SOL Hits Major Resistance — Patience Over FOMOOne of the most common mistakes traders make—especially in fast-moving markets—is jumping into trades impulsively at major resistance. It feels exciting when price is surging, but ironically, this is often where risk is highest and reward is most limited.

Why? Because historical resistance zones—like the $175–$183 region on SOL—tend to attract heavy sell pressure. These are levels where many past buyers look to exit, where smart money hunts liquidity, and where false breakouts are most common. Without volume confirmation and a proper retest, breakouts through such zones often fail.

That’s why experienced traders wait. The smarter approach is to let the market come to you, and only act when one of two things happens:

A pullback into a well-defined, confluence-rich support zone

A clean breakout above resistance, followed by a retest and confirmation

SOL has respected structure beautifully, but now is not the time to chase. Either wait for a healthy correction into support, or let price prove its strength through a confirmed breakout. No trade is also a trade — and capital preservation is the foundation of long-term success.

Patience isn’t passive — it’s a strategy. Let the market come to your desired levels. You don't need to catch every move, only the high-probability trades and there aren’t born from impulse — they’re built on patience, structure, and right timing. 💎

Technical Breakdown

SOL has entered a major resistance zone between $175 and $183 — a historically significant level respected for over a year.

Within this zone lie two key highs:

$179.85: Recently swept with a clean Swing Failure Pattern (SFP)

$180.52: Still untested — if broken, it would confirm a strong bullish continuation

Breaking through such a well-established resistance on the first attempt is uncommon — it typically requires momentum and structure. A rejection here would suggest that SOL needs a healthy correction before mustering the strength for a true breakout.

📉 Elliott Wave Count

Looking at the structure, we’ve completed a 5-wave sequence — signaling the potential end of this impulse leg. According to Elliott Wave Theory, a corrective phase is now expected before continuation.

📐 Additional Confluence: Fib Speed Fan

The 0.618 Fib Speed Fan — drawn from the all-time high at $295.83 to the swing low at $95.26 — aligns perfectly with this resistance zone, adding more weight to the idea of a potential rejection or pause.

🟢 Long Setup: The Next High-Probability Entry Zone

We now shift our focus to where the next long opportunity could arise. Here’s the technical confluence:

Anchored VWAP from the recent low at $141.41 sits at $164.70

4H bullish order block around $164.46

0.382 Fib retracement of the full 5-wave impulse: $165.42

0.412 Fib retracement: $164.25

All these levels converge in a tight band, providing a solid long entry zone between:

Long Entry Zone: $165.50 to $164.25

Stop-Loss: Below $160 (to protect against any deep wick)

Targets:

TP1: $171.75 (Point of Control from the range)

TP2: $180.00 (resistance retest)

TP3: $200.00 (psychological level)

Estimated R:R: ~6:1 — High-conviction setup

Bonus: If price returns to this $165 zone within 24 hours, it will also be supported by the 0.618 Speed Fan — adding one more layer of support.

🔴 Short Setup: Reversal Play at $200

For those watching from the sidelines or looking to fade the rally, the psychological level at $200 presents a strong short opportunity — but only on confirmation (e.g., SFP or bearish engulfing).

Short Entry: On rejection at $200

Stop-Loss: $206.10

Target: $187.00

Estimated R:R: ~2:1

🧠 Summary:

Completed 5-wave structure → potential correction phase underway

Strong resistance at $175–$183 with SFP and speed fan alignment

High-probability long setup at $165.5–$164.25 with multi-layered confluence

Potential short at $200 on confirmation

⚠️ Key Takeaway: Don’t Chase the Highs

This is where many traders slip — FOMOing into trades at major resistance. Please, don’t do it. Instead, wait for:

A pullback into well-defined support (like the $165 zone), or

A clean breakout above $180, followed by a confirmed retest

____________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

SOL

SOLANA - Tale of Two ExtremesOver the past ten months, Solana’s price action has swung from manic highs down to panic lows—and now into a disciplined base:

Euphoric Rally (Oct ’24 – Dec ’24)

SOL surged from ~$100 to a December peak near $290 on booming DeFi activity, NFT hype, and new network tooling.

