$SMH / $QQQ: Ratio below ATH; Still more room for upside It’s the semis which are the hallmark of a cyclical bull market. It is always the Semis which indicate the start of a bull market and the first to fold over towards the end of a cyclical bull market. Hence the outperformance of Semis as a momentum sector is important from a symbolism perspective and from a market indicator perspective.

When the semis outperform the NASDAQ100 we have momentous bull markets. Today we looked at the ratio chart between NASDAQ:SMH vs $QQQ. This measures the relative outperformance or the underperformance of Semis over the broader NASDAQ100.

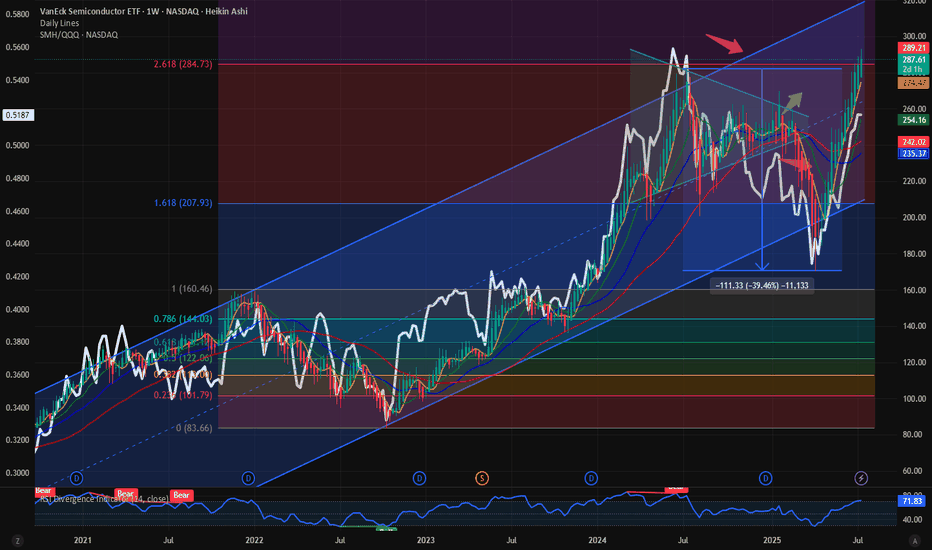

This ratio of NASDAQ:SMH / NASDAQ:QQQ touched its ATH on June 2024. Since then, the Semis lost momentum with NASDAQ:NVDA and NASDAQ:AVGO going sideways for a year. Now the momentum is on the side of Semis. Even if the NASDAQ:SMH is at 287 $ and at ATH with price is at its 2.618 Fib Retracement level, still the NASDAQ:SMH / NASDAQ:QQQ is not at its ATH. The ratio is currently @ 0.5. Before we hit 0.56 in the ratio chart just like last June 2024, SMH must outperform the NASDAQ100. If that must happen what should be the price of NASDAQ:SMH ? My prediction is the ratio NASDAQ:SMH / NASDAQ:QQQ tops @ 0.56 and NASDAQ:SMH goes to 400$ this year.

Verdict: Long NASDAQ:SMH over $QQQ. NASDAQ:SMH / NASDAQ:QQQ tops 0.56. NASDAQ:SMH price target 400$.

Smhlong

$SMH and $NVDA Dominance: Some more room to run for bothWith NASDAQ:NVDA and NASDAQ:SMH above their respective ATH the focus returns to the fact how far we can expect for both to outperform and make new highs. In this Blog we floated the idea of NASDAQ:NVDA dominance. This indicates the % of return / price movement in NASDAQ:SMH contributed by NASDAQ:NVDA as it is a cap weighted index. It captures the outperformance of the high momentum stocks like NASDAQ:NVDA and $AVGO.

On May 12 I predicated that NASDAQ:NVDA will reach 170$ before end of summer. And we are very close to our price target.

NASDAQ:NVDA : Full on Bull mode. 170 $ before end of Summer for NASDAQ:NVDA by RabishankarBiswal — TradingView

On May 30 we also favoured NASDAQ:SMH over AMEX:HACK and said that the momentum will continue and NASDAQ:SMH will touch new ATH. And here we are with NASDAQ:SMH above 280$.

