USD-CHF Free Signal! Buy!

Hello,Traders!

USD-CHF keeps falling down

But the pair will soon hit

A horizontal support

Of 0.8754 from where

We can enter a long trade

With the TP of 0.8795

And the SL of 0.8730

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Smartmoneyconcept

CAD-JPY Free Signal! Sell!

Hello,Traders!

CAD-JPY keeps going up

But as you can see there is

A strong horizontal resistance

Around 105.035 so after the

Retest a short trade can be

Entered with the TP of 104.188

And SL of 105.520

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-NZD Free Signal! Buy!

Hello,Traders!

AUD-NZD has been falling

Recently and the pair is locally

Oversold so after it hits the

Horizontal support level

Of 1.0956 a long trade

Can be entered with the

TP of 1.0990 and SL of 1.0937

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_AUD LONG SIGNAL|

✅GBP_AUD is moving down

Down now to retest a horizotnal

Support level of 2.0327 from

Where we can enter a long

Trade with the Take Profit

Of 2.0413 and SL of 2.0270

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-CHF Bearish Wedge Pattern! Sell!

Hello,Traders!

EUR-CHF was trading in an

Uptrend but the pair has formed

A bearish wedge pattern so

IF we see a bearish breakout

From the wedge we will be

Expecting a bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CAD Bearish Breakout! Sell!

Hello,Traders!

USD-CAD kept bouncing

Off of the horizontal support

Of 1.4355 but then it was

Finally broken and the breakout

Is Confirmed so we are locally

Bearish biased and we will be

Expecting the pair to go

Further down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AMAZON SWING LONG FROM SUPPORT|LONG|

✅AMAZON fell again to retest the support of 190.79$

But it is a strong key level

So I think that there is a high chance

That we will see a bullish rebound and a move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

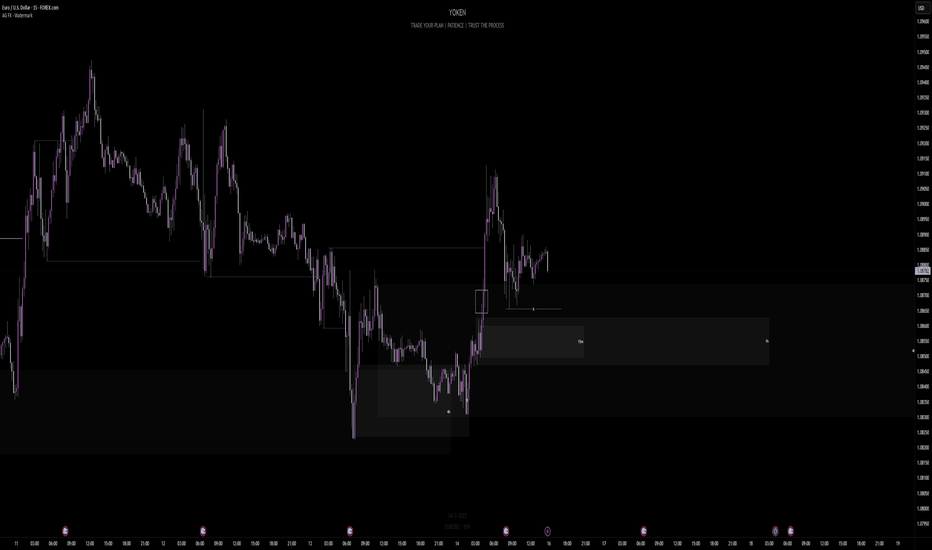

Week of 3/16/25: EURUSD Analysis FIRST VIDEO PUBLISH!First video publish, testing out my recording but also giving my insights for the week ahead. The candle color looks a bit off but hopefully it can be fixed for the next publish.

Pardon the background noise in the first few seconds of the video.

Let me know how the quality and your thoughts/analysis as well!

Happy trading and have a great week traders, let's win.

GBP_NZD NEW LONG SIGNAL|

✅GBP_NZD is going down now

But a strong support level is ahead at 2.2454

Thus I am expecting a pullback

So we can prepare to enter

A long trade with the target 2.2562

And Stop Loss of 2.2406

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-NZD Risky Long! Buy!

Hello,Traders!

