USDCHF Correction Due To Produce A Reversal Pattern?OANDA:USDCHF has been in a Correction Wave since the beginning of January and we now see that Price may have finally found Support at the 1.809 Fibonacci Extension Level of the Correction Wave.

With both Lows in March finding Support at the 1.809 Fibonacci Extension Level, Price is beginning to form what looks like a Reversal Pattern, the Double Bottom!

** Confirmation of Pattern will come when Price Breaks and Closes Above .8863, then we will be looking for a Long Opportunity to present itself as a Break and Retest Set-Up. The Retest will Validate the Trade Idea!

If we take the height of the Pattern and apply it to the Break of Confirmation, this puts the Potential Target at Previous Area of Support of the Correction Wave ( Point A ) in the .8975 area.

Fundamentals seem to Support the Bullish Idea with:

SNB Cutting Interest Rates by 25 Basis points from .5% to .25%

FED Holding Interest Rates @ 4.5% due to "Economic Uncertainty"

Unemployment Claims for USD came in as expected with no surprise and even 1K below Forecast ( Actual 223K / Forecast 224K )

Also Positive Outlook from Philly Fed Manufacturing Index and Existing Home Sales see USD rise.

Next Weeks Final GDP on Thursday, March 27th will be the next big News Event to bring some light to how the economy is doing and if USD will continue strengthening!

Snb

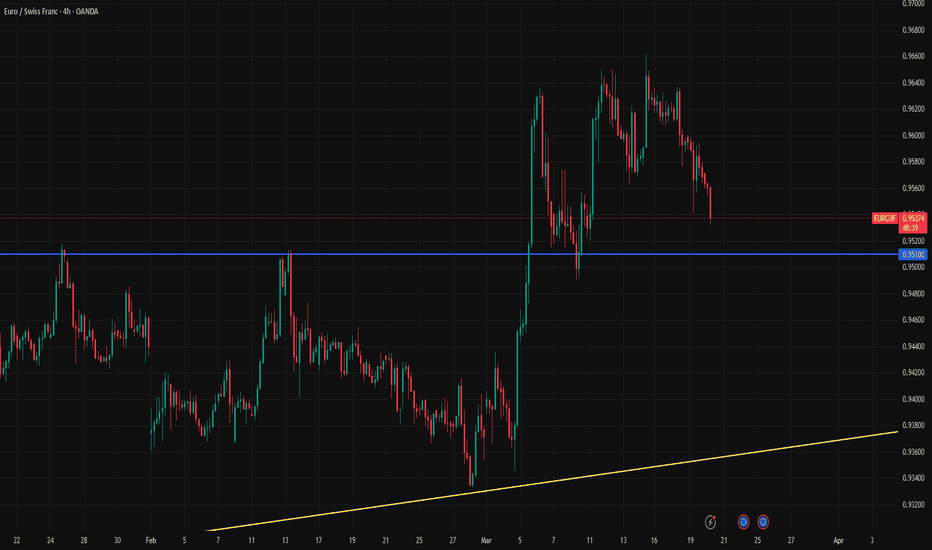

Watch Out for 0.9510 Support for EURCHFEURCHF is approaching the 0.9510 support level ahead of the SNB decision. Markets are currently pricing in a 25 basis point rate cut with a 68.1% probability. However, the recent relief in the Swiss franc may give the SNB reason to hold rates steady.

Our view is that the SNB will proceed with a 25 basis point cut today, and the 0.95–0.9510 support area is likely to hold. However, if this support zone breaks, it could trigger a medium-term selloff, potentially pushing EURCHF below 0.94.

USD/CHF: Bearish Trend Pauses, but Breakdown Risks RemainThe strong bearish trend for USD/CHF stalled this week, with buying support emerging beneath .8774, continuing the pattern seen in December. The net result has been a grind higher before running into resistance at .8854, forming what resembles a bear flag on the charts. That should put traders on alert for a potential downside break and resumption of the bearish trend.

Indicators like RSI (14) and MACD are providing mixed signals on price momentum, with the former trending higher while the latter remains below the signal line. However, the modest RSI (14) uptrend looks vulnerable, mirroring the unconvincing price action.

If the price breaks down from the bear flag, immediate levels of note include .8774, .8711, and .8617, the latter being a more substantial support level. On the topside, a break of .8854 would put .8920 and .8966 on the radar for bulls.

The price is hanging around the 200-day moving average like a bad smell this week, but having traded through it on multiple occasions like it didn’t exist, it shouldn’t be a major consideration for traders.

Good luck!

DS

USDCHF: Should we look for a weaker franc?!The USDCHF pair is located between the EMA200 and EMA50 on the 4-hour timeframe and is moving in its ascending channel. In case of a downward correction towards the demand zone, we will be provided with further buying positions in this pair with an appropriate risk-reward ratio.

