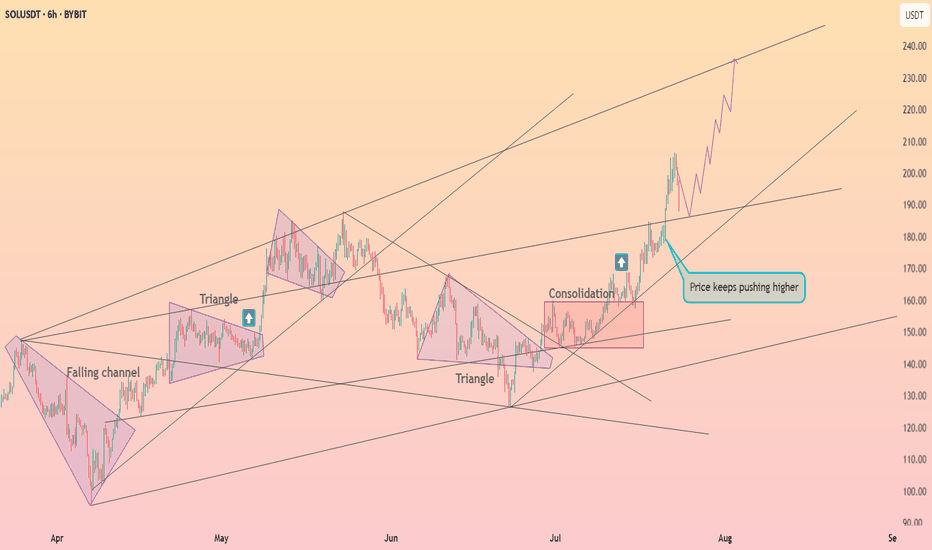

Opened longI opened a long position.

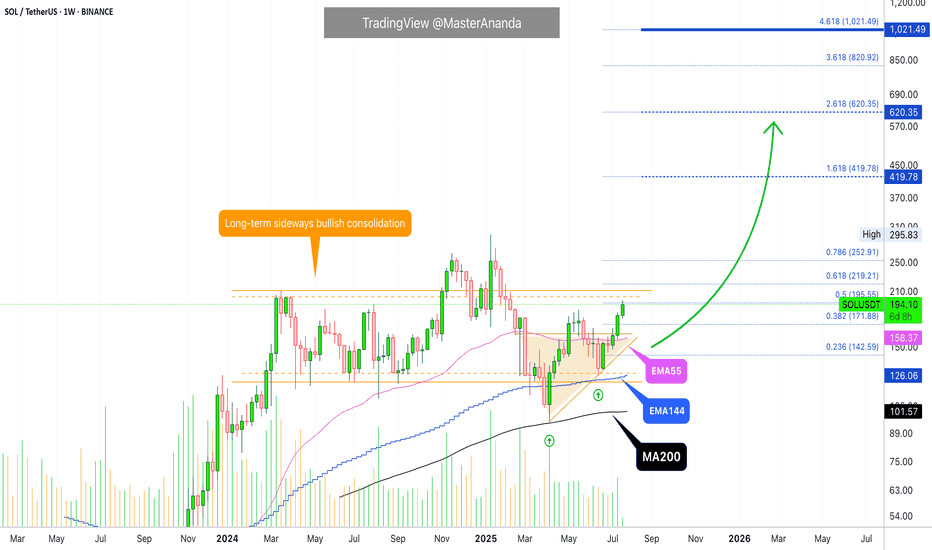

Ideally it is safe to wait for EMAs to line up for the bull trend (EMA21 > 55> 200) in the Daily chart. However, there are many indications that the price will start to move to the upside and the upside move might be quite aggressive. So I decided to open a long position with a small position size.

The reasons for opening a long position:

Daily:

Bull candle has closed above EMA21 for a few times.

RSI lines have crossed and entered the bull zone.

MACD lines are about to enter the bull zone.

Stochastic lines are above to cross and move up.

The price has been staying above Fib 0.236 level for about 10 days.

The price has broke and closed above the descending parallel channel.

4H:

All momentum indicators are in the bull zone.

EMA21 is above EMA 55.

The price has closed above EMA200.

The price is consolidating above the top descending parallel channel.

It is not the perfect bull trend set up, however, there are enough confluences for the price to start to move to the upside.

Entry price: $142.59 (blue horizontal line in 4H chart)

Stop Loss: $130.40 (red horizontal line in 4H chart)

Target: $195 (green horizontal line: Fib 0.5 level in Daily chart and fair value gap zone)

$178 is a strong support and resistance area, so if it starts to stall, I might take a partial profit.

Fingers crossed.

