SILVER LOCAL SHORT|

✅SILVER has retested a key resistance level of 39.10$

And as the pair is already making a bearish pullback

A move down to retest the demand level below at 38.61$ is likely

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

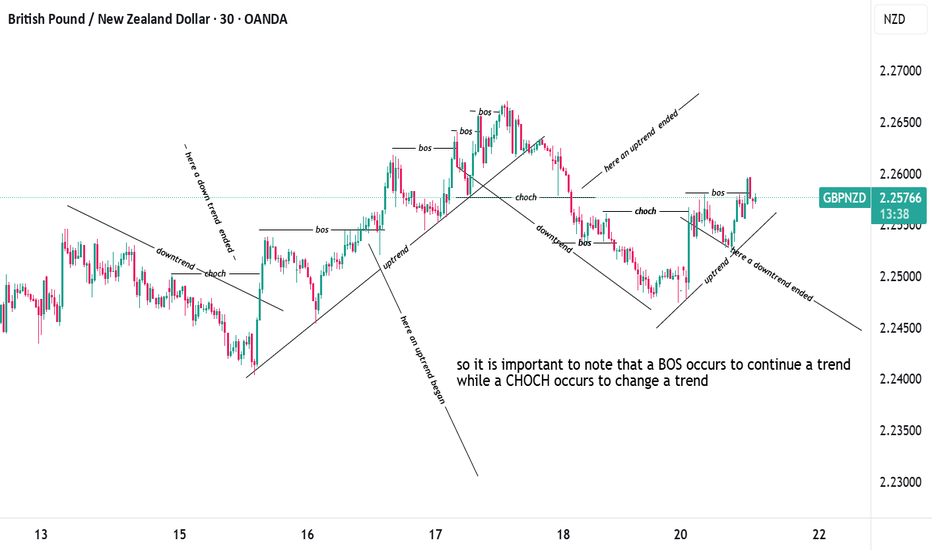

SMC

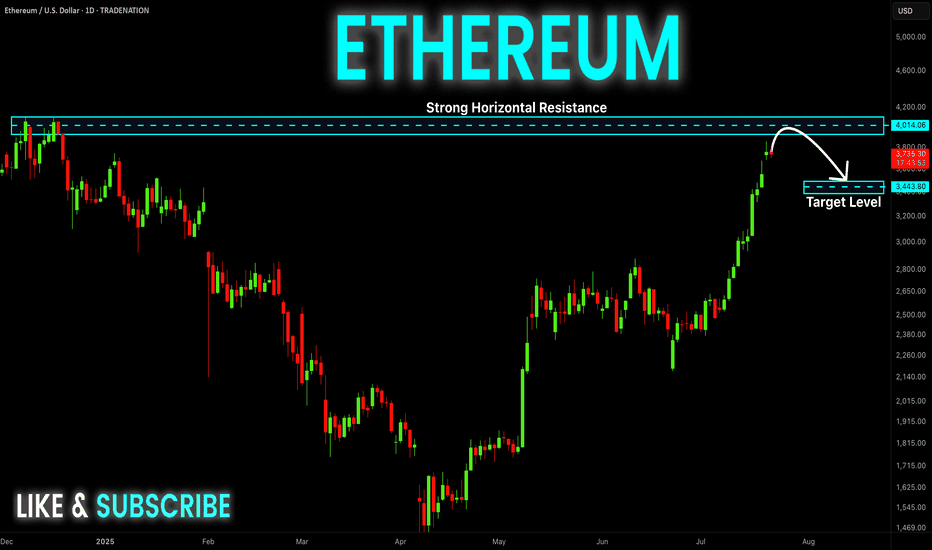

ETHEREUM Resistance Ahead! Sell!

Hello,Traders!

