NZD_USD SHORT FROM SUPPLY AREA|

✅NZD_USD is going up now

But a strong resistance level is ahead at 0.5860

Thus I am expecting a pullback

And a move down towards the target at 0.5790

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Smartmoneyconcepts

EUR_NZD LOCAL LONG|

✅EUR_NZD is going down

Now but a local horizontal

Support level is ahead at 1.9300

So after the retest a local

Bullish rebound is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_USD BULLISH BREAKOUT|LONG|

✅AUD_USD is going up now

And the pair made a bullish

Breakout of the key horizontal

Level of 0.6200 which is now

A support and the breakout

Is confirmed so we are locally

Bullish biased and we will be

Expecting a further move up

After a potential pullback

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-USD Swing Short! Sell!

Hello,Traders!

EUR-USD grew nicely

Today but will soon hit

A horizontal resistance

Level of 1.1279 so after

The retest we will be

Expecting a local bearish

Correction and a move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Examples of invalid setups | Judas Swing Strategy 07/04/2025As traders, it's crucial to spend time in the lab backtesting your strategy and exploring ways to optimize it for better performance in live markets. You’ll start to notice recurring patterns, some that work in your favor, and others that consistently lead to unnecessary losses. It might take time to spot these patterns and even longer to refine them to fit your trading system, but going through this process is what helps you evolve. In the long run, this is what you need to do to become a better trader.

We spent a considerable amount of time refining our entry technique for the Judas Swing strategy after noticing a recurring issue where entering with a limit order sometimes gets us stopped out on the very same candle. After testing a few alternative entry methods and making some key adjustments, we finally found an approach that worked consistently for us. On Monday, April 7th, 2025, this refinement proved its worth by saving us from two potentially painful losses. In this post, we’ll walk you through exactly what happened and how the improved entry made all the difference.

We got to our trading desks ready to scout for setups and were drawn to promising setups forming on both FX:AUDUSD and $NZDUSD. This was exciting since the previous week offered no solid trading opportunities. As price swept the liquidity resting above the highs of the zone our bias quickly shifted toward potential selling setups for the session. But before taking any trade, we always ensure every item on our entry checklist is met. Here’s what we look for:

1. A break of structure to the sell side

2. The formation of a Fair Value Gap (FVG)

3. A retracement into the FVG

4. Entry only after a confirmed candle close

With the first two requirements on our checklist confirmed, all that remained were the final two and at this stage, patience is key. As price began retracing toward the FVG on both FX:AUDUSD and OANDA:NZDUSD , things got interesting. Price came into the Fair Value Gap on both pairs, checking off the third requirement. Now, all that was left was to wait for the current candle to close.

But that’s where things will be clear to you now.

Had we jumped in early with a limit order, we would’ve been stopped out on the same candle. This moment served as a perfect reminder of why we now wait for a confirmed candle close before taking any trade. It’s this extra step that helps us avoid unnecessary losses and stick to high-quality setups.

This entry technique like any other, comes with its own set of pros and cons. At times a limit order might offer a more favorable entry price compared to waiting for a candle close and that can influence both your stop-loss and take-profit placements. On the flip side, there are also instances where waiting for the candle close gives you a better entry than the limit order would have. That’s why it’s so important to backtest.

Your job as a trader is to put in the time to study and test what works best for your system. We chose this candle close entry method because we did the work. After extensive backtesting and data analysis, we found this approach aligns best with the results we aim for in the long run.

AUD_NZD POTENTIAL SHORT|

✅AUD_NZD is going up now

But a strong resistance level is ahead at 1.094

Thus I am expecting a pullback

And a move down towards the target at 1.086

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_USD SHORT FROM RESISTANCE|

✅NZD_USD will soon retest a key resistance level of 0.5680

So I think that the pair will make a pullback

And go down to retest the demand level of 0.5620 below

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_USD SUPPORT CLUSTER|LONG|

✅GBP_USD is going down

To retest a strong support

Cluster of the rising and

Horizontal support levels

So a local rebound is to be

Expected but its a risky

Setup given the general

Volatility on the market

So use small lot size

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS Bearish Breakout! Sell!

Hello,Traders!

NATGAS made a bearish

Breakout of the key horizontal

Resistance of 3.626$ and the

Breakout is confirmed so we

Are bearish biased and we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Will Go UP! Buy!

Hello,Traders!

GOLD made a nice correction

Of almost 7% on the general

Panic over the trade wars which

Gives us a great opportunity

To jump into Gold with a discount

From a nice horizontal support

Level of 2945$ from where

We will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-GBP Swing Short! Sell!

Hello,Traders!