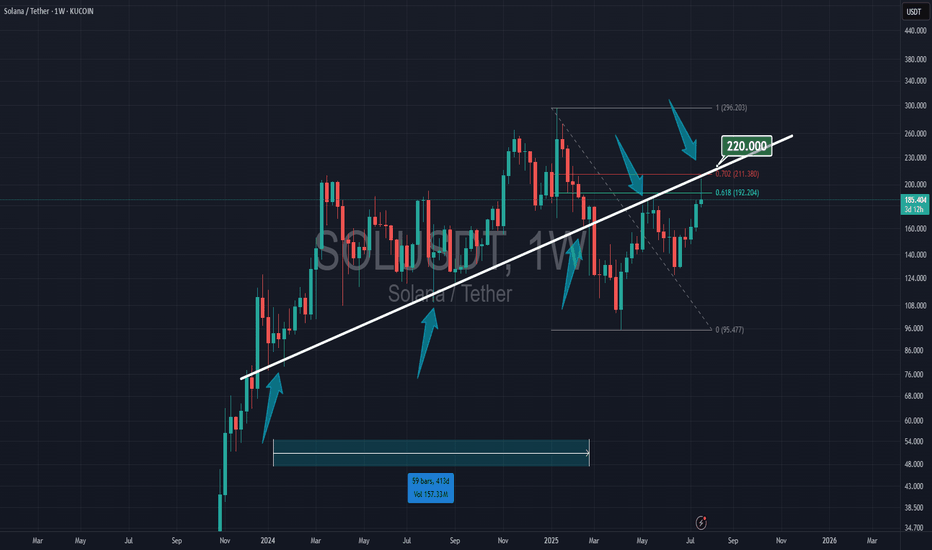

Solana

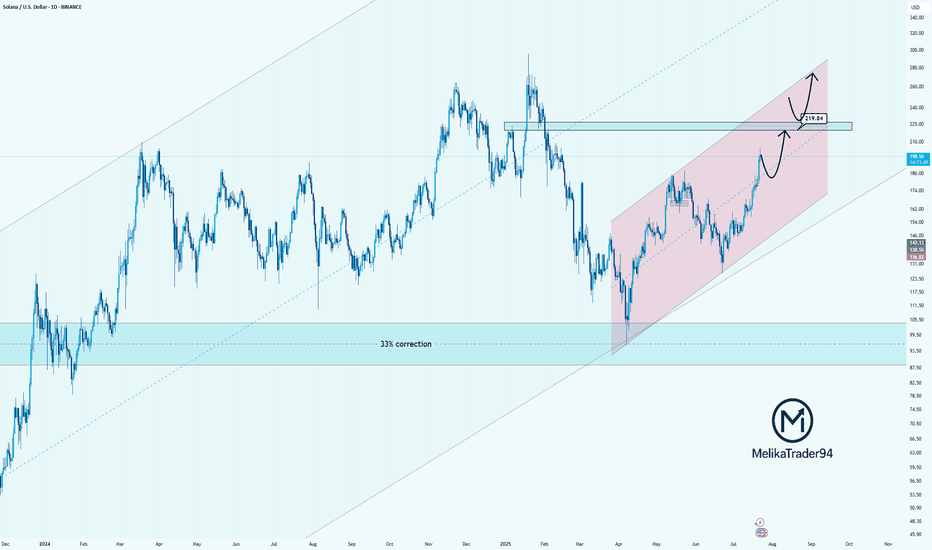

Solana Approaching Key Resistance: watch for $219Hello guys!

Solana has been trending strongly inside a rising parallel channel, recovering steadily after a significant 33% correction. The bullish momentum is clear, and the price is now approaching a key resistance zone near $219.84, which previously acted as a major turning point.

Here’s what I’m watching:

Strong uptrend within the pink channel shows controlled and healthy growth.

$219.84 is a critical decision zone. Price could:

React with a pullback before pushing higher,

Or break through it and flip the level into support for the next bullish leg.

The reaction in this zone will determine the next structure.

Whether we see a temporary correction or continuation to new highs.

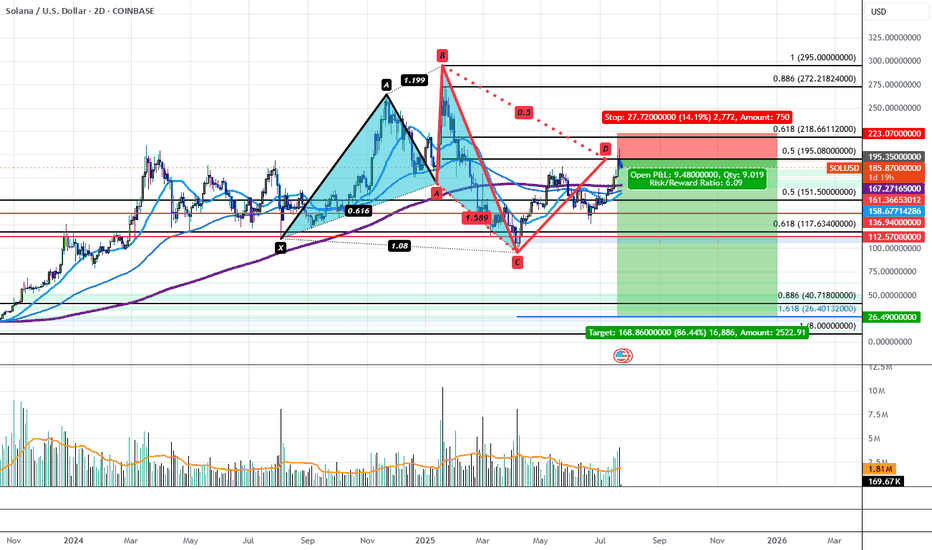

Solana's Bearish 5-0 is Locking in a Bearish Reversal to $26.40Solana has recently run up to Horizontal Resistance Zone of $195-$210 aligning with the PCZ of a Bearish 5-0 and has begun to impulse downwards with volume to back it. This could be the start of a greater move down that would take SOL back to the low of the distributive range at $95.16. If the level breaks, we would then target a drop down to the $40.72-$26.40 confluence area aligning with the all-time 0.886 retrace as well as the 1.618 extension from previous swing low to high. Only at these levels could we even possibly begin to consider Bullish Entries on Solana.