ETHEREUM is trading in a strong

Uptrend and the coin has grown

By more than 70% since the last low

So the coin is locally overbought

And after it retest the horizontal

Resistance of 4100$ we will be

Expecting a local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

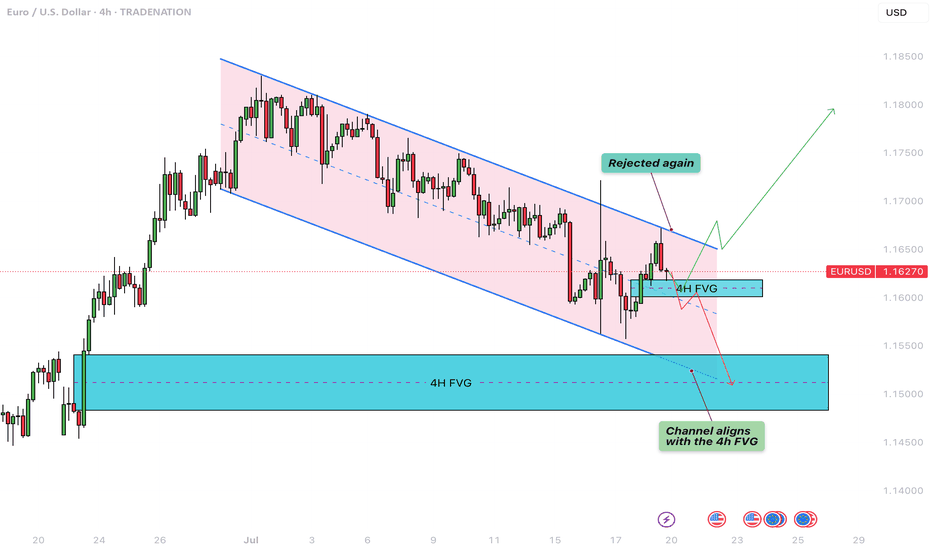

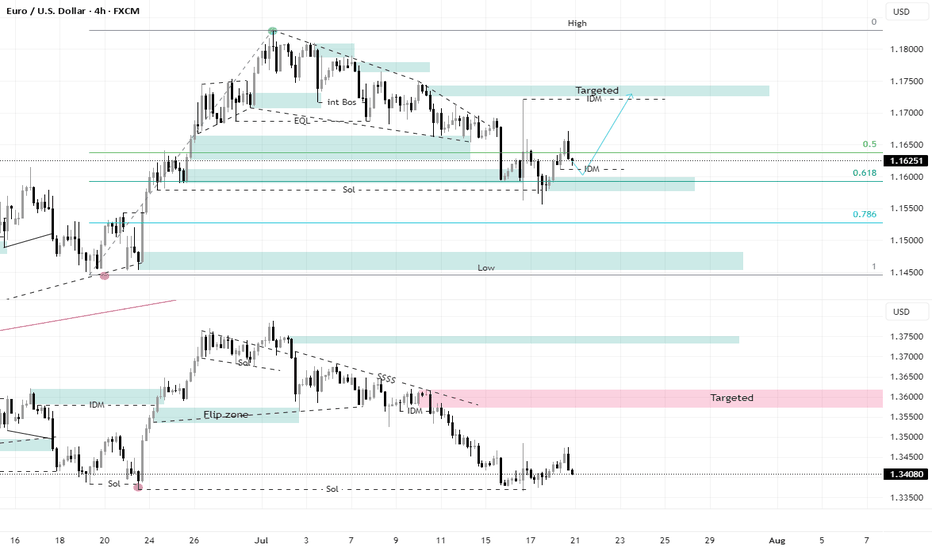

EURUSD - Parallel channel in play!The following chart offers a closer look at the current structure of the EUR/USD pair on the 4-hour timeframe. Price action has been respecting a well-defined bearish parallel channel, which has provided clear boundaries for both resistance and support. Based on the ongoing reaction to these levels, we outline both bullish and bearish scenarios that could unfold in the coming sessions.

Bearish Parallel Channel

Since June 30, EUR/USD has been consistently moving within a downward-sloping bearish parallel channel. Each attempt to break above the upper boundary of the channel has been rejected, while the lower boundary continues to act as dynamic support. This sustained rejection from the upper trendline confirms the strength of the bearish momentum currently at play. The pair remains structurally weak unless a clean breakout to the upside occurs, accompanied by strong bullish confirmation.

Bullish Scenario

A potential bullish reversal could materialize if EUR/USD manages to hold above the 4-hour Fair Value Gap (FVG) located between 1.1620 and 1.1600. This zone may provide the necessary support for the bulls to step in. If the price maintains strength within or just above this FVG and buyers begin to show dominance, a rebound toward the upper boundary of the channel could occur. A successful breakout above the channel could then trigger a stronger rally, possibly targeting the 1.1750–1.1800 region, marking a clear shift in short-term momentum.

Bearish Scenario

Conversely, if the pair fails to hold the 4-hour FVG between 1.1620 and 1.1600 and closes a strong bearish 4-hour candle below this zone, the market may be setting up for further downside. This would suggest a rejection of the FVG as resistance and open the path for a drop toward the lower end of the channel. Interestingly, this area also aligns with a previously established larger 4-hour FVG. A move into this deeper FVG could present a more favorable zone for a longer-term bullish reversal, as it offers a stronger liquidity pool and potential demand area.

Final Thoughts

The EUR/USD pair is at a critical juncture. Price is hovering near a key support zone within a bearish channel that has defined its movement for several weeks. Whether bulls can hold this support and break above the channel, or bears take control and push it lower toward the broader 4-hour FVG, will determine the next major directional move. Traders should closely monitor price action around the 1.1620–1.1600 level for clues on the likely breakout direction.

--------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like and leave a comment, I’d love to hear your thoughts!