EUR-GBP surged sharply

And is locally overbought

So after the pair hits the

Horizontal resistance

Of 0.8624 we will be

Expecting a local

Bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_USD RISKY LONG|

✅NZD_USD has hit a key structure level of 0.5520

Which implies a high likelihood of a move up

As some market participants will be taking profit from short positions

While others will find this price level to be good for buying

So as usual we will have a chance to ride the wave of a bullish correction

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bitcoin Analysis - Bear Trap Complete - Bullish Reversal StartedBitcoin recently swept the liquidity resting at the $78K level, taking out the previous lows before initiating a strong reversal with a double break of structure to the upside. This signals that smart money has engineered liquidity to trap retail traders and induce early shorts before driving price in the intended direction.

The move up has left behind a well-defined bullish order block in confluence with a fair value gap, which held firmly on the retracement. This confirms that institutional positioning is present, and the market is now efficiently repricing higher. The fact that price reacted strongly from this zone further reinforces that smart money has absorbed sell-side liquidity, and the path of least resistance is now to the upside.

With liquidity now resting above the descending bearish trendline, price has a clear target. The bearish trendlines, especially in the context of a corrective move, act as a liquidity magnet. Retail traders shorting into this structure are providing the fuel for the next leg up, as their stops accumulate above each lower high. The market makers and algorithmic liquidity providers understand this, and price is now gravitating towards that liquidity pool. The inefficiencies left on the chart from the recent aggressive down move also suggest that these imbalances need to be filled, further strengthening the case for continued bullish expansion.

The entire bearish move preceding this was nothing more than a well-structured inducement. It served to lure in breakout sellers, create the illusion of a sustained downtrend, and trap liquidity at the lows before the true direction was revealed. This is a classic example of manipulation before expansion. This principle repeats across all timeframes and market conditions.

With this in mind, the most probable scenario now is a continuation towards the next major liquidity pool above the bearish trendline, likely leading price into the 92K–98K range where a significant daily order block sits. This area will be critical to observe, as it could act as a distribution zone where smart money starts offloading positions. However, until then, the structure remains decisively bullish, and every retracement into demand zones should be seen as an opportunity to position long, rather than a sign of weakness.

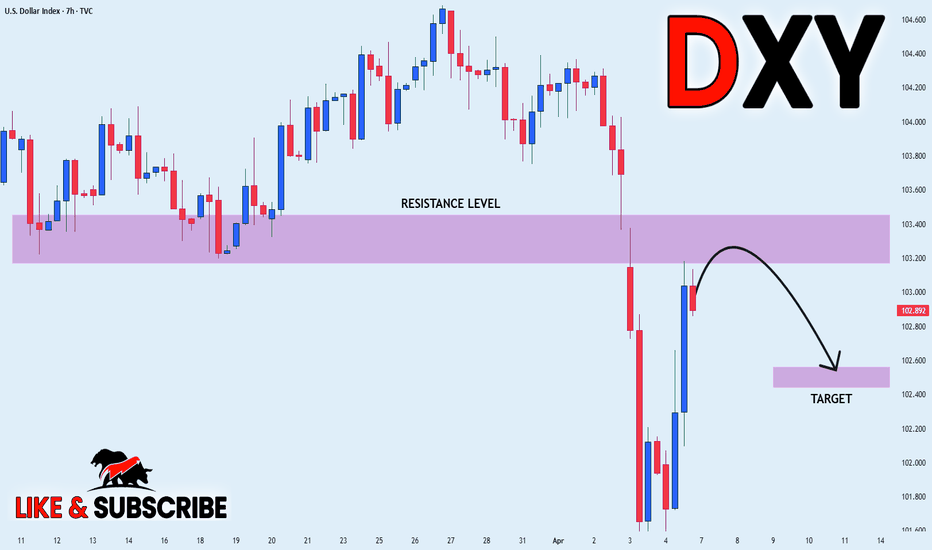

DXY PULLBACK EXPECTED|SHORT|

✅DXY surged again to retest the resistance of 103.400

But it is a strong key level

So I think that there is a high chance

That we will see a bearish pullback and a move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-USD Strong Support Ahead! Buy!

Hello,Traders!

NZD-NZD is approaching a

Horizontal support level

Of 0.5521 so when the

Market opens we will be

Expecting the pair to retest

The support first and then

Make a nice bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-NZD Massive Long! Buy!

Hello,Traders!

