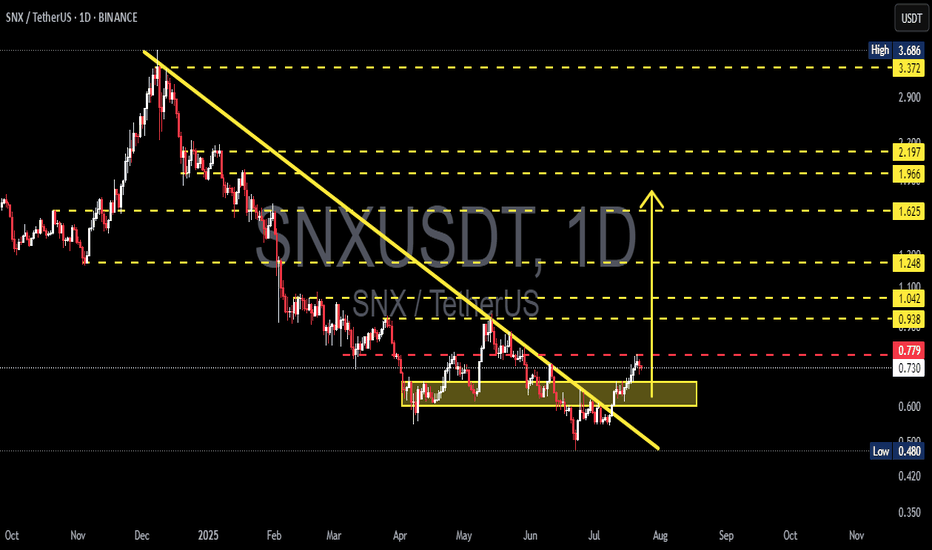

SNXUSDT Breakout Alert! Are We Witnessing the Early Stages?📌 🔍 Overview:

After months of relentless downward pressure, SNX has finally shown a strong technical breakout. The price has decisively broken above the long-term descending trendline, signaling a potential shift in structure from bearish to bullish. This could mark the beginning of a significant impulse wave to the upside.

📐 📊 Technical Structure & Key Pattern Breakdown:

🔻 Broken Downtrend Line: Price action has successfully broken above a descending trendline that has been in place since December 2024, effectively ending the bearish dominance.

🔺 Falling Wedge Pattern: A classic falling wedge has formed and recently completed with a confirmed breakout — a bullish reversal pattern that often precedes strong upside momentum.

🟨 Accumulation Zone (Base Support): The yellow box between $0.60 – $0.72 acted as a major accumulation zone and now flips into a strong demand/support area.

📈 Higher Lows Structure: The recent structure of higher lows signals a shift in market sentiment, showing early signs of accumulation and bullish interest.

✅ Bullish Scenario (Upside Continuation):

If price holds above the breakout zone and confirms strength:

🎯 Target 1: $0.938 (key horizontal resistance)

🎯 Target 2: $1.042 – $1.100 (historical resistance zone)

🎯 Target 3: $1.248 – $1.625

🎯 Target 4 (Mid-term rally): $1.966 – $2.197

🏁 Final Bullish Target (Longer term): $3.372 – $3.686

A strong continuation would require confirmation via increased trading volume and bullish momentum from the broader crypto market.

❌ Bearish Scenario (Failed Retest or Rejection):

However, if the price fails to sustain above the breakout level:

🚨 Risk of a false breakout emerges if price falls back below $0.724

🔻 Breakdown of the yellow support box could trigger a deeper correction toward:

Support 1: $0.60

Support 2 (Major Low): $0.480

This would form a classic bull trap and extend the consolidation phase.

⚠️ Validation & Risk Considerations:

Volume confirmation is key. A breakout without rising volume may lack follow-through.

Watch closely for price action in the coming days — will it hold above the breakout zone or fall back?

Strategy: Look for retest entries or enter with partial exposure, using tight risk management.