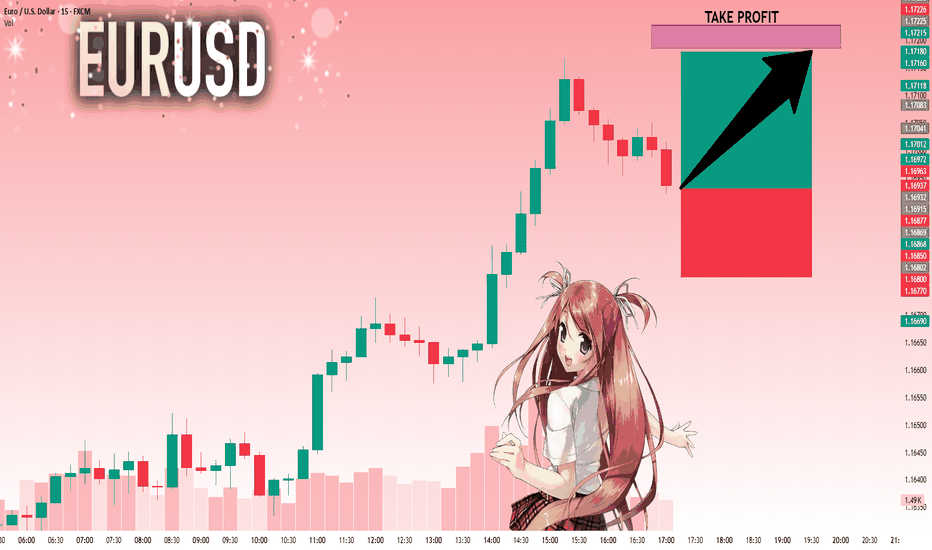

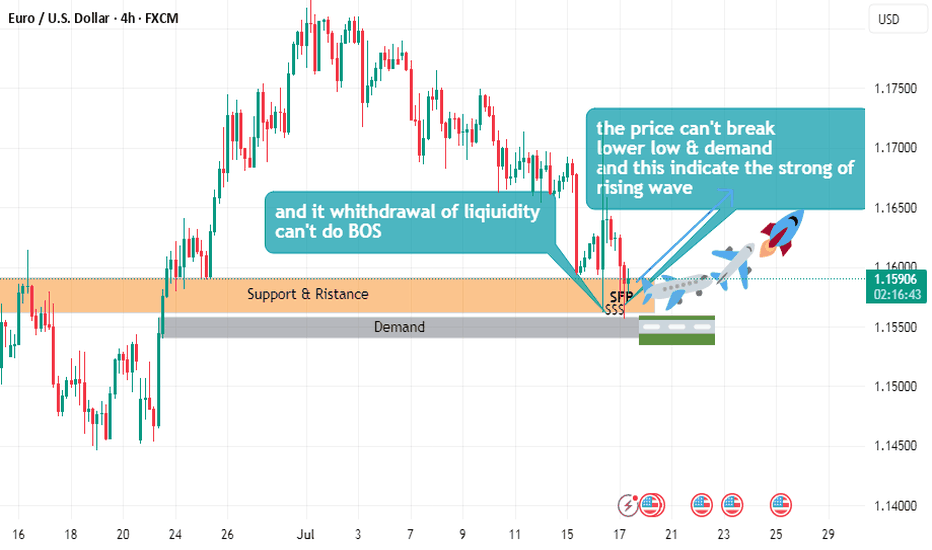

EURUSD: Target Is Up! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 1.16915 will confirm the new direction upwards with the target being the next key level of 1.17187 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

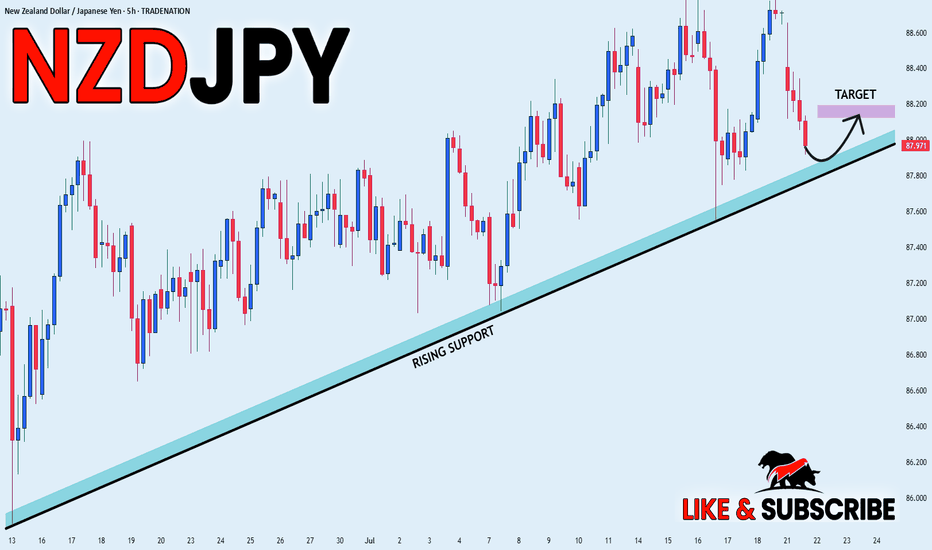

NZD_JPY RISING SUPPORT AHEAD|LONG|

✅NZD_JPY went down from

The resistance just as I predicted

In my previous analysis but now

The pair is approaching a rising

Support line from where we will

Be expecting a local bullish rebound

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

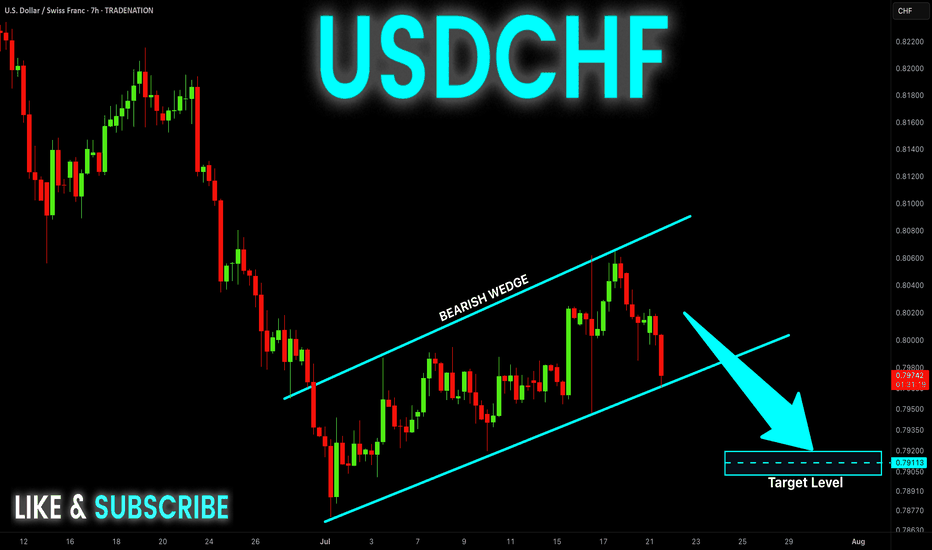

USD-CHF Bearish Wedge! Sell!

Hello,Traders!