EUR-NZD is approaching a

Horizontal support level

Of 1.8868 so after the

Retest of the support

A long trade with the

Target Level of 1.8947

And Stop Loss of 1.8851

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-CHF Move Up Expected! Buy!

Hello,Traders!

AUD-CHF made a bullish

Breakout of the key horizontal

Level of 0.5576 and the

Breakout is confirmed

Because the daily candle

Closed above the key level

So on the market open

We will be expecting a

Local pullback and then

A strong move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_AUD SUPPORT AHEAD|LONG|

✅EUR_AUD is making a bearish

Correction and will soon retest a

Key support level of 1.7100

While trading in a strong uptrend

So I think that the pair will make a rebound

And go up to retest the supply level above at 1.7260

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER Swing Long! Buy!

Hello,Traders!

SILVER made a strong

Bullish brekaout and

The breakout is confirmed

As the daily candle closed above

The key horizontal level of 33.20$

So we are bullish biased

But we will fist expect some

Correction on Monday

With the potential retest

Of the new support level

From where we believe

Growth will continue

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_NZD LONG SIGNAL|

✅EUR_NZD is going down now

But a strong support level is ahead at 1.8902

So after the retest on Monday we can

Enter a long trade with the target of 189640

And a Stop Loss of 1.8866

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-NZD Strong Support Ahead! Buy!

Hello,Traders!

GBP-NZD is making a bearish

Correction after trading in an

Uptrend for some time but a

Strong horizontal support

Level is ahead at 2.2394

So after the retest we will

Be expecting a new

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_CAD WILL FALL|SHORT|

✅GBP_CAD broke the rising

Support line after trading in an

Uptrend for a long time so

We will be awaiting a long

Overdue correction and a

Move down on Monday

Towards the target of 1.8500

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-JPY Bearish Bias! Sell!

Hello,Traders!

NZD-JPY is about to

Retest a horizontal

Resistance level of 85.647

And as it is a strong level

A local bearish correction

Is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bitcoin - Market outlook for the upcoming weeksLiquidity Sweep of the Last 4-Hour Low

Last week, Bitcoin pulled a classic sell-side liquidity sweep by breaking below the last 4-hour low. This move likely targeted stop-loss orders placed by long traders and trapped breakout sellers. The price dipped sharply below this key level but quickly reversed upward, signaling a potential bullish reversal. Such movements are often orchestrated by institutional players or "smart money" to accumulate liquidity before driving the market in their desired direction

Key characteristics of this liquidity sweep include:

Key Liquidity Zone: The 4-hour low acted as a critical support level where many traders had stop-loss orders.

Sharp Price Spike Below: The price briefly dipped below this level, triggering stop-losses and enticing short sellers.

Aggressive Reversal: Following the sweep, the price rebounded strongly, forming bullish rejection candles on lower timeframes. This confirms the sweep and suggests that smart money may now push prices higher

Resistance Zone and Current Market Structure

The current resistance level is marked by the blue zone, which represents a key imbalance area. For the bullish reversal to gain momentum, Bitcoin must break above this resistance convincingly.

A breakout above this zone would:

Confirm a shift in market structure to bullish.

Likely lead to a retest of the resistance zone as new support (a common breakout strategy).

Open the door for further upside movement toward higher targets.

However, if Bitcoin fails to break above this resistance, it could indicate continued consolidation or even another test of lower levels.

Impact of Today’s PPI Dat a

The U.S. Bureau of Labor Statistics reported that the Producer Price Index for final demand was unchanged in February 2025, seasonally adjusted. This figure came in below economists expectations of a 0.3% increase. Even tho Bitcoin did not react to this right now, it could still show some signs later.

Conclusion

The sell-side liquidity sweep below the last 4-hour low is a textbook example of smart money manipulation, setting the stage for a potential bullish reversal. Traders should closely monitor the blue resistance zone for signs of a breakout or rejection. Additionally, today’s PPI data adds another layer of complexity to market dynamics, potentially swaying sentiment depending on whether it signals inflationary pressures or relief.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

NZD-USD Short From Resistance! Sell!

Hello,Traders!

NZD-USD was going up

Yet failed to reach and

Break the horizontal resistance

Of 0.5772 before the trading week's

End so the bulls are not as strong

As we initially thought which

Give us a nice opportunity

To enter a short trade on

The pair on Monday

With the Target of 0.5732

And Stop Loss of 0.5775

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.