🧠 Conclusion:

SNXUSDT is at a pivotal turning point. The breakout from a falling wedge pattern combined with higher low formations is a textbook bullish reversal setup. If price holds and buyers step in, we may be witnessing the early stages of a major bull run for SNX.

#SNXUSDT #SNXBreakout #AltcoinSetup #BullishReversal #FallingWedge #CryptoSignals #CryptoTrading #ChartAnalysis #PriceAction

SNXUSDT

SNX About to Explode or Collapse?Yello Paradisers, are you watching SNXUSDT closely? Because if not, you might be missing one of the cleanest opportunities for bulls in this current market cycle. The setup is forming right at a critical decision point — and how price reacts here could define the next major move.

💎SNXUSDT is currently showing a bullish internal CHoCH (Change of Character) while trading directly inside a strong support zone. This zone isn’t just standing alone — it’s backed by the powerful 200 EMA and a well-respected support trendline. This confluence of support significantly increases the probability of a bullish bounce from this level, making it a high-reward setup for those paying attention.

💎Zooming out to the higher timeframe, the structure becomes even more interesting. SNXUSDT appears to be forming a bull flag pattern — a bullish continuation signal that often precedes explosive upside moves. When such a formation aligns with key support zones, it suggests that the market is simply consolidating before the next leg up.

💎However, traders must proceed with caution. If price breaks down and closes below the current support zone, this would invalidate the entire bullish scenario. In such a case, it’s best to step aside and wait for better confirmation rather than rushing into a compromised setup. Emotional decisions are the fastest way to ruin sound trading strategies.

🎖Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. Discipline, patience, and strategic entries will always outperform emotional trades. Stay focused, Paradisers — the opportunity will always favor those who are prepared.

MyCryptoParadise

iFeel the success🌴

#SNX/USDT#SNX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.827.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.880

First target: 0.900

Second target: 0.943

Third target: 0.977

#SNX/USDT#SNX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.711.

We are seeing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.744

First target: 0.765

Second target: 0.785

Third target: 0.811

SNXUSDT Bouncing from Channel SupportSNXUSDT Technical analysis update

SNXUSDT has been trading inside a clear descending channel for the last 1700 days. Recently, the price touched the lower support of the channel and is now showing signs of a bounce.

If the current momentum continues, SNX could move upward toward the upper resistance of the channel. A breakout above the upper trendline would be a strong bullish signal. Until then, the price may stay within the channel.

Price could move 100%-250% in a few months.

SNX Analysis (1D)SNX has broken an old trigger line and is also forming a CP within a channel.

We are looking for buy/long positions in the Demand zone.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

Is SNXUSDT About to Make a Big Move? Yello, Paradisers! SNXUSDT has shown an ideal retracement, setting up a high probability for a bullish bounce from the current support zone.

💎There’s potential for a W-pattern formation here. If the price successfully breaks out and closes candle above the resistance level, this would significantly increase the likelihood of a bullish continuation.

💎However, while a bullish move is possible, the probability at this stage is relatively low, making it a scenario worth watching but not acting on just yet.

💎If panic selling or a deeper retracement occurs, the strong support zone below may offer a favorable bounce. To increase confidence in this setup, we need to see a bullish I-CHoCH (internal change of character) on lower timeframes.

💎On the flip side, if SNXUSDT breaks down and closes candle below the strong support zone, the bullish thesis will be invalidated. In that case, it’s best to remain patient and wait for more favorable price action to develop.

🎖Always remember, Paradisers, discipline and patience are the keys to consistent profitability. Avoid making emotional decisions and stick to your strategy. The market rewards the patient!

MyCryptoParadise

iFeel the success🌴

Breaking: SpaceN ($SN) Surge Over 2000% Amidst Market VolatilityThe cryptocurrency market has witnessed yet another jaw-dropping rally, with SpaceN ( NYSE:SN ), an NFT one-stop investment management tool, surging over 2000% within a single day. This sudden price explosion has raised several questions regarding the sustainability of such gains, given the token’s 1 billion total supply and only 40 million currently circulating in the market.

