Solusdt

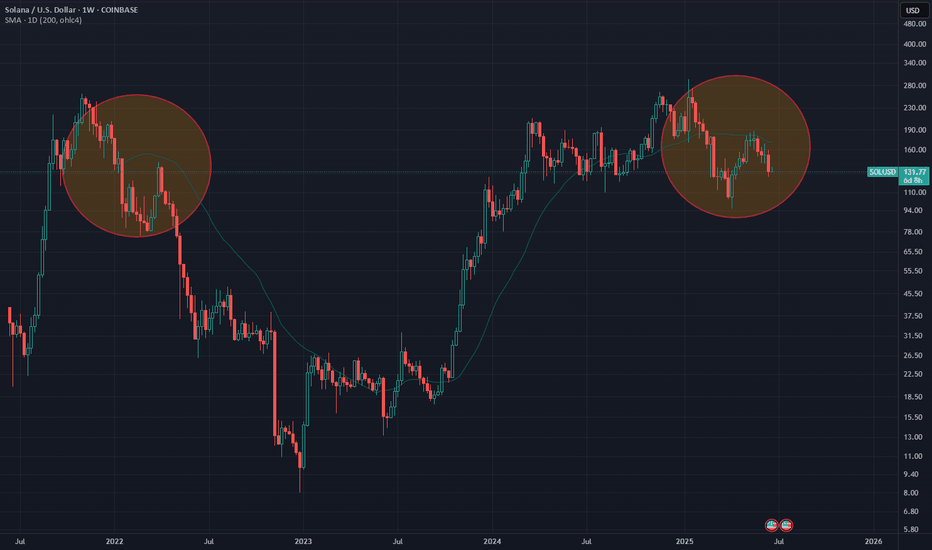

Solana Breakdown Incoming? These Are Key Levels To WatchYello, Paradisers! Are you ready for the next major flush? After failing to gain momentum since the May double top breakdown, #SOL is now showing even more bearish signs, and the market might be about to punish late bulls one more time.

💎Following the confirmed double top in May, SOL has struggled to reclaim any upside momentum. Now, on the 12-hour chart, a classic head and shoulders formation is emerging, a pattern that often precedes larger trend reversals when the neckline breaks.

💎#SOLUSDT is hanging onto critical support between $142 and $140. This zone is the neckline, and it’s the last stand for bulls. If bears break it, we get a clear breakdown confirmation, with a clean path down toward $130–$127, which marks the first major demand area.

💎That initial support likely won’t hold for long. If pressure continues, SOL is expected to drop further toward the $115–$110 region. This is not just a technical support, it’s also the target area of the H&S formation, making it a magnet zone for price.

💎Adding to the bearish developments, a death cross has now been confirmed on the 12-hour chart. The EMA-50 has crossed below the EMA-200, reinforcing short-term downside pressure. Even if a relief bounce occurs, the $155 region, where the EMA-50 sits, will likely act as fresh resistance and attract renewed selling.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

Solana Bearish Divergence, 20% Drop Incoming?Hey Realistic Traders!

Bearish Signal Flashing on BINANCE:SOLUSDT , What Signals Are Showing?

Let’s Break It Down..

On the daily timeframe, Solana has formed a double top pattern, followed by a neckline breakout, which is a classic sign of a potential shift from a bullish to a bearish trend.

This breakout was confirmed by a break of the bullish trendline, accompanied by rising selling volume, which reinforces the bearish momentum. Adding to this, a bearish divergence has appeared on the stochastic oscillator. Bearish divergence occurs when price makes higher highs while the oscillator forms lower highs, signaling weakening buying pressure and increasing the likelihood of a reversal.

Given these technical signals, the price is likely to continue moving lower toward the first target at 134.13, with a possible extension to the second target at 114.96.

This bearish outlook remains valid as long as the price stays below the key stop-loss level at 180.26.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on Solana.

Sol at Risk: Key Support Break Could Trigger Drop to $97Sol is on the verge of breaking a critical support level. If this level fails, we could see a drop towards the $130–$125 range.

However, based on the full pattern length, Sol has the potential to fall as low as $97 — aligning with a possible double bottom formation.

SOL – Sweep & Spring Play at Local DemandWe’ve got a clean rounded top → breakdown → demand sweep setup.

Current price action suggests a potential reversal is brewing.

🔍 What’s happening on this chart?

