multiyear breakout+a typical rounding boottom The above company looks a good chart to keep on watchlist

the fundamental changes are something to watch closely .

NOW talking about levels, 1400 strong positional basis support area

where a retest if takes place would be a fresh add on current entry positions

a break out taking place after 2015 ie approx 9 years is something to be truly particpate into !

expect 2300 & 2770 targets in 18 months with stop loss below 1250

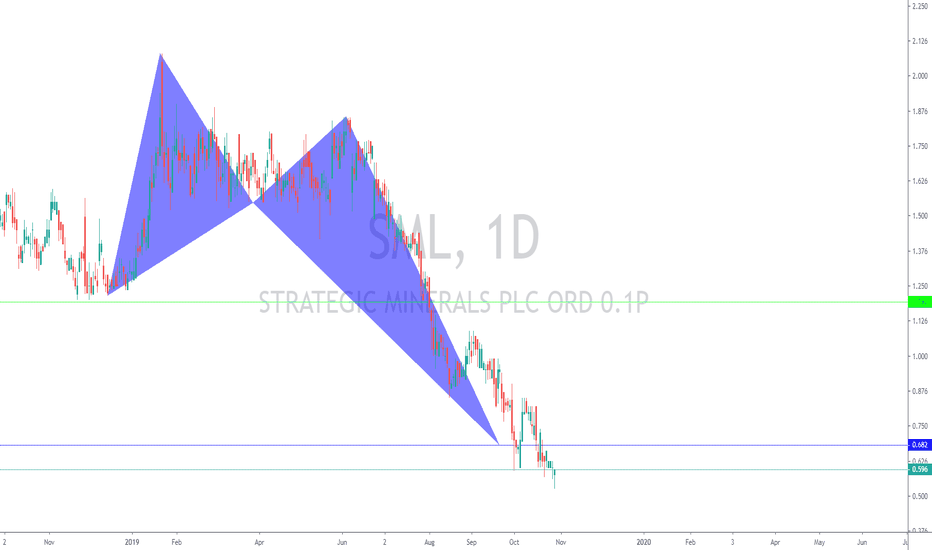

SML

SMLWho Knows really the new Zealand Share market is the most fickal in the world if u ask me very little makes sense on an earnings to share price ratio it is ridiculous .

Companies earning $350 m a year year on year are at $3.50 pr share and a company that earns $20m is $10 ? how does that work ?

Anyway based on Forex trading this is the most probable chance i think it has broken Resistence it is pulling back and will have another run then pull back then have another run as they do then take profit at the top because everyone else does

The stupidis thing you can do is sit there and watch your money dissapear, take money off the table then look for next best probable move.

When it hits $10.20 Buy safer thing to do it is moving up WAIT let the market tell you what it is doing if it doesn't hit,don't buy.

1st target 2.31p once 50% fibs are broken - 20ma bounce todayIf we hold above trend line and above 61.8% fibs my 1st target is 2.31p once we break above 50% fibs at 1.88p

3.71p and a retest of ATH is quite possible to be hit later on this year if you hold after 1st target but profits will be taken at different stages on chart.

I believe there is a LSE conference that John Peters will be apeaking at, that might give further momentum for the rise.