Market Overview & Trading Activity

SpaceN’s impressive surge has propelled its market capitalization to approximately $44.99 million, ranking it #846 on CoinGecko. However, a major concern among skeptics is the low trading volume relative to its market cap. With a reported $608,223 in 24-hour trading volume, many are questioning the legitimacy of such a steep price increase on a token with a fully diluted valuation (FDV) of over $1.12 billion.

Despite the concerns, the token has shown resilience, outperforming the broader crypto market, which is down -0.80% in the last week. Over the past seven days, NYSE:SN has seen a price increase of 420.40%, making it one of the best-performing assets within the BNB Chain ecosystem.

Technical Analysis

Following its remarkable rally, NYSE:SN experienced a sharp retracement, currently trading down 2.72% at the time of writing. While such a correction is expected after a parabolic move, the price action remains above key moving averages (MA), hinting at a potential second leg up.

Support & Resistance Levels: The recent all-time high (ATH) of $6.15, recorded on January 29, 2025, is a crucial resistance point. If bullish momentum picks up, a move toward this level is possible, with $5 acting as a pivot zone.

Volume Concerns: The lack of significant trading volume and the reliance on Gate.io as its primary exchange raises questions about liquidity. A listing on a top-tier exchange such as Binance or KuCoin could be a major catalyst for further price appreciation.

Trend Outlook: NYSE:SN is trading within a falling trend after the initial spike. However, if the daily candlestick closes in a bullish structure, a potential retest of key resistance zones could lead to renewed momentum.

The Promise of SpaceN

Beyond the price action, the fundamentals of SpaceN provide an interesting case for long-term adoption:

- NFT Management Tool: SpaceN aims to be a one-stop investment management platform for NFTs, allowing users to track investment income, stay updated on NFT projects, and access NFT-focused social circles.

- DAO Functionality: Users can create self-organized DAOs, trade NFTs, and build communities based on shared holdings.

- BNB Chain Ecosystem: Being built on the BNB Chain, SpaceN could benefit from future integrations and potential ecosystem expansions.

Final Thoughts: Is There More Room to Run?

Despite its meteoric rise and subsequent correction, NYSE:SN remains a token to watch. The low trading volume relative to market cap presents some red flags, but the token’s fundamentals and the broader NFT sector’s growth could provide the necessary fuel for another push higher. A key factor will be whether SpaceN secures additional exchange listings and maintains bullish technical indicators.

For traders and investors, keeping an eye on volume trends, resistance levels, and exchange-related news will be crucial. If momentum returns, a push toward $5 and potentially reclaiming its ATH could be on the table. However, caution is advised, given the volatile nature of such explosive moves.

Will NYSE:SN continue its rally, or was this a one-off spike? The next few days will be critical in determining the trajectory of this NFT-focused token.

SNXUSDT BULISH I believe this coin may not experience a sharp bullish movement right now. The targets are achievable in the midterm, but if the candle closes below the stop loss, the idea will be considered invalid.

Note: My ideas are not intended for any type of scalping or scalpers!

Here are my other ideas:

www.tradingview.com

SNX's bullish situationBINANCE:SNXUSDT

what is better than an already broken falling wedge!

The expected resistance and targets are shown on the chart!

⚠️ Disclaimer:

This is not financial advice. Always manage your risks and trade responsibly.

👉 Follow me for daily updates,

💬 Comment and like to share your thoughts,

📌 And check the link in my bio for even more resources!

Let’s navigate the markets together—join the journey today! 💹✨

Technical Analysis of Synthetix Network Token (SNX/USD): Key LevThis analysis examines the price movement of Synthetix Network Token (SNX) on the weekly timeframe. The structure of the waves and key trendlines have been identified to help traders determine entry and exit points.

Key Highlights of the Analysis:

Strong Support Zone ($1.75–$1.429):

The price has recently reacted to a critical support zone between $1.75–$1.429, showing a strong rebound.

This zone is significant due to the completion of the fifth wave and its alignment with historical support levels, making it a crucial entry point for buyers.

