Solana (SOL): Bullish Continuation after Neckline BreakoutWhat I see:

Chart Patterns (Head and Shoulders): The chart illustrates a classic "Head and Shoulders" pattern. The left shoulder, head, and right shoulder are formed, and the neckline (the blue dashed line) has been broken, which suggests that the price could rise towards the target zone above the broken neckline.

Target Price: Based on the pattern and technical analysis, the potential target for the price could be around $219.84, as indicated by the box in the upper right corner. This target aligns with the upward trend continuation from the broken neckline.

Support Zones: There are several key support levels below the current price, including the lower zone marked in blue around $95.50 and the potential demand area in the middle blue zone (around $136.34). These could act as areas for price to rebound from if there's a pullback.

Trend Line and Movement: The dotted blue trend line suggests an ascending trend, showing higher lows, and the price is likely to continue upward after the recent breakout above the neckline.

Given the broken neckline and the formation of the Head and Shoulders pattern, the bullish scenario appears more likely. A price target of around $219.84 seems feasible if the upward momentum continues. However, if the price fails to hold above the neckline or reverses, the support zones could provide areas for potential price bounces, with the $136.34 region as a significant level to watch for possible buying opportunities. Therefore, the most probable outcome aligns with the bullish scenario (towards $219.84).

SOL

SOL 1H – Demand Zone Bounce Brewing, Can Bulls Reach $205 Again?Solana is once again testing its high-volume demand zone near $155–$160 — a level that previously launched it toward local highs near $210. With price dipping back into this area and Stoch RSI bottoming out, the stage is set for a potential bounce play.

🔹 Structure & Key Zones

The blue box marks a clear price memory zone — tested multiple times throughout late July and early August.

Each bounce from this zone has led to significant rallies — suggesting strong underlying demand.

Two major resistance levels remain overhead: ~$195 (lower high supply) and ~$210 (range high).

🔹 Momentum Context

Stoch RSI is once again in the oversold zone, hinting at possible short-term reversal momentum.

A clean reaction from this demand area could lead to a strong leg higher — especially if the $170–$175 zone is reclaimed.

🔹 Trade Scenario

Potential setup: price tags demand → forms a local higher low → pushes through short-term resistance toward the upper range.

If this bounce plays out, bulls may target the $195–$205 zone — creating a potential 30%+ move.

Is SOL ready to bounce — or will this demand zone finally give way?

Comment below and share your setup 👇

SOL's Golden Pocket: Is This the Bottom?SOL just tapped into the golden pocket zone and swept sell-side liquidity. Creating a high-probability long opportunity.

🟢 Long Setup:

Entry Zone: $156.67 – $151.50

Stop Loss: Below $150 (clear invalidation)

Target: $172

Risk:Reward: solid R:R setup

Why This Zone? Confluence Breakdown:

Golden Pocket retracement (0.618–0.666)

1.272 Trend-Based Fib Extension

Monthly Order Block

0.5 Fib Speed Fan support

Key Level at $154.81

Anchored VWAP support layer

Pitchfork 0.618/0.666 alignment

SSL (Sell-Side Liquidity) swept

nPOC at ~$152 offers a prime entry if we see another leg down

💡 Tip: Ladder in entries within the zone and size up near nPOC if price dips further. Manage risk carefully and watch how price reacts at the zone.

🧠 Educational Insight

Golden pockets (the 0.618–0.666 Fibonacci zone) are some of the most respected levels in trading often acting as key reversal zones, especially when stacked with other tools. In this case, we’ve got a rare confluence: anchored VWAP, nPOC, monthly OB, SSL sweep etc. all lining up with the golden pocket.

When multiple technical factors align, they don’t just increase probability, they give you a tighter invalidation and a better risk-to-reward setup. That’s how professional traders spot sniper entries.

_________________________________

💬 If you found this helpful, drop a like and comment!

SOL 15m Ready to Rumble? Possible Double Setup!Two decent setups on Solana’s 15m, one bounce play off key support, the other a breakout rip targeting quant resistance.

