GBP_CHF LONG SIGNAL|

✅GBP_CHF is trading in an uptrend

Along the rising support line

Which makes me bullish biased

And the pair is about to retest the rising support

Thus, a rebound and a move up is expected

So we can enter a long trade with

The TP of 1.1410 and SL of 1.1350

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Smartmoneyconcepts

TRADE IDEAS: ES FUTURES (ESM2025) – 3/26/2025 PLAYBOOK# 📊 TRADE IDEAS: ES FUTURES (ESM2025) – 3/26/2025 PLAYBOOK

## 🟢 SCENARIO 1 (BULLISH)

**DIRECTION:** Long

**STRUCTURE BIAS:** Bullish

**ENTRY LEVEL:** 5,795-5,815 (current zone, buying sell-side liquidity raids)

**STOP LEVEL:** 5,785 (invalidate if hourly close below this level)

**TARGET LEVELS:**

- **Target 1:** 5,880-5900 (Weekly Key High Resistance Level)

**R/R RATIO:** ~3:1 (depending on final execution)

### EXECUTION STRATEGY

- **Entry Confirmation:** Look for price to raid previous unhit weekly lows (sell-side liquidity)

- **Long Entries:** Establish long positions as price successfully raids these lows but fails to sustain below them

- **Stop Placement:** Use 5,785 as a hard stop (hourly close below invalidates the trade idea)

- **Target:** Take profits at 5880 - 5,900 (Weekly Key High Resistance)

### KEY POINTS

- Current price action targeting sell-side liquidity in the form of previous unhit weekly lows

- Wednesday typically not a low/high of week formation day, suggesting potential for continued movement

- Tomorrow's High Impact News Event (GDP at 8:30 AM) likely to create volatility and could accelerate the move

- Bullish structure prevails as long as price maintains above liquidity raid zones

---

## 🔴 SCENARIO 2 (BEARISH)

**DIRECTION:** Short

**STRUCTURE BIAS:** Bearish after bullish extension

**ENTRY LEVEL:** 5,880-5910 (Weekly Key High Resistance Level)

**STOP LEVEL:** 5,9550 (invalidate if hourly close above this level)

**TARGET LEVELS:**

- **Target 1:** 5,740 (Weekly Opening Gap upper boundary)

**R/R RATIO:** ~3:1 (depending on final execution)

### EXECUTION STRATEGY

- **No Immediate Short:** Wait for price to extend to Weekly Key High Resistance Level (blue line ~5,900)

- **Rejection Confirmation:** Look for reversal candles and selling pressure at resistance

- **Short Entries:** Establish short positions once price trades below confirmation level after testing resistance

- **Stop Placement:** Use 5,925-5950 as a hard stop (hourly close above invalidates the trade idea)

- **Scaling Out:** Partial profit near 5,800, hold remaining for potential move to 5,745 area

### KEY POINTS

- After liquidity is taken at the Weekly Key High Resistance (blue line), expect manipulation and reversal

- Short opportunity emerges only after bulls exhaust momentum at key resistance

- Weekly Opening Gap (red zone) remains a significant downside target for next move

- Any sustained hourly close above 5,965 **invalidates** this bearish setup

## MARKET BIAS

- **SHORT TERM (Today – 1 Day):**

- **Bullish** bias as price is likely to find support at current levels and move toward the Weekly Key High Resistance

- Current price action suggests accumulation before a move higher

- Tomorrow's GDP numbers (8:30 AM) represent a potential catalyst for accelerated movement

- **LONGER TERM (1–2 Weeks):**

- After testing the Weekly Key High Resistance level (~5,900), expect a reversal and move back toward the Weekly Opening Gap (red zone)

- Market structure suggests a "liquidity hunt" pattern – first to the upside, then reversing to the downside

- Major liquidity draw currently at the blue line, once exhausted, focus will shift back to the Weekly Opening Gap

SPY WILL FALL|SHORT|

✅SPY has hit a key structure level of 577.50$

Which implies a high likelihood of a move down

As some market participants will be taking profit from their long positions

While others will find this price level to be good for selling

So as usual we will have a chance to ride the wave of a bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL SHORT FROM RESISTANCE|

✅CRUDE OIL has hit a TP

Of our last free signal and

Went further up just as we

Predicted but will soon hit

A horizontal resistance level

Of 70.57$ from where we will

Be expecting a local bearish

Correction and a move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_CAD LOCAL LONG|

✅USD_CAD fell again to

Retest the support of 1.4420

But it is a strong key level

So I think that there is a high chance

We will see a bullish rebound and a move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NIKKEI INDEX BEARISH BIAS|SHORT|

✅NIKKEI is going up now

But a strong resistance level is ahead at 38,400

Thus I am expecting a pullback

And a move down towards the target of 37,530

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CAD Long From Support! Buy!

Hello,Traders!