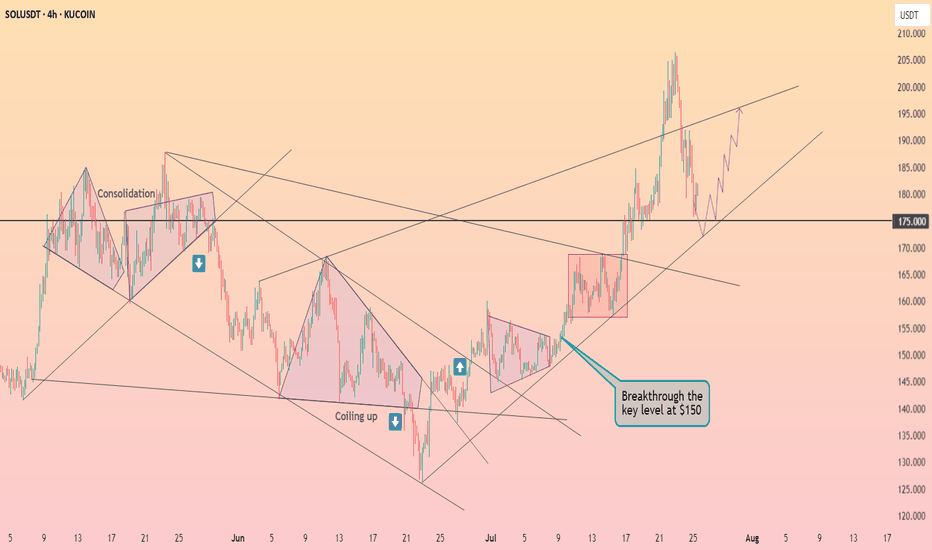

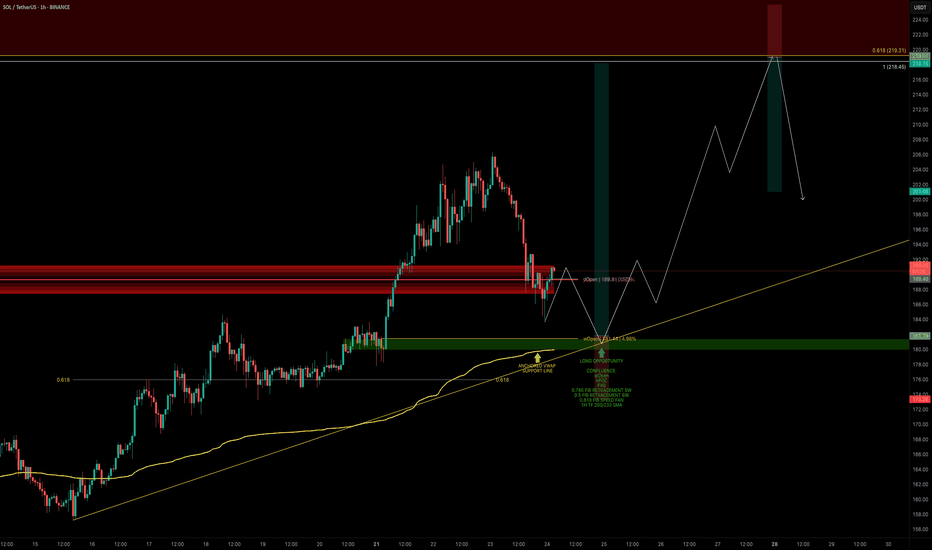

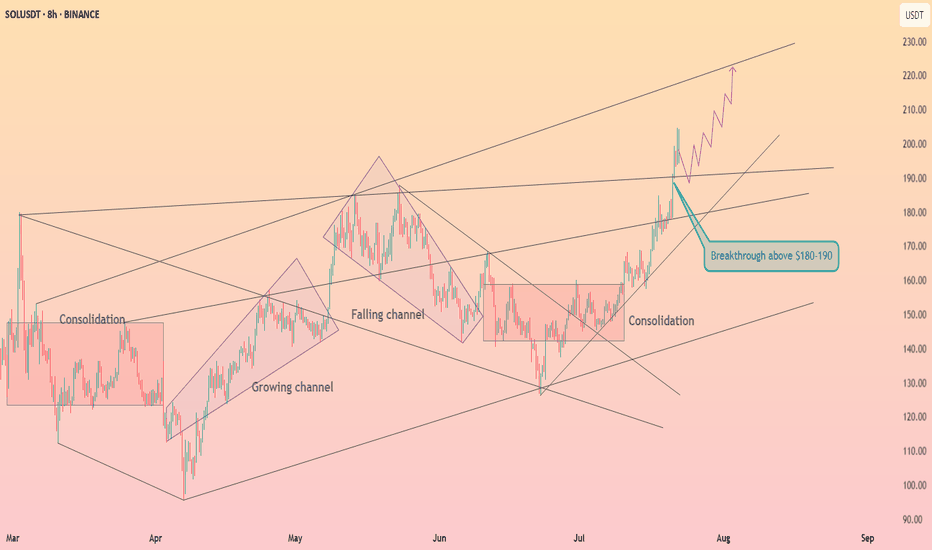

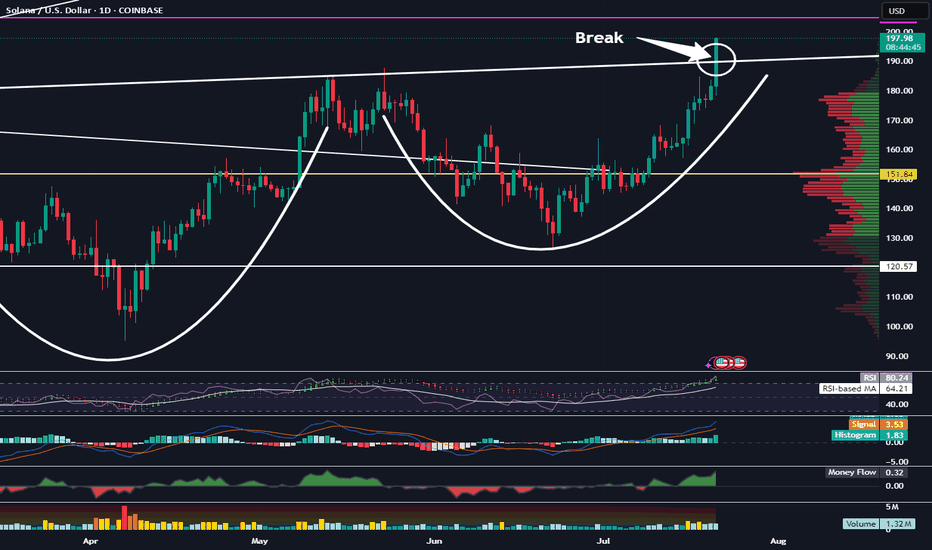

SOL — Bullish Retest in Motion: Time to Strike?SOL has finally broken through the $180 barrier decisively — a key zone it failed to clear back in May.