Rounded top marks a local distribution — aggressive short entries

Price broke lower, swept the demand zone (gray box), and now shows rejection wick + bullish reaction

Fibonacci levels mapped out the structure

0.5 = 154.51

0.618 = 157.76 = key resistance liquidity zone

🎯 Trade idea:

Entry: inside demand zone (OB marked on chart)

Target 1: 151.25

Target 2: 157.76 (0.618)

Full fill: 162.40 – 168.30 (complete inefficiency sweep)

🧠 Mindset:

This setup is classic spring + reclaim. If price consolidates and flips 147.2, upside becomes favorable.

If you like clean trade setups with logic and clear invalidation, check the account bio for more updates and live breakdowns.

Solana SOL price analysis📞 Rumor has it that as soon as the global geopolitics reach a “temporary lull”, the following ETFs will be launched

Solana ETF is the most likely to be the next one (but there are at least 2 coins more on the list, which we will talk about in the coming days)

🪙 So, are you ready to buy CRYPTOCAP:SOL in your investment portfolio? For example, in the range of $117-123

🤖 Maybe we need to launch a long trading bot OKX:SOLUSDT so that it can buy in micro portions on the current possible price correction to get a “tasty price” as a result

◆ Would you like to join such a trading bot and copy them?

◆ And then compare the results with all “ETF candidates”

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

$SOLANA $180 PUMP INCOMINSOL/USDT – 4H Chart Summary

Market Structure:

HTF: Bullish trend remains intact.

LTF: Previously bearish, now showing early signs of a bullish reversal.

Pattern Formation:

Potential Inverse Head & Shoulders forming.

Neckline at $157 — must hold for pattern to complete.

Break above previous high will invalidate Inverse Head & Shoulders.

Trendline & Breakout:

Price has broken above the descending bearish trendline.

Indicates a momentum shift from bearish to bullish.

Fair Value Gaps (FVG):

1D FVG below current price – potential retest & long entry zone.

2x 1D FVG above price – act as targets or supply areas.

Psychological Levels & Volume:

Key levels at $165, $170, $175.

Volume profile shows high liquidity at each of these levels – strong TP zones.

OBV Indicator:

OBV has broken above resistance – supports bullish continuation.

Trade Scenarios:

Bullish Setup:

Long on retest of lower FVG zone ($142–$145).

Target TPs: $165 → $170 → $175 (align with psychological & high-volume areas).

Invalidation:

Break below FVG support or failure to hold above $142.

How Bitcoin can impact alt coins like sol and sui This video is a very quick update on the potential for bitcoin to drop into the 96/97k region and the effect it will have on alt coins .

If you hold altcoins and you see them bleed in price then its important to know and understand whats ahead for Bitcoin .

Understanding this will help you with your entry's and your exits on all altcoins .

#SOL/USDT#SOL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 149.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading for stability above the 100 moving average.

Entry price: 153

First target: 155

Second target: 159

Third target: 162

Impulse without purpose? Not in Smart Money termsSOL didn’t just break structure — it filled inefficiency and positioned above. Now price is sitting in the upper FVG, where decisions are made — not guesses.

What just happened:

Price rallied from the OB below and left an IFVG in its wake

Current price is hovering at the edge of a higher FVG, right where liquidity rests from trapped shorts

The move is complete — now it’s about what price does next in this zone of intent

From here, two paths:

Sweep into FVG, reject, and rotate back down toward the 154–147.4 range

React bullishly from mid-FVG, reclaim structure → break to new internal high and keep running

The OB down at 145 is still valid if price unwinds — that’s where Smart Money bids.

Execution view:

Rejection from 158–159 = short bias down to 147–145

Clean invalidation above FVG high

If price consolidates at 154 and reclaims → setup flips bullish

The setup isn’t about what price did — it’s about what it’s preparing for.

You want more trades like this — precision zones, mapped logic — check the profile description.

#SOL/USDT#SOL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 142.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading for stability above the 100 moving average.

Entry price: 144

First target: 149

Second target: 153

Third target: 157

SOLUSDT Forming Bullish FlagSOLUSDT is currently forming a classic bullish flag pattern on the chart, which is often seen as a continuation pattern indicating the potential for a strong breakout to the upside. The price has consolidated within a tight range following a significant upward move, creating a flag-shaped formation that typically precedes the next wave higher. This structure is being supported by solid volume behavior, which is an essential confirmation for bullish breakouts. Based on historical performance and technical projections, a 50% to 60% gain could be on the horizon if this pattern resolves upward.

Solana (SOL) has remained one of the strongest-performing layer-1 blockchain projects in the market, and current investor sentiment is highly favorable. With recent developments in its ecosystem and increased institutional interest, SOL continues to attract substantial inflows. The bullish flag pattern aligns perfectly with the broader market optimism and technical indicators such as RSI and MACD that are showing early signs of renewed momentum.