USD-CAD made a retest of

The horizontal support level

Of 1.4256 and we are already

Seeing a bullish rebound so

We will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

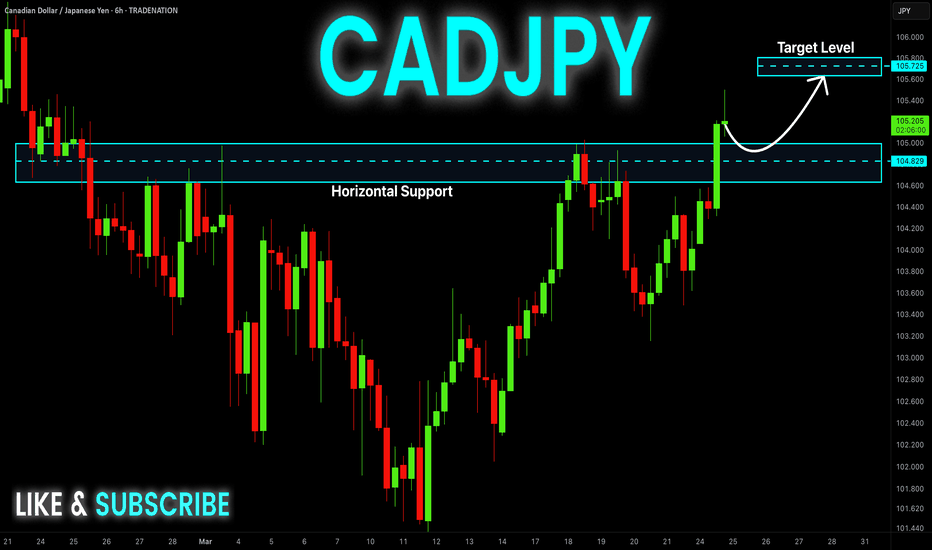

CAD_JPY POTENTIAL LONG|

✅CAD_JPY made a bullish

Breakout of the key horizontal

Level of 104.800 and the breakout

Is confirmed which reinforces our

Bullish bias and makes us expect

A further move up after the

Retest of the new support

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-CAD Risky Long! Buy!

Hello,Traders!

NZD-CAD made a retest

Of the horizontal support

Of 0.8170 and we are already

Seeing a bullish rebound

So we are bullish biased

And we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD-JPY Bullish Breakout! Buy!

Hello,Traders!

CAD-JPY is trading in a

Local uptrend and the pair

Made a nice bullish breakout

Of the key horizontal level

Of 104.829 which is now

A support and the breakout

Is confirmed so we are

Locally bullish biased and

We will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_USD SUPPORT AHEAD|LONG|

✅NZD_USD is set to retest a

Strong support level below at 0.5690

After trading in a local downtrend from some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 0.5750

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

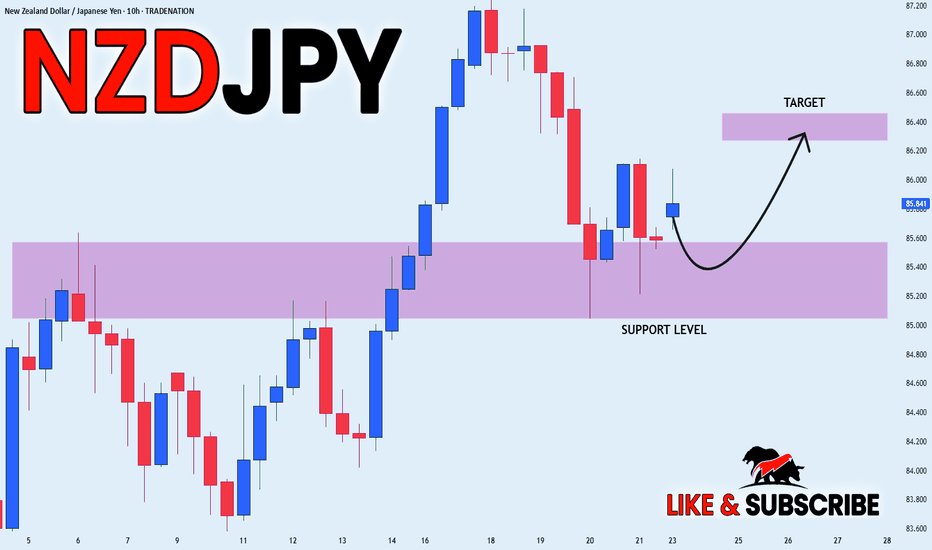

NZD_JPY WILL GO UP|LONG|

✅NZD_JPY has retested a key support level of 85.200

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 86.400 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_CHF RISKY LONG|

✅NZD_CHF is going down to retest a horizontal support of 0.5050

Which makes me locally bullish biased

And I think that we will see a rebound

And a move up from the level

Towards the target above at 0.5073

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Risky Short! Sell!

Hello,Traders!

GOLD made a rebound

From the support and went

Up but will now retest a

Local horizontal level

Of 3030$ from where

We will be expecting

A local bearish reaction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-CAD Bearish Breakout! Sell!

Hello,Traders!