Now we’re seeing a retest, which may offer one final dip before continuation. Let’s break down the next high-conviction long opportunity.

🧩 Key Retest Zone: $182–$180

➡️ Retesting Prior Resistance as Support

SOL broke above $180 with conviction and is now pulling back.

➡️ First Reaction at $184

A clean bounce occurred at the anchored VWAP, but this might not be the final low.

➡️ Strong Confluence at $180–$182 Zone

This zone is packed with support elements:

Weekly Open (wOpen): $181.44

nPOC: $180.85

Anchored VWAP: ~$179.90

0.5 Fib retracement (of the larger wave)

0.786 Fib retracement (of the smaller wave)

0.618 Fib Speed Fan — projected for tomorrow’s price path

1H 200 & 233 SMAs supporting from below

SOL is currently trading at yOpen — another key pivot level to watch

🟢 Long Trade Setup

Entry: Laddered between $182–$180 (ideal long entry would be at wOpen)

Stop-loss: Invalidation at $173.35

Target (TP): TBFE 1.0: $218.45 / 0.618 Fib retracement: $219.21

R:R: ~1:4.5

Potential Move: ~+20%

🛠 Indicator Used: DriftLine — Pivot Open Zones

For this analysis, I’m using my own published indicator called "DriftLine – Pivot Open Zones " feel free to check it out on my profile.

It helps identify and visualise critical opens (daily, weekly, previous days), providing real-time support/resistance zones.

➡️ You can use it for free — just check my profile under “Scripts” and add it to your chart.

💡 Pro Tip: Support Zones Are Stronger with Confluence

Don’t rely on a single fib or level. When opens, VWAPs, SMAs, and fibs cluster, the probability of a strong reaction increases.

This is how smart traders define clear entries and invalidation.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

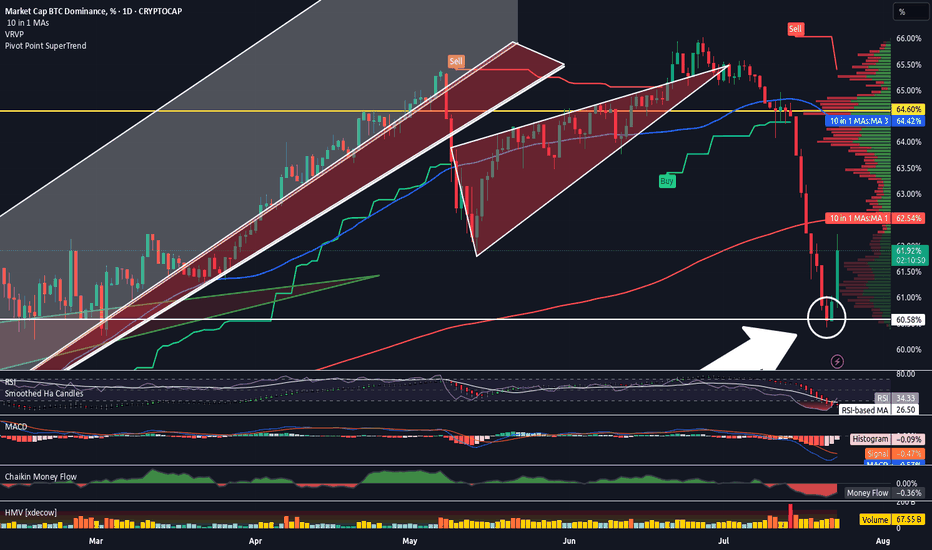

Altcoin Season Has Started. And A Quick Look At The Stock MarketHey Traders,

Time for me to catch you up on the latest price action in both the stock market and crypto as well as touch upon a few changes on my platform and subscription services and what I plan for the future.

Timestamps:

