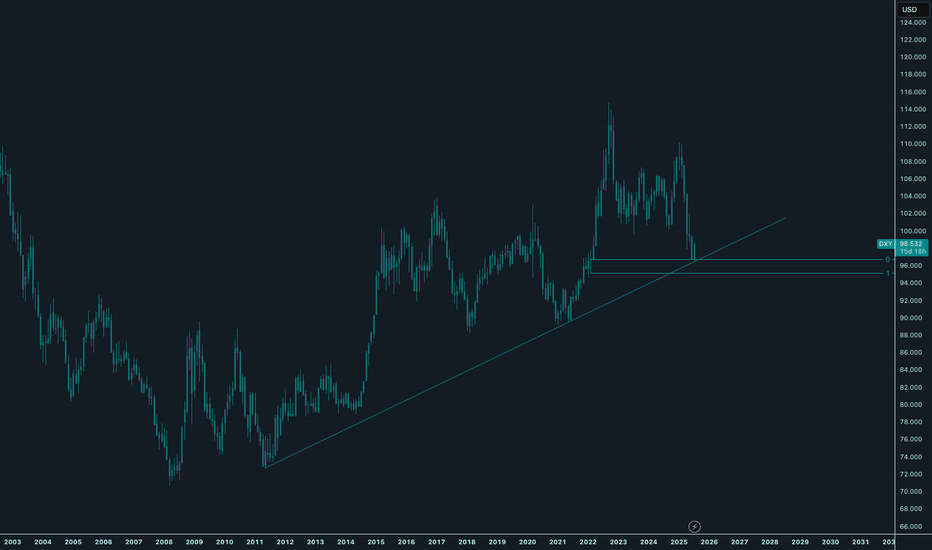

Dollar MoonHey,

Been a while that I shared a chart here, sorry for that.

I love the place where the dollar is at the moment.

The easiest plays are from these long-term value areas, and this one is also stacked with a trendline making it a bit more obvious for everyone.

The daily trend is broken since yesterday, shifting bullish long-term. I think a daily pullback is likely, perhaps even back to daily lows to fill up demand.

But long-term, I am super bullish for the dollar.

The $ has been bullish since 2008, we all see it.

Time for the next leg up.

Let's go!

Kind regards,

@ mnieveld

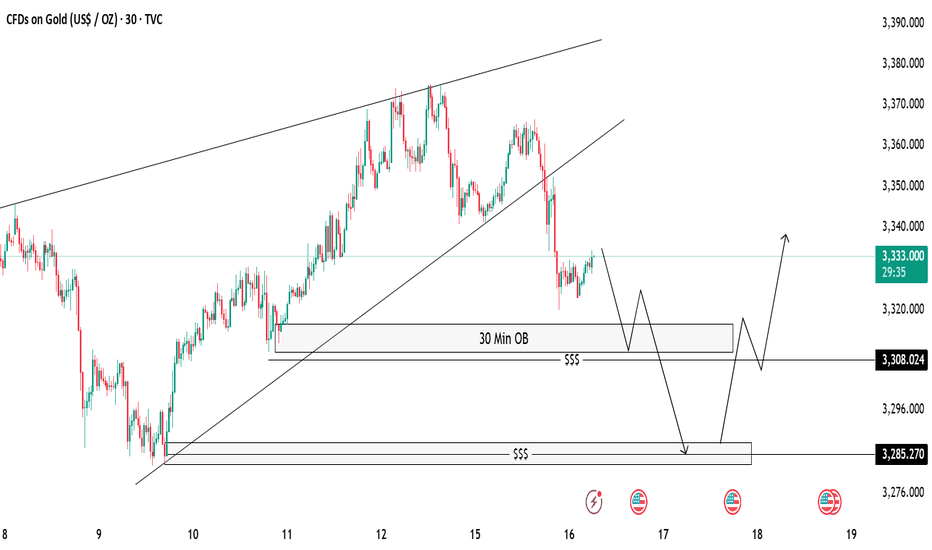

Gold 30-Min OB Analysis – Bounce or Drop..?Gold is showing a break of structure after a big sell-off 🔻. We have marked a 30-Minute Order Block (OB) 📍 which can act as a possible reaction zone.

📌 Two Scenarios We Are Watching:

✅ Scenario 1 (Bullish):

If price taps into the 30M OB and shows bullish rejection 🟢, we can look for buy opportunities, targeting the previous highs near 3335-3340 🎯.

❌ Scenario 2 (Bearish):

If price fails to hold the OB, we will watch for a liquidity sweep (marked with $$$) and expect price to move lower towards the next demand zone near 3285 📉.

⚠️ Key Notes:

Always wait for confirmation before entry.

Patience is the key 🧘♂️ — let the market come to us.

