Solana

SOLANA - BULLISH & BAERISH

Hello everyone,

here is my current outlook on Solana (SOL):

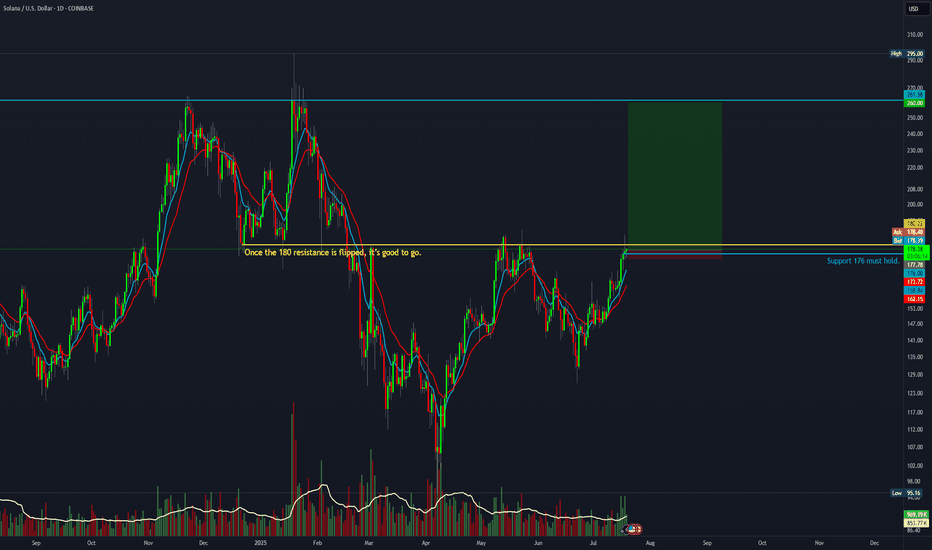

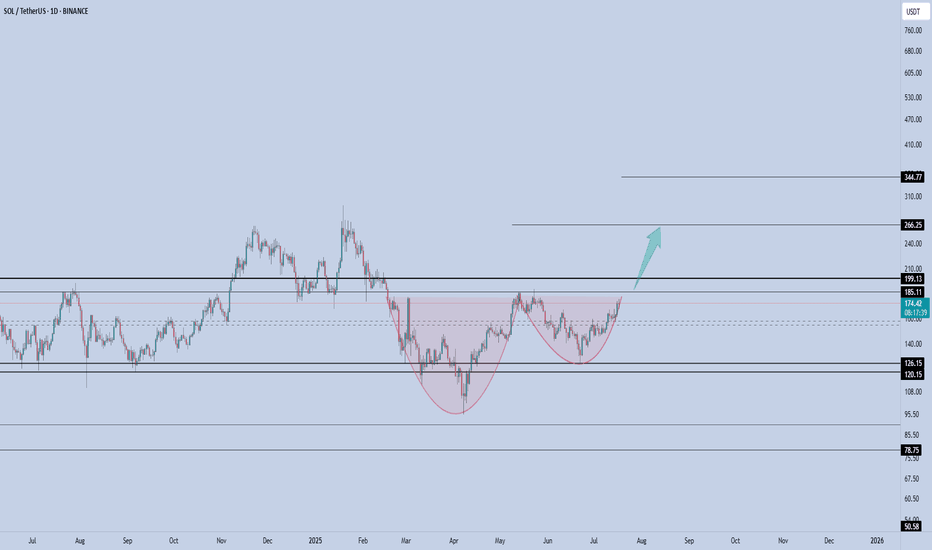

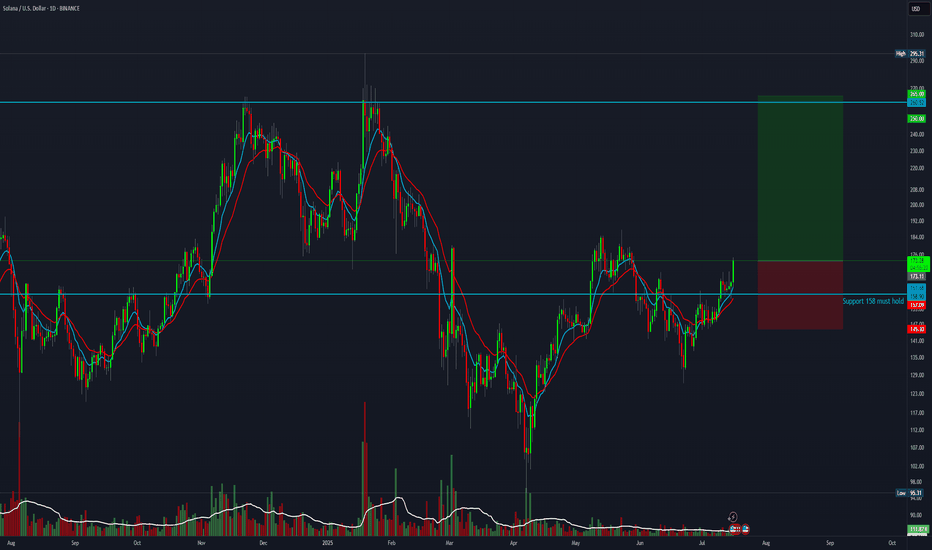

Personally, I am currently only watching Solana as we may already be in a correction phase. Nevertheless, there is an interesting scenario where we could still be in a green wave 5, which could potentially reach prices above USD 300.

Possible course:

In April 2025, the bottom may have been found following an ABC formation.

Wave 1 (yellow) could be completed in May 2025.

Wave 2 (yellow) could end in June 2025.

We could currently be in wave 3 (yellow).

Important point to watch:

If the price does not make it sustainably above the yellow wave 1 (approx. USD 190), the probability increases strongly that we are still in a B wave.

