SNXUSDT Breakout Alert! Are We Witnessing the Early Stages?📌 🔍 Overview:

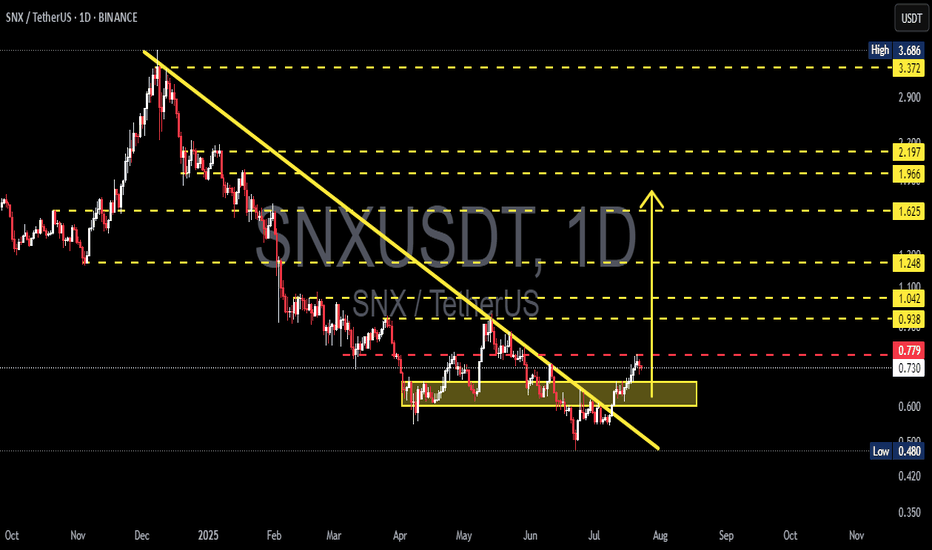

After months of relentless downward pressure, SNX has finally shown a strong technical breakout. The price has decisively broken above the long-term descending trendline, signaling a potential shift in structure from bearish to bullish. This could mark the beginning of a significant impulse wave to the upside.

📐 📊 Technical Structure & Key Pattern Breakdown:

🔻 Broken Downtrend Line: Price action has successfully broken above a descending trendline that has been in place since December 2024, effectively ending the bearish dominance.

🔺 Falling Wedge Pattern: A classic falling wedge has formed and recently completed with a confirmed breakout — a bullish reversal pattern that often precedes strong upside momentum.

🟨 Accumulation Zone (Base Support): The yellow box between $0.60 – $0.72 acted as a major accumulation zone and now flips into a strong demand/support area.

📈 Higher Lows Structure: The recent structure of higher lows signals a shift in market sentiment, showing early signs of accumulation and bullish interest.

✅ Bullish Scenario (Upside Continuation):

If price holds above the breakout zone and confirms strength:

🎯 Target 1: $0.938 (key horizontal resistance)

🎯 Target 2: $1.042 – $1.100 (historical resistance zone)

🎯 Target 3: $1.248 – $1.625

🎯 Target 4 (Mid-term rally): $1.966 – $2.197

🏁 Final Bullish Target (Longer term): $3.372 – $3.686

A strong continuation would require confirmation via increased trading volume and bullish momentum from the broader crypto market.

❌ Bearish Scenario (Failed Retest or Rejection):

However, if the price fails to sustain above the breakout level:

🚨 Risk of a false breakout emerges if price falls back below $0.724

🔻 Breakdown of the yellow support box could trigger a deeper correction toward:

Support 1: $0.60

Support 2 (Major Low): $0.480

This would form a classic bull trap and extend the consolidation phase.

⚠️ Validation & Risk Considerations:

Volume confirmation is key. A breakout without rising volume may lack follow-through.

Watch closely for price action in the coming days — will it hold above the breakout zone or fall back?

Strategy: Look for retest entries or enter with partial exposure, using tight risk management.

🧠 Conclusion:

SNXUSDT is at a pivotal turning point. The breakout from a falling wedge pattern combined with higher low formations is a textbook bullish reversal setup. If price holds and buyers step in, we may be witnessing the early stages of a major bull run for SNX.

#SNXUSDT #SNXBreakout #AltcoinSetup #BullishReversal #FallingWedge #CryptoSignals #CryptoTrading #ChartAnalysis #PriceAction

Snxsignals

#SNX/USDT#SNX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.827.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.880

First target: 0.900

Second target: 0.943

Third target: 0.977

#Snx 1W chartNYSE:SNX 1W chart;

At its level in June 2022. Therefore, it continues its course in the cheap zone

While the pattern formation with its harmonic structure continues, it is also nearing the end of the trend contractions from October 2021 and March 2024

After the movement on the Bitcoin side, we may see a journey up to the target zones on the chart

OB will complete its pattern with the resistance level seen.

🚀 SNX: A Crypto Marvel Unveils Its Potential! 🌐💎Greetings Crypto Enthusiasts! 👋

SNX, a true gem in the crypto cosmos, shines brightly with a market cap of 958M.