NASDAQ:SMH vs AMEX:HACK : Recent good correlation with breakout potential for AMEX:HACK by RabishankarBiswal — TradingView

Now the question comes , how far these 2 can go and the bigger question is will NASDAQ:NVDA claim its Dominance in NASDAQ:SMH ? As you can see in the chart below the NASDAQ:NVDA Dominace in NASDAQ:SMH peaked at 0.6 or 60% on Nov 11. Currently we are @ 57% and still below its ATH. My estimate is NASDAQ:NVDA will claim its Dominance and go to the highs of 65% before SMH also completes it highs in this upward slopping channel with 315$ as my price target on $SMH.

Verdict: NVDA Dominance in NASDAQ:SMH can reach 65%. NASDAQ:SMH Target 315 $. NVDA Price target remains 170$ and above.

SMH Long Swing Setup – Buy the Dip or Overbought Trap? (2025-06-📈 SMH Long Swing Setup – Buy the Dip or Overbought Trap? (2025-06-12)

Ticker: NASDAQ:SMH | Strategy: 🟢 Equity Long Swing

Bias: Bullish with caution | Confidence: 70%

Hold Period: 3–4 weeks | Entry Timing: Market Open

🔍 Technical & Sentiment Snapshot

• Trend (Daily/Weekly): Strongly Bullish

• Short-Term (30m): Mixed – price above 50/200 EMAs, but below 10-EMA, MACD cooling

• RSI: Overbought (~77), suggests caution

• Bollinger Bands: Price hugging upper band

• MACD Daily: Mild bearish crossover – signals a potential short-term pullback

• Support Levels: 260–261 zone

• Sentiment: Falling VIX, Intel-led chip sector strength → bullish backdrop

🧠 AI Model Consensus

✅ DS, LM, GK (3 Models):

• Recommend long trade at open

• Confidence: ~70–72%

• Target range: $269–276

• Stop zone: ~$255–259

⚠️ GM Report:

• Suggests waiting – daily overbought + bearish MACD → not favorable R:R

• Recommends no immediate entry

✅ Recommended Trade Plan

🎯 Direction: LONG (Buy Shares)

💵 Entry Price: 262.85

📅 Hold Period: 3–4 weeks

🎯 Take Profit: 269.66 (+2.6%)

🛑 Stop Loss: 259.50 (–1.3%)

📏 Size: 100 shares (adjust to your risk profile)

📈 Confidence: 70%

⏰ Entry Timing: Market Open

📍 Entry Validity: Only if SMH opens at/above 262.50 and holds support (~260–261)

⚠️ Risk Factors

• 😬 Overbought RSI may cause short-term profit-taking

• 📉 Bearish MACD crossover could lead to near-term consolidation

• 🧨 Negative market surprise could invalidate long setup

• 🧮 Risk only 1–2% of your portfolio on this trade

💡 SMH bulls stay in control—but for how long?

🗣️ Are you going long, waiting for a pullback, or shorting the top? Drop your plan below 👇

📲 Follow for daily AI-generated trade signals & edge-backed setups.

$HACK and $SMH : The road to outperformanceHere in this space, we regularly check on the 2 subsectors i.e. Semis and Cybersecurity within the broader Tech sector. NASDAQ:SMH and AMEX:HACK have always outperformed the broader Tech sector ETF $XLK. During the last couple of quarters, we have seen the Cybersecurity sector has shown relative outperformance in comparison to the Semiconductor subsector within the technology index. When the NASDAQ:SMH lost more than 37% of its value during the recent downturn, while AMEX:HACK only lost 25% of its value. IN this blog space we have time and again focused on the topic of intrasector rotation. On 15th April I told you guys that the ratio chart of NASDAQ:SMH / AMEX:HACK looks overdone, and we might be set up for a reversal.

With both the sectors off of their local lows we can see that there is potential upside in both the sectors. But the question comes which one will outperform the other and if both of then outperform the broader index $XLK.

As I opined on 15th of April NASDAQ:SMH looks to have a higher BETA from its lows in comparison to $HACK. In the last downturns we have seen from its lows of 2022 NASDAQ:SMH 3Xed its price and AMEX:HACK 2X in the same time period. So, if you are looking for relative outperformance in the near to medium term then we should rather LONG NASDAQ:SMH over $HACK. And both NASDAQ:SMH and AMEX:HACK will outperform the AMEX:XLK in the near to long term.