This would mean that we are still in a major correction, which could theoretically take us back to around USD 60. In this scenario, wave 1 would have already ended in January 2025 and we would still be in the correction of wave 2.

Conclusion:

The indicators are particularly important in this phase. Keep a close eye on them to better understand the structure.

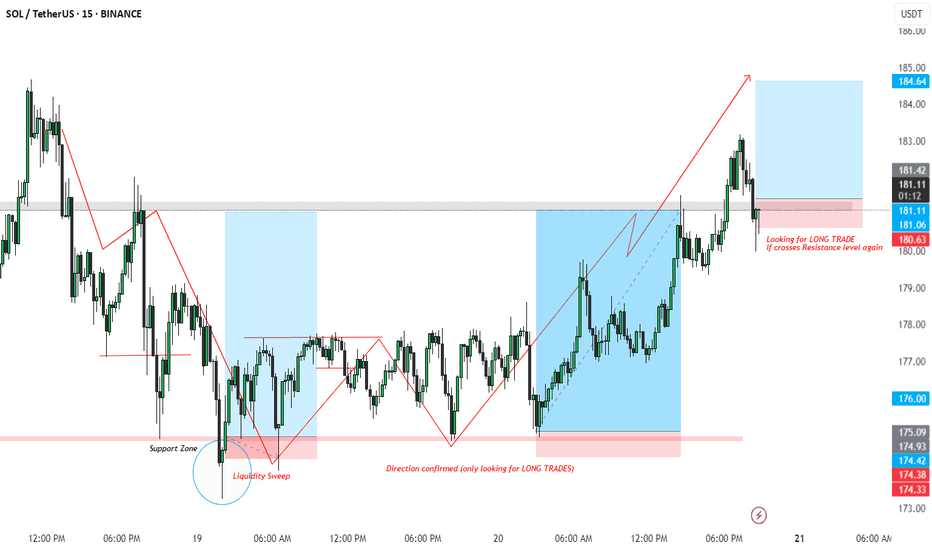

SOL/USDT LONG Setup – Liquidity Sweep + Break of Structure

Timeframe: 15m

Market Bias: Bullish (Long only)

Setup Type: Liquidity Sweep + BOS + Retest

📌 Breakdown:

Liquidity Sweep Identified:

Price dipped below the previous support zone, triggering stop hunts and grabbing liquidity.

Marked as a clear sweep of lows, signaling possible reversal.

Shift in Structure:

Following the sweep, price printed a Higher High and Higher Low, confirming change in structure.

At this point, we shift bias to Long Only trades.

Retest & Entry Zone:

After bullish momentum, price has pulled back to a key resistance-turned-support zone (highlighted in pink).

Looking for long entry on confirmation if price reclaims the resistance again (~181 zone).

📈 Trade Plan:

Entry: On reclaim and candle close above 181.00

SL: Below the recent structure low (~180.00 or dynamic based on confirmation)

TP: Previous high at 184.60 zone (approx 1:3 RR)

🧠 Trading Psychology:

Patience is key — wait for structure confirmation and avoid pre-emptive entries. The liquidity sweep setup gives us a solid probability edge when combined with market structure shift.

#SOLUSDT #CryptoTrading #SmartMoneyConcepts #LiquiditySweep #TradingSetup #BOS #MarketStructure #ReversalPattern #CryptoAnalysis #LongTradeOpportunity #PriceActionTrading #15MinSetup