The green‐shaded bars in late November/early December mark a near-vertical ramp, with “B” buy signals clustering as momentum supercharged itself.

Brutal Unwind (Jan ’25 – Mar ’25)

Once Bitcoin stalled and macro headwinds arrived, SOL gave back almost two-thirds of its value, plunging from $270 to a $96 trough by mid-March.

Red “S” sell markers at lower highs confirmed aggressive profit-taking and capitulation.

Disciplined Base Building (Mar ’25 – May ’25)

A clear single bottom at the P0 pivot around $96 (also last year’s low) drew in fresh bids each time price tested that floor.

Since early April, SOL has chopped sideways between $100–$140, tightening volatility and coiling like a spring.

2. Technical Anatomy of the Bounce

As of today, SOL sits at $175.43, flirting with short-term resistance and carving out a fresh up-move:

Level Price Role

Current (Monday’s High) $175.43 First line for breakout conviction

Year-Open Pivot (Y0) $189.50 Next hurdle—flip to support if cleared

Year-High (YH) $295.00 Measured target of the Dec rally

Dynamic Fib R1 $160.56 Prior falling-wedge resistance, now support

Dynamic Fib R3 $137.76 Secondary support on pullbacks

Volume & Momentum: Recent green candles have arrived on increasing volume, and fractal buy signals (“B” dots) cluster on each higher low—classic signs of renewed demand.

Pattern Resolution: What looked like a falling wedge from January has broken up through its upper trendline, validating the bullish bias.

3. Catalysts & Sentiment Drivers

Macro Tailwinds: Any dovish shift in Fed policy or a sustained Bitcoin rally above $70K will likely turbocharge altcoins like SOL.

On-Chain Upgrades: Watch for network announcements (e.g., new staking features, throughput improvements) that can reignite developer interest.

Event Flow:

FTX Claim Distributions: Final phases due in late May could return tokens into the ecosystem and fuel liquidity.

DeFi Incentive Programs: Fresh liquidity mining launches often spark sharp altcoin reprieves.

4. Strategic Playbook

Aggressive Entry:

Trigger: A daily close above $175.43 (Monday’s high) locks in the breakout.

Targets:

$189.50 (Y0 pivot)

$230–$250 (interim swing highs)

$295 (YH, the December peak)

Risk-Managed Longs:

Pullback Setup: A retrace to $160.56 (Dynamic Fib R1) offers a lower-risk entry with tight stops below $155.

Stop Loss: Under $137.76 (Dynamic Fib R3) keeps you clear of a retest of the March low.

Option Flavor:

Call Spreads: Consider a $180/$200 call spread into June expiries—defined risk with asymmetric upside if SOL breaks higher.

Caution:

A failure to hold $160 on a daily close exposes SOL back to the coiled range ($140–$100), so trim or hedge if that level cracks.

5. Conclusion: Coiled for Altseason

Solana’s collapse from $290 to $96 cleaned out weak hands. The subsequent wedge-style base and recent breakout attempt speak to a market that’s ready for its next leg up—provided it can conquer $175.43 and flip $189.50. Keep an eye on on-chain news and macro flows: if they align, SOL could sprint toward $230 and beyond, rejoining the next chapter of crypto’s broader altseason.

SOL - Strong Structure Rejected!Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

The picture says it all!

📈As long as the $134 structure marked in red holds, I will be expecting a bullish continuation towards the $180 resistance level.

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

SOUL for a SOL - Part 1Hey Guys! This is M-Prof of SOL

The 4H SVP chart of SOL/USDT shows a clean bullish continuation with strong volume acceptance at higher levels. After consolidating around the $166–$170 range where the POC and VAL stacked tightly, Solana broke out impulsively, forming a fresh profile with value clearly migrating higher. The new POC and VAH are now centered near $174–$176, confirming that buyers are comfortably accepting higher prices. The thin tail below $171 shows rejection of lower prices, suggesting a strong demand zone now sits between $171 and $173. As long as SOL holds above this value area, any dip into that range offers a good risk-reward long opportunity. If the price accepts above $176.5, it could trigger further upside targeting $180+. Bias remains bullish above $171.

