Why $SUNW skyrocketed in January?%SUNW stock popped on Wednesday as projected Democratic victories in Georgia runoff elections boosted investors' hopes for a more robust green energy agenda.

Democrats Raphael Warnock and Jon Ossoff are set to win their races giving the party control of the Senate, according to projections from Decision Desk HQ and Insider.

It seems Washington is set to go green with a Democrat-controlled Senate, plus Joe Biden's stated goal of a 100% clean grid at the core of his climate agenda. As the Washington Post reported green energy lobbyists are lining up for their shot to influence the Biden Administration.

The rally comes on the back of multiple positive reports on the sector from the likes of Goldman Sachs and JP Morgan.

JP Morgan analyst Paul Coster said in the company's December Alternative Energy Outlook that "the falling cost per watt of renewable energy…positions wind and solar as the lowest-cost source of energy in approximately 70% of the world.

markets.businessinsider.com

After nearly running out of cash last year, the company has a new lease on life after selling $20 million in stock in December and paying off a $2.7 million loan. Sunworks intends to use its improved balance sheet to drive growth.

The biggest problem for Sunworks is that it isn't even close to making money. Revenue in the first nine months of 2020 was just $29.3 million and losses were $11.1 million, or $0.75 per share. Those trends look like they'll continue, and with bigger, more established solar stocks available, this isn't a gamble I would be taking today.

www.fool.com

Solarwind

SolarWinds 50 products for specific IT tasks, but they are combined in a single interface, which SolarWinds calls the Orion platform.

"hackers funded by a foreign government broke into the computer networks of the american software manufacturer solarwinds and implemented a malicious update for its orion software in order to infect the networks of government and commercial organizations using it," fireeye reported on sunday, december 13 .

The damage can be much broader and risk factors for reputation, which can even become a death trap for the company.

However, let's look at it from the other side, many companies were attacked and only a few failed to get out , while out of 18 thousand organizations that downloaded malicious updates for SolarWinds Orion software, only forty (about 0.2%) were subjected to further cyber attacks through the installed backdoor. However, SolarWinds is unique in the ecosystem. Almost everything they provide can be replaced with other software, but it will take time to build, it will cost a lot of money, and it will not have the unified user interface that Orion offers. I think this is a sufficient reason to keep the company afloat . .

Following the news of the hack, the stock nearly halved from $ 24.20 to $ 14 . On the chart, we see the interest of large buyers at the level of 11.50 -12.20 . if the price breaks through the level of 12.00 and does not slip too far , then this formation will be ideal for entry and you can work out a false breakout. Take will be good ..

Share your opinion in the comments and support the idea with likes.

Thank you for your support!

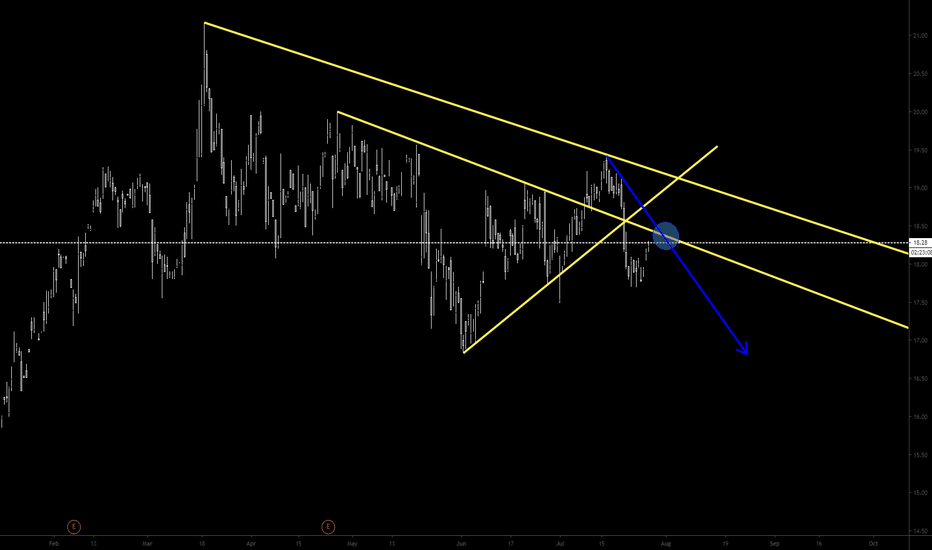

Bearish Idea for Solar WindsBased on these trend lines, and retesting of previous levels, I have bearish sentiment for this market.