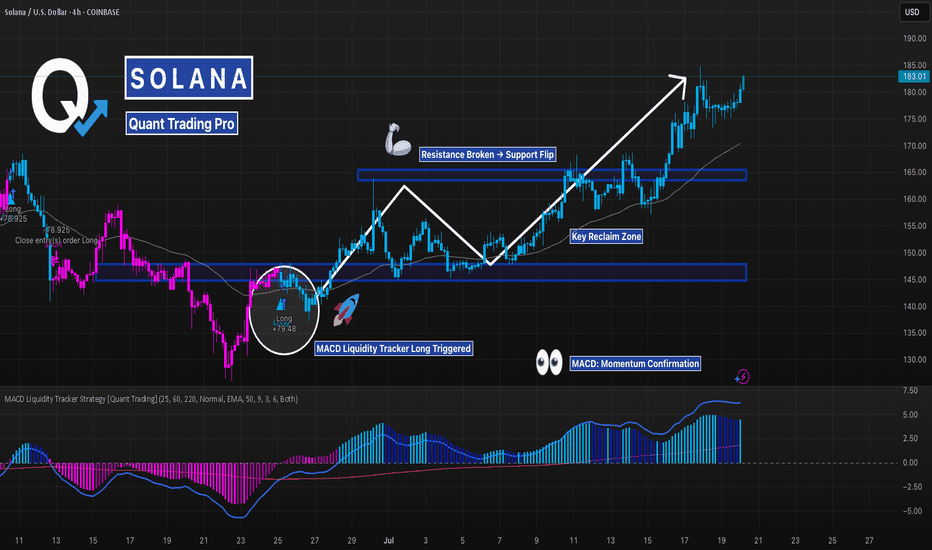

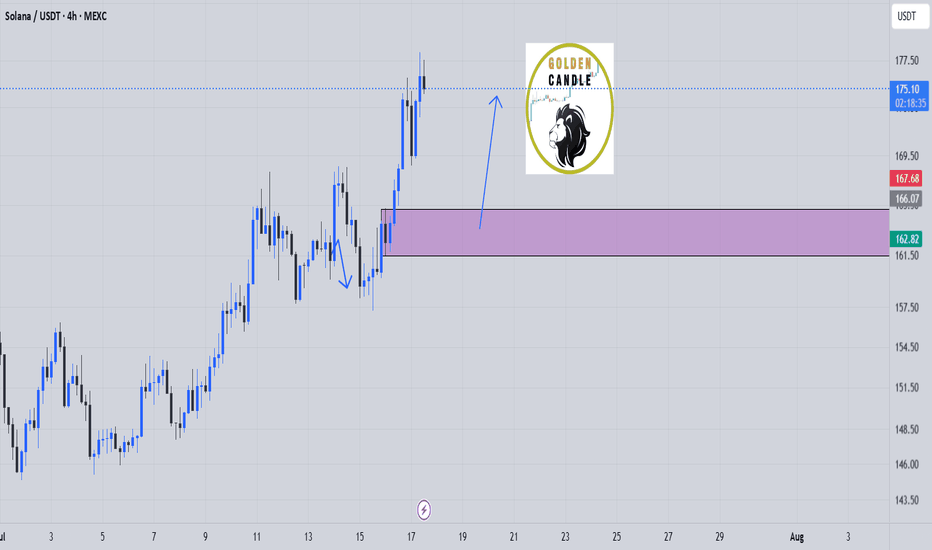

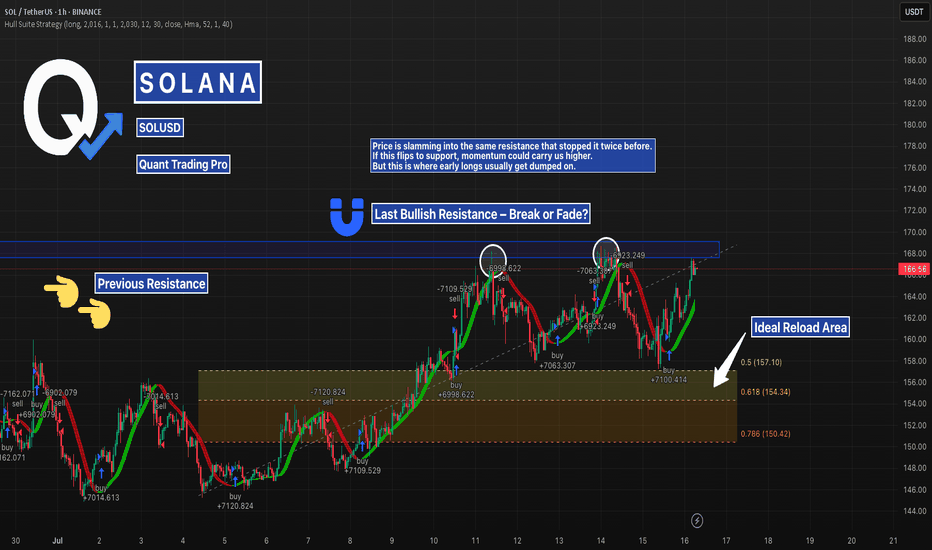

SOL Breakout Fueled by Momentum — $165 Flip Holding StrongSolana continues its strong uptrend after reclaiming key structure. Price broke out above the $165 resistance zone and turned it into support — a classic continuation setup.

What makes this move stand out isn’t just the structure, but how clean the momentum confirmation has been throughout.

The **MACD Liquidity Tracker Strategy** — designed to filter signals based on both trend alignment and momentum compression — flagged a long around the $155 reclaim.

From there, we saw rising histogram bars, a clean crossover, and price action that respected the entry all the way up through consolidation.

This type of strategy doesn't just look at MACD crosses alone.

It analyzes whether liquidity is *compressing or expanding*, and filters trades based on whether there's actual follow-through potential — especially useful in choppy markets like what we saw in late June.

This latest run is a good example of how pairing structure (support flips, key reclaims) with smart momentum filters can keep you in the move — and out of the chop.

We’re watching to see how SOL behaves above $180 and whether momentum sustains into higher resistance zones.

—

#SOLUSD #Solana #MACDStrategy #MomentumBreakout #SupportFlip #TradingEdge #BacktestBetter #QuantTradingPro #CryptoTrading #TradingView

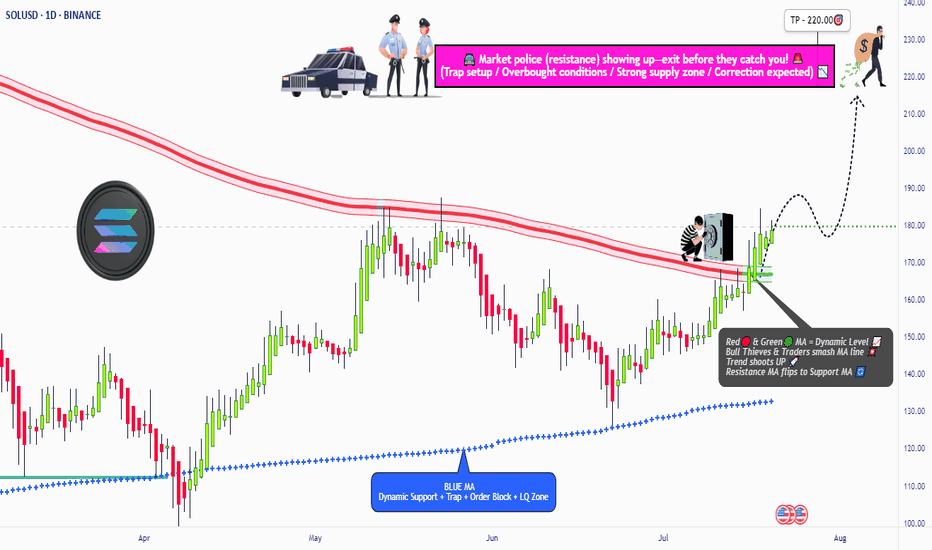

"SOL/USD BULLISH HEIST! Steal Profits Like a Pro"🏆 "SOLANA HEIST ALERT! 🚨 Bullish Loot Ahead – Thief Trading Style (SOL/USD)" 🏆

💸 Steal Profits Like a Pro – Day/Swing Trade Plan 💸

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

Hola! Bonjour! Hallo! Marhaba! 🤑 Dear Thieves & Trend Snipers, the SOL/USD vault is WIDE OPEN! Time to execute the heist with precision.

