EUR_NZD LOCAL SHORT|

✅EUR_NZD is set to retest a

Strong resistance level above at 1.9488

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 1.9420

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Smartmoneyconcepts

USD-CAD Local Rebound! Buy!

Hello,Traders!

USD-CAD is trading in a

Strong downtrend but

The pair made a retest

Of the horizontal support

Level of 1.3540 from where

We are already seeing a

Bullish rebound and we

Will be expecting a

Further move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_JPY RISKY SHORT|

✅AUD_JPY is set to retest a

Strong resistance level above at 95.600

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 95.081

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER Short From Resistance! Sell!

Hello,Traders!

SILVER is trading in an

Uptrend but the price will

Soon hit a horizontal resistance

Area around 37,32$ from

Where we will be expecting

A local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_GBP BULLISH BIAS|LONG|

✅EUR_GBP broke the key

Structure level of 0.8620

While trading in an local uptrend

Which makes me bullish

And I think that after the retest

Of the broken level is complete

A rebound and bullish continuation will follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-JPY Correction Ahead! Buy!

Hello,Traders!

GBP-JPY will soon make

A retest of the rising support

Line and as we are bullish

Biased we will be expecting

A local bullish correction

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-AUD Rising Support Ahead! Buy!

Hello,Traders!

GBP-AUD made a sharp

And sudden move down

And the pair is oversold

So after it retest the rising

Support line we will be

Expecting a local bullish

Correction and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

UJ, will we see a bearish leg today?USDJPY looks quite interesting after the wick rejection from key level 144.000. Will this area be respected and give us a bearish leg. Hmm, let's see how price unfolds for this pair today.

Regards,

Aman | SMC Wolf FX

1-1 student onboarding is currently open (website in my signature & profile)

GJ: 50 pip bear leg forecastHi everyone,

I'm forecasting a 50 pip bearish leg on GBPJPY from 197.5 down to 197.0

Looking at price to sweep the highs first (liquidity sweep), before then waiting for the right confirmations to take it lower... IF the price says so.

Kind regards,

Aman | SMC Wolf FX

1-1 student onboarding is currently open (website in my signature & profile)

GU: Asian highs > Previous Day Low?Hi everyone,

Here is my forecast this morning for GBPUSD. Overall I'm thinking bearish, but I reckon that price could take out the Asian range highs first and then give us a bearish leg towards the previous day low.

Regards,

Aman | SMC Wolf FX

1-1 student onboarding is currently open (website in my signature & profile)

How to Trade Liquidity Sweep in Forex Market (SMC Trading)

I will show you a real example of trading liquidity sweep with Smart Money Concepts.

You will learn the essential SMC liquidity basics, a simple and profitable strategy to identify and trade liquidity sweep.

I will share with you an accurate entry confirmation signal that works perfectly on any Forex pair.

Liquidity Basics

In order to trade liquidity sweeps profitably, you should learn to identify significant liquidity zones.

To spot them, analyze a historic price action and find clusters of important historic key levels.

Examine a price action on EURUSD on an hourly time frame.

I underlined multiple horizontal key levels.

The price respected each level, found support on them, and rebounded.

What is so specific about these levels is that they are lying close to each other, composing a liquidity cluster.

That fact that EURUSD strongly bounced from these levels suggests that buying interest and high buying volumes were concentrated around them.

We can unite these levels and treat them as a single demand zone that has just been broken and turned into a supply zone.

After we found a valid liquidity zone, we can look for a liquidity sweep.

First, we should let the price approach that area and look for a specific price behavior then.

That is a perfect example of a liquidity sweep.

You can see that the price formed a wide range candle with a long tail.

Its high went way beyond the underlined area, but its body closed within.

In order to understand, why a liquidity sweep occurred, let's zoom in our chart and try to understand a behavior of the market participants.

Our supply zone concentrated selling orders , we assume that sellers were placing their orders across its entire length.

Their stop losses were presumably lying above that area.

Smart Money know that and with a liquidity sweep they manipulate the market, making sellers close their positions in a loss (buying back their positions from the market) and providing a liquidity for big players.

After a formation of a such a candlestick, a reliable confirmation of a saturation of the Smart Money is a formation of a strong bearish candle - a clear sign of strength of the sellers.

A bearish engulfing candle above confirmed a completion of a liquidity sweep and indicates a highly probable bearish continuation.

Your perfect sell entry is immediately after a close of such a candlestick.

Stop loss should strictly lie above the high of a liquidity sweep.

Take profit is based on a local low.

Look, how quickly the price reached the goal.

Your strategy of trading liquidity sweeps of demand zones is absolutely the same.