GOLD LONG FROM RISING SUPPORT|

✅GOLD is trading in an uptrend

Which makes me bullish biased

And the price is retesting the rising support

Thus, a rebound and a move up is expected

With the target of retesting the level above at 3,350$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

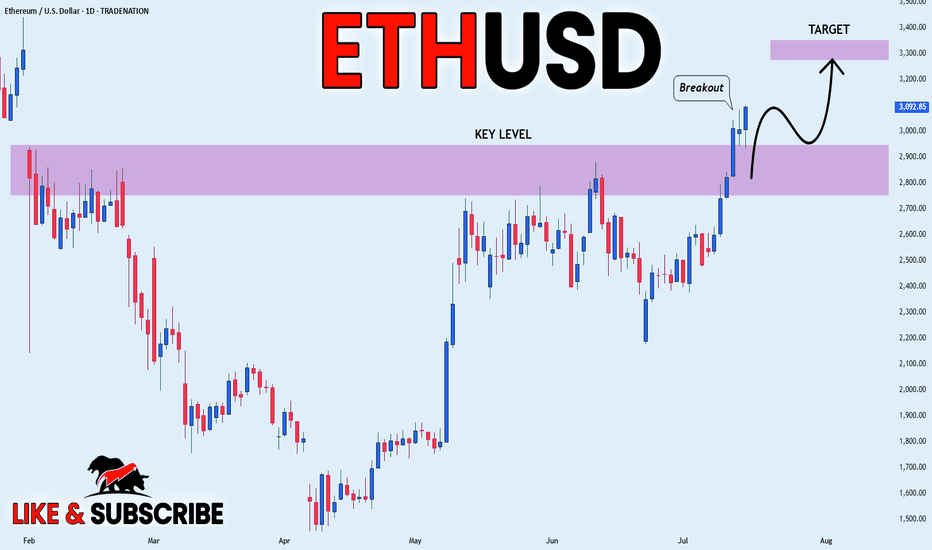

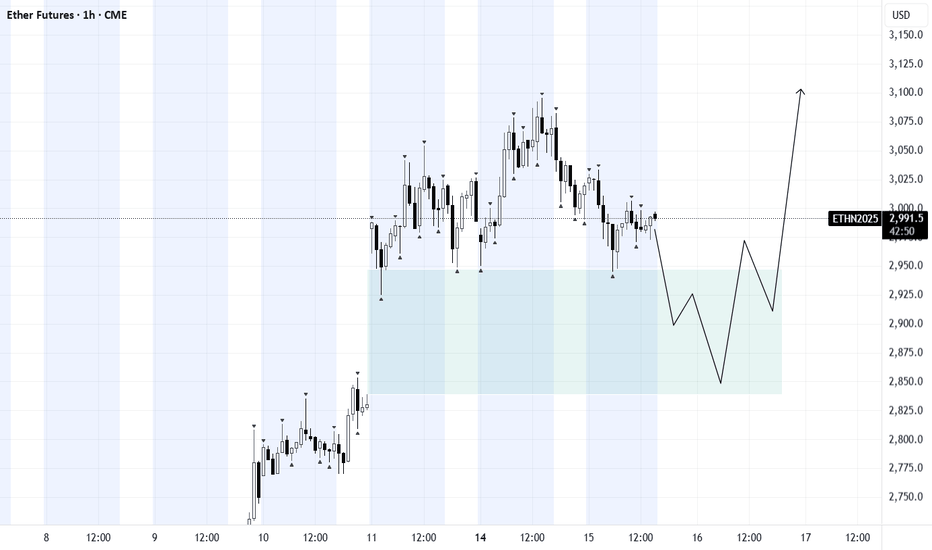

ETHEREUM WILL KEEP GROWING|LONG|

✅ETHEREUM is going up

Now and the coin made a bullish

Breakout of the key horizontal

Level of 3000$ and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

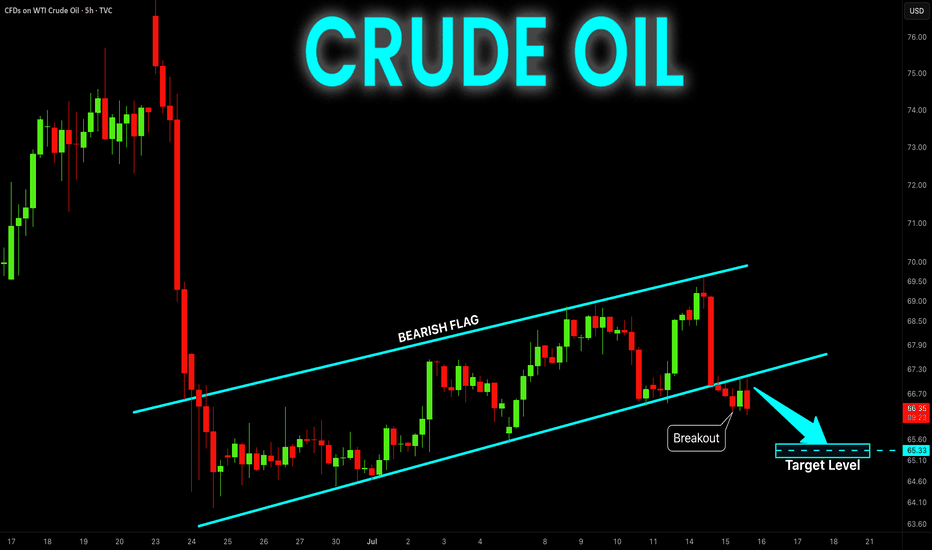

CRUDE OIL Bearish Flag Breakout! Sell!