The continuation of the pair’s rise and its placement in the supply zone will provide us with a selling position.

The President of the Swiss National Bank (SNB), Schlegel, stated in an interview with SRF that while the SNB does not favor negative interest rates, it also cannot completely rule them out. He emphasized that implementing such a policy would not be a decision taken lightly.

In recent weeks, Schlegel has repeatedly mentioned the possibility of negative interest rates, particularly in light of Switzerland’s inflation dropping to 0.6% in December, which has raised concerns about deflation. However, he noted that temporary periods of negative inflation would not necessarily pose a problem.Additionally, Schlegel reaffirmed the SNB’s commitment to maintaining price stability over the medium term, within the 0–2% target range.

Currently, market expectations indicate a 60% probability that the SNB will cut interest rates from 0.5% to 0.25% in March, with a 25% chance of rates reaching 0% by June.

In the United States, GDP data for Q4 2024 showed that the economy grew at an annualized 2.3% rate—below market expectations (2.6%) and lower than the 3.1% growth seen in the previous quarter. However, a 2.5% year-over-year growth rate remains substantial and aligns with the Federal Reserve’s outlook.

A key takeaway from the recent GDP report is the strong performance of U.S. consumers, who exceeded expectations with 4.2% growth in spending. According to CIBC, American consumers have shown a notable preference for durable goods, with spending in this category surging 12.1% last quarter—a figure significantly above pre-pandemic trends.

However, CIBC warns that other sectors of the economy are not as strong. Business investments remain weak, and government spending has played a crucial role in supporting economic growth. Additionally, a 0.9% decline in inventories, driven by weather disruptions and labor strikes, has negatively impacted GDP growth.

These factors are expected to persist into Q1 2025, as businesses stockpile inventory ahead of potential tariffs. However, when stripping out inventory effects, final sales to domestic buyers remain strong at 3.1%, which is nearly in line with the two-year average.

CIBC also believes that consumer spending will remain resilient, supported by rising asset-related incomes and millennials’ enthusiasm for technology and discretionary spending. That said, trade tariffs could ultimately shave 1% off GDP growth, with their effects likely to linger for some time.

Overall, CIBC concludes that while GDP growth may slow slightly under a Trump presidency, the decline is unlikely to cause major concern for the Federal Reserve. Fed Chair Jerome Powell remains more focused on rising prices, their impact on inflation expectations, and wage pressures, as the economy remains strong but inflation is not yet fully controlled.

Today’s data reinforces the Fed’s data-dependent approach. Underlying growth is still around 3%, and there is no indication that consumers are scaling back spending, suggesting that they can absorb moderate price increases.

As a result, Nomura now expects the Federal Reserve to keep interest rates unchanged through the end of 2025, revising its earlier forecast, which had anticipated at least one rate cut in 2025.

USDCHF - Looking for a Weaker Dollar?!The USDCHF pair is trading in its ascending channel on the 4-hour timeframe, between the EMA200 and EMA50. In case of a downward correction towards the demand zones, the next long positions in this pair with a good risk-reward ratio will be available for us.

Morgan Stanley Investment Bank anticipates that the Federal Reserve will keep interest rates unchanged at its January meeting but is expected to revise its assessment of labor market conditions. Jerome Powell, the Fed Chair, is likely to emphasize the reliance on data and prevailing uncertainties while keeping the option for a rate cut in March on the table.

Morgan Stanley analysts predict that the Fed may revise its description of the labor market from “cooling” to “stable.” This shift reflects recent employment data trends, which have demonstrated consistency over the past 6 to 9 months.

According to Morgan Stanley, Powell is expected to reiterate ongoing progress in reducing inflation, highlighting that monetary policy remains appropriately restrictive. Furthermore, the Fed is likely to delve deeper into balance sheet policies and may signal that the process of balance sheet reduction could soon conclude. Meanwhile, Sergio Ermotti, CEO of UBS, has warned that high government debt could lead to a major crisis.

Goldman Sachs, in its analysis of President Donald Trump’s inaugural policy statements, noted that his tariff policies appeared softer than initially expected and currently carry less priority than previously anticipated.

The firm also observed that Trump’s rhetoric regarding Mexico and Canada was more aggressive than projected. Goldman Sachs concluded that the likelihood of a global U.S. tariff on all import sectors this year has diminished, thereby reducing the risk of reigniting inflationary pressures.

David Solomon, CEO of Goldman Sachs, stated that as the new U.S. administration begins its term, the country’s economy appears to be in excellent shape. He also highlighted that key questions regarding tariffs pertain to their speed of implementation and targeted countries. Solomon remarked that tariffs would ultimately lead to a rebalancing of trade agreements over time and that trade policies would directly influence interest rate equilibrium.

