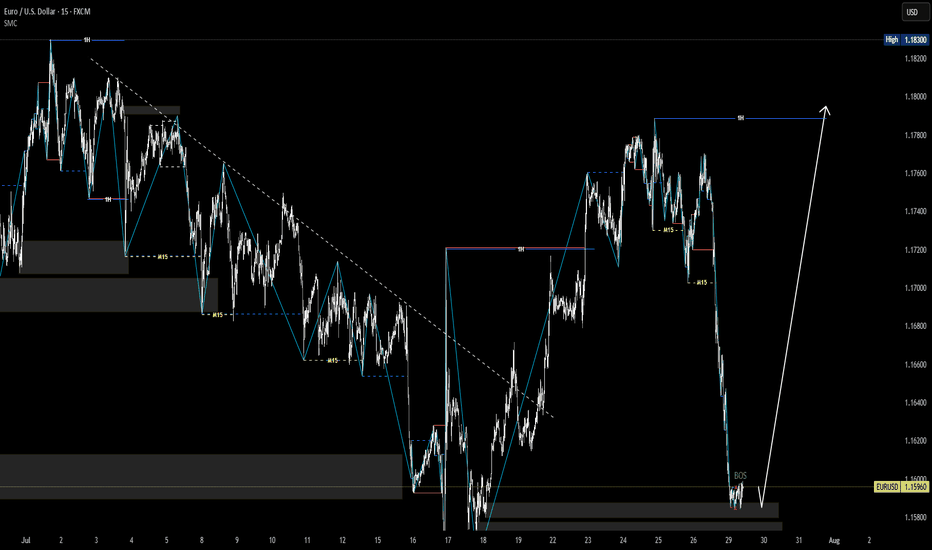

EURUSD market structure analysis on M15, H1 timeframesH1 Timeframe – Main Trend: BULLISH

🟢 Current Situation:

The H1 structure is showing a clear sequence of Higher Highs (HH) and Higher Lows (HL) ⇒ indicating an uptrend.

The market is currently in a retracement phase following the last bullish impulse.

Price is approaching a demand zone from a previous structure, where buy orders may be stacked.

📉 M15 Timeframe – Main Trend: BEARISH (within H1 pullback)

🔍 Current Observations:

While H1 is in a retracement, M15 shows a clear bearish market structure (Lower Lows – Lower Highs).

However:

Price has tapped into the H1 demand zone.

A liquidity grab (sweep of highs/lows) just occurred on M15.

This was followed by a Break of Structure (BOS) to the upside ⇒ signaling potential absorption of sell-side liquidity and a reversal in alignment with the higher timeframe (H1).

Smcanalysis

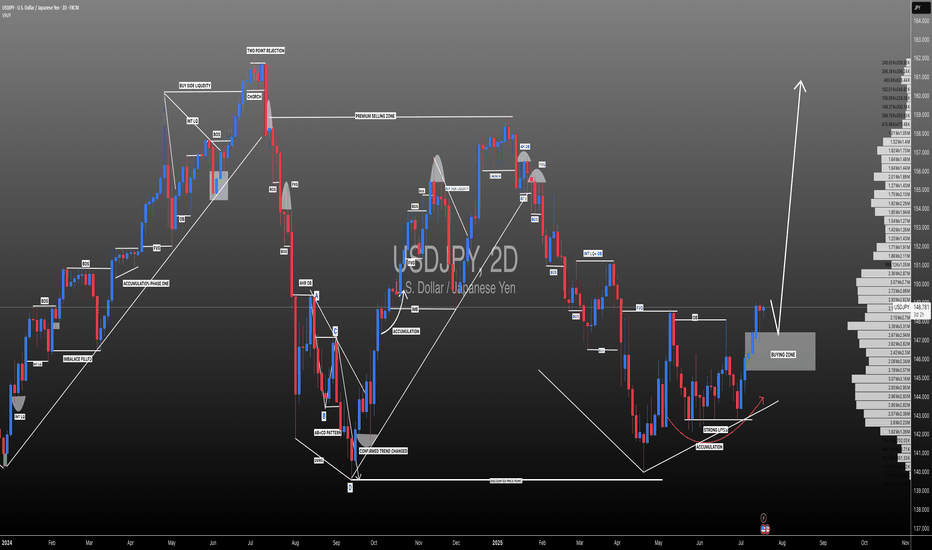

#USDJPY: Swing Buy Almost +2000 Pips! Dear Traders,

The USDJPY currency pair appears to be in an accumulation phase at the moment, as evidenced by the lack of significant price movement throughout the current week. Several factors contribute to this trend.

Firstly, several significant economic events are scheduled for this week, particularly tomorrow and Friday. These developments will have substantial implications for the future trajectory of the USDJPY pair. Consequently, there’s a possibility that the price may experience a decline before initiating a bullish trend. We’ve recently seen a strong bullish candle, which suggests a strong bullish move in the coming weeks. Additionally, the strong USD could continue rising, while the JPY is dropping.

Secondly, there are two primary areas where the price could reverse its course. The extent to which the USD reacts to the economic data will indicate potential reversal zones.

It’s crucial to conduct your own analysis before making any financial decisions. This chart should be used solely for educational purposes and does not guarantee any specific outcome.

Regarding the stop loss, as this is a swing trade, it’s advisable to employ a larger stop loss if the price reaches entry zones. The take profit level can be determined based on your entry type and analysis.

We wish you the best of luck in your trading endeavours and emphasise the importance of trading safely.

Please share this analysis with others through likes, comments, and social media platforms. If you have any questions or require further assistance, don’t hesitate to comment below. We’re here to provide support.

Team Setupsfx_

❤️🚀

BTC wave structure analysis on 4 hour and daily timeframe- Daily time frame, after price gave stop hunting signal, price increased again.

- On the 4-hour time frame, the price broke through the strong peak and gave a bullish reversal signal.

- So there is a high possibility that BTC will continue to rise and break the previous top.

Week of 7/13/25: AUDUSD AnalysisLast week pushed bullish and demand is still in control on all time frames, so we are going to follow bullish order flow.

Looking for bottom liquidity to be taken in the local range before getting in on a long.

Major News:

Tuesday - CPI

Wednesday - PPI

Thursday - Unemployment

#EURUSD: Nothing to expect from DXY| View Changed Swing Trading|Hey there! So, we were previously thinking EURUSD was going to be bearish, but things have turned around and it’s looking bullish for now.

The extreme bearish pressure on USD has caused all the major USD pairs to be in a range. As the week goes on and we get the NFP data, the market will probably focus more on these economic indicators. So, it’s not surprising to see some market ranges during this time.

We’ll keep a close eye on the market, as there might be some manipulation going on this week.

We recommend waiting until Monday’s daily candle closes to see if the bullish trend is strong enough. Then, based on the price momentum, you can make your decisions.

We hope you have a great week and safe trading! If you like our work and analysis, please consider liking, commenting, and sharing our content.

Cheers,

Team Setupsfx

❤️🚀

#GBPJPY: Buyers and Sellers Both Has Equal Chances! Hey there! So, GBPJPY is at a pivotal moment, and we might see a mix of buying and selling activity in the market. Since the bulls aren’t exactly sure what to do next, here’s what we think:

- The GBPJPY pair is having a tough time breaking through the 194 region. The Japanese yen (JPY) is holding steady, making it hard to predict what will happen next. This has made trading JPY pairs a real challenge.

- Looking back at how prices have behaved in similar situations can give us some clues about what might happen in the future. But it’s important to do thorough research before we start trading. Just because something happened in the past doesn’t mean it will happen again.

- The Japanese yen (JPY) also tends to go down when the US dollar (USD) goes up. Since we’re bullish on the DXY index in the coming days, we think the JPY will probably take a hit, and it could go down a lot. It’s also worth keeping an eye on the GBP, which has been one of the most popular currencies since the market opened earlier today.

- In the meantime, we suggest setting two take-profit targets: one at 197 and another at 199. These levels are likely to see a lot of selling activity.

Now, let’s talk about what sellers should do:

- The price is currently in favour of sellers since it dropped from 195.50 to 193.50. And since the last two daily candles closed with strong bearish volume, it looks like the price is going to keep going down.

- If the price breaks below 190.50, that would be a great opportunity for sellers to make some money.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

Week of 6/1/25: EU AnalysisEU 1h and 4h structure are bearish, but there was a large rejection of the daily CHoCH last week leading to large bullish price movement. Our 1h internal structure is bullish, so we will follow that trend for now.

Major news:

PMI - Monday

PMI/ADP NFP - Wed

Unemployment Claims - Thurs

NFP/Unemployment rate - Friday

Week of 6/1/25: AU AnalysisA lot of consolidation from the prior week, all time frames are technically bullish and internal 1h structure is bullish. I am going to be cautious around the current level until there is a prime entry model to get in long.

Major news:

PMI - Monday

PMI/ADP NFP - Wed

Unemployment Claims - Thurs

NFP/Unemployment rate - Friday

VIEW: EURUSD-Cut your losses short and let your winners run.

-The market is a device for transferring money from the impatient to the patient.

-In investing, what is comfortable is rarely profitable.

-Trade what you see, not what you think.

CONFIRMATION

-Price is bullish

-Strong order block

-BOS

-Liquidity sweep

-FVG filled

-Price retraced

NB: Do not ever compare yourself to other traders. Take regular breaks from trading Maintain a trading journal Love your craft Learn from other successful traders.

XAUUSD 1H | Bearish Order Block Reaction + Liquidity Sweep🔻 XAUUSD 1-Hour Breakdown — May 14, 2025

Gold gave a strong supply rejection at a marked Order Block zone. This isn’t just a pullback — it’s a potential continuation setup targeting lower lows. Here’s what’s cooking:

🧩 1. Market Structure

Clean rejection from premium OB zone at ~$3,220

Massive bearish impulse candle right after sweeping demand zone liquidity

Price formed a lower low and is now forming a lower high

🛠 2. Key Confluences

🟪 Order Block: Solid rejection with no candle closes above

💧 Liquidity Sweep: Deep wick into OB zone → trapped breakout buyers

🔺 Strong High Protected: Market respects structure, suggesting continuation

🔻 Weak Low Targeted: Clean draw to imbalance & potential sweep zone near $3,116

🧠 3. Trade Setup

Entry: Rejection near $3,207–3,220 OB

SL: Above $3,229 (invalidates structure)

TP: First TP zone near $3,116, extended TP: $3,100

RRR: 1:4 to 1:6 setup depending on partials

⚠️ 4. Risk Management

Watch for NY session reversal attempts

Secure profits at first demand zone reaction

Consider trailing stop above last bearish engulfing candle

📌 Price respects structure. If bulls don’t step in quick, sellers will run the table. This is a classic SMC bearish continuation off OB + liquidity grab — don’t sleep on it!

💬 Type “🔻” if you're riding this short wave with us!

🎯 Follow @ChartNinjas88 for sniper SMC plays every day!

USDCHF Premium Tap into Order Block🚨 USDCHF Smart Money Setup Unfolding – One Shot, One Kill Opportunity

Here’s why this setup is packed with confluence and how Smart Money might be laying the perfect trap before a big drop...

🧠 Structure Breakdown:

We’re currently seeing a textbook retracement into premium pricing after a clear bearish move, and Smart Money seems ready to strike again.

✅ Swing High to Low Fib Analysis

We’ve pulled from the most recent swing high to the swing low — and price is now retracing into the 61.8%–79% golden zone. That’s classic territory for Smart Money to reposition short.

📍 Premium Trap Zone:

Between 0.8375 and 0.8395, we’re stacking multiple confluences:

Fib Golden Zone (61.8% – 79%)

Bearish Order Block

Strong High (Liquidity Pool)

Diagonal Trendline Resistance

Break of structure beneath current price

Price action is walking up cleanly, likely to attract late longs — but we know better. This is liquidity engineering at its finest. 📊

🧱 Smart Money Zones:

🔲 Order Block (OB) at ~0.8380–0.8395)

This OB aligns beautifully with 79% fib retracement and sits right below a Strong High — where liquidity is waiting to get grabbed.

🎯 Entry Logic:

Wait for a tap + bearish rejection candle inside the OB.

Set stop loss just above the Strong High.

Ride the momentum back down toward discount zones.

🎯 Target Zones:

TP1: Back to 0% fib level (~0.8325)

TP2: Extension to -27% fib (~0.8295)

TP3 (if momentum flows): Sub 0.8280 levels

This setup offers a clean 1:3+ RRR with sniper-level precision. Low risk, high reward — exactly what we love!

🧘♂️ Psychology of This Move:

Smart Money creates the illusion of bullish strength to:

Lure breakout traders above the high.

Fill institutional sell orders inside the OB.

Sweep weak lows after rebalancing inefficiencies.

This is not a random pullback — it’s a calculated liquidity sweep before expansion. 🚀

⚡ Game Plan:

✅ Wait for price to reach premium zone

✅ Look for rejection (engulfing or SMC candle confirmation)

✅ Enter with SL above high

✅ Take partials at equilibrium and trail to discount

✅ Don’t rush — let price come to you 💎

🧨 Risk Management Tip:

This is a surgical setup — you don’t need to overleverage to win.

Let the chart do the heavy lifting. Stick to 1–2% risk and let the RRR carry the profit.

✍️ In Summary:

USDCHF is retracing into a major premium zone packed with Smart Money confluence — Order Block, Fib, BOS, liquidity, and trendline resistance.

This could be one of the cleanest bearish setups this week if you stay patient and time it right.

🗣️ Drop "USDCHF READY" in the comments if you're planning to catch this setup!

📲 Tag your trading partner and don’t let them miss this sniper entry!

BTCUSD 30M | OB Rejection + FVG Target | Liquidity BelowSmart Money Concept Breakdown | May 18, 2025

This BTC setup is screaming institutional manipulation — and we’re ready to ride the wave. The most recent candle shows another clean rejection from the 30M Order Block, giving high confidence in bearish continuation.

🔍 Key Breakdown:

Entry Confluence:

Bearish OB between 103,569–103,634 tapped with a perfect wick

Candle rejected CRT High (high-probability manipulation zone)

Rejection confirmed with a bearish engulfing candle structure

Target Mapping:

Sell Side Liquidity: 102,643.59

Fair Value Gap: 102,200 zone

Weak Low: 101,420.70 (likely final draw on liquidity)

RR Setup:

Entry: 103,570 zone

SL: Just above CRT High at 103,811

TP1: SSL pool

TP2: FVG

TP3: Weak Low

Risk-Reward Range: From 1:2.5 to 1:5+ 💰

🧠 Institutional Logic:

The rally into the OB was likely a buy-side liquidity grab, faking retail breakout traders before dropping. If price breaks below 102,643 with momentum, expect a sweep of the FVG and weak low.

🎯 Bonus Watch:

If price returns to the OB but fails to break CRT High again = solid re-entry confirmation 📉🧠