Solana - Don't miss it General background and conclusions

Solana is showing a pre-split state - neutral with an upward slope, holding above MA-200 and receiving confirmation from structural patterns.

Technical signals point to the importance of the $188 level: its breakout will open the way to $200-206 and potentially to $247.

In the short term, growth to $180 is possible if the direction is confirmed.

In the absence of volumes and strength, a downward movement to the lower support of $160 and further is possible.

Recommendations

Strategy "buy on breakout": entry at the close and holding above $188 with a target of $200-206. Alternative: buy on dip to $160 in case of a technical rebound.

Stop loss: it is reasonable to place it just below $160.

Additional monitoring: It is important to monitor the dynamics of volumes, price behavior around $188, as well as the development of fundamental drivers (ETF, Firedancer, etc.) in order to clarify the movement scenario.

Solanacoin

Solana - is showing reversal signalsTechnical structure and patterns

On the daily chart, SOL has formed an inverse head and shoulders pattern, a classic reversal pattern. A breakout above the neckline with increasing volume could lead to a move to $247.71. However, weak demand could jeopardize this scenario, triggering a fall even to $138.05.

The asset has grown by 18% in a week, reaching $181, but there are liquidation clusters and strong resistance at $184–185. A breakout of this range could accelerate growth, with a possible surge to $256.

Support and resistance levels

Resistance:

The key zone is $180–184, a breakout of which would open the way to growth.

Support:

Important zones are $153–143, where cumulative activity was previously observed.

Network background and volume dynamics

The number of tokens on exchanges has decreased by almost 10%, which indicates a decrease in selling pressure. A "golden cross" is also forming between the 100- and 200-day EMAs - a bullish signal with target levels above $176.

Earlier, SOL rebounded from the support zone around $160 and is moving towards a breakout of $175. The further trajectory - growth or consolidation - will depend on how the price behaves at the border around $175.

Solana - The bullish background remains strongCurrent Technical Signals

SOL is trading around $180-$181, holding above the key 20-day EMA, which is around $178.25. A break below this level could open the way to support around $171.78, while holding above this level creates potential for a rise towards $186.40-$190.47.

A golden cross is forming between the 100- and 200-day EMAs on the daily chart - a classic bullish signal, strengthening the chances of a rise to $200.

Your network volume and balances on exchanges are showing a decline, which indicates a decrease in supply - easing pressure on the price and supporting bullish sentiment.

Support and Resistance

Support:

$178.25 (20‑EMA)

$171.78 — lower limit in weak market

The Currency analytics

Resistance:

$180–$190 zone — critical for further gains

Upper resistance at ~$200 — critical for rally continuation

Structural and Valuation Signals

A test of the daily bullish divergence on SOL indicates potential for further gains after correction.

SOL recently broke out of its ascending channel, indicating a possible reversal and the beginning of a new move higher.

Finance Feeds

Solana definition of movementSOL is in a squeeze phase: the price is holding above $163, but meets resistance around $183-186. Indicators show neutral, slightly weak momentum. A break above $186 with increasing volumes will open up potential at $190+; a break below $178 will lead to a deeper correction to $171-170. Until then, it is worth watching the 20-d EMA hold and reactions to it.

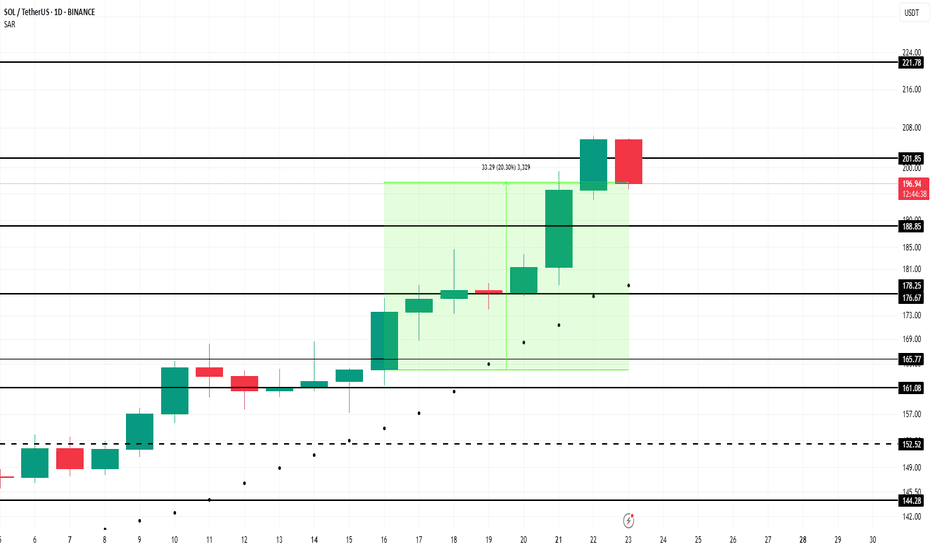

Solana Price Faces Reversal At $200 As Profits Hit 5-Month HighBINANCE:SOLUSDT price has risen 21% in the past week , now trading at $199. Despite breaching the $200 mark, Solana has failed to maintain this level, marking a five-month high.

The Net Unrealized Profit/Loss (NUPL) indicator for BINANCE:SOLUSDT shows that profits have reached a five-month high . This signals that many investors are in profit, raising concerns about a potential sell-off.

If these factors hold true, BINANCE:SOLUSDT price could decline toward the support levels of $188 or even drop to $176 . A move below these levels could erase a significant portion of the recent gains and shift the altcoin into a bearish trend.

However, if investor confidence remains strong and the market continues to show bullish signs, BINANCE:SOLUSDT could stabilize above $200 . Securing this level as support could propel the price back toward $221, invalidating the bearish outlook.

"Solana Heist in Progress! Will the Breakout Hold or Fake Out?"🔥🚨 "SOLANA HEIST ALERT: The Ultimate Bullish Raid Plan (Breakout or Fakeout?)" 🚨🔥

🌍👋 Greetings, Market Pirates & Profit Bandits!

(English, Spanish, Portuguese, French, German, Arabic—we speak MONEY.)

💎 STRATEGY BASED ON THIEF TRADING STYLE 💎

(High-risk, high-reward—steal the trend or get caught in consolidation!)

🎯 MISSION: SOL/USD (Solana vs. Dollar) CRYPTO HEIST

🐂 Direction: LONG (But watch for traps—cops & bears lurk nearby!)

🚀 Escape Zone: ATR line (High-Risk Profit-Taking Area)

⚠️ Warning: Overbought? Reversal? Police line at resistance? TAKE PROFITS EARLY!

📈 ENTRY: "THE BREAKOUT HEIST BEGINS!"

Trigger: Wait for candle close ABOVE 148.50 (MA)

Alternative Entry: Buy stop above MA OR buy limit on pullback (15m-30m TF)

🛎️ SET AN ALERT! Don’t miss the breakout—thieves strike fast.

🛑 STOP LOSS: "DON’T GET CAUGHT!"

Thief SL: 136.00 (2H Previous structure Swing Low) (Adjust based on your risk & lot size!)

⚠️ Warning: If you ignore this, you’re gambling—your loss, not mine.

🎯 TARGET: "LOOT & BOUNCE!"

🎯 167.00 (or escape earlier if the trend weakens!)

🧨 Scalpers: Only play LONG—use trailing stops to lock in gains!

📢 NEWS & RISK WARNING

🚨 Avoid new trades during high-impact news! (Volatility kills heists.

🔒 Use trailing stops to protect profits if the market turns.

💥 BOOST THIS HEIST! (More boosts = more profit raids!)

👉 Like ✅ | Follow 🚀 | Share 🔄

💬 Comment your take—bullish or bearish trap?

🚀 Next heist coming soon… Stay tuned, bandits! 🤑

Solana: Below ResistanceOur primary scenario for Solana is that the coin is already close to the top of the green wave 4. Therefore, we expect a bearish trend reversal below the resistance at $192.33, followed by a move toward our blue Target Zone (coordinates: $56.56 – $29.87) with the green wave 5. Down there, we see an opportunity for long trades with the low of the blue wave (ii), which should be followed by a fresh upward impulse. According to our alternative scenario (probability: 38%), however, we may have already seen the low with wave alt.(ii) in blue prematurely. To validate this alternative scenario, the price would have to rise directly above the resistance at $192.33 from here and extend the blue wave alt.(iii) .