AUD-CAD made a bearish

Breakout of the key horizontal

Level of 0.9022 which is now

A resistance and the breakout

Is confirmed so we are bearish

Biased and we will be expecting

A further move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_CHF SHORT FROM RESISTANCE|

✅USD_CHF is going up now

But a strong resistance level is ahead at 0.8866

Thus I am expecting a pullback

And a move down towards the target of 0.8810

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPUSD – Bearish Setup Forming | Fair Value Gap Rejection PlayThe 4H chart on GBP/USD shows a clean bearish market structure, with price currently in a corrective phase after recent downside momentum. A Fair Value Gap (FVG) has been identified between the 1.29700–1.30000 range, which acts as a key supply zone for potential short setups.

📊 Technical Breakdown

1. Fair Value Gap (FVG)

A visible imbalance was left after an aggressive bearish move—marked in the yellow zone.

Price is expected to retrace into this inefficient zone to fill orders before continuing downward.

The anticipated entry for shorts is around 1.29798, near the midpoint of the FVG.

2. Bearish Market Structure

Lower highs and lower lows dominate the current structure.

The bounce is corrective in nature and lacks momentum, indicating a potential bull trap.

Expecting a short-term retracement up to the FVG zone, followed by a continuation to the downside.

3. Target Zone

Target: 1.28042 — this level sits just above a previous demand zone, making it a natural TP1.

This area also overlaps with previous price reactions, giving it high confluence.

🧠 Trade Idea

Entry: ~1.29798 (within the FVG)

Target: 1.28042

Risk Management : A stop loss above 1.30000 or above the upper boundary of the FVG to account for false breaks.

Rationale: Risk-reward is favorable due to tight invalidation zone and strong downside continuation probability.

⚠️ Key Notes

Watch for confirmation at the FVG zone such as bearish engulfing or lower timeframe break of structure.

If price breaks above 1.3000 and holds, the idea will be invalidated.

USD-JPY Move Down Ahead! Sell!

Hello,Traders!

USD-JPY is trading in a

Downtrend below the falling

Resistance line and the pair

Will soon hit the resistance

From where we will be

Expecting a further move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DAX WILL GO UP|LONG|

✅DAX is trading in an uptrend

Along the rising support line

Which makes me bullish biased

And the index is about to retest the rising support

Thus, a rebound and a move up is expected

With the target of retesting the level above at 23,200

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

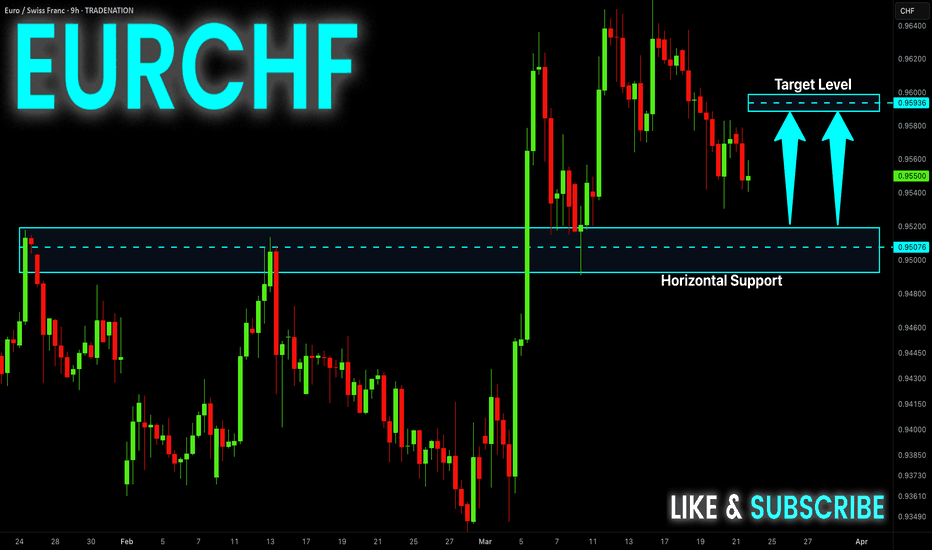

EUR-CHF First Down, Then UP! Buy!

Hello,Traders!

EUR-CHF keeps falling down

After making it through the

Local structure of 0.9580

So we think that the pair will

First fall further down to

Retest the horizontal support

Of 0.9507 and after that

We will see a rebound and

A new wave of growth

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DAX Growth Ahead! Buy!

Hello,Traders!

DAX is going down

And will soon retest the

Rising support and after

The retest we will be

Expecting a bullish rebound

Because we are bullish biased

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_USD RISING SUPPORT AHEAD|LONG|

✅AUD_USD is trading along the rising support

And as the pair will soon retest it

I am expecting the price to go up

To retest the supply levels above at 0.6300

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_CHF SUPPORT AHEAD|LONG|

✅EUR_CHF will be retesting a support level of 0.9500 soon

From where I am expecting a bullish reaction

With the price going up but we need

To wait for a reversal pattern to form

Before entering the trade, so that we

Get a higher success probability of the trade

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.