Let the price test a demand zone, wait for a formation of wide range bearish candle with a tail going below its lows.

Wait for a bullish imbalance candle and buy immediately then.

Stop loss will be below the low of a liquidity sweep, take profit - a local high.

This SMC strategy works on any time frame and can be applied for trading any Forex pair, Gold, Silver, Crypto and commodities.

Try it by your own and let me know your results.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_CAD WILL KEEP GROWING|LONG|

✅GBP_CAD is trading in an

Uptrend and the pair made a

Retest and a rebound from the

Horizontal support of 1.8675

So we are bullish biased and

We will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-CAD Swing Short! Sell!

Hello,Traders!

NZD-CAD keeps growing

In an uptrend but the pair

Will soon retest a wide

Horizontal resistance level

Around 0.8350 so after the

Retest we will be expecting

A bearish pullback

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_CHF BEARISH BREAKOUT|SHORT|

✅AUD_CHF is going down currently

As the pair broke the key structure level of 0.5240

Which is now a resistance, and after the pullback

And retest, I think the price will go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-CHF Long From Support! Buy!

Hello,Traders!

EUR-CHF is trading in a

Parallel range and we see

A rejection from the horizontal

Support area below around 0.9293

And we are already seeing a bullish

Reaction so a further move up

Is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD-JPY Bullish Bias! Buy!

Hello,Traders!

CAD-JPY keeps trading

In an uptrend along the

Rising support line and

We are already seeing a

Bullish rebound so we are

Bullish biased and we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Support Ahead! Buy!

Hello,Traders!

GOLD keeps falling just

As I predicted but the price

Will soon hit a horizontal support

Around 3235$ from where we

Will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_AUD LOCAL SHORT|

✅EUR_AUD is going up now

But a strong resistance level is ahead at 1.8018

Thus I am expecting a pullback

And a move down towards the target of 1.7900

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

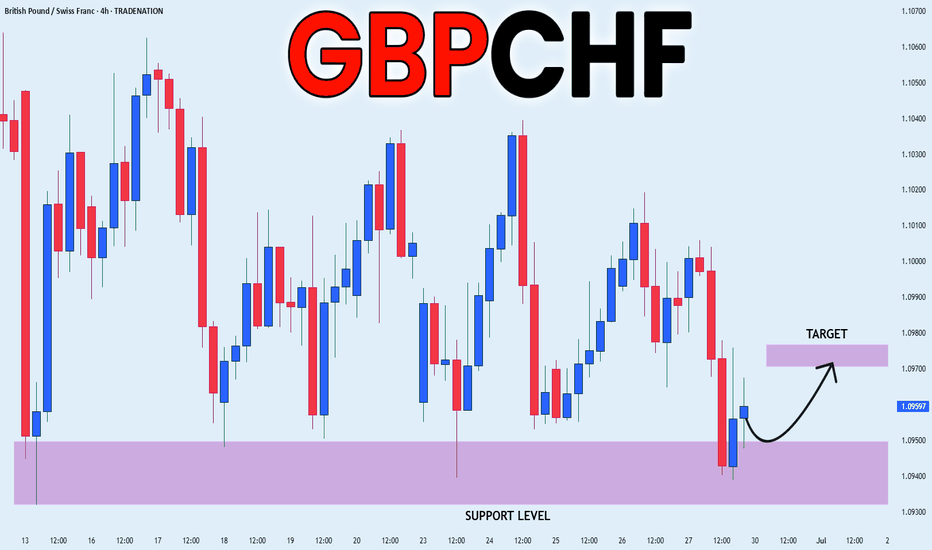

GBP_CHF RISKY LONG|

✅GBP_CHF fell down sharply

But a strong support level was hit at 1.0932

Thus as a rebound is already happening

A move up towards the target of 1.0970 shall follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_JPY SHORT FROM RESISTANCE|

✅NZD_JPY is set to retest a

Strong resistance level above at 88.000

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 87.341

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_NZD LOCAL LONG|

✅AUD_NZD is trading along the rising support line

And as the pair is going up now

After the retest of the line

I am expecting the price to keep growing

To retest the supply levels above at 1.0789

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GU Friday Bearish ReviewHi everyone,

GBP/USD played out exactly as per forecast (link below if you'd like to revisit):

It was fairly simple price action to forecast, price sweeped 1.375 initially, taking out the Asian highs and the similar equal highs (liquidity)

Before then creating its bearish leg towards the next liquidity zone of 1.37.

I was able to jump onto a few moves throughout both London & NY (have thrown in those screenshots onto the chart for you guys)

Regards,

Aman | SMC Wolf FX

1-1 student onboarding is currently open (website in my signature & profile)