Setup #1 — Mean Reversion Long:

• Entry: 161 to 162

• Stop: 158.78 (sits on quant S1 = 158.67)

• Target: 166.62

• R/R: 2.4x

This setup rides the bounce from support that matches pivot S1. Confirm with candle wick + volume punch.

Setup #2 — Breakout Continuation:

• Entry: Above 166.62

• Stop: 164 (tight) or 154.86 (sits above quant S2 = 153.41)

• Target 1: 171.38 (just under quant R1 = 172.46)

• Target 2: 180.99 (quant R2 if price rips)

• R/R: 1.6x to 3.4x

Break needs volume. R1 is the battlefield. If we nuke through, R2’s next.

Quant Levels to monitor:

• Support:

S1 = 158.67

S2 = 153.41

• Resistance:

R1 = 172.46

R2 = 180.99

R3 = 186.25

Daily ATR ~11 pts — volatility is favorable

Structure and confluence are clean. Execution depends on price confirmation.

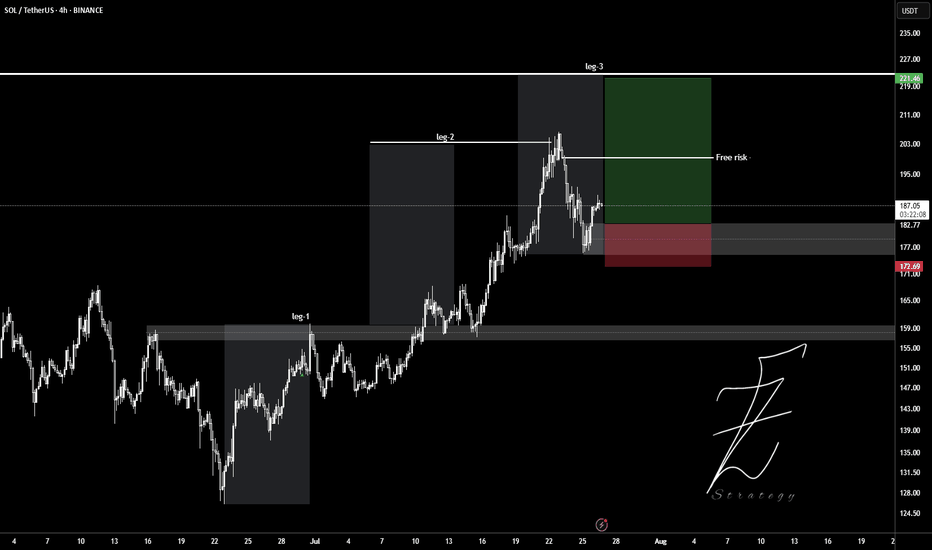

SOL | Solana Game Plan - Swing Long IdeaSOL | Solana Game Plan - Swing Long Idea

📊 Market Sentiment

Market sentiment remains bullish, supported by expectations of a 0.25% rate cut at the upcoming FOMC meeting. The weakening USD and rising risk appetite across global markets continue to favor crypto assets.

We’re currently seeing a minor retracement, primarily driven by the Nasdaq’s pullback — but the overall outlook for the crypto market remains bullish in the weeks ahead.

📈 Technical Analysis

Price was rejected from the HTF bearish trendline near $207 and is now retracing.

The retracement aligns with a HTF bullish trendline, which I believe could spark a strong move to the upside.

This area also aligns with the 0.5 Fibonacci retracement level (discount zone) and a HTF demand zone — forming a strong confluence for a potential bounce.

📌 Game Plan

I want to see price hit the HTF demand zone at $152 (purple box).

It should also tap the bullish trendline.

The zone aligns with the 0.5 Fibonacci level — my key discount area.

🎯 Setup Trigger

After these levels are tagged, I’ll be looking for a 4H bullish break of structure, which should also form a new 4H demand zone for confirmation.

📋 Trade Management

Stoploss: Below swing low of the 4H demand zone

Targets:

• TP1: $188

• TP2: $207

• TP3: $297

I’ll trail my stop to lock in profits aggressively as price moves in my favor.