Verdict : Long NASDAQ:SMH and $HACK. Overweight $SMH. Sell $XLK.

$SMH is in undecided watersMany Wall Street analyst will say there are no bull markets without the Semis. We have been going sideways for a few months. We are in a range within a major upward trend in the markets and the NASDAQ:SMH ETF. The same looks in the charts of NASDAQ:NVDA , NASDAQ:AVGO etc.

In this chart we plotted an upward trending parallel channel. The NASDAQ:SMH price have been within the parallel channel sweeping the upper and lower bound in this multiyear bull market. This is also evident here. But since hitting an ATH in July 2024. It has been sideways since then. It is forming a consolidating wedge pattern which can break either way. But usually, such consolidation pattern breaks in the direction of the underlying market trend.

Long NASDAQ:SMH now and here when in consolidation pattern.

Daily dose of Chart :Intrasector rotation with Tech. SMH vs HACKEven if the XLK (Tech sector ETF) hitting all time highs. But within the sector we see major rotation from Semis to Software to Cyber security. Last 6 months the Semis underperformed the Cybersecurity sector. But this has flipped recently on the daily basis. There is a bullish head and shoulders pattern forming on the SMH / HACK.

LSE:SMH (VANECK SEMICONDUCTOR ETF) LongAsset Class: Indices

Income Type: Daily

Symbol: SMH

Trade Type: Long

Trends:

Short Term: Up

Long Term: UP

Set-Up Parameters:

Entry: 42.330

Stop: 41.930

TP 44.320 (5:1)

Trade idea:

Retest of 4H demand zone formed by a drop-base-rally. TP set at the nearest SZ with a 5:1 risk-reward ratio. The RSI is oversold.

!!Be aware of pending Economic Reports. If price is within 20 pips of proximal value at time of major impact report, then Confirmation entry.

Trade management:

**When price hits 1:1 or T1, consider moving stop to entry in case of pullback.

**Disclaimer**:

The trading strategies, ideas, and information shared are for educational and informational purposes only. They do not constitute financial advice or a recommendation to buy or sell any securities, currencies, or financial instruments. You should do your own research or consult with a licensed financial advisor before making any trading decisions. The author assumes no responsibility for any losses incurred from following these trading ideas.

Semis may be ready to surge.NASDAQ:NVDA has reclaimed most daily supply and may trade into the earnings high if it can reclaim this week's range. NASDAQ:SMH has similarly reclaimed the daily 50 SMA and will go higher upon confirmation of the daily 100 SMA supply. Higher prices in semiconductors, such NASDAQ:AVGO as well, may help NASDAQ:QQQ follow AMEX:SPY to a new all-time high.

Analysis of SMH Chart (Daily Timeframe)SMH Daily Chart Analysis

The VanEck Semiconductor ETF ( NASDAQ:SMH ) is showing interesting technical patterns!

We're seeing the completion of Elliott Wave (3) with a potential corrective Wave (4) forming. This suggests we might see some consolidation or minor pullback before the next bullish wave.

The RSI is trending in a downward channel, reflecting decreasing momentum. Currently sitting at 43.91, it indicates a neutral to slightly bearish sentiment. It's essential to watch how the RSI behaves—whether it breaks below the channel or bounces back.

Support is around $240, while resistance lies near the $280 mark.

Stay tuned and trade wisely!

#Trading #Investing #TechnicalAnalysis #ElliottWave #RSI #SMH #Semiconductors

-------------------------------------------------

Overview

The chart of VanEck Semiconductor ETF (SMH) shows a clear Elliott Wave pattern, with Wave (3) nearing completion and Wave (4) beginning to form. This is confirmed by the RSI, which is exhibiting a downward channel trend, indicating weakening momentum.

Key Points:

Elliott Wave Analysis:

Wave (3) appears to be completing its cycle, marked by a peak in price.

Wave (4) is forming, typically a corrective phase that may lead to further price consolidation or a minor pullback before the next upward movement.

RSI Trend:

The RSI is currently in a downward channel, trending lower from overbought levels.

This suggests decreasing buying momentum and potential further downside or consolidation in the near term.

The RSI level is around 44.69, indicating a neutral to slightly bearish sentiment. It’s crucial to watch if it breaks below the lower channel trendline or bounces back within the channel.