🔥 THIEF TRADING MASTER PLAN 🔥

🎯 Mission: LONG SOLANA (Escape Near Blue ATR Line)

⚠️ Danger Zone: Overbought | Consolidation | Bear Trap Ahead

🏆 Rule: "Take Profit & Treat Yourself – You’ve Earned It!" 💪💰

📈 ENTRY STRATEGY (The Heist Begins!)

"SWIPE THE BULLISH LOOT!" – Enter at any price, but smart thieves use:

Buy Limit Orders (15-30min timeframe)

Swing Low/High Pullbacks for optimal entry

DCA/Layering Strategy (Multiple limit orders for max loot)

🛑 STOP-LOSS (Escape Plan)

📍 Thief SL: Below nearest low (Daily MA @ $160.00)

⚠️ Adjust SL based on: Risk tolerance, lot size, & DCA layers.

Pro Tip: Tighten SL if market flips bearish!

🎯 TARGETS (Profit Escape Routes)

🎯 Main Take-Profit: $220.00 (or exit earlier if momentum fades)

🧲 Scalpers: Only LONG! Use trailing SL to lock gains.

💰 Big Bank Thieves: Go all-in. Smaller Raiders: Join swing traders.

📰 WHY SOLANA? (Fundamental Boosters)

Bullish Momentum (Tech + Sentiment Driving Price)

Macro Trends, On-Chain Signals 👉 Check Liinkss 🔗

Intermarket Analysis: Crypto & equities syncing for gains!

⚠️ TRADING ALERTS (News & Risk Control)

🚨 News = VOLATILITY! Avoid new trades during major releases.

🔒 Protect Running Trades: Use trailing stops to secure profits.

💥 SUPPORT THE HEIST! (Boost & Win Together) 💥

🔥 Hit the "LIKE" & "BOOST" button to strengthen our Thief Trading Squad!

🚀 More Heist Plans Coming Soon – Stay Tuned! 🤑🎉

📌 Reminder: This is NOT financial advice – DYOR & manage risk!

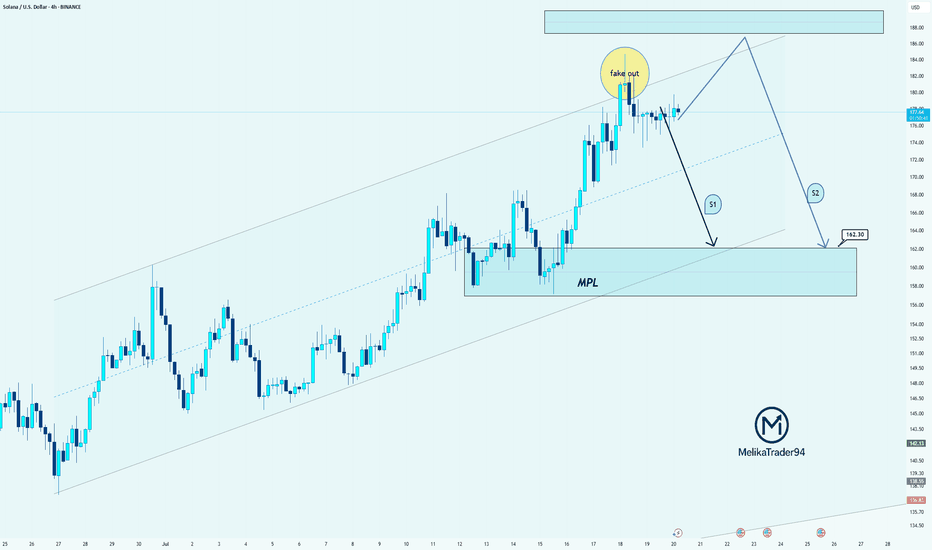

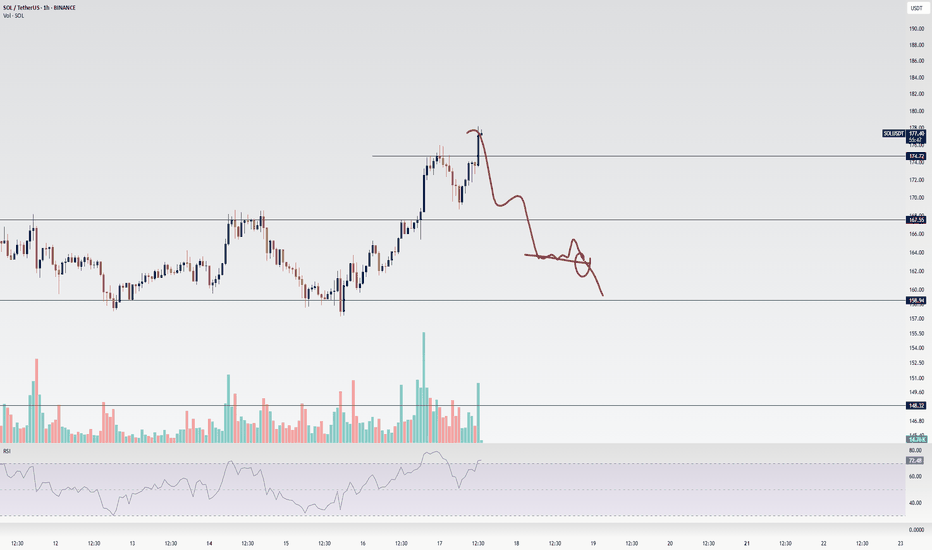

SOL: Clean Fakeout & Two Bearish Scenarios AheadHello guys!

Price just created a textbook fakeout above the resistance zone, grabbing liquidity and quickly dropping back into the range!

Here’s what the chart is showing:

Price is still inside the ascending channel, but the breakout attempt failed

The MPL (maximum pain level) around $162.30 is the key downside target

Two possible paths:

S1: Direct drop from here toward the MPL

S2: Another move up to retest the highs or form a lower high before the deeper drop

I think the S2 is more probable!

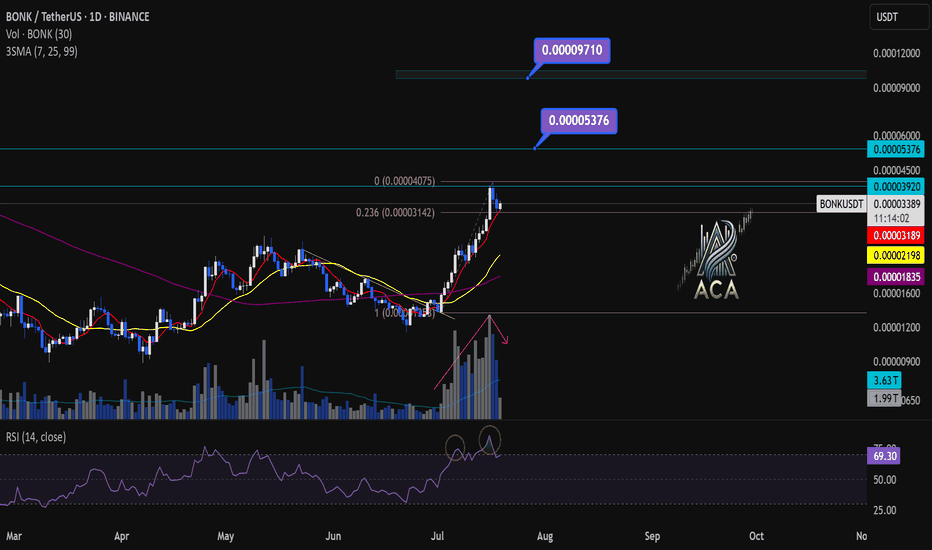

BONKUSDT 1D Chart Analysis | Bullish Momentum is coming...BONKUSDT 1D Chart Analysis | Bullish Momentum Builds After 0.236 Fibo Pullback

🔍 Let’s break down the BONK/USDT daily chart, focusing on the latest price action, strategic moving averages, RSI convergence, and volume dynamics for a complete bullish scenario setup.

⏳ Daily Overview

BONK is showing strong upward momentum, printing consecutive higher highs (HH) in both candles and RSI—a clear bullish trend indicator. After an explosive move, price is currently staging a healthy pullback to the key 0.236 Fibonacci retracement level (0.00003142), which commonly acts as a support platform during aggressive uptrends.

📈 Technical Convergence and Trend Structure

- 3SMA Support: The 7, 25, and 99 SMAs are all trending upward and stacked correctly, with price sitting comfortably above them. The 7SMA acts as immediate dynamic support, reflecting trend strength and buyer interest at every dip.

- RSI Dynamics: RSI just bounced from the 69–70 zone, confirming convergence with price action. The indicator made its own higher high in tandem with the candles, and now, as price pulls back, RSI is reentering the overbought territory—which often precedes renewed momentum.

- Volume Confirmation: Notably, volume surged as the trend accelerated, and is now tapering off during this corrective phase. This is a classic bullish volume signature, showing profit-taking by early longs but no major selling pressure, suggesting trend continuation likely after consolidation.

🔺 Bullish Setup & Targets

- First target: 0.00005376 — retest of the last all-time high (ATH).

- Next resistance to watch: 0.00003920, followed by the ATH region.

- Long-term target: 0.00009710 — an upside of 170–180% from current levels, mapped by technical extension and price discovery zones.

📊 Key Highlights

- Price holding the 0.236 Fibo retracement signals a shallow, healthy correction.

- 3SMA alignment confirms long-term bullish bias—actively supporting every dip.

- RSI and price are convergent, reaffirming uptrend strength; RSI’s move back into overbought could ignite the next price surge.

- Volume decreasing on corrections and rising during rallies—bullish confirmation.

🚨 Conclusion

BONK/USDT remains technically poised for further upside. The blend of higher highs, support at the 0.236 Fibonacci retracement, positive 3SMA structure, and RSI convergence all point to bullish continuation. Watch for renewed momentum as RSI reenters overbought territory and volume confirms the next breakout. Next targets: 0.00005376 (ATH), with a long-term projection toward 0.00009710.

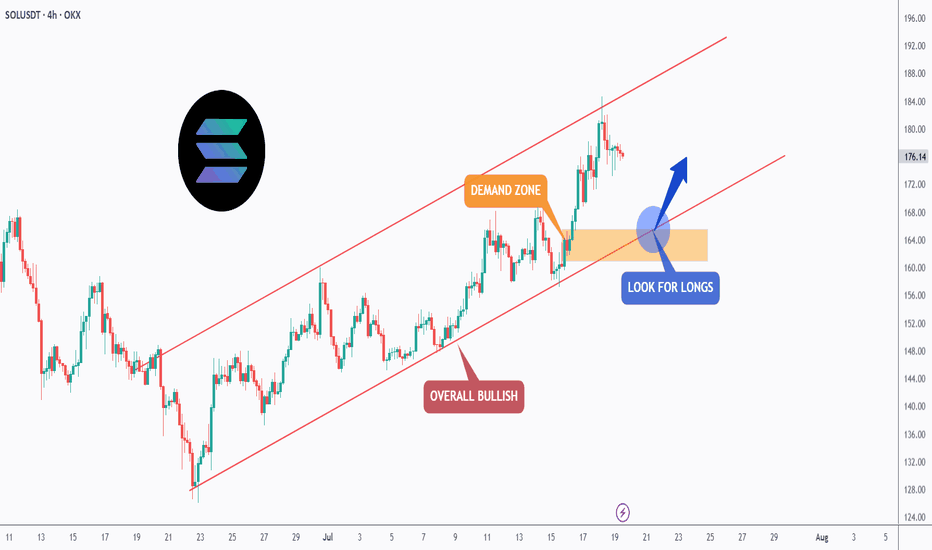

SOL - Trend-Following Longs in the making!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈SOL has been overall bullish trading within the rising channel in red.