On the other hand, Thomas Schlegel, the president of the Swiss National Bank, stated that the Swiss franc remains a safe haven asset in global markets, although trade disputes have adverse implications for Switzerland’s economy. He also emphasized that there is no current concern regarding inflation, which remains within the bank’s target range and aligned with cyclical forecasts. Schlegel further mentioned that the possibility of employing negative interest rates cannot be ruled out.

Swiss inflation declines, Swiss franc steadyThe Swiss franc is higher for a third straight trading day. In the European session, USD/CHF is currently trading at 0.9038, down 0.09% on the day.

Switzerland's inflation rate continues to fall and that is raising concerns at the Swiss National Bank. Other central banks are worried about the upside risk of inflation but the SNB is worried about inflation dropping below its target band of between 0% and 2%.

December CPI came in at -0.1% m/m for a third straight month, in line with the market estimate. Annually, CPI ticked lower to 0.6% from 0.7% in November, also matching the market estimate. Food and services prices decelerated, while housing and energy inflation rose to 3.4%, up from 3.3% in November.

The SNB only meets four times a year and the next meeting isn't until Mar. 30. Still, the soft December CPI report has cemented a rate cut in March, with the markets currently pricing in a 25-basis point cut at 98%. Could we see a larger cut in March? The answer is yes, if inflation continues to decelerate.

The SNB slashed rates by 50 basis points in December and the 0.1% decline in inflation in November likely was an important factor in the oversized rate cut, which was the largest in 10 years. There are two more inflation reports ahead of the March rate meeting and the SNB could respond with another 50-bp cut if inflation is close to the bottom of the 0%-2% target range.

The US releases ISM Services PMI for December, the key services indicator, later today. Over the past two years, the PMI has pointed to expansion in every month but two, pointing to prolonged growth in business activity. The PMI is expected to improve to 53.0, following 52.1 in November.

USD/CHF tested resistance at 0.9053 earlier. Above, there is resistance at 0.9097

0.9001 and 0.8957 are the next support levels

USDCHF - Looking for a weaker franc?!The USDCHF currency pair is above EMA200 and EMA50 in the 4H timeframe and is moving in its upward channel. If the upward movement continues, we can see the midline of the channel and the supply zone and sell within that zone with the appropriate risk reward. A downward correction towards the demand zones will provide us with the next buying positions for this currency pair.

1. U.S. Budget Deficit:

The U.S. Treasury Department reported that the federal budget deficit for November reached $367 billion, reflecting a 17% increase compared to the previous year. This rise is primarily attributed to calendar adjustments in benefit payments, which led to approximately $80 billion in additional government spending compared to November 2023.

2. BNP Paribas on Trump’s Tariff Policies:

BNP Paribas believes market analysts have underestimated the implications of Trump’s tariff policies and need to take them more seriously. The bank predicts that Trump will implement a significant portion of his tariff threats, even if not entirely. BNP Paribas anticipates these policies will cause a permanent shock to consumer prices in the U.S. while having a temporary effect on inflation. Additionally, the bank expects the Federal Reserve’s target interest rate to remain at 4.5% in 2025, with the U.S. dollar likely to strengthen further, particularly against the Chinese yuan, Mexican peso, and Canadian dollar.

3. Swiss National Bank Cuts Interest Rates:

On Thursday, the Swiss National Bank (SNB) unexpectedly cut its interest rate by 50 basis points, marking the largest rate reduction in a decade. This move was aimed at staying ahead of potential rate cuts by other central banks and curbing the rising value of the Swiss franc.Most economists had predicted a smaller rate cut of 25 basis points.

This reduction represents the most significant decrease in borrowing costs since the SNB’s emergency rate cut in January 2015. With inflationary pressures subsiding, the SNB opted for further monetary easing. Inflation in Switzerland fell to 0.7% in November and has remained within the bank’s target range of 0–2% since May 2023. The 0.5% rate cut aims to further stimulate the economy and boost labor market activity.

4. Remarks by SNB President:

Thomas Schlegel, president of the Swiss National Bank, stated that the bank considers all aspects of the franc’s value, not just its exchange rate against the euro. While acknowledging the effectiveness of negative interest rates, Schlegel emphasized that the SNB does not favor them but would resort to such measures again if necessary, as they have helped reduce the franc’s attractiveness.

5. Managing the Swiss Franc’s Value:

The Swiss franc, known as a global safe-haven currency, often appreciates during periods of market volatility, prompting the SNB to invest significant effort in managing its value. However, UBS has noted that this issue is no longer a major concern: “While the franc has strengthened against the euro, it has weakened against the U.S. dollar, maintaining a relatively stable trade-weighted exchange rate.”

Swiss National Bank cuts by half-point, Swissy dipsThe Swiss franc is down on Thursday following the Swiss National Bank rate announcement. In the North American session, USD/CHF is trading at 0.8880, up 0.43% 80on the day at the time of writing.