00:00 | Housekeeping - site changes, etc

04:35 | BTC Dominance

06:45 | DXY Dollar Chart

10:00 | SPY

14:25 | BTC Bitcoin Chart

15:45 | Bitcoin Liquidity Heatmap

17:30 | Solana

19:05 | Ethereum

20:20 | Crypto & Stock Trackers

24:25 | My Indicator

26:10 | Where I Went Wrong & How I Plan To Course Correct

✌️ Stew

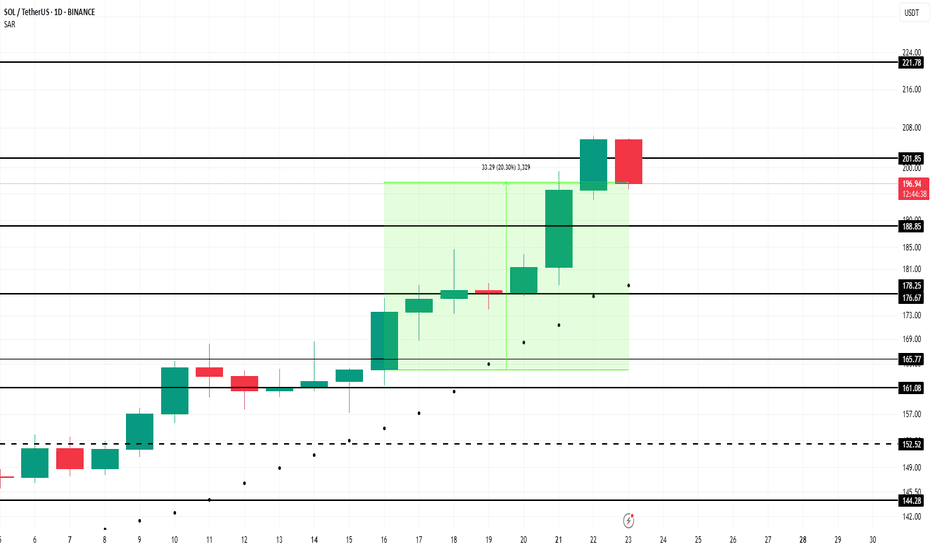

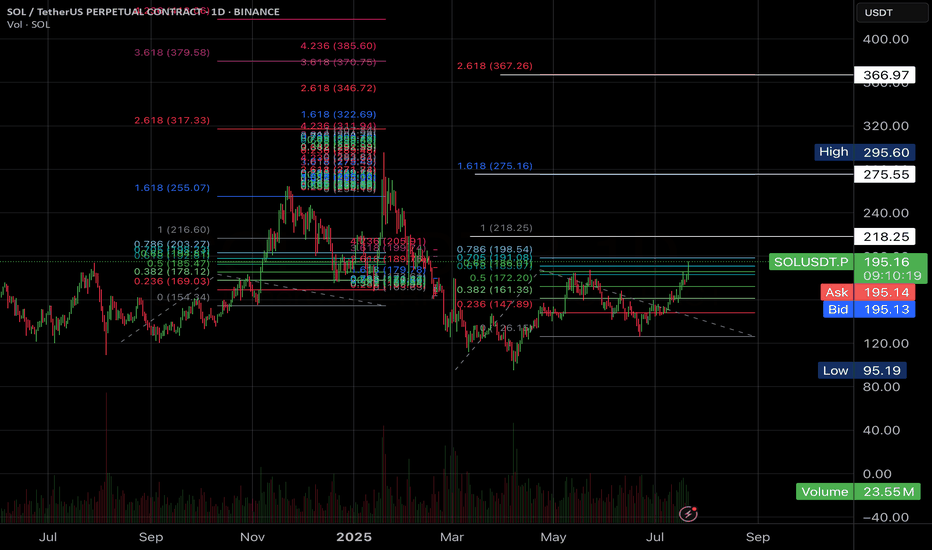

Solana Price Faces Reversal At $200 As Profits Hit 5-Month HighBINANCE:SOLUSDT price has risen 21% in the past week , now trading at $199. Despite breaching the $200 mark, Solana has failed to maintain this level, marking a five-month high.

The Net Unrealized Profit/Loss (NUPL) indicator for BINANCE:SOLUSDT shows that profits have reached a five-month high . This signals that many investors are in profit, raising concerns about a potential sell-off.

If these factors hold true, BINANCE:SOLUSDT price could decline toward the support levels of $188 or even drop to $176 . A move below these levels could erase a significant portion of the recent gains and shift the altcoin into a bearish trend.

However, if investor confidence remains strong and the market continues to show bullish signs, BINANCE:SOLUSDT could stabilize above $200 . Securing this level as support could propel the price back toward $221, invalidating the bearish outlook.

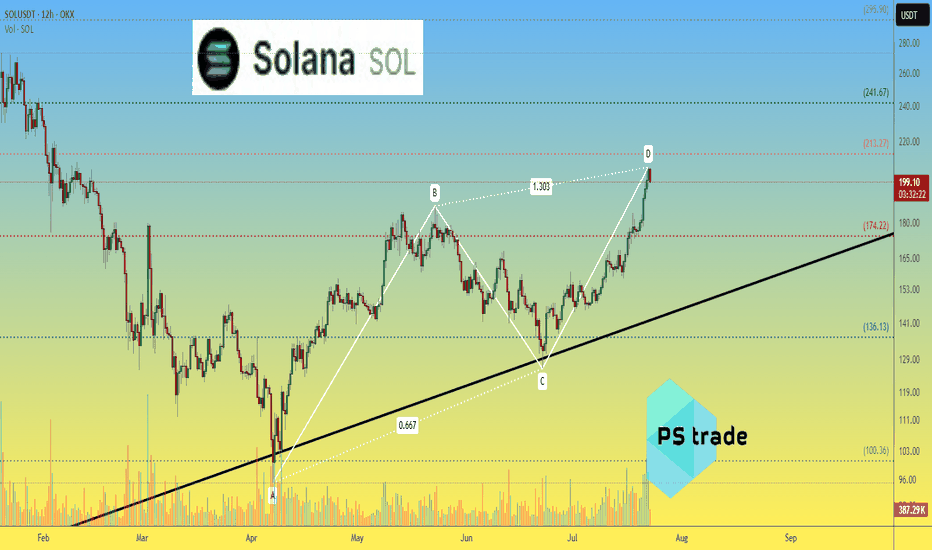

Solana SOLusdt: ABCD Completion & Reversal Candle Forming?The ABCD pattern on the 12H OKX:SOLUSDT chart is nearly complete near $213.

🔻 Current candle attempts to engulf the previous bearish one — an early reversal signal.

📊 Volume is declining after impulse — adding confluence.