Moreover, the orange zone is a strong demand.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the orange demand zone and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #SOL retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

TON/USDT | Another Bullish Move Ahead? (READ THE CAPTION)By analyzing the Toncoin chart on the 3-day timeframe, we can see that, as per yesterday’s analysis, the price climbed to $3.36 before facing a slight correction — which is perfectly normal since every strong bullish trend needs a healthy pullback. The $3.05–$3.20 zone could serve as a good accumulation area for buyers, and we may soon witness another impressive rally from Toncoin! Based on the previous analysis, the next targets are $3.63, $4.20, and $4.68.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

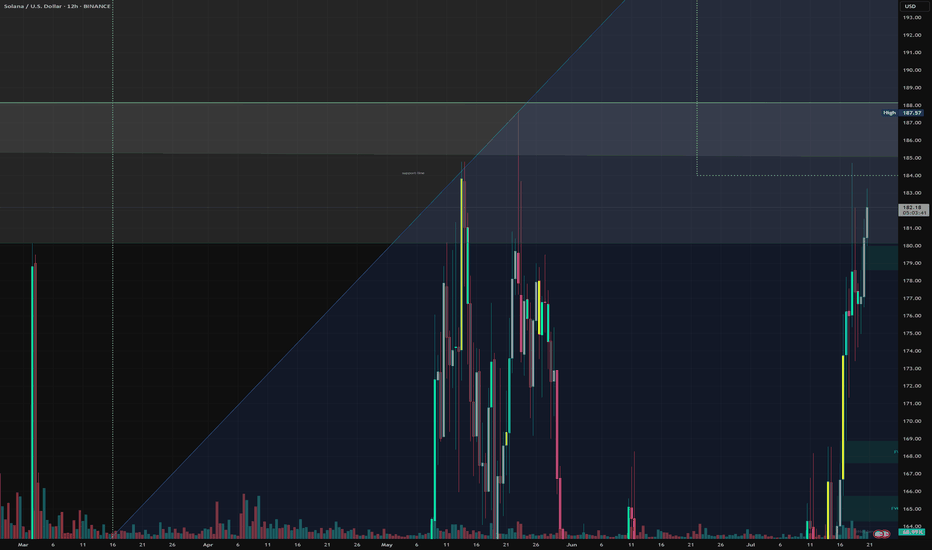

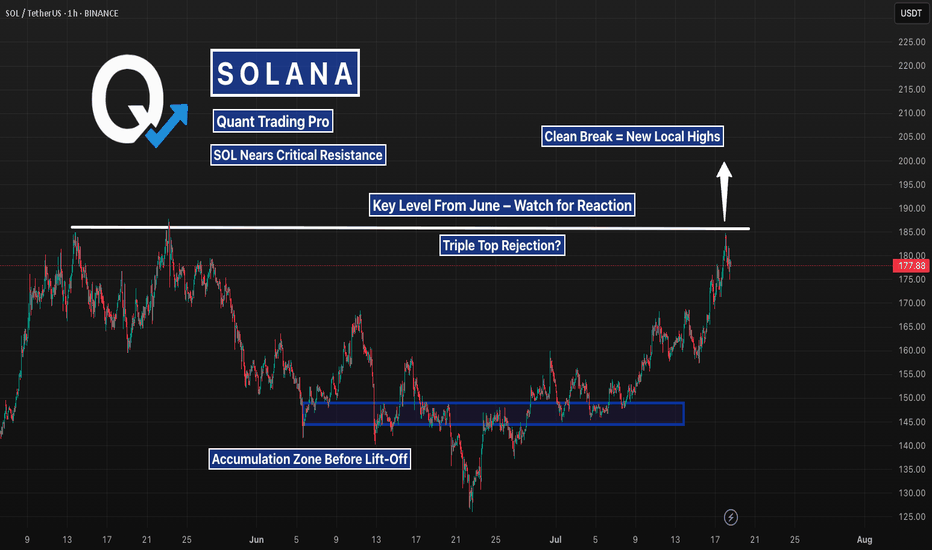

Solana Testing the June Breakdown Level — Decision TimeAfter weeks of slow grind, SOL is now pressing into a level that triggered a major selloff in June. A clean breakout here could flip momentum hard — but if buyers stall again, a short-term double top could catch late longs off guard. Watching $185 closely.