Today's Swiss National Bank meeting was live, with the market uncertain as whether the SNB would cut rates by 25 or 50 basis points. In the end, the central bank opted for a jumbo 50-bp cut, bringing the cash rate to 0.50%.

The driver for the today's oversized cut was the November inflation report, which came in at -0.1% for a second straight month. Inflation hasn't posted a gain in six months and the SNB is concerned that inflation could fall below the 0%-2% target.

The 50-bp cut marks the SNB's biggest rate reduction in 10 years. In its statement, the Bank pointed to lower-than-expected inflation, risks over US economic policy and political uncertainty in Europe. The statement was somewhat dovish, noting that "the forecast for Switzerland, as for the global economy, is subject to significant uncertainty".

Today's rate cut marks the fourth reduction this year. The SNB has been aggressive in its easing cycle, with the twin goals of avoiding deflation and combating the Swiss franc's appreciation. The SNB does not want a highly-valued Swiss franc as this hurts the critical export sector. The central bank implemented a negative rate policy until mid-2022 and the SNB has not ruled out a return to negative rates. After the meeting, SNB President Martin Schlegel said that today's 50-bp cut had reduced the probability of negative rates.

The SNB also released its updated inflation forecast at today's meeting. The September inflation report was revised downwards, with a forecast of 1.1% in 2024 and 0.3% in 2025.

USD/CHF has pushed above resistance at 0.8860 and is testing resistance at 0.8879. Above, there is resistance at 0.8903

0.8836 and 0.8817 are the next support levels

USD/CHF edges up ahead of SNB rate decisionThe Swiss franc is slightly lower on Wednesday. In the European session, USD/CHF is trading at 0.8845, up 0.19% on the day.

'Tis the season of central bank decisions, with four major central banks making rate announcements this week. The Swiss central bank meets on Thursday and a rate cut has been fully priced, but what will the SNB do? The market has currently priced a 50-basis point cut at 60% and a modest 25-bp cut at 40%. Just one week ago, the odds were 70-30 in favor of a 50-bp cut.

Inflation declined by 0.1% in November and Switzerland hasn't posted a gain in inflation since May. The signs of deflation support the case for a jumbo 50-bp cut. Still, central banks prefer modest rate moves in 25-bp increments and with the cash rate at just 1%, policymakers may opt for a 25-bp cut.

US inflation for November was a non-event for the US dollar, which has shown little movement today against the major currencies. Headline CPI ticked higher to 2.7% y/y up from 2.6% in October, while the core rate rose 3.3% y/y for a third straight month. Monthly, headline CPI rose from 0.2% to 0.3% and the core CPI rose was unchanged at 0.3%. The data matched expectations which explains the muted response of the US dollar.

In the aftermath of today's inflation data, the market expectations for a rate cut at the Dec .18 meeting have jumped. The rate odds for a quarter-point have climbed to 97%, compared to 88% immediately prior to the release. The Fed has lowered rates twice this year and is poised for a third cut next week, even though the inflation downswing has stalled and inflation remains higher than the Fed's 2% target.

USD/CHF tested resistance at 0.8853 earlier. Above, there is resistance at 0.8876

0.8810 and 0.8787 are the next support levels

USDCHF - The new Treasury Secretary will weaken the dollar?!The USDCHF currency pair is located between EMA200 and EMA50 in the 4H timeframe and is moving in its upward channel. If the upward movement continues, we can see the midline of the channel and the supply zone, and sell in the form of scalps with the appropriate risk reward. A downward correction towards the demand zones will provide us with the next buying positions for this currency pair.

Chris Turner, an analyst at ING, noted in a recent report that the dollar is likely to remain stable through the end of the year, even if the Federal Reserve cuts interest rates in December. While markets remain divided on the likelihood of a rate cut next month, ING anticipates a 25-basis-point reduction. Turner suggested that such a move, coupled with potential seasonal weakness, could weigh negatively on the dollar. However, amid geopolitical uncertainties and the stronger performance of the U.S. economy compared to the Eurozone, the dollar is expected to remain supported by demand for safe-haven assets.

According to the U.S. Conference Board’s Consumer Confidence Index, “the probability of a U.S. recession within the next 12 months reached its lowest point in November.”

The minutes from the Federal Reserve’s November meeting, released last night, revealed that some policymakers believe the pace of rate cuts could accelerate if economic activity declines or the labor market weakens. Conversely, some officials warned that persistent inflation might necessitate halting the easing cycle and maintaining rates at restrictive levels. Many policymakers highlighted uncertainty about the neutral rate, emphasizing the need for a gradual reduction in monetary restrictions.

Scott Bennett, the newly appointed U.S. Treasury Secretary, believes that a weak dollar policy could become a cornerstone of Trump’s second administration. In a letter published earlier this year by Bennett’s hedge fund, he argued that Trump is more likely to pursue a dollar-weakening strategy than rely on tariffs. Bennett stated that tariffs tend to drive inflation and strengthen the dollar, which conflicts with efforts to revive U.S. manufacturing.

