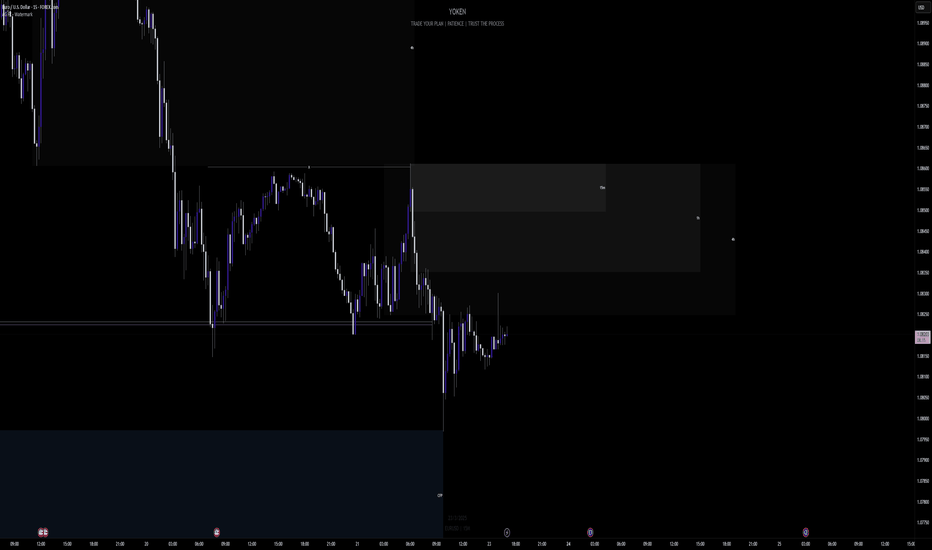

Week of 3/30/25: EURUSD Weekly AnalysisEURUSD has healthy price action with the MTF switching to bullish, once MTF aligns with the daily, we're definitely good to go on longs. For now waiting for price action to show us that it wants to move higher.

Major news: NFP Friday

Thanks for coming, goodluck this week with your trades!

Smcconcepts

Week of 3/30/25: AUDUSD Weekly AnalysisWeekly analysis this week, price has been congesting and tightening the last 2 weeks, expecting hopefully a good move this week to breakout of consolidation.

Starting the week with a bearish bias.

Major News: NFP Friday

Thanks for stopping by, have a great trading week!

Week of 3/23/25: EU AnalysisWeekly analysis of EU, my analysis shows bearish signals and where I am looking to trade from.

The chart looks very healthy for a daily retracement with the medium time frames aligning to it.

Only volatile news this week for me to watch out for is:

Unemployment Claims - Thursday

Let me know your thoughts, analysis, or what you'd like to see!

Thanks for watching, good luck this week, let's kill it.

Week of 3/23/25: AUDUSD AnalysisAnalysis of my main pair AUDUSD, last week resulted in the bears taking over and my analysis explains why my bias is bearish going into the new week.

Not much volatile news except for Unemployment Claims on Thursday.

Let me know what you guys think, your analysis, and if you want to see anything else!

Goodluck this week traders, let's kill it.

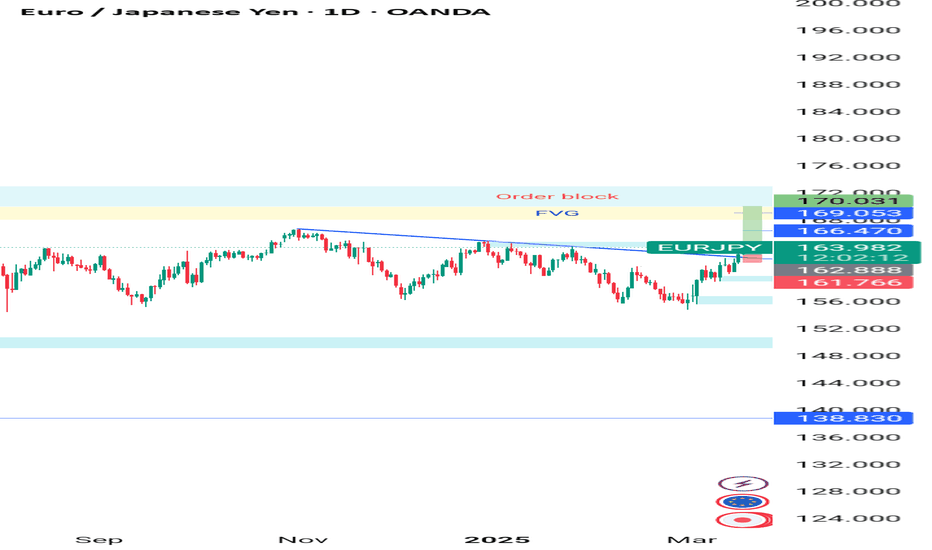

EURJPY. TUESDAY, MARCH 18TH, 2025As we eagerly practiced patience yesterday by waiting for the market to Break above the Weekly and Daily resistance trend line, this Break came about during the later hours of the New York session.