📉 Correction targets:

$175 — Fibo 0.5 + support

$136 — consolidation area

$100 — start of CD move

❌ Breakout above $213 invalidates reversal scenario.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

SOLUSDT on Fire! Bullish Wedge Fuels INSANE Upside Potential!BINANCE:SOLUSDT has been exhibiting strong bullish momentum, currently trading within a broadening wedge pattern. This technical structure often signals increased volatility and the potential for decisive moves in either direction. In the present scenario, the breakout above the psychological $200 resistance level suggests that bulls are firmly in control, fueling hopes of further upside.

The continuation of momentum hints at the market preparing for another leg up. The immediate price target lies at $300, where traders may expect some profit-taking and resistance. However, should momentum sustain and buying pressure persist, BINANCE:SOLUSDT has the potential to surge toward the $700 region, aligning with the pattern’s projected price expansion.

As always, managing risk is key. Use a well-placed stop loss below the support level to protect your capital. Breakouts can be explosive, but discipline and proper risk management make all the difference.

BINANCE:SOLUSDT Currently trading at $201

Buy level : Above $200

Stop loss : Below $150

Target 1: $250

Target 2: $300

Target 3: $500

Target 4: $700

Max leverage 2x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

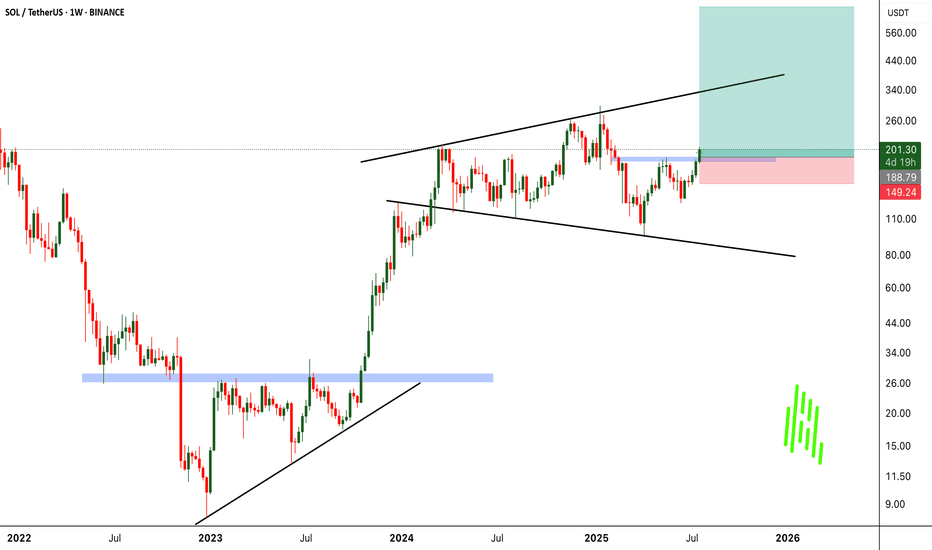

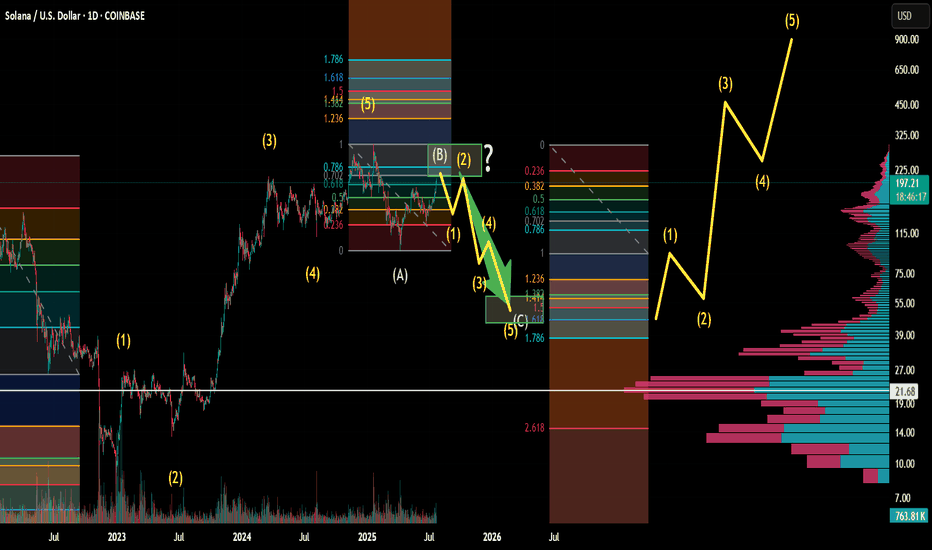

Solana Macro Cycle Elliotwave countTop has been in for solana since going back to ATH. We are in a bear market retrace rally. Looking to scoop between 50-40 about 1 year from now. Let me know what you think below.

Trading alts on solana right now during the retrace rally, then potentially looking to rotate into radix plays or other coins finishing their wave 2's