Bennett predicted that a weaker dollar early in Trump’s second term could enhance the competitiveness of U.S. industrial production. He argued that a weaker dollar, coupled with cheap and abundant energy, could fuel economic growth. This perspective diverges from Wall Street’s current consensus, which leans toward a stronger dollar. Bennett remarked that dollar strengthening might only occur later in Trump’s term if efforts to onshore production prove successful.

He also pointed to the constraints imposed by tariffs, corporate tax cuts, and budget deficits, which he believes hinder Trump’s economic objectives. Bennett suggested that focusing on deliberate currency devaluation could simultaneously achieve GDP growth, fiscal improvement, and stock market gains—at least in nominal terms.

Bennett stressed that targeting a weaker dollar against the Chinese yuan and Japanese yen could yield more impactful results. He even suggested that such a strategy could allow China to claim it had avoided U.S. tariffs, presenting it as a “win.”

Bennett’s statements carry significant weight given his new role as Treasury Secretary. He also briefly referenced the concept of Bretton Woods 3, noting that while it is not currently a primary scenario, conditions for its realization are in place.

Meanwhile, Swiss National Bank Chairman Schlegel stated that Switzerland benefits from a flexible inflation framework that enables it to respond more effectively to economic shocks. He noted that while the Swiss franc is recognized as a safe-haven currency, this very characteristic can lead to appreciation during global recessions, which may harm Switzerland’s economy. The SNB remains committed to price stability, which Schlegel identified as a key factor in the country’s economic success. He also did not rule out the possibility of a return to negative interest rates.

EURJPY | MarketoutlookThe policy divergence between the US Fed and SNB supports the pair at lower levels.

Jobless claims dropped to 227,000 for the week ending October 19, down from 242,000 the week before, suggesting some stability in the labor market. The four-week moving average rose by 6,750, reaching 231,000, which indicates that jobless claims are still showing fluctuations despite the recent decline.

The S&P Global Flash U.S. Manufacturing PMI increased slightly to 47.8 in October, up from 47.3 in September. However, this still shows that manufacturing activity is contracting for the fourth month in a row. On the other hand, the Flash Services PMI rose to 51.5, indicating modest growth in the services sector, which is important since it makes up a large part of the U.S. economy.

USDCHF - Dollar will continue to grow after FOMC?!The USDCHF currency pair is above EMA200 and EMA50 in the 4H timeframe and is moving in its upward channel. In case of upward correction, we can see the supply zone and sell within that zone with appropriate risk reward. The bottom of the ascending channel will be the target of this move.

The Federal Reserve recently reduced its interest rate by 0.25%, bringing it to 4.75%. The Fed’s statement indicates that the “labor market has cooled,” whereas the previous statement had only mentioned a “slower job market growth.” Additionally, there appears to be a slight decline in confidence regarding inflation reduction.

Jerome Powell, the Federal Reserve Chair, emphasized that he will remain in his role until the end of his term. When asked about fiscal policies, Powell stated that such matters are outside the Fed’s authority. He added that if the economy remains strong and inflation does not reach the 2% target, monetary policy adjustments may occur at a slower pace. He also highlighted that the policies of any administration or Congress could have significant economic impacts, but these effects will be evaluated alongside other factors.

The recent report on Switzerland’s consumer inflation index indicates that the global landscape has not changed significantly from the pre-COVID era. After the inflation shock of the COVID period, some banking officials speculated that the world was entering a new phase where zero or negative interest rates were unlikely, and the neutral rate would be higher. However, there is no strong evidence to support this claim, especially with the major transformations anticipated from the growth of artificial intelligence. Furthermore, many analysts believe that the risks associated with de-globalization and demographic arguments are not as compelling.

In September, the Swiss National Bank revised its inflation forecast for 2025 from 1.1% to 0.6% and also adjusted the interest rate. The inflation forecast for this year was revised down from 1.3% to 1.2%. The next meeting of the Swiss National Bank is scheduled for December 12, and if current conditions persist (including energy prices and exchange rates), a 50-basis-point rate cut could become a strong option.

Deutsche Bank also sees an increasing likelihood of a return to negative interest rates, noting factors that could lead to higher risk and a stronger Swiss franc. These challenges are not exclusive to Switzerland; Europe as a whole is facing similar issues. Deutsche Bank has indicated that, currently, inflation in Europe does not pose a significant problem.

Will USDCHF reverse its course due to the new SNB's prospect?Macro theme:

- Swiss inflation unexpectedly slowed to 0.6% in Oct—the lowest in over three years—raising expectations that the SNB may opt for a more significant 0.5% rate cut in Dec to keep inflation within its 0-2% target range.

- Meanwhile, the Federal Reserve cut interest rates by 0.25% but issued a slightly more hawkish statement.

Technical theme:

- USDCHF broke the descending channel after testing both EMAs, which just golden crossed each other, indicating a bullish momentum exists.

- USDCHF may retest the broken descending trendline, confluence with the support level around 0.8693-0.8700 before resuming its upward movement to retest 0.8825.

- On the contrary, a closing below 08626 may prompt a deeper correction to a nearby support around 0.8550.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

USDCHF Reaffirms Bearish Bias after Timid SNB & US PCEThe Swiss National Bank was the first major institution to shift to monetary easing and remains at the forefront after its third consecutive rate cut this week. However, it stuck with the small 0.25% increments, which are meager compared to the Fed’s jumbo 0.5% pivot and aggressive easing path. Furthermore, with rates already at 1%, the SNB easing runway may not be very long. Today’s US inflation figures favor the Fed’s dovishness, as headline PCE decelerated to 2.2% and the lowest in more than three years. These dynamics weigh on the pair and reaffirm the bearish below the EMA200. This sustains risk for further losses below 0.8333 and levels not seen since at least 2015, although sustained weakness below it is hard.

Core PCE ticked up to 2.7% y/y and the Fed’s frontloading may fuel further persistence in price pressures and lead to fewer cuts later on. On the Swiss front, policymakers may not be able to avoid larger rate cuts. Inflation dropped to 1.1% in August and they expect further deceleration to 0.6% next year, while the elevated Franc harms exports and ads to the pressure for bigger policy moves and/or FX intervention. Despite the post-pandemic shift, the SNB has generally sought to keep the Swiss Franc from appreciating and has kept rates below zero for most of the past ten years.

As a result, we can see another effort surpass the EMA200 and pause the bearish bias. This would bring the 38.2% Fibonacci of the May-September slump into the spotlight, but we are cautious around the ascending prospects as the upside looks unfriendly.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (trading as “FXCM” or “FXCM EU”) (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 59% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763). Please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this video are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed via FXCM`s website:

Stratos Markets Limited clients please see: www.fxcm.com

Stratos Europe Ltd clients please see: www.fxcm.com

Stratos Trading Pty. Limited clients please see: www.fxcm.com

Stratos Global LLC clients please see: www.fxcm.com

Past Performance is not an indicator of future results.

Swiss franc edges lower after Swiss central bank cuts ratesThe Swiss franc is showing limited movement on Thursday. USD/CHF is trading at 0.8483, down 0.24% on the day. In the US, it’s a busy day with US GDP, unemployment claims and durable goods orders. As well, Federal Reserve Chair Powell and several FOMC members will deliver remarks.

The Swiss National Bank lowered its cash rate by 25 basis points to 1%, its third straight reduction. The cash rate is now at its lowest level since early 2023. The move was not a surprise and the Swiss franc has showed a limited reaction to the rate announcement.

The SNB statement noted that inflation has “decreased significantly”, in part due to the appreciation of the Swiss franc and that inflation, which has fallen to 1.1%, was lower than expected. The statement added that further rate cuts “may become necessary” to ensure price stability.

The stronger Swiss franc has raised the possibility of a currency intervention by the SNB and investors were on the look-out for any hints from the SNB at today’s meeting. The statement didn’t point to any intervention plans, noting that the central bank “remains willing to be active in the foreign exchange market as necessary.” The Swiss franc’s safe haven status has made it an attractive asset at a time of market volatility but this is hurting the critical export sector. The SNB could step in if the Swiss franc continues to appreciate.

The SNB has become a frontrunner among central banks in cutting interest rates, a result of its success in taming inflation. Other major banks have also lowered rates but are still concerned about the upside risk of inflation and have not chopped rates as aggressively as the SNB.

USD/CHF is testing support at 0.8475. Below, there is support at 0.8444

0.8536 and 0.8567 are the next resistance lines

AUDCHF: RBA and SNB Can Send Pair even higherIn this article, I will take a closer look at AUD/CHF, and the reason for focusing on this pair is the potential divergence between the RBA and the SNB, which could push the pair even higher. The RBA is expected to hold rates at 4.35%, as inflation slightly increased year-on-year to 3.8% in the second quarter, up from 3.6% in the first quarter. On the other hand, the Swiss National Bank (SNB) may once again cut rates, which could help keep AUD/CHF in an uptrend.

Looking at the wave structure, we have seen a very nice ABC setback down to 0.5605, which ended in mid-September. Ideally, we are now in a new impulsive phase. However, for this current leg up to be completed, we need to see five waves up, and based on the subdivisions, that is not the case yet. In fact, a wave four correction could appear in the next few days, presenting an opportunity to join the uptrend. Support can be found around the 0.5780 area, which also aligns with the previous wave B swing area.

The price should not fall below 0.5729, otherwise the wave count will become invalid.

AUD/USD sinks ahead of GDPThe Australian dollar is sharply lower on Tuesday. AUD/USD is trading at 0.6732 in the European session, down 0.88% today at the time of writing.

Australia’s economy has been sputtering and the markets aren’t expecting much change from second-quarter GDP on Wednesday. GDP is expected to trickle lower to 1% y/y, down from 1.1% in Q1, which was the weakest pace of growth since Q4 2020. Quarterly, the market estimate for GDP stands at 0.3%, compared to 0.1% in Q1.

GDP-per-capita is expected to be negative, another indication that economic activity remains subdued. Australia has been hit by a drop in iron ore and core prices and exports fell by 4.4% in the second quarter, which doesn’t bode well for the Australian dollar.

The GDP is unlikely to change the Reserve Bank of Australia’s plans when it meets on Sept. 24. The central bank is closely watching inflation, which remains stubbornly high, as well as the labor market. Governor Bullock has said she has no plans to lower the cash rate from its current 4.35% for the next six months. The RBA has stuck to its “higher for longer” stance and has maintained rates since November.

The Federal Reserve is widely expected to lower rates on September 18, with a 70% likelihood of a quarter-point cut and a 31% likelihood of a half-point cut. Ahead of the meeting is a crucial employment report on Friday. The previous jobs report was much weaker than expected and triggered a meltdown in the financial markets. Another weak jobs report would raise the likelihood of a half-point cut, while a solid release will cement a quarter-point cut.

AUD/USD has pushed below support at 0.6780 and is testing support at 0.6737. Below, there is support at 0.6708

0.6809 and 0.6852 are the next resistance lines

USDCHF: Elliott Waves and Dovish SNB Are Pointing HigherUSDCHF turned higher this year, after breaking some important trendline connected from 2022 highs on a daily chart, where a breakout can lead to higher prices within a big triangle range. One of the reasons why Swiss franc is that weak compared to others is because SNB surprised and cut rates twice after inflation has softened. So as long as FED sticks to current rates, USDCHF may do well, but this cycle may change later this year when FED finally cuts if data convince them that inflation is back at normal levels again. But for now, we have to focus on the current trend and pattern which seems to be pointing higher, on USDCHF.

Looking at the 4-hour chart, it looks like pair recently pulled lower into a higher degree corrective setback, temporary (A)-(B)-(C) corrective decline, where wave (C) appears completed because of five subwaves down from wave (B). We also see some nice reactions higher, from new low and back above 0.900 where overlap confirms the resumption of an uptrend. However, there can be some intraday setback as pair comes into a channel resistance now, near 0.9050. But sooner or later we think the channel will be out and more upside ahead, while the market is above 0.8826, the short-term invalidation level.

USDCHF Tests Critical Resistance on Dovish SNBHaving pivoted away from its tightening cycle in March, the Swiss National Bank delivered the second straight rate cut last week, making it a frontrunner in the shift to monetary easing. Officials also lowered their inflation forecasts, creating scope for more moves ahead. Its US counterpart on the other hand, is reluctant to pivot due to stubborn inflation and Fed officials see just one cut this year.

This monetary policy divergence is beneficial for USD/CHF, which surges after the SNB back-to-back rate cut. It now tries to take out a pivotal resistance cluster, comprising of the EMA200 (black line), the 38.2% Fibonacci of the last decline and the daily Ichimoku Cloud. Successful effort will give control back to the bulls and allow them to look towards the 2024 peak (0.9225-46), but this may prove elusive in the near term.

On the other hand, with two rate cuts already under their belt, Swiss policymakers may become less bold. Furthermore, the Fed may have adopted a higher for longer stance, but still sees less restrictive stance ahead and markets are more optimistic, pricing in two rate cuts within the year.

Overbought conditions indicated by the RSI and the aforementioned critical resistance confluence, can put pressure on USD/CHF. So a pullback that would challenge 0.8825 would not be surprising, but deeper losses towards and beyond 0.8730 are not compatible with the monetary policy dynamics.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (trading as “FXCM” or “FXCM EU”), previously FXCM EU Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763). Please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this video are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed via FXCM`s website:

Stratos Markets Limited clients please see: www.fxcm.com

Stratos Europe Ltd clients please see: www.fxcm.com

Stratos Trading Pty. Limited clients please see: www.fxcm.com

Stratos Global LLC clients please see: www.fxcm.com

Past Performance is not an indicator of future results.

EUR/CHF: Navigating SNB Cut and French Election DynamicsHey Traders, In today's trading session, we are closely observing the EUR/CHF pair for a potential selling opportunity around the 0.95500 zone. This level is identified as a key support and resistance area, aligning with the ongoing downtrend. The pair is currently in a corrective phase, approaching the trend line near the 0.95500 level.