💬 Like, follow, and comment if this breakdown supports your trading!

More setups and market insights coming soon — stay connected!

SOL vs ETH: Bleeding Until Catalyst?

SOL/ETH on the Daily

On June 17, 2025, a death cross formed — and since then, SOL has been steadily losing ground to ETH.

Attempts to pause or reverse the trend at the 0.382 and 0.5 Fib levels have failed. Momentum is strong to the downside.

The next potential support is the 0.618 Fib, around 0.04000.

In my view, this is closely tied to Ethereum’s dominance narrative: ETF inflows, real-world assets, stablecoins, Trump support, protocol upgrades — the spotlight is firmly on ETH.

Unless SOL gets its own ETF (which, to my knowledge, it currently doesn't), it’s likely to keep bleeding against ETH — just like other altcoins in similar positions.

Bias: bearish until proven otherwise.

Always take profits and manage risk.

Interaction is welcome.

An Example of Trading a Coin (Token) You're Hesitant to Trade

Hello, fellow traders!

By "Following," you'll always get the latest information quickly. Have a great day today.

-------------------------------------

There are coins (tokens) that are showing positive trends, but are reluctant to trade.

BNB and TRX are two such coins.

(BNBUSDT 1W chart)

(TRXUSDT 1W chart)

What these two coins have in common is that their representatives are Chinese.

These two coins are consistently making efforts to expand globally.

BNB is ranked first among exchange-traded coins, while TRX is steadily making efforts to expand into the US market to expand globally.

Despite this, some are reluctant to trade due to concerns about being an exchange-traded coin and being a Chinese coin.

To mitigate this risk, it's best to increase the number of coins (tokens) that ultimately generate profits.

In other words, by selling the amount of the original purchase price, you retain the number of coins (tokens) that represent profit.

This way, even if the price plummets, you'll always be in profit, allowing you to seize new opportunities.

For coins (tokens) that demonstrate long-term growth potential, increasing the number of coins (tokens) that represent profit is recommended. While these coins (tokens) appear to have potential for long-term growth, they currently carry some risk.

This also applies to coins that are considered worth holding for the long term, such as BTC and ETH.

Therefore, coins (tokens) that have a large user base and are considered to have future value, such as XRP, ADA, SOL, and DOGE, still carry some risk.

-

Thank you for reading to the end.

I wish you a successful trading experience.

--------------------------------------------------

$SOL CRYPTO FUTURES SETUP – BEARISH BIAS (Aug 2, 2025)

🚨 **\ CRYPTOCAP:SOL CRYPTO FUTURES SETUP – BEARISH BIAS** (Aug 2, 2025) 🚨

Multi-Model AI Consensus | 🔻 Short Bias with Defined Risk

---

### 📉 **MARKET CONTEXT**

* **Current Price**: \$158.84

* 🔻 Trading below all key MAs:

* SMA20: \$178.72 (-11.1%)

* SMA50: \$161.29 (-1.5%)

* SMA200: \$162.06 (-2.0%)

* 🔻 Market Structure:

* **Death Cross** confirmed

* **Lower highs/lows** across all timeframes

* **-12.36%** drop over 5 days = capitulation signal

* 🔥 Liquidity Zone: **\$155.29** = key bounce OR breakdown level

* 📉 Volume declining = no buyer conviction

* 💣 Volatility High: BB Width = 26.2% of price (⚠️ Stop risk!)