Descending Trendline:

The price remains under the influence of a long-term descending trendline that has capped further upside movement.

Breaking above this trendline and holding above $2.5 could signal the beginning of a new bullish trend.

Key Resistance Level ($5.884):

The major resistance lies at $5.884, aligning with the peak of previous waves.

Reaching this level could serve as a medium-term target for buyers if the price successfully breaks the descending trendline.

Stochastic Oscillator:

The stochastic oscillator is moving toward the overbought region, suggesting a potential short-term correction.

However, further upward movement is possible, especially if the price consolidates above $2.5.

Potential Scenarios:

Bullish Scenario:

Breaking the descending trendline and surpassing the $2.5 resistance could push the price toward $5.884. This scenario is ideal for medium- to long-term traders.

Bearish Scenario:

If the price declines and retests the support zone at $1.75–$1.429, this area could provide another buying opportunity.

Breaking below this support zone could lead to further declines.

Conclusion:

With the technical structure and key levels outlined, Synthetix Network Token is at a critical juncture. Traders should closely monitor the price’s reaction to the descending trendline and the support zone.

SNX LongThe Accumulation Phase (2023-2024) is marked on the chart, showing a period of consolidation where price moves within a range. This phase indicates that buyers and sellers are reaching equilibrium, setting up a strong foundation for future price movement.

The Demand Zone (2025) is represented by the blue dashed area, a key level of support where price could experience a bounce. This zone is crucial as it could offer an entry point for long trades before a potential breakout.

The chart projects a Bullish Breakout (2025 and beyond) , where the price is expected to rise significantly after the accumulation phase.

Potential Target: The price is projected to rise significantly after the breakout, potentially reaching targets as high as $16 based on the breakout from the demand zone.

Overall Outlook: The chart suggests a well-planned accumulation phase with a likely bullish breakout in 2025. Keep an eye on the demand area for potential entries and watch for upward momentum as price breaks above key resistance levels.

#SNX/USDT#SNX

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 2.16

Entry price 2.20

First target 2.24

Second target 2.31

Third target 2.40

#SNX/USDT

#SNX

We have a bearish channel pattern on a 12-hour frame, the price moves within it, adheres to its limits well, and is expected to break it upwards strongly.

We have a support area at the lower border of the channel at $2.50 from which the price rebounded

We have a tendency to stabilize above moving average 100

We have a downtrend on the RSI indicator that is about to break higher, supporting the price higher

Entry price is 2.60

First goal 3.26

The second goal is 3.60

The third goal is 4.20

SNXUSDT Signals Bullish Move AheadSNXUSDT Technical analysis update

BINANCE:SNXUSDT has been ranging at the bottom for the last 120 days. The price has now broken out above the resistance line with high volume and is trading above the 100 EMA, signaling a bullish trend. This breakout indicates the potential for a strong bullish move in the coming days.

Buy zone : Below $1.77

Stop loss : $1.50

Take Profit 1: $1.99

Take Profit 2: $2.40

Take Profit 3: $3.30

Thank You

Hexa🧘♀️

#SNX. Great entry point and upside potential. 11/21/24Synthetix Network Token (SNX) is an Ethereum-based token powering the decentralized protocol for issuing synthetic assets, Synthetix.

Synthetic assets are created when SNX token holders provide them as collateral using Mintr, a decentralized application for interacting with Synthetix contracts.

Currently, the protocol supports synthetic fiat currencies, cryptocurrencies, and commodities.

The situation is similar to #DYDX. The token is in a sideways trend and near the lower boundary. Buying at current levels up to $1.22 is a reasonable idea for spot trading. The nearest target is $3.144. On spot, you can easily achieve at least a 2x return.

SNX buy setup (12H)SNX seems bullish. We have iCH on the chart and important trigger lines have been broken and it has stabilized on the upper orderblock range.

By keeping the last OB, you can move towards the targets.

Closing the daily candle below the invalidation level will violate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you