Solana: More RoomSolana’s countermovement of the green wave 4 has some more room on the upside. Once the wave-4-top is established (below the resistance at $192.33), we primarily anticipate a wave 5 sell-off down into the blue Target Zone on the downside (coordinates: $56.56 – $29.87). In this range, the wave (ii) corrective movement should conclude, and the altcoin should start the next sustainable upward impulse. However, if the price rises above the mentioned $192.33 mark during the current upward movement (36% likely), this will suggest that the low has already formed via wave alt.(ii) in blue.

Solana (SOL) Holding Strong – Can It Reclaim $200?Solana (SOL/USDT) is currently testing a critical support zone around $140, aligning with a long-term ascending trendline that has provided strong support in previous market cycles. The 50-week EMA ($168.03) is also acting as dynamic resistance, making this an important decision point for the market.

The recent pullback from resistance at the previous ATH zone suggests some profit-taking, but if SOL can hold this key support level, a bullish reversal could follow, pushing prices back toward $200+ in the coming weeks.

However, a break below $140 could lead to a deeper retracement toward the trendline support around $100-$120.

SOL/USDT – Double Zigzag Completed! Is a Bullish Reversal Next?Solana (SOL) has likely completed a Double Zigzag (WXY) correction, with Wave C of Y bottoming at $130.60 (1.0 Fibonacci extension). This suggests a potential trend reversal, but SOL must first break key resistance at $146-$150 to confirm a bullish move.

🔹 Elliott Wave Analysis & Bullish Scenario

If the Double Zigzag correction is complete, SOL could begin a new impulse wave, targeting:

✅ $169-$173 (0.5 Fibonacci retracement, previous Wave B resistance)

✅ $180-$195 (0.382 Fib & major supply zone)

✅ $220+ (Wave 3 extension target)

🔻 Bearish Scenario – Extended Correction?

If SOL fails to break $150, it could indicate that the correction is not yet over, leading to:

❌ Retesting $130 support

❌ Possible extended correction towards $113-$100 (1.272 Fib extension)

📌 Key Level to Watch:

🔹 A break & close above $150 signals bullish continuation.

🔹 A rejection could mean further downside.

📊 Is SOL ready for a breakout, or will we see another leg down? Share your thoughts below! 👇🔥

Solana Analysis Solana Analysis

Solana is currently finding robust support on the daily chart, as indicated by the significant impact of the recent bearish trend that has dominated the cryptocurrency market over the past week. A rebound towards a bullish trend is anticipated, as the asset has recently bounced off this strong support level.

Please note that this is my personal analysis and should not be construed as financial advice to invest in or purchase this asset. It is crucial to exercise your own judgment and conduct thorough research and analysis prior to making any investment decisions.

Trade cautiously and ensure you fully understand the associated risks before executing any trades

Cheers!!

We're off to a great start SOLANAWe're off to a great start SOLANA

🚀 Trade with the professionals of THS - Wave Theory!

🔹 All trades are based on wave analysis.

🔹 Fixed stop loss and take profit for risk management.

🔹 100% automation: copy trades through CopyFX service.

🔹 Reliability and transparency: the results are confirmed by the market.

📈 Don't miss the chance to earn steadily!

👉 Connect to CopyFX with THS and start copying profitable trades right now!

💡 Details on our channel and in the app!

Solana Eyes Breakout: Is a New All-Time High on the HorizonSolana (SOL) is in a strong uptrend, holding above the $140 key support zone, aligned with a rising trendline. The price is near resistance at the previous ATH, with the 51-day EMA providing dynamic support.

A breakout above this resistance could lead to significant upside and potentially a new ATH. The trend remains bullish as long as SOL stays above $140.

SOL/USD "Solana vs USD" Crypto Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the SOL/USD "Solana vs USD" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at anypoint,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Goal 🎯: 250.00

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, I would conclude that the SOL/USD (Solana/US Dollar) pair is: Bullish

Reasons:

Growing adoption and usage: Solana's blockchain platform is gaining traction, with an increasing number of projects and applications being built on top of it.

Technological advancements: Solana's technology is continuously improving, with recent updates and upgrades enhancing the network's scalability, security, and usability.