---

### 🧠 **MULTI-TIMEFRAME MODEL SIGNALS**

**1-Hour**:

🟥 Bearish MACD, RSI \~39 (no reversal yet)

**4-Hour**:

🔻 Still trending down, no structure break

**Daily**:

⚠️ Death Cross active, must hold \$155.29

💡 Reclaim of \$162.06 = **bullish trigger**

---

### 🔬 **TECHNICAL INDICATOR SYNTHESIS**

* **RSI (14)**: 39.84 → nearing oversold

* **MACD**: Strong bearish momentum, no reversal

* **Bollinger Bands**: Price hugging lower band @ \$155.29

* **Volume**: Weak, no accumulation on dips

* **Funding Rate**: Neutral (0.0001%) = no squeeze setup

---

### 🔎 **TRADE SETUP (OA MODEL)**

🛑 **Direction**: SHORT

🎯 **Entry**: \$158.84

📉 **Target**: \$155.29

🛡️ **Stop**: \$161.29

💪 **Confidence**: 80%

🕰️ **Timing**: Market Open

🧠 Model Notes: Favoring momentum short w/ tight stop & fast exit

---

### ❌ **DS MODEL (No Trade)**

🟡 Recommends standing aside due to:

* Missing OI data

* Elevated volatility

* Lack of reversal OR divergence

---

### 🤖 **FINAL CONSENSUS**

🧠 **Models Agreed**: 2

📊 **Average Confidence**: 68%

📉 **Bias**: SHORT

📛 **Risk Level**: MODERATE

🚨 **Key Breakdown**: < \$155.29 = opens door to \$145

---

### ⚠️ **WATCH LEVELS**

* 📈 **Bull Trigger**: Close above \$162.06 (SMA200) + MACD cross

* 📉 **Bear Continuation**: Break < \$155.29 = fast drop to \$145

* 📌 **Optimal Long Setup**: RSI divergence + volume spike @ support

---

🧨 **RISK WARNING**: High volatility zone – futures carry liquidation risk >100%. Always use proper sizing and stops.

---

📢 #CryptoFutures #SOLUSDT #TradingView #AITradeSignal #BearishSetup #SolanaAnalysis #MultiModelConsensus

SOL - Support Broke, Is This Just a Retest Before The Pump?Solana just lost a key structural level on the 4H chart — the former range high (~163–166), which had acted as resistance throughout June and flipped to support in mid-July. Price is now sitting just below this zone, forming a weak retest without any real bullish momentum.

This setup often leads to trap scenarios: either a fast reclaim (bullish deviation) or a clean continuation to the next demand. So far, the price is holding below the EMAs and failing to reclaim lost ground — not a bullish look.

📌 Confluence for Further Downside:

Break and close below prior support

EMA 50/100 acting as dynamic resistance

No bullish divergence present (if RSI confirms)

Weak volume on current bounce attempt

If sellers stay in control, eyes are on the next demand zone around 144–146, which supported the last major breakout. Conversely, a clean reclaim above 166 and back inside the range would flip bias neutral-to-bullish.

Bias: Bearish unless 166 is reclaimed

Invalidation: Break above 177–180 (EMA cluster)

Next Key Support: 144–146

Potential Setup: Short on failed retest / Long on demand reaction

Do you see this as a breakdown or a trap? Let me know 👇

#SOL Update #7 – Aug 02, 2025#SOL Update #7 – Aug 02, 2025

Solana has broken below the low of its last impulsive move, forming a new, deeper bottom. The first area where it may find support is the $158 level. If this fails, the next support level lies at $147. At the moment, Solana is clearly in a downtrend on the 4-hour chart. For Solana to resume its upward movement and confirm a trend reversal, it needs to break above the $206 level with a strong, high-volume candle. Currently, Solana might be considered a cheap opportunity only for those looking to hold spot positions long-term. Otherwise, I don't see it as a suitable option for trading.

Long-Term Technical Outlook: Critical Decision Point Approaching

The chart illustrates a long-term technical structure where the price has been following an ascending channel after a prolonged bearish trend. However, recent price action indicates a breakdown below the green ascending trendline, raising concerns about a potential shift in market sentiment.

Currently, the $117 level is acting as a pivotal support zone. A sustained breakdown below this level — and more critically, below the red lower trendline — would validate the bearish scenario. This could trigger a deeper correction phase, with downside targets aligned along the red projection path. Such a move may lead to significantly lower price levels in the medium to long term.

🔽 Bearish Scenario:

If the price fails to hold above $117 and breaks below the red trendline, this would confirm the start of a bearish leg. Based on historical structure and projected trajectories, this could result in a descent toward the $93 level initially, with the possibility of extending further downward depending on market conditions.