Key notes;

1. EURJPY moves, if not always, around the early hours of the Asian session, so the Break above the Weekly and Daily resistance gave me a greenlight to go long.

2. The key area to look out for today is a break and close above the Daily resistance zone at 163.816, this will indicate further momentum to the upside targeting Daily resistance areas of 166.443, 169.070 & 171.697 which are well within the daily FVG & Order Block.

I am a swing trader and I use SMC strategy combined with one indicator (Pivot Points Standard).

US30 Analysis: Demand Zone Rejection – Reversal Incoming? The Dow Jones (US30) is experiencing high volatility as investors digest recent economic data and Federal Reserve statements. The latest U.S. ISM Services PMI came in stronger than expected, signaling economic resilience 📊, but concerns remain about inflation and the Fed’s next move on interest rates 💰.

🔹 Key Market Drivers:

✅ Federal Reserve Rate Decision – Hawkish or Dovish? 🏦

✅ Upcoming NFP Data – Job growth impact on the index 📉📈

✅ Bond Yields & USD Strength – Affecting institutional risk appetite 💵

With economic uncertainty still in play, traders are looking for key structural levels to position themselves in the market.

🔍 Technical Analysis (1H Chart)

US30 is reacting from a strong demand zone (42,400 - 42,500), showing a possible reversal after a liquidity grab below recent lows.

📊 Key Observations:

🔹 Break of Structure (BoS) at the lows, signaling potential bullish momentum ✅

🔹 Change of Character (ChoCh) – Early signs of a shift from bearish to bullish 📈

🔹 Premium/Discount Zone – Price is in a discounted area, offering potential long entries 💰

🔹 Liquidity Sweep – Stops taken out before an impulsive move upward 🚀

🎯 Trade Setup & Targets:

📍 Bullish Bias: Looking for long entries from the 42,400 - 42,500 demand zone

🎯 First Target: 43,112 (mid-range resistance)

🎯 Second Target: 43,858 (supply zone)

🚨 Invalidation: Below 42,400 – If price breaks lower, expect further downside

💡 Confluence: The combination of smart money concepts (BoS, ChoCh, liquidity grab) and fundamental factors supports a potential bullish reversal. Traders should watch price action closely and confirm momentum before entering.

👀 Final Thoughts

US30 is showing signs of demand zone strength, but macroeconomic risks remain. Traders should stay cautious and monitor how price reacts at key levels. A confirmed break above 43,112 could fuel a rally toward 43,858 and beyond.

📊 How are you trading US30 this week? Bullish or Bearish? Let’s discuss below! ⬇️🔥

AUDCHF: Bearish continuation - Will it reach 0.55190?OANDA:AUDCHF is trading within a well-defined descending channel, with price action respecting both the upper and lower boundaries. The recent rejection from the resistance zone suggests sellers are maintaining control, supporting a potential continuation of the downtrend.

As long as the price remains below the resistance level and the channel's upper boundary holds, the bearish structure remains intact.

A potential downside target is 0.55190, aligning with the lower boundary of the channel. A break and close below this level could signal further bearish momentum.

However, a breakout above the resistance zone would invalidate the bearish scenario and may indicate a potential reversal or deeper pullback.

Always confirm your setups and trade with solid risk management.

Best of luck!

XAU/USD - Buy Limit Setup for a Bullish Reversal Overview

Gold (XAU/USD) is showing signs of a potential bullish reversal after a recent decline. A buy limit order is placed around the $2,911 level, targeting a move towards the $2,928 resistance zone. This setup follows a structured risk-reward approach with a stop loss below recent lows at $2,900.90.