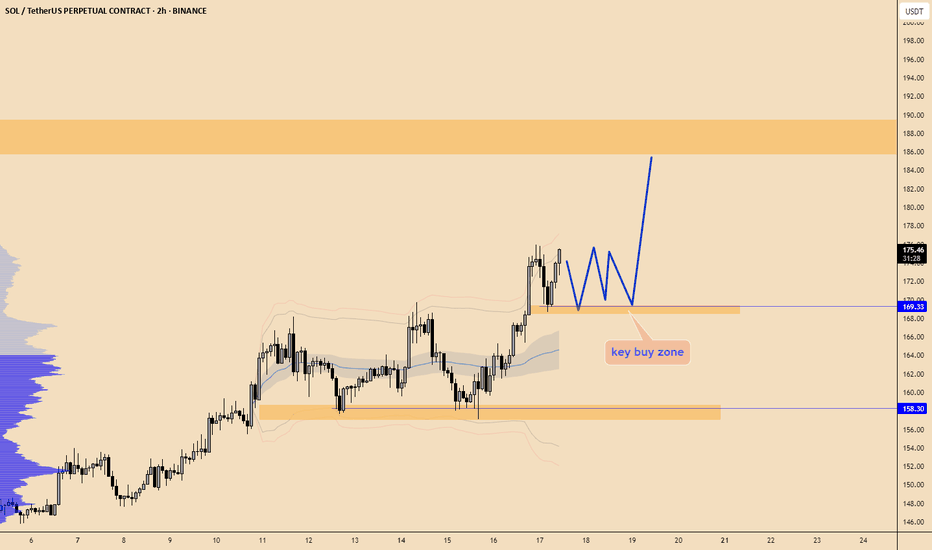

SOL/USDT Technical Outlook – Breakout Holding, Eyes on 175+Solana has successfully broken above the key resistance zone at $155–157 and is currently testing it as new support. If the level holds, this breakout could extend toward the next major target around $175–178.

📌 Key Insights:

Clean breakout followed by a potential SR flip

Watch for confirmation of support before continuation

Target aligns with previous swing high

Invalidated on breakdown below reclaimed level

🟢 Bias remains bullish as long as price holds above the breakout zone. A confirmed retest could provide a high-probability long setup.

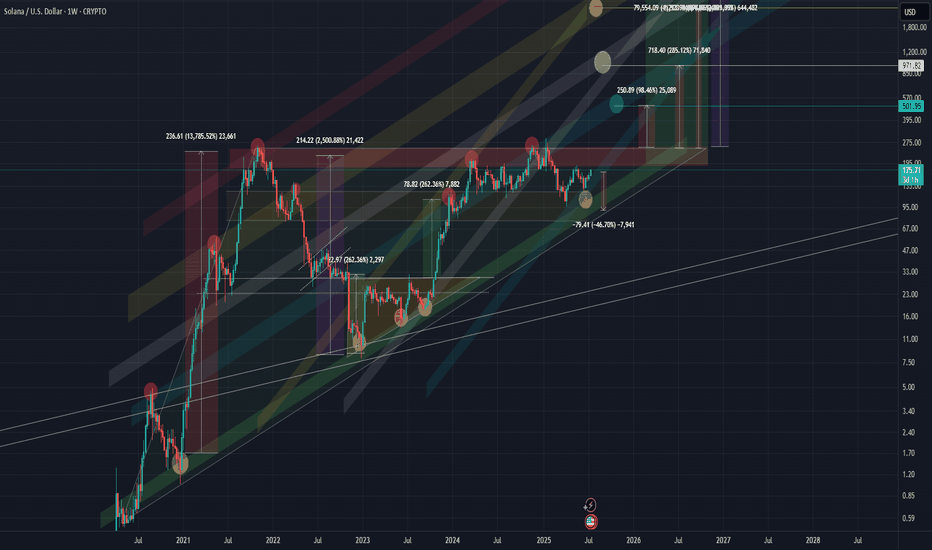

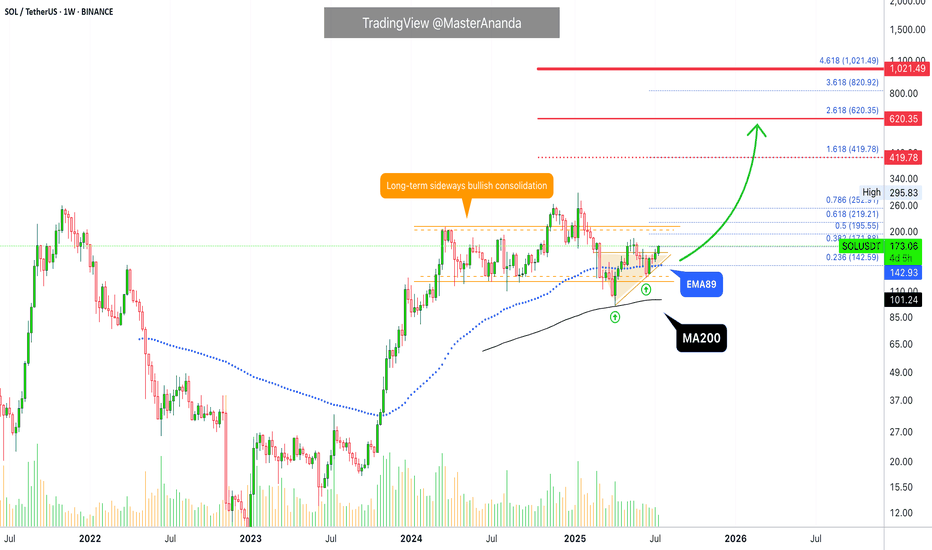

SOLANA SOL 1WThis coin is showing very interesting development, and the market maker seems to be painting clear structural patterns.

🔷 Macro Structure: Rising Triangle

On the higher timeframes, we can clearly see a rising triangle formation taking shape. If this pattern breaks out to the upside, the potential measured move suggests a target of up to ~2,500% from current levels.

📊 Chart Overview

Wide zones = key support and resistance

Former resistance often becomes support after a breakout

All target levels and zones are clearly marked on the chart

⚠️ Risk Warning & Realistic Scenario

Be mindful of market behavior:

Often before a bullish breakout, we see a fake breakdown — a trap to liquidate early longs — followed by a return into the triangle and a strong move upward. Don’t rush. Let the pattern confirm itself.

💡 Plan Accordingly

If you're already in, consider protecting your position with a stop-loss

Don’t overleverage, and take profit partially on strong levels

#SOL Update #5 – July 18, 2025#SOL Update #5 – July 18, 2025

Solana has returned to the region where its last impulsive move was formed. It appears to be attempting another bounce, but when we look at the SOL/BTC pair, it is currently facing a strong resistance zone.