Coming to my doodle - Breaking the blue box would drag to the green one, changing structure though the latter towards the top is most probable!

HolderStat┆SOLUSD bullish channel points higherAfter a consolidation base, SOL launched into a growing ascending channel. As long as price respects the lower trendline, bullish momentum is expected to continue with a potential target near $170-180.

💡 Short-term pullbacks inside the channel may offer entries as bulls eye higher resistance zones.

This Low Cap Alt will 20-50x (CULT DAO)This crypto cycle has been brutal for alts. There have been massive shakeouts over and over, a relentless onslaught of rug pulls and scams, and the "Pump.fun" casino on Solana that’s drained billions of retail liquidity and transferred it to the few.

The few always seem to win, and the many always seem to lose. Today, if you’re reading this, it might all change.

CULT DAO could easily 20-50x from now until October 2025. Let’s take a look at the MACD divergence.

### Technical Divergence

For 750 days, this bullish divergence has been forming on the histogram MACD. Every new low on price has formed a higher low on the MACD.

Let’s take a look at a case study of what happens when we get this form of divergence.

I traded this exact same pattern in 2022 that resulted in a nearly 425% move. The play function doesn’t work because they rebranded, and that ticker is no longer valid, but you can scroll to the bottom in my comments on that TA and see the move. I’ll post it under this as well.

As you can see, we got that 425% move. Currently, CULT DAO is showing exactly the same histogram divergence.

Here are some examples of zigzag impulses on low-cap alts. You tend not to get 5 waves; instead, you get this zigzag pattern. This is what I predict CULT DAO will do since it’s only a 5 million market cap.

We can also see in the chart that the 0.618 time Fibonacci level hits at the end of October 2025, which is exactly where I think the altcoin market will top. Check out previous TA on that.

This is only scratching the surface of what is to come for CULT DAO. I have presented to you the technical reason why a big move is stirring and why, at the apex of these divergences, the stars align, and you have the catalyst present itself, and boom—the explosive move comes all at once, and it will be extremely volatile because of its low market cap.

### Let’s Start with the Tokenomics

Every time someone sells or buys CULT DAO on Uniswap, there is a 0.40% tax that goes to a treasury. The top 50 stakers get to pass proposals that fund projects/investments. The idea is to remove the centralized component of funding a project.

121 projects have been funded over the last three years with 3 million dollars.

- Total CULT Funded: 479,751,081,214 CULT

- Total ETH Funded: 1,573 ETH

- Proposals Funded: 121

- Total USD Funded: $3,289,596

- Total ETH Burned: 303 ETH

Allocating these funds has been a learning process over the last three years, but every failure has been necessary in preparing the DAO for what’s to come next.

### The Big Catalyst

The creator of CULT DAO has been working on a blockchain that will function on a custom gas token—that’s right, and that custom token will be CULT DAO. You heard correctly.

Every transaction, every deployment on the blockchain will require the CULT DAO token as gas to execute. The implications are massive. There are multiple dApps that are currently being constructed on the Modulus blockchain.

A privacy-first zkEVM blockchain like Modulus means a scalable, Ethereum-compatible blockchain that prioritizes user privacy through zero-knowledge proofs, allowing optional private transactions while maintaining decentralization.

Modulus is a privacy-first zkEVM blockchain and is scheduled to release this year between April and August 2025. I hope now you’re starting to see the picture.

### CULT DAO and ETH Liquidity Pools

So, why does the price of CULT go down if there is currently very little volume? Well, CULT DAO and ETH liquidity pools are tied together, so if the ETH price goes down, so does CULT. In turn, if ETH goes up, so does CULT.

You can see that CULT is nearly at a 1:1 ratio with ETH for now, coming in at a 0.91 ratio.

In other words, if my thesis is correct about ETH and it goes to 15,000 dollars, the price of CULT would be as follows:

- ETH at $10,000:

CULT Price: $0.000005008 (4x increase).

Market Cap: $21.38M (4x increase).