Traders should watch closely for a breakout above the flag's resistance line, as this could trigger a new wave of buying pressure. Key levels to monitor include the breakout point and potential price targets around the previous highs and Fibonacci extensions. The market structure remains bullish, and if confirmed by volume and market momentum, SOLUSDT may offer one of the most attractive risk-reward setups in the current crypto landscape.

In summary, SOLUSDT is technically poised for another rally, supported by a bullish flag and growing interest from both retail and institutional investors. With a favorable risk profile and strong fundamentals, this is a setup that many traders will be watching in the coming days.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

SOLUSDT | The Final Liquidity Hunt | $250 is the Next StopSOLUSDT is currently in an uptrend after recently breaking out of its extended downtrend to $95 which took out millions of long positions. Now, we are seeing yet another extended downtrend on the lower time frame, but the overall direction is still up.

Last week, price action printed two very bullish pinbars at the $155 level which could have been considered support, where price was consolidating around late April. High leverage traders entered here and eventually got liquidated last Friday.

Following the liquidity hunt, price reversed quickly, but not strong enough to reclaim the $155 zone. Many of those who were liquidated likely re-entered on this fast move, thinking that the liquidity hunt is over and price cannot move lower.

I am anticipating one FINAL move down to $140 before the uptrend resumes. This will be the move that takes out the dumb money and where smart money will take their positions. The alternative is that the liquidity hunt never happens, and price breaks out of the falling wedge to resume its uptrend.

What about macro and micro factors?

⚖️ Ripple vs SEC Case

On 8th May, both parties agreed to settle, which ignited a massive market-wide rally. Unfortunately, their filings were rejected due to a procedural issue. The next deadline for refiling is on 16th June. Once accepted, we can expect another massive rally.

🤝 US-China Trade Talks

This week, US and China will meet at the negotiation table again. On 12th May, US & China reached a deal in Geneva and sent markets on another rally. IF (big if) they come to another deal this time, we can expect another rally.

✂️ Fed Rate Cut Expectations

The Fed talked about cutting interest rates in late 2025. They are currently in a "wait and see" stance however, due to uncertainties. Eventually we will see a rate cut, and I believe this would be a "buy the rumor, sell the news" event. Markets will price in the anticipated rate cut before it happens later this year.

Our first price target is $250.

They saw a crash. I saw where the next rally beginsThis isn’t chaos. It’s sequence. SOL sold off into a well-defined 1H OB, paired with a high-volume low. Price didn’t break. It anchored.

The setup:

After an aggressive dump, price settled into an Order Block between 140–143. This isn’t weakness. It’s rebalancing. Right above? A perfect FVG at 149 and inefficiency zones that align with liquidity draws at 152 and 160.

Volume is telling — it spiked into the OB, not on exit. That’s how Smart Money positions.

Expectation:

Accumulation near the OB → quick reversal → reclaim 145

From there, watch price reprice through:

TP1: 149 (FVG reclaim)

TP2: 152 (full inefficiency fill)

TP3: 160 (external liquidity sweep)

Any deeper dip below 140 becomes a deviation — not a breakdown — unless structure is violated with follow-through.

Execution:

Entry: 141–143 zone

SL: Below 139.8

TP1: 149

TP2: 152

Final: 160

This is engineered — not emotional.

Final thought:

“You don’t need to predict the bottom. You just need to know where price is built to return.”

#SOL/USDT#SOL

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 148, acting as strong support from which the price can rebound.

Entry price: 153

First target: 156

Second target: 159

Third target: 162

Solana Weekly TF, Good NewsI've gone deeper into Solana's chart and I have good news... You are looking at the weekly timeframe.

I looked at EMA34 and MA200 for some of the major Crypto projects, Bitcoin, Dogecoin, XRP, Cardano and Ethereum. You can find these in my profile @MasterAnanda.

Some were clearly bullish as the action was happening above both moving averages, others were mixed and one was bearish.

Solana is trading below EMA34 weekly but safely above MA200.

MA200 weekly sits at $100 for SOLUSDT.

There is another level of relevance, EMA89. On this chart shown as a blue line and this is the good news. EMA89 is working as support, it worked last week and this week it still holds. This same level matches perfectly the 0.5 Fib. retracement support relative to the move from 7-April to 19-May.

This is all to say that we are looking at a strong support zone, which means that it is likely to hold. If it breaks, it should be brief followed by a recovery right away.

Namaste.

Solana - Your chance to be a millionaireThere is a 50/50 chance that we have topped...

The wave structure is very indicative of a completed impulse. However, i'm betting that we are just in a complex wave 4 and if this is the case, we should see a wave 5 taking out the high.

The risk to reward is pretty nice and playing spot will pay off.