Trade Setup

📍 Buy Limit: $2,911 (Key support zone)

📍 Stop Loss: $2,900.90 (Below recent lows for risk management)

📍 Take Profit: $2,928 (Major resistance zone)

📍 Risk-Reward Ratio: 1:2+

Technical Analysis

🔹 Support Zone: Price is testing a demand area where buyers previously stepped in.

🔹 Bullish Structure: After a sharp sell-off, gold is attempting a recovery.

🔹 Potential Reversal: Expecting price to trigger the buy limit before rallying towards resistance.

🔹 Volume Confirmation: Watching for increasing bullish volume near the entry.

Trade Plan

1️⃣ Wait for price to reach the buy limit zone (~$2,911).

2️⃣ Monitor price action for bullish confirmation (e.g., bullish engulfing, rejection wicks).

3️⃣ Ride the move towards the take profit zone (~$2,928).

4️⃣ If structure shifts bearish, adjust SL accordingly.

🔥 Gold remains volatile, so risk management is key! Watch for market reactions at key levels before entering the trade.

📊 Like & Follow for more gold trade ideas! ✅

GBP/USD - Weekly Liquidity & Fair Value Gaps AnalysisOverview

The British Pound (GBP/USD) is currently trading around 1.2652, showing a bullish recovery after sweeping weekly sell-side liquidity. Price has reacted from a weekly fair value gap (W.FVG) / BISI and is approaching key resistance levels.

Key Levels & Liquidity Zones

📌 Weekly Sellside Liquidity: Taken, leading to a bullish reversal.

📌 Weekly Buy-side Sweep: Possible target around 1.2774 (50% retracement).

📌 W.FVG // BISI (Bullish Imbalance Sellside Inefficiency): Acting as support.

📌 W.FVG / SIBI (Sell-side Imbalance Buy-side Inefficiency): A potential rejection zone around 1.2774.

Technical Outlook

🔹 Bullish Reversal: The price has bounced from key liquidity zones, suggesting further upside.

🔹 Fair Value Gaps (FVGs): The market has filled some inefficiencies but still has upside targets.

🔹 Potential Scenarios:

A continuation towards 1.2774 (weekly resistance & FVG fill).

A possible rejection at that level before resuming the trend.

Trade Plan

✅ Bullish Bias: Looking for pullbacks into support (W.FVG) for long opportunities.

❌ Bearish Confirmation: Rejection from 1.2774 could signal a retracement.

📊 Risk Management: Stop-loss placement below recent structure lows.

🔥 Watch these liquidity sweeps and fair value gaps for potential trading opportunities!

📌 Like & Follow for more trade ideas! 🚀

GBP/USD - Fair Value Gap (FVG) Short SetupOverview:

A bearish reversal setup based on Fair Value Gaps (FVGs), a concept used in Smart Money trading strategies.

Key Technical Insights:

🔹 Fair Value Gap (FVG) Zones:

The price is approaching an FVG entry zone around 1.2700, which may act as resistance.

A second FVG zone is located around 1.2850 - 1.2900, offering a secondary entry for shorts.

🔹 Bearish Trade Setup:

The plan anticipates a reaction at the first FVG zone, leading to a downside move.

If price continues higher, the second FVG zone provides another opportunity to enter shorts.

🔹 Stop Loss & Target:

Stop Loss: Placed above 1.2928 to protect against invalidation.

Target: 1.2350 - 1.2400, aligning with previous demand zones and imbalance filling.

Trade Plan:

📌 Entry Strategy:

Watch for bearish confirmation (e.g., rejection candles, lower time frame structure shift) at the FVG entry zone.

If price moves beyond the first FVG, consider a second entry at 1.2850 - 1.2900.

📌 Exit Strategy:

Take Profit: At the 1.2350 - 1.2400 target zone for a favorable risk-to-reward trade.

Stop Loss: Above 1.2928 to mitigate risk.

Final Thoughts:

✅ Bearish bias unless price breaks above 1.2928.

✅ Look for rejection at FVG zones for ideal entries.

✅ Potential downside move towards 1.2350 target.