AUD-NZD has also fallen

Down by a lot last week

And we think that the

Initial panic move is over

So as the pair is oversold

And is about to retest a

Horizontal support of 1.0740

A strong bullish correction

Is to be expected on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

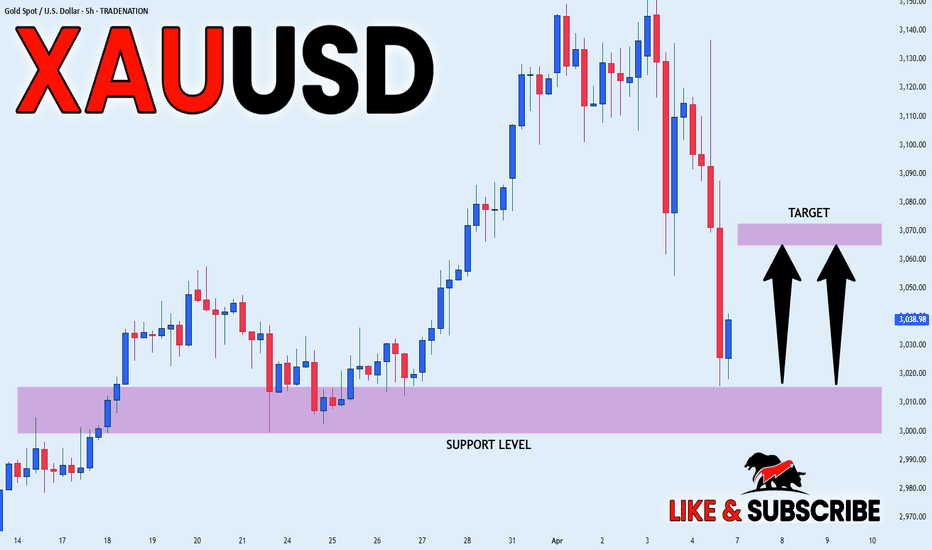

GOLD BULLISH BIAS|LONG|

✅GOLD fell again to retest the support

But it is a strong key level of 3000$

So we are already seeing a rebound

And we will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS SUPPORT AHEAD|LONG|

✅NATGAS will soon retest a key support level of 3.728$

So I think that the pair will make a rebound

And go up to retest the supply level above at 3.887

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER Strong Support Ahead! Buy!

Hello,Traders!

SILVER got decimated

By the bears last week

And lost almost 15%

Of its value, which is

Clearly an overreaction

And an oversold situation

So after the potential retet

Of the strong horizontal

Support below around 28.97$

On Monday we are likely

To see a bullish correction

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DAX RISKY LONG|

✅DAX is going down to retest

A horizontal support of 20,400

Which makes me locally bullish biased

And I think that we will see a rebound

And a move up from the level

Towards the target above at 20,800

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD 3000$ Key Level Ahead! Buy!

Hello,Traders!

GOLD is making a bearish

Correction just as pretty

Much everything else on

The market, but Gold is

Trading in a long-term

Uptrend so after the

Price hits an important

Psychological level

Around 3000$ a local

Bullish trend-following

Rebound is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CAD Short From Resistance! Sell!

Hello,Traders!

USD-CAD went down and

Then up sharply on the

Tariff announcements

And the pair is now approaching

A horizontal resistance of 1.4264

From where we will be

Expecting a local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Ethereum Analysis - Bull Trap - Don't Buy!COINBASE:ETHUSD recently tapped into the 1,800$ order block, but rather than signaling a bullish reversal, this level appears to be pure inducement. There is no fair value gap above this zone, meaning there’s no true imbalance that price needs to mitigate. This suggests that smart money is not positioning for higher prices here, but instead using this level to lure in retail longs before engineering a deeper move to the downside.

The broader market structure remains bearish, with price continuously making lower highs and lower lows. While many traders may see the 1,800 order block as a support level, the absence of a fair value gap indicates that this area lacks real institutional interest. Instead, it serves as a liquidity pool where market makers can absorb buy orders before driving price lower. The true liquidity targets lie below, particularly around the 600$ levels, where a significant number of stop losses and liquidation points are resting. These levels act as magnets, and until they are taken, the probability of a sustained bullish move remains low.

Additionally, the inefficiencies left in the previous sharp upward move suggest that price still has unfinished business to the downside. Smart money thrives on liquidity, and the clean lows below 600$ offer an attractive area for a deeper sweep before any meaningful bullish expansion can take place. This is a classic case of market manipulation, where early longs are baited into the market just before a significant downside move clears out weaker hands.

Once liquidity has been swept from the 600$ regions, the probability of a true reversal increases. At that point, institutional players will have accumulated enough liquidity to justify a move higher. The most logical upside target following this sweep is the 2,700 order block, which aligns with a previous imbalance and a major area of institutional interest. However, until the sell-side liquidity is fully taken out, any attempt at longs is premature and likely to result in being used as exit liquidity for smart money.

In conclusion, the current price action is a textbook example of liquidity engineering. The move down into 1,800$ was a carefully orchestrated inducement to trap buyers before a deeper price correction. The most probable scenario is a continued decline to sweep liquidity below 600$, at which point smart money will begin repositioning for a true bullish move toward 2,700. Until then, every attempt to push higher is likely just part of a larger manipulation cycle designed to fuel the next major market move.