Support and Resistance:

Immediate support is around the $240 region, coinciding with previous resistance turned support and the lower trendline of Wave (4).

Resistance is near the previous high around $280, marking the peak of Wave (3).

Analysis of SMH Monthly Chart (Buying 3 more @ 257.52)Decided to buy 3 more shares of SMH today, taking advantage of the 9% pullback from its previous all-time highs. Here’s why:

The chart shows a well-defined Elliott Wave pattern, currently in Wave (4) with Wave (5) expected next. This suggests further gains are on the horizon.

The RSI is at 76.25, approaching overbought territory but not quite there yet. Historically, SMH has sustained high RSI levels, indicating that there’s still room for growth.

SMH is a long-term play. The semiconductor sector is vital for tech innovation and growth. With continuous advancements in AI, IoT, and more, this ETF is positioned to benefit significantly in the coming years.

This pullback presents a great buying opportunity for long-term investors looking to capitalize on the potential growth in the semiconductor industry.

------------------------------------------------------

Analysis of SMH Monthly Chart

The chart depicts the monthly performance of the VanEck Semiconductor ETF (SMH), showing some promising signs for long-term investment, especially considering the recent pullback.

Elliott Wave Analysis:

The chart illustrates a clear Elliott Wave pattern, with waves (1), (2), (3) already completed, and (4) in the making.

The current position appears to be in Wave (4), suggesting that Wave (5) could be on the horizon, indicating potential for future upward movement.

RSI (Relative Strength Index):

The RSI is currently at 76.25, which indicates that SMH is approaching overbought territory. However, it's not yet at extreme levels, suggesting there is still room for upward movement before a significant correction.

Historically, the RSI has shown that even when the ETF reaches higher levels, it can sustain those levels for extended periods.

Recent Price Movement:

SMH is currently down 9% from its previous all-time highs, making it an attractive entry point for long-term investors.

This pullback provides a buying opportunity, especially given the historical performance and future potential as indicated by the Elliott Wave analysis.

Long-Term Relevance:

The VanEck Semiconductor ETF (SMH) is a critical investment for those looking to gain exposure to the semiconductor industry, which is foundational to technology and innovation.

The semiconductor sector has shown consistent growth over the years and is expected to continue its upward trajectory, driven by advancements in AI, IoT, and other tech developments.

BEAR TRAP ENDED BULL PHASE TO SEPT 10 /oct10 focus 9/21 topThe chart posted has given what state is a very clear ALL GO for the LAST BULL MARKET LEG. This last leg will end into mid sept . I will post more but a min is 4666/4731 . This will mark the END of The bull rally from oct 2022 and we will then see a very neg cycle One in which you all do not want to in the market for . Use this leg to Sell all long term holdings into WAVE B

NVDA DAILY WOLFE WAVE SETUP OVER THE WEEKENDOn Sept 2, 2022, a daily wolfe wave entry was triggered. The projected target is calculated by extending a linear line between pivot 1 and 4 and projecting the line. This is represented as the green perforated line, as shown in the chart. Since there is no apex associated with the daily wolfe wave, an alternative price objective would be required using gaps, previous support levels or time. If there was an apex formec, then the projected target is defined by identifying the apex location and projecting a vertical line toward the green perforated projection tgt which is extending from left to right. Short term target is near gap at 150 or 21 day ma which is 164. Conservative level would be 155. I hope this helps.

MU daily wolfe wave SMHThere is a daily wolfe wave setup that triggered on July 1 closing day at 53.65. The projected target is calculated by extending a linear line between pivot 1 and 4 and projecting the line. This is represented as the green perforated line, as shown in the chart. The projected target is 84.69 which is expected to reach this price target before Sept 22. Projected targets are defined by identifying the apex of the wolfe wave and projecting a vertical line toward the green perforated projection tgt which is extending from left to right. Using the customizable gap finder indicator there are sets of gaps along the way toward 84.69.

2/27/22 ONON Semiconductor Corporation ( NASDAQ:ON )

Sector: Electronic Technology (Semiconductors)

Market Capitalization: 27.464B

Current Price: $63.50

Breakout price: $65.35

Buy Zone (Top/Bottom Range): $60.30-$55.40

Price Target: $72.00-$73.40(1st)

Estimated Duration to Target: 49-54d

Contract of Interest: $ON 4/14/22 65c

Trade price as of publish date: $4.05/contract