USD-CHF is trading in a

Downtrend and has formed

A bearish wedge pattern

So IF we see a breakout

Then we a further bearish

Continuation will be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

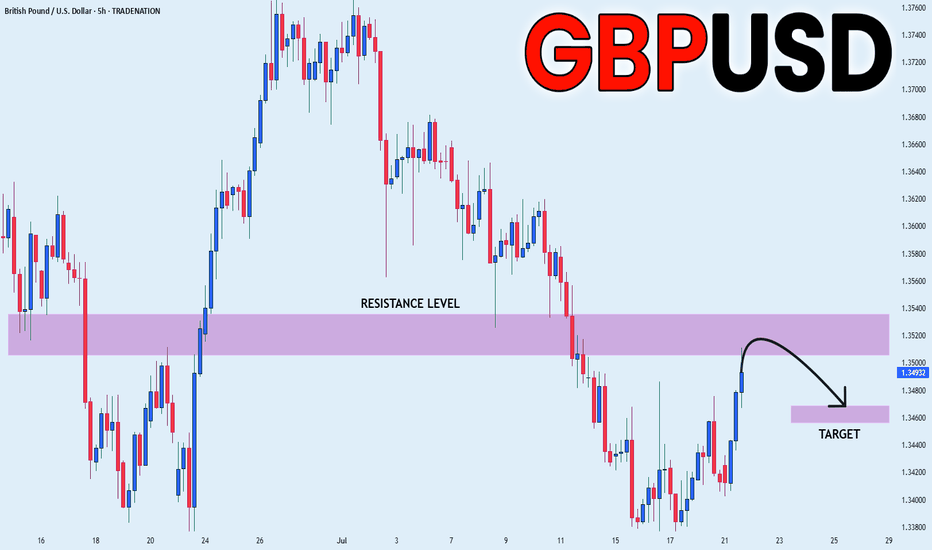

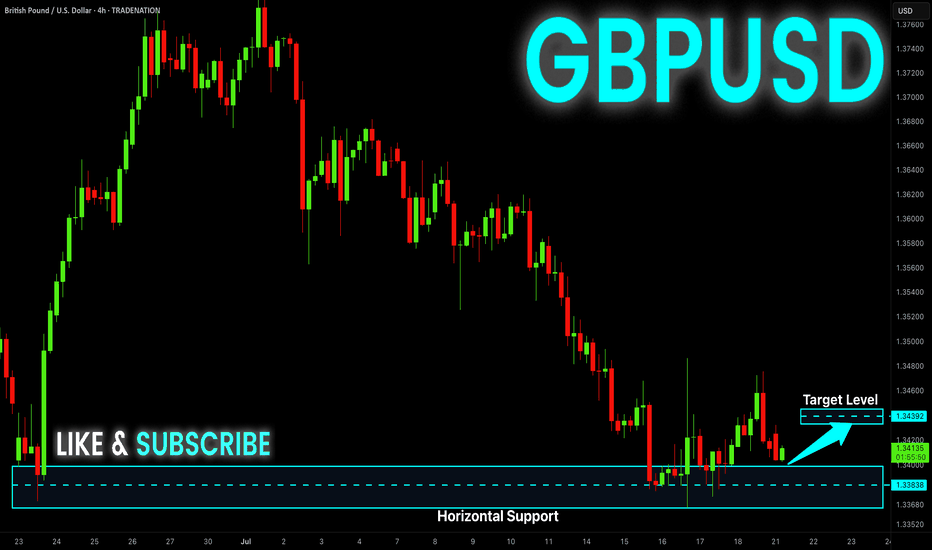

GBP_USD RESISTANCE AHEAD|SHORT|

✅GBP_USD has been growing recently

And the pair seems locally overbought

So as the pair is approaching

A horizontal resistance of 1.3520

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

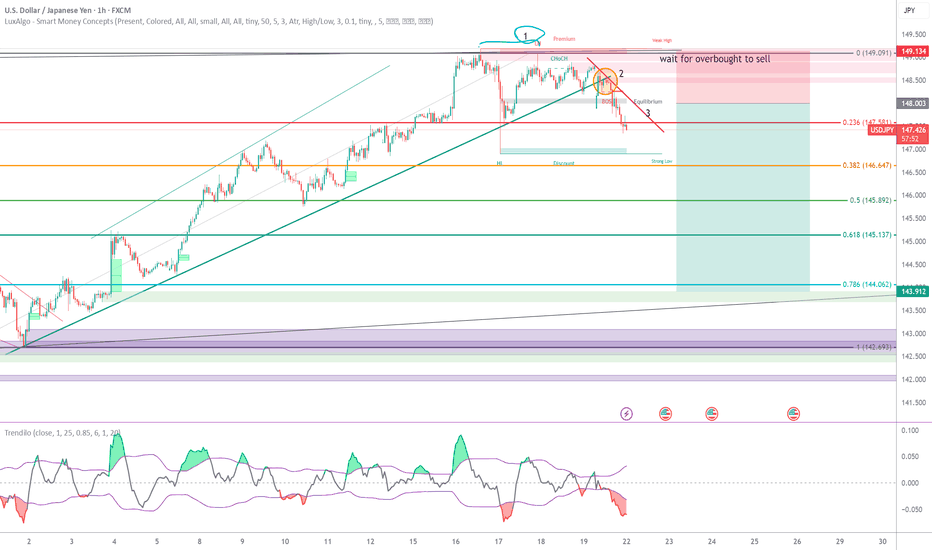

USDJPY sell1. price created a double top near the premium zone

2. price moved down and broke the bullish trendline and closed below it

3. Created a new bearish trendline with multiple touches confirming that that the bullish move has ended

Entry idea:

will wait for price to pullback into the 50% zone fora limit order or alternatively wait for price to be overbought with a stochastic cross to enter at market order then exit/TP at the next available order block