Recent Developments:

Swiss National Bank (SNB) Policy Adjustment: Yesterday, the SNB implemented a 25 basis points rate cut. This move typically signals a dovish monetary stance, which might initially weaken the Swiss Franc.

French Elections: As we approach the French elections, demand for the Swiss Franc is anticipated to remain robust. Political uncertainty often drives investors towards safe-haven currencies like the CHF.

Given these dynamics, we expect the recent SNB rate cut's impact on the Swiss Franc to be temporary. The heightened demand for the Franc amid electoral uncertainty should bolster its strength, making the 0.95500 zone a critical level to watch for potential selling opportunities in the EUR/CHF pair.

Best Regards,

Joe

USD/CHF downtrend pauses for breath ahead of SNBThere is quite a bit of uncertainty with today's SNB rate decision, over whether they'll cut or hold. And that has seen the 1--day implied volatility level more than double its 20-day average. The market is clearly in a downtrend on the daily chart, having broken key support on Tuesday.

Prices are now consolidating above the weekly S1 pivot on the hourly chart. If the SNB do cut and spark a rebound on USD/CHF, the preference is to step aside and seek evidence of a swing high. This is because we now know the SNB no longer want a weaker currency, so any upshot today is likely to be temporary. And this scenario would be preferred as it allows for an improved reward to risk ratio.

However, as the decline of the inflation rate rate is slowing, growth was stronger than expected and the SNB do not want a weaker currency, a hold seems more likely. In which case, a move towards 0.88 is on the cards near the high-volume node of the prior uptrend and the lower 1-day implied volatility band.

USD/CHF – flat ahead of SNB rate decisionThe Swiss franc is almost unchanged on Wednesday. USD/CHF is trading at 0.8838 in the North American session, down 0.04% on the day.

Switzerland’s central bank will announce its rate decision on Thursday and the markets are on edge. Will the Swiss National Bank lower rates or hold? The SNB last met in March and that meeting was memorable, as policy makers shocked the markets with a quarter-point cut, bringing the cash rate to 1.50%. Investors had expected the SNB to continue to maintain rates at the March 21st meeting, but the SNB decided to respond to declines in inflation and growth and became the first major central bank to lower rates this year.

The Swiss franc took a bath and fell 1.2% against the US dollar the day of the March meeting, its second-to-worst daily performance this year. The Swissie proceeded to lose more ground in the following weeks but has recovered almost completely.

Economists are split 50/50 on whether the SNB will cut on Thursday, while the money markets have cut expectations of a rate cut to 60%, compared to 80% just one month ago. The ultra-cautious SNB has been mum, with no public comments from Bank policy makers over the past three weeks, which has only intensified the suspense.

Inflation has been steady in the upper half of the SNB’s target range of 0% to 2% and Swiss growth has been steady, which would support the case to hold rates. On the other hand, exports have been weak and the Swiss franc has appreciated 3.3% against the US dollar since May 30th. A rate cut by the SNB could weigh on the Swiss franc and make Swiss exports more attractive on world markets.

The uncertainty ahead of the SNB meeting makes this a live meeting and could translate into volatility from the Swiss franc on Thursday.

There is support at 0.8809 and 0.8777

0.8860 and 0.8892 are the next resistance lines

Swiss franc climbing, eyes Swiss inflationSwiss franc has extended its gains on Monday. USD/CHF is trading at 0.8961 in the North American session, down 0.68%.

The Swiss franc posted its strong weekly gain of the year last week, rising 1.35%. The Swissie jumped over 1% on Thursday after Swiss National Bank President Jordan hinted that the central bank could intervene in the currency markets in order to keep a lid on inflation.

Thomas’ comments gave a boost to the Swiss currency, which has sagged in 2024. Even with last week’s strong gains, however, the Swiss franc has plunged 7.1% against the US dollar. The Swiss franc weakened after the Swiss National Bank unexpectedly lowered interest rates in March. A weaker Swiss franc helped make Swiss exports more competitive on world markets, but the currency’s sharp descent may have become too much of a good thing, as it is feeding inflation and raising concerns at the central bank.

The Swiss franc’s downswing has had a strong impact on market expectations for a rate cut at the June 28th meeting. In early May, swap markets priced a 66% probability of a rate cut, which has fallen to around 40%. The SNB isn’t likely to make good on Jordan's threat to buy Swiss francs unless the currency continues to show a sharp depreciation, but last week’s jump shows how comments from central bankers can cause sharp swings in the currency markets.

Switzerland releases May CPI on Tuesday. This is the final economic release prior to the central bank’s rate meeting and could be a major factor in the SNB’s rate decision. Swiss CPI is expected to tick up to 0.4% m/m in May, compared to 0.3% in April.

USD/CHF is testing support 0.8966. Below, there is support at 0.8909

0.9061 and 0.9118 are the next resistance lines