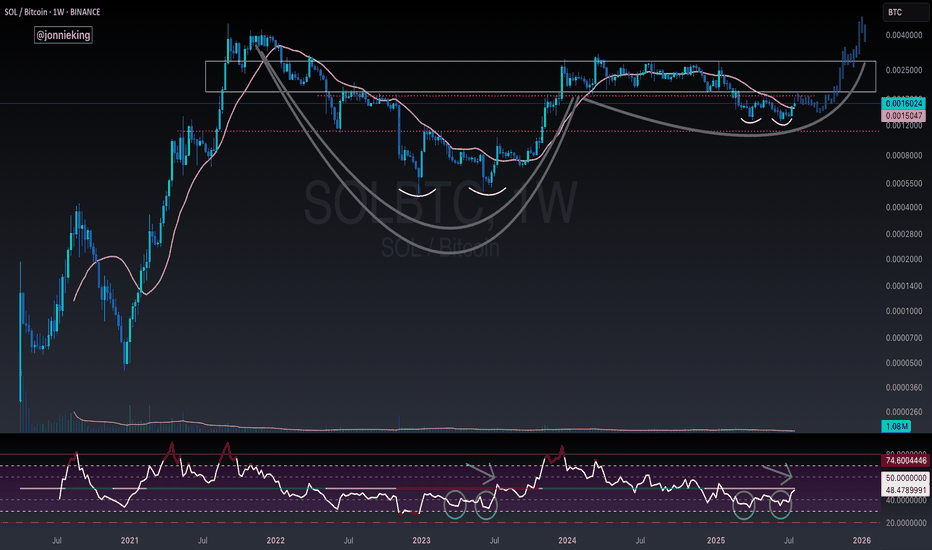

ALT SEASON Cycle Finale Special | SOL/ETH & TOTAL3Our last analysis of BTC.D ⬇️ and ETH/BTC ⬆️ () is now playing out, and we are entering the final stage of the 4-year crypto cycle -- ESCAPE VELOCITY for the rest of the crypto market.

As money flows up the risk curve, expecting SOL to outperform ETH from here, and the rest of the crypto market to outperform majors.

Welcome to the cycle finale special!

Solana About To Gain Bullish Momentum Towards $420, Later $1000+It seems like Solana has been taking forever to grow, to recover; it seems like a long time. Let's do some maths. The bottom was in 7-April and we are now on July 21. 98 days. A little over three months. That is how long it has taken Solana to move back above $200. Seeing that the all-time high is $295, this isn't a long time, we are getting close to resistance and this resistance will break easily just as it happened with Bitcoin. Solana is set to grow to $420 mid-term and this bull market is likely to give us a target of $620 and potentially $1,000. $1,000 is the bright spot we want to hit on the bull run phase.

Why aim so high? Because the correction was really small in comparison to Solana's major bullish cycle since 2022. Solana crashed and crashed really hard but this hard-crash led to the strongest bullish cycle ever. Only in January 2025 did Solana stop too breathe and it did so by doing a 60% drop-market flush. With this drop over, Solana can produce the continuation of its long-term, eternal bullish cycle. Higher and higher, week after week, month after month.

If you are a Solana holder I just want to tell you to be patient on this pair. All the gains that have not been done in the past will be fulfilled in a matter of days. Solana will catch up with the rest of the giants and grow strong. Once Solana is up there at a new all-time high, the rest of the market will continue to grow.

Think of Solana behaving just like Bitcoin; when it reaches high up, instead of crashing we can experience some consolidation followed by additional growth. When we are close to the true cycle top, money will flow out of these big projects into the smaller ones, creating a major bull run.

All is good and perfect and it is early still today. Think about it, would it be late to buy below $200 when you know the potential is 1K?

Thanks a lot for your continued support.

Namaste.

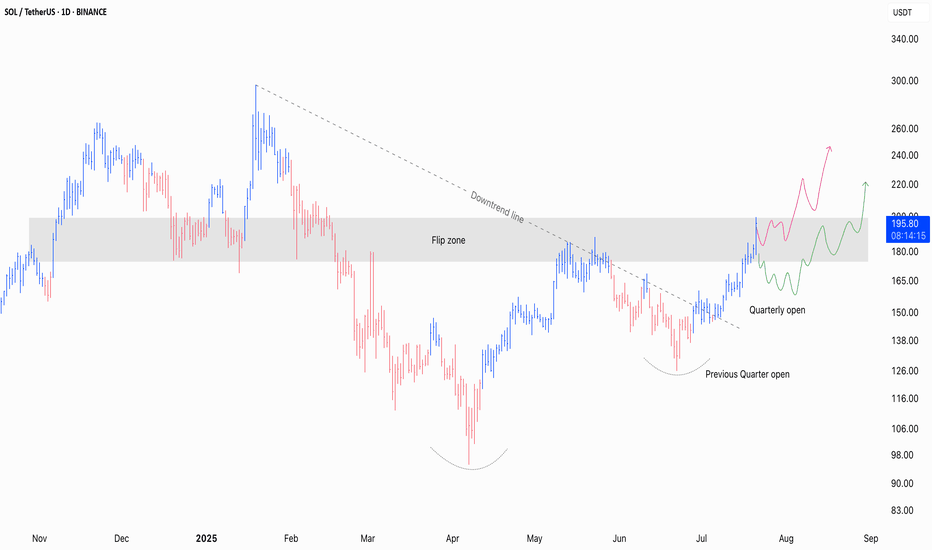

SOL / USDT - Current ThoughtsSolana’s been stealing the spotlight again and not just for the memes this time!

After months of getting smacked down at key levels, it’s finally reclaiming the lost ground with conviction. Price is grinding its way through zones that had been solid resistance for ages, flipping sentiment along the way.

The combination of structure, volume, and market psychology paints a clear story here. Let's break it down piece by piece in simple terms.

———x———x———x———

Table of Contents

⦿ Volume Profile

⦿ Key Technical Levels & Insights

⦿ Market Structure

———x———x———x———

⦿ Volume Profile

The Volume Profile offers crucial insight into where meaningful participation has taken place throughout this range and how these levels continue to influence the current structure.

Point of Control (POC) – ~145 USDT

This is the level where the highest volume changed hands during the entire consolidation. In simple terms, this is where buyers and sellers were most active in establishing positions.

The POC is like a price magnet where the market finds equilibrium when direction becomes uncertain. If bulls lose momentum, the price may gravitate back towards it.

Value Area Low – ~123.50 USDT

Below this threshold, prior market interest thinned out significantly. A breakdown here would likely accelerate downside as it signals acceptance below value, typically inviting stronger bearish flows and forcing trapped longs to capitulate.