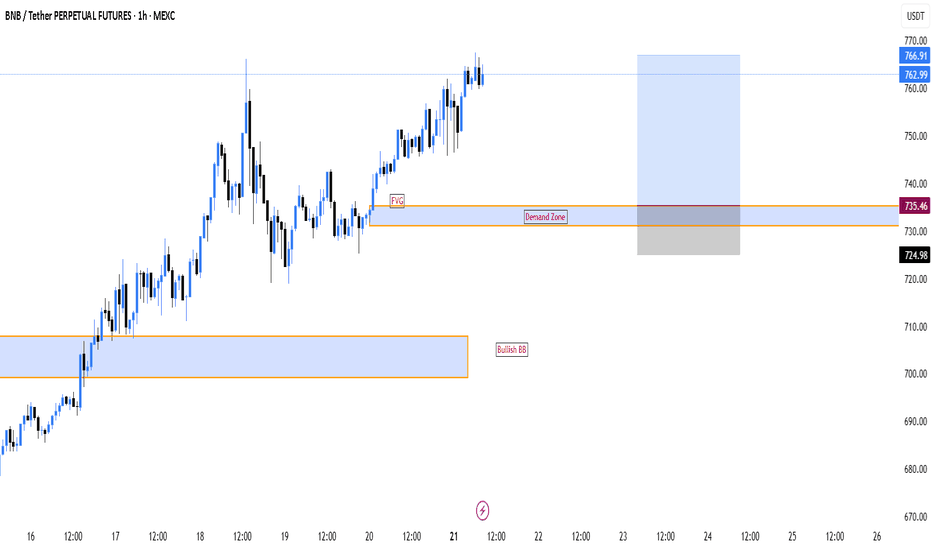

BNB LongI see a buy zone around 735 just after a significant FVG, and moreover, given the overall bullish strength of BNB, the pullback to happen next won't be a deep pullback but rather a light one. Confirming with the Fib retracement tool that zone sits well at the 38% pull back level, which is a good sign of a light bull back to continue the bullish move

Smart Money Concepts in Action: XAUUSD Tests Strong Resistance Market Context and Structure

On the 1-hour chart, XAUUSD (Gold) has been in a bullish market structure, forming consecutive Breaks of Structure (BOS)—a clear sign of buying pressure and upward momentum. These BOS points mark moments when the market forms new highs, confirming bullish continuation.

However, as price approaches the 3370–3380 zone, it reaches a well-defined resistance/supply area. This zone has previously rejected price and can be viewed as a region where institutional selling may occur.

🧠 Smart Money and Liquidity Concepts

From a Smart Money Concepts (SMC) perspective, price often moves to areas of liquidity—zones where buy stops (above highs) or sell stops (below lows) are collected. In this chart:

Price pushes up towards 3370, potentially grabbing liquidity above recent highs.

This move could be a liquidity sweep, where the market fakes a breakout to trap retail traders before reversing.

Such behavior often occurs near institutional zones, suggesting a possible distribution phase—where large players offload positions before a move in the opposite direction.

⚙️ Resistance Analysis: Why 3370 Matters

The 3370–3380 area has acted as a ceiling in the past.

Price is currently reacting near this level, showing early signs of rejection.

This zone aligns with previous order blocks, where institutions may have placed sell orders.

In educational terms, this shows how supply zones can act as natural turning points in a market, especially when price approaches them after an extended move.

📦 Support & Potential Downside

If a reversal happens from this resistance, the next key support zone lies between 3300–3320. This level has historically acted as demand and could be revisited for price rebalancing or order filling.

📝 Educational Summary

This XAUUSD chart provides a great learning opportunity in observing:

How Break of Structure (BOS) confirms trend direction.

The role of liquidity zones in trapping retail traders.

How smart money operates around key levels like 3370.

The importance of combining structure, zones, and reaction for confluence.

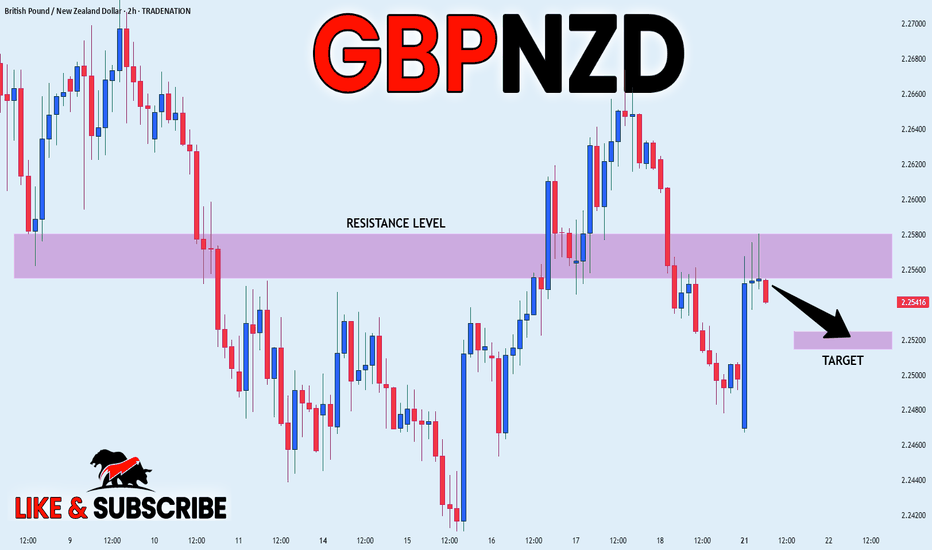

GBP_NZD LOCAL SHORT|

✅GBP_NZD made a retest of the

Local horizontal resistance level of 2.2580

And as you can see the pair is already

Making a local pullback from

The level which sends a clear

Bearish signal to us therefore

We will be expecting a

Further bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-USD Local Long! Buy!

Hello,Traders!

GBP-USD is about to retest

The horizontal support

Level below at 1.3383

And as this is a strong

Support level we will be

Expecting a local bullish

Rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

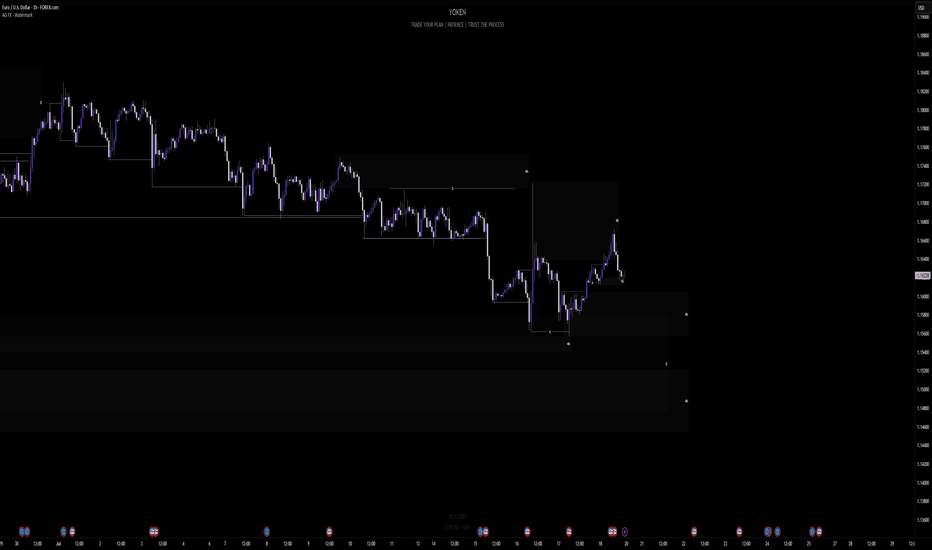

Week of 7/20/25: EURUSD AnalysisLast week's price action was bearish and has finally reached the extreme daily demand level and provided some reaction. Price has swept bulls and bears, so now we follow internal structure and wait to see where price actually wants to go. If internal 1h structure breaks bearish, we have confirmation to trade bearish until price goes deeper into the daily extreme zone.

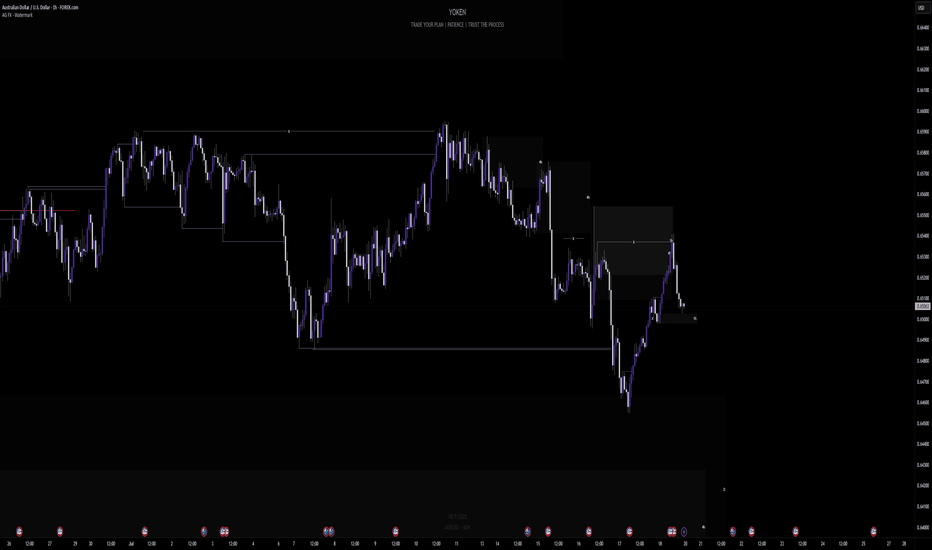

Week of 7/20/25: AUDUSD AnalysisLast week's price action was bearish and this week I will follow bearish order flow unless internal 1h structure continues to be bullish. I'm going to look for shorts after 1h internal structure is broken as confirmation, then take trades down to the daily demand zone and then look for bullish signals.

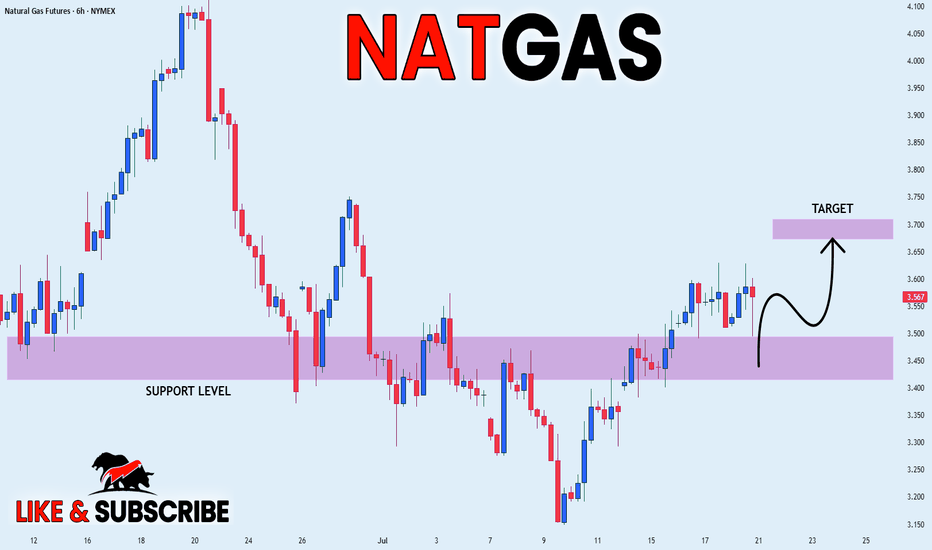

NATGAS REBOUND AHEAD|LONG|

✅NATGAS is going up now

And the price made a bullish

Rebound from the horizontal

Support level around 3.50$

So we are bullish biased and

We will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

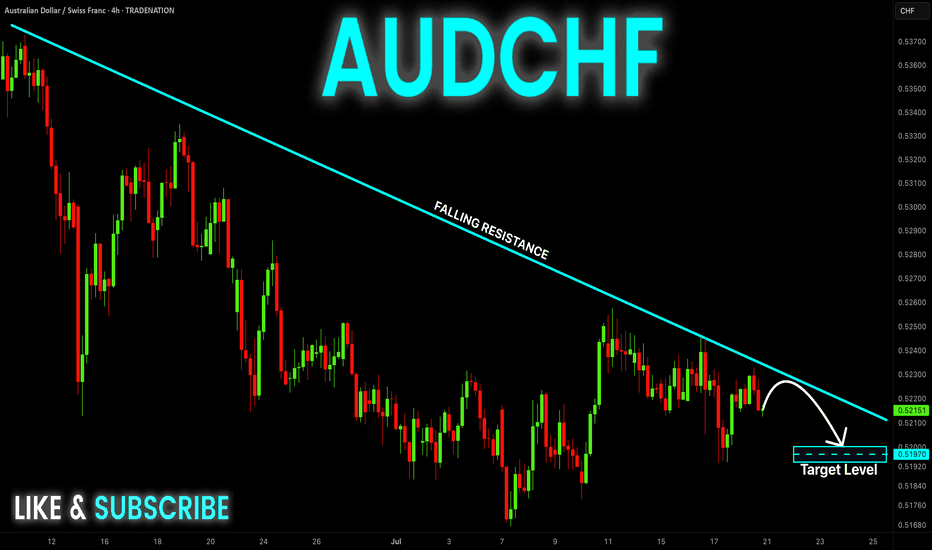

AUD-CHF Risky Short From Falling Resistance! Sell!

Hello,Traders!

AUD-CHF is trading in a

Downtrend along the falling

Resistance line so we are

Bearish biased and after

The potential retest of the

Falling resistance we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

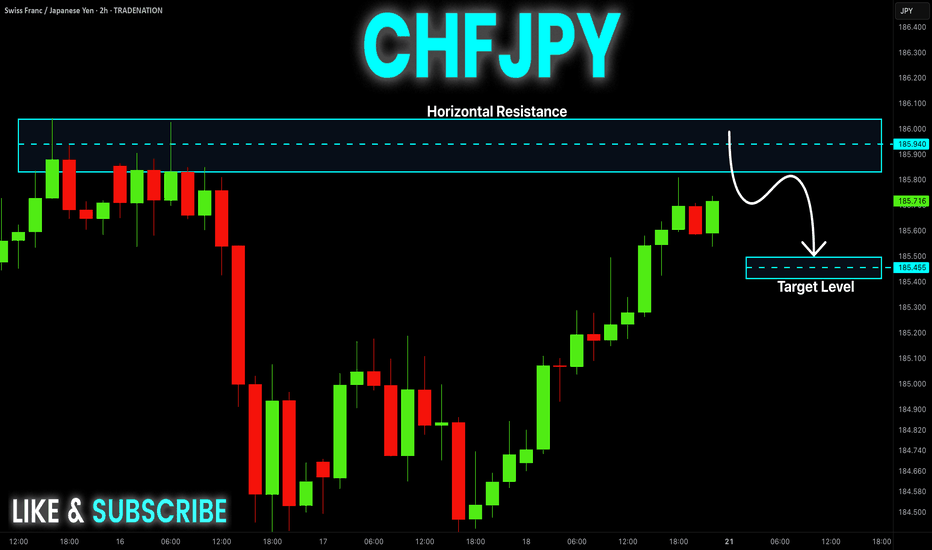

CHF-JPY Resistance Ahead! Sell!

Hello,Traders!