- ETH at $15,000:

CULT Price: $0.000007512 (6x increase).

Market Cap: $32.08M (6x increase).

That’s right—if nobody even bought CULT, not one dollar, the base liquidity increase of ETH would bring the market cap to possibly 32 million, in other words, if you were thinking of buying ETH, why don’t you just buy CULT DAO?

You can buy ETH now; from this price, 15,000 is 7x, or you can buy CULT DAO, get 6x plus whatever extra volume is coming in. It seems like a logical play, really.

Everything you’ve seen so far is why I believe this MACD histogram divergence has been forming for 750 days. As I said, the stars will align at the apex, and the explosion will come.

### Unruggable and No Whales Controlling Supply

As you can see from the bubble map, the largest wallet that is not an exchange has a cluster total of 0.7%. The rest of the clusters you see in the image are basically exchange wallets, which are the red and dark green circles mostly.

Liquidity is also locked for over 200 years.

- Burned Supply = 1.29664T

- Circulating Supply (including staked) = 4.27T

- Staked Supply = 1.07599T

- Remaining Tradable Supply (excluding burned and staked) = 4.27T - 1.29664T - 1.07599T ≈ 1.89737T

So, no whales, and it’s not possible to rug because liquidity is locked.

### Modulus Blockchain Liquidity Injection

The average liquidity injection for DAOs in ZK would be anything from 200,000 to 10 million. Let’s assume it’s a $1M injection that is split 50/50 between CULT and ETH, a common practice for Uniswap-style pools.

- CULT Amount in Pool: At the current price of $0.000001252, $500,000 buys ~399.36B CULT ($500,000 ÷ $0.000001252).

It would increase the price to a 10 million market cap overnight.

### Conclusion

- Liquidity is locked for 200 years

- No whales

- Not possible to rug

- Mainnet launching this year

- ETH pools tied to CULT

- MACD histogram divergence

The target I have for CULT is just based on Fibonacci levels. Honestly, it’s unpredictable what will happen, how high it will go, or the impact the Modulus chain will have. 120 million is my low-end estimate; the macro Fibonacci is much higher.

The last extension puts it at a 1.4 billion market cap and 266x from where we are now.

This is where you want to be for the upcoming alt season—right here, down 98% with this massive divergence and all these factors that come into play. Just the mainnet launch and ETH going to 10,000 basically sends this to a 30-50 million market cap.

Cult DAO and Satoshi Nakamoto share a common ethos of decentralization and anti-centralization. We need to embrace this notion and bring back the power to the many. If CULT DAO hits 1.4 billion dollars, the treasury funds would be in the millions; we fund our own future.