🔼 Bullish Scenario:

On the other hand, if the price manages to reclaim the green trendline and more importantly, stabilize above the $204 resistance zone, it would signal renewed bullish strength. Such a move would open the path toward higher highs, potentially re-entering the previous upward channel and continuing the macro uptrend.

🧭 The price structure is now approaching a decisive zone, where either a confirmation of bearish continuation or a bullish recovery will likely unfold. Both scenarios have been visually outlined — green lines indicating bullish continuation, and red lines representing bearish momentum.

📌 Note: This analysis is for educational purposes only and should not be interpreted as financial advice.

Solana Update · Retrace, Bears & The Bullish BiasSolana had a retrace in May. Notice the 19-May date on the chart. This retrace produced four weeks red. The bullish move that led to this retrace lasted 6 weeks. The last rise lasted five weeks and the current retrace might last only two weeks, can be less.

We are seeing Solana rising but this rise is not a one-time off event, this is a trend that is developing. An uptrend as a long-term phenomena is different to a short-term bullish moves. A short-term move tends to be really fast, one strong burst and that's it. A long-term move is different. Instead of seeing 2-3 candles and Solana trading at $1,000, we see dozens and dozens of candles with prices slowly rising. There are strong fluctuations but the end result is always up. And that's how you see the fluctuations on the chart.

Solana moved up and then immediately started to retrace. Then another rise and another retrace again. This retrace will end and prices will continue to grow long-term. The bulls are in. The bull market is on. Solana, Bitcoin, Crypto and the rest of the Altcoins market is going up.

Namaste.

SOL/USDT | NFP Volatility Could Trigger Drop Toward $154!By analyzing the Solana chart on the daily timeframe, we can see that the price is currently trading around $169. If it fails to hold above the $168 level, a deeper drop could follow. With the upcoming NFP data release, increased volatility is expected across the markets. If Solana begins to decline, the potential correction targets are $163, $157, and $154. Watch the $145–$154 zone closely for a possible bullish reaction and buy opportunity.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

#SOL Update #6 – Aug 01, 2025#SOL Update #6 – Aug 01, 2025

Unfortunately, Solana failed to hold the last low where its most recent impulsive move had started, and it closed below that level. This close also occurred below the MA200 band. In other words, Solana broke a very strong support on the 4-hour chart and moved downward, reaching the previous K-Level zone. It’s hard to say anything positive for Solana at this stage. If the current K-Level fails to hold, Solana may look for support around the $158 level. A long position on Solana is definitely not recommended. I also do not suggest a short position. However, unless there’s a strong reversal, it’s safe to say that Solana has entered a bearish phase on the 4-hour chart.

SOLUSD H4 | Bullish bounceBased on the H4 chart analysis, the price could fall to the buy entry, which acts as a pullback support that aligns with the 50% Fibonacci retracement and the 138.2% Fibonacci extension and could bounce to the upside.

Buy entry is at 167.42, which is a pullback support that aligns with the 50% Fibonacci retracement and the 138.2% Fibonacci extension.

Stop loss is at 157.16, which is an overlap support that aligns with the 61.8% Fibonacci retracement.

Take profit is at 181.53, which is a pullback resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Massive Move Loading? $SOL Prepping for a BreakoutSolana is showing real strength here.

CRYPTOCAP:SOL consistently taking support from the long-term rising trendline, a sign that buyers are defending key levels. We're also approaching a critical resistance zone, which was the previous ATH area.

If SOL manages to close above this zone, we could witness a strong rally towards $500 and beyond. Until then, it’s a crucial level to watch, a breakout here could set the stage for the next leg up.

DYOR, NFA

Solana is forming the falling triangle ┆ HolderStatOKX:SOLUSDT is compressing into a possible falling triangle, with support around 180–185 and upward projections pointing toward 210+. The chart has repeatedly shown triangle breakouts into strong rallies. As long as the lower trendline holds, the upside setup remains valid.