Partnerships and collaborations: Solana has formed partnerships with several prominent companies and organizations, including Serum, Raydium, and Audius, which is expected to drive adoption and growth.

Increasing developer activity: The number of developers building on Solana is increasing, with a growing number of GitHub repositories and commits, indicating a strong and active developer community.

Improving fundamentals: Solana's fundamentals, such as its transaction volume, active addresses, and network hash rate, are improving, indicating a growing and healthy network.

However, it's essential to consider the following risks:

Market volatility: The cryptocurrency market is known for its volatility, and SOL/USD is no exception. Price fluctuations can be significant and unpredictable.

Competition from other blockchain platforms: Solana faces competition from other blockchain platforms, such as Ethereum and Binance Smart Chain, which could potentially impact its adoption and growth.

Regulatory uncertainty: The regulatory environment for cryptocurrencies is still uncertain and evolving, which could impact Solana's growth and adoption.

Bullish Scenario:

Growing adoption and usage, technological advancements, and partnerships drive up demand and price

Increasing developer activity and improving fundamentals support the bullish case

Key Fundamental Indicators:

Solana's transaction volume: 100,000 transactions per day

Solana's active addresses: 10,000 active addresses

Solana's network hash rate: 100 GH/s

Solana's GitHub repositories: 100 repositories

Solana's GitHub commits: 1,000 commits

Market Sentiment:

Bullish sentiment: 80%

Bearish sentiment: 20%

Neutral sentiment: 0%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

Solana (#SOL): current situation and future prospectsSolana (#SOL): current situation and future prospects

Current Price: The SOL price level remains volatile, reflecting the overall market sentiment.

Trading volume: After a period of low activity, volumes are starting to gradually recover.

Technical Analysis: The price is approaching key support and resistance levels. It is important to keep an eye on the areas around TSXV:XX (depends on the current price) to confirm further direction.

📈 Outlook:

Solana continues to grow the ecosystem and attract new projects. Several factors could influence the future of the cryptocurrency:

Fundamental potential: The Solana network is actively used in DeFi, NFT and other areas. An expanding ecosystem will keep interest in the token alive.

Updates and improvements: Constant updates to the network make Solana competitive with other blockchains.

Investor interest: Increased institutional interest in Solana could be a driver of price appreciation.

⚡ Trading strategy:

Short-term: Given the volatility, SOL is suitable for active traders. Keep an eye on support/resistance level breakouts and trading volumes.

Long-term: For investors with a 1-2 year horizon, Solana remains a promising asset, especially if the cryptocurrency market enters a growth phase.

Solana Best DCA LevelsAs an investor who likes to act with the DCA strategy, I have compiled the best buy zones for you by determining the support and resistance points for Solana on a weekly basis. I will explain why I named these buy zones in this way.

$260 - $202.29 (Not Preferable): Since this level is the psychological resistance level where the previous ATH is located, I think those who have Solana in their pocket should keep it at this level. If an investor who does not have Solana in their pocket wants to buy Solana, since this level is psychological resistance, the probability of rejection and breaking is 50-50. Therefore, it is not a very suitable position for buying. In the correction that will occur in the event of a resistance break, buying would be much more logical.

$202.29 - $128.16 (Good to Buy): This level has found good volume in 2024 and a side channel has been experienced. As long as the price does not fall permanently below the moving averages or the Hodrick-Prescott filter that I am currently showing on the chart, this level is a very good buy level. Investors who are especially waiting for an ATH breakout have made their preparations at this level.

$128.16 - $87.79 (Cautious): Although it has been used as support twice, this level cannot be considered a perfect buy area since it is a level with relatively low volume. Therefore, it would be more accurate to expect Solana to converge to one side.

$87.79 - $48.72 (Not Preferable): Probably one of the worst buy areas on the chart. Volume is almost non-existent. There is a big gap. Therefore, the price moves very sharply from $87 to $48.

$48.72 - $28.26 (Good to Buy): This is the area where Solana is starting to recover. It is a good area to buy.

$28.26 - $14.48 (Best Place to Buy): I don't know if this level will be seen again, but it is the level where Solana is extremely cheap. While most investors cry at this level, smart investors continue to collect Solana.

Any DCA is suitable for investors who think Solana has a 4-digit intrinsic value. This analysis only indicates the best areas.