moduluszk.io

cultdao.io

cultdao.io

coinmarketcap.com

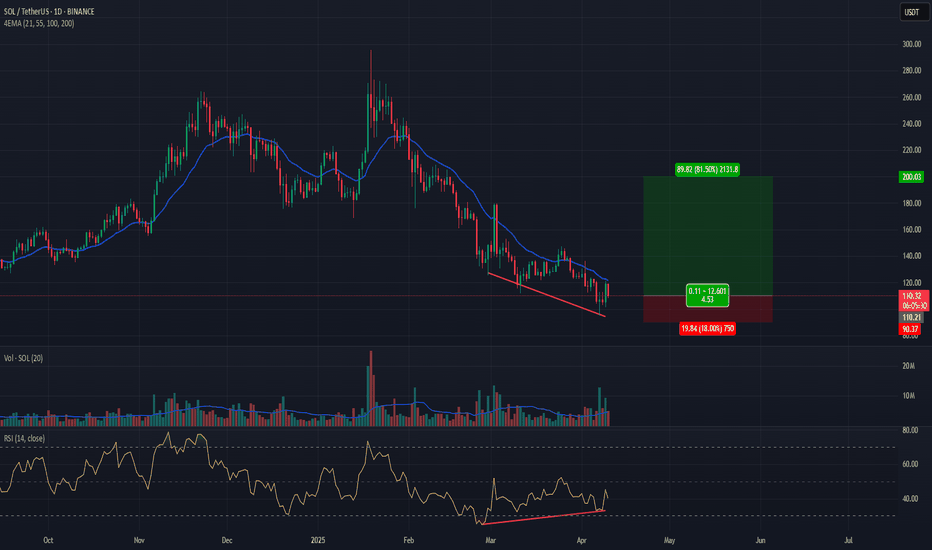

SOL Analysis Deep Dive: Identifying Optimal Entry and Exit ZonesYesterday, SOL gave a sharp downside shakeout, dropping from the weekly open at $147.98 (perfectly retested) down to the 0.5 Fib retracement of the swing at $140.25. Here’s a structured breakdown of the key levels, trade setups, and R:R profiles for both longs and shorts:

🔑 Key Levels & Confluences

1. Higher-Timeframe Opens

Weekly Open & Retest: $147.98 – pivoted price before the drop

Monthly & Prior-Day Open Cluster: $147.98–$146.31 – strong support confluence zone

2. Fibonacci Support Zones

0.5 Fib at $140.25 – primary mean-reversion entry

0.786 Fib (smaller wave) at $138.78 – secondary, deeper support

3. Order Block

Daily Bullish Order Block at $139.87 – just below 0.5 Fib, adds extra support

4. Volume-Weighted Average Price

Anchored VWAP (from ATH $295.83) at ~$166.45 – key upside resistance

5. Market Profile Value Areas (10-Day Range)

Value Area High (VAH) at ~$153.00 – overhead resistance confluence

Value Area Low (VAL) at ~$145.75 – underpins support

📈 Long Trade Setups

1. 0.5/0.786 Fib + Daily Bullish Order Block

Entry: $141-138.78

Stop-Loss: $137.5

Target: $165 (anchored VWAP / Fib zones)

R:R ≈ 9:1

2. Higher-Timeframe Open Cluster

Entry Zone: $147.98–$146.31(monthly/weekly open)

Stop-Loss: $142.5

Target: $165

R:R ≈ 3:1

• Why these levels? The 0.5 Fib is a classic mean-reversion zone, bolstered by the daily order block. The $147–146 zone ties together multiple opens (weekly, monthly, prior-day), offering a solid demand area if price retraces back up.

📉 Short Trade Setup

Trigger: Rejection / swing-failure around $153.4

Entry: $153.4

Stop-Loss: $154.3

Target: Weekly/Monthly open (~$147)

R:R ≈ 6:1

• Low-risk short: A clean rejection at the recent high lets you define risk tightly above the swing, aiming to capture the retrace back to the opens.

🎯 Summary & Game Plan

Primary bias: Look for long entries at the 0.5 Fib ($140.25) or the open-cluster zone ($147–146), with targets toward the anchored VWAP at ~$166.

Alternate bias: A short on clear rejection from $153.4, targeting the opens as support.

Risk management: Keep stops tight (SL below $137.5 or above $154.3) to maximize R:R on your favored setups.

Volume & Price Action: Confirm entries with an uptick in volume or bullish price structure (for longs) or swift failure patterns (for shorts).

Now it’s a waiting game! Let price revisit these zones, watch for confirmation signals, and then scale into your chosen side. Good luck! Don't chase, let the charts come to you!

____________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

Solana - Here Comes The Bullish Reversal!Solana ( CRYPTO:SOLUSD ) might head for new all time highs:

Click chart above to see the detailed analysis👆🏻

Just a couple of months ago, Solana perfectly retested the previous all time high and created an expected short term rejection. However, with the current major support area and a potential bullish reversal, Solana remains in a strong market, potentially heading for new all time highs.

Levels to watch: $120, $250

Keep your long term vision,

Philip (BasicTrading)

SOL/USDT – Bullish Market Structure Shift with Clean Targets AheSolana has shown a clear change of character (CHOCH) followed by a break of structure (BOS) on the 4H timeframe, indicating a strong bullish reversal. After forming a series of bearish BOS during the downtrend, the recent structural shift suggests buyers have stepped in.