There isn't much room between this resistance and the 200 MA band, which makes this a critical decision zone. At the moment, I do not recommend entering either a Long or Short position — it’s best to wait and observe.

If Solana breaks out to the upside, the next target will likely be $179.

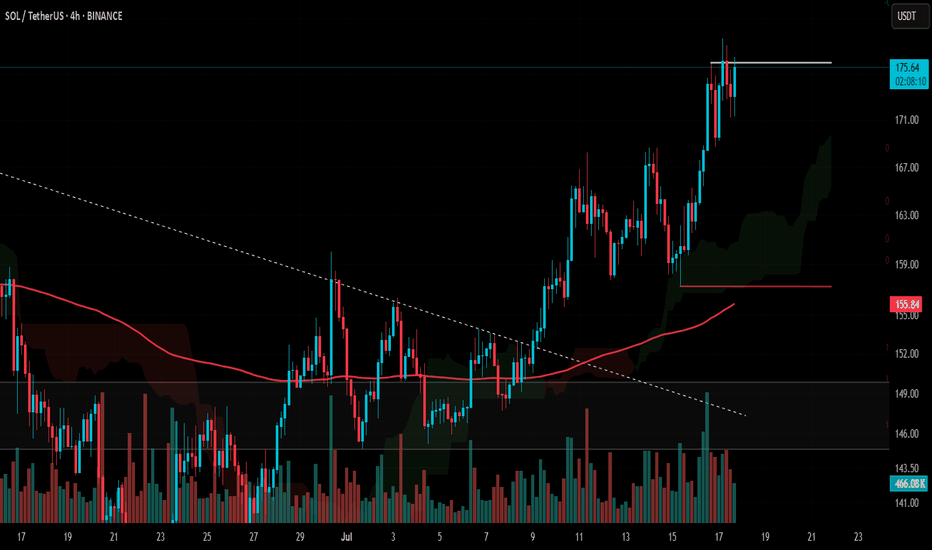

Solana - The Cup is Almost FullSolana is printing a textbook cup & handle formation on the daily, and price is now pressing against the neckline resistance near $185, just below the psychological $200 zone.

This structure reflects months of accumulation and rising momentum. A confirmed breakout above the $185–$199 resistance would likely trigger the next upward leg.

This setup signals trend reversal continuation, and if SOL closes above $199 on high volume, momentum traders may pile in quickly.

📌 Invalidation below $150 = pattern risk-off.

sol buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

SOL/USDT : SOL Rebounds Strong – Is a 25% Rally Just Beginning?By analyzing the Solana (SOL) chart on the daily timeframe, we can see that after dropping to the $147.75 zone, the price experienced renewed buying pressure and has since rallied to around $159, delivering over 6% return so far.

This cryptocurrency shows strong bullish potential, with short-term gains possibly exceeding 25%.

The next upside targets are $168.5, $187, $220, and $263.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

SOL Back at the Same Level It Dumped From — But with BackupSOL is right back where the last major dump started — but the structure this time is way cleaner. Higher lows, trendline support, and strong momentum behind the push.

If it clears this zone, we could see fireworks. But don’t fade resistance this thick without confirmation.

#Solana #SOLUSD #CryptoCharts #BreakoutWatch #ChartAnalysis #TrendlineSupport #CryptoTraders #QuantTradingPro #TradingView

Solana Update: Miss This Analysis, Miss the Next Leg!Hey, I’m Skeptic! 🩵 Solana’s recently kicked off a strong uptrend momentum , and there are solid triggers waiting to activate that could bring good profits. In this analysis, I dove into Solana on weekly, daily, and 4-hour timeframes, and checked SOLBTC and BTC.D too, to get a grip on the current liquidity flow.

💬What’s your trigger on Solana? Drop it in the comments, and if you want an analysis on a coin, write it for me so I can check it out.

Solana Ultra-Bullish Above MA200 & EMA89 · $1,000 ExplainedOne guy was saying Solana was set to move lower because it already produced a "3,000% bullish wave." What nonsense... Solana is ultra-bullish. We don't do an analysis based on some unintelligent assumption rather, we focus on the data, the signals, the indicators, the chart.

Solana corrected and found support perfectly, exactly at MA200 in April 2025. Boom! It never went below so it was never bearish to start. A true long-term bull market a la Bitcoin.

And more recently, on the 16/23-June weeks, it traded briefly below EMA89 just to recover and later start rising. This is a strong bullish signal on its own. The fact that bears tried to push prices lower and failed; bullish. The fact that there is a strong higher low between the test of MA200 and EMA89. The fact that we can make mistakes with our interpretations but the chart is never wrong.

The fact is that Solana is going up with the next easy but strong target being $420. It can reach, later down the road, $620 and even higher to peak at $1,000+. Can you see what I see? Crypto is going up.

Bitcoin is going up. Solana is going up. Ethereum is going up. Cardano is going up. XRP is going up. Dogecoin is going up. We are going up. The new financial market is growing. It is not just these projects but Cryptocurrency will replace the old financial system, this is another fact. The older system will be left behind because Crypto's market cap. will grow so strong and so fast, maybe a 10 years long bull market will do the trick, we will start with four.

If you want to be high more forever rich, buy Crypto. Solana is a good choice.

Thanks a lot for your continued support.

Namaste.

SOLUSD – Big Test at Local Resistance | Fib Reload if RejectedSolana just tapped into prior resistance from July 13–14, a level that previously rejected price.

With fib confluence between $157–$150 below, this is a textbook setup: breakout or rejection → smart money looks for the reload.

Watching closely for structure shift before taking position.

#SOLUSD #Solana #Crypto #Breakout #SupportResistance #QuantTradingPro #TradingView