📊 SNX Essentials:

Market Cap: 958M

Circulation Supply: 304,391,280 SNX

Total Supply: 328,193,104 SNX

TVL : 647M

⚖️ Chart Analysis:

Accumulation Unfolding: Witness the grand accumulation depicted by the dark green rectangle and a smaller, already conquered one (light green rectangle). A potential retest might linger until the yellow trend line. Brace for the skyward journey upon the breakout from the larger accumulation.

⚡️ Trading Strategy:

Timing is Everything: Recognize the market's correction mood. This is a weekly chart, demanding a patient stance – could be a day, could be months.

Strategic Alerts: Set alarms at 2.61 - 2.00 - 1.45. Distribute your SNX funds into thirds, ready for action at these levels.

📈 Optimistic Outlook:

While the current level may signal a reversal, patience is key. Hold off on buying here. Anticipate reaching the upper red level, with a realistic mindset.

Golden Rules:

DCA Always: A timeless strategy in crypto.

DYOR (Do Your Own Research): Knowledge is paramount.

No All-In: Navigate wisely; avoid going all in.

🚨 Disclaimer:

This isn't financial advice but a friendly guide for strategic crypto exploration.

Wishing you the best on your SNX adventure! 🚀🌟💰

#SNX/USDT#SNX

The price is trading in a large descending triangle and has been gaining bullish momentum recently

Supported by reversal triangle patterns

The price is now in the downtrend breach zone at

the current price of 2.37

With the first goal 3.27

Second goal 4.32

With oversold conditions

During the uptrend there may be some price correction

SNX / SNXUSDTGood Luck >>

• Warning •

Any deal I share does not mean that I am forcing you to enter into it, you enter in with your full risk, because I'll not gain any profits with you in the end.

The risk management of the position must comply with the stop loss.

(I am not sharing financial or investment advice, you should do your own research for your money.)

Synthetix / US Dollar (SNX/USDT) Token Analysis 11/09/2023Fundamental Analysis:

Synthetix is in the process of constructing a decentralized liquidity provisioning protocol accessible for various purposes by any protocol. Its substantial liquidity and minimal fees act as the infrastructure for numerous exciting protocols on both the Optimism and Ethereum networks. A multitude of user-facing protocols within the Synthetix ecosystem, such as Kwenta (Spot and Futures), Lyra (Options), Polynomial (Automated Options), as well as 1inch & Curve (Atomic Swaps), harness Synthetix liquidity to empower their functionalities.

Synthetix is developed on the Optimism and Ethereum mainnet platforms. The Synthetix Network is secured by collateral in the form of SNX, ETH, and LUSD, enabling the creation of synthetic assets known as Synths. These Synths mimic and generate returns based on underlying assets without necessitating direct possession of the assets themselves. This pooled collateralization paves the way for a variety of on-chain, composable financial instruments supported by liquidity sourced from Synthetix.

Some of the most highly anticipated forthcoming releases from SNX include Perps V2, which seeks to enable cost-effective on-chain futures trading by leveraging off-chain oracles, and Synthetix V3, designed to rebuild the protocol in line with its original objective of becoming a fully permissionless derivatives protocol. You can find more information about Synthetix on their blog or by joining the SNX Discord community.

The platform's mission is to expand the cryptocurrency realm by introducing non-blockchain assets, thereby granting access to a more expansive and robust financial market.

Synthetix operates as a decentralized exchange (DEX) and serves as a platform for synthetic assets. Its architecture is designed to provide users with exposure to underlying assets through synths, eliminating the need to hold the actual assets themselves.

This platform empowers users to autonomously trade and exchange synths, while also offering a staking pool where SNX token holders can stake their tokens and receive rewards in the form of a share of transaction fees from the Synthetix Exchange.

To track the underlying assets, Synthetix employs smart contract price delivery protocols known as oracles. This approach ensures that users can seamlessly trade synths without encountering liquidity or slippage issues, and it eliminates the requirement for third-party intermediaries.

SNX tokens play a crucial role as collateral for the minting of synthetic assets. Whenever synths are generated, SNX tokens are locked up within a smart contract.

Since its inception, the protocol has transitioned to the Optimistic Ethereum mainnet to mitigate gas fees on the network and reduce oracle latency.

The SNX token is compatible with Ethereum’s ERC20 standard. The Synthetix network is secured through proof-of-stake (PoS) consensus. Synthetix holders stake their SNX and earn returns from the network fees.

Another way for SNX stakers to earn rewards is via the protocol’s inflationary monetary policy, known as staking rewards.

The maximum supply of SNX is 323,506,696 coins, of which 269,871,212 SNX is in circulation as of September 2023.

At the seed round and token sale stages, Synthetix sold more than 60 million tokens and was able to raise $30 million. Of the total 100,000,000 coins issued during the ICO, 20% was allocated to the team and advisors, 3% to bounties and marketing incentives, 5% to partnership incentives and 12% to the foundation.

The network was initially launched in September 2017 by Kain Warwick under the name Havven (HAV). Approximately a year later, the company underwent a rebranding, adopting the name Synthetix.