📌 Key Highlights:

Clear CHOCH confirming trend reversal

Recent BOS signals bullish continuation

Price reclaiming demand zone and flipping structure

Targeting major supply area near $240–$250

Ideal RR setup with stop below recent structure and target into inefficiency/liquidity zone

If price holds above the recent breakout zone, we could see a strong continuation toward previous highs. Watch for minor pullbacks to validate entry opportunities.

Solana SOL price analysisToday, a press release was published that CRYPTOCAP:SOL Strategies (aka MicroStrategy from the world of #Solana) bought another 122,524 CRYPTOCAP:SOL at $149

Earlier, the company said it would sell $500mn in convertible bonds, to buy #Solana, which capitalized now is at $74bn

Well, if you look at the OKX:SOLUSDT chart, we can say that it would be good to keep the price above $107-115, above the trendline, which has been going on since the beginning of 2023.

Once this condition is met, we can start dreaming again about the start of a super march of the #SOLUSD price to $790 in 2025.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Solana Daily Outlook | Key Levels & Market Momentum👀 Welcome to my Trading View Analysis and Trading Channel Here , we share the latest market analysis, trading signals, and key insights together .

Ready for smarter trades ? ⭐️

⚡️Today , we're going to analyze the SOL( Solana ) coin together on the daily timeframe and find triggers for our positions .

💠 🔍Daily Technical Overview

Solana (SOL) recently broke out of its descending trendline on the daily chart, leading to an impressive 30% price surge. This breakout marked a key shift in market sentiment and highlighted a fresh wave of buyer interest.

Currently, SOL is moving through a distribution phase, where price consolidates and profit-taking occurs. All eyes are on the $152.55 resistance level – a breakout above this zone, backed by solid volume, would present a strong long entry opportunity.

📊 🧠 Fundamental Insights

Solana isn’t just showing strength technically – the fundamentals are also aligning for a bullish outlook:

✅ After a 65% correction, buyers are returning to accumulate at discounted levels.

✅ Ecosystem growth continues, with strong developer activity and use case expansion.

✅ Trading volume is on the rise, supporting the price recovery.

📰 🔥 This Week’s Positive Solana News

Here are the major developments from the past week that are giving Solana a strong boost:

📈 Price Forecast: Analysts now project that SOL could reach $155–$160 by the end of May, with potential upside toward $180 in the near term.

🏦 Institutional Investment: Upexi Inc. has announced plans to allocate $100 million toward purchasing Solana tokens — a major show of confidence.

📊 ETF Filing: Franklin Templeton has filed for a Solana-based ETF to track SOL’s price, which could open the door for more mainstream investment.

🇺🇸 US Government Involvement: Reports suggest the U.S. government is considering Solana as part of its strategic digital asset reserve, highlighting its growing legitimacy.

📝 Conclusion

🚀 Trendline breakout = bullish confirmation

📌 Consolidation = distribution zone

📊 Break above $152.55 = long setup

📉 Previous 65% correction = attractive accumulation zone

📰 Positive news flow = fundamental support for continued growth

I love you all so much . 👀

don't forget about capital management and risk management .

Be careful with your positions . 🥇

BTC (Post Weekly Close Update)BTC has seen a weekly close above the 93700 support, suggesting bullish strength and likely continuation if this level holds on the weekly. We remain bullish as long as 93700 is maintained; a drop below it would be the first SOW on the HTF, potentially targeting 89K–90K, and possibly 1D OB at 83K–85K. Technically, this remains a LH until the 99500 SH is convincingly reclaimed, ideally on a weekly close.

On the daily, however, we’ve observed the first SOW, closing below the SH at 95K after a rejection from the 1D supply zone, refined into MTF HOBs, where whales initially sold off aggressively. This isn’t alarming, but it warrants attention. With the SPX at resistance, the DXY at support, USDT.D closing the weekly well above the SL at 5.03, and TOTAL at resistance, these are signs of caution, in my view, despite the series of bullish news we’ve seen. That said, with the HTF remaining bullish, we’ll focus on exploiting LTF and MTF moves. The FOMC meeting on Wednesday could certainly bring volatility in the markets, particularly as BVOL24H and BVOL7D, as mentioned in the last update, are at support.👀

To further examine the weakness, note the contrast between the two horizontal ranges (grey boxes). The first range saw a BO followed by impulsive PA, smashing through the 90K key level. In contrast, the second range produced a BO but encountered an HTF supply, resulting in a notably weaker bounce compared to the first BO from the lower range. This could potentially manifest as a deviation if the price closes below the RL, making the 8D HOB at 89K–90K our next target.