Hello,Traders!

CRUDE OIL is trading in a local

Downtrend and formed a bearish

Flag pattern and now we are

Seeing a bearish breakout

So we are bearish biased

And we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER Support Ahead! Buy!

Hello,Traders!

SILVER is going down now

But the price is trading in a

Long-term uptrend so we are

Bullish biased and after the

Price retests of the horizontal

Support support below

Around 37.20$ we will be

Expecting a bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_USD BEARISH BREAKOUT|SHORT|

✅EUR_USD was trading along

The rising support line but

Now we are seeing a strong bearish

Breakout and the breakout is

Confirmed so we are bearish

Biased and we will be expecting

A further bearish move down

After the potential pullback

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

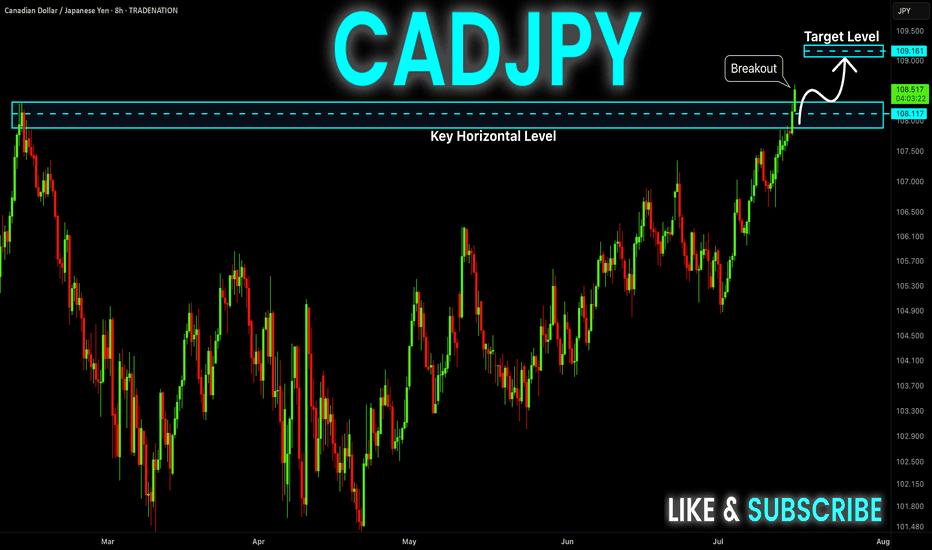

CAD-JPY Strong Bullish Breakout! Buy!

Hello,Traders!

CAD-JPY keeps trading in a

Strong uptrend and the pair

Made a strong bullish breakout

Of the key horizontal level

Of 108.299 so we are bullish

Biased and we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD: Long Trade Explained

GBPNZD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long GBPNZD

Entry - 2.2484

Sl - 2.2425

Tp - 2.2599

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD: Long Trade with Entry/SL/TP

EURUSD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURUSD

Entry - 1.1635

Stop - 1.1597

Take - 1.1708

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

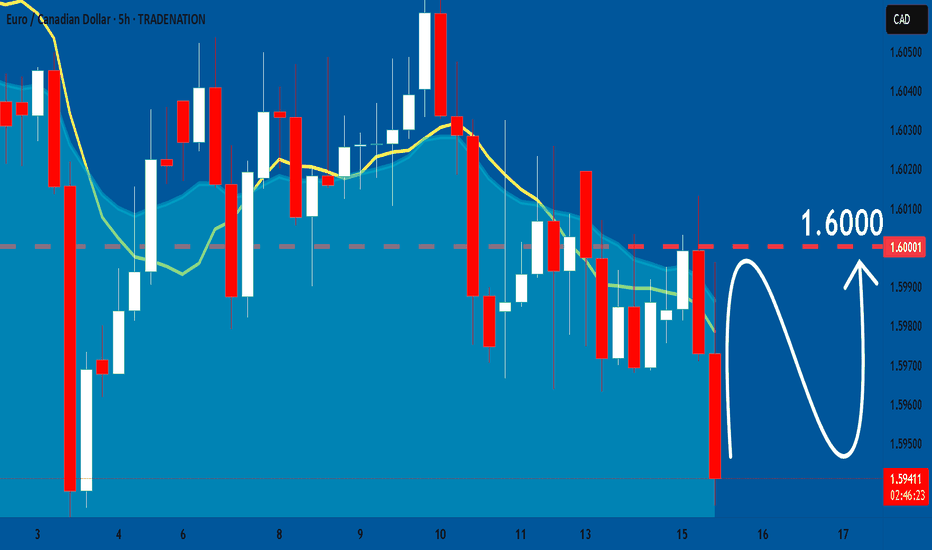

EURCAD: Bullish Forecast & Bullish Scenario

The price of EURCAD will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZDCAD: Will Start Growing! Here is Why:

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy NZDCAD.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️