📉 Patience is key—wait for confirmation before entering! 🚀

MY IDEAL MOVE FOR MNQ1!so MNQ recently broke the bearish daily gap that it had been struggling with for awhile which i expected to happen by the end of this month, and in turn it created a bullish daily imbalance. There are 2 moves that i am expecting right now, the first is for it to either stay in a range for the next 2 days and create a weekly gap, and after we fill the gap next week we push towards ATH's. And the second move is for it to fill the daily gap in these next two days and have a slow and weak approach towards ATH's or completely disrespect the daily and just range. SO MARKET RANGE FOR THE NEXT 2 DAYS IS IDEAL (for me)

Silver/U.S DollarSilver is exhibiting strong bullish momentum fueled by ICT-driven buy signals and bullish divergence on key timeframes. A decisive break above dynamic resistance confirms the path toward initial targets at 32.500. Hidden bullish divergence suggests sustained upside potential, with 33.500 as the next objective if momentum holds. Monitor price action and divergence patterns near these levels to validate continuation.

USDJPY → Fake Breakdown Gives Bulls a Chance!FX:USDJPY The price dips into support and creates a false breakdown below the lower boundary of the current trend. Meanwhile, the dollar is gaining strength, which could provide an opportunity for the currency pair to rise.

The price has paused near a strong support zone, as the fundamental backdrop has been increasingly unstable and heavily influenced by developments in the USA. Attention has shifted away from Japan's interest rate hikes, with market participants now closely monitoring economic data from the West.

From a technical perspective, the chart presents two potential triggers—one for buying and one for selling. However, given that both the global and local trends are upward, the bias leans toward buying. If the currency pair manages to sustain above the 151.9 - 151.95 level, short- to medium-term growth toward the targets marked on the chart is likely.

Resistance levels: 151.94, 153.7, 153.97

Support levels: 150.95, 149.52

That said, if the dollar's correction persists and buyers fail to capitalize on the false breakdown of support, a drop back to 150.95 could trigger a breakdown, potentially leading to a decline toward 148.64.

Weekly Market Forecast: PLATINUM Is a BUY!This forecast is for the week of Feb 10-14th.

As the Monthly and Weekly timeframes show, this market is in a ranging consolidation. So the strategy is to buy at the lows and sell at the highs until there is a definitive breakout on either side.

With price having swept the lows of the consolidation, it makes sense price will be heading to the buyside liquidity next.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

XAU/USD: Bearish Continuation Setup with SMC Framework~On the 4H chart, the previous bullish structure shifted to bearish intent after breaking the recent major higher low (HL). This confirmed a change of character (CHoCH) and suggested a potential trend reversal. Following the break, price took out buy-side liquidity (BSL) as inducement and fully mitigated the supply zone/order flow area, solidifying the bearish bias.

~Lower Timeframe Plan (30M & 5M):

As we approach the Sunday evening or Monday opening, I am closely watching the 30-minute chart for confirmation of a CHoCH that aligns with the 4H bearish intent. Once the CHoCH on the 30M is validated, I will refine my entry on the 5-minute chart by looking for a CHoCH flip into a precise order block or order flow zone.

Expectations:

I anticipate price to respect the mitigated supply zone on the 4H and continue its bearish trend. My targets are set at liquidity zones aligned with the higher timeframe structure. I will patiently wait for the setup to develop in alignment with Smart Money Concepts (SMC) principles, focusing on structure, liquidity inducements, and precise entries.

Key Levels:

• 4H bearish intent confirmed after HL break.

• 30M CHoCH confirmation: Awaiting.

• 5M entry: Pending precise setup during Sunday evening or Monday open.

Let’s Connect:

Does this setup align with your perspective on XAU/USD? Drop your thoughts or questions below!

Bless trading!

GBPCHF - Bullish Setup at Key Support ZoneThe GBPCHF pair is currently testing a key demand zone, where previous price reactions suggest potential for a bullish reversal. This area has historically been a support level, indicating that buyers could regain momentum at this juncture.

A confirmation of bullish sentiment, such as the emergence of a bullish candlestick pattern or a strong rejection wick, would reinforce the likelihood of a rebound. Should this scenario unfold, the price could target the 1.12417 level.

What are your thoughts on this outlook?

Bullish Bias Until Opposing DisplacementClassic SMC concept:

Price at Premium area, in order to gather liquidity it has to go to Discount area.

Lets break down it into available Week unfolding Scenario:

Scenario A:

The easiest target for Price is to take PWH (Premium) and then we may face the some sort of displacement it could create Daily/4h -OB then we may trade up to Thursday for having Bearish Bias (short term) by keeping in mind Bullish Bias intact in mind (long term).

Scenario B:

Price may drop into FVG:BISI(4h) and may turn Bullish and then we may notice FVG creation on Monday and may ride Tuesday retracement to frame Bullish trade up to Thursday/Friday.