Solana (SOL): 430% Gain at 10x LeverageSolana (SOL) Trade Overview:

Solana (SOL) has delivered an incredible rally on the 4-hour timeframe. Using the Risological Swing Trader , the trade not only hit all predefined targets but exceeded expectations, achieving a 430% gain at 10x leverage.

Key Levels:

Entry Price: $175.68

Stop Loss (SL): $165.36

Take Profit Targets:

TP1: $188.45 ✅

TP2: $209.10 ✅

TP3: $229.75 ✅

TP4: $242.51 ✅

Analysis:

The Risological Lines perfectly highlighted a sustained bullish trend. Solana maintained its upward momentum, achieving rapid target hits. The Risological green lines provided a clear path for the trade's continuation, enabling traders to maximize their profits.

Outlook:

With all targets hit, Solana's trajectory remains strong. Traders may look for additional entries or secure profits as the bullish momentum shows no signs of slowing down. A well-executed trade like this emphasizes the power of Risological indicators for precision trading.

Solana (SOL) - Crucial Key LevelsExpect a short term pullpack for Solana due to Bitcoin dominance in the market. SOl will hold major support around: $174. In addition, the price action will range between= $189 - $203 will likely see a consildation.

However, if a weekly candle closes above: $215 by Monday 12AM; Solana could create momentum to push a correction to the upside. Allow the price to head for a target of "$247" EST.

Long term Solana still remains bullish and positive, SOL has also had a daily candle close above a major previous Resistance level dating back since 2021 bull run cycle.

‼️DISCLAIMER PLEASE READ CAREFULLY‼️

*(THIS NOT FINANCIAL ADVICE, ALWAYS DO YOUR OWN RESEARCH! I AM NOT RESPONSIBLE FOR ANY LOSS OF EARNINGS FROM ANY INVESTMENTS THAT YOU MAY MAKE BASED OFF ANY OF MY IDEAS. ONLY INVEST WHAT YOU CAN RISK TO AFFORD TO LOSE IF YOU MAKE THE DECISION TO DO SO. DO NOT INVEST, UNLESS YOU'RE PREPARED TO LOSE MONEY, IF NOT ALL.)

(CRYPTOCURRENCY CAN BE HIGH-RISK INVESTMENTS DUE TO THE VOLATILLITY OF IT'S NATURE, AND YOU SHOULD NOT EXPECT TO BE PROTECTED IF SOMETHING GOES IN THE WRONG DIRECTION. SEEK PROFESSIONAL ADVICE FROM A CERTIFIED FINANCIAL ADVISOR.)

Solana Targeting All-Time Highs – SOLANA SWING LONGSolana has hit all the targets I shared here weeks ago!

I hope you took some profits. We've reached the third and final target—the March 2024 high. Now, it looks like we're retracing back into the weekly demand zone. I expect a potential bounce from the top of this zone, which aligns with the Fibonacci retracement. From there, we could see price movement toward new all-time highs.

I’ll be watching for lower-time-frame confirmations to enter the trade. Price could wick all the way into the weekly demand and fail to close below, especially if Bitcoin drops impulsively. So, look for confirmations first.

Stop Loss: 153

Target 1: 225

Target 2: 260

Guacamole Giving Multiple Buy SignalsThere are very few coins rn now that are flashing buy signals at me, but GUAC is one of them. Also, it flashed the buy signal twice. The last time GUAC flashed my buy signal at me multiple times (4 to be exact), it rocketed up over 200%. Whether or not you would have DCA'ed in, you have been in the profit at the point at which my indicator then gave a sell signal. The next time it gave us a buy signal, it made over 100% gainz. My followers and I took profits right around 88%. And now recently we once again have two GREEN DOTS, telling us GUAC will soon make a move. This move may be days away or it may be weeks but be prepared to make some nice profit either way.

Solana Full Analysis Everything You Need to Know Afternoon Traders

So I break down Solana for you today as its shaping up our first tp is 189 that we are heading to however if we break past that 195 is a great next tp to get to.

In this video I go through the levels and why behind it to make sure you understand what levels to look out for when trading.

If you found this video helpful let me know with a comment, follow or boost. I appreciate it

Mindbloome Trading/ Kris

Trade What You See