CHF-JPY keeps growing in

An uptrend and the pair is

Locally oversold so after the

Retest of the horizontal

Resistance of 186.000

From where we will be

Expecting a local bearish

Pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

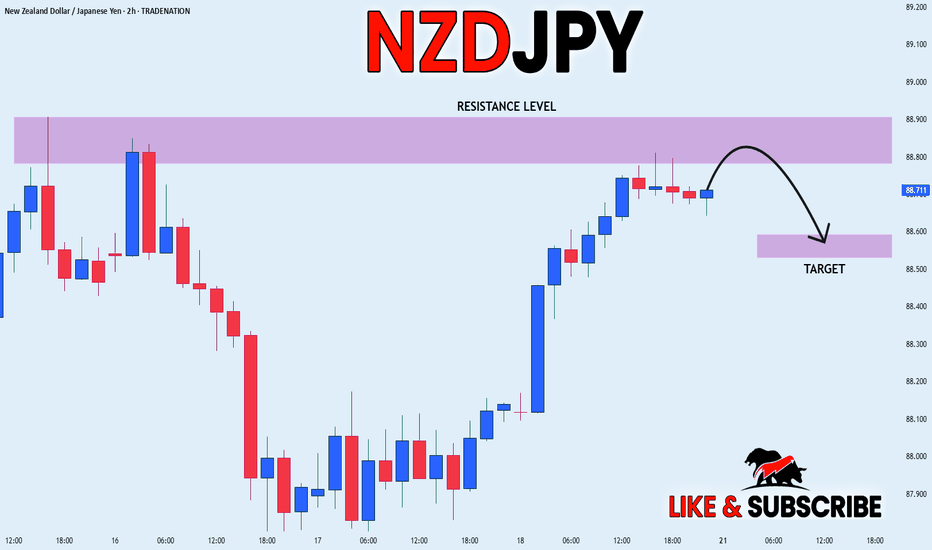

NZD_JPY PULLBACK EXPECTED|SHORT|

✅NZD_JPY has been growing recently

And the pair seems locally overbought

So as the pair has approached

A horizontal resistance of 88.900

Price fall is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DXY was looking for More Liquidity to sweepIt appears that the DXY was searching for more liquidity before continuing its decline. There are good buying areas for the EURUSD, as the liquidity swept to the bottom, and the immediate rebound indicates the strength of this area and can be considered a buying zone.

This area coincides with the 61 Fibonacci support line, confirming the possibility of an upside move.

The GBPUSD was targeting the bottom to trigger a liquidity sweep on the weekly timeframe. This is also an SMT signal, but it is somewhat weak, but it confirms the complete vision of the analysis.

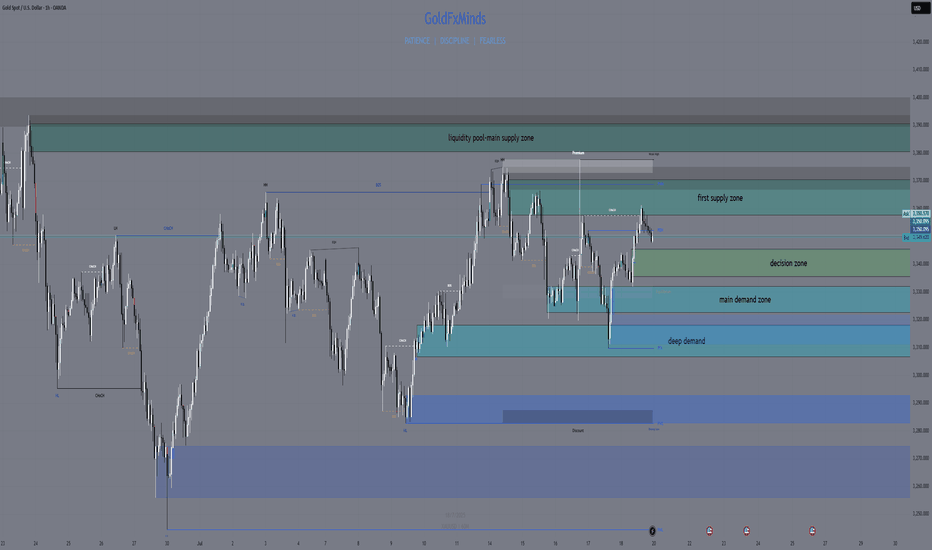

GOLD SNIPER PLAN – July 21, 2025Hey, GoldMinds! 🔥

This isn’t just another range day — it’s the type of market that separates disciplined snipers from impulsive chasers. If you want an edge, you need a plan that’s both sharper and more refined than what most see on their charts.

After a week full of fake breakouts, confusing swings, and whipsaw price action, gold is giving us the gift of clarity — but only for those patient enough to let the market reveal itself. Here’s how you cut through the noise and focus on the only zones that actually pay.

🚩 SELL ZONES

1. Primary Supply: 3358–3370

This is the fortress where real sellers pushed back hard. The structure here is crystal clear: last week’s failed breakout, sharp rejection, and a textbook H1/M30 order block. You want the sniper entry? Wait for price to tap here and only short if you see an instant, aggressive bearish response on M15/M5 — not just a slow drift.

2. Upper Liquidity Trap: 3380–3395

Classic trap for late buyers. This is where price loves to sweep stops and trigger emotional FOMO — but the real professionals are only interested if the move fails hard. Watch for a fake breakout and sudden reversal; this is the sniper zone for “fade and run” shorts.

⚪ DECISION ZONE (Neutral / Pivot)

Pivot Range: 3335–3345

Forget this level — it’s where amateurs get chopped up. There’s no order block, no real fair value gap, just confusion and false hope. A true sniper waits here, watching, not acting.

🟢 BUY ZONES

1. Main Demand: 3326–3332

This is the engine room for bulls: a refined order block, evidence of real absorption, and a history of sharp reversals. Don’t try to anticipate — let price come here and look for a snapback move on M15/M5. This is where patient buyers take their shot.

2. Deep Demand: 3311–3320

Where the fear turns to opportunity. This zone sits under recent lows, home to panic sweeps and emotional selling. Only consider a long if you see a powerful, impulsive bounce. The risk is high, but the reward for perfect timing is even higher.

BIAS & EXECUTION

Bias: Neutral, but watch for range expansion — the market is coiling for a bigger move.

Execution:

– Only act at the true edges, never in the middle.

– Let M5/M15 price action prove your setup — the market owes you nothing.

– If a zone breaks with momentum, do not fight the flow; stand aside or prepare for the next edge.

FINAL SHOT

This is where discipline pays.

Sniper trading is about letting the market come to you and striking only when your zone lights up with confirmation. Every other move is just noise, meant to shake out the impatient. Drop a comment below with the zone you’re watching most , follow and🚀🚀🚀 GoldFxMinds for daily sniper maps, and remember: in gold, only real structure pays.

Disclosure: Charts powered by Trade Nation. Educational content only.