On the LTF/ MTF, we’ve also seen a break below the TL, with the other resistance TL being respected, indicating further weakness. Although we haven’t yet seen HTF weakness, I believe a scalp-sized short from the 11H OB, refined into a 2H HOB at 95500 SH, makes sense with a tight invalidation, or from the MTF level around 97500, if provided. If the daily closes above 95500 again, I might consider a scalp long into the 1D supply for a potential DT or even the 100K psychological level.

SOL/USDT – 3D Long Signal Active📅 April 29, 2025

The system triggered a long entry at the last 3D bar close.

Currently, the price remains around the same levels.

✅ System conditions for a long are fully met:

MLR > SMA > BB Center > PSAR

Price is trading above the 200 MA on the 3D timeframe.

⚠️ Caution:

On the 1D timeframe, price is still below the 200 MA, which suggests some lingering weakness. Proceed carefully.

📍 Strategy Plan:

Consider entering long at today’s daily close or at the next 3D bar close.

Suggested stop-loss: below the latest PSAR dot for system integrity.

🔔 Keep an eye on updates and thank you for reading! 📈📊

sol buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

SOLANA's massive 1W MA200 rebound hints to enormous rally ahead.Solana (SOLUSD) made a very strong rebound on its 1W MA200 (orange trend-line) on the very first week of April. Now that the month is about to close, it has already completed three straight green 1W candles and is aiming for the critical 1W MA50 (blue trend-line) test.

If broken, we expect it to turn into a long-term Support again and target the Higher Highs of the Wedge at $350. After all, the 1W MA200 rebound also made contact on the 2-year Higher Lows trend-line of the Bull Cycle, so technically it is a massive Bottom cluster. The 1W RSI also broke above its MA last week, confirmed the buying pressure.

Given that the recent 3-month correction was -67.23%, identical to the last correction (May 2021) of the previous Cycle, we expect one final rally to the 2.0 Fibonacci extension at $900, if the Higher Highs trend-line breaks.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

SOL Trade Setup – Structure Shift & Higher Low FormationSolana (SOL) has shown significant strength after deviating below range lows and tagging $95, quickly recovering and reclaiming key support, indicating a bullish structural shift. We’re now watching for a retrace into the $120 zone, which could confirm a higher low and set up a strong medium-term long entry.

🔹 Entry Zone:

Around $120

🎯 Take Profit Targets:

🥇 $162

🥈 $187

🥉 $213

🛑 Stop Loss:

Daily close below $110

Solana Classic Signals (5 Total) & Bullish ConfirmationIt is the first time that Solana moves back above EMA55 after producing a major low since late 2024. Naturally, when this event happened back in late 2024 what followed was a bullish impulse. This is always the case as this is a confirmed classic bullish signal.

Solana is trading daily above EMA55 and this confirms mid-term growth potential.

The low happened 7-April and produced the highest buy volume in more than a year, since March 2024.

The difference is that March 2024 was a peak while April 2025 was a bottom. The volume signal is another classic.

The RSI is really strong with a reading reaching ~60.

The MACD is on the bullish zone now, it has been trading in this zone since 19-April.

There is a broken downtrend line (black) and this is another classic.

We have a total of five classic signals and we used these one hundred trillion times in the past few years to predict how the market would behave next. The list goes as follows:

» Moving averages

» Volume indicator

» Oscillators (MACD & RSI)

» Chart patterns

» Trendlines

Another one that we use very often is candlestick reading. Even if it is not mentioned in the analysis, it is always there. The bottom is confirmed with a reversal candlestick pattern.

» These are some of the classic signals, all bullish. Bullish means up. Solana is going up.

Thank you for reading.

Namaste.