Kain Warwick, the founder of Synthetix, also holds a position as a non-executive director at the blueshyft retail network. Before establishing Synthetix, Warwick had been involved in various other cryptocurrency projects. Additionally, he is the founder of Pouncer, a live auction site exclusive to Australia.

Peter McKean, serving as the project's CEO, boasts over two decades of experience in software development. Prior to his role at Synthetix, he worked as a programmer at ICL Fujitsu.

Jordan Momtazi, the COO of Synthetix, brings to the team his expertise as a business strategist, market analyst, and sales leader, with a wealth of experience in blockchain, cryptocurrency, digital payments, and e-commerce systems.

Justin J. Moses, the CTO, formerly held the position of director of engineering at MongoDB and served as the deputy practice head of engineering at Lab49. He also co-founded Pouncer.

Technical Analysis:

As we observe, the price has experienced a decline from its all-time high (ATH) of $29 and is currently fluctuating within the Fibonacci retracement levels of 88.6% and 95%. Within this range, there are two noteworthy price support zones at $0.8 and $0.3.

We have identified three potential price targets:

First Target Price (1TP): $28.8

Second Target Price (2TP): $36.5

Third Target Price (3TP): $46.5

Furthermore, we can regard the major Fibonacci retracement levels as potential resistance levels, which we have indicated on the chart.

Sentiment Analysis:

Considering the possibility of depreciation in the total market capitalization of cryptocurrencies and the price of Bitcoin (BTC) in the upcoming months, it is reasonable to consider employing a Dollar Cost Averaging (DCA) strategy for long positions at the specified support levels.

SNXUSDTBINANCE:SNXUSDT SHORT

⚠️Note:

In this type of signals, only the entry point and trade direction are specified, and stop loss and target are not determined.

If you are interested in entering these signals, please provide a stop loss and a logical market-based target.

⛔"Daily crypto market analyses I provide are personal opinions & not financial advice. Trading carries risks, so do your own research & seek advisor's help.#DYOR"

Don't forget to like and comment

SNX - Accumulation 🧲 LONG Setup +500% TPHi Traders, Investors and Speculators

Ev here. Been trading crypto since 2017 and later got into stocks. I have 3 board exams on financial markets and studied economics from a top tier university for a year. Daytime job - Math Teacher. 👩🏫

I've been Bullish on SNXUSDT for the longest time and I believe we are close to the market bottom - perhaps one more drop. This would be the low volume sell-off according to the Wyckoff Method for the Accumulation phase.

In this 4min video, a quick buy setup with a potential +500% target ad take profit point (TP).

Interested in my view on BTC? Check out this idea:

Have a great weekend 🥂

_______________________

📢Follow us here on TradingView for daily updates and trade ideas on crypto , stocks and commodities 💎Hit like & Follow 👍

We thank you for your support !

CryptoCheck

SNXUSDT BULLISH, Breakout OPPORTUNITY +180%Hi Traders, Investors and Speculators 📈📉

Ev here. Been trading crypto since 2017 and later got into stocks. I have 3 board exams on financial markets and studied economics from a top tier university for a year. Daytime job - Math Teacher. 👩🏫

Synthetix Network Token (SNX) is an Ethereum token that powers Synthetix, a decentralized synthetic asset issuance protocol. For a few months, I have been extremely bullish on SNXUSDT. I've been mentioning it in videos on altcoins that I am watching multiple times. After the last video, the price of SNXUSDT has increased by 20%. Now I know this is not the whopping 120% or 150%, but it was a very low risk trade with extremely high upside potential. Considering that it's previously done a +1000% in 3 months during the previous parabolic bull run, a target of 180% for mid-cycle is modest.

My next target is also considering a spot trade, and it could take another few months to get there (unless the bullish market comes early. The best time to accumulate altcoins is when they are trading in-between the 0 and the 0.236 Fibonacci Retracement level, as this one currently is. The risk to reward ratio is exceptional in such cases. It is also comforting to see the period of consolidation trading/range trading and a contraction in the Bollinger Bands for nearly a month, indicating that the price is getting ready for another move.

Here's the video on the 3 Altcoins that I was watching earlier this year:

Synthetic assets / tokens are minted when token holders stake their SNX as collateral using Mintr, a decentralized application for interacting with the Synthetix contracts. If you want to know a little bit more about how this works and how to start staking and yield farming, check out this easy guide for making money with DeFi :

Interested in the Merge on Ethereum and how it may affect the price of ETHUSDT ? Check out this idea 👀

_________________

📢Follow us here on TradingView for daily updates and trade ideas on crypto , stocks and commodities 💎Hit like & Follow

We thank you for your support !

CryptoCheck

💎 SNXUSDT : 575.99% Profit Potential in Next 6 Months💣💣💣💣last 2-3 weeks we seen huge buying in SNX coin, in upcoming months its to going pump very hard.

entry and targets are given on the chart. Treat this idea as long-term investment

please Like and comment if there are any queries.

#bitcoin #altcoinseason #altcoin #altnews