Value Area High – ~213 USDT

This area marks a logical short-term upside target if the current rally can sustain its footing. VAH is where the prior range began to thin out and sellers historically pushed back. If buyers want to reclaim control, this is a key level to watch.

Currently, the price has cleanly reclaimed the POC and is now pressing into what I’d define as the Flip Zone (an area where former resistance is getting retested as potential support). Acceptance above the VAH will lead a rally towards the ATH.

⦿ Key Technical Levels & Insights

Several key factors are aligning here to create a compelling case and it’s about the broader narrative these levels are constructing together.

Quarterly Open – ~150 USDT

The recent breakout and push above the QO shows a clear intent buyers' intent. It’s a important reference point for ongoing structure.

Yearly Open – ~188 USDT

Reclaiming the Yearly Open is rarely a trivial event. Currently, the price is flirting with the YO. If the price manages to reclaim it with a strong push, it'll shift the broader sentiment back in favour of the bulls.

Flip Zone – 175–190 USDT

This zone has historically been a battleground, serving as both support and resistance since March 2024. A clean breakout above this zone won't just clear resistance, it'll open the door for further upside as sidelined participants as well as trapped shorts will be forced to react.

Downtrend Line – Broken

The trend line that was established earlier this year has been breached now, adding another positive factor for the bulls.

200 EMA / 200 SMA – ~163 USDT

Both KMAs are converging here, adding weight to this level as a reference for long-term trend direction. Price reclaiming and holding above these MAs often signals a meaningful shift in market sentiment.

The confluence of reclaiming major opens, breaking downtrend resistance, and positioning above critical moving averages strengthens the bullish case.

⦿ Market Structure

The current structure shows a market transitioning from bearish exhaustion, through a phase of accumulation, and now stepping confidently into breakout territory.

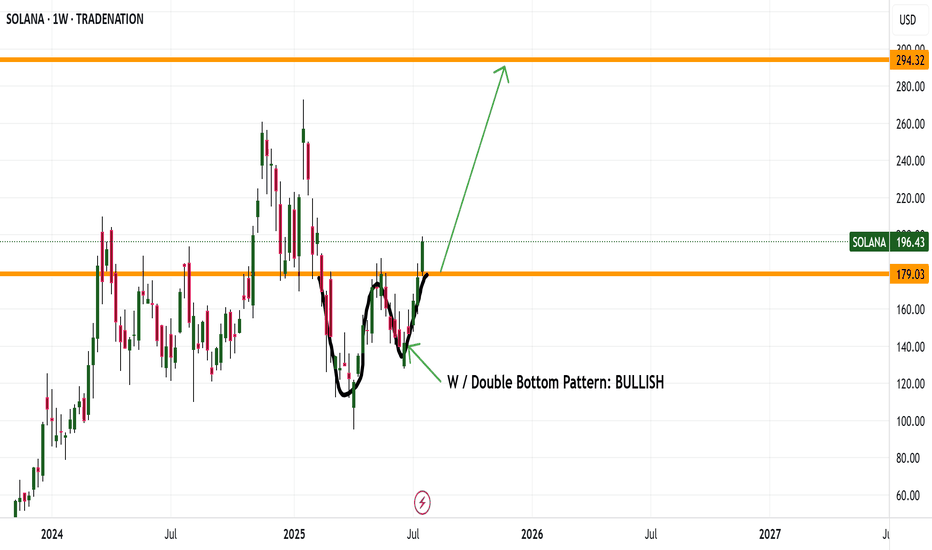

Double Bottom Formation (April lows ~95 USDT to recent highs):

This is a textbook accumulation. It’s not a fast V-shape reversal but a slow build. These kinds of structures often lay the groundwork for sustained trends.

Higher Lows in Place: 95 → 126 → 150 → 190 USDT

Each successive low is higher than the last, showing consistent buyer strength and deliberate positioning by participants with a longer-term view.

Breakout Above Prior Range Highs (187–190 USDT):

This area acted as clear resistance in previous attempts, capping price for months. Once this range is reclaimed with force, expect higher prices for multiple weeks/months.

TLDR

✅ Current Bias: Bullish while above 175–190 USDT.

✅ Structure: Breakout of multi-month downtrend, reclaiming key levels.

✅ Volume: Strong above POC, targeting Value Area High next.

✅ Invalidation: Failure below 150 USDT flips bias back to bearish.

I’m only focused on bullish continuation or healthy pullback scenarios for now, as I plan to keep holding my existing spot positions.

If you found this breakdown helpful, drop a like and let me know your thoughts in the comments. Always keen to hear how others are seeing the market. 👇

⚠️ Disclaimer

As always, this post is purely for educational purposes. I am not a financial advisor, and nothing here should be taken as financial advice. Always consult your financial advisor before making any investment or trading decisions. Or at the very least, consult your cat. 🐱

Solana Has Broken This Important Resistance LevelTrading Fam,

Things are definitely heating up in the altcoin space. Two big key movers are ETH and SOL. Right now SOL has broken a very important resistance level in the neckline of this inverse H&S pattern. Watch closely. If the body of our daily candle closes above this today and remains above it tomorrow, this pattern is in play and our target would be around $275.

✌️Stew

SOL/USDT | Next Bullish Leg Ahead if Key Support (READ)By analyzing the Solana chart on the daily timeframe, we can see that today the price climbed to $184, almost hitting the next target at $187, before facing a correction. It is currently trading around $176. If Solana manages to hold above the key support zone between $168 and $174, we can expect the next bullish leg to start, potentially extending up to $227. The previous analysis remains valid, with the next upside targets at $187, $220, and $263.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban